Ann Arbor’s Budget Data to Go Online

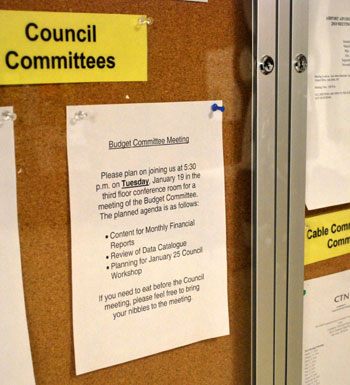

Ann Arbor City Council Budget Committee (Jan. 19, 2010): Sometime within the next two months, Ann Arbor city councilmembers and Ann Arbor residents – or anyone, for that matter – can expect to start getting access to raw data files of all city financial transactions.

At a meeting of the Ann Arbor city council’s budget committee, the city’s chief financial officer, Tom Crawford, sketched a plan to start making available a wide range of raw data from the city, starting with numbers from the finance department. Crawford said he hopes to have a pilot in place by the end of February.

Budget committee members also discussed what the contents of a monthly statement should be that will now be provided to the committee and to the council as a body – such a report is required by the city’s charter.

The other main point addressed by the budget committee was raised by city administrator Roger Fraser, who suggested to councilmembers that they owed it to the community to put the question of a city income tax before the voters. Fraser said they had a responsibility to float the question, regardless of what their personal feelings were on the issue.

The meeting was also attended by Mayor John Hieftje, who is a member of the city council, but no longer part of the 5-member budget committee – the council reorganized its committee structure at its Dec. 21, 2009 meeting. Hieftje participated in deliberations on the question of when a city income tax ballot question might feasibly go on the ballot.

Data Catalog

The city’s chief financial officer, Tom Crawford, put the posting of the city’s financial data online in the context of a broader initiative – modeled on Washington D.C.’s data catalog – to make available basic data on the city’s website. The idea is that other interested parties might use the data to create reports and analyses that the city staff might not think to create, or simply not have the time and resources to create.

Crawford reassured councilmembers that the data could not be altered and then re-posted to the city’s website by the public. Addressing the issue that someone could alter the data, then disseminate in by some other means, Crawford cited the experience of the Ann Arbor Downtown Development Authority in developing a disclaimer that is included with the provision of its realtime parking data. [That disclaimer reads: "The DDA is not responsible for third party use of this data." For some background on the realtime parking data kerfuffle leading to that disclaimer, see "Plus, Data Access Talk"]

The first kind of data that would be posted as a part of the city’s data catalog, Crawford said, would be data from his own department. As a pilot, the data would be provided as comma-separated value (CSV) files, together with documentation summarizing what was contained in the data set, a contact person within the city, a statement addressing accuracy, and a list of field names.

Also included for each group of data would be one of the standard kind of reports that can be run from the data, Crawford explained. These sample reports could range from hundreds to thousands of pages, he said. [They will not be printed out.] Examples of the kinds of data that would be available are journal entries, P-card transactions, the check register, the aging report (people who owe the city money), and the investment report.

The move towards providing the financial data as a part of the data catalog comes in advance of deployment of new financial software, which the city council authorized purchase of at its Dec. 7, 2009 meeting. The new software will cost around $900,000, with a payback through savings realized in a little under three years. One of the benefits touted for the new software is the ability to generate a variety of different reports by a broader range of users, and with less effort.

Even using the old software, however, Crawford said the idea was to post the data in a way that involved “minimal human effort.” This came in response to a concern expressed by Christopher Taylor (Ward 3) about the burden it would place on city staff.

The question of city staff burden arose at a couple of points during the meeting. City administrator Roger Fraser responded to councilmember concerns that they were placing an undue burden on staff. He said that, yes, there’d been an uptick in council requests for reports and data – but that was understandable given the current budget climate and that city staff accepted that as a part of their job.

Monthly Report

The budget committee also discussed what the contents of the monthly report should be, which will now be provided to the council. A monthly financial statement is required under the city’s charter:

SECTION 5.6. The Controller shall be the chief accounting officer of the City. The Controller shall:

(6) Submit to the Council, through the City Administrator, by the tenth working day of each month, a statement showing the balances at the close of the preceding month, in all funds and budget items, the amount of the City’s known liabilities and budget items to which the same are to be charged, and all other information necessary to show the City’s financial condition;

Tom Crawford, the city’s CFO, reported that he and his staff had looked at the charter and come up with a report that they thought met the definition as described in the city charter.

One of the elements of that report will be a report of the general fund’s revenues and expenditures. Crawford cautioned that the year-to-date percentages would not necessarily match the percentage of time that has passed to date in the fiscal year – it’s not linear. For example, now halfway through the fiscal year, most of the taxes were collected – but that’s a function of when taxes are collected, at the beginning of the year. Or halfway through the year, revenues from licensing and inspections in the building department are more than 50% of the year’s budgeted amount – but that actually translates into a projected shortfall.

Christopher Taylor (Ward 3) asked if the comparative year-to-date percentages could be included in the monthly report, just to orient councilmembers to the possible significance of the percentages. For example, 20% could either be awesome, Taylor said, or it could also mean that “the sky is falling.”

In discussing how the monthly report should be disseminated, Roger Fraser suggested that it be sent directly to all councilmembers. However, Marcia Higgins (Ward 4) weighed in in favor of first having the budget committee review it before disseminating it to other councilmembers. She reasoned that the rest of the council might not understand what they were looking at, and that budget committee members would then be in a position to help others on council.

Sabra Briere (Ward 1) said that she preferred to “err on the side of everybody-sees-it.” Crawford said that it could be posted on the website. Taylor suggested that if the report changed after review and questions by council, then it could be held until a final version was determined.

City Income Tax

City administrator Roger Fraser told the budget committee that revenue was not one of the items on the list of issues staff had been given to consider in preparation for the council’s Jan. 26 budget workshop [starting at 6 p.m. in city council chambers]. But on the question of a city income tax, Fraser said, “We owe it to the community to have that question out there.” He suggested that it be put before the voters either at the August 2010 primary election or the November 2010 general election.

Mayor John Hieftje would subsequently point out that choosing the primary versus the general election would not affect how soon the tax could be implemented.

When there seemed to be little enthusiasm in the room for the idea of floating a ballot question for voters on the implementation of a city income tax, Fraser pressed the point. He suggested that they spend a little bit of money to have a survey of voter attitudes done – similar to what the Ann Arbor Transportation Authority had undertaken recently to measure attitudes about a countywide transportation millage. He called undertaking such a survey “due diligence.”

Stephen Rapundalo (Ward 2) wondered if there was a good enough set of information out in the public for a survey to be meaningful – we might want to try to educate first and then survey voters. One specific example cited by Rapundalo was that many people are under the erroneous impression that an income tax would be implemented on top of a property tax for general operating expenses. [The city charter forces a choice between a property tax or an income tax – it's not possible to have both for general operating expenses. That said, there would still be other property taxes collected – for transportation, solid waste, and schools, for example.]

There was some sentiment expressed in the room that people essentially calculated whether their individual taxes would go up or down and decided their vote based on that.

Fraser responded that a properly designed survey would actually find out what it is that voters understand about the issue. He allowed that when the results of the survey came back, the council might well decide that there was no point in putting it on the ballot.

Quorum and Open Meetings Issues

The five-member budget committee as determined by a city council resolution at its Dec. 21, 2009 meeting consists of Mike Anglin (Ward 5), Marcia Higgins (Ward 4), Christopher Taylor (Ward 3), Stephen Rapundalo (Ward 2) and Sabra Briere (Ward 1). Prior to that resolution, the council had combined its budget committee with its labor committee. Now, the labor committee is combined with the council administration committee.

At one of the spring 2009 Sunday night city council caucus meetings, Higgins had rejected the idea that other councilmembers should attend the budget committee’s meetings, citing the possibility that a quorum could be reached, with implications about whether any decisions made would become decisions of the council as a body as opposed to decisions of the budget committee.

The attendance on Tuesday of all five members of the budget committee, plus the mayor as an additional member of the council, constituted a quorum of councilmembers. The meeting was not social in nature and thus met the standard for definition of a meeting under Michigan Open Meetings Act.

Notice of Tuesday’s meeting of the budget committee was properly posted in the lobby of city hall; however, the notice did not include mention of the possibility that a quorum of councilmembers could be present.

The Open Meetings Act requires that minutes be recorded for the meeting – in the “action minutes” style used by the council, this would amount to a list of topics addressed as posted in the meeting notice, names of attendees, date and time of the meeting. Councilmembers present at the budget committee meeting did not vote on any resolutions.

Editor’s note: Commenter has self-corrected, noting that it was intended for a different article, and it has therefore been deleted here.

Editor’s note: Commenter has self-corrected, noting that the comment was intended for a different article and its thus deleted here.

Sabra get’s it! Don’t tell us we not sophisticated enough to understand the data. Lay it out for everyone to see.

Stew