County Road Proposal Gets More Scrutiny

Washtenaw County board of commissioners working session (Oct. 6, 2011): After a lengthy discussion at their Oct. 5 meeting, county commissioners again tackled the issue of road repair at their working session the following evening.

Ken Schwartz, a Washtenaw County road commissioner, talks with Curtis Hedger, the county's corporation counsel, before the start of the Oct. 6 county board of commissioners working session. (Photos by the writer.)

This time, however, the board heard directly from representatives of the road commission: Ken Schwartz, a former county commissioner who’s now one of three road commissioners; and Roy Townsend, the road commission’s director of engineering. Schwartz was instrumental in identifying a 1909 state law that would allow the county board to levy a millage for road repair without voter approval.

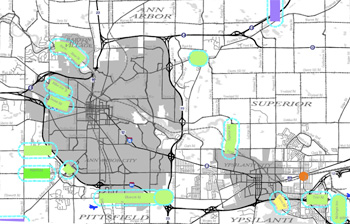

But in presenting the proposal for a set of possible road projects throughout the county costing about $8.7 million, Schwartz backed off from advocating for a millage. Instead, he said the road commission was simply bringing forward a list of needed projects and the amount that it would cost to pay for them. It’s up to the board of commissioners, he said, to decide what funding source to use, or whether to act on the proposal at all.

Commissioners expressed a variety of concerns during the hour-long discussion. Board chair Conan Smith worried about “tax weariness,” indicating that other countywide millages might be in the offing. Yousef Rabhi was cautious about taking action that could jeopardize a street repair millage that’s on the November ballot in Ann Arbor.

Smith also broached the issue of possibly expanding the road commission board – a controversial topic that was last discussed seriously in 2010. Currently there are three road commissioners, and Smith wondered how often the small size caused concerns over violating the state’s Open Meetings Act.

The road repair proposal and related issues will almost certainly be taken up again. The board has pushed back consideration of the plan to its Dec. 7 meeting.

Other topics of the Oct. 6 working session included an update on the county’s fiscal “score card,” and a presentation by bond attorney John Axe about factors contributing to the county’s bond ratings. This report focuses on the road repair issue. [Full Story]