Commissioners Discuss County Road Tax

The Washtenaw County road commission plans to request a countywide millage to help pay for road repair. It’s a tax that the county board of commissioners could impose without seeking voter approval. Road commissioners say the millage is needed because the county is faced with diminished funding from the state, increased costs for labor and materials, and a growing number of deteriorating roads.

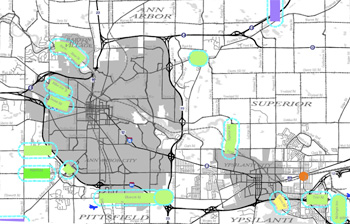

Map of road work proposed by the Washtenaw County Road Commission for Ann Arbor and Ypsilanti. Other work is proposed throughout the county. The proposal asks the county board to levy a road millage to pay for the work. (Links to larger image.)

The topic emerged at a Sept. 8 working session of the county board of commissioners, which would need to authorize the millage before it could be levied. The issue was not on the agenda, and was discussed late in the meeting.

Wes Prater brought up the issue of a possible road millage during the time set aside for items for current or future discussion. He said he’d received an email indicating that the road commission planned to ask the board to levy an 0.6 mill tax, and he wanted more details. The millage, if authorized, would raise about $7 million for more than three dozen proposed road projects.

County administrator Verna McDaniel reported that she and Curtis Hedger, the county’s corporation counsel, had met with road commissioner Ken Schwartz and Roy Townsend, the road commission’s director of engineering, regarding a possible county millage. Road commissioners believe the millage could be levied under Public Act 283 of 1909. Because that act pre-dates the state’s Headlee Amendment, it could be levied by the board and would not require voter approval.

The staff and board of the road commission have been discussing this proposal at their public meetings as well as privately with elected and appointed officials throughout the county, including county commissioners. At least one of those private meetings may have violated the state’s Open Meetings Act.

It’s expected that Townsend and Schwartz – a former county commissioner, who was instrumental in finding this possible funding source – plan to make a presentation at the county board’s Sept. 21 meeting. The county currently levies two other taxes in this pre-Headlee category, though they are for considerably smaller amounts: (1) 0.05 mills to support economic development and agriculture; and (2) 0.025 mills to support services for indigent veterans. Both were also put forward by Schwartz when he served on the county board. A final vote on renewal of those two millages will occur at the Sept. 21 meeting.

McDaniel said she asked Hedger to seek advice on the road tax from the state’s attorney general. The county needs to look at the statute carefully, she said, to determine what the board’s rights are. [Full Story]