Column: Stew on This

For the past several months I have been attending the city of Ann Arbor’s pension board meetings. At the last meeting on Nov. 20, the atmosphere in the room was a little quieter than it had been in previous months. The city of Ann Arbor Employees’ Retirement System board of trustees was preparing to receive the latest report on the monthly performance of the city’s Pension Fund.

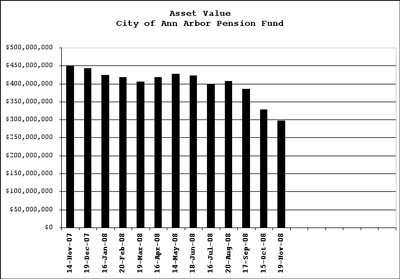

Willie Powell, the executive director of the retirement system, needed a couple of tries to get the grim news out: plan assets had dropped $30 million (preliminary) in October, and combined with a $50 million drop in September, the asset value was now just below $300 million – down 33% year to date. I noticed a definite groan coming from the vicinity of Tom Crawford, chief financial officer for the city of Ann Arbor.

Bar chart by The Chronicle based on data from minutes of City of Ann Arbor Employees' Retirement System board of trustees meetings, available on the city's website.

Since the city employees’ retirement plan is a defined benefit plan, it puts “us the taxpayers” on the hook for making up for any shortfall in funds. What that means for you and me is difficult to assess at this point, but don’t count on your taxes going down anytime soon.

We should not single out our pension trustees as the source of the problem. In less demanding years the plans have performed satisfactorily. Ann Arbor is not alone in feeling the pain as wave after wave of banks, insurance companies and other businesses fail despite the $700 billion bailout initiated by Federal Reserve Chairman Ben Bernanke and Treasury Secretary Henry Paulson. Many public and private investment portfolios are down even more percentage-wise than ours as the “bear market” devours stocks and bonds indiscriminately.

We all should care about these losses because Michigan law stipulates that required employer contributions to pension trusts are not optional. Deficiencies can be amortized out over 30 years, but they must be made up. Several trustees pressed very hard for the plan’s independent actuary to identify a new Actuarially Required Contribution (ARC) for fiscal year 2010, which starts next June. The consensus was that, ceteris paribus, the ARC would increase from approximately $7.5 million to $9 million and potentially more. This additional $1.5 million or more will have to come from somewhere: cutting expenses, increasing revenue, or from the general fund surplus.

For almost two years I have been mildly cajoling our elected representatives (chiefly city council members and the mayor) that it was time to take our collective foot off the spending accelerator. My main message has been that the city should conserve our “rainy day” fund cash (surplus money in the general fund) for contingencies just such as this. Now, thanks to credit default swaps, collateralized debt obligations and a lot of other things that you have never heard of and have no control over, our “weather forecast” has changed to partly cloudy with a 75% chance of rain!

In the past, Ann Arbor liked to boast that we were immune from the seemingly perpetual economic malaise that plagued the rest of the state. When Pfizer abruptly pulled out of Ann Arbor, we began to sense that this time things might be different. Now, with a two-month paper loss equal to the entire annual budget of the general fund, it should be perfectly clear, in fact obvious, that it is a time for fiscal restraint. Even University of Michigan Hospital Systems has announced layoffs. When our city council meets for their annual budget retreat in January, they must make it clear to the taxpayers and municipal employees that it will not be business as usual for the foreseeable future.

Henceforth, every expenditure must be examined and prioritized. No doubt we will emerge from this recession, but we must protect ourselves from core service cuts by hunkering down and spending more wisely. Our options are becoming extremely limited.

Editor’s note: The Ann Arbor Employees’ Retirement System board of trustees meetings are held the third Thursday of every month at 8:30 a.m. These meetings are held in the Retirement System conference room at 532 S. Maple Rd., Ann Arbor. Next meeting: Dec. 18. The budget retreat to which Nelson refers takes place on Jan. 10 at the Wheeler Service Center, 4150 Platt Road, starting at 8:30 a.m.

An update provided by Stew Nelson today after attendance at a committee meeting of the pension board has the fund asset value nudging back over the $300 million mark to $313,945,000.

“ceteris paribus”

That’s a new one to me. I’m going to guess that it means “all other things being equal”. Did I win?

“In the past, Ann Arbor liked to boast that we were immune from the seemingly perpetual economic malaise that plagued the rest of the state.”

Et tu, Stew? It’s not enough to have had AAIO and multiple Ypsi residents and bloggers bash AA for elitism and snobbery (not to mention “liberalism”)? If your claim is true, at least name names instead of painting the whole community with that broad brush.

Nit picking aside (that’s for you, HD), thanks for following this, Stew.

Sorry, it’s folks in other parts of the county that have an issue with “liberalism”, not the Ypsi-ites I referred to. I’ll put down my stones (and my brush) now. See what you started with your generalizations? ;-)

Steve,

You win the bet!

And sorry for the generalizations. I would like everyone to consider Ann Arbor and Ypsilanti as one entity. What good would it do for us to recover and leave our brothers and sister in Ypsilanti behind. We need to make sure Ypsilanti takes part in the prosperity when we finally see it again. SPARK understands that.

PS When I name names I tend to get in trouble and am branded as a dissident.

Sounds like it’s time to put the City Hall on hold and start covering obligations the City has already made!

What active employees of the City still are eligible for a pension? If there are jobs still eligible for this benefit, maybe it’s time to phase that out, following the suit of most other businesses.

Stew,

Your work on this subject is invaluable and I thank you for it.

I hope that this information gets disseminated to every tax payer in the City.

Liberal, “shliberal.” This is just another example of well meaning but naive and under informed people (City Councils and City Administration of the last two dozen years, in this case) making promises that they cannot keep.

The only solution is to put the spending on a diet (sorry, no City Hall) and to freeze the current defined benefit plan for all current employees and switching to a defined contribution plan.

This is what most businesses in the country are now doing. There is no reason that government can continue to be immune from economic realities such as this.

Bob

Bob,

Thanks.

We have not reached bottom of the trough in real estate prices also which will eventually translate to lower tax revenues for the City. Pfizer the largest taxpayer has asked for tax relief. Can Briarwood Mall (the second largest taxpayer) be far behind in their request as vacancies and lower lease rates translate to lower property values? The warning signs are clear that spending restraint is needed. Homeowners are tapped out and juggling bill payments to make ends meet. A tax increase to fill the “pension bucket” will not be embraced this time.