Washtenaw County board of commissioners meeting (Sept. 18, 2013): With a third of the nine-member board absent, commissioners dispatched their business in one of the shortest sessions in recent memory, lasting only 45 minutes. The early adjournment elicited a round of applause from staff in attendance – the previous meeting on Sept. 4 had lasted about five hours.

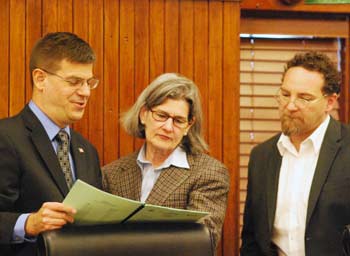

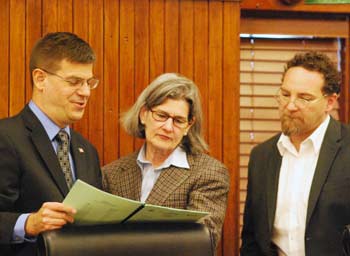

From left: Commissioner Dan Smith (R-District 2), county treasurer Catherine McClary, and commissioner Conan Smith (D-District 9). The treasurer’s office is instrumental in a new approach to helping local municipalities pay off bonds backed by the county, which received initial approval on Sept. 18. (Photos by the writer.)

Even so, a wide range of resolutions were passed – mostly with no discussion. The absence of three commissioners also led to non-votes on two items originally on the agenda, out of concern that there would not be sufficient support to pass them.

During the meeting, the board postponed a final vote on a countywide micro loan program for small business. Under the county board rules, a resolution requires votes from “a majority of the members elected and serving” in order to pass – that is, five votes. Supporters of the resolution weren’t certain they could achieve that number. A resolution regarding the state’s “Stand Your Ground” law had been pulled from the agenda earlier in the day for the same reason.

Opponents of the “Stand Your Ground” resolution – which called on the state legislature to repeal the law enacted in 2006 – had been expected to appear at the meeting in force, prompting county administration to add extra security. However, after the resolution was pulled, only a handful of people attended to speak against it, as did one supporter.

In another resolution that addressed a statewide issue, commissioners voted to direct staff to explore options – including possible legal action – to help set cleanup criteria in Michigan for the carcinogen 1,4-dioxane. In part, the item relates to a 1,4 dioxane plume stemming from contaminants at the former Gelman Sciences plant, west of Ann Arbor.

Dan Smith (R-District 2) stated “present” during that vote, rather than voting for or against the resolution – because board rules do not allow for abstention. After the meeting, corporation counsel Curt Hedger told The Chronicle that he’d be looking at the board rules to determine how Smith’s vote will be recorded. Hedger pointed out that the resolution needed five votes to pass, which it garnered even without Smith’s vote.

Commissioners also gave initial approval for a new approach to paying off debt incurred from bonding – typically for public works projects in local municipalities. The proposal would allow local units of government to repay bonds early via the county’s delinquent tax revolving fund (DTRF), which is administered by the county treasurer. The intent is to reduce interest rate payments and the county’s debt burden. In a related resolution, commissioners gave initial approval to restructuring debt held by Bridgewater Township, using this new approach.

Several items that received initial approval at the board’s previous meeting on Sept. 4 were passed in a final vote on Sept. 18 with minimal discussion, including: (1) strengthening the county’s affirmative action plan, as well as other nondiscrimination in employment-related policies; (2) authorizing a range of grants administered by the county’s office of community & economic development, as well as a resolution that would give blanket approval in the future to nearly 30 annual entitlement grants received by the county; (3) adding three new full-time jobs for stewardship of the county nature preserves; (4) adding a new 10-bed treatment program for female teens in the county’s youth center that will create a net increase of 5.46 jobs; and (5) budgets for the county’s public health and community support & treatment service (CSTS) departments.

And after postponing action on Sept. 4, the board voted to create a 13-member community advisory group to look at options for the county-owned Platt Road site in Ann Arbor. The Sept. 18 resolution was much more general in its direction than the one that was debated on Sept. 4, stripping out most of the details related to a previous focus on affordable housing.

Also on Sept. 18 as an item of communication, Yousef Rabhi updated the board on plans to fill a vacancy on the county road commission, which will result from the recent appointment of current road commissioner Ken Schwartz as Superior Township supervisor. Applications for the road commissioner job are being accepted until Sept. 25, with the county board likely making an appointment at its Oct. 2 meeting. [Full Story]