Council Preview: Marijuana, Art, TIF

The Ann Arbor city council’s April 2, 2012 agenda will touch on three areas that have previously generated substantial debate on the council and throughout the community: (1) medical marijuana; (2) funding of public art; and (3) calculation of the tax increment finance (TIF) capture by the Ann Arbor Downtown Development Authority.

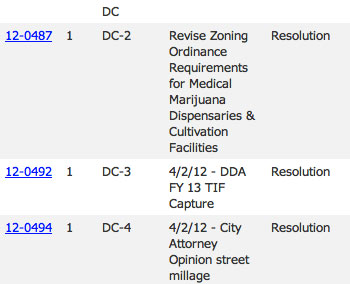

Screen shot excerpt for April 2, 2012 Ann Arbor city council's online agenda. Image links to online agenda.

Medical marijuana is the subject of three different agenda items. The first has previously been postponed twice – at the council’s March 19 and March 5 meetings. It would direct the city attorney to delay enforcement of the Michigan Medical Marijuana Act, as well as the city’s licensing and zoning ordinances (with one exception), until the city council has acted on possible amendments to the city’s local ordinances on medical marijuana.

Amendments to those ordinances, as recommended by the city’s medical marijuana licensing board at its Jan. 31, 2012 meeting, are covered in two other items on the April 2 agenda. One item includes a series of amendments to the licensing ordinance, which in part help clarify the role of city staff, as compared to the licensing board, in the licensing process. The council will be considering the amendments for the first time at the April 2 meeting. If approved, the amendments would require a second and final approval by the council at a subsequent meeting before taking effect.

The other agenda item regarding the city’s ordinances on medical marijuana is not itself a proposed amendment. Instead, the council resolution would give direction to the city planning commission to review the recommended revision to the zoning regulations for medical marijuana businesses. That’s because it’s the purview of the city planning commission to review changes to the zoning code. The planning commission would then forward its recommendation to the city council.

Added to the agenda on Friday were two items that Stephen Kunselman (Ward 3) had announced at the council’s previous meeting, on March 19, that he would be bringing forward. The first is a resolution that would direct the city attorney to prepare a written opinion on the transfer of funds from the street millage fund to the city’s public art fund. It’s a point of contention that has a history going back at least two and a half years. Kunselman’s resolution refers to the context of the fiscal year 2013 budget, which the council will be presented by the city administrator on April 16. The council will need to act on that budget by the end of May.

Another item on the agenda that’s related to public art is the approval of a $150,000 sculpture for the interior of the new municipal center, in the Justice Center building. And finally, the report from the public art commission’s planning retreat, held on Feb. 26, 2012, is attached to the council’s agenda as a communication.

The second item added to the agenda by Kunselman on Friday directs the city staff to analyze the compliance of the Ann Arbor DDA with Chapter 7 of the city’s code, which is the legislation that established the DDA in 1982. Kunselman’s resolution asks for an analysis by Ann Arbor city staff of the DDA’s capture of taxes in its tax increment finance (TIF) district. The DDA is slated on April 9 to present its board-approved FY 2013 budget at a city council working session.

Chapter 7 appears to impose a limit on the amount of TIF capture, based on the rate of growth of property valuation inside the DDA district. Last year, when the relevance of the ordinance was pointed out by city financial staff, the DDA returned over $400,000 to other taxing authorities in the district. The city of Ann Arbor waived its share of over $700,000.

However, the DDA subsequently has contended that the money it reimbursed to other taxing authorities was not required. The DDA claims that Chapter 7 does not impose a limit on TIF capture, but rather addresses how money would be returned to other taxing authorities, if the DDA did not use the money. At stake this year and in future years is several hundred thousand dollars, depending on how the calculations are done. The Ann Arbor District Library, one of the taxing authorities whose taxes are subject to DDA capture, has publicly stated that it has not changed its original legal position – which interprets Chapter 7 as a limit on TIF capture and questions the methodology used by the DDA to calculate the excess.

The April 2 Ann Arbor city council meeting begins at 7 p.m. in city council chambers on the second floor of city hall, located at 301 E. Huron. The meetings are broadcast live on Channel 16 of the Community Television Network. The Channel 16 broadcast is also streamed live on the Internet.

Medical Marijuana

Three different medical marijuana-related items appear on the council’s April 2 agenda.

Medical Marijuana: Background

The Ann Arbor city council enacted two kinds of regulations for medical marijuana businesses last year, at its June 20, 2011 meeting. One piece of legislation established the zoning laws that apply to such businesses – establishing where medical marijuana dispensaries and cultivation facilities could be located. The other piece of legislation established a process for granting licenses to medical marijuana dispensaries. Cultivation facilities are not required to be licensed.

Part of the licensing legislation included the establishment of a five-member licensing board. The board began meeting in the fall of 2011. The board was required to review license applications and make recommendations to the city council for any changes in the medical marijuana ordinances by Jan. 31, 2012. The board met on Jan. 31, 2012 and made recommendations to grant licenses to 10 dispensaries, some of them conditionally. The city council has not yet considered the recommended license awards. The board also agreed at its Jan. 31 meeting on recommendations for specific changes to the city’s licensing and zoning ordinances. [.pdf of medical marijuana licensing board report to the city council]

Throughout the license review process, a certain amount of tension has emerged between the licensing board and city attorney’s office. Among other disputed issues is whether the board has purview over the question of whether an application for a license is complete. The city attorney’s office was also pursuing legal action against at least one dispensary, while its licensing application was being considered by the board.

Medical Marijuana: Tension Between Board, City Attorney

That tension between the medical marijuana licensing board and the city attorney’s office was highlighted in a statement sent by members of the board to city councilmembers on March 2, which reads in part: “[The city attorney's office] has been aggressively trying to shut [dispensaries] down while we actively try to license them.” The statement goes on to point out that a representative from the city attorney’s office had been present at all of the board’s meetings and that the board’s recommendations had been reported to the city council. But after that, the city attorney’s office had sent out new letters to all dispensaries requesting them to provide information about how their business operates. [.pdf of entire statement from Ann Arbor's medical marijuana licensing board to the Ann Arbor city council]

Before sending that letter, the city’s medical marijuana licensing board had met on Feb. 28 in response to concerns raised by several dispensary owners, who had received letters dated Feb. 24 from the city attorney’s office. The letters make specific inquiries into several aspects of the business model of dispensaries – in order to assess whether they are in compliance with the Michigan Medical Marijuana Act. Compliance with the MMMA is a requirement for issuance of a medical marijuana license, and recipients of the letters have license applications pending with the city. Although the legal position of the city attorney appears to be that it’s possible for a dispensary to operate in compliance with the MMMA, no explication of what that model would entail has been set forth publicly.

Among the questions being posed to all dispensaries in the letters is the following: “Does any person or entity deliver marijuana to [Dispensary Name]? If so, does [Dispensary Name] ever pay, donate, or in any way give money to the person or entity who delivers the marijuana or to anyone else? If so, to whom is the money paid, donated, or given and how much?” [.pdf of set of letters]

Medical Marijuana: Agenda Item – Direction to the City Attorney

The resolution on the April 2 agenda directs the city attorney to:

… delay all enforcement activities against medical marijuana dispensaries and cultivation facilities except for claims that they violate Section 5:50.1(3) of the City Code [zoning regulations], until the Council amends or rejects amendments to the zoning and licensing ordinances for medical marijuana.

The part of the city code called out for continued enforcement in the resolution [Section 5:50.1(3)] specifies the zones in the city where medical marijuana businesses may be located. From the code: “Medical marijuana dispensaries shall only be located in a district classified pursuant to this chapter as D, C, or M, or in PUD districts where retail is permitted in the supplemental regulations. Medical marijuana cultivation facilities shall only be located in a district classified pursuant to this chapter as C, M, RE, or ORL.” [.pdf of Section 5:50.1(3)]

The city council resolution on the April 2 agenda was sponsored by Sabra Briere (Ward 1), who is the council’s representative to the medical marijuana licensing board.

The council has twice-previously postponed voting on the resolution giving direction to the city attorney. On March 5, the council did not arrive at the agenda item until after midnight, due to lengthy deliberations on the four-party transit agreement. So on that occasion the council opted to postpone until they were mentally fresher. And on March 19, three of 11 members were absent, and the prevailing sentiment on the council was that postponement would be appropriate, in order to allow those three absent members to vote.

At the March 19 meeting, Briere circulated a possible revision to the resolution. The amended text reads in relevant part:

… delay all enforcement of Medical Marijuana Act and the licensing and zoning ordinances against medical marijuana dispensaries and cultivation facilities that the Licensing Board had recommended for licensing and that the Licensing Board found to be in operation prior to Aug. 5, 2010, except for claims that they violate Section 5:50.1(3) of the City Code …

So the revised version restricts the topic of the resolution to the 10 dispensaries that the licensing board recommended for licenses, and even further to just those of the 10 that the board found to be in operation prior to Aug. 5, 2010. That was the date when the city council imposed a moratorium on additional dispensaries or cultivation facilities in the city. Of the 10 dispensaries that were recommended for licenses, the Medical Grass Station, on West Liberty, was found to have started operation after the Aug. 5, 2010 moratorium.

The resolution directing the city attorney on enforcement actions ties the duration of the direction to the time at which the council acts on recommendations for amendments to the city’s medical marijuana ordinances. The resolution stipulates that the council act by June 18, 2012.

Medical Marijuana: Agenda Item – Licensing Ordinance Revision

Also appearing on the agenda for the April 2 meeting are revisions to the medical marijuana licensing ordinance suggested by the city’s licensing board. [.pdf of recommended revisions]

The revisions are covered in somewhat more detail in The Chronicle’s coverage of the licensing board’s Jan. 31, 2012 meeting. Representative of the revisions are the following changes, which make explicit that the role of city staff in determining completeness of applications be struck from two places in the ordinance [added language in italics; deleted language with strike-through]:

7:504 (4) Following official confirmation by staff that the applicant has submitted a complete application City Council approval of the issuance of a license, a new license shall not be issued to a medical marijuana dispensary until the applicant for the license complies with all of the following requirements…

7:505. If the applicant has successfully demonstrated compliance with all requirements for issuance of a license within 10 weeks (70 calendar days) after the date of City staff’s official confirmation that the application for a license was complete City Council’s approval of a license, the city administrator or designee shall grant renewal of an existing or issue a new license…

It’s possible that the changes will generate little discussion by councilmembers on April 2, because the changes, even if unanimously approved on April 2, will still need to receive a second and final approval by the council after a public hearing at a subsequent meeting.

Medical Marijuana: Agenda Item – Zoning Ordinance Revision

The zoning ordinance revision recommended by the medical marijuana licensing board is not being considered by the city council on April 2. Because zoning is the purview of the city planning commission, the council is considering a resolution directing the city planning commission to review the licensing board’s recommended change.

The one recommended change is to strike the following sentence: “Medical marijuana dispensaries and medical marijuana cultivation facilities shall be operated in compliance with the MMMA (Michigan Medical Marijuana Act).” [.pdf of the recommended zoning ordinance change]

The board’s recommendations on the award of the 10 licenses is not on the April 2 agenda.

Public Art Ordinance

The Ann Arbor city council enacted an ordinance in 2007 that sets forth funding requirements for public art in the city. It stipulates that all capital projects in the city set aside 1% of their budgets for public art, with a limit of $250,000 per capital project.

The nature of the funding mechanism – capital budgets – puts constraints on the type of project that can be funded as public art under the Percent for Art program. For example, the work of art must be permanent. The ordinance has faced criticism based on the fact that it appears to take funds designated and approved by voters or rate payers for one purpose (for example, repairing streets or providing a stormwater system) and to re-appropriate those funds for a different purpose (public art).

Ann Arbor’s city attorney, Stephen Postema, has to date resisted individual requests to produce a legal analysis of the city’s public art ordinance in the form of written opinion, which by city charter must be filed with the city clerk’s office and made public. But because the city attorney is, according to the city charter, under the direct supervision of the city council, he would be required to produce such an opinion if directed to do so by the city council.

That’s the direction that Kunselman’s resolution would give. In relevant part:

RESOLVED, City Council directs the City Attorney to provide a written opinion on the legality of transferring funds from the “street millage” fund to the “public art” fund as proposed in the FY 13 draft budget; and

RESOLVED, The City Attorney shall provide the written opinion to City Council by Monday, April 16, 2012; and

RESOLVED, The City Attorney shall file said written opinion with the Clerk in accordance with the City Charter.

[.pdf of complete resolution on city attorney opinion on public art]

Public Art Ordinance: Timeline

By way of additional background, the public art ordinance has been somewhat controversial since its approval in 2007.

- 33,000 BCE: Dude in cave draws on the wall.

- 2007-Nov-05: City council gives final approval to Percent for Art ordinance. [.pdf of ordinance text as approved on Nov. 5, 2007]

- 2009-Feb-01: At Sunday night council caucus, Marcia Higgins (Ward 4) expresses concern about the amount of money accumulating in the public art fund. Christopher Taylor (Ward 3) ventures that a Half-Percent for Art Program doesn’t have the same ring as the Percent for Art program.

- 2009-Nov-16: Through an attachment of a communication to the city council’s agenda, Stephen Kunselman (Ward 3) requests a written opinion from the city attorney on the legal basis of the public art ordinance. See Chronicle coverage: “Getting Smarter About City Charter“

- 2009-Dec-07: At the council’s meeting, Stephen Kunselman (Ward 3) expresses dissatisfaction that no city attorney opinion analyzing the legal basis for the public art program has been made public, and contends that the opinion is required to be made public in accordance with a city charter provision. (The city attorney asserted attorney-client privilege in responding to Kunselman’s Nov. 16, 2009 request.)

- 2009-Dec-07: Ann Arbor city council gives initial approval to a change in the city’s Percent for Art ordinance, reducing the amount allocated from capital project budgets from 1% to 0.5%.

- 2009-Dec-21: Ann Arbor city council decides to reject final approval to reducing the Percent for Art allocation from 1% to 0.5%.

- 2011-May-31: Marcia Higgins (Ward 4) proposes a budget amendment directing the city attorney to prepare a revision to the city’s public art ordinance, that would reduce the percentage of all capital projects designated to support public art – from 1% to 0.5%. The amendment fails.

- 2011-Aug-04: Mayor John Hieftje nominates Tony Derezinski (Ward 2) to serve on the public art commission, replacing Jeff Meyers, who resigned in June 2011. Derezinski is the first councilmember appointed to the commission. Hieftje indicates he’d like to review the city’s public art ordinance in September. Hieftje thus heads off council deliberations at that meeting about incorporating restrictions on the use of the city’s street millage for public art. The street millage was approved for the November ballot at the same meeting. The street millage easily passed.

- 2011-Sep-06: Stephen Kunselman (Ward 3), during communications time, points to a Tuscola County document that assures voters on a potential millage that funds for that millage could not be transfered out of the millage fund to be used for some other purpose. He questions how Ann Arbor’s public art ordinance conforms with that principle.

- 2011-Sep-19: Ann Arbor city council postpones public art ordinance amendements to Nov. 21, 2011. At the meeting, Carsten Hohnke (Ward 5) challenges Stephen Kunselman (Ward 3) to bring forward a resolution directing the city attorney to produce a public opinion on the legal basis for the the Percent for Art program. Kunselman indicates it should be a supporter of the program who would bring such a resolution forward.

- 2011-Nov-21: Ann Arbor city council gives initial approval to ordinance revision that would, among other things, reduce the funding level of the Percent for Art program from 1% to 0.5%.

- 2011-Dec-5: Ann Arbor city council votes to maintain funding level at 1%, but does agree to explicitly eliminate the general fund from use in the public art program. Another revision to the Percent for Art ordinance that did survive was an exclusion of sidewalk repair from the definition of capital projects that trigger the Percent for Art ordinance.

- 2012-Mar-19: At the city council’s meeting, during communications time, Stephen Kunselman (Ward 3) announces he’ll be bringing forward a resolution at the next meeting requesting an opinion from the city attorney on the transfer of street millage money to the public art fund.

TIF Capture

Another item added to the agenda on Friday by Stephen Kunselman (Ward 3) involves an issue that has lingered unresolved for almost a year. Last year, on May 2, 2011, the Ann Arbor Downtown Development Authority was set to ratify its side of a new agreement with the city of Ann Arbor under which the DDA would continue to manage the public parking system.

At the May 2 board meeting, however, it was announced that the vote would be postponed, in light of a previously overlooked detail of the ordinance that governs the tax increment finance (TIF) capture inside the DDA district. The ordinance (Chapter 7) appears to indicate a clear limit on the taxes that the DDA can capture from the taxing authorities in its district. The DDA postponed that vote, but eventually ratified the contract and reimbursed taxing authorities in its district for $473,000 in excess TIF that had been captured since 2003. Those taxing authorities include the Ann Arbor District Library, Washtenaw County and Washtenaw Community College. The city of Ann Arbor was due to be reimbursed for $712,000, but the city council waived that amount.

Subsequently, the DDA reversed its legal position and currently claims that Chapter 7 does not indicate a clear limit on its TIF capture.

Before taking a look at what the ordinance says, here is some brief background on how TIF works in general.

TIF Capture: Brief Background

A tax increment finance (TIF) district is a mechanism for “capturing” certain property taxes to be used in a specific geographic district – taxes that would otherwise be received by the entity with the authority to levy the taxes. So in the DDA’s TIF district, the DDA doesn’t levy taxes directly. Rather, a portion of the property taxes that would otherwise be collected by taxing units (like the library, community college and the county) is instead used by the Ann Arbor DDA for improvements within a specific geographic district, covering about 66 city blocks downtown.

What is the portion of the property taxes that is captured by the DDA? The captured tax is only that which applies to the difference between (1) the baseline value of the property when the district was first formed, and (2) the value of the property after new construction or improvements to the property. That difference is the “increment” in “tax increment finance.” Subsequent appreciation of property value due to inflation, after it’s been constructed or improved, is not included in the Ann Arbor DDA’s TIF capture.

TIF Capture: What the Ordinance Says

Chapter 7 of the city of Ann Arbor’s city code lays out how the tax capture of the Ann Arbor DDA is limited, or capped. The mechanism used to cap the amount of tax that can be captured by the Ann Arbor DDA is the projected value of the increment in the TIF district, as laid out in the TIF plan – a required document under the state enabling legislation for DDAs (Act 197 of 1975). From Chapter 7 [emphasis added]:

If the captured assessed valuation derived from new construction, and increase in value of property newly constructed or existing property improved subsequent thereto, grows at a rate faster than that anticipated in the tax increment plan, at least 50% of such additional amounts shall be divided among the taxing units in relation to their proportion of the current tax levies. If the captured assessed valuation derived from new construction grows at a rate of over twice that anticipated in the plan, all of such excess amounts over twice that anticipated shall be divided among the taxing units. Only after approval of the governmental units may these restrictions be removed. [.pdf of Ann Arbor city ordinance establishing the DDA]

The TIF plan includes a table that lays out the projected valuation of the increment in the district, starting in 2003. The table includes three scenarios for the projected valuation: “realistic,” “optimistic” and “pessimistic.” They’re each based on a constant percentage increase each year. So the three different scenarios are generated from three different estimates of the percentage increase each year. [.pdf of DDA TIF plan appendix]

TIF Capture: What Kunselman’s Resolution Says

Kunselman’s resolution does not acknowledge the DDA’s current legal position that Chapter 7 is inapplicable, but implicitly challenges that position by assuming Chapter 7 is applicable and asking for an analysis of the calculations. Among the issues that factor into the calculation are: (1) Does Chapter 7 involve real property only, or does it include personal property? (2) Which set of projections in the DDA TIF plan should be the baseline for the Chapter 7 calculation – the optimistic, pessimistic or realistic projections? (3) For Chapter 7 purposes, should the rate of increase be calculated year-to-year or cumulatively?

Depending on how the calculations are done, it could result in the DDA capturing several hundred thousand dollars less taxes each year in the future. For a look at the tax arithmetic, see previous Chronicle op-eds: “Column: Tax Capture Is a Varsity Sport” and “Column: Taxing Math Needs a Closer Look.”

In relevant part, here’s what Kunselman’s resolution says [.pdf of complete resolution on TIF capture]:

RESOLVED, Council directs city staff to review, analyze, and report on the compliance of the DDA provided TIF calculation and capture amount for the FY13 budget in accordance with the DDA development and financing plan, State law, and local ordinance; and

RESOLVED, city staff shall provide to Council an example of a TIF calculation and capture amount using the same methodology that resulted in the return of excess TIF funds to the taxing authorities in 2011 by the DDA; and

RESOLVED, city staff shall provide the example TIF calculation and capture amount and the report on the compliance of the DDA TIF calculation and capture amount in accordance with the DDA development and financing plan, State law, and local ordinance to Council by Monday, April 9th.

TIF Capture: Timeline Overview of Excess TIF Issue

- 2011-Apr-28: City of Ann Arbor chief financial officer Tom Crawford steps in as interim city administrator in the wake of Roger Fraser’s departure.

- 2011-Apr-29: City financial staff notice the implications for TIF capture that are written into the city’s 1982 ordinance which established the DDA. The timing of the discovery was reported by mayor John Hieftje at the DDA board’s May 2 meeting. In summary strokes, the ordinance provides that if the rate of growth in taxable value is more than what was anticipated in the TIF plan, then the DDA would capture only half of the increment on that additional value.

- 2011-May-02 (noon): The Ann Arbor DDA board was expected to ratify its side of the contract with the city of Ann Arbor under which it would continue management of the city’s parking system. Instead, it was announced that the board would be tabling the vote on the parking contract pending a closer review of the excess TIF capture issue.

- 2011-May-02 (7 p.m.): Ann Arbor city council strikes the city-DDA parking contract approval from its agenda.

- 2011-May-16: Ann Arbor city council begins its second meeting in May, at which it must approve the FY 2012 budget. The council does not vote on the budget, but recesses the meeting until May 23.

- 2011-May-20: At a special meeting, the Ann Arbor DDA board approves a parking contract with the city of Ann Arbor that provides 17% of gross parking revenue to the city of Ann Arbor. The approved contract includes a provision that the city of Ann Arbor will backstop the DDA’s financial position if the DDA’s fund balance falls below $1 million.

- 2011-May-20: At the same meeting, the Ann Arbor DDA board votes to affirm the excess TIF calculations raised at the May 2 meeting. The DDA calculates that a total of $1,185,132 should be returned to taxing authorities that levy property taxes in the downtown district. The city of Ann Arbor’s share of that is $711,767, with the remaining money owed to the Ann Arbor District Library, Washtenaw County and Washtenaw Community College. The method of calculation is “year-to-year” not cumulative, and is based on the “optimistic” projections in the DDA’s TIF plan.

- 2011-May-23: City council convenes the continuation of its May 16 meeting, but immediately recesses, likely in order to prevent any discussion of a proposal from Stephen Kunselman (Ward 3) to return responsibility for the public parking system from the DDA to the city of Ann Arbor’s public services area.

- 2011-May-25: “Mutually beneficial” committees from the city council and the DDA board meet and finalize language on fund balance underwriting and required consultation with the city council on rate changes in the proposed parking agreement.

- 2011-May-31: Ann Arbor city council votes to waive the $711,767 in excess TIF capture that the DDA calculated it owed to the city of Ann Arbor.

- 2011-May-31: At the same meeting, the Ann Arbor city council ratifies the city-DDA parking contract, which provides 17% of gross parking revenue to the city of Ann Arbor. The approved contract includes a provision that the city will backstop the DDA’s financial position if the DDA’s combined fund balance falls below $1 million.

- 2011-Jul-27: At a special meeting, the DDA convenes in closed session and emerges to approve a resolution that reverses its previous position on excess TIF capture. Now the DDA contends that the local ordinance doesn’t actually place a limit on its TIF capture.

- 2011-Aug-15: Ann Arbor District Library board holds closed session as part of its regular meeting to review the written legal opinion of its legal counsel with respect to the excess TIF capture. AADL board director Josie Parker indicates that the AADL will ask its legal counsel, Hooper Hathaway, to prepare a response to the DDA’s new position on the interpretation of the ordinance.

- 2011-Nov-02: Ann Arbor DDA holds a closed session to review the written opinion of its legal counsel on the issue of excess TIF capture.

- 2011-Dec-07: Ann Arbor DDA holds a closed session to review the written opinion of its legal counsel on the issue of excess TIF capture.

- 2012-Mar-19: Ann Arbor District Library director Josie Parker tells The Chronicle that AADL is not pressing the matter of the excess TIF, but is open to a conversation with the DDA.

- 2012-Mar-19: Stephen Kunselman (Ward 3) announces he’ll be bringing forward a resolution to address the issue of excess TIF capture. Kunselman has not consulted with AADL on the issue.

- 2012-Mar-21: During a budget update at the Washtenaw County board of commissioners meeting, the $348,000 received by Washtenaw County from the DDA in TIF reimbursement is presented as one of several factors contributing to the better-than-expected financial condition for the county.

April 2, 2012 Council Meeting

The Ann Arbor city council’s agenda includes a range of other business items as well. Each agenda is published online on the Wednesday before the council’s Monday meetings, using the city’s Legistar system.

The April 2 council meeting begins at 7 p.m. in city council chambers on the second floor of city hall, located at 301 E. Huron. The meetings are broadcast live on Channel 16 of the Community Television Network. The Channel 16 broadcast is also streamed live on the Internet.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor city council. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!