Ann Arbor Council Punts on DDA Issue

A final vote on a revision to the Ann Arbor city code regulating the Ann Arbor Downtown Development Authority’s tax increment finance (TIF) as been postponed again – until Sept. 16. The postponing action was taken by the city council at its Sept. 3, 2013 meeting. At stake is around $1 million or more a year in tax revenue.

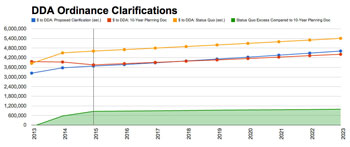

Ann Arbor DDA TIF revenue projections. The vertical line indicates the year when the clarified calculations would be implemented. The red line is the amount of TIF revenue assumed by the DDA in its FY 2014 and FY 2015 budgets, and in its 10-year planning document. The blue line is the estimated TIF revenue under the proposed clarified ordinance calculations. The yellow line is the estimated TIF revenue that the DDA would receive if the DDA continued to interpret the city’s ordinance in its own way. (Numbers from the city of Ann Arbor and DDA. Chart by The Chronicle.)

A joint council-DDA committee was appointed on July 1, 2013 with a charge to begin meeting immediately to work out a recommendation on possible legislation that would clarify the ordinance. However, that committee did not convene until eight weeks later, on Aug. 26. The committee met on just that one occasion before the Sept. 3 council meeting. The postponement until Sept. 3 had come at the council’s May 6, 2013 meeting.

The council had given initial approval of an ordinance change at its April 1, 2013 meeting. The change would clarify the existing language in the ordinance – which outlines how the DDA is supposed to return excess TIF revenue to other taxing jurisdictions – to the extent that the revenue exceeds projections in the DDA’s TIF plan.

Until two years ago, the existing limitation expressed in the ordinance had never been applied. But in May 2011, the city treasurer called the issue to the DDA’s attention, characterizing it as a roughly $2 million issue, dating back to 2003. However, when the DDA retroactively calculated its revenue, as well as rebates to other taxing jurisdictions, it applied a methodology chosen to minimize the amount of “rebate” owed to other taxing jurisdictions, reducing the amount to roughly $1.1 million.

When challenged on its method of calculation, the DDA subsequently changed its position, claiming that the money it had already paid back to other taxing jurisdictions was a mistake. The DDA’s new position was to claim an interpretation of a clause in Chapter 7 as providing an override to limits on TIF revenue – if the DDA has debt obligations, which it does. So in 2012 and 2013, the DDA did not return any of its TIF capture to other taxing authorities. In addition to the city, those taxing authorities are the Ann Arbor District Library, Washtenaw County, and Washtenaw Community College.

The proposal as approved at first reading by the council on April 1, 2013 would essentially enforce the language that is already in the ordinance, but disallow the DDA’s interpretation of the “debt override” clause. Compared to the DDA’s own 10-year planning document, revenue to the DDA under the ordinance change would be roughly similar. The minimal impact compared to the planning document depends on the enactment of the ordinance to apply beginning with fiscal year 2015. However, the 10-year planning document in question did not include a large amount of new construction in the downtown area, which has already generated higher TIF revenue than estimated in the 10-year plan.

The ordinance revision as approved at first reading also includes term limits for DDA board members, and would make the appointment of the mayor to the board of the DDA contingent on a majority vote of the council. Without majority support, the mayor’s spot on the board would go to the city administrator.

Serving on the joint council-DDA committee for the council are: Stephen Kunselman (Ward 3), Christopher Taylor (Ward 3), Sally Petersen (Ward 2) and Jane Lumm (Ward 2). Representing the DDA are Sandi Smith, Joan Lowenstein, Bob Guenzel, and Roger Hewitt.

The Aug. 26 committee meeting was dominated by political squabbling. The only substantive concept that was batted around briefly at that meeting was the idea of defining some kind of fixed cap on TIF revenue. This approach would replace the existing ordinance language, which calibrates the DDA’s TIF capture with projections in the TIF plan. But the discussion never went as far as to include dollar amounts for the fixed cap.

Deliberations at the Sept. 3 council meeting were relatively scant, consisting primarily of the date to which the item would be postponed.

This brief was filed from the city council’s chambers on the second floor of city hall, located at 301 E. Huron. A more detailed report will follow: [link]