Work Progresses on Public Housing Overhaul

The Ann Arbor housing commission board was updated recently about efforts to renovate and redevelop the city’s public housing properties, a massive undertaking that’s been in the works for more than a year.

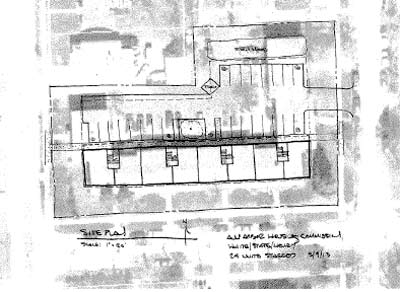

Lori Harris, Norstar Development senior project manager, describes a potential site plan for redeveloping the Ann Arbor housing commission’s North Maple complex. Harris and Norstar president Rick Higgins attended the AAHC board’s June 19, 2013 meeting. (Photos by the writer.)

Norstar Development president Rick Higgins and Lori Harris, the firm’s senior project manager, briefed commissioners at the board’s June 19, 2013 meeting. The board had selected Norstar as a co-developer for this overhaul in January.

Norstar’s presentation included a review of the two low-income housing tax credit applications that the AAHC plans to make in August to the state of Michigan. The applications will cover a total of five public housing properties: Miller Manor, South Maple, Baker Commons, Hikone and Green/Baxter complexes. These properties make up the bulk of public housing units in the AAHC portfolio – 248 out of a total 326 units.

If approved, the tax credits would provide a large funding source for renovating those properties. It’s part of Norstar’s effort to help AAHC convert Ann Arbor’s public housing units into public/private partnerships through a new rental assistance demonstration program, known as RAD, offered by the U.S. Dept. of Housing and Urban Development (HUD). AAHC was accepted into the program late last year. The goal is to allow AAHC to use private financing for capital improvements in its existing housing stock, which is decades-old and in need of major upgrades.

The Ann Arbor city council signed off on this process by unanimously passing a slate of resolutions at its June 3, 2013 meeting. One of the most crucial actions was approval of an ownership transfer for public housing properties – from the city of Ann Arbor to the housing commission. AAHC has managed, but does not own the properties.

As part of the tax credit application review process, Norstar representatives described the financing and legal structure to be used in renovating these first five properties. Among the challenges is the potential need for significant asbestos abatement at most of the locations, as well as major HVAC infrastructure upgrades at Miller Manor. Higgins indicated that he’s somewhat worried about the budget for these renovations, and thought it might be necessary to seek additional funding from the city and other sources.

In addition to the five initial properties that will be renovated, Norstar also is developing site plans – working with AAHC and the city’s planning staff – for four AAHC complexes that will likely be demolished and, with some exceptions, rebuilt: North Maple Estates, Platt Road, White/State/Henry, and Broadway Terrace. Redevelopment of these sites, particularly at North Maple Estates and on Platt Road, is expected to add 26 new units to the city’s low-income housing stock.

Related to this conversion process, no action was taken by the AAHC board on June 19 . Jennifer Hall, AAHC executive director, told commissioners that she plans to bring forward a voting item for them at their July 17 meeting – related to amending the city’s RAD application. The original application covered only about 80% of AAHC properties, but now the goal is to include all properties in the RAD conversion. Hall noted that because Norstar representatives were in town on the date of the June 19 board meeting, she’d asked them to brief commissioners on the redevelopment efforts so far.

Tax Credit Financing Update

Rick Higgins, Norstar’s president, began by focusing on the tax credit application that the AAHC plans to make in August. The AAHC is applying to the state’s low-income housing tax credit (LIHTC) program. “That’s key, because that will be our biggest source of funding,” he said. The federal program is administered by the Michigan State Housing Development Authority (MSHDA). Tax credits are awarded for projects, and are in turn sold to investors who provide funding for construction or renovation. Pricing for those credits varies, depending on market conditions and other factors. For this project, Norstar expects to get roughly 83 cents on the dollar.

Originally, Norstar had planned to package the city’s two mid-rise public housing projects – Miller Manor and Baker Commons – into one application, Higgins said, with a second application to include the group of Hikone, Green/Baxter and South Maple townhouse complexes. But for a variety of reasons, including the way that points are scored for the LIHTC program, Norstar decided to group the five properties in a different way. For example, an application gets more points if 10% of the units have barrier-free access. It’s not possible to reach that target with a rehab of South Maple, Higgins said. “It would cost an exorbitant amount of money to try to do that for the townhouses.” However, by combining South Maple with one of the larger mid-rise complexes, which can more easily be made barrier-free, Norstar can reach that 10% target of total barrier-free units in its application.

Higgins told commissioners that the LIHTC program is very competitive. He estimated that only about 30-40% of applications are actually funded. There’s no point in applying if you don’t have competitive scores, he added. “So we have to continually look at what we’re doing and how we’re doing it, so we can get those points. If we don’t get those points, we have nothing.”

Lori Harris, Norstar Development senior project manager, noted that Norstar has been trying to rearrange these five properties into ways that will yield the highest scores. The reason they had originally grouped the two mid-rises together was that those properties are very similar, she explained, and they thought it might be easier for investors to understand. But when they looked closer, they decided it made more sense from a scoring perspective to group each mid-rise with one or more townhouse complexes. “It’s really about how we’re going to package the plan,” she said. Harris noted that AAHC can only make two applications to MSHDA per round. The hope is that both applications made in August will be funded.

The two applications are: (1) for Miller Manor (103 units) and South Maple (29 units); and (2) for Baker Commons (64 units), Hikone (29 units) and Green/Baxter (23 units). That combination was most advantageous for scoring, Higgins said. These five properties also make up the bulk of public housing units in the AAHC portfolio, he noted – 248 out of the total 326 units.

Hall added that this approach doesn’t change the overall scope of work for redeveloping the AAHC properties.

Higgins reported that in addition to these five properties in the first phase, Norstar has evaluated other AAHC properties as well, including North Maple, Broadway, lower Platt, and White/State/Henry. “We think those are very difficult to rehab,” he said. The property at 504-1506 Broadway in particular was a challenge, he said. “It’s not well built, it’s terribly designed. It’s built into a hill – I don’t even know how you’d fix it.” Though they haven’t yet made a final recommendation, Higgins said they’re leaning toward tearing down the housing at all of those sites and rebuilding, rather than trying to rehab. In the case of Broadway, Higgins questioned whether anything should be rebuilt there, given the topography.

He also criticized the units at lower Platt, where there are four houses, each with five bedrooms. He said he’s been doing this kind of work for 20 years, and can walk into a building and quickly determine if it can be saved. He didn’t think the Platt property could be rehabbed.

The goal is to end up with more public housing units than the AAHC now has, Higgins said. At North Maple, for example, Norstar believes the site can be configured to get more units there. [North Maple Estates consists of 20 single-family homes with a total of 85 bedrooms. In that same complex, there are two three-bedroom duplexes, for a total of 12 bedrooms.]

Harris explained that Norstar’s presentation to the AAHC at that June 19 meeting was to assure commissioners – so that commissioners could in turn assure city councilmembers – that there would be at least as many public housing units after converting to RAD as there are now.

In response to a query from Gloria Black – the commissioner representing AAHC tenants – Higgins explained that if a property is torn down and rebuilt, during the construction phase the tenants will be temporarily relocated to other housing. It usually involves relocating to vacant units within other AAHC complexes, or giving tenants housing vouchers for rental property. When the new units are finished, the tenants previously housed there will have a “right of return,” as long as they’re in good standing with AAHC.

Norstar is focusing on the first five properties – Miller Manor, South Maple, Baker Commons, Hikone and Green/Baxter – for the funding round in August 2013. Norstar’s June 19 presentation to AAHC board members included an overview of financing for those conversions. The remainder of the AAHC properties will be handled in subsequent applications in February and August of 2014, Higgins said.

Legal Structure, Financing

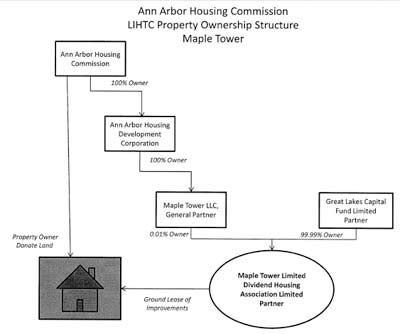

Rick Higgins of Norstar briefed commissioners on the legal and financial aspects of the first phase of RAD conversion, with two applications for low-income housing tax credits and two separate ownership structures: (1) Miller Manor and South Maple; and (2) Baker Commons, Hikone and Green/Baxter.

He noted that the city of Ann Arbor, which owns the properties, has agreed to transfer ownership to AAHC. [That action was approved unanimously at the city council's June 3, 2013 meeting. However, the ownership change won't occur until the AAHC is ready to bring in investors.] By owning the properties, AAHC will be able to enter into a long-term ground lease – likely 60 years or more – with the low-income tax credit partnership.

For the Miller Manor and South Maple properties, for example, the ground lease would be held by an entity called Maple Tower Limited Dividend Housing Association. That entity would be owned by the investors Great Lakes Capital Fund Limited Partner (with a 99.99% ownership stake) and Maple Tower LLC (with an 0.01% ownership). Maple Tower LLC would be owned by the Ann Arbor Housing Development Corp., which in turn is owned by the AAHC.

Chart provided to the AAHC by Norstar showing the ownership structure for Miller Manor and South Maple public housing properties.

Higgins said he’s talked to potential investors in great detail about the ownership structure, and he believes the AAHC will be able to achieve its goal by being the sole general partner, without any ownership participation by Norstar. The investor will be a limited partner, but have 99.99% ownership of the company that will hold the ground lease with AAHC. AAHC will continue to manage the properties, under a management agreement with the partnership that holds the long-term ground lease. That agreement will outline the fees paid to AAHC for its management activities.

So ultimately, Higgins said, the ownership and management structure won’t change, though AAHC will have to account for it differently. But as a practical matter regarding day-to-day operations, “it won’t really change at all,” he said.

Norstar will be a turnkey developer on these projects. As part of that, the company offers certain guarantees, he said. The biggest one is the guarantee that the project will be built – and that’s what the banks, investors and others will be looking for from Norstar, Higgins said, because AAHC “doesn’t have the wherewithal to be able to do that.” Norstar will also run the job, with all the financing flowing through the firm. They’ll manage the books and oversee the general contractor, subject to AAHC’s approval.

However, AAHC will be responsible for certain operating guarantees, Higgins noted. For example, AAHC will need to guarantee to cover operating deficits – possibly $300,000 or more – for these projects, in needed. AAHC will also be responsible for complying with conditions of the tax credits. It means making sure residents meet the income requirements that qualify the project for tax credits. Initially, Higgins explained, AAHC will enter into an oversight agreement with an experienced tax credit management company, which will allow AAHC to earn points with MSHDA when it evaluates the tax credit application.

Commissioner Marta Manildi asked Hall if all of these elements have already been incorporated into AAHC’s future operational plans. Who will staff the task of monitoring tax credit compliance, for example?

Hall replied that the AAHC staff won’t change. All of the staff will need to be trained on these requirements, however. MSHDA requires a certain amount of experience handling these tax credit regulations, Hall noted, and right now, AAHC staff doesn’t have that experience. That’s why a management company is needed as a partner. So instead of dealing with public housing regulations, Hall said, the AAHC staff will deal with tax credit regulations and vouchers. “The rules aren’t that different,” she added.

In response to another question from Manildi, Hall noted that the status of AAHC employees was clarified at the city council’s June 3, 2013 meeting. [The council approved a resolution stating that current employees of the housing commission are city employees and will continue to be city employees – even after the conversion of AAHC properties to project-based vouchers.]

Higgins added that none of the new ownership entities will have any employees. The employees of the AAHC will provide services to the other entities under a management agreement. The ownership entity for the tax credit financing will be primarily a legal and accounting entity only, he said.

Manildi also wanted to know what mechanism the AAHC would have for auditing or evaluating issues that Norstar is taking care of on AAHC’s behalf. Higgins replied that Norstar has to provide a “cost certification” report to AAHC, MSHDA and others involved in this process. It’s prepared by an accountant, and includes a list of all costs for developing a property. Higgins said he would also make a detailed report to the AAHC board at the end of the project.

Responding to a query from commissioner Gloria Black, Higgins said that part of the reason AAHC hired Norstar is that banks will lend to Norstar, and investors rely on Norstar for these kinds of tax credit deals. “We have the financial wherewithal to stand by our guarantees – that’s one of the reasons you brought us to the table,” he said. Norstar will continue to provide AAHC with updated financial statements throughout this process, he added.

Higgins reviewed the initial development budgets and operating budgets for a 15-year period. From a private sector point of view, he said, the expenses are very high, but from a public sector perspective, the expenses aren’t out of line. “That’s what we’re buying into – it is what it is,” he said. [.pdf of Norstar-prepared budgets]

He noted that public housing properties have a very high expense-to-income ratio – so there’s not a lot of surplus. Investors require a 15-year scenario, allowing for a 2% income increase every year and a 3% annual increase in expenses. Investors want to assess the worst-case scenario, he said, if expenses increase more than income. Unfortunately, he added, because of the high expense-to-income ratio, in the 15th year of this trending scenario, the cash flow is negative. Because of that, Higgins said he can’t borrow as much as he normally would for this kind of project.

Norstar is now estimating debt of $500,000 for the 132-unit Miller/Maple project and $1.6 million for the Baker/Green/Hikone project, with 116 units. Those debt levels are achievable, he said.

Given those amounts that can be borrowed, Higgins said the next step is to look at other possible funding. Luckily, he said, the city of Ann Arbor and Washtenaw County are very supportive of affordable housing. In addition, AAHC is applying for $500,000 loans for each of these two projects from the Federal Home Loan Bank. That’s also factored into the budgets that Norstar has prepared, he said. Lori Harris noted that Avalon Housing, an Ann Arbor nonprofit focused on affordable housing projects, had done a good job in helping with that FHLB application, as a consultant on the project.

Higgins then explained that the AAHC properties have been appraised, so that the value of those buildings can be transferred into the new partnership. It’s possible to obtain tax credits on the value of those buildings, he said, so it’s important for those appraisals to be as high as possible. [In the budgets, these appraisals are listed in the "structures" line item: $1.04 million for Baker/Green/Hikone, and $1.64 million for Miller Manor/South Maple.] As an example, Higgins said he could generate an additional $250,000 for the Baker/Green/Hikone project by using this strategy.

Hall observed that the value of the buildings might seem very low, but it’s not based on market rates. Harris explained that the appraisals are based on the fact that the buildings are rent-restricted, and on the assumption that they’ll be part of the RAD program.

The bottom line, Higgins said, is that Norstar can generate nearly $52,000 per unit for the Miller Manor/South Maple project, and about $37,000 per unit for the Baker/Green/Hikone project. These estimates reflect the hard costs for the work that will go into these buildings, he said.

Now, Norstar is working with a raft of contractors to look at the cost of redevelopment. [.pdf of consultants chart] One of the biggest challenges is asbestos, Higgins said. It’s likely that asbestos is in the joint compound tape of every building in the first phase of this RAD conversion, except for Baker Commons. Most of the buildings were constructed in the late 1960s and early 1970s, when asbestos was commonly used. If asbestos is determined to be in these buildings, then removing drywall and certain other construction activity would have to be handled by an asbestos removal company, to protect the construction workers. It’s possible that the asbestos removal alone could cost as much as $10,000 per unit. Higgins stressed that there’s no safety risk for residents, but the health issue concerns workers who’ll be removing materials that might contain asbestos.

The other challenge relates to Miller Manor. Higgins reported that there’s no air-conditioning in the bedrooms, which impacts quality of life. The plan is to put new windows into the bedrooms, and new HVAC units outside on the balconies, with ducts leading into the bedrooms. That’s an expensive project, he said, especially considering the asbestos issue. These renovations also must meet certain energy efficiency standards in order to be considered for funding, he said, which adds to the expense.

Another problem relates to the sewage systems in these developments, which need to be addressed. All of these things add to the cost of the redevelopment, Higgins said. So the question is how much money will be left after that.

Right now, Norstar is evaluating all the costs and all the aspects of the project that will be required. They’re still talking about other possible elements, like adding geothermal energy or solar arrays. There are many moving parts, he said.

Gloria Black asked how tenants will be affected by all this. Hall replied that the residents won’t see much change, because most of it will be happening administratively. The same AAHC staff will still be working with residents, and residents will need to meet the same income requirements that are in place now.

Christopher Geer clarified that in the Baker/Green/Hikone estimated development cost of $9.941 million, about $6 million in funding will come from the low-income housing tax credits. But that funding from investors won’t come in until after construction, so Norstar plans to take out a $5.25 million construction loan at an estimated 3.5% interest. Other sources of construction funding include possibly $300,000 from the Ann Arbor Downtown Development Authority, a $500,000 loan from the Federal Home Loan Bank, and $750,000 in equity.

For the Miller Manor/South Maple $13.293 million redevelopment, the construction funds include a $9.4 million construction loan, a $500,000 loan from the Federal Home Loan Bank, $200,000 from the Ann Arbor housing trust fund, and $950,000 in equity.

Higgins said he’s worried about the budget, but noted that Hall “keeps saying she can go with her hand out some more” to get additional funds from city sources. That might be necessary, he said.

Hall noted that if the rents weren’t restricted, it would be possible to borrow more upfront and therefore do a broader rehab. So the challenge will be in determining how much can be done with the resources available, she said.

Demolition & Redevelopment

As part of the June 19 presentation to the housing commission, Norstar’s Rick Higgins and Lori Harris also presented preliminary site plans for redevelopment of four AAHC complexes that believe should be demolished and, with some exceptions, rebuilt: North Maple, lower Platt, White/State/Henry, and Broadway Terrace.

Demolition & Redevelopment: North Maple Estates

The current AAHC complex at 701-739 North Maple – north of Dexter Avenue, on the west side of North Maple – consists of 19 single-family homes with a total of 85 bedrooms, as well as two three-bedroom duplexes with a total of 12 bedrooms. AAHC executive director Jennifer Hall noted that it’s the busiest of AAHC’s properties.

Higgins described it as the site with the most exciting potential for improvement. The housing was built at the lowest portions of the site, he noted, while an asphalt basketball court is at the highest point. The current configuration does not make sense from the perspective of drainage and stormwater management, he said.

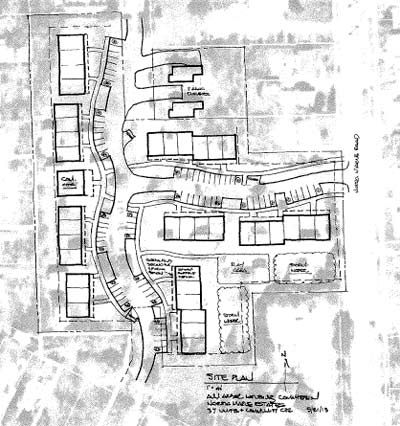

Harris reported that AAHC staff have met with the city’s planning staff to get a sense of what kind of development would be possible. The site plan has gone through a couple of iterations so far, she noted.

Draft site plan for redevelopment of North Maple Estates public housing complex. North Maple is the road running north to south on the east (right) side of this aerial view.

An earlier site plan had larger buildings, Harris said, but the current plan calls for smaller buildings, to be respectful of the types of housing in the surrounding neighborhood. A community center would be centrally located on the west side of the site, and parking will be located adjacent to each of the buildings.

Currently, the drive coming off of North Maple Road dead-ends in the complex, Harris noted. In addition to that entrance, the new plan calls for a drive to connect to Vine Street on the north end, with another drive to the south exiting onto Dexter Avenue. Hall noted that she has talked with city fire department officials, and current standards would not allow for a dead-end like the one that currently exists in this complex.

Harris said there’s a great opportunity for improving the site, from a quality of life perspective for residents. New construction would improve accessibility and “visitability,” she said. Visitability means that guests with disabilities would have access to the first floor of a resident’s living area. That’s something that most AAHC properties don’t have, she noted.

All the new units would be built to be energy efficient and modern, Higgins said.

Commissioner Gloria Black described the current North Maple complex as a “hodge-podge of buildings.” She wondered if the new units would be less vulnerable to damage caused by tenants. Harris replied that some Norstar projects include “high-abuse” drywall. Those are design details that need to be worked out, she said. Harris also pointed out that if a unit has 4-5 bedrooms but only one bathroom – as is the case with the North Maple units – then “that’s a very high-abuse bathroom.” So by designing units that will better fit the needs of families, she said, those units will fare better in terms of wear and tear. Higgins added that new five-bedroom units will have 2.5 bathrooms, and four-bedroom units will have two bathrooms.

Higgins noted that the North Maple buildings have vinyl siding. He reported that in other Norstar projects, they typically use brick or other durable material for entryways or porches, which are high-traffic areas.

These site plans are more conceptual, with many of the details – including building materials and other design issues – to be worked out as the projects move forward.

The proposed redevelopment on North Maple would increase the number of units from 23 to 41. Hall noted that the two duplexes on the site won’t be torn down, but rather will be rehabbed. The duplexes were built in the early 1980s and aren’t in as bad of shape as the single-family homes, which were built in the late 1960s.

Demolition & Redevelopment: Lower Platt

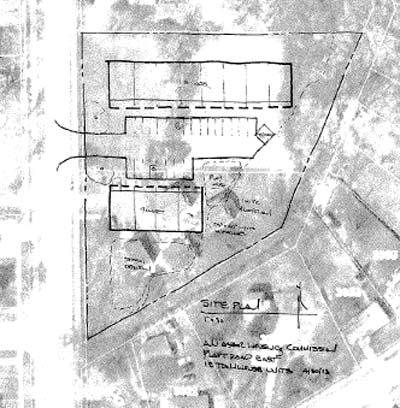

The AAHC property described as lower Platt is located at 3451-3457 Platt – on the east side of Platt Road, north of Belvidere. Currently, there are four single-family houses at that site, each with five bedrooms. Three of those houses are in the floodway, Hall noted, and the water table is higher than the basements. When it rains, the properties flood. The plan is to tear down the existing buildings, and rebuild 12 new townhomes further north on the same site, on land that’s currently vacant.

Draft site plan for Ann Arbor Housing Commission’s Lower Platt redevelopment, on the east side of Platt Road, north of Belvidere.

In addition, there’s a strip of vacant city-owned land on the west side of Platt, north of Verle and south of Sharon. The land runs from Platt over to Springbrook. Norstar’s development plan calls for building four duplexes there – a total of eight units – with two duplexes accessed from Platt, and the other two accessed from Springbrook.

Draft site plan for redevelopment of city-owned vacant land between Platt Road and Springbrook, south of Sharon. In this image, Platt is the north-south road on the east (right) side.

Gloria Black asked whether these projects would address the site’s drainage issues. Higgins replied that new construction must meet city code, regarding drainage and all other code requirements.

Demolition & Redevelopment: White/State/Henry

Currently, AAHC has 28 units in a building along Henry Street, between South State and White Street. The addresses are 1514 and 1520 White St., 1521 S. State St., and 701-719 Henry St. The proposal calls for tearing down the existing building.

Draft site plan for Ann Arbor Housing Commission building on Henry Street, between South State and White streets.

This was the site that the city planning staff had the most trepidation about, Harris said. The city staff want the layout to fit better into the neighborhood’s streetscape. So Harris reported that this particular site plan is being put on the back burner for now. The goal is for the new construction to keep the same number of units (28).

Higgins called the current layout a security and maintenance nightmare. Norstar is trying to come up with a design that gives every unit its own door, to eliminate common space in the building. It helps security and makes for better quality of life for residents, he said.

Regarding parking, Harris said the site would need a parking variance from the city. Hall added that the new site plan has more parking than currently exists at that location, but she noted that for the city planning staff, parking “seemed to be the least of their concerns.” The city is moving toward alternative transportation, she said, and isn’t as car-centered. There’s a lot of on-street parking in that location, she added.

The new units would be ADA compliant, Hall noted. That’s something that could not be done by simply rehabbing the existing units.

In a follow-up phone interview with The Chronicle, Hall said another possibility for that site is to gut the existing building and do a complete internal rehab.

Demolition & Redevelopment: Broadway Terrace

The Broadway Terrace property, 20 units located at 1504-1506 Broadway, has serious challenges, according to Norstar. Higgins joked that in a few years, parts of it could simply fall down a cliff.

Draft site plan for Broadway Terrace at 1504-1506 Broadway. The street is located at the top left corner of this image.

Harris said the proposed site plan includes 14 units, but a lot more due diligence must be done to ensure that rebuilding on the site is feasible. Higgins added that the amount of earthwork that’s needed is formidable, and 20-30 foot retaining walls would probably be necessary. The cost of that might be prohibitive, he said. The current construction, with the buildings abutting the hill, “is a disaster waiting to happen.” Norstar isn’t yet ready to make a recommendation, Higgins added.

Another factor relates to cost caps that MSHDA implemented about a year ago, Harris explained. For every type of project, there’s an upper limit of total development cost per square foot. The current limit is $173 per square foot for new construction. The cap is different for rehabs or historic preservation. “It’s really been squeezing projects that are in urban locations,” Harris said.

Higgins put it this way: “There’s no way this project [on Broadway] will come in at those cost caps.” Even North Maple will be a challenge, because of the earthwork involved. The buildings that Norstar is proposing aren’t cheap, either, he said. Duplexes are more expensive than buildings with multiple units, he said. But the site plans are good, he added, so it’s Norstar’s job to figure out how to make it work for AAHC, the community and investors.

Gloria Black suggested using the Broadway property as green space. Higgins replied that if Norstar recommends demolishing those units and not rebuilding, then it’s up to the AAHC and city to decide what to do with the property.

Marta Manildi asked if MSHDA could waive the development caps. Harris explained that the caps are punitive. That is, if the project goes above the cap, then MSHDA gives the project’s funding application negative points in that category. If the project is below the cap, then it’s awarded positive points.

Higgins noted that there are ways to work around it. For example, if the city contributed $500,o00 to demolish the existing buildings and regrade the site, then that amount doesn’t need to be included in the budget that’s presented to MSHDA – which makes the development costs lower, for the purpose of getting funded through MSHDA. Regardless of funding considerations, the site presents a serious challenge, he said.

Hall told commissioners that she knew it was a challenging site. But her direction to Norstar was to push it. “In the end, we can’t have less units than we started out with,” she said. “Politically, it would be extremely difficult for me to go to city council and say ‘We’re getting rid of 20 units.’”

Harris explained that Norstar is working to relocate those units at other sites. Higgins added that when Norstar gets a final estimate for redeveloping Broadway, it will be AAHC’s decision about whether to move forward.

In a related comment, Hall said that commissioners will need to look at AAHC’s entire portfolio, which is not within Norstar’s scope of work. Several properties won’t be eligible for tax-credit financing because they’re so small, she said. Those include Upper Platt, Oakwood, Malletts, Hillside, and South Seventh. The goal for this group of properties is to renovate those smaller sites with existing capital funds as well as AAHC reserves, Hall said. That work will likely be done in November 2013.

In addition, Hall said, the plan would be to sell the public housing properties at 909 Evelyn Court and 805-807 W. Washington, as well as the AAHC lease-to-own site at 2072 Garden Circle. These moves would reduce the number of AAHC units by three, and would need to be replaced at other locations.

For additional background on the Ann Arbor housing commission’s conversion process, see Chronicle coverage: “Housing Commission Eyes Major Transition” (December 2012); “Housing Commission Selects Co-Developer” (January 2013); and “Round 3 FY 2014: Housing Commission” (February 2013).

Housing commissioners present: Gloria Black, Christopher Geer, Marta Manildi, Ron Woods (president).

Absent: Leigh Greden.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor housing commission. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!