Column: Is Public Education A Charity Case?

If you’re like me, then every January you think to yourself, “This year, I’m going to spread out my charitable giving over the course of twelve months. It would be so much better for my cash flow, and probably it would be better for the nonprofits as well.”

And then, come November and December, I realize that once again, I failed to spread out my giving – and I had better pull out my checkbook. Writing the bulk of these checks at the end of the year has a benefit, in that it allows me to look at all of my donations at once. But it also means that I’m in a rush and I don’t always take the time to reflect. So this is my opportunity.

Like many of you, we make donations to local, national, and international groups that focus on a wide range of issues. For us, those organizations do work related to health, the environment, politics, women’s issues, Jewish groups, social action, human services, and more.

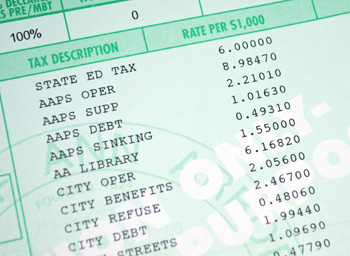

Although I do give to some groups that, loosely speaking, fit the category of “education,” those entities do not make up a significant proportion of our donations. I confess to a certain ambivalence to giving to such groups – because, in many ways, I’m already a big contributor to public education. And it’s likely that you are, too. [Full Story]