Frederick Farm in Line to Join Greenbelt

Not many people attended the September meeting of the Ann Arbor Greenbelt Advisory Commission, so it was easy to figure out who was there, and why. Scott Rosencrans, for example, came to introduce himself to the commission – he’s the new chair of the city’s Park Advisory Commission. He said he hoped the two groups could find ways to work together, given their common interests.

Others attending had a more specific goal in mind: To see whether GAC would approve the purchase of development rights to the Frederick Farm.

The commission did approve the PDR, sending it on to Ann Arbor’s city council for a vote to authorize the deal – it might be on the council’s agenda as early as November. If approved, it would be the first time the city’s greenbelt program has undertaken an agricultural project without federal funding, and the first time they’ve made a purchase in Lodi Township. If the Legacy Land Conservancy joins in on the deal as expected, it also would mark that nonprofit’s first participation in the city’s greenbelt initiative.

The Farm and The Buyer

The Frederick Farm sits on about 100 acres in Lodi Township, with a house, barn and out-buildings facing Wagner Road, just north of Ann Arbor-Saline Road and across from Turner’s nursery. It was owned by the late Erwin and Dorothy Frederick – Erwin Frederick served as Lodi Township supervisor for more than 40 years, and his photo still hangs in the township hall.

Now owned by the Fredericks’ three grandsons – Chris, Fred and Steve Girbach – it hasn’t been an active family farm for several years, though they’ve leased out the land to other farmers for corn and soybean crops.

The parcel has attracted developers in the past. Most recently, Fairview Land Development of Auburn Hills had planned to build 450 houses on the land, but was denied a zoning request by Lodi Township, according to an April 30, 2008 article in The Ann Arbor News. Residential development would run counter to the township’s zoning for that area – the draft of a master plan that’s currently being considered by township officials designates the bulk of the township for agricultural preservation.

And that use fits the goals of Mike Vestergaard, one of the people attending GAC’s Sept. 9 meeting. If the deal for the purchase of development rights gets approved by city council, Vestergaard says he’ll realize a plan that’s been a long time in the making.

Mike Vestergaard at the Sept. 8 meeting of the Ann Arbor Greenbelt Advisory Commission. (Photo by the writer.)

Vestergaard first came to Michigan nearly 20 years ago as an exchange student from Denmark. He met his future wife Hope, who’s from Ann Arbor, while working as a camp counselor in northern Michigan. He returned to Denmark to finish college, majoring in dairy management, then came back to the U.S. and worked at a dairy farm in the Connecticut River Valley.

The land there was lush and fertile for farming, but residential developers were purchasing farmland at a rapid rate to build housing, Vestergaard said. It was there that he was first introduced to the concept of buying development rights.

The tool allows governments and conservancy groups to pay landowners the difference between what a developer would be willing to pay for the land, and what the land would be worth if it couldn’t be developed. It allows farmers to keep their land or preserve it, while taking advantage of the profits they would otherwise get from selling it to developers.

Moving to Ann Arbor in the mid-1990s, Vestergaard hoped to buy a farm in this area but couldn’t afford anything on the market other than a 10-acre hobby farm he now owns on East Delhi Road, where he keeps four cows and raises pigs in the summer. Instead of making farming his main business, Vestergaard started a construction company – Vestergaard & Sons – which has done pretty well, he said. “Financially, I should stay at that – there’s no doubt about it.”

But earlier this year he found out that the Frederick Farm was for sale, and that its owners might apply to be part of the greenbelt. The location – on a frequently traveled road between Saline and Ann Arbor – was perfect for the kind of operation he’d like to start: a working farm and retail store, with a strong educational component.

Calder Dairy & Farms serves a model and inspiration for what he’d like to do, Vestergaard said. That family-owned business – located in Carleton, Mich., southeast of Milan – produces milk, ice cream and other items, but also opens its farm to visitors, and has a store on site. “I thought, why is there not anything like this in Ann Arbor?” Vestergaard said.

Vestergaard also had been working with Mike Score, an agent with the local Michigan State University Extension office. Score advised Vestergaard to specialize, like Calder, and to sell what the farm produced.

Given Vestergaard’s background in dairy farming, he hopes to raise grass-fed cattle, selling the meat at the farm store along with items from other local producers, possibly including Calder, Backwoods Beef Jerky (made in Chelsea) and others. He says he wants people to see how a working farm actually operates, and to show how food can be produced safely and humanely. “I have to be able to sell this product with a good conscience,” he said.

Structuring the Deal

Vestergaard plans to invest a total of $2 million into the purchase of the farm, renovation of the old barn and construction of a store. He has offered $3,500 per acre for the property. The land, including development rights, appraised for $9,000 an acre – Vestergaard said he wouldn’t have been able to pay that amount, plus invest in the necessary renovations.

What’s lowering the price for him is the city’s pending purchase of development rights. Through the greenbelt program, the city will pay the current owners an amount that will allow them to lower the purchase price for the property, after it’s been stripped of development rights. According to a resolution passed by the Greenbelt Advisory Commission, the city’s share of that payment will not exceed $835,400.

Funds to pay for the PDR come from a millage that Ann Arbor voters passed in 2003. Approved for 30 years, the millage levies 0.5 mill annually, or 50 cents for each $1,000 of a property’s taxable value.

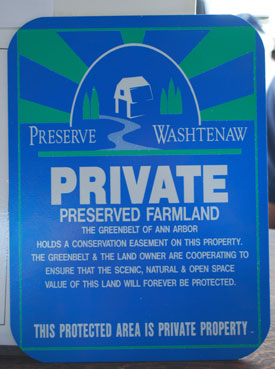

A prototype for a sign being designed to mark land that's part of the greenbelt program. (Photo by the writer.)

Vestergaard had been working with Charlie Koenn of Swisher Commercial, who was helping him look for suitable property. Koenn is also from a local farming family – he noted that his grandfather, Herm Koenn, was friends with Erwin Frederick, and his brother still runs a dairy farm near Chelsea.

Koenn knew of other farm families who’d sold their development rights through the greenbelt program, and thought that might be a way to make the transaction work for the Frederick Farm. As part of the deal, the Girbachs are contributing 16.5% of the PDR price – meaning they’ll get 16.5% less than they would have otherwise received for the development rights.

Landowner contributions of this kind, which typically result in a tax benefit, are a common component of a PDR deal, but are not as common in farmland transactions. The city’s current policy calls for between 20-25% of the PDR price to come from matching funds from other sources, which might include landowner contributions. For agriculture deals, however, those matching funds are usually from the U.S. Department of Agriculture’s Farm and Ranchland Protection Program, or FRPP.

The city applied for FRPP funds in the Frederick Farm deal, but did not receive any. Instead, Lodi Township and the Legacy Land Conservancy – an Ann Arbor-based nonprofit previously known as the Washtenaw Land Trust – have been asked to chip in, along with the landowner.

Lodi Township does not have a dedicated millage for land preservation, and The Chronicle did not receive a response from township officials about their plans to participate in the Frederick Farm PDR deal.

Susan Lackey, executive director of the Legacy Land Conservancy, said the nonprofit’s board will likely vote on the issue in November. There are several factors that make this a good transaction, she said. Preserving the farm will keep the historic connection to the land, and the kinds of things that Vestergaard hopes to do in that very visible location will highlight the local food system. The deal, which transitions the farm from one active use to another, is also proof that the greenbelt program actually works for agricultural land, she said, if the price is low enough.

Greenbelt’s Added Emphasis on Farmland

Jennifer Santi Hall, vice chair of the Greenbelt Advisory Commission, said the commission is putting more of an emphasis on land that produces food sold locally, so it’s likely there’ll be more such deals than in the past. That’s reflected in the newest version of its strategic plan, approved by GAC in March 2009:

This year, the Greenbelt Advisory Commission has identified locally produced foods, agritourism, and other agricultural specialty products sold directly to local markets as an emerging issue. Our local markets, restaurants, non-profits, and most recently, the Homegrown Festival have all focused on the environmental, health, economic and community benefits of buying and selling local foods and other agricultural specialty products. In addition, we feel that a visible connection to our Greenbelt through the foods and other products that we buy and eat provides a tangible reminder of our preservation efforts. Local foods and other crops can find their way in to our Ann Arbor economy in a number of diverse ways: the Ann Arbor Farmers Market, local food stores, direct restaurant purchases from farms, U-pick farms, and even at larger chain groceries through regional food distributors.

Recognizing that the Greenbelt’s mission and direction is solely the protection of land, the Greenbelt program will make a priority to protect those farms that are producing foods for local markets. Even without this priority in our previous strategic plans, the Greenbelt program has actually preserved several farms that provide local food or other crops to the Ann Arbor area.

To date, the Greenbelt has focused on large parcels of active agriculture, however, many farms that are likely to produce vegetables or specialty crops for sale to our local markets or restaurants are likely to be less than 40 acres. Furthermore, these parcels are likely not going to qualify for Federal Farm and Ranchland Protection Program grant dollars. As such, our existing scoring system precludes these types of farms from our consideration. The Greenbelt Advisory Commission will amend our scoring system to award points to those applications that are supporting local food production or direct marketing production.

[.PDF of 2009 Ann Arbor Greenbelt District Strategic Plan]

Since the greenbelt program began in 2003, the city has spent a total of $10.089 million on 12 properties encompassing 1,321 acres in Washtenaw County – land that includes both farmland and open space. Another nearly $10 million for those purchases has come from landowner contributions, grants and partnerships with other governments.

More funds are available. As of June 30, 2009, the greenbelt fund had a balance of $11.847 million. Of that, city council has approved three additional purchases totaling $2.54 million from the greenbelt fund: The 286-acre Braun farm in Ann Arbor Township; the 51-acre William Gould property, also in Ann Arbor Township; and 265 acres owned by the Nixons in Webster Township. Those deals haven’t yet closed.

[.PDF of June 30, 2009 summary of Ann Arbor Greenbelt acquisitions]

In addition to the city of Ann Arbor, the townships of Ann Arbor, Scio and Webster also have millages for land preservation, allowing them to partner in the greenbelt. In 2003, Ann Arbor Township voters approved a 20-year, 0.7 mill property tax for that purpose. Scio Township’s 0.5 mill land preservation tax was passed in 2004 for 10 years. Webster Township’s five-year, 0.5 mill land preservation tax was approved in 2005 and is on the ballot for renewal in November, to take effect in 2010.

The other local government with a dedicated millage for land preservation is Washtenaw County, which levies 0.25 mill to fund its Natural Areas Preservation Program.

To find property that might be eligible for the greenbelt program, the city typically mails out applications and letters each year to large landowners in the greenbelt area, said Ginny Trocchio of The Conservation Fund, a consulting firm that’s managing the program for the city. The program has received nearly 80 PDR applications from landowners since the program began, including 13 so far this year.

The Conservation Fund has managed the greenbelt program since 2005, and its contract expires next year. In a Sept. 9, 2009 memo to city council, Jayne Miller, the city’s community services administrator, said she plans to issue a request for proposals on the contract this fall. According to city council minutes, in 2007 council approved a three-year contract for the Conservation Fund at $209,879 for the first year, $222,175 in year two and $233,460 for year three.

Thank you for this excellent summary, and to the Greenbelt Advisory Commission for moving in this direction. This appears to be an superb opportunity to achieve what many Ann Arbor residents doubtless expected when they voted for the Greenbelt millage: preservation of a farm with historic buildings that contributes to the viewshed along a major nearby rural road, and that produces and supplies local food.

I’d like to know whether individuals can make targeted donations to support such a purchase.

Note that unless things have changed, the county’s Natural Areas millage cannot be used for agricultural land or land containing farm buildings. In reviewing the ordinance, I am unable to find a specific exclusion though I have the impression that there has been controversy in the past over the existence of farm buildings. But the criteria for selection include only water resources, plant and animal communities, scientific or recreational use, and proximity to other protected land.

I can understand the desire to save this land (I would love to see it go undeveloped), but market forces should be left to determine the value of the land. Just because it appraised at $9K an acre, only means it’s worth that if someone will buy it and it can be developed. Doesn’t look it can be. So it’s not worth $9K an acre. Why should the taxpayer make up the difference?

This is great news, and yet… I can’t get all that enthusiastic about it when I compare it to the acquisition of, say, the Fox Preserve. It’s nice to preserve the farmland and the viewshed, but $800,000 just doesn’t seem like that great a deal compared with the $771,000 the Commission and partners spent on Fox. Fox is only half the size, but the public owns it and has full access (and it’s awesome). With the Frederick Farm, the public can look at it as they drive by.

Nevertheless, what Vestergaard wants to do sounds great and I hope things work out for him.

yes! my wife grew up in the north lake area..n.territorial rd..golf beauty..she is 50 now but as a kid she summered there from ypsi. we met here in alaska, the love for nature is in both areas..owr 40 acre homestead ison mi.243 of the alaska r.r. google the talkeetna area..why it is wth same area here that the famous band of “mishiganders” called the 49′ers or something like that, a band of mi. settlers came up here and left a big mark here. any how, the area of n.territorial rd should be rescued from the greedy developers..land leaches, those that cover up there dasterdly deeds by rippin’the mother nature from the soils of michigan! hark!..calm down rod..i want to retire to michigan from ak..odd eh? but i look up in the mi. sky and see visions of (artistic)expression..if i had a barn there ..i would turn it into a..thieater a art school, a meseum of automobil mechanic history..after all wasn’t h. ford the one that brought life to the greagory cnty? area?..viva alaska–viva michigan!

Vivienne, you asked about targeted donations…

The Legacy Land Conservancy board meets in early November, and I’m hopeful they will agree to participate in this project. It fits our priorities.

That being the case, we will start a fund raising campaign to support our portion of it. So — yes! You can certainly make targeted donations. If you’d like to start the fund, we’d certainly be honored to take your contribution.

Susan

I think that Jonathan poses a valid question. Maybe Susan could address that. Better yet, maybe the commission could make a practice of including a ‘whereas’ clause in their recommendations that would state the rationale for the valuation, including the probability of sale for development.

Steve, you have a lot of confidence in me. Entire courses are given in valuing conservation easements!

I can’t speak for the Greenbelt Commission’s rationale, but I can speak to the broad issue of valuing development rights.

When any of us purchase development rights, we do so with the guidance of an appraiser. Most of us are prohibited from paying above appraised value. Briefly, we have a qualified appraiser determine the value of the land, based on comparable sales. The appraiser then does a second appraisal that establishes the value of the land with the conservation easement in place. (Generally, the value of the land for housing in the first instance; the value for farming or recreation in the second instance.) The difference between those two values represents what the landowner gives up by establishing the conservation easement, and is the value of the development right.

This process is more complicated, but not significantly different, than what a private buyer would probably use to establish the value they’d be willing to pay.

Frequently, the landowner does not receive the full amount of that value, and chooses to donate some portion of the value, meaning that, in total, they receive less cash for the land than they would receive if they sold it outright.

That said, timing is everything in life.

On the one hand, a few years ago, when competition for land was higher, it was far easier – if more costly – to draw a direct line between an immediate threat of development and protecting a specific parcel of property.

On the other hand – and this is important – the goal of good conservation is to protect land that is important to advancing other public policies (clean air, clean water, recreation, wildlife habitat, farming, among others.) In that regard, while the direct line may be a little blurrier today, the opportunities to advance those public policies by land protection come at a much lower cost in this economy.

If we wait until the threat of development is immediate, the costs of land protection will be significantly higher than they are now.

Don’t know if this helps, or simply confuses things further. In short – the amount paid for development rights is, to the degree humanly possible – driven by market forces.

Thanks, Susan. That was informative.

I think, though, that Jonathan’s question, which I’ll phrase in my own words, remains unaddressed: if zoning prohibits development of the land in question, some of those considerations (owner donation, etc.), while helpful and appreciated, are irrelevant, and “comparable sales” would be those of properties with similar restrictions, so wouldn’t the value be lower?

If the case is that the owner is willing to take the risk that the property won’t sell for a higher value for development in the future and demands more today than we might be willing to pay, that’s not a market or an appraised valuation, that’s the owner setting the price. I hope you (or a commissioner) can clarify this for us as well.

I think this is advanced conservation easement valuation! Let me try to address your restatement of Jonathan’s question…

Zoning is part of the consideration in the valuation. However, ag zoning doesn’t prohibit residential development. It may limit lot sizes to five or 10 acres, but that is still going to net the landowner a great deal more than land sold for purely agricultural purposes.

Without looking at an individual appraisal, it is hard to determine what ‘lower’ is. Each property is different. I’ve seen development rights valued from a ‘whole lot of money’ to ‘not very much’, depending on a lot of factors — soils, proximity to town, etc. etc.

The point, I think, is that the seller doesn’t set the price. All they can do is agree to the terms or not. And, often, those terms include a less than market value (as established by the appraisal) sale of the development rights.

Anything more technical than this and I’ll have to defer to an appraiser.

“However, ag zoning doesn’t prohibit residential development.”

Sounds like that may be the key. Thanks again.

“Just because it appraised at $9K an acre, only means it’s worth that if someone will buy it and it can be developed. Doesn’t look it can be. So it’s not worth $9K an acre. Why should the taxpayer make up the difference?”

Susan didn’t touch on this directly but $9,000/acre is consistent with land values of agricultural land with limited development potential due to AG zoning. While property values are down due to the economy, I can’t think of any properties, farmland or otherwise, that could be had for $3,500/acre as Mr. Vestergaard was hoping to pay. Land with development potential due to zoning or location has in the past fetched far more than $9,000/acre. It’s not uncommon for land with water and sewer access and residential zoning to have fetched upwards of $50,000/acre. Whether those prices will return when the economy turns around remains to be seen. But the $9,000/acre value is reasonable and consistent for agricultural property.

I’m confused. I thought that property was in the Saline district.

never mind, I just looked at the map.