2011: Ann Arbor $1.6M Better than Planned

Editor’s note: Before this article was finalized for publication, it was inadvertently posted for a brief time, then removed from the website. Between versions, some added material gave more precision to the planned expenditures and use of fund balance in the city of Ann Arbor’s FY 2011 budget.

The Ann Arbor city council audit committee met on Dec. 19 to review the audit for FY 2011, which ended June 30, 2011. Clockwise, starting with Stephen Kunselman (Ward 3), with his back to the camera, are Sabra Briere (Ward 1), Sandi Smith (Ward 1), city administrator Steve Powers, auditor Alan Panter, accounting services manager Karen Lancaster, and Margie Teall (Ward 4). Carsten Hohnke (Ward 5) was absent. (Photo by the writer.)

In mid-December, the audit committee of the Ann Arbor city council received what could be considered good news from the final audit for the last fiscal year. It was clean. The city also managed to add incrementally to its fund balance, instead of using more than $1 million from that balance, which it had anticipated doing.

The council’s audit committee met on Monday, Dec. 19 at 6 p.m. just before the council’s last meeting of the year, which started at 7 p.m. Last year, the committee did not meet at all, a point of complaint made by committee member Stephen Kunselman (Ward 3) at a recent council meeting.

Alan Panter of the accounting firm Abraham & Gaffney, P.C. presented the audit committee with an overview of his findings for fiscal year 2011, which were summarized in the report as “an unqualified (‘clean’) opinion on the City of Ann Arbor financial statements for the year ended June 30, 2011.”

One finding that was not deemed a “material weakness” – but was nonetheless described as a “significant” deficiency in internal controls – involved adequate documentation of employee purchase card (P-Card) use. It’s an issue familiar to the city from previous audits.

In terms of the overall financial state of the city, as reflected in the audited numbers, the city added around $127,000 to its general fund balance.

That’s significant, because the city council-approved FY 2011 budget had anticipated drawing around $1.5 million from the fund balance reserve to help cover about $81.5 million in planned general fund expenditures. So on balance, the city appears to have done at least $1.6 million better than it had planned for FY 2011. No single factor was identified during the audit committee’s discussion to account for the better performance.

At the end of FY 2011, the city’s fund balance reserves stood at around 13.6% of expenditures – which is within the range of 12-15% that Panter said was recommended.

The audit committee’s discussion included the fact that the city’s audit is required by the city charter to be completed by Sept. 30 each year – within 90 days of the end of the fiscal year. This year’s audit was not completed until Dec. 9. Based on discussion among the audit committee members and accounting services manager Karen Lancaster, missing the charter’s deadline has become routine. Lancaster indicated that the first year she’d worked for the city, in the early 1990s, that deadline had been met.

In order for the city’s overall audit to be completed, the audits from the component units have to be done first. Lancaster attributed at least part of the now-routine delay to the fact that two such units – the Ann Arbor Downtown Development Authority and the city employees’ retirement system – have their own accounting staff. That was not the case when she first began working for the city. Because the auditor first works with those separate staff to complete their individual audits, the overall process is slower than it might otherwise be, she said.

The audit committee voted to recommend acceptance of the auditor’s report.

Based on its responsibilities described in the 2006 council resolution creating the committee, next up for committee members in 2012 will be working to come up with a recommendation on the selection of an auditing firm – the contract with Abraham & Gaffney expires with this year’s audit.

FY 2011 Audit

The main business of the committee’s meeting was to receive a presentation from the city’s auditor on the report for this year.

FY 2011 Audit: Introduction

Small talk near the start of the meeting included a quip by Abraham & Gaffney’s Alan Panter that he feared most of his work winds up in someone’s drawer. Stephen Kunselman (Ward 3) indicated he stored the past years’ audit reports in milk crates in his basement.

Panter noted that the committee had been given the comprehensive annual financial report (CAFR) as well as the “single audit,” which includes federal program testing. He told the committee that the process had gone very well. He thanked accounting services manager Karen Lancaster and her staff for their help and assistance during the audit. Panter said the city was well prepared when he arrived.

Panter said he’d spent a total of four weeks on site. He’d spent time at the Ann Arbor Downtown Development Authority, with the city’s employees’ retirement system, and with the 15th District Court. On Dec. 9, he said, the audit was finalized. He called that a typical schedule. The procedures started back in May, he said, and he returned in September. He’d finished in December.

FY 2011 Audit: Working Through the CAFR

Panter pointed committee members to page 8 of the CAFR – the independent auditor’s report. He highlighted the fact that the point of the audit is not to detect fraud – it’s an opinion on the city’s financial statements. He noted that the opinion he’d given the city was “unqualified,” which means a “clean” opinion. That’s the best you can get, he noted.

A clean opinion, Panter said, means in part is that the city’s books are formatted correctly according to the governmental accounting standards board (GASB). Also, Panter said, “the numbers are good,” which means they are “materially correct.” Panter pointed the committee to page 10 of the CAFR – management’s discussion and analysis. This is the part the city compiles – a plain English discussion. Panter encouraged people to read it.

Panter then pointed to page 24 of the CAFR – governmental funds balance sheet. That’s a snapshot as of June 30, 2011 of the city’s assets, liabilities and fund balances, he said. The major funds are shown – the general fund, capital funds, and special revenue funds. The “business type activities” are not included in that page.

FY 2011 Audit: Fund Balance

Focusing on the general fund, Panter noted its unassigned fund balance of $10.5 million. As a percentage of total expenditures, that’s 13.6%, he said. Panter said that the recommended “sweet spot” is 12-15%. Sandi Smith (Ward 1) asked if that range was an absolute minimum or was more like what is “acceptable.” Panter indicated that it depends on your outlook on the future, as well as economic and political factors. In some cases, he said, an organization might be building a fund balance for a capital project, for example.

Lancaster indicated that the city’s policy is to maintain a fund balance reserve of 8-12%. Panter responded to the lower range cited by Lancaster, saying that he recommended a little more, because local governments are currently under revenue pressure, due to declines in property taxes and state shared revenue.

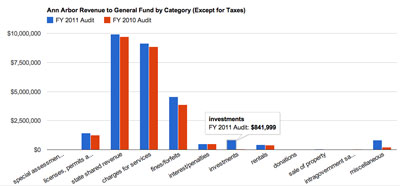

The bottom line for the general fund for the year, Panter said, is that $127,667 was added to the fund balance over the course of the year. The general fund had around $76.7 million in total revenues, which is about $600,000 more than last year. Some categories went up, while some went down, he said. Property taxes went down $2.2 million, but that was made up partly through state shared revenue, parking payments, as well as investment income, he said. [For FY 2010, the city's CAFR shows $51,215,295 of property tax revenue to the general fund, which dropped to $49,019,013 in FY 2011.]

Blue bars show FY 2011 audited figures and red bars show FY 2010 audited figures. Despite a $2.2 million drop in property tax revenue, total revenue to Ann Arbor’s general fund increased by around $600,000. In nearly every other revenue category, there were marked increases, most notably in investment income, from $47,994 in FY 2010 to $841,999. The “miscellaneous” category grew from $210,822 in FY 2010 to $835,982 in FY 2011. (Chart by The Chronicle)

The $127,667 mentioned by Panter is the difference between $13,454,777 (the general fund balance as restated at the end start of FY 2011 on July 1, 2010 to reflect the closure of the city’s economic development fund) and $13,582,444 (the general fund balance on June 30, 2011). The $10.5 million figure cited by Panter as “unassigned” is the portion of the general fund balance that “may be used to meet the government’s ongoing obligations to citizens and creditors.”

In addition to “unassigned,” the new fund balance policy adopted by the city council on June 20, 2011 to conform with the latest GASB guidelines includes the following categories of funds: (1) non-spendable – not in spendable form or legally/contractually unable to be spent; (2) restricted – constraints on funds placed by creditors or through enabling legislation; (3) committed – specific constraints placed on use of funds by the city council (for example, funds set aside by council resolution); and (4) assigned – constrained by the intent of the city, but not restricted or committed (for example, those funds to which authority for assignment is given to the chief financial officer).

At the audit committee meeting, Lancaster noted that the city had planned to use more than $1 million from the general fund balance reserve in FY 2011, so to add more than $100,000 is better than the city thought it would do.

By way of background, the FY 2011 budget was approved by the council in May 2010. The proposed budget from the administrator included a planned use of fund balance of around $1.5 million. Through a series of budget amendments made by the city council, revenue was added (boosted notably by a $2 million payment from the Ann Arbor Downtown Development Authority and more optimistic revenues for state shared revenue and parking fines) along with additional expenditures. The effect was that the amended revenues essentially matched amended expenditures, leaving intact the plan to tap the fund balance reserve for around $1.5 million.

PROPOSED FY 2011 ANN ARBOR BUDGET

-$1,532,012 initially proposed impact on fund balance

ADDITIONAL REVENUE ADDED THROUGH COUNCIL AMENDMENTS

$2,000,000 DDA payment

$952,000 more optimistic state shared revenue

$625,000 projected increase parking fines

$62,000 capital expense eliminated for fire department

ADDITIONAL EXPENDITURES ADDED THROUGH COUNCIL AMENDMENT

-$1,585,783 police officer layoffs avoided

-$1,509,620 firefighter layoffs avoided

-$283,000 restored mowing cycles in parks

-$260,000 restored human services

ADOPTED FY 2011 ANN ARBOR BUDGET

-$1,531,415 planned impact on fund balance

-

In the audit report, Sandi Smith zeroed in on $835,000 worth of miscellaneous revenue. Lancaster characterized some of those revenues as reimbursements. Smith wanted examples of those kinds of revenues.

FY 2011: Federal Programs

Panter told the committee that for expenditures by Ann Arbor of federal grants, he’d tested four major programs – a justice assistance program, a transportation grant, a community development block grant, and one involving drinking water funds. There were no findings as a result of his testing, he said. Panter noted that the “strings that come with federal money” is a large focus of what he does.

It’s significant, he said, that Ann Arbor as an auditee qualifies as “low risk” – it’s a designation earned by the city. It means the audits of the federal programs are clean, proper internal controls are in place, and the result of the testing shows that the city is generally aware of and follows the federal requirements. As a result of the “low risk” designation, only 25% of Ann Arbor federal programs are required to be tested.

FY 2011: Significant Deficiency – P-Cards

Panter introduced the one deficiency identified in the audit by first describing a different kind of more severe deficiency, which was not the kind he was reporting. From the single audit:

A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. … We did not identify any deficiencies in internal control over financial reporting that we consider to be material weaknesses, as defined above.

But the other sort of finding, continued Panter, is still a “significant deficiency” – a weakness that’s less significant than a material weakness, but still significant. He noted that the issue has been identified before: documentation associated with the city’s purchasing cards (P-Cards). P-Cards provide a way for city employees to make needed smaller purchases (less than $3,000) without creating a purchase order. At the committee meeting, Lancaster gave as an example the need for a field services employee to buy nails for $4.99 . [For a recent column that includes discussion of P-Cards, see "Culture of Spending: JunketSleuth"]

Panter said generally that some documentation of P-Card expenditures was lacking. Documentation of support and approval was lacking, as was documentation of the business purpose for purchases. Panter said he looked at it in light of the city’s Policy 512. Panter noted that Policy 512 had been developed and adopted based on the fact that the city had been alerted to the problem in the past (as recently as last year). “It’s there again,” he said.

Although the missing documentation eventually had been tracked down for the problematic transactions, the audit report still concludes that the issue is not resolved:

During our analysis of internal controls over the purchasing card process in 2010 we noted that several transactions sampled contained no purchasing card statement listing the details of transactions that occurred during the month. The receipts detailing the purchases and the appropriate business purpose pertaining to these statements were also missing. Credit card payments are made by the City on a monthly basis so the City had paid for these transactions without valid review of the statement or any supporting receipts to authorize the purchase and determine that there was a business purpose for the transaction. Resolution: A similar issue was noted in our current year audit comments. We do not consider this issue resolved.

Sabra Briere (Ward 1) acknowledged that the P-Cards had been an issue previously. [One episode had involved the purchase of plasma screens for use out at the Wheeler Center. More detail can be found in The Chronicle's write up of the budget retreat held at the Wheeler Center in January 2009.]

Lancaster’s subsequent remarks indicated agreement with Sandi Smith (Ward 1), who ventured that the current issue was not “malevolent behavior.” The previous [plasma screen] issue had been a case of willful circumvention of the policy, Lancaster said. In that case, Lancaster said, the only word to describe it was “appalling.” [Employees had apparently pooled cards together to overcome the $3,000 limit.]

Lancaster reported that the city’s CFO, Tom Crawford, has now assigned a person to go through every statement and look for missing signatures and make sure all the documentation gets turned in. Crawford had hoped that it would not have been necessary to assign someone to babysit the process, but that turned out not to be the case.

To illustrate the nature of the problem, Lancaster gave an example of a park employee who failed to document that a Gordon Food Service charge was for a day camp at the park – so the business purpose for the expenditure was not documented. From the employee’s perspective, it was self-evident that the charge was for the day camp.

Briere acknowledged that when she’d inquired last year about charges to P-Cards involving charges to local lodging establishments, Lancaster had eventually been able to produce the receipts and to account for the charges. Some of the local lodging charges were for people who had to be relocated temporarily by the office of community development to complete mold removal in their dwellings. Other charges were related to lodging snow plow drivers overnight, so that they could be more easily available for their plowing shift when an extraordinarily heavy snowfall was forecast.

Responding to a question from Stephen Kunselman (Ward 3) about the idea of using P-Cards as opposed to purchase orders, Lancaster explained that for very small purchases, the cost of processing the transaction exceeded the dollar amount of the transaction – if the city were to use purchase orders. She noted that the total number of transactions on P-Cards makes up 10% of accounts payable transactions, but is only a fraction of a percent of the dollar value.

[Part of the audit committee's responsibility is to oversee the auditor's recommendations, including those on P-Card documentation.]

Outcome: The committee voted to recommend acceptance of the audit report.

Audit Committee

Just after the November elections, the city council establishes several subcommittees for the next year. [.pdf of 2012 committee appointments] This year’s edition of the five-member audit committee is: Sabra Briere (Ward 1), Sandi Smith (Ward 1), Stephen Kunselman (Ward 3), Margie Teall (Ward 4) and Carsten Hohnke (Ward 5). It’s the same audit committee from last year with the exception of Briere, who is replacing Stephen Rapundalo. Rapundalo lost his Ward 2 election to Jane Lumm.

The council established the audit committee through a resolution passed in 2006. The content of the resolved clause from that 2006 resolution is reflected in the description of the committee in the city’s online Legistar system [emphasis added]:

Purpose: To interview and recommend to the City Council the selection of the auditor, oversee the audit process, and oversee the implementation of the auditor’s recommendations. Special Qualifications for Appointment: Councilmember appointed by the Mayor pursuant to Section 4.2(8) of the City Charter. Meeting Times and Frequency: As needed. Membership / Committee Composition: 5 councilmembers.

Audit Committee: Meetings, Chair

At the council’s Sept. 22, 2011 meeting, during his communications, Stephen Kunselman (Ward 3) raised the question of when the audit committee would meet, noting that in the previous year, the audit committee had not met. In his remarks, he was essentially challenging the decision of the committee’s chair at that time, Stephen Rapundalo, not to call any meetings the previous year. From The Chronicle’s meeting report:

Stephen Kunselman (Ward 3) said he was a member of the audit committee and there had not been a meeting held the previous year, but that he would try to meet with the auditor to discuss the FY 2011 audit this year. [Other members of the council's audit committee include: Carsten Hohnke (Ward 3), Stephen Rapundalo (Ward 2), Sandi Smith (Ward 1) and Margie Teall (Ward 4).]

Rapundalo responded to Kunselman’s point on the audit and the apparent lack of a meeting. He said the decision not to call a meeting of the audit committee was based on the fact that there was little to discuss in the report and that instead, the audit came to the full council, which accepted it and passed it. There was no need to meet, he said. Rapundalo said he was awaiting the FY 2011 audit to see if it merits a meeting of the audit committee or if it can go straight to the full council.

It fell to Rapundalo to call the meeting, because Rapundalo was chair of the committee – but Kunselman had questioned how Rapundalo had been selected as chair, if the committee had not met to select its chair.

Robert’s Rules of Order are supposed to govern the council’s workings, unless Robert’s Rules are in conflict with other explicitly stated council rules. From Robert’s Rules on the issue of committee chairmanship [emphasis added]:

Unless the assembly has appointed a chairman, either directly or through its presiding officer, the first named on a committee, and in his absence the next named member, becomes chairman, and so on and should act as such unless the committee by a majority of its number elects a chairman, which it has the right to do if the assembly has not appointed one, and which a standing committee usually does.

At the audit committee’s Dec. 19 meeting, Teall began to preside over the meeting – she was the most senior member of the committee. Briere asked Teall to pause. Briere noted there’d been some question about how the chair of the committee was determined. There was apparent interest in having an election, she said – and she was willing to elect a chair. In Briere’s remarks, she seemed to indicate that she had no objection to Teall chairing the committee, but rather simply wanted to engage in the deliberate act of electing Teall as chair.

Smith pointed out that Teall had more seniority than any one of them – by three elections. Teall responded to the idea of voting on who would be chair, saying that she was concerned about the precedent that an election would set.

Accounting services manager Karen Lancaster, who was taking minutes for the committee, inquired if the committee members would be voting. Briere indicated she would be content if it was simply explicitly documented that Teall would be chair, based on her seniority on the council.

Consistent with Briere’s preference, the meeting minutes submitted by Lancaster read:

The committee discussed how the chairperson for the Audit Committee was selected. It was agreed that the selection based on Council seniority was appropriate.

As chair, it’s up to Teall to call any future meetings of the audit committee, but any two members of the committee can also call a meeting. From Robert’s Rules:

It is the duty of the chairman to call the committee together, but, if he is absent, or neglects or declines to call a meeting of the committee, it is the duty of the committee to meet on the call of any two of its members.

Although the audit committee dispatched with its main business of the year on Dec. 19 – by voting to recommend that the audit be accepted by the whole council – the committee will likely need to meet again in 2012.

Audit Committee: Selection of Auditor

One of the prescribed duties of the audit committee as reflected in the council’s 2006 resolution establishing the committee is to interview and recommend a selection of the auditor to the council. Abraham & Gaffney’s five-year contract, with a one-year extension, was approved by the council in April 2006.

With the one-year extension, the city of Ann Arbor’s contract with Abraham & Gaffney expires after this year’s audit. That means that the audit committee will need to interview and recommend an auditor.

This year, the city paid the auditing firm a total of $42,100 through Nov. 17.

Timely Completion of Audit

The remarks Stephen Kunselman made at the council’s Sept. 22, 2011 meeting – asking if the audit committee would meet – were timed to a deadline set by the city’s charter for completion of the audit. Ninety days after the close of the fiscal year translates to Sept. 30. From the city of Ann Arbor’s charter [emphasis added]:

Independent Audit SECTION 8.15. An independent audit shall be made of all accounts of the City at least annually, and more frequently if the Council deems it necessary. The annual audit shall be made by certified public accountants employed by the Council and shall be completed within ninety days following the close of the fiscal year. The audit shall be made public in such manner as the Council may determine.

Timely Completion: Component Units

At the audit committee’s Dec. 19 meeting, Kunselman again questioned why the audit had not been completed until Dec. 9 – well after the 90-day deadline. Accounting services manager Karen Lancaster indicated that the city typically does not meet that deadline. It had been met once when she’d first begun working for the city in the early 1990s.

Lancaster identified part of the problem as receiving the other ancillary reports that go into the city’s audit. If all those ancillary reports were turned in by Sept 15, the city could potentially get its audit done by Sept 30, she said – but the city can’t compel component units of its organization to get things done. Kunselman asked Lancaster if one of the component units that couldn’t get its audit completed quickly enough was the Ann Arbor DDA.

Alan Panter of Abraham & Gaffney (which also performs the DDA’s audit) indicated that the schedule had been moved up this year and the DDA’s audit information was released earlier than in the past. Lancaster indicated that a certain skill set is required to provide the information for the audit. She said she previously handled all the component units within one financial system. But because the DDA now has its own financial system, it needs its own audit.

Kunselman asked why the city doesn’t bring the DDA’s accounting and financials back under the city’s financial services. Answered Lancaster: “That’s a political discussion.” She indicated she’d lost that battle previously when the systems were separated years ago. She indicated she was worried that when the accounting for an organization (like the DDA) is handled through a one-person accounting shop, in a “church secretary” approach, there are fewer checks and balances.

Kunselman inquired further about why, years ago, the responsibility for the DDA’s accounting had moved from the city to the DDA’s own staff. Lancaster said the issue had emerged when the DDA did not want to get city council approval for every purchase order. The DDA had said it was its own authority and began handling its accounting separate from the city, Lancaster explained. With the pension system, it was a similar issue, she said. The pension system wanted The Northern Trust Company to do its accounting – there wasn’t one precipitating event. It had been a struggle between the city council and the retirement board, Lancaster said.

Sandi Smith – who serves on the DDA board, as well as the city council – asked Lancaster if she would need more staff in order to re-absorb the accounting services for the DDA and the retirement system. Lancaster indicated she would need at least one more accountant, but the city would charge out the cost of the accounting services to the other funds it would be supporting.

Margie Teall ventured that the city sees the financial statements for the component units anyway, even though the accounting is separate. Lancaster indicated that the city does not see all of the detail. For expenditures that rely on bonds issued by the city, she said, the city does see all the detail, but not necessarily for other items. The retirement system, she said, used to have a director and secretary – now it has a staff of four. Back in the early 1990s, she said, the DDA had a director, Reuben Bergman, and no one else.

Kunselman asked about the problem the DDA’s audit had identified with an expenditure of more money than had been appropriated, noting that the city council adopts the DDA budget along with the rest of the city’s budget. Lancaster indicated that the DDA amends its budget and doesn’t ask for approval. Kunselman asked why not. Lancaster replied that she didn’t know. Kunselman wondered how the DDA can even spend that money. Lancaster indicated that it is because the DDA keeps its own books and has their own bank accounts.

Addressing the overage identified in the DDA’s audit, Abraham & Gaffney’s Alan Panter, who also performed the DDA audit, told Kunselman that as a separately reported component unit, DDA issue is not material to the city’s financial condition. [See Chronicle coverage: "DDA Accepts Audit, Violation Noted"]

Committee members present: Sabra Briere (Ward 1), Sandi Smith (Ward 1), Stephen Kunselman (Ward 3), Margie Teall (Ward 4).

Also present: Accounting services manager Karen Lancaster, city administrator Steve Powers.

Absent: Carsten Hohnke (Ward 5).

Next meeting: TBD