Equalization Report Shows Stronger Economy

Washtenaw County board of commissioners meeting (April 16, 2014): Most local governments in Washtenaw County will see increases in tax revenue this year, according to the 2014 equalization report that county commissioners approved on April 16.

From left: Washtenaw County equalization director Raman Patel with commissioners Conan Smith (D-District 9) and Dan Smith (R-District 2) at the April 16, 2014 board of commissioners meeting. (Photos by the writer.

The report was presented by Raman Patel, the county’s long-time equalization director. “Washtenaw County is showing improvements in the market,” he told commissioners. “We are slowly regaining our county’s equalized base. It appears that the worst part of the decline in market value is behind us.”

For 2014, taxable value in the county increased 2.02% to $14.18 billion. That’s a greater increase than the 1.68% climb in 2013, and an improvement over declines seen in recent years. Patel cautioned that several factors are impacting revenue for local governments, including the phase-out of personal property taxes, a variety of exemptions, and tax capture from entities like downtown development authorities.

More of the tax burden is also being shifted to residential property owners, he noted, compared to other categories, like commercial property. The category of residential property accounts for 67.34% of total property value in the county. Five years ago, in 2009, it was 63%.

In other action on April 16, commissioners gave initial approval to distribute proceeds from a countywide tax on hotels and other accommodations. For 2013, $472,846 was available for distribution. If the resolution is given final approval, the county will keep 10% ($47,285) to pay for enforcement of the accommodation ordinance. The remainder will be divided between the Ann Arbor Convention & Visitors Bureau ($319,171) and the Ypsilanti Convention & Visitors Bureau ($106,390).

During public commentary, Mary Kerr, president of the Ann Arbor Convention & Visitors Bureau, and Jason Morgan, director of government relations for Washtenaw Community College, highlighted the union training programs that will be coming to the area this summer. The CVBs have been instrumental in recruiting these kinds of events to Washtenaw County.

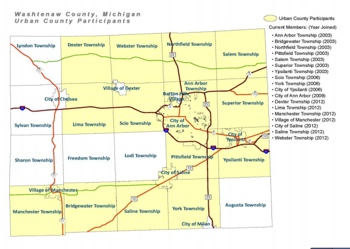

Commissioners also gave initial approval to the annual Urban County action plan, which outlines proposed projects funded by the U.S. Dept. of Housing and Urban Development. The Urban County is a consortium of Washtenaw County and 18 local municipalities that receive federal funding for low-income neighborhoods. Members include the cities of Ann Arbor, Ypsilanti and Saline, and 15 townships.

Final authorization was given to a two-year pricing proposal – for 2016 and 2017 – to provide police services to local municipalities through contracts with the county sheriff’s office. And commissioners gave final approval to a new brownfield redevelopment plan for the Thompson Block in Ypsilanti’s Depot Town.

In other action, the board passed a resolution declaring April 13-19 as National Public Safety Telecommunicator Week in Washtenaw County. They also honored Dr. Eugene Glysson, who had served on the county’s board of public works (BPW) since 1986, and was its chair since 1996. He died on April 2.

Several issues were raised during public commentary, including concerns about emergency sirens installed by a pasture in Scio Township. The owner told commissioners that the sirens spook his horses, causing a dangerous situation if anyone is riding them or standing nearby. Other topics discussed by the public included the creation of a new group to help end homelessness, called Our 2020 Vision, and efforts by University of Michigan students to reduce the use of plastic bags by imposing a per-bag usage fee. They’re garnering support in part through a MoveOn.org petition.

Equalization Report

The 2014 equalization report was presented by Raman Patel, the county’s long-time equalization director. He began by noting that this was Washtenaw County’s 56th report, and he’s been involved in the process for 43 of those years. [.pdf 2014 equalization report] [.pdf chart of largest county taxpayers]

This year, Patel said, “Washtenaw County is showing improvements in the market. We are slowly regaining our county’s equalized base. It appears that the worst part of the decline in market value is behind us.”

Equalized (assessed) value is used to calculate taxable value, which determines tax revenues for the county as well as its various municipalities and other entities that rely on taxpayer dollars, including schools, libraries and the Ann Area Arbor Transportation Authority, among others. There are 72 units of government in Washtenaw County that rely on property tax revenues.

For 2014, taxable value in the county increased 2.02% to $14.18 billion. That’s a greater increase than the 1.68% climb in 2013, and an improvement over declines seen in recent years.

It’s also an improvement over projections made when the county administration prepared its 2014 budget. The general fund budget was approved with a projection of $63.79 million in tax revenues. But actual revenues, based on 2014 taxable value, are now estimated at $64.511 million – for an excess in 2014 general fund revenues of $720,486. Patel stressed that at this point, the taxable value is a recommendation and must be approved at the state level.

Patel also presented tentative taxable values for specific jurisdictions. The city of Ann Arbor shows a 2.68% increase in taxable value, while the city of Ypsilanti’s taxable value is an 0.87% increase over 2013. All but three municipalities showed an increase in taxable value. Those municipalities with decreases are the city of Saline (-1.41%), Ypsilanti Township (-0.37%), and the city of Milan (-0.85%).

Properties in the Ann Arbor Public Schools district – which includes the city of Ann Arbor and parts of surrounding townships – will see a 2.37% increase in taxable value. Properties taxed by the Ann Arbor District Library, covering a geographic area that in large part mirrors the AAPS district, increased in value by 2.36%.

Taxable value is determined by a state-mandated formula, and is the lower of two figures: (1) a parcel’s equalized (assessed) value; or (2) a capped value calculated by taking last year’s taxable value minus any losses (such as a building being torn down), multiplied by 5% or the rate of inflation (whichever is lower – this year inflation is 1.6%), plus the value of any additions or new construction.

In 2014, commercial property showed a 3.97% gain in equalized value. Residential property value – the largest classification of property in the county – showed an increase of 5.84%. That’s stronger than last year’s 2.37% increase, which had been the first climb in value since 2007.

Values for developmental property – a relatively small category that covers properties not yet developed – continue to struggle, registering a decrease of 9.54% in equalized value. Industrial property, which dropped 4.78% in equalized value last year, is essentially flat in 2014 at 0.1%. Over the past few years that category has lost significant value, falling from an equalized value of nearly $1 billion in 2007 to this year’s value of $422.146 million.

Countywide, about $400 million is captured by entities like local downtown development authorities (DDAs), local district finance authorities (LDFAs), brownfield tax increment financing, and other entities that are allowed to capture funds from taxing jurisdictions. For taxes levied by Washtenaw County government alone, $2.472 million goes to these other tax-capturing entities that would otherwise be revenues for the county’s general fund. That’s an increase of $67,409 compared to last year.

Patel reported that in 2013, the county had seen new construction valued at $368.14 million. Of that, 30% of that taxable value is capture by DDAs within the county, he said. This year, new construction is valued at $334.18 million, with 26% of that captured by DDAs.

The category of residential property accounts for 67.34% of total property value in the county. Five years ago, in 2009, it was 63%. That means the tax burden is shifting onto residential property owners, Patel said. He noted that residential property values are increasing – from an average sales price of $154,015 in March 2009 to $231,541 this March.

This year, Patel noted that 1,709 appeals were made to the various boards of review – property owners who contested their assessments. That’s significantly lower than last year, when 2,793 appeals were made. Of this year’s appeals, 1,128 appeals were granted, decreasing the total assessed value of property countywide by $21.112 million. In addition, 134 poverty exemptions were granted and 73 parcels were given exemptions for disabled veterans.

Patel highlighted state legislation regarding personal property taxes (PPT) that would affect the overall growth of equalized and taxable value. This year, property valued at up to $40,000 is exempt from the PPT, affecting 5,137 parcels. It’s part of a gradual phase-out of the PPT over the next 10 years, he said. The county’s equalization department is responsible for tracking this process for each unit of local government in Washtenaw County. A referendum on the Aug. 5, 2014 ballot will ask voters to approve a replacement of PPT revenues, directing a portion of the state’s “use tax” to local governments.

In addition, Public Act 161 of 2013 extends the homestead property tax exemption for disabled military veterans to spouses of deceased veterans. These new exemptions and the resulting losses in tax revenues are reflected in the county’s equalized and taxable value, Patel said.

Patel noted that Washtenaw County’s gross tax revenue is further decreased from downtown development authorities (DDAs), local development finance authorities (LDFAs), tax increment finance authorities (TIFAs), brownfield redevelopment authorities, and obsolete property rehabilitation authorities (OPRAs). These are issues that commissioners should be aware of, Patel said.

Equalization Report: Board Discussion

Several commissioners thanked Patel and his staff for their work. Yousef Rabhi (D-District 8) asked how the number of appeals granted this year (1,128) compared to last year. Patel replied that last year, more appeals were granted than this year – but in 2013, more appeals were sought as well.

Dan Smith (R-District 2) noted that the report gives separate equalized and taxable values for Willow Run and Ypsilanti public school systems. He wondered when the consolidation that took effect last year would be reflected in the equalization report. Patel indicated that the report will continue to list the districts separately for two more years, in case they split up again.

Smith also asked Patel if he could provide more historical information about the shift toward residential property, as a greater percentage of the total property in the county. “I think we need to be more aware of that shift that may be taking place, because it affects a lot of different policies in various ways,” Smith said.

Regarding that percentage, Felicia Brabec (D-District 4) asked if there were an optimal balance to be struck, in Patel’s opinion. Patel replied that 72 units of government rely on the tax base. The only way to increase or decrease that base is through changes in market value, he said. Aside from market value, the base is decreased through legislative exemptions. “And when you reduce your tax base, somebody has to pick up the burden – that’s the bottom line for everybody,” Patel said.

In Washtenaw County, he said, there are 140,161 parcels. Of those, 4,509 parcels are tax-exempt, he noted. Every year, additional parcels go into this category. In 2014, 69 parcels were exempted, with a taxable value of $8.27 million. Those exemptions are issued by townships, cities, the county and other entities. Someone has to pick up the burden, Patel said, adding that “it’s not a small thing.” In addition, a portion of the taxes from certain properties are being captured by entities like DDAs, he noted. “It all adds up.”

Conan Smith (D-District 9) referred to information that Patel had provided showing how property tax revenue would have increased if the state’s Headlee Act and Proposal were not in place.

By way of background, the Headlee Amendment was approved by a voter referendum in 1978 as an amendment to the state constitution (Article IX, Sections 24-34). It limits the growth of property tax revenue by controlling how the maximum authorized millage rate is calculated. The maximum authorized millage rate is “rolled back” when taxable growth is greater than inflation. That limits the increase in tax revenue to the rate of inflation.

In 1994, Michigan voters approved Proposal A, a constitutional amendment that affected Article IX, Sections 3, 5, and 8. Designed to slow the increase of property taxes on individual parcels, it limits the increase in taxable value of each property to either the rate of inflation or 5% annually, whichever is less – even if the state equalized value (SEV) grows at a greater rate. When property is sold or transferred, the taxable value is reset – or “uncapped” – to the SEV.

Smith noted that during a strong economy, Proposal A didn’t have much effect. But when the economy turned down, Smith said “you saw this pretty dramatic skewing of what our revenue could have been from what it is.” In order to keep local governments whole, he said, legislative fixes are needed.

Patel noted that when the market value increases, it doesn’t mean that local governments will see that same growth in tax revenues. He pointed out that this year, equalized value for properties countywide grew 4.7%, but the increase in taxable value is only about 2%.

If Proposal A weren’t in place, the estimated tax revenue in 2014 would be about $87 million for the county’s general fund, Patel reported. Instead, it’s about $65 million.

Outcome: Commissioners voted to approve the equalization report.

Police Services Contract

A two-year pricing proposal for contracts to provide police services to local municipalities was on the April 16 agenda for final authorization. Initial approval had been granted by the board on April 2, 2014.

For 2016 and 2017, the police services unit (PSU) price will be $156,709 and $158,276, respectively. An initial vote had been taken on April 2, 2014.

By way of background, on July 6, 2011, commissioners had authorized the price that municipalities would pay for a contract sheriff’s deputy through 2015. The price in 2012 – $150,594 per “police services unit” – was unchanged from 2011, but has been rising in subsequent years by about 1% annually. The complex, politically-charged process of arriving at those figures in 2011 involved more than a year of discussion between the sheriff’s office, other county officials and leaders of local municipalities that contract for these services.

The board’s decision in 2011 was based on a recommendation from the police services steering committee. That same group recommended the next pricing changes as well, based on the cost of a police services unit (PSU). The PSU price for 2014 is $153,621. For 2015, the PSU price will be $155,157. In the following two years, the PSU price was proposed to be $156,709 in 2016 and $158,276 in 2017. The pricing for those two years was authorized by the board in its April 16 action.

Those figures are based on a 1% annual increase in direct costs to contracting municipalities. That rate of increase for PSUs is included in revenue projections for the county’s four-year budget, which the county board passed at its Nov. 20, 2013 meeting. The budget runs from 2014-2017, and includes revenue projections based on contracts for 79 PSUs.

According to a staff memo, there will be an addition to the 2016 and 2017 prices for in-car printer replacement, after the total cost of ownership is determined. The memo also notes that the pricing is based on salaries stipulated in current union contracts with the Police Officers Association of Michigan (POAM) and the Command Officers Association of Michigan (COAM). Those contracts run through 2014, and new contracts are currently being negotiated. The memo states that “no assumptions were made for salaries or fringes change in this cost metric in anticipation of any union negotiations.” [.pdf of staff memo]

The county – through the sheriff’s office budget – pays for the difference between the price charged for each PSU, and the actual cost to provide those services. In 2011, that difference was $25,514.

In 2016, the cost per PSU is expected to be $195,104 – a difference of $38,395 compared to the price being charged to municipalities. In 2017, the cost per PSU is estimated at $199,188 – a difference of $40,912. [.pdf of cost estimates]

Discussion during the April 2 meeting included concerns by some commissioners about the financial sustainability of this approach to funding police services, and the need for new revenue sources for public safety. Sheriff Jerry Clayton had been on hand to present the pricing proposal, and supported suggestions to seek new funding for public safety. He characterized the issue of public safety as one that encompasses economic development, human services and other aspects of the community.

There was no discussion on this item during the April 16 meeting.

Outcome: Commissioners gave final approval to the police services contract price.

Thompson Block Brownfield

A resolution giving final approval to a brownfield redevelopment plan for the Thompson Block in Ypsilanti’s Depot Town area was on the April 16 agenda. [.pdf of Thompson Block brownfield plan] Commissioners had granted initial approval on April 2, 2014.

This photo of the Sept. 23, 2009 fire on the Thompson Block property was included in the brownfield redevelopment plan packet.

The plan covers 400-408 N. River St. and 107 E. Cross St., an historic property that has been declared ”functionally obsolete and blighted.” That qualifies the project as a brownfield under the state’s brownfield redevelopment financing act (Public Act 381), which allows the owner to receive reimbursements for eligible activities through tax increment financing (TIF). Approval also would allow the developer to apply for Michigan Business Tax Credits. The property is currently owned by Thompson Block Partners LLC, led by Stewart Beal of Beal Properties.

Beal plans to create 16 “luxury lofts” in the structure’s second and third floors, and up to 14,000 square feet of commercial space in the remainder of the site. The project is estimated to cost about $7 million.

The resolution considered by the board also ends a previous brownfield plan for part of the same site, which was approved in 2008. A fire in 2009 delayed the project. The new plan now covers the 107 E. Cross, which was not part of the original plan, and includes public infrastructure improvements, such as streetscape enhancements along North River Street.

The Washtenaw County brownfield redevelopment authority approved this plan at its March 6 meeting. Subsequently, the plan was approved by the Ypsilanti city council on March 18. The city council’s action included approving an “Obsolete Properties Rehabilitation” certificate, which freezes local millages at the current, pre-development level for 12 years. Because of that, the project’s TIF capture will apply only to the state’s school taxes.

The project can get up to $271,578 in eligible cost reimbursed over a 12-year period, for activities including brownfield plan and work plan preparation, limited building demolition, selective interior demolition, site preparation and utility work, infrastructure improvements, architectural and engineering design costs, asbestos and lead abatement, and construction oversight.

The intent of the state’s brownfield redevelopment financing is to support the redevelopment of urban sites that will increase the municipality’s tax base. Tax increment financing allows an entity to capture the difference between the taxable value before a project is undertaken, and the value of the property after it is developed.

A public hearing on this proposal was held at the April 2 meeting, when the board also voted to give initial approval to the plan. Only one person – Tyler Weston, representing Thompson Block Partners – spoke, telling the board that it would help the project.

Weston attended the April 16 meeting, but did not formally address the board. There was no discussion on this item.

Outcome: Commissioners gave final approval to the Thompson Block brownfield redevelopment plan.

Accommodation Tax Distribution

A resolution to give initial approval to distribute proceeds from a countywide tax on hotels and other accommodations was on the April 16 agenda.

Mary Kerr, president of the Ann Arbor Convention & Visitors Bureau, and Jason Morgan, director of government relations for Washtenaw Community College.

For 2013, $472,846 was available for distribution. If the resolution is given final approval, the county will keep 10% ($47,285) to pay for enforcement of the accommodation ordinance. The remainder will be divided between the Ann Arbor Convention & Visitors Bureau ($319,171) and the Ypsilanti Convention & Visitors Bureau ($106,390).

A final vote on that distribution is expected on May 7.

The county collects the 5% excise tax from hotels, motels, and bed & breakfasts, which is then distributed to the Ann Arbor and Ypsilanti convention & visitors bureaus and used to promote tourism and convention business. The contract calls for the county to retain 10% of that tax to defray the cost of collection and enforcement. (Until 2009, the county had only retained 5% for this purpose.) The remaining funds are split, with 75% going to the Ann Arbor Convention & Visitors Bureau, and 25% going to the Ypsilanti Convention & Visitors Bureau.

In December 2009, the board approved five-year contracts with the CVBs, outlining the distribution arrangement and creating an accommodation ordinance commission to oversee the process. An amendment made in September 2011 addressed the process for distributing excess funds that might accumulate from the county’s 10%, if that amount exceeds the expenses required to administer and enforce compliance with the tax. Beginning in May 2013, the county retained 10% of the tax proceeds, plus 10% of any remaining fund balance. If additional funds accumulate in the fund balance, they are to be returned proportionally to the two convention & visitors bureaus – 75% to Ann Arbor, and 25% to Ypsilanti.

Subsequently an ordinance change was made in October 2012, when the board voted to shift responsibility for collecting and enforcing accommodation tax from the county treasurer to the county finance director. The ordinance amendment transferred a 0.7 full-time equivalent accounting job from the treasurer’s office to the county finance department, and amended the accommodation tax policy to clarify that the tax is only assessed against the actual price of a hotel, motel or other rental – not against other amenities that the business might charge its customers, such as Internet access or an extra cot in the room.

Accommodation Tax Distribution: Public Commentary

The specific resolution was not addressed directly during public commentary. But Jason Morgan, director of government relations for Washtenaw Community College, and Mary Kerr, president of the Ann Arbor Convention & Visitors Bureau, attended the meeting to highlight the union training programs that will be coming to the area this summer. The CVBs have been instrumental in recruiting these kinds of events to Washtenaw County.

The United Association (UA) is coming in August, marking the 25th year that UA training has been held at WCC, Morgan said. The ironworkers union will also be training at WCC for the fifth year. The National Joint Apprenticeship and Training Committee (NJATC) National Training Institute for electricians is coming in July.

Morgan said he and Kerr wanted to make sure that the unions know they are appreciated by Washtenaw County and by WCC.

Kerr noted that the NJATC is celebrating its 25th year as a training program, so that milestone – along with the UA anniversary – will be bringing hundreds of additional people to this area. Collectively, the economic impact from these union training programs is $12 million annually in Washtenaw County, she said. That amount includes money spent on hotels, restaurants, entertainment, retail and transportation. “They do have a significant economic impact on the community,” Kerr said. “Our goal is to keep them here. Our goal is to roll out the red carpet and make this not only an educational opportunity for them, but also an entertaining and relaxing one as well.”

Accommodation Tax Distribution: Board Discussion

Several commissioners thanked Morgan and Kerr, and said they supported the economic vitality that unions bring to this community. Commissioner Ronnie Peterson (D-District 6) praised the work of the AACVB, saying that the county had an excellent partnership with them. He requested that Kerr return in the future to talk about the full range of activities that the CVB does. He wanted people to know that sometimes the government works well with the private sector. [.pdf of 2013 AACVB annual report]

Outcome: Commissioners voted unanimously to give initial approval to the accommodation tax distribution. Commissioners Dan Smith (R-District 2) and Conan Smith (D-District 9) were out of the room when the vote was taken. A final vote is expected on May 7.

Urban County Action Plan

The 2014 Urban County action plan was on the April 16 agenda for initial approval. The plan covers the period from July 1, 2014 through June 30, 2015 and outlines how the Urban County consortium intends to spend federal funding received from the U.S. Dept. of Housing and Urban Development (HUD). [.pdf of draft action plan]

The Urban County is a consortium of Washtenaw County and 18 local municipalities that receive federal funding for low-income neighborhoods. Members include the cities of Ann Arbor, Ypsilanti and Saline, and 15 townships. “Urban County” is a designation of HUD, identifying a county with more than 200,000 people. With that designation, individual governments within the Urban County can become members, entitling them to an allotment of funding through a variety of HUD programs. Locally, the Urban County is supported by the staff of Washtenaw County’s office of community & economic development (OCED).

Two HUD programs – the Community Development Block Grant (CDBG) and HOME Investment Partnership – are the primary funding sources for Urban County projects. For the upcoming year, the Urban County will be receiving $2.914 million, including $1.832 million from CDBG and $925,308 from HOME. That represents a 5% decrease in CDBG compared to the current year, and a 2% increase in HOME funding.

The 2014 plan identifies six overarching goals: (1) increasing quality, affordable homeownership opportunities; (2) increasing quality, affordable rental housing; (3) improving public facilities and infrastructure; (4) promoting access to public services and resources; (5) supporting homelessness prevention and rapid re-housing services; and (6) enhancing economic development activities.

A public hearing on the 2014 plan was previously held on March 19, 2014. A final vote on the plan is expected on May 7.

Urban County Action Plan: Board Discussion

Discussion was brief. Felicia Brabec (D-District 4) noted that there was almost a $90,000 decrease in CDBG funding. She asked what that decrease means in terms of the county’s ability to provide services.

Mary Jo Callan, director of the county’s office of community & economic development, replied that the decrease is “better than we feared.” The staff had been anticipating more of a 7% cut, so a 5% decrease was good news. The $90,000 in cuts won’t affect just one program, she said. So it will result in either fewer projects or scaled-down projects.

Outcome: Commissioners voted unanimously to give initial approval to the Urban County action plan. Commissioners Dan Smith (R-District 2) and Conan Smith (D-District 9) were out of the room when the vote was taken. A final vote is expected on May 7.

Bond Re-Funding

Commissioners were asked to give final authorization to the re-funding of up to $16.5 million in outstanding capital improvement bonds, which were originally issued in 2006 to fund expansion of the county jail. Initial approval had been given at the board’s April 2, 2014 meeting.

According to a staff memo, $16.9 million in principal remains of the original $21.675 million bond sale. The county’s bond counsel, Axe & Ecklund, is advising the re-funding because of lower interest rates, and estimates a net savings of about $869,000 over life of the bond issue. The new issue would be called “County of Washtenaw Capital Improvement Refunding Bonds, Series 2014.” [.pdf of refunding resolution]

At the board’s April 2 meeting, bond counsel John Axe had told the board that current interest rates are between 4% and 4.3%. He estimated that the re-funding interest rates would be between 2.2% and 3.8%.

Outcome: Without discussion, commissioners gave final approval to the bond re-funding proposal.

Honoring Eugene Glysson

Commissioners held a moment of silence for Dr. Eugene Glysson, who had served on the county’s board of public works (BPW) since 1986. He died on April 2. They later passed a resolution of appreciation for his service to Washtenaw County. [.pdf of resolution for Eugene Glysson]

Glysson had served as chair of the BPW since 1996, and was considered an expert in solid waste management and planning. He also was a professor emeritus of civil and environmental engineering at the University of Michigan.

The resolution noted several of Glysson’s accomplishments, including his leadership in reviewing and approving an agreement with Washtenaw County’s only active landfill “that has provided long term support for the County’s solid waste program including its household hazardous waste program that has removed tons of hazardous materials from the environment…”

Glysson’s son, Ned Glysson, was on hand to accept the resolution, saying it would have meant a lot to his father. He noted that his father refused to retire from the BPW, and about a month ago he had attended a meeting “and was incredibly rejuvenated by it.” It had given his father something to live for.

Evan Pratt, who as the county’s water resources commissioner also serves as director of public works, said Glysson had been a good chair. Commissioner Yousef Rabhi, who served on the BPW for almost four years, recalled that in the early days he’d been late to a few meetings, and Glysson hadn’t been happy about that. “He told me I wouldn’t be late anymore, and I wasn’t,” Rabhi quipped. Rabhi called Glysson a mentor to him and a great environmental leader.

Rabhi noted that a new member will need to be appointed to the BPW, so he’ll be seeking applicants for that.

Telecommunicator Week

The board passed a resolution declaring April 13-19 as National Public Safety Telecommunicator Week in Washtenaw County. [.pdf of board resolution]

From right: Marc Breckenridge, the county’s director of emergency services; commissioner Yousef Rabhi; and Dave Halteman, manager of the county’s dispatch operations.

Marc Breckenridge, the county’s director of emergency services, was on hand to receive the resolution. He noted that six or seven dispatchers were working that night just a few blocks away.

Breckenridge introduced Dave Halteman, saying he’s worked with the county for 22 years, starting as a 911 dispatcher. In the mid-1990s, Halteman was promoted to lead the countywide 911 effort. Most recently, Halteman was involved in co-locating and integrating dispatch operations in Washtenaw County.

This month, Halteman was promoted to be manager of the county’s dispatch operations, Breckenridge said.

Halteman thanked the board, saying that the job of dispatcher is very difficult and requires the ability to multi-task.

Communications & Commentary

During the April 16 meeting there were multiple opportunities for communications from the administration and commissioners, as well as public commentary. In addition to issues reported earlier in this article, here are some other highlights.

Communications & Commentary: Emergency Sirens

Speaking during public commentary, James Richardson of Scio Township told commissioners that there’s a potential life-threatening danger – a new emergency siren that was installed at the edge of his pasture.

When the county approved the expansion of emergency sirens into the townships, he said, they probably viewed it as an improvement in public safety. But they might not have considered the resulting unintended danger. When he first learned that the siren would be installed, he expressed concern that it would bother his horses. He eventually spoke with Marc Breckenridge, the county’s director of emergency services, who assured him that studies show that livestock get used to these types of sounds. “I can assure you that these experts haven’t seen horses very near a siren,” Richardson said.

On Saturday, April 5 at noon, the sirens went off for the first time that he was aware of, Richardson said. He happened to be watching his horses, who reared and bolted, running wildly through the pasture. If someone had been riding a horse at that time or even standing near them, it could have caused serious injury and possibly death, he said. If the horses had been near the north end of the pasture, they might have bolted through the fence and onto Liberty Road.

Richardson said he was appealing to the board to have the siren removed from this location. He doubted that his horses would get used to the sound, especially since the sirens are only tested once a month for 1-2 minutes. “I’m notifying you of this danger, and also notifying you that if you fail to act, the board and the county will assume full responsibility for all and any of the resulting damage or injury to my horses, to my property, or any personal injury resulting from the dangerous situation that the emergency siren creates.”

Commissioner Conan Smith (D-District 9) urged Breckenridge to explore how the county can protect the interests of landowners as well as public safety. Sometimes those things come into conflict, he added, but it’s worth having a conversation to explore the options. Commissioner Ronnie Peterson (D-District 6) said he’d like to ensure that someone in the county administration follow up on this issue.

Communications & Commentary: Budget

Responding to a query from Ronnie Peterson (D-District 6), Felicia Brabec (D-District 4) described the process for this year’s budget affirmation. Although the board passed a four-year budget in late 2013 – for the period of 2014 through 2017 – they also need to vote each year to reaffirm the next year’s budget, with any changes they might make.

Commissioner Andy LaBarre (D-District 7) talks with Greg Dill, the county’s director of infrastructure management.

As a first step, Brabec said, commissioners authorized the county administrator to hire a contract employee who will support budget-related work this year for the county board and administration. That authorization took place at the board’s March 19, 2014 meeting. That person will help the board work on aligning the budget to support community outcomes that commissioners had identified.

By way of additional background, as part of adopting a four-year budget, the board set up a new strategic model to help it determine where the county’s resources should go. The board set goals as well as outcomes that are intended to measure how those goals are being achieved. The priority areas for investment that were approved by the board in 2013 are: (1) ensure community safety net through health and human services, inclusive of public safety; (2) increase economic opportunity and workforce development; (3) ensure mobility and civic infrastructure for county residents; (4) reduce environmental impact; and (5) ensure internal labor force sustainability and effectiveness.

On April 16, Peterson asked whether there could be a working session to review the goals and outcomes, saying that some things might have changed since those goals were adopted. Brabec replied that those kinds of discussions are being planned. Because of frequent low attendance at working sessions, she wondered whether it might be better for the discussion to occur at a ways & means committee meeting. “The discussion will happen,” she said. “We just need to find the best way for those discussions to happen.”

Communications & Commentary: MPRI

Ronnie Peterson (D-District 6) spoke at length about the need to support the Michigan Prisoner Re-Entry Initiative (MPRI), calling it an unfunded mandate from the state. Yousef Rabhi (D-District 8) agreed that it was an issue the board needs to tackle. Rabhi noted that he serves on the board of the Religious Action for Affordable Housing (RAAH), which has made the Washtenaw County prisoner re-entry program one of its three top priorities. He thought the county should prioritize it too.

Peterson said he wanted a working session on the topic, including a discussion about how the county allocates its dollars for human services programs in relationship to the coordinated funding approach. “It’s not about stopping coordinated funding,” he said. “It’s about how we address the unmet needs of this community.”

Andy LaBarre (D-District 7), who chairs the board’s working sessions, said he’d be glad to schedule a session on this topic. He noted that this year, the working sessions had not yet achieved 100% attendance. So he hoped commissioners would attend.

The following week, on April 22, LaBarre emailed commissioners an updated schedule of the next six working sessions:

- May 8: MSU Extension update; and follow-up on road commission expansion

- May 22: Community Health Improvement Plan report; and report on homelessness in Washtenaw County task force

- June 5: Report on Virtual Business Advisor initiative

- July 10: Dog licensing public awareness campaign; and Mental Health Court update

- August 7: ID task force report

- September 4: Prisoner reentry (MPRI)

Communications & Commentary: Smoking

During the time on the agenda to bring up items for current or future discussion, Alicia Ping (R-District 3) pointed out that earlier this year, she’d raised the issue of possibly requiring that new hires be tested to make sure they’re nicotine-free. It’s a policy that’s trending in the private sector, Ping noted, and she’d like to have a broader discussion about it. “It’s an expensive liability to take on people who are purposefully are not contributing to their good health,” Ping said.

County administrator Verna McDaniel replied that staff are looking at a range of wellness issues, including that one.

Communications & Commentary: Homelessness

Elizabeth Kurtz spoke about the Delonis Center homeless shelter’s warming center. She thanked the board for funding an extension of the warming center until April 30. If it had closed on April 6 as previously planned, she said, a lot of people would have been outside during cold weather. She told commissioners that she’s lived on the streets for over a year, and based on the needs that she sees, she’s been working with others to end homelessness.

They’ve formed an organization called “Our 2020 Vision,” and are seeking support from local governments and private entities to help end homelessness by the end of this decade. The urgency of this issue will no longer allow it to be placed on the back burner, Kurtz said. Specifically, she called on commissioner Ronnie Peterson (D-District 6) to help acquire the vacant East Middle School in Ypsilanti for use in this effort, and asked other commissioners to help as well.

Ray Gholston also thanked commissioners for helping extend the warming center through April. The county had provided $35,000 to keep it open, he noted, but he questioned why it would cost so much “just to throw a few mats on the lunchroom floor, say goodnight and turn off the lights.” He said he still has a job and is still trying to figure out where he’ll sleep after this month. He’s part of the Our 2020 Vision effort, calling it a human rights organization that’s focused on the homeless population. The group is requesting a meeting with some or all commissioners, to help deal with the crisis.

Commissioner Yousef Rabhi (D-District 8) thanked advocates for the homeless for coming to the meeting, and said he looked forward to the board’s May 7 meeting when a timeline would be presented for addressing an update to the Blueprint to End Homelessness. [At its April 2, 2014 meeting, commissioners had directed county administrator Verna McDaniel to bring forward a plan by May 7 for updating the county’s Blueprint to End Homelessness, which was originally adopted in 2004. The process of updating that plan is to be completed by Oct. 1, 2014. For board discussion on this issue, see Chronicle coverage: "Homeless Issues Emerge on County Agenda."]

Communications & Commentary: US-23

Yousef Rabhi noted that an environmental assessment is being conducted for MDOT’s proposed expansion of US-23 near Ann Arbor. MDOT is seeking public input, and Rabhi said he intended to express his opposition to the project because of environmental concerns. It would be expanded from M-14 to just north of 8 Mile Road near Whitmore Lake. He encouraged others to provide input as well.

Communications & Commentary: Misc. Public Commentary

Several University of Michigan students spoke during public commentary. As a class project, they’re working on an initiative to reduce the use of plastic bags in Washtenaw County.

Their proposal is based on a model used in Washington D.C. that includes imposing a small usage fee on single-use plastic bags. The goal is to nudge consumers to be more aware of their consumption choices. They’ve spoken with commissioner Yousef Rabhi to explore their options. To gauge possible support, they’ve started a petition on MoveOn.org and have reached out to community groups like Recycle Ann Arbor and the Huron River Watershed Council, as well as student groups at UM, Eastern Michigan University and Washtenaw Community College.

Lefiest Galimore touched on several issues during public commentary. As he has in the past, Galimore argued that the coordinated funding approach tends to prevent African-American organizations from getting funded. If his small organization is given $1,500 and a larger organization is given $35,000, then that larger organization will have more capacity to do its work, he said. So the county needs to look at that. Galimore also said that people with mental illness who get involved in the criminal justice system get labeled as criminals, and it’s then impossible for them to get productive jobs. “We need to look at that as a community.”

Thomas Partridge told commissioners that the agenda needed to give more attention to greater priorities, including efforts to eliminate homelessness by providing true affordable housing and countywide public transportation. He supported the transit tax that’s on the May 6 ballot in Ann Arbor, Ypsilanti and Ypsilanti Township.

Present: Felicia Brabec, Andy LaBarre, Kent Martinez-Kratz, Ronnie Peterson, Alicia Ping, Yousef Rabhi, Rolland Sizemore Jr., Conan Smith, Dan Smith.

Next regular board meeting: Wednesday, May 7, 2014 at 6:30 p.m. at the county administration building, 220 N. Main St. in Ann Arbor. The ways & means committee meets first, followed immediately by the regular board meeting. [Check Chronicle event listings to confirm date.] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public commentary is held at the beginning of each meeting, and no advance sign-up is required.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Washtenaw County board of commissioners. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Just to note, the phrase “Equalized (assessed) value is used to calculate taxable value” might be misconstrued to suppose that equalized and assessed are synonyms. They are not. Assessors located in many parts of the county (Ann Arbor has its own, for example) prepare a list of assessed values for their own region. The Equalization Department is then charged with verifying that those assessments are fairly made. The principal concern is that in a particular community, assessments might be made that are lower than a true market assessment would indicate: in other words, that taxes are being held down by collusion. Equalization is done to guarantee that all communities’ properties are being assessed according to the same guidelines.

A better way to express it might be “Assessed and equalized value…”

“In addition, Public Act 161 of 2013 extends the homestead property tax exemption for disabled military veterans to spouses of diseased veterans.”

I think you meant “deceased” vs. “diseased”.

Re: “I think you meant “deceased” vs. “diseased”.”

Yes, thanks, corrected.

“It appears that the worst part of the decline in market value is behind us.”

Appearances can be deceiving. What if the worst is ahead of us (which I believe it to be)?

The fact that commercial property values haven’t increased as much as residential suggests that the latter reflects a re-inflation of the housing bubble (though only partial at that) as well as a still-weak(ening?) economy, as much evidence supports: [link]

The county would do well to prepare for a surge in foreclosures over the next few years and plan for how to keep those houses occupied and maintained, not start dreaming of a return to a strong tax revenue stream.