Column: Taxing Math Needs a Closer Look

A bit more than a month ago, the Ann Arbor Downtown Development Authority board was poised to ratify a new contract with the city of Ann Arbor, under which it would continue to manage the city’s public parking system. But at noon on May 2, when board members met, they were greeted with some news that caused them to postpone their vote on that 11-year deal, which called for 17% of gross parking revenues to be transfered to the city of Ann Arbor.

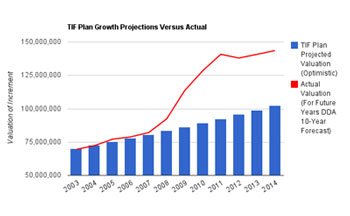

Blue bars represent the "optimistic" projections of the increment valuation in the Ann Arbor DDA's TIF plan. The red line represents actual valuation of the increment on which taxes have been captured. For 2013-2014, the valuation is based on estimates in the DDA's 10-year planning document.

That news had been conveyed to DDA staff by the city of Ann Arbor’s finance department just that morning: Some of the taxes captured in the DDA’s tax increment finance (TIF) district since 2003 might be owed to local taxing units, including the city. With an uncertain financial obligation to return TIF monies that had already been captured from taxing units in the district, the DDA board understandably balked at approving the new parking contract on May 2.

The postponement of the DDA’s vote on that contract ultimately led to a delay in the Ann Arbor city council’s adoption of the city’s fiscal year 2012 budget – as the council stretched its May 16 meeting to May 23 and then on to May 31. But by the end of May, the issue of excess TIF capture had been settled to the DDA board’s satisfaction, and the parking contract was ratified – first by the DDA, and then by the city council.

The Ann Arbor city council was also content with the DDA’s proposed solution to the excess TIF capture. That solution included returning a total of roughly $473,000 to the Ann Arbor District Library, the Washtenaw Community College and Washtenaw County. The city of Ann Arbor chose to waive its $712,000 share of the calculated excess.

Those three other taxing units no doubt welcomed the news that their budgets would get an unexpected boost. But the governing bodies of those taxing units should take a closer look at how the excess TIF was calculated. If they do, they will discover that the amount actually due to be returned to them (and divided proportionately as required under the city’s of Ann Arbor’s DDA ordinance) may not be $473,000, but more than twice that: $1.27 million. In ballpark numbers, for the Ann Arbor District Library that translates to the difference between about $75,000 and $200,000. For Washtenaw County, it’s the difference between $242,000 and $648,000. And for Washtenaw Community College, it’s the difference between $157,000 and $419,000. [Full Story]