Debate Details: Ann Arbor FY 2013 Budget

Ann Arbor city council meeting (May 21, 2012) Part 2: The council approved the city’s fiscal year 2013 budget – with disagreement about what priorities it reflected.

Tony Derezinski (Ward 2) looks on as Jane Lumm (Ward 2) pleads her case for increased police staffing levels. Though Derezinski had little sympathy for Lumm’s amendment on police officers, he joined her in supporting a budget amendment to restore collection of loose leaves in the fall as a city service. The city now collects leaves and compost in containers instead of allowing residents to sweep piles of leaves into the street. The amendment failed. (Photos by the writer.)

The cumulative impact of the amendments approved by the council on May 21 increased general fund expenditures to $79,070,842 against revenues of $79,193,112, for a surplus of $122,270. The entire city budget, across all funds, was proposed at $404,900,312 in revenues against $382,172,603 in expenses. The fiscal year begins on July 1.

Jane Lumm (Ward 2) saw two of her proposed amendments fail – which would have funded five additional police officers from non-specific reductions in other general fund departments, and would have restored the service of loose leaf collection in the fall. She also opposed the addition of a court secretary position for the 15th District Court, which the rest of her colleagues agreed to add into the budget that evening. That combination prompted her to vote against the overall budget, saying it did not adequately prioritize public safety. She was joined by Mike Anglin (Ward 5) in voting against the budget.

But Mayor John Hieftje summarized the majority view on the council in framing this year’s budget as a reflection of public safety as a top priority of the city – because nearly half of the general fund is being spent on public safety, and the vast bulk of additional revenue for FY 2013 (compared to the forecast in last year’s budget planning) is being spent on public safety. Those investments in public safety prevented further reduction in budgeted firefighters (by five) and in police officers (by nine) – reductions that were originally called for in the two-year budget plan. Those investments also allowed the city to add one police officer.

However, former police chief Barnett Jones and current fire chief Chuck Hubbard have identified ideal targets for staffing levels for their departments that are higher than the budgeted levels for FY 2013. For the fire department, that’s 82 firefighters compared to Hubbard’s ideal 88; for police, that’s 119 sworn officers compared to Jones’ ideal 150. The point of disagreement on the council essentially reduced to this: Should the city take additional steps this year to reduce the gap in public safety staffing between current levels and the ideal targets?

One resolution approved at the meeting – which did not actually modify the budget – simply directed the city administrator to bring a future mid-year budget amendment to add up to six firefighters to the budget – if a federal grant and increased state fire protection allocations materialize. Although it would have been conceivable to pass a parallel resolution on the police side of public safety, there was no effort at the table (by Lumm or other councilmembers) to modify Lumm’s resolution and stipulate that additional police officers would be hired, if a federal grant application were successful.

Voting for the budget were eight councilmembers, including Stephen Kunselman (Ward 3), who saw two of his own amendments fail. One would have interpreted the city ordinance on DDA TIF capture differently, which would have resulted in additional revenue to the city’s general fund – revenue sufficient to fund two firefighter positions. Also failing was an amendment that would have prevented the transfer of money to the public art fund from a variety of different sources. [The 8-2 overall budget vote on the 11-member council was due to the absence of Marcia Higgins (Ward 4) for the final vote. She attended the meeting and stayed for the better part of it, but succumbed to a persistent hacking cough before it ended.]

Although several amendments failed, others were approved by the council. Those included budget modifications that added a secretary position to the 15th District Court, increased human services funding by $46,899, added $78,000 to the Ann Arbor Housing Commission budget, and eliminated a contract with RecycleBank to administer a coupon program to encourage recycling.

The council’s budget discussion came in the context of a briefing from the city’s paid lobbyist in Lansing, Kirk Profit, who sketched an uncertain state budget picture, but offered compliments to the city’s approach to managing its budget.

Box-score style results on the budget amendments were previously covered in a report filed from the city council chambers on the night of the vote. Below we’ve summarized the deliberations by the council on the budget amendments. Items not related to the FY 2013 budget are detailed in Part 1 of this meeting report: “City Council Expands North Main Task Force.”

Background Concepts

The budget deliberations by councilmembers depended in part on some basic budget-specific notions. They include the idea of recurring versus non-recurring expenses and revenues, as well as the idea of “reduction targets.”

Background Concepts: Recurring versus Non-recurring

Councilmembers invoked the idea of recurring versus non-recurring revenue or expenses in arguing for and against different amendments.

A simple example of recurring revenue is money from taxes – the city levies taxes every year in a recurrent way. The exact amount might vary based on the economy, but the city’s tax levy will reliably generate money in a way that can be reasonably estimated each year into the future. A simple example of a recurring expense is an employee’s salary. When the city hires someone to do a job – like arrest criminals, or put out fires, or review proposed new buildings – our basic expectation is that we’ll have a recurring need to pay that person’s salary each year.

A simple example of non-recurring revenue is proceeds from the sale of land. When the city receives a $90,000 payment from the Ann Arbor Transportation Authority for a strip of land in downtown Ann Arbor, the city cannot reliably expect every year in the future that it will have an available strip of land it can sell and that someone actually wants to buy for $90,000. On the expense side, an example of a non-recurring item would be a payment made to induce a police officer to retire earlier than that officer would have otherwise retired. The following year, that payment would not need to recur – because the employee has already retired.

Background Concepts: Reduction Targets

During deliberations, Jane Lumm (Ward 2) identified departments for further cuts, based on failure to achieve their reduction targets. How are reduction targets developed?

At a Jan. 31, 2011 city council work session, Tom Crawford, the city’s CFO, explained this concept to councilmembers as a stepwise process:

- Assume the same activities will be maintained next year at the same level they exist this year [staffing levels will remain the same; the same services will be provided; etc.].

- Project to next year how much it will cost to maintain that same level of activity. [If the cost of electricity is expected to increase by 10%, that's calculated in; if union contracts stipulate that there's a 1.5% salary increase, that's calculated in.]

- Compare next year’s projected cost with next year’s projected revenue. If cost exceeds revenue, that defines the percentage reduction the organization needs to achieve as a whole.

So it’s not a matter of looking at expenses last year and cutting that number by some percentage.

Budget reduction targets for each department and the amounts achieved toward meeting those targets are laid out in budget impact statements. [.pdf of budget impact statements]

Budget reduction targets factored into the first of several amendments, which are presented below in the order in which they were discussed.

Amendment: Court Secretary for 15th District Court

An amendment to add $76,193 to the 15th District Court budget in order to add a court secretary position was put forward by Christopher Taylor (Ward 3).

By way of brief background, Michigan’s district courts handle all civil claims up to $25,000, including small claims, landlord-tenant disputes, land contract disputes, and civil infractions. District court judges emphasize that their workload also includes preliminary exams for the circuit courts, as well as their own dockets. Washtenaw County has three district courts – 15th District Court for the city of Ann Arbor, 14B District Court for Ypsilanti Township, and the 14A District Court (with four physical venues) for the rest of Washtenaw County.

The state of Michigan pays salaries of district court judges, provided those salaries meet the guidelines set forth by the state. The city of Ann Arbor bears other costs for the 15th District Court.

The rationale for the added position was that it restored a job that had been eliminated when it was uncertain whether Gov. Rick Snyder would appoint a replacement for judge Julie Creal, who resigned in 2011. Joe Burke was eventually appointed on Feb. 15, 2012 to replace her. The argument for adding the position was essentially that Burke needs the support staff.

Taylor introduced the amendment and its rationale. Jane Lumm (Ward 2) noted that the 15th District Court had a reduction target this year of $94,617, but instead showed an increase of $40,783. With the additional court secretary position, Lumm said, the 15th District Court was around $212,000 over its reduction target. On that basis, Lumm indicated she would not support adding money to the court’s budget.

Sabra Briere (Ward 1) offered a perspective based not on the specific situation of the 15th District Court, but of courts more generally. She told her colleagues that as one of the other courts has lost staff members, it doesn’t affect the judges, as much as it impacts the people who come seeking services. Plaintiffs and defendants need to understand what’s going on, she said, which is part of the function of a court secretary. Her own reflex, Briere said, was not to support the addition to the court’s budget. But she felt that was a punitive rather than a reasonable response. When people come seeking assistance from the court, the city council needs to give the court the ability to provide that assistance.

Stephen Kunselman (Ward 3), responding to remarks by Briere and Lumm, characterized both of their sentiments as well-spoken. He said he found himself torn. He was under the impression that the number of court cases is declining. He wondered about the possibility that court secretaries could serve more than one judge each. He wondered if it were possible to fund the position in years ahead. [The amendment proposed simply to tap the general fund surplus anticipated this year, as opposed to identifying some additional recurring revenue.] Kunselman wished for more information about case loads in the court.

Keith Zeisloft, administrator for the 15th District Court, was asked to address the question of declining work load. He distinguished between citations and other kinds of work load definitions. Traffic citations, he allowed, have declined over the last several years from around 30,000 to 20,000. However, he noted that those are cases that are typically paid “across the counter.” A few are contested, he said, but predominantly they are paid in person or online. There’s also been a decline in misdemeanors. Zeisloft’s point was that the greatest decline has been in cases that have the least impact on the staff’s workload.

Zeisloft described a decrease in court staffing from 45 employees down to 29 over the last 10 years. He told the council that the court has shrunk its workforce as its case load has gone down. He described current staffing levels as a “skeleton crew.” The specific position that would be added through the budget amendment is a senior court secretary position, he said. But he then described how people in a variety of different positions pitch in to cover work in the court clerk’s office when their own work is done. The bailiff might be tasked for court clerk work, depending on the circumstances. The work is covered by moving people around. He described how the general principle is: If there’s nothing else you need to do for your judge, then go to the clerk’s office. In the event that the city council did not fund the position, he said, the blow is not to the judge, but it will ripple through the entire court.

Lumm followed up by inquiring about missed dockets. Zeisloft indicated that when the court was down one judge [when Creal resigned] the court had tried to be frugal by using a visiting judge frugally. Lumm said her understanding was that there had been missed dockets when the court was fully staffed with three judges. Lumm told Zeisloft the court has missed the savings target by a significant amount. Reduction targets were set for all departments, she said: Why set the target if you’re not going to hit it?

Zeisloft expressed regret that the court had missed the target that had been set. He assured the council that the court had worked over its budget and made every attempt to be as frugal as possible. He reiterated his regret that the court had missed its reduction target.

Outcome: The council amended the FY 2013 budget to add a court secretary position to the 15th District Court on a 10-1 vote, with Jane Lumm (Ward 2) dissenting.

Policy Resolution: Fire Protection

After approving the court secretary position, the next resolution offered by a councilmember did not actually amend the budget, but rather gave a policy directive to the city administrator to hire additional firefighters, but only if funding became available. The amendment came from Margie Teall (Ward 4), who was joined by Christopher Taylor (Ward 3), mayor John Hieftje and Jane Lumm (Ward 2) as sponsors.

The resolution was different in a significant way from a draft resolution earlier circulated by Teall, which amended the budget by adding to the budgeted expenditures the amount needed to fund six additional firefighters, bringing the total budgeted firefighters to 88. The number of 88 had been identified by fire chief Chuck Hubbard as ideal at a working session conducted on March 12, 2012.

The earlier draft specified money allocated by the state, as well as a federal grant, as funding sources, but used the city’s general fund to backstop the funding allocation. From the earlier draft amendment:

RESOLVED, the city increase the general fund fire services unit FTEs by six, and funding for the positions totaling $477,594 ($79,599 per FTE) be added to the adopted budget, funded from the receipt of additional fire protection monies from the state, potential grant funds and the use of fund balance, as needed, from the general fund.

In more detail, the funding for additional firefighters would potentially be a combination of a federal grant – for which the city has applied through a FEMA program called Staffing for Adequate Fire & Emergency Response (SAFER) – and possible increases in the state of Michigan’s fire protection allocation to municipalities that are home to state-owned facilities like the University of Michigan.

Policy Resolution: Fire Protection – State Grants

The fire protection grants from the state of Michigan are dependent on an allocation from the state legislature each year. The allocation is governed by Act 289 of 1977. [.pdf of Act 289 of 1977] The statute sets forth a formula for a state fire protection grant to all municipalities that are home to state-owned facilities – a formula that attempts to fairly determine the funding allocated for fire protection grants in any given year. The statute explicitly provides for the possibility that the legislature can choose not to allocate funds sufficient to cover the amount in the formula [emphasis added]:

141.956 Prorating amount appropriated to each municipality.

Sec. 6. If the amount appropriated in a fiscal year is not sufficient to make the payments required by this act, the director shall prorate the amount appropriated to each municipality.

That part of the statute did not inform the council deliberations that came later in the meeting – on the question of whether the city council could choose not to follow the requirements of the city’s public art ordinance, to transfer money from various city funds into the public art fund. Stephen Kunselman (Ward 3) claimed that the historical failure of the state legislature to allocate funds to cover the entire amount in the fire protection grant formula was an example of the state legislature failing to follow state law. Carsten Hohnke (Ward 5) countered by accepting Kunselman’s premise of the legislature’s “bad behavior,” but wondered why the council would want to copy bad behavior.

The fire protection grant formula, on which the prorated amount is based, defines the state grant for any municipality in terms of the relative value of the state-owned property in the municipality. More precisely, the percentage in the grant formula is the estimated state equalized value (SEV) of state-owned facilities, divided by the sum of that estimated value and the actual SEV of the other property in the community. For example, in Ann Arbor, the total SEV of property on which property tax is paid is roughly $5 billion. The estimated value of state-owned facilities (primarily the University of Michigan) is around $1 billion. So the percentage used in the state fire protection formula for Ann Arbor is about 16% [1/(1 + 5)].

The percentage in the formula is different for each municipality. That percentage is then multiplied by the actual expenditures made by a municipality for fire protection in the prior fiscal year.

So the formula can be described as equitable among municipalities – because the grant amount depends in part on the relative value of state-owned facilities in a given municipality. All other things being equal, a city with a greater number of state-owned facilities receives more fire protection grant money than one with a small number of state-owned facilities. The formula can also be described as equitable to the state of Michigan, because the formula calibrates the state’s investment in a municipality’s fire protection to the level of funding that a local municipality itself is willing to provide.

The roughly $14 million spent by Ann Arbor on fire protection last year would translate to a state grant of around $2 million. But the legislature allocated about half that amount. At a legislative briefing at the start of the council’s May 21 meeting, the city’s lobbyist – Kirk Profit of Governmental Consultant Services Inc. (GCSI) – described for councilmembers how this was an area he was focusing on. He expressed some very guarded optimism that fire protection grants could enjoy a higher level of funding by the legislature this year. However, he talked about attitudes in the legislature that range from advocating zero funding to full funding of the grants. He noted that the grants have not been fully funded in several years.

Policy Resolution: Fire Protection – Contingent Amendment

It emerged during deliberations that the version of the budget resolution offered by Teall at the meeting had not been circulated (by email) to other councilmembers until an hour and half before the council meeting’s scheduled start. It did not change the expenditure budget, but rather directed the city administrator to bring a budget amendment to the council later, if any increased funding becomes available:

RESOLVED, that Council directs the City Administrator to monitor the receipt of additional funding from grants and from the State’s fire protection funds; and

RESOLVED, that if additional funding is received during FY 2013 that the city administrator immediately present council with a mid-year budget amendment appropriating funds to hire additional firefighters up to 88 FTEs.

Jane Lumm (Ward 2) led off deliberations by saying it was no surprise that she supported Teall’s budget amendment [she'd circulated an amendment of her own adding fire protection].

Policy Resolution: Fire Protection – Addition to Amendment

Lumm wanted to amend Teall’s amendment in a way that she wanted to be accepted as “friendly” – which would not have required a separate vote. It was to add the second “resolved” clause in her own draft amendment:

RESOLVED, that if the revenues from the SAFER grant and increases in state fire protection grant do not total at least $477,594, that city council directs the Administrator to prioritize the funding of any shortfall in the development of the FY14 budget and FY15 plan.

Lumm characterized the additional clause as establishing a priority of identifying additional recurring revenues – in the event the two types of grant funding did not come through. She noted the high level of uncertainty about that grant revenue.

Teall said she was concerned that the funding described in Lumm’s clause did not identify it as “recurring.” Lumm explained that all her additional clause would do is state that if the additional grant funding did not materialize for fire protection, then finding additional funding is a priority. It’s all about whether this is or isn’t a priority, she said. Teall declined to accept Lumm’s modification as friendly. So Lumm offered the clause as a non-friendly amendment to Teall’s resolution, which meant that it was subjected to separate deliberation and a vote.

City of Ann Arbor CFO Tom Crawford confers with councilmember Margie Teall (Ward 4) before the meeting.

Sabra Briere (Ward 1) thanked Teall for the originally-proposed amendment. It was clear to her, she said, on reading the language of the amendment, that the council has directed the city administrator to hire additional firefighters. The problem she had with Lumm’s modification, she said, is that it presupposes that the additional firefighters have been hired [through use of the characterization "shortfall"] and that there’s a need to find recurring funds to pay for already-hired firefighters. That’s a “leap of logic” Briere said she had not managed to make.

Briere said it’s appropriate to talk about recurring funds and making the hiring of additional firefighters and police a priority if that’s what the council wants to do. But she felt it was not logically consistent to state what’s in Teall’s amendment, and then state that the council will make it a priority to have at least $477,594 to keep those people employed in future years.

Carsten Hohnke (Ward 5) agreed with Briere – he felt the council would be getting ahead of itself. It felt redundant to him. The priority on public safety was clear to the city administrator, Hohnke felt. He said that priority is clear from the fact that public safety continues to take up more and more of the general fund, as a percentage compared to other services. Lumm’s addition, he said, serves no real functional purpose.

Marcia Higgins (Ward 4) said she wouldn’t support Lumm’s addition to the amendment – because the council and the community will have a separate discussion for FY 2014 and FY 2015 budget years. While safety services will be an important priority, she said, the council will also want to hear about all the other priorities the community has. So she would not support Lumm’s change. Higgins didn’t want to tie the budget resolution this year to the next two-year budget planning cycle.

Lumm rejected the idea that the greater percentage of safety services expenditures from the general fund actually reflects a priority on safety services. That greater percentage, Lumm contended, was due to the way the composition of the general fund had evolved over time. The solid waste department had been moved out of the general fund, she pointed out. That had the arithmetic impact of making safety services a greater percentage of the general fund.

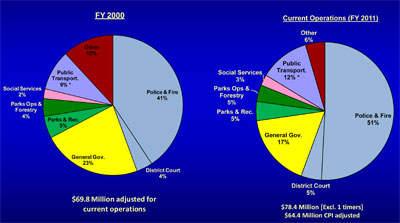

Safety services as a percentage of general fund expenditures – FY 2000 compared to FY 2011. The slide is from a 2011 town hall budget presentation by city staff. The key part of the pie chart label for FY 200o is “adjusted for current operations”– i.e., adjusted to eliminate solid waste from the activities in the general fund. (Image links to higher resolution .pdf file.)

Not much later in the deliberations, Christopher Taylor (Ward 3) returned to Lumm’s contention that the increased percentage of general fund allocations was an artifact of arithmetic, not a reflection of a greater priority on safety services.

Taylor asked the city’s chief financial officer, Tom Crawford, to the podium. Taylor noted that the information the council had been provided was that the general fund expenditures on safety services had gone from 40% to 50% in the last 10 years. Was that generally speaking right? Taylor noted that Lumm had suggested that the increased percentage is due to removal of activities like solid waste from the general fund.

Crawford explained that when the city compares those expenditures, activities that are no longer included in the general fund are factored out of years when they were previously included. And the effect of a greater percentage is still seen. It’s due to the fact that safety services have a high personnel expense related to those activities.

Mayor John Hieftje asked Crawford to confirm again that in these comparisons, the solid waste activities are eliminated from prior years – the years when solid waste activities were included in the general fund – so that the same activities are compared between years, and you still see that effect of an increased percentage for safety services.

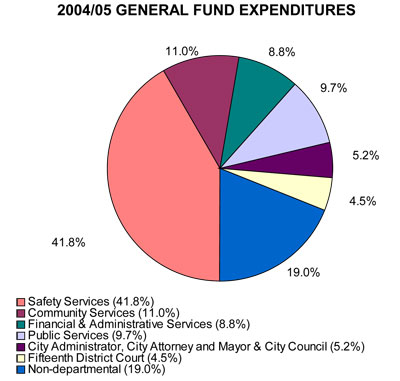

Safety services as a percentage of general fund expenditures – from the FY 2005 budget book. The city’s budget book for FY 2005 describes how solid waste activity has been pulled out of the general fund and put into an enterprise fund that year. (Image links to higher resolution .pdf file.)

Lumm came back with a question for Crawford of her own: If solid waste were included in the general fund, would the percentage for safety services be as large? Crawford confirmed the arithmetic fact – no. “That’s my point,” said Lumm.

Hieftje again asked Crawford for confirmation that the city has presented the information in an apples-to-apples kind of way. Yes, Crawford said. Hohnke stated that it’s obvious that if solid waste activities were added in to the general fund, then safety services would make up a lower percentage. He noted that if you normalize the calculation as Crawford described, safety services still take up a greater portion of the general fund. Hohnke concluded that it’s hard to look at the council’s actions over the last few years and say there hasn’t been an emphasis on safety services. He allowed that you can argue it should have been more, but that it’s clear the council has prioritized safety services.

Teall said she appreciated the intent of Lumm’s addition to her amendment, but felt the clearest argument against it was by Higgins. There’s an opportunity to give direction to the city administrator before the draft budget is prepared for FY 2014, Teall said. Hieftje also felt there would be plenty of time to express priorities. He felt that city administrator Steve Powers already knows the council wants to prioritize fire and police.

Stephen Kunselman (Ward 3) said he wouldn’t support the amendment because it includes FY 2014 and FY 2015 – which is just way beyond what the council can see. Kunselman felt that the council doesn’t need this kind of policy statement for the budget.

Outcome on Lumm’s addition to the amendment: Lumm cast the sole vote for it.

Policy Resolution: Fire Protection – More Deliberations

Stephen Kunselman (Ward 3) expressed concern about the idea of identifying as general fund revenue some grants that were not certain to materialize. His concern was based on confusion about the actual text of the budget amendment put forward by Margie Teall (Ward 4). The new version, which she’d introduced, did not actually change anything in the expenditure budget, but simply gave direction to the city administrator to bring a budget amendment to the council if the grant money did materialize. That version, it was revealed, had not been sent by email to other councilmembers until around 5:30 p.m. that day. [Council meetings are scheduled to begin at 7 p.m.]

Carsten Hohnke (Ward 5) thanked Teall for working on the amendment. He supported the approach of anticipating additional grant funds and providing an action when those funds arise. Jane Lumm (Ward 2) said she was very excited to join in her support for that amendment. She said the city had 126 firefighters in 2001, which had dropped to 82 in this year’s proposed budget – for a 35% reduction, she said. Lumm expressed concern about the probability that grant funding would be available. She hoped that there will be an increase in state fire protection grants.

Mayor John Hieftje said he felt the city had made a lot of progress in being able to preserve the budgeted 82 positions and he expected that the fire department would be staffed up to its budgeted numbers by July 1. It’s not remarkable that Ann Arbor has fewer firefighters than it had previously, he contended. Compared to 2001, he said, there now are 2,400 fewer firefighters in Michigan. One of the reasons is that there are fewer fires in structures than there used to be, he said. It’s also one of the worst financial periods in our lifetime, he said. Hieftje said that the fire inspection work the city is now doing means not just additional revenue, but also that the city can prevent fires. He said it would be a good idea to have more frequent inspection of older housing stock rented by students.

Sabra Briere (Ward 1) noted that she wanted to find a way to increase fire protection but was uncomfortable using grant money or non-recurring money as a way to go forward. The city’s policy when she was first elected to the council was not to seek grant money, if the city did not believe it could get that grant money in the future. That was fine for then, she said. But times change and you have to “roll with that.” She was delighted to see this variant of a budget amendment, because it says that the city will hire additional firefighters if it gets the money it has sought. The goal, she said, is to bring the number to 88, and frankly, she said, 88 is where the city will start. Certainly no councilmembers feel comfortable at 82. If the city receives the SAFER grant and still hasn’t identified additional recurring funds, then councilmembers will have a much more interesting discussion, she felt.

Kunselman concluded the deliberations by noting that Teall’s amendment was a policy statement – but the council had just voted down Lumm’s addition amendment, on the grounds that it was a policy statement. He said he’d support the amendment – it makes the council feel good, but doesn’t actually amend the budget. “So let’s keep on track,” he said.

Outcome: The council unanimously approved the resolution on fire protection.

Amendment: DDA TIF, Firefighters

The next amendment was brought forward by Stephen Kunselman (Ward 3), who introduced it by saying that he felt it would be difficult to pass, because many people on the council were supportive of the Ann Arbor Downtown Development Authority. The council took that as a frame for the ensuing discussion, and did not delve into the specific substance of the resolution that related to Chapter 7, which regulates how the DDA’s TIF (tax increment finance) capture works.

Amendment: DDA TIF, Firefighters – Background

Downtown development authorities in Michigan do not levy taxes of their own, but rather “capture” taxes levied by other entities within a specific geographic area – the TIF district. The “increment” in a tax increment finance (TIF) district refers to the difference between the initial value of a property and the value of a property after development. Among other things, Chapter 7 sets forth how the Ann Arbor DDA’s tax capture is confined to the initial increment on the value of a property after improvements are made, and does not include subsequent increases due to inflation.

Last year, the impact of a specific clause was identified by city financial staff as having been previously overlooked [emphasis and paragraph number added]:

¶1 If the captured assessed valuation derived from new construction, and increase in value of property newly constructed or existing property improved subsequent thereto, grows at a rate faster than that anticipated in the tax increment plan, at least 50% of such additional amounts shall be divided among the taxing units in relation to their proportion of the current tax levies. If the captured assessed valuation derived from new construction grows at a rate of over twice that anticipated in the plan, all of such excess amounts over twice that anticipated shall be divided among the taxing units. Only after approval of the governmental units may these restrictions be removed. [.pdf of Ann Arbor city ordinance establishing the DDA]

That section of Chapter 7 resulted in a combined refund of roughly $473,000 from the DDA to the Ann Arbor District Library, Washtenaw Community College and Washtenaw County in 2011. The city of Ann Arbor chose to waive its $712,000 share of the calculated excess. It can be argued that the method used by the DDA to calculate the excess was incorrect, and the amount returned should have been even greater. [See Chronicle coverage: "Column: Tax Capture is a Varsity Sport"]

Subsequently, the DDA reversed its legal position and contended that no money should have been returned at all, making the method of calculation moot. The DDA’s position is based on the following clause of Chapter 7 [emphasis and paragraph number added]:

¶3 Tax funds that are paid to the downtown development authority due to the captured assessed value shall first be used to pay the required amounts into the bond and interest redemption funds and the required reserves thereto. Thereafter, the funds shall be distributed as set forth above or shall be divided among the taxing units in relation to their proportion of the current tax levies.

The DDA’s legal position appears to rely on ¶1 as referent of the phrase “as set forth above.” That interpretation allows for the possibility that ¶1 is not a limit on TIF capture to be paid to the DDA in the first place, but rather is meant to explain how money is to be returned to the district’s taxing authorities only after debt obligations are satisfied. That interpretation, however, makes it somewhat challenging to harmonize the terms “distribute” and “divide.” Another candidate for the referent of “as set forth above” is “a development plan and financing plan for the downtown district or a development area within the district” – mentioned earlier in Chapter 7.

Though it has received scant public discussion in the context of Chapter 7, the intervening ¶2 also appears to have a potential impact on the amount of TIF captured by the DDA:

¶2 After the then earliest dated bond issue of the downtown development authority is retired, the captured assessed valuation prior to the date of sale for that issue shall be returned to the rolls on the next succeeding tax levy.

Amendment: DDA TIF, Firefighters – Resolved

Kunselman’s amendment first stipulated that Chapter 7 would be interpreted in the same general way it had been interpreted last year, but specified a method of calculation for the excess that was different. Based on that method of calculation, the excess this year would recur and likely increase substantially in subsequent years.

RESOLVED, That City Council directs the DDA to interpret and apply Chapter 7 of City Code using:

- both real and personal property,

- the “realistic” capture projection from the 2003 DDA Tax Increment Financing (TIF) Plan,

- a cumulative comparison of projected capture to actual capture; and

- consideration of only debt service payments for TIF related projects (i.e. exclude all debt service for the construction, maintenance, and management of the City’s parking system).

RESOLVED, That City Council directs the City Treasurer to distribute future TIF revenue to the DDA only up to the amount that would be realized in the plan plus any increases that are permissible in Chapter 7;

RESOLVED, That City Council directs the City Treasurer to distribute the excess amounts of future TIF revenue to the taxing authorities from which they were captured; and

RESOLVED, That the increased revenue to the General Fund in the amount of $199,360 be utilized to increase the Fire Department expenditure authorization in FY 2013 and to increase the authorized number of Fire FTEs by 2 positions.

Based on this “cumulative” approach to Chapter 7, the amount of additional revenue to the city’s general fund will recur.

Here’s how the $199,360 described in the resolution was calculated. In FY 2013, Kunselman’s Chapter 7 interpretation would result in an excess TIF capture of $659,771. Of that amount, $399,146 would go to the city of Ann Arbor – with the other $250,000 returned to the other taxing jurisdictions. Those jurisdictions include the Ann Arbor District Library, Washtenaw Community College, and Washtenaw County. Of the city of Ann Arbor’s $399,146 portion, $249,198 would go to the general fund, with the remaining roughly $150,000 going into other city funds – distributed among all the city millage funds. Of that $249,198, $49,838 would be would passed through to the Ann Arbor Transportation Authority, leaving the city’s general fund with $199,360.

In subsequent deliberations, the $199,360 was incompletely characterized as the “city’s share” of the $659,771 – by Carsten Hohnke (Ward 5) and Sandi Smith (Ward 1). The city’s share, across all of its funds, would have been twice that – $399,146. Kunselman’s resolution, however, did not specify how the additional city funds would be used, except for that amount that would have accrued to the general fund. In Kunselman’s resolution, the general fund’s additional revenue was earmarked for hiring two firefighters.

Amendment: DDA TIF, Firefighters – Deliberations

Sabra Briere (Ward 1) asked Susan Pollay, executive director of the DDA, to come to the podium. Briere said when she first read the resolution, she thought: At least Kunselman has identified recurring income and there’s a benefit to the city’s budget for that. But Briere wondered what the impact would be on the DDA. She noted that a lot of people don’t understand what the DDA does. She said people think [erroneously] that it just manages the parking system. So Briere wanted to know what would not be done by the DDA if the money were tasked for firefighters.

Pollay addressed the specific resolution, and noted that only the debt service related to TIF projects would be factored in – not parking system projects. The Ann Arbor DDA, Pollay explained, was created in 1982 in large part to create parking structures – Ann Ashley and Liberty Square among them. So the idea of the DDA taking on debt to build parking structures has been interwoven in the concept of the DDA since its inception, she said. Pollay also pointed to the new contract the city council had approved last year, under which the DDA operates the city’s public parking system. That contract assigns the DDA responsibility for the debt service for the parking structures. From the contract:

The DDA, at its own expense, shall operate, maintain, pay related debt service, and keep the Municipal Parking System in good repair and the total expense of routine maintenance and repair in connection therewith shall be borne and paid by the DDA.

The total debt service for the coming year, Pollay said, is approximately $6 million and the TIF capture is anticipated to be around $3.6 million. So at this point the debt service is far greater than TIF capture. [On the DDA's interpretation of ¶3 above, that would mean that ¶1 would not apply.] Pollay also pointed out that the city council had agreed to backstop the DDA’s fund balance as part of the parking contract:

Through Fiscal Year 2015-16, should the DDA’s combined fund balance (excluding the Housing Fund) (“DDA Fund Balance”) fall below ONE MILLION DOLLARS ($1,000,000), as shown by the DDA’s annual audited reports, then DDA may reduce amounts payable to the City under Section 4(a) by amounts equal to the difference between the DDA Fund Balance and ONE MILLION DOLLARS ($1,000,000) (“Withheld Payments”), provided, however, that Withheld Payments shall not exceed (i) ONE MILLION DOLLARS ($1,000,000) in any given fiscal year; or (ii) TWO MILLION DOLLARS ($2,000,000) in the aggregate. …

The debt service has to be paid by someone, Pollay said. As a city resident, Pollay said, she understood the struggle to restore positions in safety services. It would be an unintended consequence of the resolution that in adding firefighters, the city might end up having to cover the debt service currently paid by the DDA.

Briere wanted to know what else, besides debt service, the DDA used TIF capture to do. Pollay said that paying debt service is a large part of what the TIF capture is used to pay for. She said the DDA has a very small staff – four people – to run a $20 million organization. [In addition to TIF capture, the DDA handles the revenue and expenses of the city's public parking system, including a 17%-of-gross payment to the city of Ann Arbor.] TIF money is used also for cash down payments for projects – for example, a couple million dollars is coming out of the TIF revenues for the underground parking garage on South Fifth Avenue. Pollay also described how the DDA has taken responsibility for curb ramps that have been installed in the downtown area as the result of an Americans with Disabilities Act lawsuit. Among the other activities mentioned by Pollay, which are funded by TIF, were upgrading of water mains, alley repairs, and sidewalk replacements. The DDA works hard to use TIF capture for the positive impact on the community, Pollay said.

Briere noted that if the DDA’s TIF capture were to be significantly reduced (by 18%, she calculated) the city would not be spending the money on the same items that the DDA would. That becomes, Briere said, as Lumm had described earlier in the evening, a matter of competing priorities. Pollay reiterated it’s the DDA’s position, based on the city’s own ordinance, that there is no TIF that should be given back to other taxing authorities, and she quoted ¶2 above. It’s the DDA’s position, Pollay said, that the $6 million in debt service should be paid before any TIF capture should be returned to taxing authorities. Those funds are committed, she contended.

Sandi Smith (Ward 1), who also serves on the DDA board, said that Kunselman’s resolution feels to her like the establishment of a policy in the middle of a budget discussion. She did not support it, for all the reasons that Pollay had given. Hearing that there was $659,000 less TIF the DDA would be capturing, but of that only $200,000 would be available to the city, led Smith to analyze that as a $459,000 loss to the city. [The idea is that the $459,000 that would otherwise be invested in the city of Ann Arbor by the DDA would now be given to other taxing jurisdictions instead of the city of Ann Arbor. That's not an accurate characterization – because of the $659,000 total, the city's share across all of its funds would be around $400,000. The $200,000 figure is just the amount that would accrue to the city's general fund.] The city is the beneficiary of the DDA’s TIF investments in infrastructure, Smith said.

Stephen Kunselman (Ward 3) reads aloud the amendment on DDA TIF capture as Christopher Taylor (Ward 3) looks on.

Kunselman observed that it’s always interesting how the DDA’s responsibility between TIF and parking is intermingled. If there’s a funding shortage, the parking rates get raised, he said. He felt it’s important to understand how much of the TIF is not being spent – because the DDA’s debt service is not “credit card debt,” rather it’s bond debt. There’s a schedule of payments, he noted.

That’s why, at a previous meeting, Kunselman had asked for the “actuals” for the DDA’s finances from the prior year. Unspent TIF money left over at the end of FY 2012 gets carried forward, he said, so the DDA has not spent that money. Therefore it can be used for safety services. Responding to Smith’s characterization of the issue as a policy discussion, Kunselman said it was not merely a policy discussion, but a budget amendment: “We’re amending the budget.”

Kunselman granted that the city’s general fund would benefit only by $200,000, but he wondered why the Ann Arbor District Library, Washtenaw County and Washtenaw Community College had to suffer. He wondered why the AADL had to send a letter to mayor John Hieftje saying that they disagreed with what was going on and asking the DDA and the city to work with the AADL. [Hieftje serves on the board of the DDA.] Kunselman said he did not feel that the AADL should have to sue to get an interpretation of Chapter 7. [The AADL has not announced any plans to litigate, though the library's leadership has reviewed the TIF distribution with their legal counsel.] He felt that the council should step up and do what’s right, to ensure that all of the city’s neighbors – the other taxing jurisdictions – get the money they deserve.

Kunselman then settled on a specific question for Pollay: How much fund balance from FY 2012 will be brought forward to FY 2013? Pollay said that at the end of this fiscal year there would about $1 million left in TIF. That’s money that has not been spent in this fiscal year, but may be obligated for next year’s activity, Pollay said.

Kunselman pointed out that the DDA would be capturing another $3.6 million in TIF next year as well. Pollay wondered if what Kunselman was saying was that there should not be a fund balance – which is not what the DDA’s auditors had told the DDA, she said. Kunselman noted that the DDA is not required to maintain a bond reserve for its debt. So if the fund balance is for things other than debt, Kunselman said that could be used to address public safety needs.

The DDA was formed in 1982 when the downtown was struggling, Kunselman said, but the downtown is no longer struggling in the way it struggled in 1982. There are now four very large buildings that will be completed in the near future, Kunselman said. [He was referring to the Landmark Building, The Varsity, City Apartments, and Zaragon West.] So that’s hundreds of thousands of additional TIF revenue that will be coming in. Those fund balances will continue to increase, he said, because it can’t all be spent on debt – because the debt repayment is on a schedule and can’t be pre-paid.

Kunselman felt there’s a lot of money in the DDA’s TIF capture that could otherwise be spent on public safety. He understood that his colleagues are supportive of the DDA. Kunselman concluded by saying he felt it’s important to distinguish between the DDA as a parking authority and the DDA as a state-enabled TIF-funded entity. Mixing the two, he felt, causes a lot of confusion.

Mayor John Hieftje, who sits on the DDA board in a position provided to the mayor by the DDA’s state-enabling act, noted that the DDA’s current plan includes drawing down fund balances to pay for major projects. Hieftje then reviewed several of the standard arguments for downtown development authorities – downtowns can be an important economic driver as a center of activity. Hieftje then cited a Chronicle op-ed column, which he described as characterizing Kunselman’s attitude toward the DDA as using the DDA as a “political punching bag.” Hieftje cautioned that this resolution was a punch that could come around and hit the city. [In fact, the column encourages councilmembers to give Kunselman's resolution more than a reflexive "political punching bag" analysis: "... Kunselman's amendment deserves more than that kind of knee-jerk reaction."]

Hieftje cautioned that if the DDA can’t meet its financial obligations, then those obligations become the city’s obligations. He pointed out that the DDA grants roughly $0.5 million a year to the city to help pay for the new police/courts building (also called the Justice Center). In that way, he said, the DDA is contributing to public safety.

Jane Lumm (Ward 2) agreed that there’s no question the DDA makes significant transfers to the city each year. She pointed to the 17%-of-gross parking revenue (around $2.8 million in FY 2012), as well as the $508,000 annual contribution to the bond payment for the police/courts building. The DDA contributes $230,000 for free police officer parking at the Ann Ashley structure, she continued. She said there’s a lot of basis for the idea that the city uses the DDA as an ATM. Lumm said she’s torn, because she’s a strong supporter of the DDA. But when she looks at what Kunselman is advocating, it’s all about how to interpret the TIF ordinance. She then ticked through the differences between Kunselman’s interpretation and the DDA’s. She reiterated that she was torn, because Kunselman had found a way to generate recurring funding.

Smith asked Pollay to characterize the DDA’s fund balance in terms of percentage of operating expenses. Pollay said that the DDA is working toward 14% this year. Smith ventured that the DDA had dipped as low as 8%. Pollay said that by raising parking rates, the DDA had increased the anticipated fund balance from 8% to 14%. Smith drew out from Pollay that the level recommended by the city’s CFO was 15%. The DDA is still shy of the recommended fund balance level, Smith said.

Responding to Smith, Pollay ventured that reducing the fund balance by the $600,000 would reduce the fund balance by a percentage point or two. Smith noted that TIF reserves for the DDA are allocated by resolution. Pollay confirmed that about $800,000 is allocated that way – $400,000 for affordable housing in Village Green’s City Apartments project at First and Washington, and $400,000 for Avalon Housing’s Near North affordable housing project.

Smith also drew out from Pollay that the Village Green project involves construction of a parking deck on its first two floors – a $9 million investment, out of which the DDA needs to find $1.6 million in cash. The rest will be bonded, she said. Smith concluded that there are a lot of projects already in the pipeline and it may be very risky to expose the DDA to the impact of Kunselman’s resolution – because it would fall outside of the DDA’s 10-year plan. Pollay said that the Chapter 7 resolution was not on anybody’s radar when the budget was approved or when projects were approved. It would have a big impact, she said. Smith asked Pollay if it were a possibility to say to Avalon that the DDA could not support the Near North project. Pollay allowed that where there are no dollars, you have to look at what you granted.

Carsten Hohnke (Ward 5) said he appreciated Kunselman’s efforts in bringing the resolution forward, characterizing it as a detailed and thoughtful look at how to consider priorities for the budget. But Hohnke said that to him, for the two-year period it amounted to forgoing a $1.2 million investment in the downtown for $400,000 of general fund benefit. [Hohnke was not factoring in the additional $300,000 benefit to other city funds.] To him, that didn’t make sense. Hohnke used Kunselman’s examples of the four large developments as evidence that the DDA has been very effective in using their TIF funds.

Hohnke said it’s important to take the long view, given that the city asks a lot of the DDA. The city expects the DDA to drive economic development and to support public safety, and to provide merchants with additional infrastructure for their customers by bringing new parking structures on line. Due to the DDA’s efforts, he continued, the city’s public parking system has increased value, and is deserving of “increased rent.” And that benefits the city directly in the 17%-of-gross revenues from the public parking system that the DDA now provides to the city under terms of the new contract, ratified last year, he said. Hohnke cautioned against undercutting the DDA as an economic development engine.

Mike Anglin (Ward 5) felt the issue needed further discussion with the DDA. He observed that Kunselman’s resolution might not have the votes to pass. It raises some serious issues, he said. The downtown continues to be a place that’s very attractive. Into the future, he said, the DDA’s TIF capture will increase. He said he would vote with Kunselman to make a statement of support, to say this discussion should come up during the next year.

Briere observed that over the last 18 months or two years, she’s heard a lot of complaints from downtown merchants about a lack of safety services. She’s attended meetings of the DDA where board members have said they’d really rather give the city money for safety services than anything else. The desire in the downtown area is to support the need for safety services. But what Kunselman’s amendment is really about is what mechanism the council wants to use to decide the DDA TIF capture. It’s a discussion that started last year, she said. When many councilmembers read the DDA’s TIF plan, she said, they felt like intellectually the council should have used the “realistic” instead of the “optimistic” or the “pessimistic” forecast in the plan. Looking at the effect of Kunselman’s resolution, she said, the council is making a decision about whether “to cut off our noses.”

Briere said she’d oppose the amendment reluctantly. Looking at the impact on the city’s budget, the amount the city would accrue would not equal the loss of funding and opportunity for the DDA, she said.

Kunselman told his council colleagues that he wanted to bring forward the resolution so that people know “there is a lot of money over there at the DDA that can be used for public safety services ….” He noted that many of the programs cited as evidence of the DDA’s success include the use of parking revenues. Parking structures and parking revenues are separate, he said. The DDA can raise parking rates, but the DDA can’t change the TIF capture other than to change the interpretation of Chapter 7.

When people talk about economic development, Kunselman said, he felt the Ann Arbor District Library is the biggest economic draws besides the University of Michigan. But the city is taking money from the ADDL – so the AADL struggles. He commented as an aside that he hopes the AADL builds a new library on top of the underground parking structure on South Fifth Avenue. Responding to the discussion of the grant to Avalon for the Near North affordable housing project, he wondered how that was possible, given that it’s located outside the DDA TIF district.

Pollay explained the DDA policy on housing investments within 1/4 mile of the district boundary. Kunselman ventured that the 1/4 mile distance is arbitrary and that “residents down my way” would love to have some DDA affordable housing investments. Kunselman then assured Pollay that he did not mean anything personally toward her. He concluded that he felt the DDA has $600,000 available in unrestricted TIF funds.

Lumm said that what she really liked about the amendment is the funding it provided. She felt that the element of policy that it included is entirely appropriate. She said she was torn, but would still support it.

Outcome: The council rejected the amendment with support only from Stephen Kunselman (Ward 3), Jane Lumm (Ward 2) and Mike Anglin (Ward 5).

Amendment: Eliminate $6,500 Council Travel Budget

By way of background, the amount of $6,500 in the council’s travel budget appears to arise out of an allocation of $550 for each of 10 councilmembers and $1,000 for the mayor. Two years ago on March 1, 2010, as the council was giving direction to then-city administrator Roger Fraser, a proposal was made to direct Fraser to eliminate travel for the mayor and councilmembers. The council decided on that occasion to preserve mayor John Hieftje’s allocation of $1,000.

Sabra Briere (Ward 1) introduced the amendment along with its history from 2010. Jane Lumm (Ward 2) noted that the financial unit comprising the mayor and council had not met its budget reduction targets and the elimination of the travel budget seemed reasonable, because it’s not being used.

Tony Derezinski (Ward 2) said he’d never used any of the travel money, so he wanted to know if the travel money has been used much by anybody. The city’s CFO, Tom Crawford, told Derezinski that it’s been used very little. He noted that the Ann Arbor Downtown Development Authority had assisted with some travel expenses for councilmembers to attend International Downtown Association conferences, but that did not come out of the city council’s travel budget. Derezinski allowed it was fine that the resolution was symbolic, but he wanted to stress that the travel money was not being abused.

Hieftje indicated that his problem with eliminating the travel budget was that it meant that you can’t attend conferences or make use of educational opportunities unless you can afford it. The implication is that you shouldn’t be on the city council if you can’t afford it. He said he was particularly concerned that there would be at least two new councilmembers elected in the fall who might find it useful to have travel funds available to support additional education. In his memory, Hieftje said, it hasn’t been abused.

Marcia Higgins (Ward 4) said that travel funds are something most councilmembers never use. And it does not accumulate in future mayor/council budgets, but simply rolls back into the genera fund, she said. She noted that the Michigan Municipal League offers some good educational opportunities for elected officials. There’s not a person around the table who hasn’t paid out of their pockets to cover travel expenses, she said. She would not support the elimination of the travel budget, she said.

Briere appreciated her colleagues’ concern about out-of-pocket expenses. She said that when she was elected to the council, new councilmembers were never informed there was such a budget for travel or opportunities for training. As a member of council who is not wealthy, she continued, she had paid her own way to International Downtown Association conferences – even though the DDA offered to pay for it. She said she wouldn’t suggest anyone hold themselves to her standard. She allowed that elimination of the $6,500 won’t fix a budget hole or break the bank, but when the council argues over whether the city can afford sufficient fire and police protection, it looks like councilmembers are giving themselves a benefit. People will imagine that councilmembers are benefitting, she said. Just as it was symbolic to forgo the travel budget back in 2010, the resolution this year is also symbolic.

Sandi Smith (Ward 1) said that on the surface, she’d be in support this. She didn’t want to belabor it, but it’s $500 per seat. There’s plenty of people who could benefit from the Michigan Municipal League who want to learn how to do things. She wanted to see it stay in the budget. Christopher Taylor (Ward 3) indicated wholehearted agreement with the idea that the council needs to be like Caesar’s wife [i.e., above suspicion] on a wide variety of things. However, he said, the travel budget can help with councilmember education, and it’s proper to say that education is important and that councilmembers may not actually know everything.

Margie Teall (Ward 4) looks The Chronicle right in the eye, as Carsten Hohnke (Ward 5) in the background reflected the energy levels of many attendees by the end of the meeting, which concluded around 1:30 a.m.

Margie Teall (Ward 4) echoed the idea that travel and training is something that’s important. She took issue with the idea that the council should take the action because of any misperceptions that might arise. She knew the truth – that the travel money is used rarely. She would not vote to eliminate it because of what someone might think.

Stephen Kunselman (Ward 3) said he wished he’d known about this in 2006, when he was first elected to city council, so that he could have taken advantage of some educational opportunities. “Maybe I’d be more effective!” he quipped. A comment Briere had made inclined him to vote against eliminating the council travel budget – she’d said that it could be restored when the corner had been turned on the economy. He said that this year there’s a small surplus, so the council should reward itself with a little education.

Derezinski followed up by saying that the travel budget hasn’t been abused. He ventured that by taking advantage of educational opportunities, councilmembers could learn a lot of valuable things, including the difference between “governance” and “administration.”

Lumm – who is the newest member elected to the council, though she also served back in the 1990s – indicated that she went through in-house city orientation and that city staff had done a great job of orienting her. She felt that the travel budget was something the council could give up.

Outcome: The council rejected the amendment that eliminated the council’s travel budget. It got support only from Jane Lumm (Ward 2) and Sabra Briere (Ward 1).

Amendment: Add $46,899 to Human Services

The city of Ann Arbor does not provide human services directly, but rather makes an allocation to a range of different nonprofits in a coordinated funding model. The other entities in the model include Washtenaw County, United Way of Washtenaw County, Washtenaw Urban County, and the Ann Arbor Area Community Foundation. Last year, for FY 2012, the council amended the proposed budget to increase human service funding by $85,600. That amendment brought the total allocation to nonprofits providing human services to $1,244,629. Compared to the originally proposed FY 2012 human services amount, this year’s FY 2013 amount is about $39,000 greater. But that reflects a $46,899 decrease from the level to which the council amended the budget last year.

So the amendment brought the budget for human services funding back to the same level as last year. Sabra Briere (Ward 1) noted in a deliberation on a subsequent amendment that last year’s increased human services funding had been intended to be a one-time increase – but that nonprofits who receive the human services funding didn’t get that message. Margie Teall (Ward 4) expressed support for the resolution, from her perspective as the council’s representative to the executive committee of the Urban County.

The additional money was taken from the projected general fund surplus.

Outcome: The council unanimously approved the additional $46,899 for human services.

Amendment: One-Time Increase for AAHC

The next amendment considered by the council increased the budget of the Ann Arbor Housing Commission by $78,000 – to offset an increased cost of allocating retiree healthcare costs.

The increase to AAHC is intended to offset the additional costs to AAHC from the new method of allocating retiree health costs to different departments – based on where the liability is accruing. For the city’s general fund departments, this resulted in decreased costs this year totaling around $1 million. But for some organizations within the city, like AAHC, it resulted in increased costs. For detail on retiree cost allocation methodology, see The Chronicle’s coverage of a Feb. 13, 2012 working session.

Sandi Smith (Ward 1) introduced the amendment and stressed that it was a one-time transfer. As part of the context for the one-time support, she noted that AAHC has a relatively new executive director – Jennifer L. Hall. Jane Lumm (Ward 2) noted that the resolution talks about the one-time nature of the additional transfer. She wondered: If the council is flexible on this issue for the AAHC, why not in other cases?

Margie Teall (Ward 4), the council’s liaison to the AAHC, indicated that it’s her understanding that the director is okay with the one-time nature of the transfer. Teall said the council was, in fact, trying to play by the same rules. Just the one extension would be needed, she said. Tony Derezinski (Ward 2), who served as council liaison to AAHC before Teall, said that the last two AAHC directors had made substantial improvements. The general direction the city has taken with AAHC over the last few years has been not to “cut it loose,” but rather to “embrace it.” It’s important not to stop the progress that’s being made, he said.

Sabra Briere (Ward 1) appreciated Lumm’s comment about whether the allocation might become a recurring event. Briere allowed that last year the council had made a one-time-only additional allocation for human services. Even though it was meant to be one time, the nonprofits didn’t get that message. Briere said she didn’t regret that the council had added the human services funding again this year. For the AAHC, the difficulty arose because of the way that the city allocated retiree health care costs, and the AAHC didn’t realize it. The additional money the council had previously allocated to AAHC to hire staff could not be used to hire staff, if the council did not cover the increased costs that the city had caused, Briere said.

Stephen Kunselman (Ward 3) noted that it’s important to continue with the process, working with the AAHC. The housing commission continues to struggle, he said, but the commission has good leadership. The amount is small, compared to what the AAHC needs to do, which is to rehabilitate a lot of housing stock at considerable expense, he said.

Outcome: The council unanimously approved the additional $78,000 for the Ann Arbor Housing Commission.

Amendment: Eliminate Contract with RecycleBank

RecycleBank administers a coupon-based reward program that is intended to increase rates of curbside recycling in the city. At its Sept. 19, 2011 meeting, the city council voted to retain the contract it had signed the previous year with RecycleBank. Leading up to that vote, there had been some interest on the council in canceling the contract entirely – because it was not clear that the impact of the coupon-based incentives was commensurate with the financial benefit to the city. But the council settled on a contract revision that was favorable to the city. The cost of continuing the contract this year would be $103,500. The cost of canceling is $107,200 – $90,000 in an equipment purchase settlement in accordance with terms of the contract and $17,200 for 60 days of contractual notice. Savings will be realized in subsequent years.

Amendment: RecycleBank – Public Commentary

During public commentary, near the start of the meeting, RecycleBank regional account manager Duane Maladecki reviewed some of the history of RecycleBank’s relationship with the city of Ann Arbor.

In September 2010, the city and RecycleBank started a 10-year contract. After one year, RecycleBank proposed a contract adjustment – a 33% ($50,000 per year) downward adjustment in cost, to help save money for the city, Maladecki said. The original $0.52 per house per month was reduced to $0.35 per house per month – with a $50 incentive for every ton of additional recycling above a reset baseline. The baseline was reset, to acknowledge the city’s switch from a dual-stream system to a single-stream system plus wheeled carts, which was implemented at roughly the same time as the RecycleBank program.

Maladecki said the reset baseline essentially assigned the 36% “lift” in recycling to the single-steam and cart program. The new baseline, he told the council, was set at 944 tons/month. However, RecycleBank had recently discovered that the new baseline was incorrectly calculated using data from the city – because it included both multi-family and commercial recycling weights. He reported that between December 2011 and June 2012, the recycling levels were expected to be 5% above the new baseline. That translated into a benefit to the city – due to saved disposal costs and commodity revenue – of about $21,000, he said.

Maladecki continued by reporting results of surveys that were done by the city and RecycleBank about what kind of rewards program participants wanted. After June, he said, RecycleBank would offer the opportunity for participants to contribute to local nonprofits – Leslie Science and Nature Center, Huron River Watershed Council, and the Ecology Center – as well national donation opportunities. He also described how RecycleBank would be providing a new suite of reports after June. He concluded by saying that he looked forward to a continued partnership with the city.

Amendment: RecycleBank – Council Deliberations

Sabra Briere (Ward 1), who had helped to bring the budget amendment forward, described a number of questions that had been raised – about how many people are actually using the coupons, and how much they are benefiting. She did not express much enthusiasm for the new option Maladecki had described for making local donations, characterizing it as an opportunity to donate points to a nonprofit of someone else’s choosing. She said the coupon program was not something she felt is resulting in something positive in the community. Residents are enthusiastic about the switch to a single-stream cart system, but have not embraced the coupon rewards program with the same passion, she said.

Carsten Hohnke (Ward 5), who had co-sponsored the amendment, declined to characterize the council’s decision to enter into a contract with RecycleBank at the same time it implemented the single-stream cart program as a bad decision. Instead, he said that good decisions don’t always lead to good outcomes. It’s incumbent on the council to re-evaluate things. He compared the re-evaluation of RecycleBank to the city’s experiment with reduced street lighting. The city had swiftly acted to restore the street lighting. Hohnke said he did not see the positive impact of the RecycleBank program reflected by increased numbers – certainly not enough to justify spending $100,000 a year for the next 10 years.

Margie Teall (Ward 4) asked city solid waste manager Tom McMurtrie to the podium to describe the effects he’d seen on recycling numbers from the RecycleBank program. McMurtrie allowed that in hindsight, it would have been better to separate the timing of the implementation of the single-stream program and the RecycleBank coupon program. The data show healthy increases since the start of the programs, but how much increase is the result of which program was difficult to say.

McMurtrie suspected there would be some drop in recycling numbers with the cancelation of the RecycleBank contract, but he could not estimate what that would be. Teall drew out the fact that the implementation of the RecycleBank program had extended only to single-family and duplex housing, not multi-family units. McMurtrie noted that assigning reward points to shared carts would be a challenge.

Sandi Smith (Ward 1) rejected the idea that it would be too difficult to assign reward points with a shared cart. With single-family carts, it’s possible to set out an empty cart and still receive credit for participation, she said. She’d have preferred to have started the program in multi-unit locations, where residents are younger or newer in town. As far as diminished participation upon cancellation of the contract, however, Smith didn’t think people would choose to throw something in the garbage instead of recycling it, if they did not receive reward points.

Briere agreed with Smith’s sentiments that the wrong audience (single-family households) had been targeted.

Marcia Higgins (Ward 4) felt that University of Michigan students are already committed to recycling and that the Ann Arbor Public Schools system is doing a great job at teaching the city’s young people about recycling.

Jane Lumm (Ward 2) expressed disappointment that there are no savings in the first year.

Stephen Kunselman (Ward 3) was dismissive of the value of the coupons that he’d received, and drew out from McMurtrie a description of the city’s recycling educational efforts – which include advertising and a periodic publication called “Waste Watcher.”

McMurtrie pointed out to the council that in the RecycleBank contract, there’s a $90,000 cancellation fee that applies this year, but at the end of the third year (next year) that goes to zero. Briere exclaimed that the city would pay the same amount – to keep the service another year, then cancel – compared to canceling now. Kunselman said he wasn’t willing to extend the contract another year. Residents who want coupons have plenty of opportunities. He encouraged the solid waste department to promote recycling to the multi-family housing units in partnership with Recycle Ann Arbor. He said he’d vote “to can the RecycleBank program.”

Christopher Taylor (Ward 3) felt the marginal cost ($13,000) of keeping the program another year then canceling, compared to canceling now was reasonable. He said he’d be willing to extend another year, then re-evaluate next year with a skeptical eye.

Teall said she’d also like to see the RecycleBank contract extended one more year.

Outcome: The council voted to cancel the RecycleBank contract, with dissent from Margie Teall (Ward 4), Christopher Taylor (Ward 3) and Tony Derezinski (Ward 2).

Amendment: Eliminate $307,299 in Transfers to Public Art

This proposed amendment stipulated that the transfers from various city funds into the public art fund would not take place, “notwithstanding city code” – a reference to the city’s Percent for Art ordinance. The Percent for Art ordinance requires that 1% of all capital improvement projects, up to a cap of $250,000 per capital project, be set aside for public art. The amendment would have prevented the transfer of $60,649 out of the drinking water fund, $22,400 out of the stormwater fund, $101,750 out of the sewer fund, and $122,500 out of the street millage fund. The council had re-debated the city’s public art ordinance most recently at its May 7, 2012 meeting, in the context of funds for a sculpture in the Justice Center lobby, which were ultimately approved.

Stephen Kunselman (Ward 3) introduced the budget amendment. He said that the funds from which the money was being transferred are the core of public safety, health and welfare. He recalled that the council has been addressed by residents who’ve had problems with stormwater and with their basements flooding. Councilmembers hear about streets being in bad shape. Granted, there’s a lot of work being done this year, he said, but that’s one reason the city needs to have money in the street millage fund – because there is so much work yet to do.

In defense of not following the city code, which requires the fund transfers, Kunselman cited the remarks by Kirk Profit, the city’s lobbyist, at the start of the meeting. Profit had described the state’s fire protection grant program, requiring the funding of grants to municipalities based on a formula. Historically, the legislature has not funded the full amount in the formula.

However, the statute places the requirements on the budget director, not on the legislature. The statute also explicitly provides for the possibility that the legislature can choose not to allocate funds sufficient to cover the amount in the formula [emphasis added]:

141.956 Prorating amount appropriated to each municipality.

Sec. 6. If the amount appropriated in a fiscal year is not sufficient to make the payments required by this act, the director shall prorate the amount appropriated to each municipality.

Kunselman contended that as city councilmembers, they could not have their hands tied. He pointed out that his resolution did not take any funds away from the Percent for Art program that had accumulated from past years, or say anything about future years. In that respect, Kunselman noted that the resolution was similar to one that mayor John Hieftje had said at an earlier meeting that he would eventually bring forward. Hieftje’s resolution, described at the council’s May 7, 2012 meeting, would transfer $50,000 from the city’s public art fund to the general fund. The rationale for the transfer was this: Of the money that had gone into the public art fund as a result of the municipal center (police/courts Justice Center) project, $50,000 could be linked to the general fund.

Kunselman recited some of the legal arguments that have been made against the city’s public art ordinance, citing the Bolt v. City of Lansing court decision from 1998.

Hieftje responded to Kunselman’s invitation to follow through on his expressed intention to bring forward a resolution that would transfer $50,000 of public art money back into the general fund. Hieftje said he would not be bringing forward the resolution, because it would be a violation of the public art ordinance. [On May 7 when Hieftje announced that he wanted to bring forward such a resolution, it was clear to observers of that meeting that Hieftje's proposal foundered on the same legal problem that a resolution of Jane Lumm's did – which related to her desire to cancel the Justice Center lobby art project.]

Tony Derezinski (Ward 2) characterized the budget amendment as “attacking public art.” Sandi Smith (Ward 1) noted that the council had debated the merits of the public art ordinance before. This time it’s in a slightly different form, but she felt the community had spoken loud and clear that art is a priority. Smith noted that she herself had brought a resolution forward in the past to reduce the percentage allocation to public art – from 1% to 0.5%. But she reported that when this has come up, 98% of the communication she receives is in support of the public art ordinance, and 2% is not. She felt that it speaks volumes that one of the community’s priorities is art.