Health Care Impacts County’s Bottom Line

Health care benefit costs for Washtenaw County employees have increased 33% since 2005, according to an update given to the county board of commissioners at their Aug. 5 working session. Diane Heidt, the county’s human resources and labor relations director, also briefed commissioners on the anticipated impact of recent federal health care reforms. It’s not yet clear how much the county might save from the reforms – and it’s possible that in some cases, the changes could cost the organization more money.

The working session also included a presentation by executives of the Southeast Michigan Council of Governments (SEMCOG) and a brief update on the progress of the jail expansion. This report focuses on the health benefits presentation.

Cost of Health Benefits

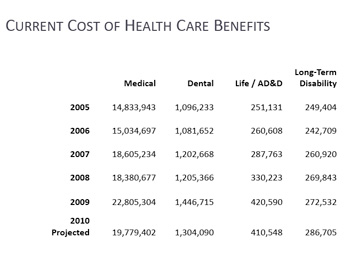

Jennifer Watson, the county’s budget manager, began the report by giving an overview of current costs and a comparison of expenses over the past five years in the major categories of health care: medical, dental, life insurance and long-term disability. Medical costs are the largest expense, projected to be $19.779 million in 2010 – an amount that includes coverage of about 1,350 employee positions as well as about 700 retirees. That cost represents a 33% increase from $14.833 million in 2005.

Dental costs climbed 19% during that five-year period, from $1.09 million in 2005 to a projected $1.3 million this year.

However, medical and dental costs were even higher in 2009 – $22.8 million and $1.44 million, respectively. Union concessions and a shift from HMOs to Blue Cross/Blue Shield PPOs accounted for much of the cost savings in 2010.

The health benefit costs include amounts paid by the county as well as modest employee contributions. Most union employees pay no contribution toward their health care. However, all of the county’s 184 non-union employees contribute $600 annually. Members of four unions – representing a total of 51 employees – pay $400 annually. Those include members of the Assistant Prosecutors Association, the Public Defenders Association, and two bargaining units of the Michigan Nurses Association. There are 17 bargaining units representing county employees, and each negotiates its own contract with the county.

The county is self-insured for its medical and dental costs, buying its coverage through Blue Cross/Blue Shield – that company is projecting significant annual increases in the coming years, Heidt said. In addition to standard benefits offered by the county, employees can choose to buy additional optional coverage, at their own expense.

Impact of Federal Reforms

Going year by year, Heidt outlined several changes anticipated from recently passed federal health care legislation. Starting this year, the county will be reimbursed for part of the health care costs for retirees over the age of 55 who aren’t yet eligible for Medicare. Only $5 billion in subsidies were available nationwide and employers had to apply to be selected. Heidt said that the county’s application was accepted, and reimbursement began in July.

In 2011, employers must extend coverage to the married or unmarried dependents of their employees through the age of 26, unless the dependent is covered under another plan. This is expected to add a 1% to 1.5% cost increase, Heidt said.

Also in 2011, employers will be expected to offer plans that include preventive health care services. This won’t impact the county, Heidt said, because their coverage already includes preventive care. Nationwide, the change is expected to increase costs for employers by 3.5% to 4%, she said.

An additional change next year is that health care plans can’t put lifetime dollar limits on certain coverage. However, the county has never had an employee hit their lifetime limits, Heidt said, so she doesn’t expect this to be a factor. Also starting next year, employers will be required to enroll their workers in a new public long-term care program starting in 2011, unless the employee opts out. It will be paid for through a mandatory payroll deduction.

Fewer details are known about changes coming in 2012 and beyond, Heidt said. There will be significantly more reporting requirements to the federal government in 2012, she said, and in 2013 there will be a new Medicare payroll tax for people with wages over $200,000 for individuals or $250,000 for joint filers.

One fairly significant impact would occur in 2018, Heidt noted, when the county would be required to pay a 40% excise tax on its health coverage, which is considered a “Cadillac” plan by the federal government. A “Cadillac” plan is defined as a plan in which the aggregate annual value of an employee’s health coverage exceeds $10,200 for an individual or $27,500 for a family. Heidt said they’ll need to decide how to address this issue in the coming years.

Heidt also informed commissioners that as part of their open enrollment this fall, the county would be doing a complete audit of its employees to determine whether dependents that are claimed for coverage are actually eligible. She said that typically, up to 12% of employees in an organization have ineligible dependents covered by their health care plan. It’s possible that savings from this effort will amount to 5% of the county’s overall health plan.

Heidt also described a fringe benefit workgroup that’s being formed, with representatives from most of the county’s labor groups. It’s in preparation for contract negotiations that will begin next year, she said, and will be a comprehensive review of benefits. The idea is to make sure that everyone has an understanding of how costs are derived for benefits. The effort will start later this month, and likely continue through mid-2011.

Commissioner Comments, Questions

Leah Gunn asked whether the reimbursement for retiree health coverage would save the county money. Heidt said they expect that it will – retirees account for about 30% of the county’s total health care costs. The federal program will reimburse employers 80% of the cost per retiree in excess of $15,000 and below $90,000.

Gunn asked if they had any details about the long-term care coverage that would be required in 2011. Heidt said that it’s one of the things they know very little about – it hasn’t been defined by the federal government. She said she’d update the board as details emerge.

Jessica Ping said that the company she works for has a wellness program, which offers incentives when employees do certain things, like quit smoking or get regular cholesterol testing. She wondered whether the county had explored offering something similar. Heidt said they’d looked into it, but that there are significant upfront costs for these programs. It would likely be three to four years before they’d see a return on that investment, she said.

Wes Prater asked for more details about the dependent audit that the county planned for this fall. He wanted to make sure that employees are informed about it. Cheyenne Cooper, the county’s benefits manager, told Prater that employees would be asked to provide some kind of validation, such as a birth certificate, to prove that their dependents are eligible for coverage. She said they would be communicating with employees well in advance. The county’s roughly 700 retirees won’t be part of this audit.

Kristin Judge said that she’d like to see more consistency among the different employee groups – among the unions, as well as with non-union employees. Heidt said it was one of the administration’s goals, too. Judge clarified that if an employee waives the insurance benefits, they’re entitled to a cash stipend.

Judge noted that the National Association of Counties (NACo) had been active in developing the federal health care legislation, and that the organization had resources that Washtenaw County – as a member – might tap. She also urged the human resources staff to be sensitive in their audit of dependents, saying she didn’t want employees to be embarrassed.

Mark Ouimet asked whether the county had identified a total aggregate amount that they’d be able to afford for employee health benefits. Heidt said that they hadn’t approached it that way, but that she’d appreciate direction from the board as they tackle the 2012-13 budget deficit. Ouimet praised the staff for being forward-thinking on this issue.

Ken Schwartz commented on the 40% excise tax, saying it seemed counter-intuitive that the federal government would want to tax good benefits while at the same time encouraging employers to offer better benefits. Heidt said that the county has eight years to explore its options.

Ping asked whether the county had considered increasing the premiums that employees pay, noting that $600 and $400 annually is “nothing.” [For many employees, those contributions are negotiated as part of their union contracts. Most county employees with union contracts make no contributions to their health care costs.]

Prater noted that the fringe benefits workgroup provided an opportunity to establish a standard for benefits, and to include benefits in a discussion about total compensation. It’s important that employees understand that the more they receive in fringe benefits, the less they’ll get in salary increases. He pointed out that the county will be facing some very difficult times in the coming years.

Free health care is pretty nice. I can remember that being the case in private industry, especially with the large companies. Private industry is trending towards an 80/20 system: the employeer pays 80% of the monthly premium and the employee pays 20% of the premium. A lot of private companies are already there.

Government subsidized health care will have head in this direction in order to remain affordable by the employeer and not be overly burdonsome to the taxpayer.

It strikes me that the city might want to think about getting some reinsurance. The argument that “we’ve never had an employee exceed their lifetime limits” is, of course, a fallacy. Past performance is no guarantee of future results. All it takes is one employee or dependent with a heart-wrenching and extremely complex case.