Council Again Delays DDA Ordinance Vote

On a unanimous vote, the Ann Arbor city council has again delayed final enactment to changes in the city’s ordinance governing the Ann Arbor Downtown Development Authority. The postponement is until the council’s second first meeting in September – on Sept. 3, 2013.

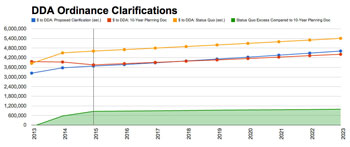

Ann Arbor DDA TIF revenue projections. The vertical line indicates the year when the clarified calculations would be implemented. The red line is the amount of TIF revenue assumed by the DDA in its FY 2014 and FY 2015 budgets, and in its 10-year planning document. The blue line is the estimated TIF revenue under the proposed clarified ordinance calculations. The yellow line is the estimated TIF revenue the DDA would receive if the DDA continued to interpret the city’s ordinance in its own way. (Numbers from the city of Ann Arbor and DDA. Chart by The Chronicle.)

Several revisions to Chapter 7, a city ordinance governing DDA, had received an initial approval from the city council at its April 1, 2013 meeting. If the revisions are given final approval, the result would be roughly $490,000 in additional annual revenue for the city of Ann Arbor – compared to what the city would receive under the DDA’s current interpretation of the ordinance.

After voting around 3 a.m. to postpone the item at its April 15, 2013 meeting, the council voted again on May 6 to postpone final consideration.

The ordinance revisions postponed by the council fell roughly into two categories: (1) those involving board composition and policies; and (2) calculation of tax increment finance (TIF) capture in the DDA district.

In the first category, the revisions to Chapter 7 that had received initial approval by the council included: a new prohibition against non-mayoral elected officials serving on the DDA board except by agreement with the other taxing jurisdictions; term limits on DDA board members; and a new requirement that the DDA submit its annual report to the city in early January.

More significantly, the revisions to Chapter 7 that would clarify how the DDA’s TIF tax capture is calculated. While the interpretation of the language is disputed, it’s mostly acknowledged that the ordinance language doesn’t provide explicit and clear enough guidance on the calculations.

The “increment” in a tax increment finance district refers to the difference between the initial value of a property and the value of a property after development. The Ann Arbor DDA captures the taxes – just on that initial increment – of some other taxing authorities in the district. Those are the city of Ann Arbor, Washtenaw County, Washtenaw Community College and the Ann Arbor District Library. For FY 2013, the DDA will capture roughly $3.9 million in taxes.

The ordinance revisions would clarify existing ordinance language, which includes a paragraph that appears to limit the amount of TIF that can be captured. The limit is defined relative to the projections for the valuation of the increment in the TIF plan, which is a foundational document for the DDA. The result of the clarification to the Chapter 7 language would mean about $360,000 less TIF revenue for the DDA in FY 2014 – compared to the $3.933 million shown in the DDA’s adopted budget for that year. But for FY 2015, the gap between the DDA’s budget and the projected TIF revenue – using the proposed clarifying change to Chapter 7 – is just $74,000.

However, an amendment to the ordinance changes – accepted as “friendly” at the council’s April 15 meeting – would apply the clarified calculations starting in FY 2015. That would result in minimal impact on TIF revenue to the DDA – compared with the DDA’s own recently adopted FY 2014-15 budgets and its 10-year planning document.

However, the total increment in the district on which TIF is computed has shown significant growth. And under the proposed clarification of Chapter 7, that growth would result in a return of TIF money to other taxing jurisdictions (which would otherwise be captured by the DDA) totaling around $900,000 each year from FY 2015 through the next 10 years. The city of Ann Arbor’s share of that would be roughly $490,000.

These projections do not include the tax capture that would result in future years from completion of major downtown projects like City Apartments, 624 Church, 618 S. Main, or 413 E. Huron (assuming that it is approved).

The amount of TIF capture that’s returned to the other taxing jurisdictions is tied to growth in the valuation by the existing Chapter 7 language. Under Chapter 7, if the actual rate of growth outpaces the growth rate that’s anticipated in the TIF plan, then at least half the excess amount is supposed to be redistributed to the other taxing authorities in the DDA district.

In 2011, the DDA for the first time returned excess TIF capture to other authorities, when the existence of the Chapter 7 language was reportedly first noticed. At that time, the DDA made repayments of TIF monies to other authorities of around $400,000, which covered what was owed going back to 2003. When the DDA calculated the amounts owed in 2011, the city of Ann Arbor waived its roughly $700,000 share.

In 2011, the DDA used a year-to-year interpretation of the Chapter 7 language instead of computing rate of growth against the base year in a cumulative fashion. That is a point that the Chapter 7 revisions would clarify.

Before giving initial approval on April 1, 2013 – but then postponing the ordinance amendments on April 15 – the council had previously postponed voting at its March 18, 2013 and March 4, 2013 meetings.

This brief was filed from the city council’s chambers on the second floor of city hall, located at 301 E. Huron. A more detailed report will follow: [link]