The Ann Arbor city council’s April 2, 2012 agenda will touch on three areas that have previously generated substantial debate on the council and throughout the community: (1) medical marijuana; (2) funding of public art; and (3) calculation of the tax increment finance (TIF) capture by the Ann Arbor Downtown Development Authority.

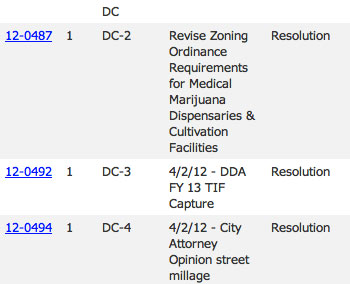

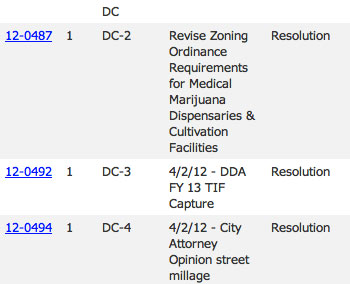

Screen shot excerpt for April 2, 2012 Ann Arbor city council's online agenda. Image links to online agenda.

Medical marijuana is the subject of three different agenda items. The first has previously been postponed twice – at the council’s March 19 and March 5 meetings. It would direct the city attorney to delay enforcement of the Michigan Medical Marijuana Act, as well as the city’s licensing and zoning ordinances (with one exception), until the city council has acted on possible amendments to the city’s local ordinances on medical marijuana.

Amendments to those ordinances, as recommended by the city’s medical marijuana licensing board at its Jan. 31, 2012 meeting, are covered in two other items on the April 2 agenda. One item includes a series of amendments to the licensing ordinance, which in part help clarify the role of city staff, as compared to the licensing board, in the licensing process. The council will be considering the amendments for the first time at the April 2 meeting. If approved, the amendments would require a second and final approval by the council at a subsequent meeting before taking effect.

The other agenda item regarding the city’s ordinances on medical marijuana is not itself a proposed amendment. Instead, the council resolution would give direction to the city planning commission to review the recommended revision to the zoning regulations for medical marijuana businesses. That’s because it’s the purview of the city planning commission to review changes to the zoning code. The planning commission would then forward its recommendation to the city council.

Added to the agenda on Friday were two items that Stephen Kunselman (Ward 3) had announced at the council’s previous meeting, on March 19, that he would be bringing forward. The first is a resolution that would direct the city attorney to prepare a written opinion on the transfer of funds from the street millage fund to the city’s public art fund. It’s a point of contention that has a history going back at least two and a half years. Kunselman’s resolution refers to the context of the fiscal year 2013 budget, which the council will be presented by the city administrator on April 16. The council will need to act on that budget by the end of May.

Another item on the agenda that’s related to public art is the approval of a $150,000 sculpture for the interior of the new municipal center, in the Justice Center building. And finally, the report from the public art commission’s planning retreat, held on Feb. 26, 2012, is attached to the council’s agenda as a communication.

The second item added to the agenda by Kunselman on Friday directs the city staff to analyze the compliance of the Ann Arbor DDA with Chapter 7 of the city’s code, which is the legislation that established the DDA in 1982. Kunselman’s resolution asks for an analysis by Ann Arbor city staff of the DDA’s capture of taxes in its tax increment finance (TIF) district. The DDA is slated on April 9 to present its board-approved FY 2013 budget at a city council working session.

Chapter 7 appears to impose a limit on the amount of TIF capture, based on the rate of growth of property valuation inside the DDA district. Last year, when the relevance of the ordinance was pointed out by city financial staff, the DDA returned over $400,000 to other taxing authorities in the district. The city of Ann Arbor waived its share of over $700,000.

However, the DDA subsequently has contended that the money it reimbursed to other taxing authorities was not required. The DDA claims that Chapter 7 does not impose a limit on TIF capture, but rather addresses how money would be returned to other taxing authorities, if the DDA did not use the money. At stake this year and in future years is several hundred thousand dollars, depending on how the calculations are done. The Ann Arbor District Library, one of the taxing authorities whose taxes are subject to DDA capture, has publicly stated that it has not changed its original legal position – which interprets Chapter 7 as a limit on TIF capture and questions the methodology used by the DDA to calculate the excess.

The April 2 Ann Arbor city council meeting begins at 7 p.m. in city council chambers on the second floor of city hall, located at 301 E. Huron. The meetings are broadcast live on Channel 16 of the Community Television Network. The Channel 16 broadcast is also streamed live on the Internet. [Full Story]