Greenbelt Gets Mid-Year Financial Review

Ann Arbor Greenbelt Advisory Commission meeting (Feb. 9, 2011): The main event of the commission’s Wednesday meeting was a review of the second-quarter financial picture. The review was presented by Ginny Trocchio, who works for The Conservation Fund, a consultant the city employs to assist with administering the greenbelt millage. Highlights of the presentation included the calculation of administrative overhead costs – including The Conservation Fund’s work – which are well below the legal maximum of 6%.

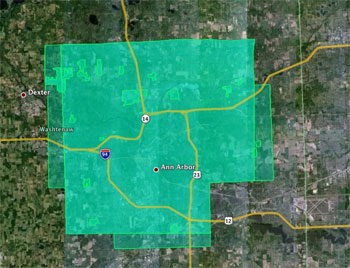

Blobs inside the squarish boundaries represent properties or development rights acquired with greenbelt millage funds. The darker squarish area is the original area where millage funds could be spent. The lighter strips to the east, south, and west were added in 2007. (Image links to higher resolution file.)

Though not included explicitly in the millage language, the city approaches the administration of the millage as a one-third/two-thirds split between a portion for parks and a portion for the greenbelt program. So as part of the financial review, commissioners also looked at current fund balances as analyzed based on the one-third/two-third split between parks and greenbelt projects. Noting that the greenbelt fund balance might be on track to be drawn down before the parks portion is exhausted, commissioners seemed to agree that now is a good time to begin mulling what should happen if that scenario played out. The group discussed holding a joint meeting between the park and greenbelt advisory commissions – their last joint session was held in April 2010.

Also discussed on Wednesday was the scheduling of a first meeting of a commission subcommittee that will look at the question of changing greenbelt boundaries. The boundaries define the region where land or development rights on land might be acquired by the greenbelt program. Any change to those boundaries would ultimately require approval from the Ann Arbor city council.

Millage, Bonds

In 2003, Ann Arbor voters passed a 30-year 0.5 mill tax for land acquisition – called the open space and parkland preservation millage. On the summer tax bill, the line item appears as CITY PARK ACQ. The millage and the programs it supports are managed with support from staff of The Conservation Fund, Ginny Trocchio and Peg Kohring. Though not stipulated in the legal terms of the millage, the city’s policy has been to allocate one-third of the millage for parks land acquisition and two-thirds for the city’s greenbelt program.

To get money upfront for land acquisition, the city took out a $20 million bond in fiscal year 2006. That bond is being being paid back with revenue from the millage. Debt service on that bond so far in FY 2011 year has amounted to $815,288.

Bonds: Down to Zero

The city keeps separate track of the greenbelt fund balances in several ways. One way is to track separately: (1) total fund balances due to accumulated unspent millage revenues; and (2) total fund balances due to proceeds from the $20 million bond issuance.

During the greenbelt advisory commission’s discussion of the financial presentation given by Trocchio, commissioner Mike Garfield called attention to the line in the spreadsheet indicating a total overall fund balance of $11,741,975. Also indicated on the sheet was the fact that all $11,741,975 is due to the separate fund balance in (1). Mike Garfield asked if that meant that the commission had spent down the bond proceeds to zero – yes, answered Trocchio. That was the “first pot of money that we wanted to spend down,” she said. Now the millage revenue is getting spent down, which has also been accruing, she explained. Garfield appeared satisfied: “Good!”

Trocchio’s spreadsheet shows that the bond proceeds fund balance in FY 2008 was $9.6 million, and that it was spent down to $6.9 million the following year, and further to $3.3 million FY 2010.

Millage: Contrast Between GAC and PAC

Another way the finances are tracked for the greenbelt and open space millage relates to the policy of allocating one-third for parks land acquisition and two-thirds for the city’s greenbelt program. This one-third/two-thirds division is reflected in the two different public bodies that make recommendations on use of the funds: the park advisory commission (PAC) for one-third of the money, and the greenbelt advisory commission (GAC) for the other two-thirds.

Jennifer S. Hall and Dan Ezekiel, chair and vice chair of Ann Arbor's greenbelt advisory commission.

Trocchio provided as part of her presentation an analysis of the millage finances, along this one-third/two-thirds division for PAC- and GAC-related money. Commission chair Jennifer S. Hall noticed that the GAC-related fund balances had been spent down steadily – from $12.4 million in FY 2008 to $7.4 million in the current fiscal year. In contrast, the PAC-related fund balance in FY 2008 was $4.4 million, and has remained relatively steady through the current fiscal year.

So Hall asked Carsten Hohnke, who serves as the city council representative to GAC, if the city council had had any dialogue about what to do if GAC-related money were exhausted with PAC-related money still available. Hohnke indicated that there was no conversation about that currently, but said it would be useful to begin that conversation with the park advisory commission.

Hall said she felt it would be wise to have the discussion before a great disparity arises between the GAC-related fund balance and the PAC-related fund balance. Garfield reminded his colleagues that the two-thirds/one-third split is not a legal division. [It's not part of the millage language.] It’s simply a working understanding, he said, so having a dialogue makes sense.

A consensus seemed to emerge among commissioners that it would be useful to have a joint GAC-PAC meeting to go over the money question – along the lines of a joint meeting the two bodies had convened on April 6, 2010. Ezekiel recalled that last year only five GAC members were able to attend the joint meeting, which meant that GAC could not go into closed session, which would have been useful on that occasion. [GAC meetings often include closed sessions to discuss land acquisition; PAC handles most of its land acquisition discussions during closed sessions at the meetings of its land acquisition committee (LAC), which includes all PAC members. Discussions of land acquisition are one of the legitimate reasons for a public body to meet in a closed session under the Michigan Open Meetings Act.]

On Wednesday, GAC commissioners expressed an interest in ensuring that a scheduled date for a joint meeting would accommodate as many commissioners as possible. Laura Rubin, for example, said she thought the proposed April 5, 2011 date fell during the Ann Arbor public schools break, and she could not commit to being there on that day.

Details of Financial Picture

Trocchio walked commissioners through the most recent numbers as of Dec. 31, 2010, which marks the midway point through the fiscal year. Millage proceeds to date stand at $2,175,804. [That is comparable to the entire year's collection of millage funds last year and in previous years. In FY 2010, for example, $2,262,001 was collected. Of the two tax bills that property owners receive, the greenbelt tax appears only on the summer tax bills. So the current figure is likely to be very close to the final tally.]

Trocchio noted that the investment income for FY 2010 now reflected a corrected number: $492,576. In response to a commissioner question, she said that the previous number – from unaudited financial statements – had been around $130,000.

[The issue had arisen at the commission's Sept. 8, 2010 meeting, when commissioners had expressed concern about the unaudited figure of $130,011 for investment income for FY 2010. They'd received an explanation from city treasurer Matthew Horning at their Nov. 10, 2010 meeting:

Regarding concerns over investment income, Horning said the good news is the amount reported to GAC in September was an unaudited figure – the final number will be much higher, at about $492,000. To explain the difference, Horning said that at the end of the year, the city does a reclassification entry, required by the Government Accounting Standards Board (GASB). This mark-to-market accounting requires that the city record the actual market value of its investments at the end of the fiscal year – that is, what the value of their investments would be, if liquidated. If it’s worth greater or less than the book value of the investments, you have to record that difference, Horning said.

At the end of the last fiscal year – on June 30, 2010 – the city made a mark-to-market entry of about $362,000 for greenbelt investment income. That figure isn’t reflected in the financial statement that had been presented to the commission, Horning said. So the total investment income is actually about $492,000, he said.

The FY 2010 investment income presented by Trocchio on Wednesday showed $492,576. That's still a decrease from $815,261 the previous year.]

The investment income to date in FY 2011, Trocchio said, is $88,148 and that will be corrected in the same way last year’s figure was adjusted.

Ginny Trocchio gave the mid-year financial update to the greenbelt advisory commission, which met on the seventh floor of the City Center building.

Federal grant reimbursements stand at $1,235,183 she said. Since Dec. 31, 2010, an additional $675,000 worth of federal grants had been received for the Honke and Whitney properties that had been closed on. The grant reimbursements, together with investment income and millage proceeds, showed a combined net income of $3,499,134.

The millage program expenditures to date in this fiscal year total $6,665,645, with $5,682,035 going towards greenbelt projects and $983,609 going towards park projects.

Commission chair Jennifer Hall pointed out that of the roughly $5.6 million that had been spent, almost $2 million was reimbursed with federal grants.

Total administrative expenditures, reported Trocchio, stand at $66,358 year-to-date. Administration costs include staff time for Trocchio and other Conservation Fund staff, as well as personnel and IT costs from the city. The cost of all projects, plus debt service and administrative costs, bring total expenditures so far in FY 2011 to $7,547,290. The net change to the fund balance is negative: $4,048,156.

Commissioner Laura Rubin drew out the fact that the mid-year numbers for some categories of expenditures and revenues made sense to measure against a 50% benchmark, while others did not. She asked if the $7 million expenditures so far meant that potentially for the whole year they could be looking at $14 million in expenditures. Trocchio replied that at year’s end last year, they’d had a lot of closings. This year she anticipated perhaps two additional closings before the end of the fiscal year and then perhaps one at the end of the calendar year.

As far as expenses lining up with the mid-point of the year, Carsten Hohnke noted that administrative expenses appeared to be tracking at or below the annual run rate for those types of expenses. Last year for the entire year, there were $178,892 worth of administrative expenses, compared to a mid-year number of $66,358 for this year. Later in the presentation, Trocchio showed how the administrative costs over the life of the millage – which are limited by ordinance to be no greater than 6% of revenues – are now tracking well under that number. Starting in FY 2005, those percentages each year have trended as follows: FY05, 7.6%; FY06, 5.1%; FY07, 2.0%; FY08, 3.8%; FY09, 4.3%; FY10, 3.5%; and so far in FY11, 0.9%.

As Trocchio worked her way through the details of each greenbelt property, which included endowments, Hall and Ezekiel both indicated they felt it was very important that these endowments be kept up to date. There’s now a separate line item for the open space endowment fund balance, which currently stands at $390,000.

Boundary Issue

At its Nov. 10, 2010 meeting GAC had established a subcommittee to consider the question of whether to recommend an expansion of the greenbelt boundary – the area where the greenbelt millage can be used to acquire land or development rights to land. Since the millage was approved by voters in 2003, the boundary has been previously expanded on one occasion, in August 2007. [Previous Chronicle coverage: "Time to Change the Greenbelt Boundary?"]

GAC vice chair Dan Ezekiel, who’s leading the committee, was keen to stress at Wednesday’s meeting that GAC did not have the authority to expand the boundaries. That power rests with the city council. The issue came up at Wednesday’s meeting only in the context of a brief conversation about the scheduling of the subcommittee’s first meeting, which has not yet taken place. They’d planned to meeting the following day, Feb. 10, at 4:30 p.m. But Catherine Riseng told her colleagues that although she’d previously been available at that time, her schedule had changed.

Commission chair Jennifer Hall suggested that because this would be the first meeting, it might be good to go ahead and meet with the members who were available – “to get the ball rolling.” Ezekiel asked Riseng if she’d be willing to provide some input via email. Peg Kohring, of The Conservation Fund, told commissioners that it would not be an easy conversation.

When it became apparent that some of the communication about the meeting and the materials related to it had been sent only to a subset of commissioners, Hall asked that communication about future meetings be addressed to all commissioners. Riseng ventured that she thought the subcommittee was, in any case, a committee of the whole. Hall responded by saying she thought it was a committee of the all-who-are-willing.

Present: Dan Ezekiel, Mike Garfield, Jennifer S. Hall, Carsten Hohnke, Catherine Riseng, Laura Rubin, Gil Omenn

Absent: Peter Allen, Tom Bloomer

Next meeting: Wednesday, March 9 at 4:30 p.m. at the Washtenaw County administration building, 220 N. Main, Ann Arbor. [confirm date]