County Board Deals with Transit, Budget, Labor

Washtenaw County board of commissioners meeting (Aug. 1, 2012): In a move that extends the approval process for a countywide public transportation system, commissioners amended the articles of incorporation for a new transit authority then ultimately approved that document and a related four-party agreement on a 6-4 vote.

Sarah Pressprich Gryniewicz, left, talks with Washtenaw County commissioner Leah Gunn prior to the start of the Aug. 1, 2012 board of commissioners meeting. Gryniewicz is community outreach coordinator for the Ann Arbor Transportation Authority. (Photos by the writer.)

Because the articles were amended, they will need to be reconsidered by the other three parties in the agreement: the city councils of Ann Arbor and Ypsilanti, and the board of the Ann Arbor Transportation Authority, which is spearheading this effort. Those governing bodies are expected to take up the issue at meetings later this month. It will be on the Ann Arbor city council agenda for its Aug. 9 meeting.

Before the county board’s Aug. 1 vote, about a dozen people spoke during a public hearing on the issue, the majority of them in support of the agreement and of expanded public transit in general.

Although amendments had been considered and voted down at the board’s July 11 meeting, on Aug. 1 Rob Turner proposed a new amendment to the articles of incorporation. The original draft stipulated that a two-thirds majority of the new authority’s board would be required to amend the articles of incorporation. Turner’s amendment would have stipulated that a unanimous vote by the new authority’s board would be needed to make such changes. Leah Gunn offered a compromise – a four-fifths majority, or 12 of the new authority’s 15 board members. That amendment to Turner’s amendment passed on a 6-4 vote, with dissent from Turner, Conan Smith, Felicia Brabec and Wes Prater. The vote on the amended amendment itself – requiring the four-fifths majority – passed unanimously.

Turner felt his original amendment offered safeguards for smaller communities. It’s possible for communities to decide to join the new transit authority, only to have the articles of incorporation – the “rules of the game” – changed after they’ve joined, he said. If his amendment had been approved, Turner said he would have supported the four-party agreement and articles of incorporation. He said it no longer seemed like a countywide authority – it seemed like an Ann Arbor system that others could join. That saddened him, he said.

Joining Turner in his final vote against the overall agreement and articles of incorporation were Alicia Ping, Wes Prater and Dan Smith. Rolland Sizemore Jr. was absent.

A range of other items were on the Aug. 1 agenda. Commissioners suspended the county’s use of Construction Unity Board (CUB) agreements, responding to a change in state law. They also gave final approval to a change in the county’s accommodations ordinance, exempting bed & breakfasts, cottages and individuals who occasionally lease out rooms from the 5% accommodations tax. And addressing a need for veterans, the board authorized the county clerk to offer photo IDs that can be used to redeem discounts offered at local businesses.

On an 8-2 vote, commissioners also approved a brownfield financing plan for a $39 million residential development at 618 S. Main St. in Ann Arbor. Before the board’s vote, both Felicia Brabec and Yousef Rabhi praised the development, but said they were voting against it because of concerns about affordability. They did not feel that most young professionals would be able to afford living there, and stressed the importance of having more affordable housing in the downtown area.

The board also heard a report from the county treasurer, and got a second-quarter financial update from staff. Commissioners then approved a $1,263,994 mid-year adjustment to its 2012 general fund budget, bringing the 2012 general fund budget to $101,162,770.

In one of the least controversial items of the meeting, commissioners passed a resolution commending the Washtenaw Community Concert Band – formerly the Ypsilanti Community Band – on its 35th season. Dan Smith, who plays the trumpet, is a member of that group.

Countywide Transportation

Commissioners were asked to approve a four-party agreement and articles of incorporation for a new public transit entity tentatively called the Washtenaw Ride Transportation Authority.

The other parties in the agreement are the cities of Ann Arbor and Ypsilanti, which both would contribute existing millages to the new authority, and the Ann Arbor Transportation Authority, which would shift its assets to the new entity. The governing bodies of those three parties had previously approved the transit documents, after going through their own amendment process. [.pdf of pre-amended four-party agreement and articles of incorporation]

The county board had given initial approval at its July 11 meeting, after a lengthy debate and a split 7-4 vote with dissent by Alicia Ping, Wes Prater, Rob Turner and Dan Smith. At that meeting, several amendments proposed by commissioner Dan Smith were discussed, but none of the amendments secured enough votes to pass. Those amendments had been similar to proposed changes that Smith had put forward at a three hour working session on June 14.

The county would not be contributing assets or a millage to the new authority. Nor would the county board be asked to put a countywide millage request on the ballot. Rather, the county’s role would be for the county clerk to file articles of incorporation with the state – an action to create a transit authority under Michigan Act 196. When formed, the Act 196 board would have authority to put a funding proposal on the ballot for voters to consider. A financial advisory group that’s been working on this effort has suggested that revenues equivalent to a 0.5 mill tax would be needed to cover the cost of expanded services for the first five years. [.pdf of financial advisory group report]

For other general Chronicle coverage of transit issues, see: “AATA Board OKs Key Countywide Documents.”

Countywide Transportation: Public Commentary

Speakers addressed the board on the topic of countywide transit during general public commentary as well as during a public hearing specifically on the four-party agreement and articles of incorporation. Several other transit supporters attended the meeting but did not formally address the board. Joel Batterman of Partners for Transit, who had sent out an email urging people to attend the meeting, was on hand to pass out stickers that stated support for expanded public transportation.

Here’s a summary of remarks made during public commentary and the public hearing on Aug. 1.

Thomas Partridge told commissioners that he’s a Democratic candidate for state representative in District 53, and he supported the countywide transit agreement. The county’s most vulnerable residents, including senior citizens and the disabled, need better access to affordable public transit, he said.

Jim Mogensen reminded the board that although people talk about the Ann Arbor public transit system starting in the 1970s, in fact the first time a local public transit system was proposed happened in the late 1950s. At that time, however, voters didn’t support the formation of a system. An alternative approach was passed in the 1970s, including a millage to support the Ann Arbor Transportation Authority. He referred to the current effort at expansion as a Pandora’s box, and likened it to a previous effort to pass a millage for a county jail expansion. That was a very complicated process, but voters ultimately rejected the bond proposal for it, he said. The jail eventually did expand, but in a different way, he noted. Now, the same dynamics are happening with public transit. Mogensen urged commissioners to take a step back, listen to concerns, then take leadership to move the county forward in a constructive way.

Joel Levitt said he’s been a resident of Ann Arbor for 40 years, and now his daughter, her husband and one-year-old grandchild are also living here. The health of the county depends on the health of Ann Arbor, he said. The city is the center for industry, commerce, health services and culture. For that to continue, the city can’t have poor and overcrowded roads and inadequate parking. There must be a superior public transit system from the city to every corner of the county, and improved services within the city as well.

Charlie Nielsen told commissioners that he’s the former Scio Township supervisor. He remembers the day when his son used to take the bus – when AATA used to provide service to Scio Township. It was invaluable in helping his son attend classes at Washtenaw Community College, he said. But Scio Township later couldn’t pay for the service, so it stopped. Nielsen noted that he serves on the advisory committee for the current countywide transit effort, and supports serving the whole county. One of the reasons he’s proud to live in this county is because of the human services that are provided, and countywide transit is in that same spirit. He noted that he’s president of the homeowners association for Scio Farms Estates, where many of the residents are getting older and could benefit from a public transit system. He urged commissioners to support it.

Waleed Howrani said he’d been a resident of Ann Arbor for 37 years. He finds it hard to believe that people aren’t doing more to save the environment. Resources should be used wisely, not recklessly. The auto industry doesn’t care about how many natural resources are dug up to build their cars, or about emissions from those vehicles. Howrani said he’s proud of the AATA. He’s taken public transportation in over 30 states, and no other system as as clean, efficient, and friendly. Although he does use Amtrak, he feels helpless when he needs to travel to neighboring towns and states. He loves that he can read on the bus and leave the driving to others. He noted that every bus can eliminate 50 cars from the road, and saves many lives as well.

Tad Wysor said he’s passionate about community organizing and mass transit. He lives in Ypsilanti Township and works in Ann Arbor, and said he’s blessed to have dependable buses on both ends of his commute, with bike racks. But for most folks, it’s not that easy. With residents struggling because of the economy, now is a great time to pull together, focus on common values, he said, and greatly improve mass transit in the county and beyond. He said he’s involved in a new coalition on the east side of the county involving clergy, labor and other community leaders. They haven’t yet decided how they’ll focus their efforts, but expanding and improving mass transit is one possible area. It’s hard for him to imagine an issue that would be more effective in helping the economy, he said. It could help connect employers and employees, get people to medical appointments and places of worship, and keep senior citizens more engaged in the community. Now’s the time to pull together and make it happen.

David Sponseller said there’s probably no one in the room who did more to help launch AATA than he did. In 1969, he spoke up to urge government leaders to support the public transit system. He encouraged his son to help promote it and urge residents to vote in favor of the millage. But that was a huge mistake, he said. He had no idea that although the system would grow, it would fail to win people over to use it. Less than 5% of people in Ann Arbor ride the bus, he said. People still love the convenience of their cars. Public transit is successful in areas that have high density – places like Toronto, Chicago and New York. But that’s not the case in Ann Arbor. Sponseller wondered how they can expect people in less dense parts of the county to embrace public transit, when Ann Arbor residents haven’t been won over. He argued that more energy is spent on fueling buses that have only one or two riders, than on cars. For the sake of avoiding costs that his grandchildren would have to pay, he urged the board to not support the project.

Larry Krieg of Ypsilanti Township said he was there to speak in favor of the agreement. For anyone who thinks the buses are empty, he urged them to ride one – it’s not the case that they’re empty, he said. Krieg, a retired faculty member at Washtenaw Community College, said he observed that if a WCC student’s car fails, then that student is likely to fail. Education is important for the entire county, as well as for individuals. Reliance on auto transportation also locks people out of the economic system, because many jobs require that you have a car, he said.

Countywide public transit will give people who don’t live in Ann Arbor and Ypsilanti the chance to participate in the economic system, he continued. Krieg said he also supports expanded public transit because of his grandchildren. One of his children went to the east coast for a job, and another went to the west coast for the same reason, because the economy is more prosperous there. He’d prefer that his grandchildren wouldn’t have to make that choice, and could stay in Washtenaw County. The county needs a solid public transit system.

Nancy Kaplan talks with Joel Batterman of Partners in Transit before the start of the Aug. 1 county board of commissioners meeting. Kaplan, a member of the Ann Arbor District Library board, raised concerns about the proposed governance of a countywide transit authority.

Nancy Kaplan of Ann Arbor described expanded public transit as a great idea, but said she had several concerns about the proposed process. Some of those concerns relate to the board for the new authority. Board members aren’t required to be residents of the county, she noted, and there’s no real oversight of the board – it’s questionable representation without accountability, she said. Kaplan noted that several services outlined in the five-year transit plan have already been implemented by AATA, which shows that these services can be provided under the current system. The services include commuter bus from Ann Arbor to Chelsea and Canton, but she wondered why Ann Arbor pays for that, without contributions from the other two communities.

Why not test out interest in service levels by signing five-year point-of-service agreements with other communities? asked Kaplan. That would let people see if residents of those communities are willing to fund transit services, and if they’re satisfied with the service they get, she said. There are many other unknowns regarding process, scope and fare increases, Kaplan said. She asked commissioners to test it out for several years before committing to a new transit authority.

Jan Wright of Pittsfield Townshp supported the agreement. She lives two miles from the nearest bus line. She just turned 70 and is doing great, she said, but she knows that won’t always be the case. She’s not the only person in this situation. As the population ages, there are a lot of people who won’t want to be stuck in their homes or forced to move, she said. Wright also has strong concerns about climate change, especially after the strange weather we’ve been having over the past year. Public transit is a way to have sustainable transportation, she said. Gas prices will probably increase, and that’s another reason to support public transit.

Matthew Braman of Milan also supports expanded public transit. He grew up in this county, attended a state-funded public university here, but is continuing his professional career in New York City – in large part because he can’t continue to live in Milan and work in Ann Arbor. He described how his car broke down earlier this year, and he had to rent a car from a friend. He’s been working with the Michigan Prisoner ReEntry Initiative (MPRI), and noted that ex-prisoners on parole are trying to find work and the community needs to find ways to help them succeed. Public transit would open up job opportunities in other communities.

Sayan Bhattacharyya told the board that he’s a graduate student at the University of Michigan. No one in his family had ever owned a car, and coming to Ann Arbor was the first time he’d seen snow. He’s afraid to drive in the winter, and that’s one reason why public transit is important. There are a lot of people like him, he said. When he graduates next year, he’ll be looking for a job, and part of the decision will be based on transportation choices. Bhattacharyya also said that he loves Ann Arbor because of its cultural offerings, but it’s frustrating that he can’t go to cultural events in places like Chelsea or Dexter unless he rents a Zipcar. He noted that he’s not a U.S. citizen so he can’t vote for them – a comment that elicited laughter from commissioners. He said he’d never been to a public forum like this, and had previously only read about democracy in action.

Robert Klingler said that about 18 months ago, he slipped on black ice and tore the tendon off his knee. It’s been humiliating, and he’s had to depend on services offered by AATA, including RideConnect. He lives just outside the Ann Arbor city limits, and taking the bus to work can take 45 minutes one way. It would be nice to catch a bus to go downtown, to restaurants, to church. If public transit were expanded, more people would come to Ann Arbor, he said. Klingler concluded by noting that the city and county are praised as good places to retire, but we’re not ready to accommodate retirees.

Countywide Transportation: Board Discussion

Yousef Rabhi, a Democrat who represents District 11 in Ann Arbor, began by thanking everyone who spoke during public commentary. He’s very much in favor of countywide transit – it’s desperately needed, and should have been expanded a while ago. He wanted to respond to some of the comments made during the public hearing. The idea that just because people love cars means that the community should give up public transit is like saying that because people like nicotine, we should give up on trying to quit smoking. We shouldn’t give up on public transit, he said. We should work to make it better.

Regarding empty buses, Rabhi said he used to regularly ride the Route 2 bus and during the winter, buses would be so packed that they would have to pass by people who were waiting at bus stops. There was no room for additional passengers. That’s not the case on all lines, but it’s not true that buses are empty. He noted that ridership is up on Route 4, between Ann Arbor and Ypsilanti, after AATA increased the frequency of bus service.

This is not the perfect plan, Rabhi continued, but you can’t expect perfection. It’s the start of the process, and moves the county in the right direction. It will make an impact on greenhouse gas emissions. He noted that he shared some concerns raised by Nancy Kaplan – saying he agreed that the AATA shouldn’t be providing service to Chelsea and Canton unless those communities are willing to pay for it. This new transit proposal does give Chelsea residents the opportunity to pay, he said, and he’ll continue to lobby AATA and ask them not to serve areas that don’t pay. But that’s not what the four-party agreement and articles of incorporation are about.

Today, the board will be creating a new entity, he said, and that entity will choose whether to put a proposal on the ballot for voters to decide. “This is direct democracy, folks,” Rabhi said. If Ann Arbor voters reject a funding proposal, then the broader public transit won’t happen. He said he supported the resolution before the board, and thinks it should move forward.

Rob Turner also thanked the public speakers. He’s been hearing from people in his district who are both for and against the proposal. [Turner, a Republican, represents District 1, which covers a large portion of western Washtenaw County, including Chelsea and Dexter.] Public transportation is important – it will help the county grow and prosper, and help people who are struggling to find jobs, he said.

Countywide Transportation: Board Discussion – Amendment

But Turner said he did have a major concern, and that’s why he was proposing an amendment to the articles of incorporation. [A written text of the amendment had been circulated by Conan Smith before the meeting started.] The original draft stipulated that a two-thirds majority of the new authority’s board would be required to amend the articles of incorporation. Turner’s amendment struck the two-thirds majority, and stipulated that a unanimous vote by the new authority’s board would be needed to make such changes. The amendment was seconded by Alicia Ping (R-District 3).

Rob Turner, a Republican representing District 1 – covering the western part of Washtenaw County – was unable to convince a majority of his fellow commissioners to adopt an amendment he put forward for the articles of incorporation of a new transit authority.

Turner said that the directors of the new authority’s board could change the structure of the authority – so it could become something different than communities originally opted into, he said. His amendment would provide a safeguard against that, he said. Otherwise, he couldn’t support the articles of incorporation or four-party agreement.

Leah Gunn responded, saying the board has gone over and over these documents, and had given initial approval at their July meeting without amendments. The problem with amending it now is that it would then need to go back to the other three parties for re-approval, she said. Gunn also felt it was unfair to require unanimity. That’s a high bar, she noted, and it means that one jurisdiction could “destroy” everything. Ann Arbor is passing over a huge amount of assets to the new entity, she said, and Ann Arbor needs as much protection as other jurisdictions. [Gunn, a Democrat, represents District 9 in Ann Arbor.]

Gunn then proposed amending Turner’s amendment – striking “unanimous” and inserting “4/5 (12 out of 15) vote of the directors seated and serving.” Four-fifths is a very strong majority, she said. Her amendment was seconded by Rabhi.

Barbara Bergman said she agreed with Gunn. She also wondered if requiring unanimity was legal, and asked Curtis Hedger, the county’s corporation counsel, for his opinion. He said he hadn’t had the chance to look at the question, but in general, whatever the four parties agreed to would be legal – though unanimity might make it more cumbersome to get things done.

Bergman said that one person could be easily swayed by a contractor, for example, and unanimity would make board members of the new authority extremely vulnerable to that kind of pressure. She said it scared her to think of the amount of capital that had been paid for with her tax dollars riding on the whim of one person.

Rabhi also supported Gunn’s amendment. As a practical matter, not every jurisdiction will opt in to the Act 7 districts that form the basis for the new authority, he said. So in some cases, it might be only one township that represents a district. If a unanimous vote of the authority’s board is required, that means that action could be blocked by just one small township, he said. Certainly the bar to change the articles of incorporation should be high, Rabhi said. Two-thirds is high, and four-fifths is even higher. He encouraged commissioners to support Gunn’s amendment.

Ping said she’d support Gunn’s amendment, but she wouldn’t be supporting the overall agreement. [Ping had voted against it at the July 11 meeting.] But she thought the agreement would pass, and a four-fifths majority would be the best option for the entire county.

Turner said he didn’t understand why Gunn could argue against his original amendment, saying that it would have to go back to the other three parties. Her amendment would also require that action, he noted. He shared the concern that Rabhi had mentioned – that one township could block a vote. But in his part of the county, one of the Act 7 districts comprises eight townships. That means that eight townships would be represented by only one director on the new authority’s board.

Any amendment to the articles of incorporation would change the structure of the new authority, Turner said. He added that this is the only instance in which he’s pushing for unanimity, because it’s an important safeguard. It’s a safeguard that might make the difference between a local entity joining the authority or not.

Wes Prater weighed in, saying these articles of incorporation should last a long time. Everyone should be on board, or it shouldn’t be done. The need for a unanimous vote might never come into play, he noted, or it might be very rare. He wanted to reject Gunn’s amendment and keep Turner’s.

Ronnie Peterson, a Democrat who represents District 6 in Ypsilanti and a portion of Ypsilanti Township, said he wanted to see the out-county jurisdictions participate in the new authority. But he found it difficult to see how unanimity could work effectively. On the other hand, he could see the difficulty of having rules change in midstream. Overall, he just hoped they could get this bus rolling.

Conan Smith said that the articles of incorporation only include five articles that state the board “shall do” certain things. The rest of the articles are characterized as “may do.” So the “shall do” items cause the greatest concern, he said. The first relates to jurisdictional boundaries and of the districts within the new authority, he said. Two other items have impact on the board makeup: Board qualifications that require a director to be a Washtenaw County resident, which the commissioners previously debated, and the board members’ terms and compensation.

Directors will serve without compensation, and people want to protect that, Smith said. [Smith did not mention this, but the articles of incorporation allow the residency requirement to be waived – that was an element of debate at the board's July 11 meeting.]

The fourth “shall” is the right of employees to collective bargaining, Smith said, and the fifth one provides pension protections to AATA employees who move to the new transit authority. On balance, the rest of the articles say “may do” or “may not do,” Smith contended. So the “shall” items are just those that would be impacted by a vote of the new authority’s board to change the articles of incorporation, he said. Setting the bar to require unanimity seems fair and reasonable, he added. Smith noted that he has served on boards that operate on a consensus basis. In cases like this new transit authority, it’s not too much to ask to make it as inclusive as possible and make sure everyone in the county has a fair say.

Gunn responded, saying she had no idea what Smith was talking about – his speech obfuscated the whole issue. The amendment being considered doesn’t apply to any specific article of incorporation. It would apply to all of them. She also noted that the idea of fairness works both ways. It’s important to be fair to the smaller communities, but also to larger communities that have “paid and paid and paid” – that’s the community she represents, Gunn said. A four-fifths majority should work.

Responding to Turner’s comment, Gunn said of course she was concerned that her amendment will also require that the documents be reconsidered by the other three parties. But she was trying to compromise, she said, because unanimity won’t work.

Directing his comments to Gunn, Prater said it’s true that Ann Arbor has paid and is contributing its assets, but it’s been Ann Arbor residents who have primarily used the AATA over these years. The AATA has also received a lot of state and federal grants, and that’s partly his tax dollars, Prater said. [Prater, a Democrat from York Township, represents District 4 covering the southeast side of the county.] He again urged support for Turner’s original amendment.

Bergman then called the question on Gunn’s amendment, a parliamentary move that forces a vote.

Outcome on Leah Gunn’s amendment to Rob Turner’s amendment: It passed on a 6-4 vote, with dissent by Turner, Conan Smith, Felicia Brabec and Wes Prater.

Countywide Transportation: Board Discussion – Amended Documents

Peterson asked for clarification – the new authority’s board can amend the articles of incorporation at any time? That’s right, Hedger said. So the authority’s board could change any of this in the future? he asked. Yes, Hedger replied.

Felicia Brabec clarified with Hedger that the vote before them was to accept the amendment requiring a four-fifths majority to alter the articles of incorporation, or to keep the original two-thirds majority requirement, which has already been approved by the other three parties. She said she appreciated Gunn’s attempt to compromise, but she was struggling with it. She generally likes to compromise, but would have preferred Turner’s original amendment. She’d support the four-fifths compromise, because she didn’t agree at all with requiring just a two-thirds majority.

Turner said he’d support the amendment, because it will provide additional safeguards for the articles of incorporation, which he felt the board would ultimately approve. But he said he’d now be voting against the four-party agreement and articles of incorporation, when it came for a vote later in the meeting.

Outcome on vote to amend the articles of incorporation: Commissioners unanimously passed the amendment requiring a four-fifths majority to change the articles of incorporation.

Later in the meeting, the board considered the resolution to approve the four-party agreement and the amended articles of incorporation. Dan Smith said he had applauded the AATA for taking a leadership role in this effort. He noted that he has no problem with the notion of public transit – he used it when he lived in the Netherlands and in Germany. The role that the county board is being asked to play puts them in the middle of this process, he noted, and it’s largely a ministerial role. They are being asked to adopt articles of incorporation that will last a very long time. He didn’t see the board’s role as saying public transit is good or bad, or as lobbying for or against it, or as determining the services that a new entity might provide. Commissioners’ role is to put a new authority in place so that the authority’s board can make those decisions.

Smith said he wasn’t satisfied about the articles of incorporation for reasons that he had elaborated on at the July 11 meeting and the previous working session. For those reasons, he said, he’d be voting no.

Wes Prater read a one-page statement about the process. He stated that as of today, the AATA was not in compliance with the section of the four-party agreement that requires the AATA to publish details about the new entity’s service and funding plan in local newspapers. Until that happens, he said, the board shouldn’t approve the four-party agreement and articles of incorporation. “Without the details,” he said, “it’s like buying a pig in a poke.”

He noted that the articles of incorporation don’t state a date for the new authority to become operative and for the articles of incorporation to take effect. Not setting that date is a violation of state statute, he contended. This information is critical for local governments to know as they decide whether to opt out or participate in the new authority. He also argued that the sections in the articles of incorporation that provide ways to dissolve the authority should be removed, because these methods of dissolving the authority have no standing under Act 196. He cited a December 1998 opinion issued by former attorney general Frank Kelly to support that fact.

All of these issues should be resolved before the county board adopts the four-party agreement or articles of incorporation, Prater said.

Rob Turner described it as a difficult situation. All he hears from Leah Gunn is how much Ann Arbor has contributed and how much Ann Arbor would be sacrificing. It doesn’t sound like a countywide authority, he said. It sounds like an Ann Arbor authority that’s allowing other local governments to join. He said he’d be voting no, and that it breaks his heart. He hopes that the new authority will be more inclusive in the future. He’ll now have to go to the governing entities in his district and make sure they know the dangers. People in his district had told him that it would be an Ann Arbor authority, and he had told them it would be countywide. Now that will be thrown in his face, Turner said. He thought his amendment would pass, but he now believes it will be an Ann Arbor authority – he’s afraid those people were right.

Barbara Bergman said she was sorry for Turner’s sad heart, but she’s been paying taxes in Ann Arbor for the last 32 years, and that’s been a fairly substantial amount. She’ll be paying even more, if voters approve an additional transit tax. But everyone has skin in the game, she said – this isn’t just an Ann Arbor system.

Conan Smith observed that a different governance model would have guaranteed other things, but they would have to trust that directors of the new authority will do what’s best.

Felicia Brabec said she’d been reassured by AATA leadership about concerns she’d raised regarding her district of Pittsfield Township. People in her district were excited about expanded transit. She hoped Turner’s concerns would be laid to rest as the process unfolds.

Prater said he wanted to get another two cents in. It doesn’t matter what the county board does, he said – as soon as the new authority’s board is in place, that board can do whatever it wants. ”We can wail about it all we want to, but they can.”

At that point, Yousef Rabhi called the question.

Outcome: On a 6-4 vote, commissioners gave final approval to the four-party agreement and amended articles of incorporation that set the foundation to form a new transit authority. Voting against the resolution were Alicia Ping, Wes Prater, Rob Turner and Dan Smith. The documents will now need to be reconsidered by the other three parties – the city councils of Ann Arbor and Ypsilanti, and the AATA board.

2nd Quarter Financial Update

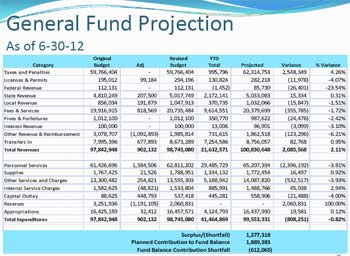

Tina Gavalier, Washtenaw County’s finance analyst, gave a second-quarter financial update that showed an improved outlook from her first-quarter presentation to the board in mid-May. The county’s fiscal year is based on a calendar year – the update covered the first six months of 2012, through June. [.pdf of chart showing general fund projections]

As she did for the first-quarter update, county administrator Verna McDaniel again introduced the presentation by saying that the main message is still “stay the course.”

Second-Quarter Budget Update: General Fund Revenues

Revenues for the general fund are now projected to be about $2.085 million more than budgeted – due primarily to about $2.5 million more in property tax revenues than originally anticipated. Total revenues for the 2012 general fund are expected to reach $100.83 million. [The board had received the news about the higher property tax revenues at its April 18, 2012 meeting, when the county equalization report was presented.]

Gavalier reviewed some of the revenue variances for specific units. Revenues for the sheriff’s office are projected to be about $835,116 less than budgeted. Much of that amount is caused primarily by delayed implementation of the county’s dispatch consolidation with the city of Ann Arbor. [At its Dec. 5, 2011 meeting, the Ann Arbor city council approved a $759,089 annual contract with the county, which was supposed to start in March of 2012. Hiring is underway, but the consolidation hasn't yet happened.] Other items that contributed to the shortfall include no revenue so far for towing contract administration fees (contract amendments are in progress) and lower-than-projected concessions revenue for the corrections service center lobby coffee shop and other food venues.

Projected revenues for the Washtenaw County Trial Court also are falling short of budgeted amounts by about $208,000, primarily because of lower-than-budgeted court equity funds that are disbursed by the state. A projected shortfall of about $114,000 in the 14A District Court is due to lower court fees and fines, attributed to a declining trend in case filings.

Second-Quarter Budget Update: General Fund Expenditures

Gavalier reminded commissioners of amendments they made to the budget in late 2011 and early 2012. At their Dec. 7, 2011 meeting, commissioners voted to reinstate $128,538 in funds for human services nonprofits – administered via the coordinated funding model – that had previously been cut from the budget. On Jan. 18, 2012, the board voted to approve the consolidated dispatch between the county and city of Ann Arbor, and authorized the creation of 15 full-time positions. That vote increased the budget – on both the revenue and expenditure sides – by about $1.4 million. Also, at their Feb. 15, 2012 meeting, commissioners approved a $165,000 expenditure increase as part of a new contract with the Humane Society of Huron Valley, for animal control services through 2012.

Regarding overall expenditures, Gavalier reported that expenses are $808,251 more than budgeted for the general fund. That’s due in part to higher-than-expected costs in the sheriff’s office from greater use of part‐time temporary workers and overtime, operating supplies, and jail medical/food contracts.

General fund expenditure projections include an assumption that there would be a lump sum expense reduction of $2.481 million for the year – an amount that’s not specific to any particular department, but that would be gained from across the organization. So far, $1 million in reductions have been identified, due to the high number of retirements last year (118) with 97 of those coming in the last quarter of 2011. The savings come from several unfilled positions following those retirements, as well as from lower salary and fringe benefit costs for new employees replacing the retirees.

However, some of those savings have been offset by increases in part‐time temporary costs and increased fringe benefit costs. A high number of medical claims were made over the last five months of 2011, Gavalier reported. Since there’s typically a six-month processing delay for those claims, most are being paid in 2012. Changes in the county’s employee medical plan are expected to contribute to the lump sum reductions later this year, she said. Overall, only about $282,000 in net lump sum reductions have been realized so far this year – about the same amount as was reported in the first-quarter update. More reductions are anticipated to be recorded in the third quarter, she said.

The 2012 budget had anticipated a surplus of $1.889 million, but the administration is projecting a surplus of $1,277,318 – a significant increase from the $272,238 that had been projected in the first quarter. That surplus is intended to carry over into the 2013 fund balance. The county faces a $612,065 shortfall in the amount it had budgeted for the fund balance contribution.

Second-Quarter Budget Update: Non-General Fund Items

Gavalier also reviewed several county operations that are not supported by general fund revenues. Units that are projected to show a surplus include child care, facilities management, Friend of the Court (due to trial court consolidation and cost containment efforts), public/environmental health, building inspection, and risk management units. Units that are on budget include the office of community & economic development, the prosecuting attorney’s office, and the office of veteran’s relief.

One unit – programs supported by the Act 88 millage, related to economic development – is projecting a shortfall, but had budgeted to use its fund balance in 2012 to cover the overage, Gavalier said.

Second-Quarter Budget Update: Issues to Watch

Gavalier listed out several areas that the administration is monitoring closely, including some that she had highlighted in her first-quarter update. Medical costs are difficult to project, because the trend of claims is evolving under the new medical plans for employees. The budget was developed based in part on projected costs provided by Blue Cross Blue Shield, Gavalier noted. But because the county is self‐insured, it pays the actual costs of its employees’ medical claims. July was the first month that the county started to see how claims have adjusted under the new medical plans, so the third quarter of this year – from July through September – will show a better reflection of actual savings.

Another area to watch relates to state revenue-sharing and the state’s new economic vitality incentive program, intended as a replacement to revenue sharing. Gavalier reminded commissioners that the county’s revenue-sharing reserve fund will be depleted in 2013. The state’s adopted budget includes a partial allocation to Washtenaw County in 2013 of $1,177,601, if the county meets three specific areas of compliance incentives: (1) accountability and transparency; (2) consolidation of services; and (3) employee compensation with defined eligibility requirements outlined for each area.

Personal property tax (PPT) reform legislation is another uncertainty, Gavalier said. There will be an impact, but the magnitude is uncertain. Currently, PPT revenue for the county is $5.6 million. Current versions of bills to repeal the PPT include reductions in tax revenue starting in 2013 of about $390,000 for industrial and commercial properties, with additional reductions phased in each year through 2022.

Gavalier also reported that the county’s annual actuarial valuations for its retirement plan (the Washtenaw Employees Retirement System, or WERS) and retiree health benefits (the Voluntary Employees Beneficiary Association, or VEBA) will be completed this summer. With 118 retirements in 2011, there will certainly be a cost impact to those plans, she said. The valuations might also increase the cost of fringe benefits for active employees too.

In addition, the county expects to complete a cost allocation plan (CAP) by this summer, Gavalier said, outlining how much each department will be accessed. CAP is an amount charged to each county department for things like the county attorney and administration. CAP amounts have been waived or frozen in recent years, but will be adjusted for the 2012-2013 budget cycle.

2nd Quarter Financial Update: Board Discussion

Barbara Bergman referred back to the budget adjustments that had been made earlier this year, and pointed out that the adjustment of an additional $165,000 for animal control services was higher than the additional $128,538 for human services. She wanted other commissioners to think about that. She noted that most public employees choose their jobs not because of large salaries, but because of the satisfaction it gives them to be public servants. Bergman expressed concern that people might no longer be able to afford that choice, if they’re asked for more labor concessions. She indicated that’s the context in which the board should consider its allocation for animal control services. [For recent background on that issue, see Chronicle coverage: "Revenue Options Eyed for Animal Control."]

In response to a question from Conan Smith, Gavalier reported that individual budget item adjustments of less than $100,000 were not reflected in her presentation. For amounts less than $100,000, county administrator Verna McDaniel has the authority to approve those adjustments.

Rob Turner told Gavalier that after her first-quarter update, he had been concerned about the county’s ability to reach the surplus they needed to carry over into 2013. Now, the projection is much better and he feels more comfortable that they can attain that amount, he said. Gavalier indicated that the finance staff feels better about it, too.

Leah Gunn thanked Gavalier for the clarity of her presentation. The increase in property values is good news, she said.

Alicia Ping asked about the shortfall for Act 88 programs. Conan Smith explained that there had been a budgeting error when the county allocated $15,000 to the Food System Economic Partnership. That’s now being handled by tapping the Act 88 fund balance to cover the $15,000 allocation. Ping didn’t feel that was a great answer – because only the revenues coming from the Act 88 millage should be expended.

Wes Prater clarified with Gavalier that although there’s currently a general fund surplus, the amount of that surplus is less than the county had budgeted to carry over into 2013.

Outcome: This was a presentation only – no board action was required.

Mid-Year Budget Adjustment

Commissioners were asked to approve a $1,263,994 mid-year adjustment to its 2012 general fund budget, bringing the 2012 general fund budget to $101,162,770.

The adjustment includes equal increases in revenues and expenditures. The additional revenues come primarily from higher-than-projected property tax revenues of $2,417,690. The main increase in expenditures comes from an increase in personnel costs over the budgeted amount for 2012. The original budget had anticipated labor savings of $2,481,008 – but the bulk of those reductions have not yet materialized. The county did realize more than $1 million in reduced labor costs due to 118 retirements in 2011. However, that savings has been offset by increased part-time temporary costs and increased fringe benefits costs related to medical claims made during the last six months of 2011, which are being paid in 2012.

Outcome: Commissioners unanimously approved the recommended mid-year budget adjustments.

Treasurer’s Report

Catherine McClary, Washtenaw County treasurer, presented an annual foreclosure report as well as a mid-year investment update.

She told commissioners that her major goal is to protect and safeguard public funds. Through June 30, 2012, her office has brought in $5.268 million in revenues. Sources include investment earnings ($415,309), delinquent taxes and fees ($3,307,004), accommodation tax ($1,497,340), dog licenses ($33,872) and tax searches ($14,656). She’s projecting revenues of about $10.5 million for the full year.

McClary said she manages about $154 million for the county, diversified by investment type, institution and maturity date. Cash and investments are allocated in the following way: CDs, CDARs, money market accounts ($59.833 million); commercial paper ($3 million); treasuries and agencies ($16.5 million); Michigan municipal bonds ($52.7 million); and bank accounts ($22.172 million).

McClary noted that in previous years, investments were laddered out over five to seven years. But with investment rates lower, she’d now taking a “barbell” approach, with shorter-term and longer-term investments. Although the average weighted yield of the county’s investment is below 1% – at 0.526% – she noted that it is well above the three-month Treasury benchmark of 0.09%.

Last year, McClary recalled, she had told the board that she expected interest rates to remain low, and that her strategy would be to increase safety and flexibility while reducing expenses. She noted that Congress authorized unlimited FDIC insurance on certain bank accounts through the end of 2012, so the county is taking advantage of that. By maintaining cash reserves in an insured account, the county is foregoing interest earnings in favor of an “earnings credit” that covers all of the county’s bank fees. This approach has saved the county’s general fund more than $80,000 annually, she said.

Conan Smith asked if McClary benchmarked Washtenaw County’s investment performance to other counties. McClary said that the county board’s investment policy had prioritized safety, and she didn’t know if that was true for other counties.

Treasurer’s Report: Foreclosures

McClary also gave her annual report on foreclosures, as required by state law. She noted that her office has been able to prevent many foreclosures through its tax and mortgage foreclosure prevention programs. Her report focused on tax foreclosures, because the county treasurer’s office is the governmental entity tasked with administering the tax foreclosure process.

The report shows a lag – because it reflects properties with unpaid taxes from 2007 that were auctioned in 2010, with excess proceeds reported as of May 31, 2012. This process is required by state law, to allow time for complete closure on the properties, McClary said.

For unpaid 2007 taxes, the process generally worked like this (the process is the same for any given year):

- 2007 taxes in any local jurisdiction in Washtenaw County that were unpaid by March 1, 2008, were declared delinquent. The county treasurer was then responsible for those taxes. A 4% administrative fee was added to the taxes, and interest started to accrue at 12% per year (1% per month). On Oct. 1, 2008 a $15 fee was added.

- On Nov. 1, 2008 the property was added to a preliminary forfeiture list. If taxes were still unpaid by Feb. 1, 2009, then mortgage lenders and banks could be notified.

- On March 1, 2009, a minimum of $205 in fees could be added to each property, and the properties were forfeited to the county treasurer. The interest rate was increased to 18% per year, retroactive to March 1, 2008.

- In June 2009, the treasurer filed foreclosure petitions in the 22nd Circuit Court.

- Between June 1, 2009 and Jan. 31, 2010, title research was conducted to identify owners and lienholders. In some cases, a personal visit was made to the forfeited property. Mortgage lenders, banks and other lienholders were notified.

- In early 2010, a show cause hearing was held. That led to a court hearing in February 2010 when the circuit court judge signed foreclosure orders. By March 31, 2010, redemption rights expire if taxes aren’t paid, and the property ownership transfers to the county treasurer.

- Property was sold at action in July 2010. The prior owner doesn’t receive any proceeds.

After two years of being unable to recover costs at tax foreclosure auctions, McClary reported net positive proceeds from 2010 of $102,746. That amount is available this year for transfer to the county’s general fund.

Interest on these properties goes into the county’s delinquent tax revolving fund. After delinquent tax notes are matured and paid off, any leftover funds are transferred to the county’s capital projects fund and used to pay the debt service of other bonds committed by the board of commissioners. In 2010 and 2011, a total of $11.2 million was transferred from the delinquent tax revolving funds to the capital projects fund. These amounts are counter-cyclical, McClary noted – they are higher when the economy is bad, and lower when the economy improves and fewer properties go into tax foreclosure.

McClary said the county is seeing better times, and appears to be pulling out of its economic trough. A leading indicator of that is delinquent taxes, which are down 20% this year, she said.

McClary also reported that the first tax foreclosure auction of 2012 went well, with 45% of the properties sold. About 80% of the buyers listed zip codes in Washtenaw County, she said, noting that it’s a positive for our neighborhoods when the buyers are local.

Treasurer’s Report: Foreclosures – Board Discussion

Dan Smith observed that the nearly $103,000 in net proceeds is a mixed bag. While it’s good for the county’s general fund, it still reflects the fact that some people lost their properties through foreclosure. McClary said that’s why she’s proud of her office’s tax foreclosure prevention program, which helps people avoid that end result.

Ronnie Peterson said he knew that McClary had prevented a lot of tax foreclosures in his district, but activity was still very high there. Over the past few years, hundreds of homes had been lost to foreclosure. [Peterson represents District 6, which covers primarily the city of Ypsilanti.] Houses sold at auction were extremely reasonable for the market, he said – some selling as low as a few thousand dollars. He wondered how the county might partner with another agency to secure some of these properties for housing families in need.

McClary said she’d like to pursue the idea of a revolving loan fund. She’d be willing to sit down with her staff and do an analysis of properties that have been sold at auction over the last few years. The city of Ypsilanti had approached her office and partnered to have open houses of the properties before auction, she reported. This year there were 10 open houses – it’s a way of encouraging local people to buy, she said. McClary noted that the county and city recently received an award for the project from the National Association of Counties.

Peterson observed that some of his business colleagues get concerned when the government gets involved in the housing market. But he noted that the government already is involved – by funding the homeless shelter. If families can be put in housing, it would help stabilize neighborhoods and bring prosperity to the community, he said.

CUB Agreements Suspended

For the second time in the past 12 months, commissioners were asked to suspend the county’s use of Construction Unity Board (CUB) agreements.

CUB agreements are a type of project labor agreements (PLA), negotiated between local trade unions and contractors. CUB agreements require that contractors who sign the agreement abide by terms of collective bargaining agreements for the duration of the construction project. In return, the trade unions agree that they will not strike, engage in work slow-downs, set up separate work entrances at the job site or take any other adverse action against the contractor.

The county board first suspended its CUB policy in September 2011, pending the outcome of litigation that’s challenging the validity of the state’s Public Act 98 of 2011. That law, which took effect on July 19, 2011, prohibited municipalities from including as a requirement in a construction contract anything that would either require or prohibit contractors from entering into agreements with collective bargaining organizations. The act also prohibited discrimination against contractors based on willingness or non-willingness to enter into such agreements.

The law was challenged in federal court by the Michigan Building and Construction Trades Council, AFL-CIO and the Genesee, Lapeer, Shiawassee Building and Construction Trades Council, AFL-CIO. They sought to rule the law invalid, contending that it was pre-empted by the supremacy clause of the U.S. Constitution and the National Labor Relations Act.

The county board’s September 2011 resolution suspending its CUB also also stated that if the state law was overturned by a state or federal Court, the county would automatically reinstate its CUB agreement policy. That happened in March of 2012, when the judge for the Federal District Court for the Eastern District of Michigan ruled that the state law was unenforceable. At that time, the county’s CUB immediately was reinstated, without additional action by the county board.

Instead of appealing that decision, the state legislature made revisions to the law, which took effect on June 29, 2012 as Public Act 238 of 2012. The new law revised several aspects of the previous version, but generally prohibits the use of CUB agreements.

According to a staff memo, the unions that filed the initial lawsuit seeking to invalidate the original version of the law are expected to file suit again to have the revised version invalidated. Meanwhile, the new law led the county board again to suspend its CUB agreement. The resolution on the Aug. 1 agenda was nearly identical to the one passed by the board in September of 2011. It suspends the county’s CUB requirement pending the outcome of any litigation challenging the validity of the new state law.

The city of Ann Arbor has taken similar action related to CUB agreements, most recently at the city council’s July 16, 2012 meeting.

CUB Agreements Suspended: Board Discussion

Dan Smith said he would reluctantly support the resolution. There were a couple of the resolved clauses that he didn’t like – Smith didn’t specify which ones – but based on the advice of the county’s corporation counsel [Curtis Hedger], he’d support it.

Rob Turner confirmed with Hedger that this resolution suspending the CUB agreements is similar to the previous one that the board discussed and passed in September 2011. Yes, Hedger replied, it’s almost identical – a temporary suspension until state or federal courts find the new law invalid.

Turner noted that suspending the agreements temporarily will prevent the county from legal entanglements. The building trades were planning to take the government to court on this, he said. Turner added that he liked the section of the board’s resolution that stated the county supports these labor agreements and will reinstate them if possible.

Yousef Rabhi agreed, saying he very much supported CUB agreements and he doesn’t agree with the state law. The only reason he could support this resolution was because it included a resolved clause similar to the one that he had proposed through an amendment at the September 2011 meeting. [That resolved clause states that "upon such time as it is permitted under State and/or Federal law or otherwise ruled legal by a State and/or Federal Court, it is understood that the County will immediately reinstate its CUB Agreement policy."]

Felicia Brabec said she echoed Rabhi’s sentiments. She asked Hedger what’s to stop the legislature from repeating this cycle? Hedger replied that the current legislature is determined to remove this type of agreement. He assumed the unions would sue again. It’s difficult for the county, Hedger said, because many projects are in the process of soliciting bids. The county must follow the law. “I don’t know if there’s an easy answer,” he said.

Wes Prater said he also believed the building trades would be challenging this law in court – as the new law is very similar to the one that was struck down in court, he noted. Probably the same process will happen again and again, until Gov. Rick Snyder gets tired of signing legislation that the courts rule is unconstitutional and “stops this silliness.”

Outcome: On an 8-2 vote, commissioners voted to suspend the county’s use of CUB agreements, with dissent from Alicia Ping and Ronnie Peterson. Neither stated their objection to the resolution. Rolland Sizemore Jr. was absent.

Change to Accommodations Ordinance

Commissioners were asked to give final approval to a change in the county’s accommodations ordinance, exempting bed & breakfasts and cottages from the 5% accommodations tax. In addition to exempting cottages and bed & breakfasts with less than 14 rooms, the change also exempts individuals who occasionally lease out rooms. These types of establishments account for less than 1% of the total tax collected in Washtenaw County, according to a staff memo accompanying the resolution.

According to the county treasurer’s report to the Washtenaw County accommodation ordinance commission, in 2011 the county collected $3.99 million in accommodation taxes. The money is primarily distributed to the county’s two convention & visitors bureaus (CVBs) – in Ann Arbor ($2.69 million in 2011) and Ypsilanti ($898,563). The county treasurer retains 10% of the tax to cover collection and enforcement expenses.

The ordinance changes received initial approval by the county board at their July 11, 2012 meeting, and several B&B owners spoke in support of the proposal.

The changes had been recommended for approval by the accommodation ordinance commission (AOC) in June. A staff memo states that the AOC had recently reviewed enforcement and administrative costs, and did not believe it was cost effective to enforce the ordinance with these smaller establishments. The staff memo also states that the local CVBs support this change, in part because the CVBs do not actively market these establishments.

No one spoke at a public hearing on the ordinance change. Mary Kerr, president of the Ann Arbor Convention & Visitors Bureau, attended the meeting but did not formally address to the board.

Outcome: Without discussion, commissioners unanimously gave final approval to the accommodations ordinance change.

Photo IDs for Veterans

The county board was asked to approve a proposal from county clerk Larry Kestenbaum that allows the clerk’s office to issue veteran photo ID cards for a $10 fee.

According to a staff memo, county clerks in Michigan are permitted to record military discharge certificates for veterans. Those certificates – called DD-214s – are bulky and can’t be carried around easily. A veteran’s ID card would serve the same purpose, allowing veterans to show more easily a proof of service – to take advantage of discounts for veterans offered by businesses. The memo notes that $10 photo IDs are currently offered in Livingston, Oakland and Macomb counties.

The $10 fee would cover the cost of printing the card, which would be handled by the clerk’s vital records division. Start-up costs are estimated at $100. The county clerk/register of deeds office is located at 200 N. Main in downtown Ann Arbor.

Photo IDs for Veterans: Board Discussion

Barbara Bergman recalled that in the past, the clerk’s office offered ID cards at little or no cost to people who needed the cards to get certain government benefits. She wondered if that program was extant – if it wasn’t, she hoped it could be re-instituted. County administrator Verna McDaniel said she’d check with the county clerk and report back to the board.

Yousef Rabhi asked whether veterans could use the photo IDs as voter identification. Michael Smith, director of veteran services for the county, replied that this ID primarily could be used for discounts at private businesses, but not as a voter ID. Companies like Lowe’s, Home Depot and restaurants often offered discounts to veterans, but require proof of service, he said. The U.S. Dept. of Veteran Affairs doesn’t offer an ID card of this type – discharge papers are used in order to obtain government benefits, but there’s nothing that can be used conveniently to show proof of service for other reasons.

There’s a need, Smith said, and this service fills that need, while also bringing in a little revenue to the county. He thanked the clerk’s office for taking the initiative on this.

Smith also said the board had been very brave in authorizing an 0.025-mill tax to pay for services for indigent veterans. If veterans were unable to afford the $10 fee for the photo ID, Smith said his office would be happy to cover that cost. He offered to work with the clerk to come up with a waiver, if needed.

Outcome: The board unanimously voted to allow the county clerk’s office to issue veteran photo ID cards.

618 S. Main Brownfield Plan

Commissioners were asked to approve a brownfield financing plan for a $39 million residential development at 618 S. Main St. in Ann Arbor. [.pdf of brownfield plan]

Previously approved by the Ann Arbor city council on June 18, the project’s brownfield tax increment finance (TIF) plan works in conjunction with a $650,000 TIF grant (paid over a period of four years) awarded by the Ann Arbor Downtown Development Authority board at its June 6, 2012.

Both the brownfield TIF and the DDA grant work in a similar way – in that the developer must build the project and pay the new taxes on the project, in order to receive the financial benefit. The brownfield plan includes developer reimbursements of $3.7 million over 26 years. Also during that period, the plan includes $462,864 of tax capture for administrative fees to support the operation of the Washtenaw County Brownfield Redevelopment Authority. An additional $457,741 of tax increment proceeds will be contributed to the Local Site Remediation Revolving Fund.

Work covered by the brownfield plan includes: site investigations for characterization of soils and dewatering if water is encountered during excavation; disposal of soils; demolition of buildings and removal of existing site improvements; lead and asbestos abatement; infrastructure improvements like water, storm sewer and sanitary sewer upgrades, street repair and improvements to streets; and site preparation like staking, geotechnical engineering, clearing and grubbing.

According to a staff memo, the project will create 80-100 temporary construction jobs, and 4-5 full-time, and 6 or more part-time, permanent jobs. Taxes from the Washtenaw County annual millage will increase from about $2,028 to $69,614 after the tax increment financing period is completed.

The 7-story building will include 190 units – which will be marketed to young professionals – plus two levels of parking for 121 vehicles.

618 S. Main Brownfield Plan: Public Hearing

The only speaker at the public hearing was the project’s developer, Dan Ketelaar. He described various aspects of the project, noting that his team has been working on it since November of 2010. The Ann Arbor planning commission had approved the development in January of 2012, followed by city council approval in June. The market niche for young professionals isn’t being addressed in downtown Ann Arbor, Ketelaar said, and this project will satisfy that need. He described it as a gateway project, close to a highway yet walkable to downtown and the University of Michigan campus.

When the three minutes for his speaking turn ended, board chair Conan Smith asked if there were any objections to allowing Ketelaar to continue. There weren’t any, and Ketelaar spoke for a few more minutes.

Ketelaar told commissioners that he had met with several local groups, including the Old West Side Association and the city’s design review board. In response to neighbors’ concerns about parking, the project doubled the number of parking space on site, he said. The project and related streetscape improvements will improve the pedestrian experience in that part of town, Ketelaar said, and encourage redevelopment of other property. He urged the board to support the plan.

618 S. Main Brownfield Plan: Board Discussion

Felicia Brabec asked whether the development included any affordable housing. Brett Lenart, housing and infrastructure manager at the office of community & economic development, replied that there would be no subsidized or public housing – most of the units would be priced around the range that’s considered affordable for the area median income. [Median income for one person in metro Ann Arbor – a region covering all of Washtenaw County – is $60,500. For a two-person household, the area median income is $69,100.] Lenart noted that the city of Ann Arbor’s site plan approval for this project did not have an affordable housing requirement.

Brabec called it an amazing project, but was concerned that young professionals couldn’t live there because the rent would be too high. When she moved to this area 10 years ago, she would have loved to live in a development like this, but with student loans, it would not have been possible. She said she’s not alone in that.

Dan Smith said he’d support the plan, but he still had the same concerns that the board had discussed at previous meetings and working sessions regarding brownfields and downtown development authorities. [For background, see Chronicle coverage: "Packard Square Brownfield Project Debated."] He noted that county taxes would be diverted because of the brownfield TIF financing. And although the plan requires approval by the Ann Arbor city council and county board, Smith pointed out that other taxing entities – including the Washtenaw Community College, Ann Arbor District Library and Washtenaw Intermediate School District – would also see a portion of their taxes diverted, yet their governing bodies have no say in the matter. The same is true of public school districts, indirectly.

Yousef Rabhi thanked Ketelaar for his work, and praised the project’s outreach efforts, green amenities, and the fact that it was adding needed housing to the downtown area. He also thanked the Ann Arbor DDA, for contributing to public upgrades related to the project. He wished Ketelaar good luck and success, and he hoped the project would bring energy to the downtown. But his concern comes from his heart, Rabhi said – the issue of accessible, affordable housing. The issue “should have been thrown into the batter before the cake was in the oven,” he said. At this point, all he could do is voice his opinion in the form of a no vote.

Rabhi said he’d be working proactively with county staff on this type of project to ensure that the downtown is accessible to all income levels. He concluded by saying that his vote isn’t a no-confidence vote against the process, but rather a vote that reflected his other concerns.

Outcome: On an 8-2 vote, the board approved the brownfield plan for 618 S. Main in Ann Arbor, with dissent from Felicia Brabec and Yousef Rabhi. Rolland Sizemore Jr. was absent.

Weatherization Grant

On the Aug. 1 agenda was a resolution to accept $289,800 in additional federal funds for the county’s weatherization program. The funds will allow the county to weatherized 26 housing units for low-income residents.

The money is available through the 2009 American Recovery and Reinvestment Act (ARRA), also known as the federal stimulus program. It’s a redistribution of funding that had previously been awarded to other communities but was not used. In total since 2009, Washtenaw County has received $5,053,338 in ARRA funding for its weatherization program, and has served 721 housing units. The program is administered through the office of community and economic development, a joint county/city of Ann Arbor department.

According to a staff memo, weatherization services include “outreach and intake, pre-inspection of homes, air leakage testing, health and safety evaluations, furnace assessments, refrigerator efficiency testing, post-inspection of the completed work and consumer education on how to keep one’s home weatherized and energy efficient. Licensed and approved contractors provide procurement and installation of weatherization materials including attic and wall insulation, air sealing, window repairs, furnace tune-ups and high efficiency furnace installations.”

To be eligible for the program, residents must have an income at or below 200% of the federal poverty level, or 60% of the state median income (whichever is lower). That translates to annual incomes less than $22,911 for a single person or $44,700 for a family of four. Residents who receive federal Supplemental Security Income, state disability assistance or who are part of the Family Independence Program are automatically eligible for the weatherization program.

Weatherization Grant: Board Discussion

Felicia Brabec asked about indirect costs – the staff memo indicated that indirect costs for this grant were not included in the budget. Brett Lenart, housing and infrastructure manager at the office of community & economic development, told Brabec that because it will be part of a program that the county already runs, there would be no indirect costs to increase the program’s budget.

Wes Prater said he hoped the grant would fund weatherization in owner-occupied homes, rather than rental properties. Lenart indicated that the “vast majority” of the projects would occur in owner-occupied homes.

Outcome: The resolution related to weatherization funding passed unanimously.

Public Commentary

In addition to the public commentary and public hearings reported above, Joel Levitt of Ann Arbor spoke during general public commentary about the need for a graduated, progressive income tax that would replace excise taxes in Michigan. He noted that last year, the state Democratic convention adopted a resolution to work to change the state constitution so that such a tax could be instituted. Property taxes made sense long ago, when property was the basis for wealth, he said. But that’s not the case today. Excise taxes on products like gasoline make it even more difficult for struggling families. He urged commissioners to pass a resolution supporting an improved financing system for the state, and said he planned to ask the Ann Arbor city council to do the same.

Responding to his commentary, Barbara Bergman said she agreed with his premise, but that the county board isn’t the forum for this kind of resolution. They generally don’t take up “political” resolutions, she said, but that didn’t mean his comments had fallen on deaf ears. She said she personally supported it.

Present: Barbara Bergman, Felicia Brabec, Leah Gunn, Alicia Ping, Ronnie Peterson, Wes Prater, Yousef Rabhi, Rolland Sizemore Jr., Conan Smith, Dan Smith, Rob Turner.

Next regular board meeting: Wednesday, Sept. 5, 2012 at 6:30 p.m. at the county administration building, 220 N. Main St. in Ann Arbor. The ways & means committee meets first, followed immediately by the regular board meeting. [Check Chronicle event listings to confirm date] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public commentary is held at the beginning of each meeting, and no advance sign-up is required.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Washtenaw County board of commissioners. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Thanks for the detailed report! It was great to have such a wide cross-section of the County represented in the folks speaking on behalf of better transit: Ypsilanti Township, Ypsilanti, Pittsfield, Ann Arbor, Scio and Milan. The applause (from Commissioners!) for Bhattacharyya’s comments was an especially nice moment. I believe he said that Tocqueville had been his previous point of reference for American democracy.

Keep current on progress towards expanded transit at the Partners for Transit blog: partnersfortransit.org.