County Takes Action on Budget, Tax Levies

Washtenaw County board of commissioners meeting (Aug. 6, 2014): County commissioners took initial votes to levy two taxes that would generate revenues for economic development, agricultural projects, and support of indigent veterans.

Chris Haslinger (second from right), director of training for the United Association (UA) of plumbers and pipefitters, received a proclamation from the county board of commissioners at the board’s Aug. 6 meeting. They were gathering for a photo to mark the event. From left: Conan Smith, Andy LaBarre, Alicia Ping, Yousef Rabhi, Chris Haslinger, and Verna McDaniel, the county administrator. (Photos by the writer.)

The county has determined that it’s authorized to collect up to 1/10th of a mill for support of indigent veterans, without seeking voter approval. That’s because the state legislation that enables the county to levy this type of tax – the Veterans Relief Fund Act, Public Act 214 of 1899 – predates the state’s Headlee Amendment. The county first began levying this millage in 2008, and collects the tax in December. The current proposal is to levy 1/27th of a mill in December 2014, which is expected to raise about $540,887 in revenues for use in 2015.

The county’s position is that Act 88 can also be levied without voter approval to fund economic development and agricultural activities. This year, the proposal is to levy 0.07 mills in December 2014 – the same rate that was levied in 2013. It’s expected to raise an estimated $1,022,276 in property tax revenues.

Final action on these tax levies is expected at the board’s Sept. 3 meeting.

Also related to Act 88, the board approved allocations of $87,760 in Act 88 revenues that were collected in 2013, to support six projects. Four of the projects are administrated by Ypsilanti-based Growing Hope, with the remaining two projects initiated by the Michigan State University Product Center.

During the Aug. 6 meeting, commissioners approved amendments to both the Act 88 projects resolution and the resolution to levy the tax this year. The amendments directed the county’s corporation counsel to provide a written opinion about how Act 88 revenues can lawfully be used, and how the tax can be lawfully levied without a vote of the people. The amendments were brought forward by Dan Smith (R-District 2).

In other action, the board received a second-quarter budget update, with projections showing a general fund surplus of $211,920 for the year. The board also made mid-year budget adjustments, which included allocating a $3.9 million surplus from 2013 into unearmarked reserves.

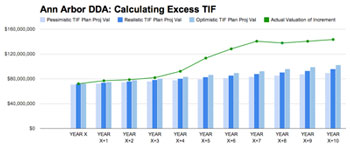

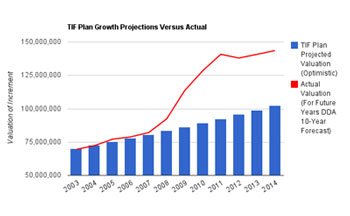

Commissioners approved a new policy to guide decisions on tax increment finance (TIF) proposals, and supported revised rules and guidelines from the water resources commissioner. Those revisions relate to procedures and design criteria for stormwater management systems.

A proclamation made during the Aug. 6 meeting honored Herb Ellis Sr., the first black man to be elected to the Washtenaw County board of commissioners. Ellis was elected in 1968 and served until 1982, representing Ann Arbor. During that time he also was the first black chair of the county board. He passed away on July 10, 2014 at the age of 98.

Another resolution recognized the contributions of United Association (UA), a union of plumbers, pipefitters, sprinkler fitters, welders, and heating, ventilation, air conditioning and refrigeration (HVACR) technicians. They’re in this area from Aug. 9-15 for their 61st annual training program, and have announced a new 15-year agreement to continue the program at the Washtenaw Community College.

The Aug. 6 meeting was held one day after the Aug. 5 primary elections. At the start of the meeting, board chair Yousef Rabhi congratulated all primary candidates, and said he looked forward to working with Ruth Ann Jamnick, the winner of the District 5 Democratic primary. He quickly added “pending the general election, but I think…” – a comment that drew laughs. District 5 – which covers August Township and parts of Ypsilanti Township – is heavily Democratic. Jamnick, who prevailed in the four-way Democratic primary, will face Republican Timothy King in the Nov. 4 general election. District 5 was the only race that was contested for the county board, with incumbent Rolland Sizemore Jr. not seeking re-election. Incumbents in all other districts of the nine-member board were unchallenged in the primary.

At the end of the meeting, the board voted to enter into a closed executive session for the purpose of reviewing attorney-client privileged communication. It is one of the exemptions allowed under the Michigan Open Meetings Act.

After about 30 minutes, three commissioners returned to the boardroom – Dan Smith (R-District 2), Alicia Ping (R-District 3) and Conan Smith (D-District 9). They indicated to The Chronicle that they thought the discussion in the closed session had strayed away from the limits imposed by the OMA, and they had left the session because of that. They did not state what the nature of the discussion had been, nor the topic of the session.

Soon after, the remainder of the board emerged from the closed session, and the meeting was adjourned. [Full Story]