Lower My Property Assessment, Please

A temporary sign taped to the permanent Community Television Network sign was guiding hundreds of residents to the Board of Review, which met last week at CTN's offices on South Industrial. More meetings are set for early next week.

One Ann Arbor resident had just refinanced in January, and politely told the city Board of Review she was “shocked” when she got her assessment in the mail this month – the city had valued her home far higher than had the appraiser, and she didn’t think that was fair. She handed the three board members a copy of the appraisal.

It didn’t take much more to convince them to lower her assessed value. “You did it!” board member Doris Preston told her.

“Really?” she said, looking startled.

Preston said that most people don’t bring in such good data to back up their appeal. “We really appreciate that very much,” Preston said. “Thank you.

“Thank you,” said the resident, smiling as she left the room.

Last week, The Chronicle spent part of an afternoon watching the review process unfold in a room at Ann Arbor’s Community Television Network headquarters on South Industrial. It’s fair to say that not everyone left with a smile. Landlords, attorneys, first-time homeowners, people hoping to sell their homes – each got about five minutes to make their case to the Board of Review: Doris Preston, Walt Hancock and Bob White, joined by city assessor David Petrak. Board members were cordial and attentive, but the appeals they heard mostly reflected frustration, anxiety, annoyance and confusion. A lot of confusion.

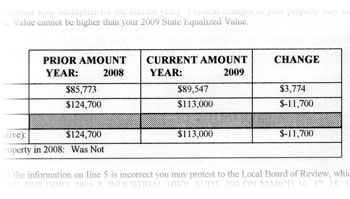

An example of a 2009 city of Ann Arbor assessment notice. For this proeprty, the top line shows an increase in taxable value, while the second line indicates a drop in assessed value. (image links to higher resolution file)

So let’s start there. Two main points of confusion surfaced in the appeals that The Chronicle observed. First, some homeowners were asking to have their taxable value lowered – and were disappointed to learn that the Board of Review had no control over that. This was a message that board members had to give repeatedly. (More on how that works below.)

Second, many Ann Arbor property owners were confused by a counterintuitive scenario in their 2009 assessments: an increase in taxable value, coupled with a decrease in the assessed value of their property. They didn’t understand why their taxes would go up while their home was worth less.

It’s a phenomenon due to Proposal A. This ballot initiative, which passed in 1994, severed the direct link between taxable and assessed value. To get an idea of why a property’s taxable and assessed values might be headed in opposite directions, it’s important to look at those values when a property is purchased.

When a property is purchased, the taxable value is reset to be equal to assessed value. And the assessed value is an amount set at roughly 50% of market value. But in years subsequent to that purchase, the assessed value of the property will increase or decrease, depending on overall market conditions.

If the market goes up after the purchase, then the assessed value goes up, and intuitively, taxes paid on the property (that is, the taxable value) should increase, and they do. But Proposal A puts a cap on how fast the taxable value can increase. That cap is 5% or the rate of inflation, whichever is lower.

Suppose you buy a home for $200,000. If you’re paying the “right” price, based on the assessor’s assumptions, then the assessed value and the taxable value would be $100,000. Further, suppose that the following year, the properties in your neighborhood appreciate by 10%, putting the assessed value at $110,000. And suppose that inflation for that period is right at 5%. The difference between the 10% appreciation and the 5% overall inflation means that for that year the taxable value can’t increase to match the assessed value . Due to Proposal A, the maximum taxable value for the property would be $105,000. On that scenario, the property would have an assessed value of $110,000 and a taxable value of only $105,000.

In a market that goes up more than inflation year after year, the gap between a property’s assessed value and a property’s taxable value would continue to increase. In the real-life example above (see image), over a period of 10 years in a upward market, the gap grew to be a $85,773 taxable value compared to a $124,700 assessed value.

Based on that gap, Proposal A still allows taxable value to rise in a given year, even if assessed value decreases – just as long as the increase is not more than 5% or the rate of inflation. This year, the rate of inflation used for Ann Arbor was 4.4%. Doing the math on the real-world example, 4.4% of $85,773 is $3,774, which is the amount that homeowner’s taxable value increased.

It’s one thing to know that the market has “gone down,” but it’s another to figure out by how much for assessment purposes. So how does the assessed value get evaluated in a given year?

The city does not appraise each individual property. Rather, the city does an annual sales study, by neighborhood, to set the assessed value of local properties. In a declining market, Petrak said, the neighborhood study looks at the previous year only. For current assessments, the period of the study was from October 2007 through September 2008. When the market is appreciating, as it has until recently, the analysis is based on a two-year study. That results in assessments going down quickly, but increasing more gradually.

The Ann Arbor Board of Review, from right: Robert White, Walton Hancock and Doris Preston. Far left: David Petrak, city assessor. White also serves on the city's Historic District Commission.

Even though taxable value and assessed value aren’t directly linked, it’s clear why people care about appealing their assessed value.

When assessed value is equal to or lower than taxable value, your taxable value won’t increase in any given year – so there’s incentive to keep your assessed value down. Or if you’re trying to sell your house in the current market, a lower assessed value might help. That’s because when a property changes hands, taxable value is reset at the assessed value – this “uncapping” is a factor that potential buyers evaluate.

It’s in this context that the Board of Review operates. Appointed by the mayor, the board hears each appeal, and after the property owner leaves, they reach a consensus – fairly quickly, during the time we observed – about whether to adjust the assessed value as requested. These changes, if any, are recorded and in two to three weeks the owner is mailed a letter stating the board’s decision. In some cases, as in the one described at the start of this article, the board tells the owner immediately.

The city does about 36,000 assessments, including commercial and residential properties, Petrak said. Last year, after the board made its adjustments, the taxable value of properties in the city totaled $2.996 billion. This year, prior to board review, that amount was $3.039 billion. Petrak said he expects that following adjustments made by the Board of Review, taxable value citywide will remain flat.

As they sit through hundreds of appeals – more than 80 per day, meeting all last week and early next week – the board sees a broad slice of Ann Arbor, and hears dozens of different stories. Here are just a few:

- One man bought his house a couple of years ago. He came to the board last year and got them to lower the assessed value to reflect the amount he paid for the house. When he got this year’s assessment, it had gone up dramatically again. “I don’t know why I had to come back,” he said. “What do I have to do so I don’t have to come back next year?” Walt Hancock told him that the board’s decisions only applied for one year. Next year, the city’s sales study would likely cause the property assessment to increase again, and the homeowner would have to return if he wanted to appeal. The man sighed. “So see you next year,” he said.

- One homeowner brought a detailed report listing private sales and foreclosure sales in her neighborhood, which she passed out to the board.”Will this be shared with the powers that be?” she asked as she was leaving. “We are the powers that be,” Doris Preston said.

- The board had a few extra minutes, and accommodated a landlord who hadn’t made an appointment to meet with them, but who was hoping to appeal as a walk-in. He said he had a three-story house that he’d had to alter to comply with city code, and it had caused him to lose some square footage. He wanted his assessment lowered on that basis. How many units were in the building? Petrak asked. Four, he replied, the same as before. How many bedrooms? Seventeen, rented at $700 a month per bedroom. When board members expressed surprise at this, he said ,”Did I get myself in trouble?” (He returned an hour or so later, asking that his appeal be withdrawn.)

- Another landlord came in, asking for adjustments on his own home as well as eight other properties he owned. “I’ll bet you guys are getting bombarded,” he said as he was getting settled. “Yes, we are,” Preston said. He hadn’t brought any documentation to support his request, and offered estimates when asked about market value for these properties. He expressed frustration that they didn’t have the power to lower his taxes. “I’m so tired of this – the taxes, the permits. Please do whatever you can do.”

- A man who owned a condo in the Northbury subdivision on Ann Arbor’s north side presented a detailed analysis of properties in that area, noting that it was difficult because not many homes had sold recently, though several were on the market. “It’s really brutal, no matter how you look at it,” he said. After his appeal, he also asked for time to talk about the University of Michigan, saying that “local taxpayers are taking care of the university,” which is tax exempt. Preston told him that only the state legislature can address that situation. The man said the university is “taking over like alligators,” specifically citing its pending purchase of the large property owned by Pfizer.

- A non-native-English speaking couple, for whom it was a challenge to express themselves, said they didn’t understand why their taxes went up and their property value went down. They had made improvements to one of the rental properties they owned, yet still the assessed value went down. They said they’d tried to get an explanation by calling the city assessor’s office, but that each time they called, different employees told them different things. Reviewing their assessments, Walt Hancock said, “You’re getting a pretty good deal, to tell you the truth.”

- An attorney representing a family that owns a local auto dealership came in on their behalf, challenging an assessed value of a home sold between family members. It was not an “arm’s length” sale, but she noted that they’d had the property independently appraised. The issue of “arm’s length” sales came up a few times in other appeals, with the board discussing how if the property is sold to family or friends (i.e., not at arm’s length), it’s fairly easy to get appraisals that reflect a lower, favorable value.

- A woman came in to appeal the assessment of her Geddes Lake home, which had recently been converted from a co-op to a condo. She described how other condos had sold much lower than what hers was assessed for, even though hers was in poorer condition. After her presentation, the board told her they had no questions. “That’s it?” she asked. “That’s all you want?” Yes, they said. Then Walt Hancock asked, “Do you still have problems with ducks out there?” “I like them!” the woman exclaimed. Doris Preston observed that the excremental mess created by the ducks added an element of privacy protection, deterring people from walking through the yards.

More information about Ann Arbor tax and property assessments is available on the city assessor’s website.

I think the home owners to challenge their taxes. There is generally a short designated period of time to present your case. Contact your area tax department and find out the specifics and then build your case by examining the local tax records to identify information that supports your position.

You can get a current appraisal on your property and if it appraises for less then take it to the tax dept. in your county and they should lower your taxes.

What many people need to realize is that those who have lived in their houses for a long time have been getting a discount on their property taxes.

Those of us who have purchased a house in the past few years have been paying more in property tax (the actual current rate) than our neighbors, even though our houses are worth the same amount. In fact it was sort of a punishment for moving; yet the real estate market was still booming.

Now that the real estate market has turned, long time homeowners are getting less of a discount; they are not paying more than they should be.

This is a different, but I feel accurate way, of looking at this situation.

MTC is correct, and another point is that recent purchasers actually have a chance to reduce their taxes, since the assessed value might actually drop below the current taxable value. A silver lining to the statement “your house isn’t worth what you paid for it”.

You gotta admire the heavy lifting the Board of Review members have to do this time of year. Don’t forget, these folks are volunteers doing a community service. Thanks.

I’m not sure a “discount on taxes” is a phrase I’m comfortable with. Taxes are rarely fair. Or evenhanded. Proposal A offered some protection for soaring values, which actually was no real value increase to those of us who bought and stayed put. I bought my house for under $60,000 and have certainly seen the value increase about 6 fold, and now it is dropping steeply. But it is only virtual value – I want to stay in my house. Proposal A has been profoundly helpful in keeping costs reasonable. Am I entitled to protection against speculators and crazy trends in home pricing, or people overpricing the houses around me? I’d say yes, to some degree. My taxes haven’t gone down, they increase EVERY year. They went up this year and will continue to do so for a long time to come even if property values drop.

Sales taxes, property taxes, income taxes, all hit people in different circumstances differently. It isn’t a fair system. I make out well having a house I’ve lived in for 25 years. I suffer deeply by paying social security self employment tax. And in other areas as well I could say I’m “penalized”. That’s life.

Meanwhile, having protection against real estate inflation has helped me be self employed, enjoy my home, and contribute to my community in the process. I’m grateful. Especially in past years when paying the taxes – lower as they were – was a stretch.

It is an imperfect system. Good luck to those trying to make sense of it, and finding a fair resolution.

I love that landlord: “He hadn’t brought any documentation to support his request …. ‘I’m, so tired of this – the taxes, the permits. Please do whatever you can do.’”

“Please do something for me for nothing!” Yeah right, buddy.

Good article. It captures the feel of the review board very well.

When I appealed last year, I got a substantial reduction in my 2008 assessment. I bought the house in 2007, so the appeal lowered the taxable value to the market value, which was well below the 2007 assessed value.

Great! I saved a lot on taxes for 2008 and was looking forward to saving thousands over the years I would live here.

What I didn’t know was that the appeal would be disallowed by the assessor the following year. For 2009, my assessment rose by more than 10%, despite lower assessments for the rest of the neighborhood. My property declined in value the same as the rest of my neighbors, but because individual properties are not assessed, my assessment rose substantially above the legally established value.

Well, that’s taxes, right? The problem is it’s nearly impossible to find out the rules. Before buying, and as I was looking at various houses, I wanted to have an idea of how much I would be spending over the years on taxes, based on how much I paid for the house. In order to learn the regulations, I did the following:

Contacted colleagues who’ve owned homes in Ann Arbor for years. Not one person had a good understanding of property tax law or the process used by the city assessor–and these were well educated folks.

Asked my real estate agent from Surovell Realtors. He didn’t understand the law or the appraisal process. When he went to Surovell’s legal staff for an explanation, they didn’t know either.

I consulted a real estate attorney. He was not aware that a decision of the Local Board of Review could be reversed and set aside by the city assessor.

Checked the city web site. It does mention the city uses mass appraisals, but that didn’t translate into an understanding for me that this would largely invalidate the benefit of appealing.

Met with with the city assessor, Mr. Petrak. He encouraged me to appeal, but didn’t mention that my appeal would be overturned the following tax year. He also didn’t tell me of the virtual certainty that even though all the properties in my neighborhood would likely have reduced assessments in 2009 due to the falling housing market, that my own property value would be increased more than 10%.

My take after all this was while you do have a legal right to have your property assessed at market value, the city’s lack of transparency combined with complex state laws made it an unpleasant and difficult task that might be worth it for the wealthy who own high value homes and hopefully have better lawyers than the one I talked to, but perhaps not too useful for me.

Although I have a strong case for the review board, I skipped it this year. I did complain to the city council about the poor atmosphere created by the process. Why not make it transparent and easy to understand?

At a minimum, the city could explain that an appeal has little value for many taxpayers. The Michigan Constitution says that assessments should be close to fair market value. Our elected officials ought to support the voters and help people enjoy their legal rights rather than oversee a process which compels them them to appeal every year. Let’s hope the city improves the process.

Thanks very much for your comment, Peter. I’d be very interested in hearing from you and others how you think such improvements might be accomplished.