Council Delays Vote on DDA Tax Capture

Several revisions to a city ordinance governing the Ann Arbor Downtown Development Authority (DDA) were postponed by the city council at its March 4, 2013 meeting. Some of the proposed revisions would have an impact of several million dollars over the next two decades, affecting several jurisdictions besides Ann Arbor. The postponement was until the council’s March 18 meeting.

Among the revisions to Chapter 7 that are being considered by the council are: a new prohibition against elected officials serving on the DDA board; term limits on DDA board members; a new requirement that the DDA submit its annual report to the city in early January; and a requirement that all taxes captured by the DDA be spent on projects that directly benefit property in the DDA tax increment finance (TIF) district.

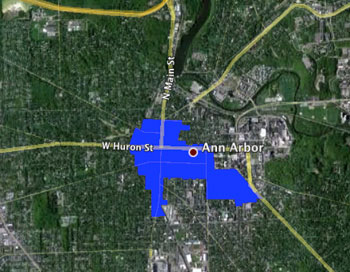

But most significant of the revisions would be those that clarify how the DDA’s TIF tax capture is calculated. The “increment” in a tax increment finance (TIF) district refers to the difference between the initial value of a property and the value of a property after development. The Ann Arbor DDA captures the taxes – just on that initial increment – of some other taxing authorities in the district. Those are the city of Ann Arbor, Washtenaw County, Washtenaw Community College and the Ann Arbor District Library. For FY 2013, the DDA will capture roughly $3.9 million in taxes.

The proposed ordinance revision would clarify existing ordinance language, which includes a paragraph that appears to limit the amount of TIF that can be captured. The limit is defined relative to the projections for the valuation of the increment in the TIF plan, which is a foundational document for the DDA.

If the actual rate of growth outpaces that anticipated in the TIF plan, then at least half the excess amount is supposed to be redistributed to the other taxing authorities in the DDA district.

What the proposed ordinance revisions clarify is which estimates in the TIF plan are the standard of comparison – the “realistic” projections, not the “optimistic” or “pessimistic” estimates. However, the ordinance revisions as currently formulated do not clarify whether a “cumulative” method of performing the calculations should be used or if a year-to-year method should be used.

Use of the cumulative method has an impact on whether the redistribution of excess TIF is made on a one-time or recurring basis. Under the cumulative method, other taxing authorities in the Ann Arbor DDA TIF district would see a total on the order of $1 million in additional tax revenue, compared to the way the DDA currently calculates the TIF capture. The city of Ann Arbor’s annual share would be more than half of that amount, around $600,000. [.jpg of chart showing DDA TIF capture using different methods]

Method: Year-to-Year

Refunds

City County WCC AADL Total Ref DDA TIF

FY14 $429,409 $149,392 $94,257 $40,163 $713,221 $3,964,457

FY15 $11,958 $4,160 $2,625 $1,118 $19,862 $4,774,758

===============================

Method: Cumulative

Refunds

City County WCC AADL Total Ref DDA TIF

FY14 $613,919 $213,583 $134,757 $57,421 $1,019,680 $3,657,998

FY15 $635,108 $211,673 $139,195 $58,539 $1,044,515 $3,773,043

-

The clarification of the ordinance crucially strikes two paragraphs related to bond and debt payments. One of the two paragraphs was key to the DDA’s current legal position – which is that no redistribution of TIF is required under the ordinance, given the DDA’s financial position. The DDA interprets the stricken paragraphs to mean that no redistribution to other taxing authorities needs to be made, until the total amount of the DDA’s debt payments falls below the amount of its TIF capture. In the FY 2014 budget, adopted by the DDA board at its Feb. 6, 2013 meeting, about $6.5 million is slated for bond payments and interest.

That clearly exceeds the amount of anticipated TIF capture in the FY 2014 budget – about $3.9 million. The DDA is able to make those debt payments because about half of that $6.5 million is covered by revenues from the public parking system. The DDA administers the public parking system under contract with the city of Ann Arbor.

This issue first arose back in the spring of 2011. The context was the year-long hard negotiations between the DDA and the city over terms of a new contract under which the DDA would manage the city’s parking system. The Chapter 7 issue emerged just as the DDA board was set to vote on the parking system contract at its May 2, 2011 meeting.

When the issue was identified by the city’s financial staff, the DDA board postponed voting on the new contract. The period of the postponement was used to analyze whether the DDA’s Chapter 7 obligations could be met – at the same time the DDA was ratifying a new parking system contract, which required the DDA to pay the city of Ann Arbor 17.5% of gross parking revenues.

Initially, the DDA agreed that money was owed to other taxing authorities, not just for that year, but for previous years as well. And the DDA paid a combined roughly $473,000 to the Ann Arbor District Library, Washtenaw Community College and Washtenaw County in 2011. The city of Ann Arbor chose to waive its $712,000 share of the calculated excess.

Subsequently, the DDA reversed its legal position, and contended that no money should have been returned at all. That decision came at a July 27, 2011 DDA board meeting.

The following spring, during the May 21, 2012 budget deliberations, Stephen Kunselman (Ward 3) proposed an amendment to the city’s FY 2013 budget that stipulated specific interpretations of Chapter 7, with a recurring positive impact to the city of Ann Arbor’s general fund of about $200,000 a year. Kunselman wanted to use that general fund money to pay for additional firefighters. That year the budget amendment got support from just two other councilmembers: Jane Lumm (Ward 2) and Mike Anglin (Ward 5).

The postponement of the Chapter 7 ordinance revisions on March 4 was unanimous, based on the need to look at a considerable amount of additional information and analysis.

For a Chronicle op-ed on this topic, see: “Column: Let’s Get DDA TIF Capture Right.”

This brief was filed from the city council’s chambers on the second floor of city hall, located at 301 E. Huron. A more detailed report will follow: [link]