Tax Question Focus of Transit Board Meeting

Ann Arbor Area Transportation Authority board meeting (Feb. 20, 2014): The audience for the board’s regular monthly meeting was the largest in at least five years, as 35-40 people attended to show support for the main item on the agenda.

Michael Ford, CEO of the Ann Arbor Area Transportation Authority, just before the start of the Feb. 20, 2014 AAATA board meeting. (Photos by the writer.)

That main item was a board vote to place a millage request before voters on May 6, 2014. The request – on a 0.7 mill tax that would be levied to pay for additional services over the next five years – would need a majority of votes across the city of Ann Arbor, the city of Ypsilanti and Ypsilanti Township to be approved.

The millage is supposed to pay for a set of service improvements over a period of five years. Those improvements include increased frequency during peak hours, extended service in the evenings, and additional service on weekends. Some looped routes are being replaced with out-and-back type route configurations. The plan does not include operation of rail-based services.

The AAATA has calculated that the improvements in service add up to 90,000 additional service hours per year, compared to the current service levels, which is a 44% increase.

The board’s vote to put the question on a May 6 ballot was unanimous, and came after more than a dozen people spoke during public commentary at the start of the meeting, urging the board to take the step of making a funding request of voters.

Elected officials as well as leaders of the faith, labor and disability communities all spoke in favor of making the request of voters to fund the service expansion, citing arguments based on economic and social justice. They pointed to the long period of planning that had begun about three years ago with a much more ambitious effort to expand service countywide. The current, more limited approach – focused just on the “urban core” area of the city of Ann Arbor and the two Ypsilanti jurisdictions – was a way to meet urgent transportation needs, they said.

After the board’s vote, during public commentary at the end of the meeting, one Ypsilanti resident recalled her own history marching with Rosa Parks down Woodward Avenue in Detroit. Although she’s been involved in activism for many years, she told the board, she could not think of anything that she was in the room to witness that was this important to her personally and to the city in which she lives.

Compared to typical AAATA board meetings, the atmosphere was relatively boisterous, as supporters at times chanted, “More buses, more places, more often!” But one speaker at the end of the meeting cautioned against the celebratory mood, saying there was now a lot of work to do. A counterpoint to the solid support the board heard from most of the speakers had been offered by the very first speaker of the evening. He asked the board to delay the election until November, arguing that it would save the roughly $80,000-$100,000 cost of holding the May election, and result in broader participation in the vote. Another point raised by that speaker was concern that everyone pay an equitable share for the additional transportation.

Although the main event was the resolution that placed the millage question on the ballot, the board’s agenda featured nine other items, many of which were at least tangentially related to the millage question.

For example, in other action the board approved a change to its budget to allow for up to $100,000 to be spent on the cost of holding the special election. The board also approved a funding agreement with Ypsilanti Township, to make explicit what will happen to the township’s existing purchase of service agreement (POSA) if the millage is approved. And as part of the board’s routine annual business, it approved a funding request to the state of Michigan – but did not factor in an increased level of service in the budget submitted to the state. That was done on the instruction of the Michigan Dept. of Transportation. That request can be amended if the millage succeeds.

Also at the Feb. 20 meeting, the board approved changes to its bylaws. Those changes were prompted by a change in governance to the AAATA last year – the addition of the two Ypsilanti jurisdictions. With the increase from seven to 10 members, the definition for the number of board members constituting a quorum or a majority needed to be modified. Out of that review of the bylaws came a decision to increase public speaking turns from a two-minute time limit to three minutes.

In other business, the board approved the hiring of a consultant to help the AAATA with a planned upgrade to its computer-aided dispatch and vehicle locating software. The board also approved the recently completed audit report for the 2013 fiscal year, which ended Sept. 30, 2013.

Another item approved by the board was a new contract for unarmed security services. And finally, the board authorized a contract for an insurance broker.

Among the various operational updates received by the board was the announcement that the newly constructed Blake Transit Center in downtown Ann Arbor would be open by March 17, 2014.

Ballot Question

Several items on the Feb. 20 agenda related to putting a 0.7 mill tax proposal on the May 6, 2014 ballot.

Ballot Question: Public Commentary – Meeting Start

Brian introduced himself as a 10-year Ann Arbor resident. He asked that the board delay the placement of the millage question on the ballot until the November 2014 general election. Given a multi-million dollar investment, a delay of six months would not be that significant. He felt there was no real reason not to talk to “the majority of citizens who want into this, or potentially not into this.” He pointed to the additional $80,000-$100,000 the AAATA would need to spend to hold a special election in May instead of waiting until November.

He also asked that all communities pay an equal millage rate. [The millage to be levied by the AAATA, on which voters will decide on May 6, will have an equal rate across all three jurisdictions. The point being raised was that the city of Ann Arbor and the city of Ypsilanti already levy city millages that are dedicated to transit and are passed through to the AAATA.] Ann Arbor property owners have paid a millage for many years, he pointed out, and that has bought a lot of capital, infrastructure and equipment to support the transportation system. Ann Arbor residents have fronted a lot of the cost to the AAATA, so it would be fair for everyone to pay equally into the system. He concluded by thanking the board for their time and service to the community.

State representative Jeff Irwin (D-53), an Ann Arbor resident, thanked the AAATA for the excellent service that is provided in his community. He reported that he’d had the opportunity to use the service many times. It was wonderful that a small Midwestern like Ann Arbor can have a bus service as great as the AAATA.

He supported the AAATA’s effort to continue to examine and propose to the public a plan to really expand that service – to increase the amount of service in the evenings or on Sundays. But he also encouraged the exploration of expanding service in a more thorough way outside the boundaries of the city of Ann Arbor. That would respect the economic reality of the region we live in, Irwin said. It’s important to do a better job of serving Pittsfield Township and Ypsilanti Township and the city of Ypsilanti.

This is a great idea, Irwin said, because when you connect people and places, then great things happen. That’s because people have an opportunity to get to the doctor or get to church or get to the store. Businesses and people also connect, he said. He asked the AAATA board to continue the effort to propose new options for citizens, so that the transportation network in Ann Arbor can expand in a complete way to include all of Ann Arbor’s neighbors “in a way that our citizens deserve.” He hoped he had a chance as a citizen to vote on this issue – because we’ve been talking about this for a long time. “The community is ready for expansion, I believe, and I’m certainly ready for expansion.”

Mark Coryell introduced himself as president of the American Federation of Government Employees, Local 3907, which represents employees of the Environmental Protection Agency lab in Ann Arbor. He was also speaking on behalf of WeROC – the Washtenaw Regional Organizing Coalition. He asked those who were there to support the board’s vote to stand – and around 30 people rose from their seats. He called the analysis that the AAATA had put into the question “really quite impressive.” He called Irwin’s comments on point, and told the AAATA it was a national leader. What WeROC sees is a good community investment in the future, at a time when other communities are disinvesting in the things that would bring them a future – future jobs, future growth and future quality of life. WeROC represents a lot of labor and faith-based organizations, he said.

And the people WeROC represents and ministers to would be using these services, Coryell said. He added that we shouldn’t take for granted that everyone owns a motor vehicle. When you arrive in southeast Michigan from a major metropolitan area in another part of the country, it’s amazing how dependent Michigan is on the motor vehicle, he said. “We are behind the times in adjusting to the new future of sharing our transportation systems,” he said. When the snow melts, people will be reluctant to drive on the roads, and he ventured that a lot of people would want to take the bus to work. So WeROC sees a lot of benefit to those people that the organization represents.

For workers, it would help get them back and forth between a job, he said, and public transportation makes it cheaper for them. WeROC supports the millage, Coryell concluded, and would like to see the board vote affirmatively.

Lois Richardson introduced herself as mayor pro tem of the city of Ypsilanti.

It’s been a real pleasure to work with the AAATA’s CEO, Michael Ford, over the last year or two to bring more service into Ypsilanti, she said. She’s looking forward to the expansion and she would support it. She’s a member of WeROC, she noted, but right now, she was speaking with her “political hat.” She appreciated the bus service in Ypsilanti.

She had moved away from the area for a while, and when she first moved back, she was a regular transit customer and always got good service. Now, she reported, she’s an occasional transit customer. And the service she gets is good. She thanked Ann Arbor for the years it has supported the bus service. She was looking forward to expanded service in Ypsilanti. Richardson congratulated Ford for doing a good job bringing the effort to this point: “You need my help? Call me.”

Dave Hendricks introduced himself as pastor at Emmanuel Lutheran Church in Ypsilanti.

He wanted to look at the issue from a religious perspective. His congregation serves a population in Ypsilanti that is sometimes forgotten, he said. They provide food pantry options, clothing and a hot meal during the week. The folks who need those services, he said, are the people who need bus services.

Just from a theological perspective, he and his congregation feel that the transportation expansion is an opportunity to serve people who are sometimes marginalized. He hoped the AAATA would continue its efforts.

Roderick Casey introduced himself as an elected Democratic delegate for Ypsilanti Township, and also a member of WeROC. He told the board, they were doing a great job. In the 36 years he’s lived here the population has boomed, he said. But he was now very concerned about a phenomenon that has come to Ypsilanti: insurance redlining. It’s really hurting a lot of people in the city of Ypsilanti and Ypsilanti Township – because it causes the price of insurance to go up. So right now transportation expansion is needed. He asked the board to continue to support expansion of service.

Jim McAsey introduced himself as an organizer with the Graduate Employees Organization, also a member of WeROC. “Is WeROC in the house?” he asked, and that drew applause and cheers. “We believe passionately that public transportation is a social justice issue,” he said. There are many people in the community who don’t own cars who still need to get around. GEO members don’t make a lot of money and cars are very expensive, he said. So a lot of GEO members depend on buses – because rent is expensive in Ann Arbor and they need to get back and forth. Many GEO members live in Ypsilanti and they have trouble getting back and forth on the weekends or late at night. GEO members need better public transportation, he said. “The bus system here is fabulous, but let’s make it even better,” he told the board. GEO supports the millage. “Let’s get it done. We’ll help you get it done,” he concluded.

Lionel Swan introduced himself as an employee of the Washtenaw Intermediate School District (WISD). He works in the young adult program – which is for 18-26 year-olds. The WISD tries to teach skills like being able to get to their jobs. These are kids with cognitive disabilities, he said. The bus system is “absolutely essential in our program,” he told the board. He agreed with everyone who spoke in favor of expansion. He allowed there were some routes he would like to see extend a little farther. He told the board he rode the bus about four times a week – and he was always impressed by the timeliness and cleanliness of the buses and the friendliness of the drivers toward a very needy group of folks.

Sam Facus introduced himself as a graduating senior at the University of Michigan. He’s very dependent on the bus service in Ann Arbor, he said. As a graduating senior who’d like to stay in the community and not own a car, it’s very enticing to him to have better public transit options to get where he needs to go and to live a sustainable life.

Joel Batterman told the board he now lives in Detroit, but he’s an Ann Arbor native, so he feels a close connection with his hometown. Since he was a high school senior at Huron High School, he’s been interested in how to improve transit – in the area and in the wider Detroit region. He now works with MOSES, which does congregation-based community organizing in Detroit. WeROC is the Washtenaw County affiliate. Better public transit is a key pillar to a prosperous region, he said.

He’d heard some concerns about the multi-jurisdictional nature of the millage. It’s a new and different thing for this community, but it’s urgently needed, he contended. Growing up in Ann Arbor, he didn’t get over to Ypsilanti that often. But he’s come to understand that the communities – in the county and in the region – are really intertwined. “We can’t allow the boundaries that Thomas Jefferson’s surveyors drew 200 years ago to get in the way of providing transportation … wherever people need to go.” Batterman concluded his remarks by saying he was looking forward to extended hours on Route #2 and Route #4 whenever he’s home.

Martha Valadez, an organizer with Partners for Transit, told the board she was happy and pleased to see the turnout at the board meeting in support of the expansion. She told the board the attendance at the board meeting by residents of all three jurisdictions was evidence that they really are adamant about the need for more transit now.

Her group was happy to see that the planning and development committee had recommended the 0.7 mill tax be placed on the ballot. It’s important that additional services be put in place this year, she said. Last week, Partners for Transit held a coalition meeting with over 35 organizations that are really passionate about transit. After the board’s decision, she said, she hoped they would be able to move forward by getting the word out about the importance of transit expansion.

Susan Borey [unconfirmed spelling] introduced herself as a former member of the Washtenaw County committee for disability issues. At that time she was employed and mostly used taxicabs. Now she’s unemployed and a senior, and she relies on the buses. She called the AAATA bus drivers the “finest ladies and gentlemen I have ever known,” which drew immediate applause.

She was very concerned about maintaining the quality of service in Ann Arbor as the AAATA expands. For example, seniors need bus shelters and benches. There’s no longer a shelter along Huron Street near Lurie Terrace, she said. She pointed out that there’s not good public transportation that lets you off directly at the Quality 16 theater on Jackson Road, in Scio Township. She also described how the bus service is wonderful in this town – but bus stops are not cleared of snow. The curbs are absolutely and positively treacherous, she said. She couldn’t imagine how people with disabilities manage with wheelchairs and scooters.

Ian Robinson introduced himself as a University of Michigan faculty member and the newly elected president of the Huron Valley Central Labor Council.

The council will be discussing endorsing the millage to support the expansion of transit at its next meeting – the first Tuesday in March. He plans to argue in favor of it on two grounds: (1) regional development; and (2) social justice.

It’s critical to have sound regional infrastructure, Robinson said. It’s critical that people can still get transportation to work. Good public infrastructure is a core principle of sound economic development, he said. As far as social justice goes, he added, the labor council stands for all working people.

Ann Arbor Center for Independent Living (CIL) director of advocacy and education Carolyn Grawi addressed the board. She told the board that if there were better transit across the state, she could have arrived 25 minutes earlier.

She’d just come from Lansing. She then led supporters in a chant: “More buses, more places, more often!” We need services everywhere, she said. Some community members across all three areas of the urban core do not have service today: “We need services to get where we need to go.”

The services from AAATA have been outstanding for many years, but improvement in necessary, Grawi said. We need to make sure that anyone who wants to ride the bus or wants to board a paratransit vehicle can get to where they need to go, as often as it’s necessary.

Right now there are people who are missing medical appointments and who can’t get jobs because of a lack of transportation. The AAATA gets lots of people where they need to go on a timely basis, she said. But there are a lot who are still waiting to get there.

Grawi concluded by telling the board that Ann Arbor CIL has endorsed the millage proposal. The Washtenaw Bicycling and Walking Coalition (WBWC) also endorsed the millage, as did Partners for Transit.

She concluded with another round of chants: “More buses, more places, more often!”

Ballot Question: CEO’s Remarks

About the millage request, CEO Michael Ford called the vote “the big ask that’s on the agenda.” He called the vote to put the millage on the ballot one of the most important actions taken by the AAATA in the last decade or so. The board had demonstrated its commitment to the vision last month when it approved the five-year program. The next commitment was to take a step toward approving the funding component of that program, Ford said. He believed that the AAATA had sufficient support, saying “I’ve heard a lot tonight.” He pointed to grass-roots organizations, businesses, community leaders, employees who had participated in the planning process – as well as bus riders.

Ford said that to get to this point, the AAATA had engaged citizens, business leaders, elected officials in pursuit of a plan to provide improved public transportation service. The AAATA had heard over and over again about the unmet service demands. The leaders of the urban core communities had supported the effort. Ford then ticked through the names of those who’d participated: Ann Arbor mayor John Hieftje; Ann Arbor city councilmembers Sabra Briere, Sally Petersen, Stephen Kunselman and Chuck Warpehoski; Ypsilanti mayor Paul Schreiber; Ypsilanti city councilmember Pete Murdock; Ypsilanti city manager Ralph Lange; Ypsilanti Township supervisor Brenda Stumbo; and Ypsilanti Township clerk Karen Lovejoy Roe.

Supported by that leadership, Ford said the AAATA had developed the five-year service plan. Based on input from the community, riders and others, adjustments had been made to the service plan. The final component is the funding proposal, Ford said.

Ford stated that the funding proposal had been fully supported by a financial task force led by former Washtenaw County administrator Bob Guenzel. Ford invited Guenzel to the podium to summarize the task force’s report.

Ballot Question: Financial Task Force

Guenzel began by congratulating Ford and the board for bringing the process to this point. He put the current financial task force in the context of the original task force that dated back to 2011, when the now-demised countywide initiative was underway.

From left: former Washtenaw County administrator Bob Guenzel and AAATA outside legal counsel Jerry Lax.

The AAATA had asked some people to come together to test that countywide plan, to see whether it was accurate in its assumptions about services, and also about the amount of money it would take to fund that plan.

A sub-group had been established to work closely with AAATA staff and issued a report saying the countywide plan was well prepared, complete and reasonable, he said.

Now, a couple of years later, Guenzel continued, we’re at a very different point. The group was asked to conduct the same kind of review for the five-year urban core transit plan.

The group had met in December, January and February, Guenzel reported. That resulted in a consensus finding that the AAATA’s methods and assumptions related to that plan were reasonable.

He read aloud from the document produced by his work group [.pdf of Feb. 5, 2014 financial task force finding]:

Findings and Recommendations. The FTF recognizes the accomplishments of the Service Review Sub-Group, as follows:

- The Service Review Sub-Group was charged with examining a Five Year Transit Improvement Program budget containing a list of proposed services for the Urban Core communities of Washtenaw County. As the result of the deliberations, analysis, and effort, the Service Review Sub-Group determined that the funding analysis (Appendix 1) is reasonable.

- The Service Review Sub-Group reviewed the development of the service program that includes later night service on weekdays, more hours of service on weekends, new service for both the east and west sides of the service areas, and more service for seniors and people with disabilities. The Service Review Sub-Group found no material issues with the method used in calculating the service hours and the proposed schedules. (Appendix 2)

- The Service Review Sub-Group discussed the assumptions made for the ridership level estimates identified in the program. Staff shared the estimates of Steer Davies Gleave (SDG) estimates and increases seen on Route 4 serving Washtenaw Avenue combined with the general system growth over the past ten years, as data supporting assumptions regarding ridership growth. SDG estimates were interpolated by Authority to arrive at annual growth rate assumptions. (Appendix 3)

- The Service Review Sub-Group further discussed revenue vulnerabilities related to ridership forecasts and 2012 legislation repealing the personal property tax beginning in 2014. The Service Review Sub-Group requested a ‘what-if’ analysis of two questions:

1. What is the financial risk of a 25% shortfall in projected ridership growth, and therefore passenger revenues?, and

2. What is the financial risk of an uncompensated shortfall in the personal property tax revenues? (The 2012 legislation will exempt personal property from taxation by local jurisdictions by 2023, but a referendum scheduled for August 2014, if successful could make up at least some fraction of the revenue shortfall.)

About the personal property tax question, Guenzel summed up the financial task force view as: “Who knows for sure?” It might affect the AAATA by a maximum of about $300,000, Guenzel said. There’s enough flexibility in the long-term plan to take care of that, he added. A shortfall in ridership projections could also be absorbed by the plan, Guenzel said. So the task force felt confident in the soundness of the planning work the AAATA had done.

Guenzel summed up by recommending that the financial task force be allowed to continue to meet from time to time. More importantly, he continued, the funding level is complete and they found it to be reasonable. So the task force found the AAATA’s assumptions to be reasonable – concerning the level of services and that a 0.7 mill tax, combined with the rest of the revenue, would support that program over five years.

After Guenzel concluded his remarks, Ford wrapped up by saying, “Tonight it’s up to you, the board, to take the next step, to make this plan a reality.”

Ballot Question: Issue Analysis

AAATA strategic planner Michael Benham gave a presentation to the board on the issue analysis. From the board’s information packet, here are the pro-con arguments listed for making a funding request.

Arguments in favor of TheRide placing a property tax levy on the ballot:

- The need for improved transit service is immediate as evidenced by the many requests for service that TheRide has received during the planning period and on a day-to-day basis, and TheRide has worked with the community to propose a specific program of services that responds to that need.

- Millage funding will allow TheRide to leverage State and Federal dollars that would not otherwise come to the region. It is estimated that each new local millage dollar will attract 2 additional dollars of State and Federal money.

- TheRide’s funding sources have been relatively fixed for many years, while demand for service in all areas has increased. TheRide provided a record setting 6.6 million trips in 2013 for example. The unmet need for transit services will only be satisfied by additional service, which must be paid for with new funding sources.

- In the particular case of Ypsilanti City, their general revenue millage has reached its cap and an Authority millage is the only way to pay for additional transit services.

- As TheRide system becomes increasingly regional – with many routes crossing jurisdictional boundaries – it makes sense to begin the transition to a more regionally funded system.

- Community surveys conducted in 2011 and 2013 indicate that support for transit is extremely high, that TheRide is regarded as a very well-run organization, and that there is significant willingness on the part of voters to support a millage for transit.

- TheRide’s reputation as a very well-run organization is reinforced by comparisons to other transit agencies, as evidenced by the findings of our recent Peer Comparison.

- The recent Annual Audit and the findings of the Financial Task Force also reinforce TheRide’s reputation as financially sound and well-managed.

Risks / Issues related to placing a property tax levy on the ballot:

- The most obvious risk is that a majority of the people will not vote for the millage and it will not be approved. However, if this was the outcome, TheRide would continue to provide service, making minor improvements within existing budget constraints, as it has for many years. Existing service would continue and unmet needs for transportation would remain unmet.

- Passage of an Authority millage will create a new level of accountability for TheRide, requiring the Authority to ‘prove’ the value of its services every five years (and this might be considered an advantage by some). TheRide’s Continuous Improvement Program will need to expand to track new services and make any needed adjustments.

- The emergence of a 4-county Regional Transportation Authority has raised a concern that a separate millage might be sought by that organization. The State Law that created the RTA provides for additional regional taxing mechanisms that might be more closely aligned with and acceptable for funding regional transportation services than local property tax millages. There is no Regional funding request planned currently. It could be years before the RTA identifies its preferred funding level and approach. Most importantly, the RTA is primarily concerned with regional (4-county) transit issues while TheRide’s program is focused strictly on meeting local transportation needs with local services.

- Many of the proposed services in the program are during off-peak travel times like evenings and weekends when fewer people are traveling. Ridership can take years to build to expected levels. TheRide will have to carefully manage expectations so that evolving services are given a chance to develop.

- TheRide’s funding model is not well understood by some, which has led to questions as to whether the funding model is ‘fair’. The 5YTIP has been designed to ensure that each community pays for the service they get, either via a millage or through a Purchase of Service Agreement. Ann Arbor will pay more for service because Ann Arbor will receive more service. The other communities pay less for service because they get less service. POSA communities pay for their services based on fully allocated costs. A particular concern voiced by several individuals is that the transit millage should be ‘flat’, that is, levied at the same rate throughout TheRide’s jurisdiction. The recommendation for funding is a flat 0.7 mil levy across the entire jurisdiction of the Authority.

- A question has been raised about the role of passenger fares in paying for the services proposed in the 5YTIP. Passenger fares currently account for about 20% of operating costs, which is typical for a transit organization of TheRide’s size. The funding proposal for proposed new services is expected to maintain that ratio over the long run. TheRide’s last fare increase was implemented in two phases, with an increase from $1 to 1.25 in May of 2009 and an increase from $1.25 to $1.50 in May 2010. There were corresponding increases in reduced fares for special users at the same time. Fares for advanced reservations on A-Ride (services for seniors and individuals with a disability) also increased during the same time period from $2.00 to $2.50 to $3.00. TheRide’s fares are in line with those seen in the industry as a whole. It is believed that another fare increase so soon after the 50% increase during 2009- 2010 would be excessive and detrimental to ridership. Staff recommends consideration of a fare increase during the implementation period of the 5YTIP, but not to include it as a foregone conclusion.

Ballot Question: Survey Results

Reporting out from the planning and development committee, board member Eric Mahler summarized a presentation from Hugh Clark of CJI Research that was given to the committee at its Feb. 11 meeting. [For earlier Chronicle coverage of those survey results, see: "Survey: Majority Favorable on Transit Tax"]

The survey of 842 registered voters in the three-member jurisdictions of AAATA was conducted by CJI in late 2013 to gauge support for public transit and possibly a future millage. It found that 63% of those surveyed would probably or definitely support a transit millage.

Mahler highlighted some of the other results of the survey: about 54% think that changes in the area are taking us in the right direction; and 59% think that in general, development improves things, while 21% think that development hinders the area. That’s counter to national trends, Mahler said. People here are feeling good about the direction the area is taking and about where they live, he said.

Of those polled, 57% reported that they’d used the AAATA in the last year, Mahler said. [The survey question asked if the respondent or anyone in the household had used the AAATA in the last year.] Of those surveyed, 79% had a favorable opinion of the ride, Mahler said. Only 6% had an unfavorable opinion, he said.

On the millage question, Mahler noted that for a survey question asking if respondents had heard anything about the proposed expansion of the AAATA’s member jurisdictions, 49% said they had not. About 45% said they’d heard something. Of those who use the AAATA at least once a month, 53% said they were likely to use the new service, Mahler said.

Mahler also noted for the survey question on additional services for seniors, 45% said they’d be in favor of more taxes to support additional services for seniors, while 40% said they would not. Mahler said that even without the educational effort that’s still to come, those numbers are good news for the AAATA.

When asked what priorities public transit should have, the top response was that public transportation supports seniors and those with disabilities – with 93% saying that is an important aspect of public transportation. Attracting jobs came in at 85%, and 83% said that it gets more people to more jobs. That’s what the message has to be, Mahler concluded.

It was clear that there’s an opportunity and a need to educate for this effort, Mahler said. It’s also clear that the AAATA has credibility and trust with the public that it’s willing to listen.

Ballot Question: Board Discussion – Ballot Language

When the board reached the item on its agenda, board chair Charles Griffith said it was a historic move for the AAATA, so the board did not take it lightly.

From the audience, Carolyn Grawi asked that the resolution be read aloud. Griffith then read aloud the entire resolution.

The specific ballot language that Griffith read aloud differed from the language drafted and included in the original board packet. The approved language explicitly highlights the capture of a portion of the millage by TIF (tax increment finance) authorities. The approved language also swaps in “seniors” for “the elderly”:

PUBLIC TRANSPORTATION IMPROVEMENT MILLAGE

To improve public bus, van, and paratransit services – including expanded service hours, routes, destinations, and services for seniors and people who have disabilities – shall the Ann Arbor Area Transportation Authority levy a new annual tax of 0.7 mills ($0.70 per $1000 of taxable value) on all taxable property within the City of Ann Arbor, the City of Ypsilanti, and the Charter Township of Ypsilanti for the years 2014-2018 inclusive? The estimate of revenue if this millage is approved is $ 4,368,847.00 for 2014. This revenue will be disbursed to the Ann Arbor Area Transportation Authority and, as required by law, a portion may be subject to capture by the downtown development authorities of the Cities of Ann Arbor and Ypsilanti, the Washtenaw County Brownfield Redevelopment Authority, and the local development finance authority of the Charter Township of Ypsilanti.

The ballot language is subject to requirements in Michigan’s General Property Tax Act.

Earlier in the meeting, reporting out from the performance monitoring and external relations committee, Roger Kerson said the committee had talked about the ballot language “a lot, a lot, a lot.”

They thought it had been finalized, but then it had to be tweaked, he said, describing a couple of cycles of finalization and further tweaking. They’d worked very hard to be compliant with all the laws that apply when you make an ask from voters. It must be clear what the money is to be used for.

The proposed language will be used for buses, vans and paratransit, he said, not airplanes, helicopters or trains. After much analysis, Kerson continued, there’s a requirement that it be noted in the ballot language that some of the new tax would be captured by tax increment finance authorities (TIFAs) like downtown development authorities and brownfield authorities.

Kerson said that the “huge majority” of the funding, 97-98%, would go to the AAATA, but that the remainder could be captured by TIFAs. The PMER committee concluded that this is “the right move at the right time.”

Ballot Question: Board Commentary

Larry Krieg led off comments by saying it’s a historic event for the AAATA. It’s important to take a moment to think about it and say why it’s important, he said. He was a teacher at Washtenaw Community College for 25 years, he said. Something he noticed when he taught there was “when a student’s car failed, they would be very likely to fail my class.” Many of his students lived in Ypsilanti Township or other parts of the county that are not served by the AAATA. That’s important because “education of our people is going to be the root of our future prosperity.”

He also saw WCC grads who were looking for jobs, who did not own cars. Even though they were qualified for certain jobs, they were sometimes not able to accept available jobs, because they could not get to those jobs. By having better transportation, job seekers will have the ability to reach other parts of Ypsilanti township and city.

Krieg said he was impressed by the careful work that AAATA staff had done in preparing the proposal. Some people might wonder why the board did not vote on this last month, he said. The reason is that there needs to be careful analysis of the likelihood of success and exactly what the money is going for. He’s now convinced that the analysis has been done and the AAATA has an excellent chance of going forward with this.

Responding to the issues of fairness that had been raised, Krieg noted that the millage rate is flat. But he allowed that Ann Arbor residents will be paying more – through an existing millage. Ann Arbor also gets more transportation services, he noted. He had checked with the staff and gone over the figures and had determined that what AAATA strategic planner Michael Benham had said in his presentation was true: People will get what they pay for. About Ypsilanti Township, which he represents on the board, Krieg said: “We are paying less, and we are getting less.”

One thing a lot of people don’t realize, Krieg said, is that a gas pump works two ways: it pumps gas into your car and money out of the state and out of the local economy. On the other hand, when you pay a few cents for a transit tax, the vast majority stays in our community, he said. Michigan is a donor state as far as money that leaves the state and goes through the rest of the county.

Roger Kerson observed that when the AAATA board had started the conversation about expanding transit, he thought there were only three current board members serving on the board at the time. [Charles Griffith and Anya Dale were also serving at the time.] At that time, the AAATA had a more expansive [countywide] vision, he said. The nature of the AAATA board is to be collaborative and transparent, he said, so that expansive plan was adjusted based on feedback from constituents and others.

What the AAATA is doing now is downscaled compared to the original vision of a countywide authority. The current plan “is the right plan and it’s the right time,” he said. It’s been an educational process, and he was glad the AAATA went through it. He felt the right lens through which to view the issue is “needs.” People need to get around, he said. He also stated that this is a “pay to play” financing mechanism.

Board chair Charles Griffith offered a final comment of his own. He told the people who came out to the meeting that the board appreciated hearing from them. Over the years, many people had asked the AAATA for this or that additional service. When those had been small requests, the AAATA had sometimes been able to meet the request. But for other larger requests, he noted, the answer had always been the same: Unless a new source of revenue can be found, a new service can’t be added without taking away some other service. Now the AAATA can finally say: If the voters agree, the AAATA can provide you with that additional service.

Griffith’s remarks prompted a standing ovation from the audience.

Outcome: The board voted unanimously to place a 0.7 mill transit tax on the May 6, 2014 ballot.

Ballot Question: Public Commentary – End of Meeting

Harvey Summers told the board that he was a member of WeROC. He thanked board members for their vote and looked forward to supporting the millage with his vote.

Carolyn Grawi spoke on behalf of CIL, WBWC and Partners for Transit. She thanked the board for their vote and the AAATA staff for their hard work.

John Waterman thanked the board for their work. [Waterman was one of five finalists for the initial appointment to the board of the southeast Michigan regional transit authority. He founded the nonprofit Programs to Educate All Cyclists (PEAC).] A good plan has been laid out, but the “game is on,” and he cautioned that there is a lot of work to be done. He also cautioned against the celebratory mood. He would put efforts of his staff and students to help pass the millage.

On the topic of paratransit service, Waterman stressed the need to train as many people with disabilities as possible to use the fixed-route service, which is more cost efficient and leads to greater independence. It also opens up paratransit service for those who cannot do without it, he said.

Michelle Barney told the board that she wanted to thank them for their vote, saying, “I was almost on the verge of tears when you voted,” because it meant that much to her personally.

She told the board that the community was losing University of Michigan grads who are moving away due to a lack of transit. There’s a real sea change going on, she said, with many young people opting not to try to own cars, because they’re sick of them. It also provides service to people of different racial groups.

She recalled her own history as a bus organizer in 1959 for a youth march for integrated schools started from Cass Tech in Detroit to Washington D.C. She also recalled marching down Woodward Avenue with Rosa Parks in 1964-65.

She’s been involved in activism for many years, Barney told the board, and she could not think of anything that she was in the room to witness that was this important to her personally and to the city in which she lives.

Funding Agreement with Ypsilanti Township

By way of background, the 0.7 mill tax, if approved on May 6, 2014, would be the first ever levied by the Ann Arbor Area Transportation Authority. Existing dedicated transportation taxes, levied by the two cities and passed through to the AAATA, would remain in place.

For Ann Arbor, the rate for the existing tax is 2.056 mills, which is expected to generate a little over $10 million by 2019, the fifth year of the AAATA’s transportation improvement plan. For the city of Ypsilanti, the rate for the existing transit millage is 0.9789, which is expected to generate about $314,000 in 2019.

For the owner of an Ann Arbor house with a market value of $200,000 and taxable value of $100,000, a 0.7 mill tax translates into $70 annually, which would be paid in addition to the existing transit millage. If the millage were to pass, the total Ann Arbor transit tax paid on a taxable value of $100,000 would be about $270 a year.

If it’s approved by voters, the total amount of revenue expected to be generated by the 0.7 mill tax in 2014 is $4,368,847.

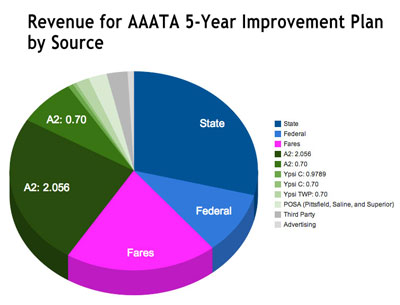

Here’s a detailed breakdown of how the roughly $4.3 million generated by the new AAATA millage would fit into the overall funding picture for AAATA services:

Revenue Source Amount State $12,910,884 Federal $4,507,490 Fares $8,801,200 A2: 2.056 $10,980,259 A2: 0.70 $3,387,910 Ypsi C: 0.9789 $313,798 Ypsi C: 0.70 $202,730 Ypsi TWP: 0.70 $778,207 POSA $1,087,344 Third Party $1,204,196 Advertising $375,000 TOTAL $42,969,822

-

Here’s how that breakdown shapes up as a pie chart:

Pie chart of revenue sources for AAATA five-year transit improvements. (Data from AAATA, chart by The Chronicle. )

In Ypsilanti Township, the AAATA calculates the 0.7 mill levy to be commensurate with the level of service the township would receive as a result of transportation improvements. But the 0.7 mill levy would generate about twice as much as the amount paid by the township in its current purchase of service agreement (POSA). So Ypsilanti Township’s POSA amount would not be paid in addition to revenue from the 0.7 mill tax.

The board considered an additional item at its Feb. 20 meeting – a funding agreement with Ypsilanti Township governing that POSA. The agreement makes clear that if the 0.7 mill tax passes, then the township’s service, which would increase under the transportation improvement plan, would be paid by the 0.7 mill tax. [.pdf of AAATA agreement with Ypsilanti Township]

Reporting out from the performance monitoring and external relations committee, Roger Kerson described the funding agreement with Ypsilanti Township.

On joining the AAATA, the township had pledged to continue to provide the same amount that it’s currently paying through its POSA, Kerson explained. If the millage passes, it will generate more than twice what the POSA amount is – $800,000 compared to about $325,000, Kerson said.

That’s the amount of service Ypsilanti Township will get, he said. So as far as fairness goes, everybody gets the service they pay for, he said. That’s why the committee recommended the agreement to the full board.

When the board reached the item on its agenda, Larry Krieg – the Ypsilanti Township representative to the AAATA board – asked the board to support the resolution on the funding agreement with the township, saying that without this agreement, the rest of the five-year plan wouldn’t work.

Outcome: The board voted to approve the funding agreement with Ypsilanti Township.

Budget Change to Cover Cost of May Election

Reporting out from the performance monitoring and external relations committee, Roger Kerson noted that because the AAATA millage would be the only item on the ballot, the AAATA would need to pay the cost of administering the election. That would be between $80,000 and $100,000, Kerson said. So the board would need to amend the budget to do that. He pointed out that in this scenario, the millage would generate $4.3 million, which would be matched about 2:1 by federal and state revenues. So if the millage proposal passes, that would equate to $12 million annually, against a $100,000 one-time expense.

Those remarks came as an indirect response to public commentary that had called for a delay until November 2014 to hold the election in order to save the cost to the AAATA of holding the millage vote.

Given the views that had been expressed during public commentary about the need for rapid implementation, Kerson said, the committee concurred that the AAATA should go ahead with that cost.

When the board reached the item on its agenda, there was no further discussion.

Outcome: The board voted unanimously to approve the budget change to pay for the cost of the May 6, 2014 election.

Bylaws

The board considered approval of several changes to its bylaws. One change gives speakers during public commentary an extra minute per turn to address the board. The time limits per speaker for each of two slots on the agenda are increased from two to three minutes as part of the bylaws changes. So someone could address the board for a total of six minutes at a meeting.

That additional change to the bylaws comes as AAATA board members reviewed their rules and revised them to reflect the addition of two new member jurisdictions in addition to the city of Ann Arbor: the city of Ypsilanti and Ypsilanti Township. It was last year, under separate processes, that the two Ypsilanti jurisdictions were admitted into the AAATA. The authority also changed its name at the time to include the word “area.” [.pdf of AAATA bylaws changes]

The bylaws changes considered by the board included some straightforward consequences of the increase from seven to 10 board members, such as: changing the definition of a quorum from four to six members; and raising the majority approval threshold from four to six members – for items like adopting a labor contract or approving a financial transaction in excess of 5% of the annual budget.

A change that was independent of the board size was also considered for some other voting items: relaxing the requirement from “a majority of the Board duly appointed and confirmed” to “a majority vote of board members present.” That means some types of resolutions could win approval with support from as few as four board members at a meeting.

In a separate board action, before the bylaws change the board considered a resolution to waive a condition in the bylaws that requires written notice be given to board members two weeks before a vote on a bylaws change. The resolution was prompted by additional amendments that had been made within the two-week window. One of the bylaws changes considered on Feb. 20 was to relax the requirement of notice to just one week in advance of a vote.

Reporting out from the performance monitoring and external relations committee, Roger Kerson noted that as some later amendments were made, the board had not provided the full period of notice to board members to take action that night – under the bylaws. The bylaws have a provision for waiving that notice, which the board would be using that evening.

Bylaws: Board Discussion

When the board reached the item on the agenda, Eli Cooper asked if there had been any follow-up on the voting provisions in the bylaws – about how other entities handled similar issues.

AAATA financial analyst and planner Bill De Groot responded to Cooper, saying staff had looked into the question of voting power with respect to the possibility that a minority of the board could count as a majority for a vote. For important business, he said, there was the greater requirement of majority already in the bylaws and that was increased consistent with the added members of the board.

Jack Bernard said he wanted to mention for the record that the newly revised bylaws include a specific time reference, related to the terms of appointments for individual board members. ["The term of office of a Board member shall be five years other than for members of the Ann Arbor Area Transportation Authority Board as of June 15, 2013, who shall serve for the remainder of their terms, as provided by the Articles."]

The next time the bylaws are changed, Bernard said, the time reference should be removed.

Outcome: On separate votes, the board unanimously approved the waiver of the notice requirement and the changes to the bylaws.

State Funding Request

The AAATA has to apply every year to the state of Michigan for its state operating assistance. According to staff memos in the board’s information packet, the Michigan Dept. of Transportation instructed AAATA not to include assumptions of the five-year service improvement plan in this year’s application.

So this year’s application to the state for the AAATA’s portion of Act 51 money will include a budget as follows: estimated federal funds of $5,348,338, estimated state funds of $9,905,017, estimated local funds of $11,241,134, estimated fare box of $6,184,503, and estimated other funds of $647,288 – with total estimated expenses of $33,326,000.

That application for state operating assistance could be amended, if the millage vote on May 6 succeeds.

Reporting from the planning and development committee, Eric Mahler said the committee had heard a review from AAATA manager of service development, Chris White, on the AAATA’s application for state operating assistance. That includes both capital and operating funds. Because the millage has not yet passed, MDOT had requested that the AAATA not include expansion of services in the request. Mahler ventured that the request from the state could be amended when the millage passes, which White indicated was the case.

Outcome: The board voted unanimously to approve the application for state funding assistance.

CAD/AVL Consulting

The board considered awarding a $168,000 consulting contract to TransSystems of Boston, Mass. to assist the AAATA in making an upgrade in its computer-aided dispatch and vehicle-locating software (CAD/AVL).

As part of a planned upgrade for this type of software for its regular fixed-route buses, the AAATA is also looking to bring in-house the reservation and booking of paratransit rides. That’s currently part of its contracted paratransit service provider’s scope of work. That service provider is SelectRide. The switch to in-house paratransit bookings is planned for May 1, 2015, the day after the AAATA’s current contract with SelectRide ends. That contract was recently extended through April 30, 2015 in action taken by the AAATA board at its Dec. 19, 2013 meeting.

By implementing the paratransit part of the project, the AAATA wants to get some experience with the upgraded software before moving forward with its regular fixed-route buses.

According to staff memos in the board’s informational packet for the Feb. 20 meeting, the type of CAD/AVL system that the AAATA is upgrading allows dispatchers to locate, track and manage fixed-route bus operations. It also provides information on real-time adherence to the bus schedule. Further, it monitors and reports the status of engine components and on-board systems, such as the wheelchair ramp.

Reporting out from the planning and development committee, Eric Mahler noted that the consultant is important to make the most of the opportunity to upgrade the technology in a cost-effective way. Without the consultant, it’s felt that the AAATA might miss important opportunities to improve the service and to save money. Mahler said the urgency of hiring the consultant had been well established, saying that it’s important that the project get started right away because the upgrade to the AAATA’s systems depends on it.

When the board reached the item on its agenda, Eli Cooper noted that Ann Arbor is a place where networked automobiles are being piloted. He would willingly support keeping transit in the high-tech game.

Jack Bernard noted that the advanced system is critical for better paratransit service – so that a rider can, for example, have as much notice as possible that a ride won’t be arriving until the end of a scheduled window. He urged the board to support the resolution.

Larry Krieg wanted people to understand that the system the AAATA will be replacing was cutting edge 15 years ago. Equating one software year to 10 human years resulted in a system that was 150 years old, he said. Some of the problems that the AAATA has had with locating buses for interactive maps relates to the way the “elderly” system is trying to get information out.

Outcome: The board voted unanimously to approve the contract with TransSystems.

CAD/AVL Consulting: Public Commentary

During public commentary at the end of the meeting, Carolyn Grawi spoke on behalf of the Ann Arbor Center for Independent Living. And she responded indirectly to some of the remarks on accessibility.

“As you know, I have high expectations,” she said. The mobile app is great, but she wanted to note that about one-third of the population or more can’t use it. It’s important that when a new feature is launched, it’s launched to be accessible from the start. The print size for the mobile app is too small and does not change in size. She was excited to see the board moving ahead with the AVL/CAD consulting, which will lead to a software upgrade. Scheduling is a nightmare right now, she said. She also told the board that the AAATA doesn’t have enough paratransit vehicles on the road.

FY 2013 Audit

The board was asked to consider a resolution accepting the audit report for the fiscal year that ended on Sept. 30, 2013 (FY 2013). [.pdf of FY 2013 audit report]

FY 2013 Audit: Presentation from Auditor

David Helisek and Josh Yde of Plante Moran gave the board a presentation on its FY 2013 audit. The AAATA fiscal year runs from October through September, so the FY 2013 audit was for the year ending on Sept. 30, 2013. Two documents were presented: the financial statements, including the federal programs audit; and the required communications to those charged with governance.

Helisek reported that the presentation had been made in greater detail to the AAATA’s performance monitoring and external relations (PMER) committee earlier in the week.

Helisek noted that the bulk of the first document is the AAATA’s document – the financial statements. The only part of that contributed by Plante Moran are the first two pages, which includes the independent auditor’s report.

Helisek told the board that the report showed an “unmodified opinion,” which is the highest level of assurance that an auditor can give a set of financial statements, he said. That means that the statements fairly reflect the position of the authority as of Sept. 30, 2013 as well as the changes in that position. That’s the opinion that the AAATA strives to achieve on an annual basis, and it’s the one that Plante Moran has given for the third year in a row, he said.

Josh Yde highlighted some details from the balance sheet. He first noted that GASB 63 standards had changed the wording from “net assets” to “net position.” The total assets are now up to $66.2 million, he noted, which is up by about $12 million compared to FY 2012. Most of that is due to the increase in capital assets with the construction of the Blake Transit Center. Equipment is also up about $6.8 million, he noted, mostly due to new bus purchases in the current year.

Liabilities increased from about $2.9 million to $4.4 million. Most of that is due to accounts payable – related to the Blake Transit Center as well as other outstanding expenses. Finally, the net position increased to about $62 million, up from about $51 million last year. Most of that is due to the investment in capital assets, he said.

The unrestricted net position is up about $400,000 this year, Yde said. That means the current revenues are covering the cost of AAATA’s current costs of providing services. He noted, however, that of the $14.7 million, about $7.5 million relates to property tax revenue that will need to be used for operations in FY 2014.

The statement of revenues, expenses and changes in net position shows that operating revenues increased about $3.2 million. The largest portion of that is due to the increase in the depreciation in all the new assets, as the infrastructure continues to grow. Operating revenues are up about $240,000. Most of that is due to AirRide revenues, which was in operation for the full fiscal year.

The non-operating revenue is all up, Yde continued. Local non-operating revenue is up about $1.4 million. And most that is due to property tax revenue as well as purchase of service agreements (POSAs).

Before capital contributions, Yde said, all that leads to a change in net position of about negative $4.7 million. After the capital contributions of $15 million, that results in a change in net position of positive $10.4 million.

Helisek picked up the presentation from there. He reviewed the federal compliance portion of the audit. If you spend more than $500,000 of federal money, then a federal compliance audit is required, he explained.

The amount of federal funds spent by the AAATA in the FY 2013 was just under $17 million. Helisek told the board that they tested the federal transit cluster of about $14 million. So about 83% of the funds that came to the AAATA were tested. He said that they’d come across no issues of non-compliance as it relates to deficiencies or weaknesses.

Helisek noted that there was one finding on the last page: related to a depreciation expense calculation. As part of the audit, they did some testing and noted there needed to be some adjustments to some specific assets related to depreciation. That was brought to the attention of AAATA financial staff and they agreed with Plante Moran’s view, and they made the adjustment. He told the board that while it was an adjustment, it was a “non-cash adjustment.” It did not affect the budget over the year. However, auditing standards do require that the issue be communicated to the board.

As far as the letter to those charged with governance, Helisek noted that the first section is pretty much boilerplate. What you’re looking for are problems, he said, adding that there’s no communication on problems. The audit went very well and there were no disagreements with management on standards or the application of auditing standards.

The second section of the letter is more focused on legislative issues and informational items – things that might be “hot in Lansing,” he said. The one item that has been hot for the last 18 months is the state’s personal property tax, and the election that’s coming up in August. That could change how property taxes are collected, and would affect any entity that relies on property taxes. [The Aug. 5, 2014 ballot measure would mitigate against loss of personal property tax revenues by replacing part of the state use tax with a local tax administered to the benefit of metropolitan areas in Michigan.]

FY 2013 Audit: Board Discussion

Reporting out from the performance monitoring and external relations committee, Roger Kerson noted that on page 8 of the audit report, the amount the AAATA had spent on administration had gone down [$7,258,563 in FY 2013 compared to $7,277,201 in FY 2012] but money spent on operations went up [$24,811,414 in FY 2013 compared to $21,635,160 in FY 2012]. That showed the AAATA was putting its resources into “putting buses on the street,” he said, calling it a good sign.

When the board reached the item on its agenda, there was no discussion.

Outcome: The board voted unanimously to accept the FY 2013 audit report.

Insurance Broker

The board considered awarding a new five-year contract to Marsh USA Inc. of Grand Rapids, Mich. – the same insurance broker that’s consulted for the Ann Arbor Area Transportation Authority for the last 10 years. The contract is for up to $270,000 of consulting work.

Marsh USA will provide insurance brokerage services for general, automobile, workers’ compensation, property and public officials/employee liability insurances.

Reporting out from the performance monitoring and external relations committee, Roger Kerson noted that the AAATA purchases about $1 million worth of insurance every year, which is necessary given that the AAATA is driving buses around. So the AAATA uses a broker to help get the best price, Kerson said.

Outcome: The board voted unanimously to approve the contract with Marsh USA.

Unarmed Security

The board considered awarding a contract for unarmed security guard services to DK Security. The contract covers three properties: AAATA headquarters at 2700 S. Industrial Hwy., the Blake Transit Center at 328 S. Fifth Ave. in Ann Arbor, and the Ypsilanti Transit Center at 220 Pearl St.

The contract was for one year, with an option to extend the contract for four one-year periods.

The contract conforms with AAATA’s living wage policy, which mirrors that of the city of Ann Arbor. The policy currently requires vendors to pay a minimum wage of $13.96 per hour without providing health care benefits and $12.52 per hour when providing health care benefits.

The amount of the contract is not to exceed $270,400, which provides up to 14,299 hours (holidays included) of security coverage at a fixed-hourly rate.

The previous vendor, Advance Security, was one of 15 bidders for the work, but was not selected.

Reporting out from the performance monitoring and external relations committee, Roger Kerson noted that the bids that came back for the unarmed security work were a little bit lower than the incumbent vendor had bid, so the AAATA would be saving a little money on that. He noted that the new vendor still complied with the AAATA’s living wage policy.

Outcome: The board voted unanimously to approve the unarmed security contract with DK Security.

Communications, Committees, CEO, Commentary

At its Feb. 20 meeting, the board entertained various communications, including its usual reports from the performance monitoring and external relations committee, the planning and development committee, as well as from CEO Michael Ford. The board also heard commentary from the public. Here are some highlights.

Comm/Comm: Ridership

Reporting out from the performance monitoring and external relations committee, Roger Kerson updated the board on ridership. Ridership is down due to the weather, he said, which would probably affect the yearly total because the drop was fairly significant in January.

Comm/Comm: Blake Transit Center

As part of his report to the board, CEO Michael Ford noted that the AAATA had received a temporary certificate of occupancy for the new Blake Transit Center last Friday (Feb. 14, 2014) and the move into the facility is scheduled for the week of March 10. The building will be open by March 17, which is St. Patrick’s Day, Ford pointed out. There’s still more work to do, but Ford wanted to thank AAATA maintenance manager Terry Black and anyone who had anything to do with supporting that project.

Ford also thanked the bus riders and the drivers for “hanging in there” during the transition. It’s been a struggle, given the weather conditions.

Comm/Comm: Blake Transit Center Art

Reporting out from the performance monitoring and external relations committee, Roger Kerson said the committee had previewed the public art component for the BTC, saying it “looks really cools.” It’s a tile mosaic of figures representing the diversity of the community, he said. It’s less than $100,000 so the board does not need to approve it, Kerson noted, but it the board will be kept in the loop.

Present: Charles Griffith, Eric Mahler, Susan Baskett, Eli Cooper, Roger Kerson, Anya Dale, Gillian Ream Gainsley, Jack Bernard, Larry Krieg.

Absent: Sue Gott.

Next regular meeting: Thursday, March 20, 2014 at 6:30 p.m. at the Ann Arbor District Library, 343 S. Fifth Ave., Ann Arbor [Check Chronicle event listings to confirm date]

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor Area Transportation Authority. Click this link for details: Subscribe to The Chronicle. And if you’re already on board The Chronicle bus, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Regarding the public art component – I thought it had been reported they chose the Michigan artist, Daniel Roache. In the report above Roger Kerson described it as “a tile mosaic of figures…” – which is the description of the other, California artists work – which also costs $10,000 more than Mr. Roache’s work. Can anyone clarify? Aesthetically, financially, and for keeping it local, I much preferred Mr. Roache’s concept.

We subsidize car drivers in a hundred different ways that we don’t get to vote on, for example by requiring businesses to provide free parking. So why does AAATA have to go to the voters?

Do we require businesses to provide free parking? I know that some requirements remain for downtown developments but have not kept up since they were downsized. Existing buildings are populated by new businesses without a parking plan. I would think that most businesses that provide free parking do so in an effort to bring in customers. Or they are trying to attract key employees.

The redevelopers of the former Dream Nite Club (I still think of it as Maude’s) propose in their submission to the Design Review Committee to use the adjacent parking structure for customer parking. I assume that customers would pay the regular parking fees. They also propose a valet parking service, with cars to be taken into the structure and returned when needed. I thought that was a rather innovative use of our existing parking infrastructure. (We know now that the new tenant is a Ruth’s Chris Steakhouse.)

We do have parking requirements for many uses: [link]

We don’t require them to be free:

“The parking spaces and bicycle parking spaces required by this chapter shall be accessible to a public street or alley and shall be kept available for the use of occupants, employees or other users of the building for which the space was provided. Nothing herein shall preclude a reasonable charge to the occupants of the building for use of the parking spaces or bicycle parking spaces”

That said, usually the commercial parking is free. So, when I walk to Nicola’s books, part of her rent pays for maintaining the large parking lot at West Gate, and so part of the price of my book pays for those parking spaces. As Jeff points out, it is a way that non-drivers subsidize drivers.

Re (4): I think you meant Jim. Jeff’s comment was about something else. Thanks for the clarification and the link.

Parking lots in shopping malls are provided in order to attract customers. They could be characterized as supporting automobile driving, but providing them is not a “subsidy”, rather, they are an amenity that is provided for purely commercial reasons.

Like it or not, commercial ventures without parking that is adequate to those who wish to drive experience problems. Consider the Whole Foods on Washtenaw Avenue, a source of complaints since they opened. The population who live within walking distance of any particular business are likely not adequate to support it.

To go back to Jim’s original question, of course the reason that AAATA must seek a vote is that we are being requested to add a new tax which is solely directed at providing a service that many of those who will be taxed will not use. We each have to decide whether the community value, as well as the personal benefit, is worth it.

Parenthetically, the Headlee amendment to the Michigan constitution requires a vote of the people for any new tax. There are a couple of grandfathered tax measures like the Act 88 which the BOC, in my opinion, is exploiting, in which an elected body may raise taxes without a popular vote. But those cases are unusual in Michigan.

Why don’t big supporters of Public Transit put more of their own skin in the game in terms of funding. They could make large personal monetary contributions to improving AAATA’s services but I don’t see them doing it. You know it is pretty easy to spend other people’s money on things that you like and benefit from but are risky and costly. Where is the public accountability for this approach.

The Ann Arbor community is already lavishly funding AAATA at 2 mills. They have plenty of money to make needed improvements if their bus business was managed well. Unfortunately it is not. You know it is pretty amazing to reasonable and informed voters that AAATA always run large annual operating deficits that must be closed with large amounts of public tax money and that they only require users of their business services pay about 25% of the costs of those services.

A public business that operates this way does not need or deserve another .7 mills in taxation.

Free parking was just an example. My point is that subsidies to car drivers are mostly in forms that we don’t get to vote on, but subsidies to bus riders require a vote. That would seem to penalize the bus riders.

It seems that we have a lobby here for turning Ann Arbor into Amsterdam-on-the-Huron with people living in $100 per day sardine can apartments in high rise buildings, few cars, busses to every nook and cranny, lots of bicycles and pedestrians. I have a question for these people. What is the population density of Amsterdam-on-the-Huron compared to that of Amsterdam in Europe?

Jim, most transportation funding is based on the gas tax. So in a sense it is a user-based tax. (Users being defined as auto users.) By law (and the Michigan Constitution), the tax is limited in application to 10% of the collected tax to be used for transit. The tax fund that pays for transit is called the Comprehensive Transportation Fund. This post [link] needs to be updated but explains it. The State of Michigan (MDOT) (via the CTF) is the biggest contributor to AAATA service. That comes from the gas tax revenue. Thus you can see that auto users are the source of money to pay for transit. There would be (and probably are) auto drivers who would say that taxes collected from them should be used to fix roads. I think it was said recently that Michigan is now #50 on road maintenance.

So actually, auto users are subsidizing the transit usage. On the other hand, transit has been constrained in the amount of tax revenue that it can use.

That leaves local tax contributions (via property tax, the only local tax that Michigan law allows us to levy) as the only way to provide discretionary upgrades to transit services.

“You know it is pretty amazing to reasonable and informed voters that AAATA always run large annual operating deficits that must be closed with large amounts of public tax money and that they only require users of their business services pay about 25% of the costs of those services.”

Roger – Every form of transportation is subsidized by taxpayers. We don’t require owners of automobiles to pay anywhere near the cost it takes to maintain the roads. The outrage directed at transit users is selective. The subsidy is fine as long as it benefits you?

For example, the following article (1 year old) by a nonpartisan research think tank: [link]

The article states that the share of road spending in Michigan covered by fuel taxes, tolls, and other user taxes and fees is 29.9%, which puts us 26th out of 50 states in terms of how much drivers pay their own way.

The balance comes from general fund spending and federal aid, which essentially forces non-drivers and drivers to pay the difference (akin to subsidizing mass transit out of general fund dollars).

Furthermore, the share of all transportation funding covered by user taxes and fees (including airports, trains, buses, etc.) is 33.6%. In other words, it gets better when you average in other forms of transit.

Re (11) Interesting – however the article does not break down the actual sources of funding other than state gas taxes and user taxes. Michigan has relatively few toll roads (are there any?) so that would make us slide down this ranking.

The article does not say this, but I gather that the “other” sources include, as you say, Federal funding. But Federal funding is also based on the gas tax. The major Federal transportation program, known as the highway trust fund, is supported by the Federal gas tax. The current Federal transportation bill, MAP-21 (see SEMCOG’s page on this [link])is due to expire in September 2014. According to a figure (p. 11) in this comprehensive overview [link] 35% of total transportation funds are from a Federal source, most of which will be MAP-21. (There have been some Federal grants, some of them for rail projects, that are likely included in this figure as well.) State restricted funds (which will be the gas tax) are 62.5% and general funds are only 0.7%. So between state and Federal gas tax sources, over 90% of transportation funding appears to be from user (gas) taxes.

In recent years the State Legislature has been obliged to put in some appropriations from the general fund to prop up the transportation budget. This has been mostly money appropriated in order to keep up the required match for Federal funds. Here is a summary [link] from mid-2013 of changes in the previous budget. Note that some of the general funds are to support rail projects, wireless communication, and other non-road items.

The city’s road streets millage is another example of subsidies for roads paid for by taxpayers generally, not just by user fees.

Buses and bicycles use the roads. People get to the airport via roads. People get to the train station via roads. Transit employees, fuel, & supplies get there by road. These icy days, I see many pedestrians using the roads . Anything you buy (e.g. food) comes to the store – or your home – via roads. Police and fire get to your home via roads.

Everyone – and all transit – directly uses, or intimately depends on, roads. Roads are the transit element most worthy of general fund monies.

Bad roads = bad buses & bikes

No roads = no buses & bikes

Whether the roads are worthy or not of these subsidies isn’t the question. Many drivers claim that they alone are paying for the upkeep of the roads, which is clearly untrue, and that their gas tax dollars shouldn’t be “diverted” to pay for transit. Also, it undercuts the claim that cars should have an exclusive claim on the use of roads. If bikers and transit users are paying for the roads through general property taxes, they should be allowed equal use of the roads, not delegated to second-class user status because they don’t directly pay the gas tax.

John Q., the original point was that AAATA was being required to have a public vote while autos were being supported without the need to vote. But our local road repair millage was enacted by a public vote.

I don’t see anyone denying the use of the roads to buses. Bicycles have more trouble, I agree, and I personally support bicycle access to roads, including bike lanes. But the question here is the transit millage, not general nonmotorized access issues.

A language question: do we properly refer to users of bicycles as “bikers”, “cyclists” or “bicyclers”?

It just seems that if the complaint is that auto drivers don’t pay their fair share of road maintenance, then diverting gas taxes from roads to other uses only exacerbates the problem of “unfair” general fund subsidy of street maintenance. I don’t see how potholes in streets helps either bus riders or bicyclists.