DDA Preps Budget for Transportation, Cops

The Jan. 25, 2013 meeting of the Ann Arbor Downtown Development Authority’s operations committee featured a preview of budgets for the fiscal years 2014 and 2015. For FY 2014, the DDA budget calls for $23.1 million in expenditures against $23.4 million in revenues. That would add about $300,000 to the total fund balance reserve, which is projected to end FY 2014 fiscal at around $5.5 million.

City Apartments, a Village Green residential property under construction on Feb. 4, 2013. (View is at First & Washington looking east) The bottom two floors are a parking deck, which is on track to be turned over to the city and the DDA on March 15, 2013. It will expand the capacity of the public parking system by almost 100 spaces. (Photo by the writer.)

The surplus from FY 2014 would be used in the FY 2015 budget, which calls for $23.8 million in expenditures against $23.5 in revenues, leaving the DDA with about $5.2 million in total fund balance reserve at the end of FY 2015.

DDA revenues come from two main sources – tax increment finance (TIF) capture and Ann Arbor’s public parking system.

Besides operation and capital maintenance of the parking system, revenues to the public parking system are used by the DDA to support the getDowntown program’s go!pass subsidy. So one focus of the Jan. 25 DDA operations committee meeting was budgeting for that program. The go!pass is a bus pass that downtown employees obtain through their employers, who pay $10 annually for passes for each of their employees. In a presentation made to the operations committee, Michael Ford – CEO of the Ann Arbor Transportation Authority – requested a total of $623,662 to support the getDowntown program, including the go!pass subsidy. That compares with $553,488 granted by the DDA last year. For FY 2014, the DDA’s draft budget calls for a $600,000 allocation that could cover most of that request.

This year’s draft budget also calls for $250,000 in parking revenue to be spent on a possible arrangement with the city of Ann Arbor to pay for additional downtown police patrols. Based on the conversation at the operations committee meeting, it’s not a topic on which any recent detailed talks have taken place. But DDA executive director Susan Pollay indicated a strong interest in having those conversations with the city. If that didn’t lead to an agreement with the city, she said, then the DDA board was certainly not obligated to spend the money in that way.

Another $300,000 in the FY 2014 budget that could be used somewhat flexibly is in the TIF fund budget, labeled “capital construction.” It could be used to fund sidewalk improvements between William and Liberty along State Street to facilitate patio dining for restaurants along that strip – or streetscape improvements for William Street, or even alley improvements near the Bell Tower Hotel, Pollay told the committee.

The full DDA board will be asked to approve the FY 2014 and FY 215 budgets at its Feb. 6 meeting. The DDA’s fiscal year is in sync with the city of Ann Arbor’s fiscal year, which begins on July 1. The city council will settle the city’s FY 2014 budget by May 20 – the council’s second meeting in May. While the city uses a two-year planning cycle – which begins fresh this year – the council approves its budget just one year at a time. [.pdf of draft DDA budgets FY 2014-15] [.pdf of FY 2013 six-month financial statements] [.pdf of monthly parking reports]

Parking Fund Budgeting

The Ann Arbor DDA operates the public parking system under a contract with the city of Ann Arbor – an agreement that calls for the city to receive 17.5% of gross revenues to the system. For this year and the following two budget years, that 17% payment to the city is projected to translate to $3.14 million, $3.20 million and $3.24 million.

In the current year, total parking revenues are budgeted for $18.1 million. But according to the financial statements through December 2012, which is mid-way through the fiscal year, actual parking revenues through that period are $9.4 million, or about $300,000 more than the budgeted year-to-date number. Projected parking revenues for the next two fiscal years are $19.3 million and $19.6 million, respectively.

Parking fund revenues pay for the direct expense of contracting with Republic Parking for the day-to-day operations of the system (about $6.5 million), rental for some properties not owned by the city but used for public parking (about $0.5 million), as well as roughly half the DDA staff compensation and administration (about $370,000). The other major allocation from the parking fund is for maintenance of the parking structures. For FY 2014 there’s $4.4 million set aside for parking maintenance.

Parking Fund: Alternative Transportation

One focus of the Jan. 25 DDA operations committee meeting was budgeting for the getDowntown‘s go!pass program, which is also funded from parking revenues. Downtown employers can purchase a go!pass at a cost of $10 per employee – with the condition that the business must purchase a pass for all their employees. Beyond that, rides taken with the go!pass are free to the pass holder or their employer. The cost of the rides has been subsidized historically by the DDA, using revenues from the parking system. The getDowntown program is administratively a part of the AATA. Through the AATA’s fiscal year FY 2012, which concluded at the end of September 2012, here’s how go!pass ridership has trended:

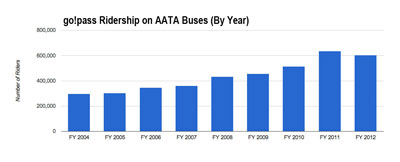

go!pass total rides by year. The number of rides taken with go!passes has roughly doubled since 2004. This past year reflected a dip, which appears to be related to a reduced number of cards in circulation: 6,591 compared to 7,226. (Data from AATA; chart by The Chronicle.)

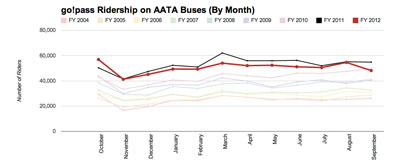

go!pass rides by month, year over year. The red trend line is the most recent year, 2012. The previous year is shown in black. (Data from AATA; chart by The Chronicle.)

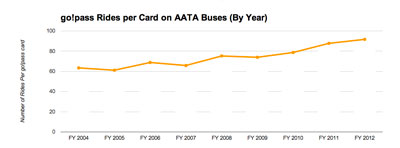

While the total number of rides dipped slightly, the number of rides per card continued its upward trend. Since 2004, the number of rides per card has increased from about 60 to about 90. (Data from getDowntown program; chart by The Chronicle.)

In a presentation made to the operations committee on Jan. 25, AATA chief executive officer Michael Ford requested a total of $623,662 to support the getDowntown program, including the go!pass subsidy. That compares with $553,488 granted by the DDA last year. In the DDA’s budget summary for FY 2014, the getDowntown subsidy falls under the line item for “alternative transportation” – for which $615,000 is allocated this year.

The detailed breakout for the parking fund, which the DDA uses to support getDowntown – indicates that $15,000 of the $615,000 is allocated for the “connector study.” That’s a study meant to determine a locally-preferred alternative mode for a high-capacity transit system along the corridor that arcs from US-23 and Plymouth southward along Plymouth to State Street and farther south to I-94. In the fall of 2012, the DDA approved that $15,000 as part of a total $30,000 commitment over two years. Other funding partners for the $1.5 million project – which is supported by a $1.2 million federal grant – include the city of Ann Arbor, the AATA and the University of Michigan.

Compared to the DDA’s $600,000 budgeted amount, Ford’s request is $23,662 more. As one way to cover that difference, DDA executive director Susan Pollay pointed committee members to $300,000 of discretionary grant funding from the parking fund that’s in the draft FY 2014 budget. Of that amount, $50,000 could be used to cover the gap between the budgeted amount and Ford’s request.

By way of additional background, in the past the AATA has essentially agreed to absorb the cost of go!pass rides that might be taken in excess of the funded amount. So, at the AATA board’s Aug 24, 2011 meeting, a decision was made to accommodate the DDA’s financial circumstances and to set the amount charged for go!passes in 2013 at the amount the DDA had already allocated – $475,571.

At the Jan. 25 DDA operations committee meeting, getDowntown director Nancy Shore put the cost-per-ride figure used to calculate the request at about $0.90 per ride. In negotiating the cost-per-ride for similar arrangements – like the University of Michigan MRide program – AATA uses as a benchmark the amount that bus riders would pay if they paid the full fare under a regular 30-day pass. The 30-day pass is the cheapest full-fare option. Full adult cash fare on boarding would be $1.50.

At the AATA board’s most recent meeting, on Jan. 17, 2013, the relationship between rides taken and fares collected was highlighted. The treasurer’s report included a note that despite greater ridership numbers, the fares collected were not keeping pace. One theory floated was that this disparity could be attributed to go!pass ridership in excess of the projected funding need.

The request from AATA this year is based on the projected ridership. In the chart below, presented by Ford at the Jan. 25 meeting, the decreased request in the first line, for getDowntown program operations, is explained by the fact that this year the program will not incur the cost of an evaluation survey. The projections based on ridership originating east of US-23 are made possible by the swipe-able go!pass cards and fare-box technology, which allow the AATA to analyze where riders are boarding the bus.

YEAR 2013 2014 getDowntown $52,488 $35,488 go!pass $475,000 $479,000 NightRide go!pass discount $5,000 $18,233 ExpressRide go!pass Discount $7,000 $18,000 Route 4 East of US-23 $14,000 $56,363 Route 5 East of US-23 $0 $16,578 ==================================== Total $553,488 $623,662

-

The $14,000 provided last year to help subsidize improved service to and from Ypsilanti on Route #4 was actually authorized by the DDA board on Dec. 1, 2010, as a “challenge grant” – which was made hoping to prod other entities to join in supporting the increased service.

And committee members on Jan. 25 wanted to know what kind of requests were being made by the AATA municipalities and entities other than the DDA. Ford responded by indicating that other communities that are a part of the “urban core” will also be asked to help fund the Route 4 improvements as part of conversations that have continued since the abandonment of the Act 196 countywide authority, which was newly incorporated in the fall of 2012.

By way of background, part of the Ann Arbor city council resolution on Nov. 8, 2012 – which withdrew the city from the new transit authority the council – also gave direction to the AATA to continue conversations with immediately neighboring communities about options for improving local transit. And the AATA has engaged in talks with communities about a smaller-than-countywide transit authority with possible members to include the cities of Ann Arbor, Ypsilanti, and Saline, as well as the townships of Pittsfield and Ypsilanti. Involvement with the townships of Superior and Ann Arbor is also a possibility.

In addition to expressing an interest that the Ann Arbor DDA not be the only entity providing additional support, committee members indicated they’d also like to see even better service provided on Route #4 – in the form of an “express” route that had no stops between downtown Ypsilanti and Ann Arbor. Ford seemed receptive to the idea in concept, and suggested it might be necessary to think about using I-94 to provide that service. DDA board member Roger Hewitt indicated that he felt one obstacle in the way of Ypsilanti becoming an even more vibrant community is the amount of time it takes to ride the bus between Ypsilanti and Ann Arbor.

Some committee members also questioned the structure of the “all-in” go!pass program requirement – which means an employer must purchase passes for all employees of the company at a cost of $10, even for those who might not ever use the card. It’s part of the reason that the cost per card to employers is relatively low – and until two years ago was even lower ($5).

Part of getDowntown director Nancy Shore’s presentation to the committee included an anecdote about a lost wallet and the holder of a go!pass saying the pass was the most valuable item in their wallet. Hewitt responded to that part of the Shore’s presentation by observing that even though the card holder contended that the go!pass was valuable, that person was not being asked to contribute to its cost – because it’s provided through the employer. Shore’s presentation indicated that many downtown employers see the go!pass as one of the only benefits they’re able to offer to their employees besides salary.

Parking Fund: Beat Cops

After subtracting $50,000 for possible alternative transportation, the remaining $250,000 of discretionary funding in the parking fund budget could be used to pay for downtown beat patrols by the Ann Arbor police department. Based on the conversation at the operations committee meeting on Jan. 25, it’s not a topic on which any recent detailed talks have taken place – but DDA executive director Susan Pollay indicated a strong interest in having those conversations with the city. If that didn’t lead to an agreement with the city, she said, then the board was certainly not obligated to spend the money in that way.

Conversation among committee members was mixed on the idea. Bob Guenzel wondered how much downtown policing $250,000 would buy. [Guenzel was Washtenaw County administrator during the time that some townships litigated over the amount they were being charged by the county for sheriff's road patrols.] John Mouat wondered if the $250,000 might not be spent more wisely on “ambassadors” for the downtown. Of the committee members, Hewitt seemed more enthusiastic about the idea, pointing to ongoing issues in the South University area, where he owns a business.

Hewitt expressed skepticism, at least in the near term, that the relatively new Main Street Business Improvement Zone could eventually be expanded beyond its current geographic boundaries – along a few blocks of Main Street – to include a significant part of the rest of downtown Ann Arbor. In any case, the Main Street BIZ was, he said, more focused on the “clean” part of the slogan “clean and safe.” So, while the self-assessment used to finance the BIZ might support snow removal and handbill removal, it would not be capable financially of hiring personnel to address the “safe” part of the slogan.

At the committee meeting on Jan. 25, Pollay alluded to the idea that the DDA had harbored an expectation that downtown beat patrols would continue to be provided – as a result of the DDA’s willingness to support the city’s municipal center project. By way of background, the DDA agreed to make an $8 million grant to the city – in the form of roughly $0.5 million in annual installments – to help pay for the city’s police/courts project, known called the Justice Center. That grant to the city comes out of the roughly $4 million in TIF capture that the DDA receives annually. The DDA board’s decision to allocate that grant came at the DDA board’s May 8, 2008 meeting.

However, the downtown beat patrols, which some officers chose to do on bicycle, were discontinued, as the total sworn officers in the AAPD decreased through the late 2000s. The strategy used by then-police chief Barnett Jones was to encourage officers to spend their “out of car time” in the downtown area. [For some coverage on that issue from the 2010 budget season, see: "Budget Round 6: Bridges, Safety Services."]

A new digital system for logging officer activity reports rolled out at the start of 2013 and could allow for a realistic assessment of the current level of downtown police coverage.

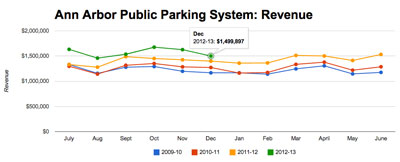

Parking Fund: Revenue Trends

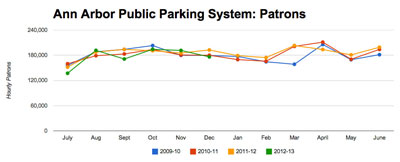

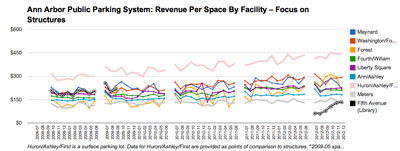

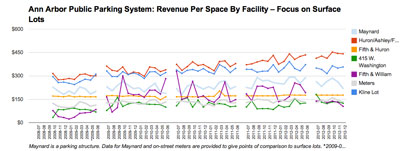

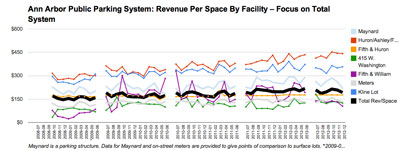

Parking revenue totals are reported monthly to the DDA operations committee. The most recent month for which data was provided was December 2012. Those numbers show an increase in revenues of about 7.2% compared with December 2011, and a drop in the number of hourly patrons by 8.5%. Those numbers come in the context of a 13% increase in the number of spaces in the system – from 6,870 to 7,805. Mitigating factors cited by Republic Parking manager Art Lowe at the Jan. 25 committee meeting included the fact that Midnight Madness fell this year in November, not December, and that in 2011 Christmas and New Year’s fell on the weekend.

Lowe also indicated that some of the decrease in the number of hourly patrons is attributable to the conversion of parking patrons from hourly parking patrons to monthly permit parkers. Above a certain threshold, for the same amount of parking activity, a monthly permit holder would be paying less for their parking. Based on numbers provided by Lowe at the meeting, and subsequent clarification with DDA staff, it appears that around 3,600 monthly permits were in play for December 2012, compared with around 3,100 for the previous year.

Lowe also said that the Fourth and William structure was likely seeing some incremental erosion of its previous patrons, as a result of the new nearby Library Lane underground garage.

Another highlight evident in the charts is the fact that the Library Lane underground structure, completed in the summer of 2012, has now reached the same revenue-per-space numbers as the on-street metered parking spaces.

And in a month and a half, capacity of the public parking system will be getting an additional 95 spaces. At the operations committee meeting, executive director Susan Pollay told the board that Village Green was still on track to hand over the parking deck component of the City Apartments project to the city and DDA on March 15, 2013. The building included a 244-space parking deck on those first two floors, 95 of which are to be available for public parking. The rest of the spaces will be used by residents of the 146-unit project, when the construction is completed.

That announcement of a March 15 handover was met with some skepticism on the operations committee – because the structure will still need a certificate of occupancy from the city before the transfer can take place. However, it was generally understood that the intent was for the parking deck to be open before construction of the entire project was completed. The building is on track for fall 2013 move-in, based on remarks from Pollay to committee members.

TIF Fund Budgeting

While the DDA’s budget is dominated by its administration of the parking system, that’s not a function assigned to the DDA by state statute. But it’s a function the DDA has performed for the city since the early 1990s.

The part of the DDA’s revenue budget that’s enabled by state statute comes from tax increment financing (TIF). Under a TIF arrangement, an entity “captures” a portion of the property taxes in a specific geographic area that would otherwise be collected by taxing authorities in the district. In the case of the Ann Arbor DDA, taxes captured include those of the Ann Arbor District Library, Washtenaw County, Washtenaw Community College, and the city of Ann Arbor. The tax capture for the Ann Arbor DDA is only on the initial increment in valuation – the difference between the value of property when the district was established, and the value resulting from improvements made to the property. In other words, the Ann Arbor DDA’s TIF doesn’t capture increases due to inflation.

For each of the next two years, the DDA is projecting around $4 million of revenue from its TIF capture. Big-ticket expenditures from the TIF fund include $3.4 million for bond payments and interest, as well as $508,608 as an annual contribution toward the city’s police/courts building.

The TIF fund budget also includes $440,631 for approximately half of the salaries, fringe benefits and administrative costs of the DDA. [The DDA splits these costs roughly evenly between the TIF fund and the parking fund. The DDA has four employees.] For the next year, the DDA is planning to spend about $1.3 million more from the TIF fund than the revenues it will receive, drawing down the TIF fund balance by that amount. That would leave about $800,000 in the TIF fund balance.

Included in the FY 2014 TIF budget is $300,000 that could be used somewhat flexibly – which is labeled “capital construction.” At the Jan. 25 operations committee meeting, DDA executive director Susan Pollay told members that the money could be used to fund sidewalk improvements between William and Liberty along State Street to facilitate patio dining for restaurants along that strip – or streetscape improvements for William Street, or even alley improvements near the Bell Tower Hotel.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor Downtown Development Authority. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Thanks for the explanation about the DDA’s TIF financing. I think these acronyms (DDA and TIF) can be confusing. Given the amount of “authority” it wields in shaping Ann Arbor, our DDA and the way it “captures” taxes are things that everyone should understand. The Citizens Research Council of Michigan recently published a report on tax increment financing. The study concludes that when a community uses TIF it can create “shadow government.” Some might argue that Ann Arbor’s DDA has crossed that line. Here is the link: [link]

“The tax capture for the Ann Arbor DDA is only on the initial increment in valuation – the difference between the value of property when the district was established, and the value resulting from improvements made to the property. In other words, the Ann Arbor DDA’s TIF doesn’t capture increases due to inflation.”

Certainly explains the “Connecting William Street” debacl.. I mean project. You know how it goes: “If all you have is a hammer, then every existing building and empty lot looks like a hotel/conference center.”

And of course the City (as distinguished from the DDA) doesn’t benefit from inflationary increases in property values when there is deflation. It would be interesting to see a graph of the value of recently built downtown buildings over the last decade. I assume that when there is a drop in value, the City does not capture anything until value exceeds (again) the initial valuation.

Will’s quote from the CRC paper is misleading. The CRC argues that separate taxing authorities can be a “shadow government” because, in the hypothetical, their budgets aren’t open to scrutiny. Dave’s article, which pieces through the DDA budget in excruciating detail, belies this assumption and accusation.

…if not the “shadow government” assertion itself- which is the thrust of the article. A machine that can pump its own gas and whose only purpose seems to be pumping gas into itself.

Re (4) The idea that the DDA budget is open to scrutiny merely because we get to look at it is silly. Real scrutiny carries with it some level of consequence.

For example, the City budget is subject to real scrutiny, because residents can hold Council members accountable when they disagree with the spending priorities of their representatives. For example, when voters were displeased with the budget priorities of former Council members Rapundalo and Derezinski, the voters were able to replace them.

There is no mechanism for holding DDA Board members accountable for their budget decisions. They are like a shadow government because they capture about $4 million in local tax revenue and spend it without any possibility of consequence.

For me, the “shadow government” charge sticks due to the fact that, when citizens vote to provide, for instance, additional (wanted and needed) school, roads or parks funding, what they’ll get, instead or in addition, is multiple proposals for hotel/conference centers and giant student housing blocs. Both un-wanted and un-needed. And that these proposals are not coming from civic need or elected representatives or citizens, but solicited by an unelected and unaccountable star chamber of secretive brahmins, spending tax money provided for other purposes. A star chamber who-when they DO engage the public- scoff at or merely dismiss public opinion. Maybe they don’t understand the criticism?

As Upton Sinclair said- ‘It is difficult to get a man to understand something, when his salary depends on his not understanding it.’

So, in spite of their business-eze language, the purpose of the DDA (in Ann Arbor) is/seems to be (remember they are secretive) to extract tax money from vital city services and use it to attract/pay off large-scale, out of state, real estate developers who then tear down existing city structures, build much larger structures on spec (or build speculative housing tracts on green fields?) whether those may one day needed or not.

Then they take their profits (formerly our taxes) and leave town. Leaving the city with holes in the budget, buildings nobody likes or needs but providing the DDA with operating income. So the DDA attracts (out of state) development to fuel their own existence, not for the betterment of city life. That’s the way it looks (to me) due to the way they operate.

Does the DDA collect TIF from new housing tracts in the county? Actual question- I don’t know the answer… Or a new library?

Then, if the buildings/houses built are not fully filled with NEW business/homeowners, they will merely provide a different address from which tax payments were already coming in. The DDA gets their money because the building is NEW and different from what was there before, though. Then those old addresses get the wrecking ball and teachers and firemen get laid off because the tax revenues aren’t NEW, only old sources coming from a different address. Lather, rinse, repeat. Although I guess SOMEONE is still paying the taxes on empty buildings left in the wake.. until they stop paying or they are bought by the U. So the increase in taxes is temporary while the buildings are permanent.

This is the way it SEEMS to be- to me. I’m open to being corrected. Still trying to piece together what good they do for citizens. What they do for out of state real estate developers is clear enough.

Re (7) “Does the DDA collect TIF from new housing tracts in the county? Actual question- I don’t know the answer… Or a new library?”

The DDA TIF skims tax revenue from improvements to property within the defined DDA district. Essentially, that area is the downtown and the area between campus and Washtenaw Ave. The public library does not pay property tax, so there is nothing to capture.

The importance of the shadow government aspect of TIF authorities is not limited to the DDA. The City is moving toward creating TIF authorities for the Washtenaw corridor study area and the South State Street corridor area. Like the DDA, these authorities would capture some local taxes and divert them to economic development within their respective districts. More shadow governments run by unelected public officials. What could possibly go wrong?

Jack,

The article states:

“In the case of the Ann Arbor DDA, taxes captured include those of the Ann Arbor District Library, Washtenaw County, Washtenaw Community College, and the city of Ann Arbor. The tax capture for the Ann Arbor DDA is only on the initial increment in valuation – the difference between the value of property when the district was established, and the value resulting from improvements made to the property.”

So that would include construction in Washtenaw County but I did not know if that meant houses or just commercial development? The District Library is listed but, as you say, pays no taxes, so why list it?

Dave could jump in there, too, I guess. Or Ms. Lowenstein, even.

Timothy,

The Library is listed because some portion of the incremental taxes the DDA captures would otherwise go to it.

Timothy,

I think there’s some confusion arising from this sentence from Jack Eaton: “The public library does not pay property tax, so there is nothing to capture.”

Eaton is talking about any potential property taxes possibly owed by the AADL on a new building they might construct – taxes owed potentially to entities like the city of Ann Arbor, Washtenaw County, Washtenaw Community College, which the DDA could potentially capture. Eaton is right – that amount is zero, all the way down the line. For example, the AADL pays no taxes to the city of Ann Arbor on its property. So there’s no city tax on the AADL’s building for the DDA to capture.

So why is AADL on the list of entities whose taxes get captured? That’s a list of entities that levy taxes in the DDA district. Let’s say you, Timothy Durham, construct a new apartment building in downtown Ann Arbor with resulting taxable value that’s $1 million greater than the property had previously. On that building you have to pay property taxes to the city of Ann Arbor, Washtenaw County, Washtenaw Community College … and the Ann Arbor District Library. On that $1 million increment, the Ann Arbor DDA captures the taxes that would otherwise have been collected by the AADL (and each of the other entities whose taxes the DDA captures).

So when we say, “The AADL’s taxes get captured by the DDA,” that’s shorthand for: “Some of the taxes levied by the AADL go to the DDA instead of the AADL”

Dave (and Jack and Tom),

Thanks for the explanation. I have recently become a (monthly) supporter of the Chronicle and this is why.

I wonder what percentage of the citizenry have any idea that this is how things work in their city?

Timothy,

“I wonder what percentage of the citizenry have any idea that this is how things work in their city?”

Probably a small percentage, but probably a large percentage of those who read the Ann Arbor Chronicle.

Glad to see another addition. I will follow your lead and provide a monthly stipend for these fine folks.

I couldn’t agree more. We have lived in AA for years and years but never knew very much about the inner workings of the city until Dave and Mary established the Chronicle and provided such salient, very detailed explanations.

@3: “I assume that when there is a drop in value, the City does not capture anything until value exceeds (again) the initial valuation.”

That raises an interesting question. The City and the DDA will both face the repercussions of falling valuations once again beginning later this year and continuing for several more. Does the drop in value come off the DDA’s ‘top’ or is it split evenly between both entities when the value of a property goes down? How did it play out in 2008 and after?

Dave, can you look into that?

It appears that the four DDA employees are easily making more than $150K each, maybe as much as $200K (depending on size of ‘administrative costs’). I wonder how this pay and benefit package compares to the Mayor, other City officials, and other ‘authority’ officials. I also think it’s rather extravagant. But, *SIGH*, it’s probably not too far out of line with other bloated administrative salaries in general, if at all.

Chai, when you write that four “DDA employees are easily making more than $150K each” and follow with the implication that “administrative costs” might also add to DDA employees’ compensation as fringe benefits, it leaves the impression that the $150K number is meant to characterize average base salary – when I think your $150K ballpark arithmetic is probably based on salaries plus fringe benefits. More precise arithmetic on total compensation costs would be: $557K/4 = $139.25K average total compensation.

From the DDA budget for FY 2014:

The most recent figures I have easily handy for a breakdown of individual salaries dates from FY 2009, when the DDA had three employees. Executive director had base of $94.6K, deputy director $86.3K and management assistant $45.2K.

Fringe benefit package is supposed to be the same as for city employees. Administrative budget line is not additional compensation for employees.

By way of comparison, the city administrator has a base salary of $145,000, and the city attorney’s is just under that. Mayor and council salaries are $42,436 and $15,913, respectively – and they’re set by the local officers compensation commission (LOCC), which meets every two years. This year (2013) is a year for the LOCC to meet and set salaries. Coverage from 2011 here: [link]

Re: [3] “I assume that when there is a drop in value, the City does not capture anything until value exceeds (again) the initial valuation.”

I’m understanding that as an intended reference to “the DDA” not “the city” – partly because I don’t think of the city as “capturing” anything, but rather just levying and collecting taxes.

Whatever the intended referent in [3], there’s this followup question in [15] “Does the drop in value come off the DDA’s ‘top’ or is it split evenly between both entities when the value of a property goes down? How did it play out in 2008 and after?”

Just want make sure I understand the kind of scenario we’re being asked to contemplate, before pursuing this further.

SCENARIO: A vacant Property A with no improvements since inception of the DDA has taxable value of $1 million. The city collects tax on the $1 million taxable value of the parcel. The DDA collects zero, because there’s no improvement-based increment.

Then in Year X, the owner completes a building that gives Property A a taxable value of $11 million. The increment on Property A is $10 million, on which the DDA captures taxes. The city continues to collect taxes on the baseline $1 million.

In Year X + 1, let’s say that market appreciation gives Property A a value of $11.5 million. The DDA captures taxes on the original increment of $10 million; and the city collects taxes on the baseline $1 million plus the $0.5 million in appreciation – so the city collects taxes on $1.5 million.

But in Year X + 2, let’s say that instead of market appreciation, we have dramatic deflation, and Parcel A has a taxable value of just $10.5 million.

Question: For Year X + 2, does the DDA capture taxes on the original increment of $10 million, leaving the city with only $0.5 million on which to collect taxes? Or does the city collect taxes on its initial baseline $1 million of Property A’s taxable value, leaving the DDA with just $9.5 million on which to capture taxes? Or is the drop from $11.5 million to $10.5 million allocated proportionately to the city’s part and the DDA’s part?

Steve, does that fairly portray the specific issue?

@18: You got it.

Re (18) never quibble semantics with a linguist, but I was in fact referring to the City’s tax capture, or if you prefer, taxes collected on valuation.

Putting the “baseline” valuation aside, what I was trying to say is that if the DDA is entitled to the taxes from the increment due to new construction (the $10 million) and the city gets the revenue from any new valuation due to inflation; but if the valuation then drops so that there is no gain due to inflation, but rather a loss from the original increment, the city does not collect any new tax from the new construction.

The baseline question complicates it but is also a good question.

From (18)

Question: For Year X + 2, does the DDA capture taxes on the original increment of $10 million, leaving the city with only $0.5 million on which to collect taxes? Or does the city collect taxes on its initial baseline $1 million of Property A’s taxable value, leaving the DDA with just $9.5 million on which to capture taxes? Or is the drop from $11.5 million to $10.5 million allocated proportionately to the city’s part and the DDA’s part?

Which is it?

Have I missed it?

Re: [20] I’ve forwarded the scenario and questions to the city finance staff that I figured would be able to answer the question.

For the scenario and question in [18] about the impact on TIF capture in deflationary contexts, from city treasurer Matt Horning, the answer is: For year X+2, the DDA would capture on the incremental value of $9.5 million. The base value of $1 million remains unchanged.

@23: Thanks, Dave. Glad to hear that won’t be a point of confusion.