Is DDA District a Disproportionate Burden?

The bottom line according to a 2005 city of Ann arbor analysis of DDA costs versus payments. (The circle means "negative") The DDA sees it differently.

On Monday evening, March 23, several Ann Arbor residents took advantage of an entire city council session devoted to public comment on the recent A2D2 zoning revisions. The zoning revisions apply to an area that coincides almost exactly with the Downtown Development Authority district. We thus take the opportunity to focus on this district, and how taxes are collected in this geographic area, in light of recent community discussion on the topic.

The Chronicle has previously reported a remark by made by Mayor John Hieftje at a recent Sunday night caucus, in which he stated that the parking agreement between the DDA and the city was renegotiated in 2005 due in part to the fact that the DDA area represented a disproportionately greater burden on city services. Also previously reported, Kyle Mazurek, vice president of government affairs for the Ann Arbor Area Chamber of Commerce, posed several questions to the DDA board at its meeting on March 4, including one about the possibility of disproportionate use of city services in the DDA district:

Does the city incur disproportionate costs downtown relative to elsewhere in the city? Do you have city estimates for cost and revenues downtown? Even rough numbers would be helpful.

In providing a response to Mazurek, DDA staff took as its starting point a 2005 analysis undertaken by city of Ann Arbor staff, which concluded that the cost of city services provided in the DDA area was greater than the payments recovered for those services from the DDA by $6,198,542.

By the city’s account, the DDA provided $720,000 in payments (mostly for snow removal and pothole repair) against $6,886,701 in city costs incurred in the area (the bulk of which were for police and fire protection, but also included historic marker cleaning, flower planting, street light amenities, and graffiti removal). Otherwise put, on the city’s analysis, over $6 million worth of city services were provided to the DDA geographic area in 2005 for which the city did not recoup any revenue from the DDA.

In replying to Mazurek, the annotations by DDA staff call into question the appropriateness of some of the city figures (e.g., the cost for police services in what the Ann Arbor Police Department calls the Adam District, which includes service to the University of Michigan and neighborhoods outside the DDA district.) However these figures are not adjusted in the reply.

The table underpinning the DDA’s response to Mazurek lays out the 2005 city analysis together with the DDA staff commentary. On the DDA’s balance sheet, the $6,886,701 in city costs are almost completely offset by $6,849,000 in cost recovery by the city. Where the bottom lines between the DDA’s and the city’s 2005 analyses differ lies in two main sources of cost recovery that are not included in the city’s 2005 analysis: (i) parking fines ($2 million levied in the DDA district out of $2.5 million citywide), and (ii) city taxes levied in the DDA district ($3,629,000).

This second point is worth noting, because it depends on the fact that the city continues to collect property taxes in the DDA district. That is to say, the DDA does not capture all of the taxes in the DDA district, but rather only the increment between the initial value of properties and the additional value that comes from improving (i.e., developing) them – hence the name tax-increment finance (TIF).

So, who gets what taxes in the DDA district?

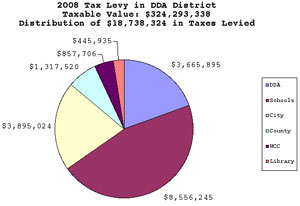

In 2008, the total taxable value of property in the DDA was $324,293,338, and yielded a total of $18,738,324 in property taxes. [Detailed breakdown by the DDA in this PDF.] Of that nearly $19 million figure, about $8.5 million went to schools, a little under $4 million went to the city of Ann Arbor, and around $3.6 million went to the DDA.

Editorial Aside

The question of whether the DDA area represents a disproportionate burden on city services is not answered by the kind of analysis undertaken by the city. That is a cost versus cost-recovery comparison, which is not the same as a measure of proportional burden. To make a case for excess proportional burden, the denominator needs to be specified. Is it the land area? Is it the built square footage? Is is the number of residents? What exactly is the X in the denominator?

The question itself as to whether the DDA area uses proportionally more city services than other areas, or even whether the city recovers its costs for those services, distracts from the real questions here: (i) Should the DDA TIF accrue to the city’s general fund and be budgeted directly by city staff with confirmation by city council? (ii) Should the other main source of the DDA’s revenue – parking fees – be budgeted directly by city staff with confirmation by city council?

In his campaign for a Ward 5 council seat in fall 2008 (a race won by Carsten Hohnke), one of John Floyd’s central themes was that the taxes captured by the DDA should be allocated based on the regular budget process. Otherwise put, Floyd’s answer to (i) was, and is, “No.” “Yes.” It’s tantamount to the position that the DDA should not exist. In fact there is no requirement that it exist. But that is a question that can be debated without the distraction of a discussion about whether the DDA area represents a disproportionate burden on city services.

This question of an existing “disproportionate burden” is also not the same as a similar-sounding theme of Floyd’s 2008 campaign, which was this: With a vision of greater density and growth downtown and the increased burden on city services associated with that increased density, there would not be a commensurate growth in the general city budget – because the increase in tax revenues would come as a result of development, i.e., on the increment that the DDA collects, and hence would go to the DDA.

As for question (ii), on the same caucus night that Hieftje contended the DDA area represented a disproportionate burden on city services, Hohnke pointed out that the enabling legislation for the DDA did not entail any particular financial arrangement on parking revenues – or even that the DDA be assigned responsibility for parking. That’s true. The city is entitled to manage the parking system in whatever way it likes. Whether it manages parking itself, or through the DDA, the salient point that is emerging is that the city has abandoned the basic assumption that parking fees should be set so that the parking system is simply sustainable, not to generate revenue to be used for non-parking purposes.

Whether it’s a good idea to abandon that assumption is a practical question that can be debated independently of the academic question of disproportionate burden imposed on city services by the DDA district.

“the salient point that is emerging is that the city has abandoned the basic assumption that parking fees should be set so that the parking system is simply sustainable, not to generate revenue to be used for non-parking purposes.”

As a taxpayer, resident, and appreciate user of the downtown, I have much less concern about the possibility of such a change as I do about the way council seems to be going about it. I would much rather have a proactive exploration of how to most effectively use community resources than a reactive shuffling of money to fill gaps.

I’m surprised and pleased by this account of this report.

I believe that the DDA has an important role to play in suggesting improvements and creating consensus around what investments are needed to keep downtown going. My contention is that it’s not good policy or budgeting for payments to be diverted blindly from the city’s general fund to the DDA outside of our regular General Fund budget process. Other city needs – police, parks, bridge repair, streets, etc. should not be given 2nd class consideration.

Undoubtedly some current DDA projects would be funded through our regular General Fund budget. It is also likely that some DDA proposals would not stand up against competing city needs.

No city can fund its basic services primarily off of homeowner property taxes. Commercial and industrial properties are needed to fund city services. The current DDA funding arrangement deprives the city of revenue for other needs – and citizens have no say in it.

As David has noted, Tax Increment Financing means that as new apartments and offices are added to downtown, with related increases in demand for city services, there is no new revenue from these new buildings to pay for increased city services, or to carry a fare share of government overhead expenses. Businesses outside the DDA, along with homeowners, pay for all the services of new downtown residents and businesses.

I think we should all remember what a mess the City’s parking system was in before the DDA took it over from the City. It is now clean, safe, efficient, and easy to navigate. As a result, it reaps huge amounts of revenue that the City is already tapping into to balance its budget. Let’s not kill the goose that laid the golden egg!

I agree with Mr. Floyd, out DDA residents will be required to pay to cover the cost of all the new downtown residents.

I wish we mere out DDA residents had similar paid lobbyists like the downtown has in the DDA.

The DDA should be disbanded. It has prove of very little use by most cities other than a money sink.

The downtown is only as strong as the community surrounding it. Lets get to work fixing the city and the downtown will rise with the rest of the community around it.

I guess it comes down to whether you think Downtown is the dog or the tail.

But, based on their respective track records, if I had to choose between the DDA and City Council managing my money, I’d choose the DDA.

I agree that the DDA has a good track record managing the parking system. The problem is that Council sees the parking system as a big pot of money that can be raided to bail them out of their own financial mess. If the city continues to demand ever bigger kickbacks from parking revenue, the only way to get it is to raise rates or stop maintaining the structures. I think the goose is at risk.

Part of the problem is that the Council and its administrator are doing (at least for public consumption) short-term planning, where yearly holes need to be plugged. But for good management of infrastructure, long-term planning is needed. I remember sitting in DDA committee meetings 3 years ago hearing discussions of the 10-year budget picture, in which parking revenues were going be adequate to meet the needs of the system only for a few years and it looked as though the TIF funds would have to be tapped to keep the system whole. But the TIF funds are surely not meeting earlier projections now that assessments are going down and many projects did not get built as planned. I can’t imagine what the budget looks like now that the DDA has had to make major contributions to the new city hall, plus the new underground parking on 5th, plus the $2 million cash payment to the Council. Of course we know part of the answer – it will cost more to park downtown. I think that will ultimately hurt downtown merchants, ironic since the parking system was originally intended to bring customers.