Despite Concerns, Coordinated Funding OK’d

Washtenaw County board of commissioners meeting (Nov. 3, 2010): The day after Tuesday’s general election, several newly elected county commissioners attended the board’s meeting, sitting in the audience for now – they’ll be sworn in at the first meeting in January 2011.

Yousef Rabhi, left, talks with Dan Smith prior to the Nov. 3 meeting of the Washtenaw County board of commissioners. Smith, a Republican, beat incumbent Democrat Ken Schwartz in Tuesday's election and will represent District 2 on the county board. Rabhi, a Democrat, was elected to the District 11 seat, defeating Republican Joe Baublis. Also attending the meeting was Republican Alicia Ping, who'll replace her sister Jessica Ping on the board representing District 3. (Photo by the writer.)

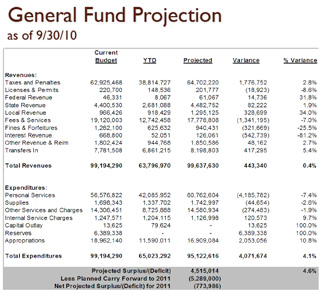

Wednesday’s meeting included discussion of the main challenge the next board will face – balancing the county budget. Jennifer Watson, the county’s budget manager, gave a third-quarter update, which shows that the county is projecting a total net surplus of $4.5 million for the year. However, the original budget passed by commissioners for 2010 called for carrying over a surplus of $5.289 million into 2011 – they’re still $773,986 short of that goal.

The board also took an initial vote on a resolution making adjustments to the 2011 general fund budget. Among other things, the resolution directs county administrator Verna McDaniel to make proposals for cutting $1,034,988 out of the original budget of $98,493,155. A public hearing on the 2011 budget adjustments is set for the board’s Nov. 17 meeting.

Other budget-related actions included giving final approval to levy an economic development tax, and an initial vote to make changes in the pension plan for commissioners.

Public commentary at Wednesday’s meeting focused on the coordinated funding model for human services – an effort that the board ultimately approved, though concerns were expressed at length by commissioner Ronnie Peterson. The idea is to formalize a partnership of the Washtenaw United Way, Ann Arbor Area Community Foundation, Washtenaw County, city of Ann Arbor and the Urban County, a consortium of 11 local governments. Allocation of roughly $5 million in funding from these entities will be coordinated by the office of community development, a joint county/city of Ann Arbor department. [The Ann Arbor city council subsequently approved the partnership at its Nov. 4 meeting.]

Coordinated Funding for Human Services Nonprofits

For over a year, discussions have been taking place about creating a public/private partnership to coordinate funding for human services. The effort involves the Washtenaw United Way, Ann Arbor Area Community Foundation, Washtenaw County, city of Ann Arbor and the Urban County, a group that oversees federal grants for housing and human services. These five entities provide a total of about $5 million annually for local human services nonprofits.

A proposed two-year pilot project is grounded in previous coordination between the city of Ann Arbor and Washtenaw County. The office of community development (OCD), led by Mary Jo Callan, already manages nonprofit funding for those entities, though the governing bodies for each entity retain final authority over their funding decisions. OCD also manages human services funding for the Urban County.

The coordinated model would focus funding on six priorities that have been identified for the entire county: housing/homelessness, aging, school-aged youth, children from birth to six, health and food. The county board had been briefed on this initiative at an Oct. 7 working session.

A cover memo accompanying the resolution to support this model stated that funding from the county would be allocated based on previous five-year historic funding trends: school-aged youth (37%); pre-school children (19%); safety net health (22%); housing & homelessness (15%); aging (4%); and food/hunger relief (3%).

The resolution proposed $507,500 to be allocated via the coordinated funding model, from July 1 through Dec. 31, 2011. This period aligns with the fiscal years for the other government entities. The county’s fiscal year begins Jan. 1. Fiscal years for the city of Ann Arbor and Urban County begin on July 1. According to the cover memo of the resolution, no county funds for 2012 have been allocated for this effort.

Coordinated Funding: Public Commentary

Three people spoke during the evening on the issue of a coordinated funding model for human services.

Lily Au, who has spoken to several public bodies that are involved in this issue, reiterated her objections to the proposal. She said the United Way can’t be trusted, and asked commissioners whether they had read the book “The United Way Scandal.” [The book by John S. Glaser describes problems at the national level in the early 1990s.] She said that commissioner Mark Ouimet should not vote on the coordinated funding resolution because he also serves as vice chair of the local United Way board, and it’s a conflict of interest. Taxpayer money should not be handled by private organizations, she said. [Commissioners later clarified that the funds of public entities and private organizations would not be co-mingled.] She pointed to the concerns raised by the Interfaith Council for Peace & Justice, which are posted online.

Cheryl Elliott, president and CEO of the Ann Arbor Area Community Foundation, told commissioners that the memorandum of understanding they were being asked to approve simply formalized an informal collaboration that’s already been occurring among these entities. She noted that funders had been asking nonprofits to collaborate, so they felt like it was time for them, as funders, to do the same. She said she strongly believes the approach will result in better outcomes for the community and for programs that address the community’s basic needs. The process of selecting programs to fund will be transparent, she said, with metrics to assess its impact. She urged commissioners to approve the two-year pilot, and noted that the boards of both the community foundation and the United Way had already approved it.

Mary Browning identified herself as a member of the racial and economic justice task force of the Interfaith Council for Peace & Justice. She said that they recognize the potential benefits of coordinated funding, but also had several concerns. She summarized six areas that ICPJ has outlined as potential issues: 1) institutional gaps in coverage, 2) different costs for providing service to different constituencies – these should be recognized when evaluating outcomes, 3) money saved from this approach should be reinvested into human services programs, 4) new projects and small nonprofits should have access to coordinated funds, and money should be set aside for startup funding to help launch new projects that have potential for big results, 5) the proposed system would concentrate power over funding decisions in the office of community development – robust checks-and-balances are needed to provide accountability, and 6) community funding efforts should recognize the different roles of funders and agencies and maintain appropriate separation of duties. [These issues are fleshed out in more detail on the ICBJ website.]

Coordinated Funding: Commissioner Response to Public Commentary

Mark Ouimet asked the county’s corporation counsel, Curtis Hedger, whether he should abstain from a vote on this issue. Hedger indicated that since funding by the United Way and the county aren’t being co-mingled, he didn’t believe Ouimet needed to abstain.

Jeff Irwin stated that he supported the resolution. The goal is to reduce time and expense related to administration of the funding, he said. And though the application review and evaluation of nonprofits would be coordinated, there would be no co-mingling of funds – the county board would still retain control over decisions related to county funds. They do need to make sure there’s oversight so that the goals of the coordinated approach align with the board’s goals, but this model is designed to do that, Irwin said. The way that the county currently collaborates with the city of Ann Arbor has already saved money, he added, and that means more funding is available for nonprofits.

Wes Prater asked whether it’s possible to measure the cost-savings of the proposed approach. Irwin recalled that Callan had addressed that issue at the board’s Oct. 7 working session, and that she had estimated the current coordination between the county and Ann Arbor had saved several hundred hours in staff time. He noted that although he would not be returning to the board next year, he would expect commissioners to ask those kinds of questions to evaluate the model’s success. [On Nov. 2, Irwin was elected to represent District 53 in the state House. His seat on the county board was won by Yousef Rabhi.]

Kristin Judge said the board took the issues raised during public commentary very seriously, but that she’s confident they’re moving in the right direction. Commissioners will be very engaged in this process, she said, citing Leah Gunn’s leadership as chair of the Urban County. They’ll make sure the money is distributed fairly, she said.

Ronnie Peterson spoke extensively about his concerns with the coordinated model. He said he supported the idea of collaboration, and that the county already does much of that. However, he said that as the architect of the county’s commitment to fund children’s well-being programs, he was concerned that funding decisions would be taken away from the board. [The allocation for the coordinated funding would come from funds set aside in the county budget for children's well-being and human services programs.]

Taxpayers entrust their money to the board, he said, and commissioners are elected to take responsibility for allocating those funds. Priorities for what programs to fund should be set by the board, he added, not a committee or staff. He said he hadn’t seen the priorities, and he didn’t know how much input the board had in setting them. His comments, he added, weren’t criticisms of the United Way or the community foundation – those are good groups, he said.

Barbara Bergman said she supported the effort, but felt a more public process is needed to assess the needs of the community. She suggested that each commissioner host a community forum to get input about the kinds of outcomes that residents would like to see as a result of human services funding. This process should be an ongoing responsibility for commissioners, she said.

Several commissioners responded directly to comments made by Browning during public commentary. During her response, Leah Gunn noted that the coordinated model specifically calls for “capacity building” to be funded by the community foundation and United Way, which would help small nonprofits. These grants would fund projects to support the infrastructure of nonprofits, such as leadership training, accounting or technology systems, or help with strategic planning.

Conan Smith acknowledged that the six issues Browning identified were important – he said the board has been very careful in setting up the model to protect against the potential problems Browning had identified. The board is not pursuing the collaboration just to reduce costs, he said, though that’s an element. The primary goal is to focus first on the community impact. They do want to ensure that the dollars get stretched as much as possible, he added, and the office of community development runs a tight ship in that regard. Funds are going to services, not to pad the staff’s budget.

Smith also responded to concerns about concentrating power in the office of community development, noting that the county was committed to transparency. He pointed to a recent initiative championed by Kristin Judge – OpenBook Washtenaw – as an example of that. Finally, he said it was the board’s responsibility to make the final decisions about recommendations for funding, and that residents should hold them accountable for that.

Peterson spoke again at length, describing several small nonprofits that are doing good work because people in the community banded together to address a problem – these aren’t large institutions, he said, but they deserve funding. Housing should also be a priority, Peterson said. He observed that he couldn’t get support for $300,000 to fund a county land bank, yet the board were willing to put $1 million into this coordinated funding effort. [Peterson has championed the land bank, which was approved by the board at their Sept. 1, 2010 meeting. The mechanism is designed to help the county deal with foreclosed and blighted properties. No funds were allocated to the bank.]

Peterson also said he was very troubled that there was no criteria for evaluating applicants, and repeated his point that the board must be responsible for making allocations. He said he would advocate for agencies that typically didn’t get funding. Despite all these concerns, Peterson said he would support the resolution.

Gunn responded to Peterson, saying she would make sure that Peterson received another copy of the complex evaluation matrix that had previously been distributed to commissioners.

The resolution was voted on as part of the consent agenda, which was moved by Gunn. Before the vote, she noted that Wes Prater had made a friendly amendment to the resolution, which she accepted, that deleted references to specific dollar amounts that have been budgeted for human services. Those specific funding allocations will be made as part of the 2011 budget adjustments, which the board will vote on later this year.

Outcome: The amended resolution to approve the coordinated funding model two-year pilot program passed unanimously.

The Ann Arbor city council subsequently approved the partnership at its Nov. 4 meeting, and the boards of the United Way and community foundation have already approved it as well. The Urban County executive committee is expected to vote on the issue at its Nov. 16 meeting.

Third-Quarter Budget Update and 2011 Budget Changes

The board dealt with three budget-related issues at Wednesday’s meeting: 1) a third-quarter 2010 budget update, 2) an initial vote to reaffirm the 2011 budget, with adjustments, and 3) an update on the planning process for the 2012-2013 budget cycle.

Third-Quarter Budget Update: Staff Presentation

Jennifer Watson, the county’s budget manager, gave an update on the county’s third-quarter budget, looking at the first nine months of the year through Sept. 30. Themes that she had discussed in her second-quarter update, presented at the board’s Aug. 4 meeting, emerged again.

Property tax revenues are still projected to show a $1.77 million surplus compared to what was originally budgeted. However, the district court is now projecting a $553,000 revenue decline compared to what was budgeted – a bigger shortfall than the $465,000 drop that was estimated earlier this year. That drop is due to reductions in local law enforcement and collections, Watson said.

The decision by Ypsilanti Township to cut the number of sheriff’s deputies that it pays for to patrol the township resulted in a revenue loss to the county of $1.07 million this year. That’s been partially offset by about $700,000 in expense reductions, but there’s still a $370,000 shortfall, Watson said. Interest income is also down, she said – there’s a roughly $540,000 shortfall from projections in 2010.

Overall, Watson is projecting a $443,340 general fund revenue surplus for the year – slightly more than the $392,000 that was projected during her second-quarter update.

Looking at expenses, Watson said there’s been a delay in some of the hiring of the new jail staff, which will result in savings for 2010. The administration has been working with all department heads and other elected officials to ensure that projected savings actually materialize, she said. But savings won’t happen in all areas. The district court, for example, had agreed to a 10% lump sum reduction – or $375,000 – but that now looks unlikely to occur this year. District court security costs are about $185,000 higher than budgeted, primarily because of increased use of part-time staff at the Saline court.

One fairly significant uncertainty continues to be the impact of tax appeals that are being made, Watson said. Appeals continue to increase – the county has just over $4 million in potential liability from those appeals, but it’s unclear how much of that amount will actually be awarded, or when.

With expense cuts and a revenue surplus, the county is projecting a total net surplus of $4.5 million for the year. However, the original budget passed by commissioners for 2010 called for carrying over a surplus of $5.289 million into 2011 – they’re still $773,986 short of that goal.

Third-Quarter Budget Update: Commissioner Questions, Comments

Several commissioners asked clarification questions. Wes Prater noted that the reserves to carry forward into 2011 were projected to be $5.289 million, but the total reserves are projected at $6.389 million. What accounts for the difference?

Watson explained that in addition to the carry-forward, there are reserves for other purposes. Those include $200,000 earmarked by the board for community supportive housing initiatives, and $100,000 of funds available to allocate at the discretion of the board.

Jessica Ping wondered why there was an increased need for security at the new 14-A District Court in Saline, which is in the district that she represents. County administrator Verna McDaniel said that court administrators had increased the number of hours during which they wanted security on site. The 7,000-square foot building on Maple Road covers south-central and western Washtenaw County, including the cities of Saline and Milan, the village of Manchester, and the townships of Bridgewater, Freedom, Lodi, Manchester, Saline, Sharon and York.

Kristin Judge asked why the county hadn’t realized the roughly $8 million in labor savings that they had anticipated in 2010 and 2011. Watson explained that when those initial budget projections were made in 2009, the administration was still negotiating with union leaders. The resulting concessions didn’t hit the county’s target of cutting labor costs by $3.5 million in 2010 and $5 million in 2011, she said.

Ronnie Peterson said he wanted to know how the savings in 2010 came about, resulting in the surplus that will be carried forward into 2011. Watson said that they had anticipated a smaller deficit in 2010 than in 2011, but in balancing the budget over two years, they implemented all cost-saving measures in 2010, rather than waiting until next year. [This strategy had been explained to the board when they approved the two-year budget in late 2009.]

2011 Budget Affirmation: Background

The county plans its budgets on a two-year cycle. In late 2009, the board approved the general fund budgets for 2010 and 2011. On Wednesday, commissioners took an initial vote on a resolution making adjustments to the 2011 general fund budget. They also voted to set a public hearing on the budget adjustments during their Nov. 17 meeting, and will take a final vote later this year. [.pdf of 2011 revised county general fund budget]

The revised budget of $98.73 million reflects revenue decreases in several areas, including $1.899 million less in fees and services, and $344,400 less in interest earnings. However, those projected declines in the budget are offset by revenue increases in other areas, including $1.628 million more in taxes and penalties.

Overall, the revised budget of $98.73 million is $241,856 higher that previously projected.

There were several changes to the county’s “outside agency” funding – the financial support it gives to local nonprofits, as well as membership fees and dues paid to various organizations. [.pdf of outside agency funding for 2011] Membership dues for the Southeast Michigan Council of Governments (SEMCOG) dropped from $175,000 to $125,000. Additional funds are now allocated to several groups, including Brown Chapel ($10,000), Legal Resource Center ($4,000), Success by Six ($7,500) and the Dept. of Human Services child abuse prevention program ($50,000). These allocations are separate from the $1.015 million earmarked for human services nonprofits, which in part will be handled through the coordinated funding model discussed during Wednesday’s meeting. That amount remained unchanged.

The budget resolution asked county administrator Verna McDaniel to make suggestions for cutting $1,034,988 out of the original budget of $98,493,155 – with an eye towards hitting the targetted surplus of $5.289 million to carry forward into 2011. The resolution directed McDaniel to bring proposals to the board to balance the 2011 budget no later than the second quarter of 2011.

2011 Budget Affirmation: Commissioner Comments, Questions

Kristin Judge noted that the budget projected an 8.5% decline in property tax revenues, compared to 2010. She asked whether the county was being extra conservative in its projections in that regard. County administrator Verna McDaniel replied that when the board passed the two-year budget in late 2009, it had included a projected 7.5% drop in tax revenues for 2010 – in fact, revenues dropped less than that, she noted. The original two-year budget had projected an 8.5% revenue drop in 2011, and McDaniel said that despite the better-than-expected situation this year, they were still budgeting for the 8.5% decline in 2011. She cautioned that they needed to be conservative in their projections – if they expected higher revenues and that turned out not to be the case, “we could be in a lot of hot water here,” she said.

Conan Smith pointed out that the revised budget included new line items for two teen programs: Washtenaw Area Teens for Tomorrow (WATT) at $50,000, and WATT Neutral Zone at $20,000. He asked why those items had been added. Smith said he was pointing it out because the board has had extensive discussions about the process of allocating funds to outside agencies. McDaniel said that those items had been in the 2008 and 2009 budgets at those funding levels, and it had been an oversight that they’d previously been taken out of the 2011 budget.

Smith also noted that the line item for commissioner expenses might change – Leah Gunn plans to introduce a resolution later this year to eliminate expense accounts for the board. Currently the line item for commissioners in the revised 2011 budget is $526,504 – an increase of $14,031 over the original 2011 budget.

Kristin Judge asked for an explanation about the additional $14,031 in the commissioners line item. Watson said they had previously under-budgeted the amount related to fringe benefits. Judge asked whether that cost would be eliminated if the board cut its pension plan for commissioners. Watson said that it would.

Judge also asked why there was a decrease of $84,458 in the budget for veteran services. Watson said it reflected labor savings similar to those that were implemented in other departments. Another contributing factor was the recent retirement of Mark Lindke, former director of the county’s department of veterans affairs, Watson said.

Wes Prater wanted to know why the revised budget included $1.6 million more in tax revenues. Watson said it was based on the 2010 equalization report, which showed that property tax revenues would be higher than previously anticipated.

Outcome: The board, at its Ways & Means Committee meeting, gave initial approval to reaffirm the 2011 budget, with some adjustments. Commissioners also set a public hearing for Nov. 17 on the revised 2011 budget. They’ll take a final vote to approve the 2011 budget later this year.

After the vote, Prater asked when the resolution would return to the board for a final vote. When he was told that it would likely be on the Nov. 17 agenda, Prater responded by saying that he’d have more questions about it then. They needed to be making reductions, he said, and the budget they’d been given didn’t reflect that.

Smith asked whether it would be a hardship on the administration to delay the vote until early December. McDaniel said that decision rested with the board.

Update on 2012 Budget Planning Process

Conan Smith told his board colleagues that since his last report about the planning process at their Oct. 6 meeting, the county’s budget team has met twice. Their goal is to have a process in place by the time the new board takes office at the beginning of 2011. He reiterated that 80% of the county’s budget is linked to personnel costs, so labor negotiations will be an element. As he had indicated in October, Smith said the county will be looking at structural changes too, which might include eliminating some business units. They’ll be looking for ways to collaborate, both within the county organization and with other governmental units.

The county is projecting at least a $20 million two-year deficit for 2012-13.

Ronnie Peterson said that the budget was the board’s No. 1 responsibility. He noted that when they talk about dealing with the deficit, the implication is that some employees will lose their jobs. But employees have already made sacrifices, he said, and they’d done so willingly. So the board needs to begin its work early, he said, adding that he hoped they’d lock in a timetable for developing the budget faster than they’d historically done.

He advocated for holding a budget retreat, and said that he’d even start attending the board’s administrative briefings, as long as they were held in the boardroom. [On the Wednesday prior to each board meeting, commissioners meet with the administrative staff in a briefing to review the upcoming agenda. These meetings are open to the public – The Chronicle has attended nearly all of the briefings over the past two years – but they are held in a smaller meeting room and not televised on Community Television Network. Peterson does not attend these meetings, arguing that they are not truly public.]

During Wednesday’s meeting, Peterson also suggested that newly elected commissioners be brought into the process as soon as possible, rather than waiting until they are sworn in next year.

Kristin Judge spoke next, saying it was the board’s responsibility to set priorities that would give guidance to the administrative staff in developing the budget. She said she’d like to see discussions start as soon as possible. [Judge had lobbied for a budget retreat during the previous budget cycle – it was held in April 2009 at the Rolling Hills County Park. Though Peterson attended, he had initially resisted holding a retreat, arguing that it should have been held in the county boardroom.]

Judge also said she hoped the county wouldn’t simply shave a little from each department, which she felt would make every department less effective. And she noted that just because a service that the county provided was non-mandated, the employees shouldn’t feel that they’ll automatically be targeted for cuts.

Barbara Bergman expressed her hope that the board would have a fulsome discussion to identify the minimum levels of mandated services, and what they want to do beyond the minimum.

Smith pointed out that the budget team is simply developing a process – no decisions about the 2012-13 budget are being made at this point.

Act 88 Economic Development Tax

Commissioners took a final vote to approve levying an economic development tax of 0.043 mills. Known as the Act 88 millage, it is expected to generate roughly $611,266 annually, and would cost homeowners $4.30 for every $100,000 of a home’s taxable value. Because Act 88 predates the state’s Headlee Amendment, it can be approved by the board without a voter referendum.

As they did when the board took its initial vote on Oct. 20, three commissioners – Kristin Judge, Mark Ouimet and Wes Prater – dissented, and Jessica Ping abstained, citing the fact that a recipient of the funds, Ann Arbor SPARK, is a client of hers. Rolland Sizemore Jr. was absent.

Ping said that although she needed to abstain, she did not support the tax and would have voted against it. There was not additional commentary on the issue from commissioners.

The millage funds will be allocated to the following groups [2010 funding is indicated in parentheses]:

- $200,000 to Ann Arbor SPARK ($200,000)

- $50,000 to SPARK East ($50,000)

- $100,000 to the Eastern Leaders Group ($100,000)

- $144,696 to the county’s department of economic development and energy ($87,000)

- $15,000 to fund a Michigan State University Extension agricultural innovation counselor for Washtenaw County ($15,000)

- $27,075 to fund horticulture programming for the Washtenaw MSUE horticulture educator ($27,000)

- $59,229 for 4-H activities, including allocation to the Washtenaw Farm Council for operating the Washtenaw County 4-H Youth Show & 4-H agricultural programming for the 4-H extension educator ($60,000)

- $15,000 to support the work of the Food System Economic Partnership (FSEP) ($15,000)

Outcome: The board approved levying the 0.043 mill Act 88 tax, with dissent from Kristin Judge, Mark Ouimet and Wes Prater. Jessica Ping abstained, and Rolland Sizemore Jr. was absent.

Changes to Commissioner Pension Plan

The board gave initial approval to transfer pension funds that have accumulated for commissioners in a Money Purchase Pension Plan (MPPP), moving the funds to a “457″ deferred compensation program of their choice before the end of 2010. Commissioners are currently the only county employees who are enrolled in the MPPP – the county pays Prudential $10,000 annually to administer the plan. In addition, the county contributes 7.5% of each commissioner’s salary to the MPPP, or a total of $13,200 annually.

Conan Smith was the only commissioner who addressed this issue. He said that while he understood the rationale for changing the plan, he couldn’t support it. One of the core values of the county is to ensure the stability of retirees, he said. He didn’t feel that eliminating the MPPP was the right approach.

Outcome: Changes to the Money Purchase Pension Plan were given initial approval at the board’s Ways & Means Committee meeting, with dissent from Conan Smith. The board is expected to take a final vote on the proposal at its Nov. 17 meeting.

Present: Barbara Levin Bergman, Leah Gunn, Kristin Judge, Jeff Irwin, Mark Ouimet, Ronnie Peterson, Jessica Ping, Wes Prater, Ken Schwartz, Conan Smith.

Absent: Rolland Sizemore Jr.

Next board meeting: The next regular meeting is Wednesday, Nov. 17, 2010 at 6:30 p.m. at the County Administration Building, 220 N. Main St. The Ways & Means Committee meets first, followed immediately by the regular board meeting. (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public comment sessions are held at the beginning and end of each meeting. [confirm date]

In the original “Coordinated Funding” presentation with explanatory flowcharts (documents), at the bottom parts of both “planning & coordination” “Capacity Building”, we can find “Community Development not expected to directly fund this area, but will help shape decisions about the work and funding of planning collaborative.

We need to make sure that “No fund co-mingled”. That’s the way to safeguard taxpayer’s benefits and observe our federal law.

There are many links about recent facts of United way across the nation can’t be uploaded here. You could search “21 non-profits withdrew from United Way 2009″ or “Michigan Lansing UW was convicted of stealing $1.9 million recently” or “newsweek.com, 15 highest-paid-charity-ceos.

Even local UW has a blurry 990 Form online. We have every evidence to be careful about taxpayer’s money.