Washtenaw County’s Taxable Value Falls

Washtenaw County board of commissioners meeting (April 20, 2011): The county’s finances were the focus of Wednesday’s meeting, which included a presentation of the annual equalization report. That report is the basis for determining taxable value of property in the county, which in turn indicates how much tax revenue is collected by local taxing entities. In the world of municipal finance, the equalization report is a very big deal.

Raman Patel, director of Washtenaw County's equalization department, presented his annual report at the April 20, 2011 board of commissioners meeting. (Photos by the writer.)

Raman Patel, director of the county’s equalization department, told commissioners there was a 2.85% drop in taxable value this year. That’s an improvement over last year’s decline, when taxable value of property in the county fell 5.33%. It’s also a smaller decrease than was projected when preparing the county’s 2011 budget, which was built on the assumption of an 8.5% drop.

The impact on local taxing entities varies. The city of Ann Arbor saw a 1.21% drop, for example, while taxable value in Ypsilanti Township fell 11.39%.

The report also highlighted a shift in the county’s largest taxpayers. Just a few years ago, the top three taxpayers were Pfizer, General Motors and Ford. Now, they are Detroit Edison, McKinley Associates and Toyota.

The meeting also included a presentation of the 2010 comprehensive annual financial report, or CAFR. Kelly Belknap, the county’s finance director, highlighted the fact that the county ended 2010 with a $5.5 million general fund surplus – slightly more than the $5.3 million calculated to carry over into the 2011 budget. Mark Kettner from the accounting firm Rehmann Robson, which conducts the county’s audit, was also on hand to give a brief report on the 2010 audit.

In other business, the board approved an amendment to the brownfield plan for BST Investments in Dexter, and set two public hearings for their May 18 meeting related to brownfield plans that are being proposed: (1) Packard Square, a complex off of Packard Street on the site of the former Georgetown Mall; and (2) the LaFontaine Chevrolet redevelopment at 7120 Dexter-Ann Arbor Road in Dexter.

The board also authorized the office of the water resources commissioner to take court action in setting winter lake levels at Portage and Baseline lakes. The office operates the dam at Portage Lake that controls those levels.

During their time for communications, commissioners raised several issues, including: (1) a call to support the special education millage renewal, which is on the May 3 ballot; (2) discussions about consolidating the office of community development, ETCS (the employment training and community services department) and the economic development & energy department; and (3) what to do about the growing deer population.

Wednesday’s meeting began with a tribute to the long-time director of the Washtenaw Community Concert Band, Jerry Robbins.

Recognition for Jerry Robbins

Since 1998, Jerry Robbins has been conductor of the Washtenaw Community Concert Band, formerly the Ypsilanti Community Band. He was honored at Wednesday’s meeting for his work – Robbins is stepping down from the position. He’s been with the group since 1993, starting out as a trombone player until the previous director retired.

Jerry Robbins, long-time director of the Ypsilanti Community Band – now called the Washtenaw Community Concert Band – was honored at the April 20, 2011 county board of commissioners meeting.

Commissioner Dan Smith read a resolution honoring Robbins, commending him for revitalizing the program, ensuring its financial stability, and forming several other groups within the band, including chamber ensembles, jazz ensembles, and a “Town Band” that’s been invited to perform at the annual Association of Concert Bands convention. Smith also noted that Robbins had served in another leadership role – as dean of Eastern Michigan University’s College of Education from 1991 to 2004.

Joe Burke, an Ann Arbor resident and the county’s chief assistant prosecuting attorney, spoke about his experiences with Robbins in the band. Burke joined the band in the same year as Robbins. But while Burke said he was happy just to play his trumpet, Robbins wanted more. Robbins’ vision is that “music needs to be accessible to everyone in this county,” Burke said. It’s accessible to the public – all concerts are free – and accessible to players, because there are no auditions. Yet the quality of music is kept high, and the group has a lot of fun, Burke said.

The Chronicle observed both those aspects at a rehearsal of the band in November 2008:

When conductor Jerry Robbins took the podium for the rehearsal of the full band, he led the group through their material for the Dec. 11 concert, but it was not without frequent interruption for fine tuning, or even more general tuning. Robbins had told the musicians at the beginning of the evening, “Watch for frequent stops!” After several passes through a particularly difficult section in the Saint-Saens piece, he offered some encouragement: “This is the hardest piece of music I’ve ever put in front of you!”

…

On one occasion, a gentle reminder from Robbins that “accidentals hold through the entire measure” yielded incremental improvement and the encouragement, “It’s getting better each time through. It’s better.” But Robbins also made it clear that it needs some work before Dec. 11: “It’s still not right, and it’s not good enough.”

Burke invited the public to give Robbins a sendoff at a free concert on Thursday, April 28 at 7:30 p.m. at the Washtenaw Community College’s Towsley auditorium. “Come join us,” Burke said. “He’s a great guy.”

Financial Report, Audit

The meeting included several reports related to the county’s finances. Carla Sledge, Wayne County’s chief financial officer and past president of the Government Finance Officers Association, presented the county with a certificate of achievement for excellence in financial reporting for its fiscal year ending December 2009. The award is based on the county’s timely completion of its state-mandated comprehensive annual financial report, or CAFR. This is the 20th year that Washtenaw County has received a certificate of achievement. “You’ve done it again,” Sledge said.

Board chair Conan Smith noted that “our superb staff did this, in spite of the board of commissioners.”

Comprehensive Annual Financial Report (CAFR), Audit

Kelly Belknap, the county’s finance director, gave a brief report on highlights from the 2010 CAFR. [.pdf file of 2010 CAFR and link to county website with CAFRs from previous years.]

The general fund finished the year with a surplus of $5.5 million, she noted. It was slightly more than the $5.3 million that had been budgeted to carry over into 2011. As of Dec. 31, 2010, the county’s unreserved fund balance stood at $15.3 million. That represents 16.2% of the county’s annual general fund expenditures.

Belknap also provided more detailed handouts listing the county’s fund balances at the end of 2010, as well as its long-term liabilities – from bonds and other debt, and retirement benefits. Debt for the county has grown from $81.469 million in 2006 to $116.490 million at the end of 2010. The bulk of that relates to general obligation bonds, which totaled $75.565 million at the end of 2010, as well as a dramatic increase in delinquent tax notes, which grew from $12 million in 2006 to $26 million in 2010. [Excel files of fund balances and long-term liabilities]

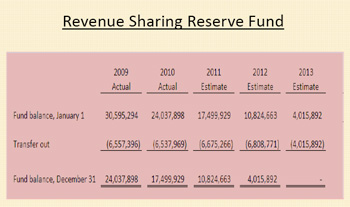

Chart showing the county's state revenue-sharing reserve fund, which will be depleted in 2013. (Links to larger image)

Belknap reminded the board that the county’s state revenue-sharing reserve fund would be depleted in 2013. This year, the county plans to use $6.675 million from that fund, leaving a balance of $10.824 million.

Turning to the county’s bond ratings, Belknap reported that the county has an AA+ rating from Standard & Poor’s and an Aa2 rating from Moody’s. County staff met with representatives from Standard & Poor’s earlier in the day, Belknap said, to discuss the county’s delinquent tax bonding. It was a positive meeting, she said, and they’ll be receiving an updated bond rating soon.

At the board’s Feb. 16, 2011 meeting, county treasurer Catherine McClary had given a report on plans to fund delinquent taxes, and commissioners approved a request to bond for that purpose. From Chronicle coverage of that meeting:

McClary reported that the amount of delinquent taxes turned over to her office for collection has more than doubled in the past seven years. For the last two years, the county was not able to self fund the delinquent taxes. Last year, there was about $29 million in delinquent taxes, and she expects a small increase this year. But the request is to borrow the same amount as last year – an amount not to exceed $50 million. She commented that the figure “takes my breath away.” One change is that interest rates on the bonds will be higher this year than last year, due to the tightening credit markets.

McClary explained that every year, the treasurer’s office sets up a separate delinquent tax revolving fund, where money is deposited as the delinquent taxes are collected. If the county is unable to collect the taxes by year’s end, they charge back that uncollected amount to the taxing jurisdiction, charging them the same interest that’s charged for the bonds – last year, interest was around 2%, McClary said.

McClary characterized delinquent taxes as a leading economic indicator. For residential properties, it’s starting to level off, she said, but there are increases in commercial properties, and especially in undeveloped vacant land.

…

There is interest charged on the delinquent taxes, she said – 1% per month for the first year, and 1.5% per month for the second year, plus a 4% administrative fee. Those funds are also deposited into the delinquent tax revolving fund. When the bonds are paid off, any remaining money in the revolving fund is transferred to the county’s capital projects fund, to be used as the board and administration sees fit, McClary said. Last year, $5.5 million was transferred – double the amount that had been budgeted.

At Wednesday’s meeting, Belknap commented on the reputation that Washtenaw County has developed in the financial community regarding its early completion of the CAFR. Two decades ago, it was typically finished in December – since 1997, the report has been done by April.

Belknap then turned the podium over to Mark Kettner from the accounting firm Rehmann Robson, which conducts the county’s audit. Kettner said he expected the 2010 CAFR would also receive an award.

As he has in years’ past, Kettner noted that the audit gives an unqualified – or “clean” – opinion about the county’s financial statements. It’s an opinion on those statements, he said, not an opinion about the county’s financial controls or conditions. He noted that the county plans to hire someone to do an internal audit, which will analyze those controls. [.pdf of Rehmann Robson audit management letter]

He suggested that commissioners look at the 10-year trending data that’s provided in the audit. In challenging times like these, he said, it’s especially important to be aware of financial trends.

Kettner said there were a few minor items that they reported to administration, who will be following up on them.

Financial Report, Audit: Commissioner Comments

Kristin Judge noted that there was some evidence of internal financial control issues cited in the audit, indicating the need for the internal audit the county will be conducting. She also said it would be helpful to have the issue of retirement benefit liabilities discussed in a future working session. Judge thanked Kettner for providing trend data. [.pdf of trend data from 2010 CAFR]

A sampling of that trend data includes:

- Total full-time employees in county government: 1,486 in 2001 compared to 1,381 in 2010 – a decline of 125 positions, or -8.4%

- General fund undesignated fund balance: $5.759 million in 2001 compared to $15.3 million in 2010 – a 165% increase.

- General fund revenues: $74.195 million in 2001 compared to $91.632 million in 2010 – an increase of 23.5%. General fund revenues reached a peak in 2007, at $99.476 million.

- Total outstanding debt for governmental activities (includes general obligation bonds, capital leases and loans): $38.45 million in 2001 compared to $76.65 million in 2010 – a 99% increase.

Wes Prater asked what formula is used to calculate the county’s liabilities from pending lawsuits. Kettner said there isn’t really a formula. The county is self-insured, he noted, and hires a third-party risk management expert to look at that issue. That person would analyze the liability by looking at claims against the county, compared to its history of litigation. For the audit, Kettner said they get a letter from the county’s corporation counsel, Curtis Hedger, which summarizes claims that are pending or that have been made, and whether those are covered. The auditors review that information and discuss with county management whether further disclosures are necessary, he said.

Prater then clarified that some of the fund balances had been consolidated in the report that commissioners were given. He said it would be helpful to have a footnote about that, so that it didn’t seem as though those funds simply disappeared.

Rob Turner asked whether Kettner had a recommended percentage for the county’s fund balance. Kettner said that the auditing firm didn’t make a recommendation, but that his personal guideline would be at least 10% of expenditures. If you go below that, it might be a reason for concern, he said. [According to the CAFR, the county's policy is not to fall below 8% of expenditures.]

Judge noted that the $15.3 million fund balance at the end of 2010 included the $5.5 million surplus that was already in the 2011 budget. So the actual fund balance is around $10 million, she said – or closer to 10% of expenditures. She said she just wanted to make people aware of that.

Judge then asked who is responsible for oversight when the county gives its full faith and credit to allow other local municipalities to issue bonds. How does that impact the county’s credit rating?

County administrator Verna McDaniel explained that after board approval, the administration monitors those bonds with its in-house counsel. Other counties have had problems with municipalities being unable to make bond payments, she said, but so far Washtenaw County has been fortunate. There is one situation that’s a concern, McDaniel noted, but they’re monitoring it closely.

[By way of background, Sylvan Township has been struggling with $12.5 million in bonds issued to build a water and wastewater treatment plant intended to serve future development. The plan was to use revenue related to that development – from connection fees to the system – to cover the bond payments. However, the economy soured and development hasn’t materialized. Last year, the county board approved a bond refunding in order to restructure the debt and lower the township’s bond payments.]

Calculating the County’s Taxable Value: Equalization Report

Commissioner Rolland Sizemore Jr. introduced Raman Patel, director of the county’s equalization department, by teasing him: “You’ve got three minutes!” The line, an allusion to the time allotted for public commentary, got a laugh from commissioners and staff in attendance – Patel’s detailed annual reports take considerably longer, and Wednesday’s was no exception.

Equalization: How the Equalization Process Works

The state-mandated equalization process runs throughout the year, as both the county and local assessors within each municipality examine the value of land and other property, such as buildings. Local assessors turn their findings over to the county, which then conducts independent assessments based on sales studies and physical appraisals. Next, the county’s equalization staff looks at how their findings compare with the local assessors’ findings. (The county has authority to request that local assessment rates be altered, if it considers them to be too high or too low.)

After this “equalization” occurs, the local municipalities send out notices to each property owner in their jurisdiction, stating each property’s assessed value as well as its taxable value. If property owners disagree, they can appeal that assessment. After appeals are ruled on, the county uses that data for its equalization report.

Taxable value is a state-mandated formula, and is the lower of two figures: (1) a parcel’s equalized (assessed) value, or (2) a capped value calculated by taking last year’s taxable value minus any losses (such as a building being torn down), multiplied by 5% or the rate of inflation (whichever is lower – this year inflation is 1.017%), plus the value of any additions or new construction.

If the property changes hands, taxable value is reset at its equalized value.

Taxable value is used when calculating taxes for the county, as well as its various municipalities and other entities that rely on taxpayer dollars, including schools, libraries and the Ann Arbor Transportation Authority, among others.

Equalization: Details of the 2011 Equalization Report

On Wednesday, Patel first covered the equalization process, then discussed implications for the county’s taxable value. [.pdf file of 2011 equalization report]

He began by noting that this is the county’s 53rd annual equalization report, and the 40th one that he’s worked on for the county. He introduced and thanked the department’s staff who were attending the meeting, and noted that one of them – Fran Patton – would be retiring soon after 17 years with the county. He also thanked the local assessors in each municipality and the local board of review for their work.

Patel reminded the board that they were being asked to approve the county’s equalized value, not its taxable value. The equalization report, after it’s approved, must be submitted to the state.

Highlights from the report:

- In 2011, the county’s overall equalized value dropped 4.82%, but that’s less of a drop than the 7.22% decline in 2010. The last time the county saw an increase in equalized value was in 2007, when it rose 4.23%.

- Some types of property saw greater declines than others. Commercial property showed a 9.5% drop in equalized value, while equalized value for industrial property dropped 11.82%. The value of residential property showed some signs of recovery, dropping 2.74% compared to a 5.69% drop in 2010. Residential property accounts for about 65% of all property in the county.

- The value of new construction over the past five years has dropped sharply, from $578.89 million in 2007 to $239.512 million in 2011.

- In years past, the largest taxpayers were Pfizer, General Motors and Ford Motor Co. Of those, only Ford remains in the top 10 list for 2011. Others are the real estate and property management firm McKinley Associates, Detroit Edison, Toyota, MichCon, Domino’s Farms, Briarwood Mall, International Transmission, Hyundai and Meijer.

- The Board of Review received 2,656 appeals of assessments, and granted 738 – for a decrease of about $13 million in taxable value. Forty-nine poverty exemptions were requested, and 31 were granted.

Patel noted that Washtenaw County is doing better than surrounding areas – Oakland, Genesee and Wayne counties all saw significantly sharper declines in property value. This county is somewhat insulated, he said, thanks to the stability provided by the University of Michigan and the area’s hospitals.

Patel also noted that the gap between equalized and taxable values is narrowing. This is important because when equalized value and taxable value are the same for a property – and if that property’s assessed value continues to fall – then its taxable value falls in tandem with that assessed value. And that means lower revenues for local municipalities. This year, 65% of property in the county – about 91,000 parcels – has equal taxable and assessed values.

Patel also talked about the possible impact of a corridor improvement authority (CIA) being considered for Washtenaw Avenue. [See Chronicle coverage: "What Does Washtenaw Corridor Need?"] There are about 600 parcels in the corridor between Ann Arbor and Ypsilanti, Patel said – if the corridor authority is approved, revenues to local taxing entities like the county will go down. However, he said, if a special assessment is used instead, property owners would pay the additional assessment and tax revenues wouldn’t be diverted.

Equalization: So What’s the Taxable Value?

The equalization report is used as the base for calculating taxable value – which determines how much tax revenue is collected by local municipalities. For 2011, taxable value in the county has fallen 2.85% to $14.08 billion. That’s an improvement over last year’s decline, when taxable value dropped 5.33%.

It’s also a smaller decrease than was projected when preparing the county’s 2011 budget. The budget was approved with a projection of $59.205 million in tax revenues. But actual revenues, based on 2011 taxable value, are now estimated at $62.878 million. [.pdf file showing 2011 taxable value for each taxing authority – including schools, libraries, etc. – in Washtenaw County]

Nearly all jurisdictions saw declines in taxable value. The sharpest drop was in Ypsilanti Township, where taxable value fell 11.39% compared to 2010. A few areas – including Salem Township, Webster Township and York Township – registered a modest increase in taxable value, but less than a half-percent. [.pdf file showing 2011 taxable values for municipalities, compared to 2010] [.pdf file showing 2011 taxable values for school districts, compared to 2010] [.pdf file showing 2011 taxable values for libraries, villages and authorities, compared to 2010]

Equalization: Commissioner Comments

Several commissioners had questions and comments after Patel’s presentation.

Conan Smith asked whether the county is likely to see an increase in assessment appeals from property owners. Patel said last year, appeals totaled about $1 billion in property value, and this year that number is closer to $900 million. Patel said it tells him there’s still a problem in the valuation.

Smith wondered whether the board should have a discussion about that process, to understand its potential impact on the budget. Patel noted that two years ago, Bob Guenzel – the county administrator at the time – asked him to form a committee and look at that question. That was how Guenzel developed the different projections of tax revenues. Patel reminded the board that they had chosen the worst-case scenario on which to base their budgeting – forecasting an 8.5% drop in taxable value for 2011. [See Chronicle coverage: "County Board: Plan for the Worst, Hope for the Best"]

Kristin Judge highlighted the impact of tax-capture districts – downtown development authorities (DDAs), tax increment financing authorities (TIFAs), and local development finance authorities (LDFAs). Because of taxes captured by those entities, the county receives $2.145 million less in tax revenues. She said when the county board is asked to approve these kinds of entities, the resolution needs to indicate what the impact will be on the county’s tax revenue.

Yousef Rabhi noted that the brownfield TIF they were being asked to approve that evening – for a BST Investments project in Dexter – did include a budget impact statement. He said that in cases like that, eventually the county would see additional tax revenues from the redevelopment.

Wes Prater pointed out that for tax-capture districts in local municipalities, the county has the option of opting-out – in that case, they would continue to receive full revenues. However, there’s a 60-day window to make that decision, and often they don’t get information about it in timely way, he said. As a result, he added, the long-term revenues that the county is missing “is really having an effect on the budget, I think.”

Rolland Sizemore Jr. asked that Rabhi – who’s chair of the board’s working sessions – add that topic for a future session.

Patel noted that it’s a political decision to be made, and that there’s no uniformity among jurisdictions about how to handle these tax-capture districts.

Prater said it’s been the county’s longstanding policy to do nothing – not to opt out. That’s ok, he said, if that’s what they decide to do. But it’s worth discussing.

Leah Gunn, who’s also a board member of the Ann Arbor DDA, noted that the Ann Arbor DDA was founded in 1982 and that the county opted in. The DDA captures only the value of new construction – beyond that, the added value of development goes back to the local taxing units, including the county. The county has benefited from that development and increased tax revenues over the years, she said.

Ronnie Peterson suggested inviting other local governments to participate in any working session they might hold on this issue. The purpose of these tax-capture districts is economic development, he observed – it’s not just a giveaway.

Commissioner Rob Turner, left, talks with Bob Tetens, director of the county's parks and recreation department, before the April 20, 2011 board of commissioners meeting.

Conan Smith drew attention to the decline in value for commercial and industrial properties – falling 9.5% and 11.82%, respectively. It’s a strong argument for maintaining investments in economic development, he said. He added that he wasn’t suggesting the county take the lead in that, but they needed to stay engaged.

Rob Turner observed that industrial businesses are often treated like the ugly stepchild, but it’s an important sector of the local economy. Auto suppliers in particular are struggling, he added, and it’s important to find ways to help them thrive.

Barbara Bergman told Turner that even though she’s a Birkenstock-wearing Ann Arbor commissioner, she understands that industrial businesses are important to the economy. Rabhi added that a symbol for industry is part of the county’s seal – it’s integral to who we are and who we’ve been, he said.

Several commissioners thanked Patel and his staff for their work on the equalization report, and gave them a round of applause.

Outcome: The board voted unanimously to accept the county’s 2011 equalization report.

Brownfield Projects

Several items during Wednesday’s meeting related to brownfield redevelopment projects.

Brownfield: BST Investments

The board gave initial approval to a brownfield plan amendment for the BST Investments redevelopment project, located at 2810 Baker Road in Dexter. Wednesday’s meeting also included a public hearing on the project – no one spoke, but board chair Conan Smith took the opportunity to pound his gavel with dramatic flair to open and close the hearing.

The BST project involves demolishing three buildings on the site and constructing a new commercial complex of three buildings. The $14 million project is estimated to retain 40 jobs and add 80 new jobs.

The revised plan was previously approved by the Washtenaw County brownfield redevelopment authority at its March 10, 2011 meeting, when the authority also approved an interlocal agreement to transfer tax increment financing (TIF) revenues from the Dexter Downtown Development Authority. The amended plan was approved on Feb. 28, 2011 by the Dexter Village Council.

An estimated total of $312,000 in local and state taxes will be captured for eligible activities, administrative costs, and the Washtenaw County Brownfield Redevelopment Authority Local Site Remediation Revolving Fund over a projected four-year period. Of this total, $24,000 will be used for the county brownfield program’s administrative fees, and $48,000 will go into the Local Site Remediation Revolving Fund. After the project is completed and all TIF activities are fulfilled, an estimated increase of $162,103 annually would be distributed among the Dexter DDA and other taxing jurisdictions. According to a memo accompanying the resolution, the Washtenaw County annual millage payment from the property would increase from roughly $5,397 to $14,222.

Commissioner Kristin Judge commented on the estimated increase in tax revenues. She noted that the county had several brownfield approvals coming up, and asked Raman Patel – the county’s equalization director – to comment on the impact to revenues. Patel said there is a short-term impact, but if the redevelopment is successful, “it’s better for us.”

Judge then said she knew the state legislature is considering a change to the brownfield tax credits, and wondered how that change might impact these projects. Brett Lenart from the county’s economic development and energy department fielded that question, reporting that there are no changes planned to the tax increment financing (TIF) aspect of brownfield redevelopment. What’s being considered are changes to the Michigan Business Tax credits that have been available for these projects, he said.

Commissioner Yousef Rabhi noted that BST was asking for TIF because they didn’t want to rely on getting state tax credits.

Outcome: The board unanimously gave initial approval the brownfield plan amendment request for the BST Investments redevelopment project. Commissioners will likely vote on final approval at their May 4 meeting.

Brownfield: Hearings for Packard Square, LaFountaine

Commissioners set two public hearings for their May 18 meeting related to brownfield plans that are being proposed for developments in the county: (1) Packard Square, a complex off of Packard Street on the site of the former Georgetown Mall, and (2) the LaFontaine Chevrolet redevelopment at 7120 Dexter-Ann Arbor Road in Dexter.

The Packard Square site plan, approved by the Ann Arbor planning commission in March, calls for 230 apartments and 23,790-square-feet of retail space in a single building. The project will entail an estimated investment of $48 million and is projected to create 45 new jobs. The brownfield plan would allow the developers to use tax increment financing to pay for environmental due diligence, contaminant removal, demolition, lead and asbestos abatement, site preparation activities and new public infrastructure development.

LaFontaine Chevrolet is redeveloping its site into a new LEED-certified Chevrolet dealership – an estimated $5.3 million investment that will include contamination removal, demolition, asbestos and lead abatement. The project is estimated to retain 74 jobs and add 50-100 jobs. The brownfield plan would allow the owner to use tax increment financing for contaminant removal and other environmental response activities, demolition, and lead and asbestos abatement.

Winter Water Levels for Portage, Baseline Lakes

Janis Bobrin, the county’s water resources commissioner, attended Wednesday’s meeting and spoke briefly about a request for the board to authorize her department to take action in Washtenaw County Circuit Court to establish winter levels for Portage and Baseline lakes, which are located in Washtenaw and Livingston counties. The court action would allow the water resources office to continue its current practice of lowering lake levels in the winter.

Her department operates the dam at Portage Lake that controls those levels. She noted that a detailed report was provided in a cover memo to the resolution. [.pdf of cover memo on winter levels for Portage and Baseline lakes]

She emphasized that the county is not incurring any costs for this action. The legal costs for obtaining a court order will be paid via a special assessment district that is already established by the court. There are 539 parcels in the special assessment district in Washtenaw County, which contains about 50% of the special assessment roll.

According to the cover memo, since the 1960s lake levels have been lowered 12-15 inches from November to mid-April, to minimize shoreline ice damage. However, there is no legal requirement for this lowering to occur – this fact was brought out in talks about the dam and lake levels with the officers of the Portage, Base, and Whitewood Homeowners Association (PBWOA).

Because the lakes are in two counties, both the Washtenaw and Livingston boards of commissioners must approve the legal action. Washtenaw County’s approval is contingent on approval by Livingston County – that county’s drain commissioner supports the action. State law requires that the levels be officially set by the circuit court, and because the Washtenaw County Circuit Court issued the original order establishing the normal lake level, it has continuing jurisdiction to set a winter lake level.

Commissioner Rolland Sizemore Jr. asked Bobrin whether she had consulted with the commissioner whose district includes the lakes. Rob Turner, who represents District 1, reported that Bobrin had talked with him about the issue.

Outcome: The board unanimously voted to authorize the office of the water resources commissioner to take court action establishing winter levels for Portage and Baseline lakes.

Appointments

Without discussion, commissioners voted unanimously to appoint Patricia Piechowski-Whitney to the county’s Dept. of Human Services board for a three-year term expiring Dec. 31, 2013.

Misc. Commissioner Communications

Several commissioner raised issues during the time set aside for items for current and future discussion.

Communications: Department Consolidation

Ronnie Peterson asked when the board would be holding a working session about consolidating the office of community development, ETCS (the employment training and community services department) and the economic development and energy department. Yousef Rabhi, who chairs the working sessions, said they’ll have that discussion in May.

Commissioner Ronnie Peterson, right, talks with Tony VanDerworp, head of the county's economic development and energy department.

Peterson said the citizens who serve on advisory boards for these departments should be included in the discussion, especially if the boards will also be reorganized. He indicated it would be good to discuss this reorganization in the public eye.

Conan Smith said at this point, there’s no plan to reorganize the boards – though the boards themselves might restructure their bylaws, if the county departments are consolidated. [The boards that would be affected by departmental restructuring include the workforce development board, the community action board, and the Urban County executive committee.]

Prater acknowledged the need for some adjustments – for example, it seems like it’s hard for members of the workforce development board to find time to attend meetings, even though they’re scheduled in advance, he said.

Prater also expressed concern over one project in particular that he felt hadn’t received sufficient input from the community action board. The Sycamore Meadows apartment complex in Superior Township, which is owned by a company based in Dallas, received federal funding via the county for renovations, he said. About $1.25 million was awarded to this project, which is owned by an out-of-state landlord and has about 260 units of mostly Section 8 housing, he said. There are problems with the landlord, Prater noted, and he felt that some residents have been abused.

Leah Gunn said she’s talked with Bill McFarlane, the supervisor for Superior Township, who has advocated for this project. McFarlane has been working with the landlord, who has paid for extra services like a part-time sheriff’s deputy to patrol the area. Any problems with the complex should be referred to McFarlane, she said.

Rolland Sizemore Jr. weighed in, saying he had toured the property and that the project was done well.

Prater noted that while an out-of-state company is getting funded, local homeowners who need help lowering their utility bills can’t get funding for insulation and other renovations. “That’s what upsets me,” he said.

Communications: Awards, Recognition

Kristin Judge pointed out that a recent report on program outcomes for children in Head Start showed that they were meeting and exceeding expectations in several areas. She also thanked Eastern Michigan University for their partnership with the county’s Head Start program.

Judge also congratulated Bob Tetens, director of the county’s parks & recreation department, for being honored with EMU’s Presidential Award for Community Partnership. He shared the award with Kirk Profit, Michael Hawks, Brenda Stumbo and Sabrina Gross, who collaborated on making improvements – including a new boathouse – at Lakeside Park on Ford Lake.

Communications: Literacy, Special Education Millage

Rob Turner gave a report from the first meeting he attended of the Literacy Coalition of Washtenaw County board. The group faces funding issues, he said, and is developing a fundraising campaign with the new slogan: “Invest in tomorrow – literacy today.”

In describing some of the group’s literacy programs, Turner noted that those efforts will become increasingly important as schools face state funding cuts. It’s especially important for special needs children, he said. Turner highlighted the fact that a millage renewal for special education funding in Washtenaw County is on the May 3 ballot. “Special needs” covers many things, he said, including autism and attention deficit disorder. As the father of two special-needs children, Turner said he’d personally seen how additional help they’d received because of programs funded by the millage have put them on track for college.

Turner said that he personally endorsed the millage, and urged the public to vote – noting that these types of elections tend to have very low turnout. The millage has made a big difference in his daughters’ lives, he said, and can help many other children in the county succeed.

Yousef Rabhi thanked Turner for calling attention to the millage, and said that he, too, endorsed it. It’s important for the community to come together on this, Rabhi said, and he also urged residents to get out and vote on May 3.

Also supporting the millage, Barbara Bergman emphasized that it’s a renewal, not a new tax – people have already been paying for this, she said.

Communications: Deer

Barbara Bergman brought up the issue of a large deer population in this area. They’re a safety hazard, she said, whether it’s spreading lyme disease or causing car accidents. Deer also cause problems for gardeners, Bergman said. “I feel I have a right to grow tomatoes and flowers.” She has tried throwing Irish Spring soap as a deterrent, as well as hanging sheets of fabric softener. Bergman said she was unsure what the county could do, but it was worth exploring.

Wes Prater noted that this likely fell into the jurisdiction of the state Dept. of Natural Resources. Both Conan Smith and Yousef Rabhi pointed to the possible role of the county’s parks & recreation department, particularly through its stewardship role under the natural area preservation program.

Rolland Sizemore Jr. pointed out that the deer have been here long before people. His comment prompted one of the commissioners to quip, “Not those deer!”

Misc. Public Commentary

Two people spoke during public commentary.

Kathleen Russell of Ann Arbor told the board that April is Parkinson’s Awareness Month – she suffers has the disease, and is an advocate for additional funding to find a cure. Parkinson’s Action Network in Washington, D.C. is lobbying for that as well, and Russell said she was pleased that the group has a strong delegation in Michigan.

Several commissioners responded to her remarks, praising her efforts and thanking her for coming to the meeting.

Thomas Partridge addressed the board during three of the four opportunities for public commentary. He urged commissioners to work on behalf of the most vulnerable in the community – the elderly, disabled, families, public employees and school teachers, who are all being unfairly attacked by Gov. Rick Snyder’s administration, he said. Partridge asked the board to bring a resolution of support for the recall effort against Snyder, saying the recall should be extended to everyone in Snyder’s administration.

Later in the meeting, Partridge noted that he had just returned from speaking at the Ann Arbor Public Schools board of education meeting, held a few blocks away at the Ann Arbor District Library. As he had there and at the previous night’s Ann Arbor city council meeting, Partridge said this month is important for people of all religious faiths. He posed the same question to all these governing groups, he said – in setting their priorities, they should ask what Christ would do, or what other religious leaders would support with regard to housing, transportation, health care and other services for the vulnerable.

As she did at the board’s April 6 meeting when Partridge made this same point, commissioner Barbara Bergman responded by saying she took umbrage at being asked to act in light of one religion.

During his final speaking turn, Partridge raised concerns over medical marijuana, objecting to its legalization and saying that residents need protection from an expanded drug trade – marijuana is still illegal under federal law, he noted. He also called on the board to form a review panel to oversee law enforcement and emergency responders in the county.

Present: Barbara Levin Bergman, Leah Gunn, Kristin Judge, Ronnie Peterson, Alicia Ping, Wes Prater, Yousef Rabhi, Rolland Sizemore Jr., Conan Smith, Dan Smith, Rob Turner.

Next regular board meeting: Wednesday, May 4, 2011 at 6:30 p.m. at the county administration building, 220 N. Main St. The Ways & Means Committee meets first, followed immediately by the regular board meeting. [confirm date] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public comment sessions are held at the beginning and end of each meeting.