Report: Better-than-Expected ’12 Tax Revenue

Washtenaw County board of commissioners meeting (April 18, 2012): Most of the recent county board meeting was devoted to what’s become an annual ritual: Delivery of the county equalization report.

Raman Patel, left, Washtenaw County's equalization director, shares a laugh with county board chair Conan Smith before the April 18, 2012 meeting. (Photos by the writer.)

The report includes a calculation of taxable value for all jurisdictions in the county, which determines tax revenues for those entities that rely on taxpayer funding, including cities and townships, public schools, libraries and the Ann Arbor Transportation Authority, among others.

It was the 41st report that Raman Patel, the county’s equalization director, has completed – and he delivered some positive news. The county’s general fund budget was approved with a projection of $59.734 million in tax revenues. But actual revenues, based on 2012 taxable value, are now estimated at $62.395 million – for an excess in 2012 general fund revenues of $2.66 million.

Despite reporting better-than-expected taxable value, Patel cautioned that if the potential repeal of the state’s personal property tax is passed – being considered by legislators in a set of bills introduced last week – it could result in a loss of more than $5 million in annual revenues for the county government alone, and more than $40 million for all taxing jurisdictions in Washtenaw County.

Although most of the meeting focused on Patel’s presentation, other business covered a variety of issues. Commissioners discussed the next steps in an effort to deal with mandated animal control services in the county. A work group has met that includes representatives from the county, the Human Society of Huron Valley, and other municipalities that have animal control ordinances, such as the cities of Ann Arbor and Ypsilanti, and Ypsilanti Township. Some commissioners highlighted the need to develop a policy to guide the work group, which will give recommendations about the cost of animal control services.

Related to the March 15 tornado that touched down in the Dexter area, board chair Conan Smith reported that he had declared a state of emergency earlier this month and sent a letter to Gov. Rick Snyder requesting reimbursement to local municipalities for costs incurred as a result of the devastation. Local governments itemized about $1 million in costs, but the total – primarily in damages to residences – is estimated at over $9 million. [.pdf of Smith's letter to Snyder] [.pdf summarizing tornado-related expenses]

During the meeting, the board also passed a proclamation recognizing the National Training Institute, put on by the National Joint Apprenticeship & Training Committee – a partnership of the International Brotherhood of Electrical Workers (IBEW) and the National Electrical Contractors Association (NECA). The training institute is held in Ann Arbor at the University of Michigan and this year runs from July 25-Aug. 3, bringing more than 3,000 people to town. Commissioner Rob Turner, an electrical contractor, is a member of both the IBEW and NECA.

Among the other action items at the April 18 meeting, commissioners (1) set a public hearing for May 2 to get public input on an annual plan for the Washtenaw Urban County, which gets federal funding for projects in low-income neighborhoods; (2) authorized the issuance of up to $6 million in notes at the request of the Washtenaw County road commission, for work in Ypsilanti Township; and (3) approved the hiring of Nimish Ganatra as assistant prosecuting attorney over the dissent of Wes Prater, who objected to paying a salary above the midpoint range.

Equalization Report and Local Tax Revenue

The state-mandated equalization process runs throughout the year, as both the county and local assessors within each municipality examine the value of land and other property, such as buildings. Local assessors turn their findings over to the county, which then conducts independent assessments based on sales studies and physical appraisals. Next, the county’s equalization staff looks at how their findings compare with the local assessors’ findings. (The county has authority to request that local assessment rates be altered, if it considers them to be too high or too low.)

After this “equalization” occurs, the local municipalities send out notices to each property owner in their jurisdiction, stating each property’s assessed value as well as its taxable value. If property owners disagree, they can appeal that assessment. After appeals are ruled on, the county uses that data for its equalization report. Local decisions can be appealed to the state, so at any given time there are a certain number of parcels with assessments that might change, depending on the outcome of the state-level appeal.

Taxable value is a state-mandated formula, and is the lower of two figures: (1) a parcel’s equalized (assessed) value, or (2) a capped value calculated by taking last year’s taxable value minus any losses (such as a building being torn down), multiplied by 5% or the rate of inflation (whichever is lower – this year inflation is 2.7%), plus the value of any additions or new construction.

If the property changes hands, taxable value is reset at its equalized value.

Taxable value is used when calculating taxes for the county, as well as its various municipalities and other entities that rely on taxpayer dollars, including school districts, libraries and the Ann Arbor Transportation Authority, among others. [.pdf of chart showing 2012 equalized and taxable values for all jurisdictions]

Washtenaw County’s equalization report – along with similar reports from all of Michigan’s 83 counties – will be forwarded to the state. If the state agrees with the county’s report, then the county equalized values become the state equalized values (SEV) that appear on tax bills.

Equalization Report: 2012 Highlights

Raman Patel, director of the county’s equalization department, began his presentation by telling commissioners that this was the county’s 54th equalization report, and the 41st one that he has completed. [.pdf of Washtenaw County equalized values from 1959-2012] He introduced the department’s staff and thanked them for their work. The report requires coordination with all 73 local units of government, assessors and boards of review – he thanked everyone for their support. He also thanked commissioners Barbara Bergman and Leah Gunn, wishing them well as they end their tenure on the board. [Both have decided not to seek reelection this year.]

Patel reported that there are pocket of improvements, as well as some areas of concern. Unique to this year’s report, he presented an update on pending legislation that would phase out the state’s personal property tax, and provided a chart showing the financial impact on local taxing jurisdictions.

Also unique to this year’s report, Patel provided a detailed calendar of the equalization process, including deadlines for steps throughout the year. [.pdf of 2012 equalization calendar] He noted that unlike most other counties, his department prepares data regarding the county’s taxable value about two months ahead of the required deadline for doing that.

Here is a summary of highlights from the 2012 report:

- For 2012, taxable value in the county has fallen 0.77% to $13.7 billion. That’s an improvement over declines in recent years, when taxable value fell 2.85% in 2011 and 5.33% in 2010. It’s also a smaller decrease than was projected when preparing the 2012 budget. The general fund budget was approved with a projection of $59.734 million in tax revenues. But actual revenues, based on 2012 taxable value, are now estimated at $62.395 million – for an excess in 2012 general fund revenues of $2.66 million.

- Although the majority of local taxing jurisdictions still saw declines in taxable value compared to 2011, more showed gains than in recent years. The county’s largest local jurisdiction – the city of Ann Arbor – registered a 1.04% increase in taxable value, to $4.683 billion.

- This year, McKinley – an Ann Arbor-based real estate and property management firm – was the largest taxpayer in the county, with properties totaling $132.177 million in taxable value. Other taxpayers on the top 10 list are Detroit Edison ($133.919 million), Toyota ($115.896 million), DTE/MichCon ($104.726 million), Ford/ACH ($74.177 million), Briarwood Mall ($63.159 million), Domino’s Farms ($62.823 million), International Transmission ($51.296 million), Hyundai ($37.517 million) and THC Ann Arbor ($36.360 million).

- The Board of Review received 2,968 appeals of assessments, compared to 2,656 in 2011. This year, 1,589 appeals were granted – compared to just 738 last year – for a decrease of about $12.2 million in taxable value. Poverty exemptions increased dramatically, from 49 requested last year to 110 requested in 2012. This year, 74 poverty exemptions were granted, compared to 31 granted in 2011.

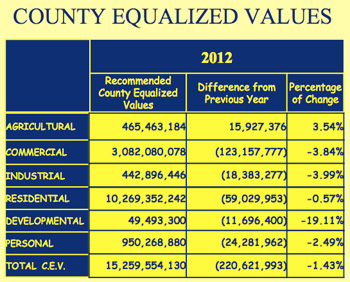

- In 2012, some types of property saw greater declines than others. Commercial property showed a 3.84% drop in equalized value, while equalized value for industrial property dropped 3.99%. Residential property value – the largest classification of property in the county – showed some signs of recovery, dropping only 0.57% compared to a 2.74% drop in 2011. The only category of property that showed an increase was agricultural, which increased in equalized value by 3.54%.

- The value of taxable new construction over the past six years has dropped sharply, from $578.89 million in 2007 to $246.313 million in 2012. However, this year showed the first increase in several years – up from $239.512 million in 2011.

- Washtenaw County’s less than 1% drop in taxable value was by far the smallest decrease compared to other counties in southeast Michigan. Both Genesee and Macomb counties saw the greatest declines in taxable values, falling by 6.83% and 6.01% respectively.

Patel noted that the gap between equalized (assessed) and taxable values is narrowing. This is important because when equalized value and taxable value are the same for a property – and if that property’s assessed value continues to fall – then its taxable value falls in tandem with that assessed value. And that means lower revenues for local municipalities. This year, 66.97% of property in the county – 92,547 parcels – had equal taxable and assessed values, compared to 65% in 2011.

There are a total of 138,203 parcels of land in Washtenaw County. Of those, 48.07% increased in taxable value, while 43.51% decreased in taxable value. The rest were unchanged.

Patel also highlighted the fact that many properties in the county are exempt from taxation, for a variety of reasons – as religious institutions, public entities like schools and universities, or businesses that are given tax abatements, for example. Since 2002, a total of 513 parcels have been granted this status with a 2012 taxable value of $230.293 million. It’s worth remembering the impact of that, he said. He also noted that this year, $2.135 million that would have otherwise come to the county government in tax revenues is being “captured” by other entities, such as downtown development authorities, tax increment finance (TIF) authorities, and brownfield authorities.

Patel’s presentation included a discussion of state legislation introduced earlier in the week – a package of eight bills that would phase out the personal property tax (commercial, industrial and utility) over the next 10 years. [.pdf of personal property tax update, including a chart showing the financial impact for all local taxing entities]

If the proposed legislation were to be in effect now, the county government would lose $5.223 million in tax revenues, Patel reported. Countywide, all local taxing jurisdictions would lose $41.679 million. Patel said he hoped lawmakers don’t enact this legislation, but that it might be wise to start looking at how to cover that loss.

Equalization Report: Board Discussion

Commissioners praised Patel and his staff for their work – Yousef Rabhi noted that Patel had been doing this work “since well before I was born.” Barbara Bergman recalled when she was a new commissioner 20 years ago, she met with Patel and he explained the equalization process to her and made her a cup of tea. It took more than a cup of tea for her to understand, she joked, and she thanked him for his kindness.

For this meeting report, the board’s comments and questions are organized thematically.

Equalization Report: Board Discussion – Personal Property Tax

Yousef Rabhi thanked Patel for presenting more detailed information about the impact of eliminating the personal property tax. He said he was glad that the board had passed a resolution opposing it, unless the state found replacement revenues. [The resolution was passed at the board's April 4, 2012 meeting.] Patel’s report should be a warning to Lansing not to follow through with this proposal, Rabhi said, calling it ridiculous and “absolutely devastating” to local communities.

From left: Washtenaw County equalization director Raman Patel with county commissioners Felicia Brabec and Leah Gunn. Patel has worked on 41 annual equalization reports. This will be the last one approved by Gunn, who is not seeking reelection, and the first one by Brabec, who was appointed to the board last year to fill a vacancy in District 7.

Rabhi pointed to a recent poll showing that 70% of voters oppose the PPT repeal. [He was referencing a poll conducted by the Lansing firm EPIC-MRA and commissioned by the advocacy group Replace Don't Erase Michigan's Personal Property Tax.] People recognize that the repeal would jeopardize local services and that it’s the wrong thing to do, he said. Rabhi noted that Saline mayor Gretchen Driskell recently testified against the repeal at a state legislative hearing. He encouraged everyone to call their state legislators to make sure that a repeal doesn’t pass. Local governments can’t keep giving up revenue sources and still provide the same level of services, Rabhi concluded.

Barbara Bergman echoed Rabhi’s remarks. She described property taxes as regressive, and said many of her constituents face increasing property taxes and decreasing pensions. They can’t sell their homes because of a soft market, so they’re forced to make tough choices. Bergman said she supported a progressive income tax in Michigan and hoped that it would happen someday.

Conan Smith asked Patel to comment on the impact of real and personal property tax laws in the county’s urban areas, which will be among the hardest hit by changes to the PPT. Places like Ypsilanti and Ypsilanti Township are also seeing declines in real property values, Smith noted. He asked whether those two communities are seeing sharper decreases in the value of commercial and industrial property, compared to other parts of the county.

Yes, Patel said – the closing of Ford and General Motors plants has affected those communities. [Ypsilanti's taxable value dropped 5.97% to $290.729 million in 2012, while Ypsilanti Township's taxable value dropped 6.09% to $1.14 billion. The only larger percentage decrease was seen in the Washtenaw County portion of the city of Milan, with an 8.16% decline in taxable value to $87.387 million. Part of Milan is located in Monroe County.]

Equalization Report: Board Discussion – Appeals

Wes Prater asked about the appeals process. There were 2,968 appeals and of those, 1,589 were granted – for a decrease of about $12.2 million in taxable value. How many of the appeals that weren’t granted locally will be appealed at the state level? he wondered. Patel pointed out that a property owner has until June to make an appeal to the state, so it’s not possible to know yet how many will be appealed.

Prater asked if there were more appeals this year than last year. Patel replied that he didn’t have the information at hand. [Last year, the local Board of Review received 2,656 appeals of assessments, and granted 738 – for a decrease of about $13 million in taxable value. Forty-nine poverty exemptions were requested, and 31 were granted. This year, 110 poverty exemptions were applied for, and 74 were granted.]

Patel explained that most of the larger appeals relate to industrial or commercial properties. There are a couple of large appeals that are still pending, he said, but in general that process appears to be stabilizing.

Equalization Report: Board Discussion – Trends, Projections

Dan Smith asked about the difference between agricultural valuations, which have increased by 3.54% over last year, and valuations for commercial and industrial properties, which dropped by 3.84% and 3.99%, respectively. Was there any history behind that, and would that trend likely continue?

Lori Cash, a management analyst in the equalization department, replied that over the past few years, the amount of land classified as “developmental” has declined. [In 2012, that category decreased by 19.11% to a total value of$49.493 million – the lowest of all property categories in the county.] The total equalized value increased in the agricultural category because local assessors have reclassified some parcels from the developmental category to the agricultural category, Cash said. So there are more properties classified as agricultural now than in the previous year.

Patel described the developmental category as a “parking lot.” Assessors will use it when they’re uncertain about how the land will be used. D. Smith clarified with Patel that farmland isn’t necessarily becoming more valuable – it’s just that more property is now being classified as agricultural.

Pointing to the 3.99% decline in industrial value, D. Smith asked whether that trend would likely continue. Patel noted that several large manufacturers have closed plants in Washtenaw County – Ypsilanti Township in particular took hits from the closing of Ford and General Motors plants there, he said. [Ypsilanti Township's taxable value dropped 6.09% from last year, to $1.14 billion.]

Even so, Patel said Washtenaw County is remarkably resilient and has absorbed a lot of losses over the past five or six years. In addition to plant closings by large automakers, he pointed to the departure of Pfizer – that alone was a loss of $400 million in taxable value for the county, Patel said. And even more taxable value was lost when Pfizer sold its large research campus to the University of Michigan, he said, because as a public university, UM is a tax-exempt institution. Despite all that, Patel said, the county is stabilizing.

D. Smith then referred to a chart showing the number of parcels in which assessed value is equal to taxable value, as well as the number of properties in which those values are within 5% of each other or greater than 5%. Smith asked whether Patel expected that there will be more parcels in the coming years with equal assessed and taxable value.

Patel replied that it will depend on whether the real estate market moves values up or down – it’s difficult to predict. He noted that working on a two-year budget cycle, as the county does, is difficult. Because of the state-mandated process, the equalization department can’t prepare its report until April. That means the county doesn’t have a solid estimate of tax revenues for the year until more than three months into that year. And for the current budget – approved by the board in late 2011 for the years 2012 and 2013 – tax revenue estimates were made for 2013 even though the market values on which those tax revenues won’t be known until late 2012.

Rob Turner explicitly asked whether Patel and his staff had worked up projections for equalized and taxable values. Patel expressed some frustration, saying that he wanted to be respectful but that he had already indicated that he couldn’t make projections. When the equalization department completes its work each year, then they announce the results, he said. There are laws, rules and regulations governing their work, Patel said, and no one has pulled a projection from his mouth in 41 years. At that, commissioners laughed and Turner apologized for putting Patel on the spot.

Prater said he’s known Patel for most of the 41 years that Patel has been working on equalization reports, ”and I have yet to hear his first projection – and I’ve asked many, many times. So that just ain’t gonna happen.”

Outcome: Later in the meeting, the board voted unanimously to accept the 2012 equalization report.

Animal Control Services

There was no action item related to animal control services at the April 18 meeting. But during the board’s liaison reports, Rob Turner told his fellow commissioners that he had attended the first meeting of the animal control services work group, which included representatives of the county, the Humane Society of Huron Valley, and other municipalities that have animal control ordinances.

By way of background, at its Feb. 15 meeting, commissioners approved a $415,000 contract with the Humane Society of Huron Valley to provide animal control services for the county just through Dec. 31, 2012. The county’s previous contract with HSHV, for $500,000 annually, expired on Dec. 31, 2011. In the interim, the two entities had been operating under a $29,000 month-by-month contract.

County officials said the new contract would provide time for ongoing talks to develop a longer-term solution to animal control services in Washtenaw County, including services that are mandated by the state. During the rest of 2012, the county plans to work with HSHV and other stakeholders to determine the cost of an “animal service unit” – that is, the itemized per-animal cost of providing animal control services. The county eventually will issue a request for proposals (RFP) to solicit bids for the next contract.

The budget approved by the county board for 2012 cut funding for animal control services to $250,000. However, during last year’s budget deliberations commissioners also discussed the possibility of paying an additional $180,000 to HSHV – if the nonprofit took over work previously done by the county’s animal control officers. That brought the total amount budgeted for animal control to $430,000 in 2012. HSHV officials have said that even $500,000 wasn’t sufficient to cover costs for all the work they do.

The $415,000 contract approved in February did not include the $180,000 that the county has budgeted for its own animal control officers. Instead, the county allocated an additional $165,000 from its general fund balance, to be added to the previously budgeted $250,000 for animal control services in 2012.

At the Feb. 15 meeting, the board spent considerable time discussing the roles of two entities – a board policy task force, and a broader animal control services work group led by the sheriff’s office – as well as a timeline for completing the work of these two entities. The resolution ultimately passed by commissioners included these resolved clauses that laid out a timeline for the work:

BE IT FURTHER RESOLVED that the Washtenaw County Board of Commissioners authorizes the Office of the Sheriff to develop a methodology to determine the cost of an Animal Service Unit (ASU) on behalf of the County. The Sheriff may choose the members of his work group, with the understanding that the Board of Commissioners will appoint Commissioner Rob Turner to act as a liaison. The work group’s report is due no later than September 15, 2012.

BE IT FURTHER RESOLVED that the Washtenaw County Board of Commissioners hereby establishes a Task Force on Animal Control Policy. This group will exist solely for the purpose of developing an animal control policy for the county. This policy will be reflected in the RFP for a scope of services that the county will purchase. Meetings will be posted. Membership is open to any Commissioner who wishes to attend, and the preliminary report will be filed May 15, 2012. Once the data from the Sheriff’s work group is published, the RFP will go out forthwith, and the final report of the taskforce will be published by October 15, 2012.

The board’s policy task force has not yet met.

The animal control services work group includes these members: sheriff Jerry Clayton; SiRui Huang and Rick Kaledas of the sheriff’s office; Greg Dill, the county’s infrastructure management director; Catherine Jones of the county finance department; commissioner Rob Turner; county prosecuting attorney Brian Mackie; Ann Arbor city administrator Steve Powers; Ann Arbor interim police chief John Seto; Ypsilanti Township supervisor Brenda Stumbo; Mike Radzik, Ypsilanti Township’s police services administrator; Bill McFarlane, Superior Township supervisor; acting Ypsilanti city manager Frances McMullen; Humane Society of Huron Valley executive director Tanya Hilgendorf; and Jenny Paillon and Matt Schaecher of HSHV.

On April 18, Turner said the work group had discussed the issue of what comes first – policy or specific services? The group is looking to the county board for direction, he said. When the work group met, Turner said he reiterated the need to determine the actual cost of taking care of animals, including the number and kind of animals, as well as the cost per animal that HSHV incurs.

The work group plans to meet every other week, Turner said. The next meeting is set for May 1.

Animal Control Services: Board Discussion

Barbara Bergman stressed the need for commissioners to give input and direction to the work group. She noted that commissioners hold various opinions on the issue, but that they need to come to a consensus so that the work group isn’t operating without guidance.

Turner said he totally agreed, and cited the need for the board’s policy task force to start meeting. Leah Gunn noted that an email had circulated trying to find acceptable dates for a meeting, so that effort is already underway.

Wes Prater said he felt like the board had already reached consensus about the need to figure out the county’s mandated, statutory duties regarding animal control. There’s a shortage of revenues available, he said – that’s a factor too. Prater felt the board shouldn’t get too involved until commissioners get a recommendation from the animal control work group.

Ronnie Peterson said he had raised this concern previously. The board needs to set the direction and scope of work for the work group, he said – that should have already happened. What’s the board’s expectation of an outcome, and how far-reaching should the work group’s recommendations be?

Peterson concluded his remarks by urging the board to make a policy that encompasses all of its nonprofit support, not just the payments that the county makes to animal control services.

Road Commission Debt

At its April 18 meeting, commissioners were asked to authorize the issuance of up to $6 million in notes at the request of the Washtenaw County road commission.

From left: County board chair Conan Smith talks with county road commissioner Ken Schwartz, who formerly served on the board of commissioners. Road commissioners are appointed by the county board.

The funding would be used by the road commission to pay for road work in Ypsilanti Township, including road repaving and reconstruction, intersection improvements, traffic control devices, drainage upgrades and other related projects.

According to terms of a contract signed between Ypsilanti Township and the road commission, the township would reimburse the road commission for the work. The notes would be issued by the road commission and backed by future tax revenues it will receive from the state. The debt would not be backed by the county’s full faith and credit.

Ken Schwartz, one of three appointed road commissioners and a former member of the county board of commissioners, attended the April 18 meeting along with some road commission staff. They did not formally address the board during the meeting.

Outcome: Without comment, the board authorized the issuance of up to $6 million in notes by the county road commission.

Urban County Plan: Public Hearing Set

A resolution on the agenda set a May 2 public hearing to take commentary on the annual plan for the Washtenaw Urban County.

The annual plan describes how the Urban County expects to spend the federal funding it receives from the Community Development Block Grant (CDBG), HOME Investment Partnerships Program (HOME) and Emergency Shelter Grant (ESG) programs, operated by the U.S. Dept. of Housing and Urban Development (HUD). [.pdf of 2012-2013 draft annual plan] [.pdf of list of planned projects]

The Washtenaw Urban County is a consortium of local municipalities that receive federal funding for projects in low-income neighborhoods. Current members include the cities of Ann Arbor and Ypsilanti, and the townships of Ypsilanti, Pittsfield, Ann Arbor, Bridgewater, Salem, Superior, York, Scio, and Northfield. An additional seven municipalities will become part of the Urban County as of July 1, 2012: the city of Saline, the village of Manchester, and the townships of Dexter, Lima, Manchester, Saline, and Webster.

“Urban County” is a HUD designation, identifying a county with more than 200,000 people. With that designation, individual governments within the Urban County can become members, making them entitled to an allotment of funding through a variety of HUD programs.

The Washtenaw Urban County executive committee meets monthly and is chaired by county commissioner Yousef Rabhi. The program is administered by the staff of the joint county/city of Ann Arbor office of community and economic development.

Outcome: Without discussion, the board set a May 2 public hearing for the Washtenaw Urban County annual plan.

Assistant Prosecuting Attorney

Commissioners were asked to give final approval to hiring an assistant prosecuting attorney at a salary of $81,690. The vacancy opened in December, following an employee retirement. The hire requires board approval because the salary is above the $69,038 midpoint of an authorized range ($68,074 to $96,565).

The position will be filled by Nimish Ganatra, who most recently has served as assistant prosecutor for Jackson County, and previously was an assistant prosecutor with the Washtenaw County prosecutor’s office from 2001-2009. He is a graduate of Ann Arbor Pioneer High School, the University of Michigan, and Wayne State University Law School.

Because of furlough days negotiated as part of the recent collective bargaining agreements, his salary will be adjusted down by 3.846% to $78,548. Brian Mackie, the county’s prosecuting attorney, had previously told commissioners that because the office is currently under-filling a senior assistant prosecutor post, there is an overall savings of $12,983.

Initial approval had been given at the board’s April 4 meeting, passing on a 9-1 with dissent from Wes Prater, who objected to paying more than a midpoint salary. Rob Turner was absent.

Assistant Prosecuting Attorney: Board Discussion

Wes Prater asked county administrator Verna McDaniel about a new hiring process that he said the county had implemented in February. McDaniel was initially unclear about what Prater was referring to, but then sussed out that he was talking about a name change to an existing policy. She said the process didn’t change, but the administration started calling it the “hiring review process.”

Prater asked if the process had been used to evaluate hiring the new assistant prosecuting attorney. It had, McDaniel said. What about the other vacancy that had been filled in that office? he asked. That vacancy had been triggered in February by Gov. Rick Snyder’s appointment of Joe Burke as judge to the 15th District Court in Ann Arbor. Burke previously served as the county’s chief assistant prosecuting attorney.

On filling that vacancy, McDaniel said her staff had worked with the county prosecuting attorney, Brian Mackie, who made an internal promotion for that position. She noted that Mackie’s restructuring had resulted in an overall savings [of $12,983].

Prater asked to see the paperwork for the review of these positions. He noted that earlier in the year the board had approved a position in the water resources commissioner’s office that was also above the mid-point salary range. He hoped the same evaluation process had been used in that position too.

McDaniel affirmed that it had. In both cases, there had been restructuring that resulted in overall cost savings, she said. Prater replied that it would save even more to consolidate positions. The county’s long-term fiscal stability is what it’s all about, he said. He requested that the board review the overall hiring process at a future working session.

Outcome: On a 10-1 vote with dissent by Wes Prater, the board gave final approval to hiring the assistant prosecuting attorney at an above-midpoint salary.

Weatherization Grants

Two items related to federal funding for Washtenaw County’s weatherization program for low-income residents were on the agenda for final approval at the April 18 meeting. Initial approval had been given at the board’s April 4 meeting.

Commissioners were asked to authorize acceptance of $185,326 in federal funds for the weatherization program. The federal program was cut by 65% compared to 2011, but the state of Michigan is reallocating the previous year’s unspent funds as “carry-forwards” for 2012. In 2011, the county received $241,863 for this program.

The funding is expected to provide air leakage testing, health and safety evaluations, furnace assessments, refrigerator efficiency testing, post-inspection of the completed work, and consumer education services to 25 units. To qualify for the program, residents must have an income at or below 200% of federal poverty, which is about $44,700 for a family of four.

In a separate item, commissioners voted on authorizing acceptance of an additional $103,600 in funds redistributed to the county through the American Recovery & Reinvestment Act (ARRA). According to a staff memo, this grant brings the total of ARRA weatherization funds received by the county to $4,867,138.

At the April 4 meeting, Aaron Kraft, who manages the program, said the applications are handled on a first come, first served basis. There’s a waiting list, and the grants now being approved are already spoken for, he said. In response to another query, Kraft said that less than half of all contractors being used for the weatherization work are based in Washtenaw County.

In response to a follow-up question from a Chronicle reader, Kraft later gave a more detailed breakdown of how the $185,326 will be allocated: Support and administrative costs covering client intake/assessment of need, project management ($63,136); energy audit inspections and quality assurance inspections ($8,820); labor and material costs to complete the recommended weatherization improvements ($106,196); and weatherization specific training funding ($7,174).

Outcome: Both weatherization items were given unanimous final approval by the board, without discussion.

Communications and Public Commentary

There are various opportunities for communications from commissioners as well as general public commentary. These are some highlights.

Communications: Dexter Tornado Aftermath

During his liaison report, commissioner Rob Turner – the board’s point person for cleanup efforts following the March 15 tornado that touched down in the Dexter area – reported that work by the county had curtailed the previous week. He itemized some of the costs that had been incurred: Between $250,000-$300,000 for road commission work; $91,697 from the county for dumpster rental, debris removal, and tree clearing; $23,039 for a county parks and recreation crew, and port-a-johns; and $53,847 in overtime expenses for the sheriff’s office.

Turner – who represents District 1, which includes the area damaged by the tornado – praised all the staff and volunteers who had helped with the cleanup. Some people who thought they’d have to declare bankruptcy were able to stay afloat, because of help from the county, he said. Turner noted that the area at least is cleaned up and people are starting to get back to their normal lives.

Board chair Conan Smith reported that he had declared a state of emergency earlier this month and sent a letter to Gov. Rick Snyder requesting reimbursement to local municipalities for costs incurred as a result of the March 15 tornado. [.pdf of Smith's letter to Snyder] [.pdf summarizing tornado-related expenses]

Specifically, the letter states that local government units “have incurred approximately $1,075,882 in unbudgeted response and recovery expenses including debris removal and disposal, emergency protective measures/ non-federal road and bridge systems, public utilities, and parks and recreation.”

An attached document summarized expenses related to the tornado, including an estimated $7.54 million in damages to residential property and $750,000 in damages to businesses.

Communications: National Training Institute

At the start of the April 18 meeting, board chair Conan Smith and commissioner Rob Turner presented a proclamation recognizing the National Training Institute, put on by the National Joint Apprenticeship & Training Committee – a partnership of the International Brotherhood of Electrical Workers (IBEW) and the National Electrical Contractors Association (NECA). The training institute is held in Ann Arbor at the University of Michigian and this year runs from July 25-Aug. 3.

Turner, an electrical contractor and member of NECA and IBEW Local 252, recalled that the training institute was formerly held in Knoxville, but moved to Ann Arbor in 2009 after “a little bit of arm twisting and a lot of work” by the Ann Arbor Convention and Visitors Bureau. It helped that UM is 100% union, he said. When members came to Ann Arbor, “it was love at first sight,” Turner said. Between 3,000 and 5,000 people attend from across the country, he said, and it’s a great benefit to local hotels, shops, and restaurants.

Turner also complimented the hospitality of local merchants and residents, saying that midwestern hospitality is as good if not better than the famed southern hospitality.

Public Commentary

Only one person spoke during public commentary. Thomas Partridge spoke at both opportunities for public commentary during the evening. He urged commissioners and U.S. president Barack Obama to give priority to serving the needs of the most vulnerable residents locally, in Michigan and nationwide. Residents should have access to affordable housing, health care, transportation, and education, he said.

Partridge argued that tax reforms are needed. Current restrictions on forms of taxation in Michigan were the result of a constitutional convention led by Mitt Romney’s father in the 1960s, he said, and since then civil rights have been denied to public employees, union employees, and schoolchildren – especially children who are physically and mentally disabled. Commissioners need to work on tax reform, Partridge concluded, as well as the reelection of Obama, and the recall of Gov. Rick Snyder and GOP state legislators.

Present: Barbara Bergman, Felicia Brabec, Leah Gunn, Alicia Ping, Ronnie Peterson, Wes Prater, Yousef Rabhi, Rolland Sizemore Jr., Conan Smith, Dan Smith, Rob Turner.

Next regular board meeting: Wednesday, May 2, 2012 at 6:30 p.m. at the county administration building, 220 N. Main St. in Ann Arbor. The ways & means committee meets first, followed immediately by the regular board meeting. [confirm date] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public commentary is held at the beginning of each meeting, and no advance sign-up is required.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Washtenaw County board of commissioners. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!