Council Votes: Y Lot Proceeds into Housing Trust

Almost $1.4 million will be deposited into the city of Ann Arbor’s affordable housing trust fund as a result of city council action taken on Dec. 16, 2013. The council’s vote was unanimous, although Jane Lumm (Ward 2) offered an amendment to cut that amount in half, which failed on a 2-9 vote. Jack Eaton (Ward 4) joined Lumm in supporting that failed amendment.

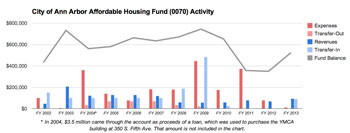

Affordable housing fund activity. Recommendations on the use of the monies in the city of Ann Arbor’s affordable housing trust fund come from the city’s housing and human services advisory board.

The dollar figure of $1,384,300 million reflects the $1.75 million in gross proceeds, less brokerage fees and seller’s costs, from the sale of a downtown city-owned parcel known as the old Y lot. The city paid $3.5 million for the property in 2003.

The council approved the sale of the property to Dennis Dahlmann for $5.25 million at its Nov. 18, 2013 meeting. The city has made interest-only payments on a $3.5 million loan for the last 10 years.

The city purchased the property in 2003, exercising a right of first refusal, in part to prevent its acquisition by the Ann Arbor Area Transportation Authority.

The Dec. 16 council decision reflects a departure from the council’s policy established on Oct. 15, 2012 – which would have first reimbursed the city and the Ann Arbor Downtown Development Authority for various other costs, including interest payments, and relocation of the residents of the YMCA building that previously stood on the site. In October 2005, two years after the city purchased the property, the mechanical systems in the building failed, and the building eventually was demolished. It was converted to a surface lot in the public parking system.

The DDA has calculated $1,493,959 in reimbursements that it thinks it could claim – for interest payments and cost of demolition, among other items. But the DDA board voted at its Dec. 4, 2013 to waive that claim. And the city has calculated, for example, that $365,651 that the city itself paid in interest could be reimbursed, as well as $488,646 for the relocation of residents of the former Y building.

It’s not clear if the DDA can waive all of its claim in light of the fact that the DDA used at least some TIF (tax increment finance) funds to pay for items like demolition and some of the interest payments on the loan. [.pdf of DDA records produced in response to a Freedom of Information Act request by The Chronicle] If that were analyzed as a distribution of TIF to the city of Ann Arbor, then under state statute the DDA would need to distribute a proportional amount to the other jurisdictions whose taxes are captured in the DDA district.

The history of the city’s policy on the proceeds of city-owned land and the connection to the city’s affordable housing trust fund goes back at least 20 years.

The specific connection between the affordable housing trust fund and the former Y lot is the 100 units of single-resident occupancy housing that previously were a part of the YMCA building on the site.

Various efforts have been made to replace those units over the years. [See, for example: "The 100 Units of Affordable Housing."] Recently, the Ann Arbor housing commission and its properties have started to receive more attention from the council as an integral part of the city’s approach to providing housing to the lowest income residents. The council approved a series of resolutions in the summer of 2013 that will allow the AAHC to convert many of its properties to project-based vouchers.

At the Dec. 16 meeting, several advocates of affordable housing spoke to the council during public commentary, urging councilmembers to allocate funds from the proceeds of the Y lot sale to support affordable housing.

For details about the council’s deliberations on this item, see The Chronicle’s live updates from the Dec. 16 meeting.

This brief was filed from the city council’s chambers on the second floor of city hall, located at 301 E. Huron. A more detailed report will follow: [link]