Edwards Brothers Vote: Town-Gown Relations

Ann Arbor city council meeting (Feb. 24, 2014): Mayor John Hieftje welcomed high school students attending the meeting to satisfy course requirement by telling them they were probably getting off easy compared to other nights.

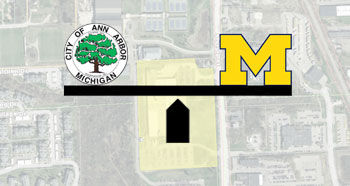

The Ann Arbor city council declined to exercise its right of first refusal on the Edwards Brothers Malloy property at its special session on Feb. 24, 2014. Chuck Warpehoski (Ward 5) compared the process of reviewing the options over the last few weeks to riding a “see saw.” (“Art” by The Chronicle.)

That’s because the meeting was a special session, dealing with just one substantive issue: a resolution to exercise the city’s right of first refusal to purchase the 16.7 acre Edwards Brothers Malloy property on South State Street, and a closed session to discuss that issue.

The council’s 5-6 vote on the land acquisition fell short of a simple majority, let alone the 8-vote majority it needed. That vote came after the closed session, which lasted an hour and 40 minutes. The council then deliberated for about an hour and 10 minutes.

The council’s decision came four days after the University of Michigan’s board of regents had authorized proceeding with a purchase of the property for $12.8 million. The site is located at 2500-2550 South State Street, immediately adjacent to existing UM athletic facilities. It’s assumed the university would use the land at least in part to support its athletic campus.

Voting to exercise the right of first refusal were: Sabra Briere (Ward 1), Sally Petersen (Ward 2), Jane Lumm (Ward 2), Margie Teall (Ward 4), and mayor John Hieftje.

Voting against exercising the right of first refusal were: Sumi Kailasapathy (Ward 1), Christopher Taylor (Ward 3), Stephen Kunselman (Ward 3), Jack Eaton (Ward 4), Chuck Warpehoski (Ward 5) and Mike Anglin (Ward 5).

Deliberations focused on two main issues: (1) the financial risks and benefits; and (2) the city’s relationship with the university.

The motivation for the city to exercise its right of first refusal on the property was based in large part on a desire to protect the city’s tax base. The property current generates roughly $50,000 in annual real property tax revenue to the city’s general fund. But the city’s total revenue from the parcel is just 28% of the total taxes levied by all jurisdictions. The net present value over the next 25 years of the levy from all jurisdictions is roughly $6 million. That was weighed by the council against a purchase price of $12.8 million that reflected a “premium” over the appraised value of around $8 million.

Also a factor weighed by the council was a $218,000 annual holding cost for the land, which reflected a 1.7% interest rate that Flagstar Bank had offered. That’s about half the rate the council was assuming in its earlier review of its options.

Another piece of the financial equation was that the some of the tax abatement previously granted by the city to Edwards Brothers would be coming back to the taxing jurisdictions. That’s because by selling the property, Edwards Brothers would not be meeting all the terms of the tax abatement. There’s a clawback provision in that case – which returns taxes to jurisdictions amounting to a total of $200,000. Of that total, the city’s portion is $90,000. It’s under the terms of that tax abatement that the city had obtained a right of first refusal on the sale of the property.

The deal would have been financed from the general fund. According to the city’s year-end audited statements for FY 2013, the general fund unassigned balance stood at $14,392,854 as of June 30, 2013.

Councilmembers like Eaton and Kailasapathy were clearly opposed to exercising the city’s right of first refusal, based on the substantial risk they thought the city would be taking. Everything would need to go right, in order for the city to come out ahead, they said. Kailasapathy indicated that the “premium” price to be paid by the city for the real estate was a significant reason to vote against it.

Kunselman, in voting against the resolution, relied on what’s become for him a familiar criticism of “speculative development.” He cited in part what he’d learned taking a course on real estate from local developer Peter Allen, a lecturer at UM.

Councilmembers like Warpehoski and Taylor were less adamant about their no votes. Warpehoski thought the odds were “better than even” that the city would come out ahead long-term. But because the city would be gambling with public funds, he wondered if “better than even” was good enough. “Right now, I’m thinking maybe not,” he concluded. Earlier in the meeting Taylor had offered similar sentiments, saying that he’d “regretfully” vote no. “We could have pulled it off; we had a reasonable shot at pulling it off. In light of our mission, I think a reasonable shot is not good enough,” Taylor said.

The sixth vote against the resolution came from Anglin. He responded to one of the arguments made by those who supported the resolution – that by exercising its right of first refusal, the city could leverage some collaboration with the university on the future of the parcel. For Anglin, the price was too high just to sit at the same table with the university.

Petersen, Briere and Lumm specifically mentioned the ability to leverage some cooperation from the university on the future of the land as one argument for exercising the city’s right of first refusal. Kunselman called that trying to take the parcel hostage and holding a gun to the university’s head. But some who supported the resolution saw the possibility that exercising the right of first refusal could lead to improved city-university relations.

Hieftje ventured that the city-university relationship is as good now as it has ever been, adding: It’s a good relationship as long as things happen the way the university wants them to.

Those voting yes generally felt that the risk to the city posed by exercising the right of first refusal justified the potential benefit to the city’s tax base. They also cited the opportunity to control the future of the parcel, and to influence development in that part of the city. Responding to a remark from Warpehoski earlier in the meeting – that the South State Street corridor did not give him “warm fuzzies” – Teall said: “I like it. It’s my neighborhood.”

Some background information on the possible acquisition of the property by the city was released last week, on Feb. 18, the day of a regular council meeting. [Edwards Brothers chart] [Additional offer for Edwards Brothers] [Feb. 18, 2014 memo to council]

This article provides more background on the council’s handling of the issue, a sketch of the deliberations, and a more detailed presentation of the deliberations. [Full Story]