DDA Ramps Up PR After First Council Vote

Ann Arbor Downtown Development Authority board meeting (April 3, 2013): The board had no voting business on its agenda, but still dealt with serious business: the city council’s initial approval of changes to the DDA ordinance. The changes are meant to clarify the authority’s tax increment finance (TIF) capture, as well as place restrictions on board composition. [.pdf of Chapter 7 amendments]

The proposed amendments to Chapter 7 of the city code, given initial approval at the council’s April 1, 2013 meeting, would reduce the DDA’s TIF capture by roughly $931,000 for FY 2014 – compared to the amount the DDA would receive based on the DDA’s current interpretation of the ordinance. But in adopting its two-year budget recently, DDA did not factor in recent building projects in the downtown – which add to the increment on which the DDA can capture taxes, starting in FY 2014.

So compared to the amount of TIF revenue in the DDA’s adopted FY 2014 budget, the clarified calculations would result in only about $363,000 less TIF revenue for the DDA. And compared to the DDA’s adopted FY 2015 budget, the clarified calculations would result in about $74,000 less revenue than budgeted. The clarified calculations would result in TIF revenue to the DDA in FY 2014 and FY 2015 of $3.570 and $3.682 million, respectively.

A dispute on the clarity of the existing Chapter 7 language had emerged in May 2011 just as the DDA and the city were poised to sign a newly renegotiated agreement under which the DDA manages the public parking system. At that time, the city’s financial staff reportedly first noticed the implications of an existing Chapter 7 paragraph that appears to place a cap on the DDA’s TIF capture – a cap that’s calibrated to projections in the DDA’s TIF plan. The TIF cap rises each year based on forecast growth in the DDA’s TIF capture district.

Several board members weighed in on the issue during the April 3 meeting. The idea of any kind of cap – let alone one that’s based on estimates contained in the appendix of the DDA’s TIF plan – was sharply criticized by Joan Lowenstein, who characterized the approach as based on “a fallacy.” She also called the idea of a cap poor public policy. However, both the cap and its basis are already in the existing ordinance language that the city council’s ordinance amendment seeks to clarify.

Roger Hewitt took the board’s meeting as an opportunity to question whether the ordinance amendments actually clarify how the calculations are to be done, contending that he’d come up with different results than the city treasurer, starting from the same ordinance language. He cautioned that the DDA’s financial planning and the DDA’s budget would need to be re-evaluated – allowing for no “sacred cows” – if the council gave final approval to the ordinance changes.

Russ Collins contrasted the amount of net revenue received by the city from the geographic area of the DDA district before the DDA was established back in 1982, compared to today. The net proceeds from taxes and the public parking system (which lost about $250,000 a year during that era) came to about $1.25 million 30 years ago, according to Collins. Today, the city receives nearly $8 million annually – around $4 million in taxes, $3 million in parking revenue, and a grant to the city of roughly $0.5 million a year toward debt on the city’s new Justice Center building.

Bob Guenzel focused his remarks less on the financial side and more on the aspects of the ordinance change that would restrict future board membership. He saw no benefit to the proposed DDA term limits, noting that the city council has an opportunity to end a DDA board member’s service by deciding not to re-appoint someone to the board. John Mouat was critical of the proposed ordinance changes that would prevent elected officials of taxing jurisdictions from serving on the board, saying he’d found the participation of politically-connected people to be beneficial to the board.

The extended remarks by board members on the topic came in the context of a 7-3 vote by the city council on April 1, giving initial approval of the ordinance changes. [Christopher Taylor (Ward 3) was absent from the meeting of the 11-member council.] A second vote, expected at the council’s April 15 meeting, would be required to enact the changes. Based on their remarks made at the council table, two of the seven votes in support of the changes – by Marcia Higgins (Ward 4) and Sabra Briere (Ward 1) – were widely read as likely to change at the second vote. Ordinance changes require a six-vote majority.

In addition to discussion of the possible ordinance changes, the DDA heard its usual range of committee reports, including the monthly parking update. Public commentary related to a possible artificial ice-skating rink atop the Library Lane underground parking garage.

Chapter 7 Ordinance Amendments

On April 1, the Ann Arbor city council gave initial approval to a set of changes to Chapter 7 of the city code, which governs the Ann Arbor Downtown Development Authority.

Chapter 7 Amendments: Background

The revisions considered by the council fell roughly into two categories: (1) those involving board composition and policies; and (2) calculation of tax increment finance (TIF) capture in the DDA district.

In the first category, the revisions to Chapter 7 that were given initial approval by the council included: a new prohibition against non-mayoral elected officials serving on the DDA board except by agreement with the other taxing jurisdictions; term limits on DDA board members; and a new requirement that the DDA submit its annual report to the city in early January.

Another amendment stipulates that if tax increment financing is used as the financing method for an approved authority project, the project must meet one of the DDA’s adopted plan goals. Among those plan goals is support of housing. The amendment provides the ability of the DDA to make investments in properties not strictly in the district, but also in neighborhoods near the district.

More significantly, the council gave initial approval to proposed revisions to Chapter 7 that would clarify how the DDA’s TIF tax capture is calculated. The “increment” in a tax increment finance district refers to the difference between the initial value of a property and the value of a property after development. The Ann Arbor DDA captures the taxes – just on that initial increment – of some other taxing authorities in the district. Those are the city of Ann Arbor, Washtenaw County, Washtenaw Community College and the Ann Arbor District Library. For FY 2013, the DDA will capture roughly $3.9 million in taxes.

The proposed ordinance revision would clarify existing ordinance language, which includes a paragraph that appears to limit the amount of TIF that can be captured. The limit is defined relative to the projections for the valuation of the increment in the TIF plan, which is a foundational document for the DDA. The result of the clarification to the Chapter 7 language would mean about $363,000 less TIF revenue for the DDA in FY 2014 – compared to the $3.933 million shown in the DDA’s adopted budget for that year. For FY 2015, the gap between the DDA’s budget and the projected TIF revenue – using the proposed clarifying change to Chapter 7 – is just $74,000.

However, the total increment in the district on which TIF is computed would show significant growth. And under the proposed clarification of Chapter 7, that growth would result in a return of TIF money to other taxing jurisdictions – that would otherwise be captured by the DDA – totaling $931,000 each year for FY 2014-15. The city of Ann Arbor’s share of that would be roughly $559,000, of which $335,000 would go into the general fund. The city’s general fund includes the transit millage, so about $69,000 of that would be passed through to the Ann Arbor Transportation Authority.

The amount of TIF capture that’s returned to the other taxing jurisdictions is tied to growth in the valuation by the Chapter 7 language. Under Chapter 7, if the actual rate of growth outpaces the growth rate that’s anticipated in the TIF plan, then at least half the excess amount is supposed to be returned to the other taxing authorities in the DDA district. In 2011, the DDA for the first time returned excess TIF capture to other authorities, when the existence of the Chapter 7 language was reportedly first noticed. At that time, the DDA made repayments of TIF monies to other authorities of around $400,000, which covered what was owed going back to 2003. When the DDA calculated the amounts owed in 2011, the city of Ann Arbor waived its roughly $700,000 share.

In 2011, the DDA used a year-to-year interpretation of the Chapter 7 language instead of computing rate of growth against the base year in a cumulative fashion. That is a point that the Chapter 7 revisions would clarify. At the two previous meetings when the council had considered but postponed voting on the ordinance amendments, that specific point had not been addressed. But the substitute ordinance revision offered on April 1 clarified the current language in favor of the cumulative methodology. Previously, the council had postponed voting at its March 18, 2013 and March 4, 2013 meetings.

The figures below come from the city of Ann Arbor’s financial services staff. Labels are The Chronicle’s.

MOST RECENT PROJECTIONS FOR TIF CAPTURE (in millions)

FY 13 FY 14 FY 15

==========================

3.957 3.933 3.756 DDA Adopted Budget TIF Revenue

3.957 4.501 4.613 Projected TIF, DDA View

3.957 3.570 3.682 Projected TIF, Clarified Ch. 7

.568 .857 Budgeted vs Projected, DDA View

(.363) (.074) Budgeted vs Projected, Clarified Ch. 7

==========================

ADDITIONAL REVENUE FROM CLARIFIED CH. 7

FY 13 FY 14 FY 15

==========================

.335 .335 City General Fund

.223 .223 City Non-General Fund

.559 .559 Total City

.372 .372 Total AADL, WCC, WC

.931 .931 Total

-

These projections do not include the capture that would result in future years from completion of City Apartments, 624 Church, 618 S. Main, or 413 E. Huron (assuming that it is approved).

Chapter 7 Amendments: DDA Director Summary

Susan Pollay, executive director of the Ann Arbor DDA, gave the board an update on the city council’s action on April 1. She reported to the board that a fair number of questions had been asked and answered – via e-mail preceding the meeting and also during the meeting that evening. She characterized the ordinance changes as involving three main points. The first relates to the definition of the DDA’s tax increment finance (TIF) capture – which would reduce the amount received by the DDA by imposing what Pollay called a “permanent cap.” [The cap induced by the ordinance is keyed to the estimates in the TIF plan, which increase each year. That is, the cap Pollay described is not a fixed amount, but rather increases each year.]

Pollay explained that there are some confusions about the interpretation of the current ordinance – saying that if the annual (year-to-year) method is used, that would have some impact but not as dramatic an impact on the TIF capture as the cumulative method. So there have been questions about why that particular interpretation has been used.

The second point Pollay characterized as an elimination of the DDA’s obligation for its bond issuances. She noted that the DDA has responsibility for $67 million worth of projects – including the parking deck component of the City Apartments project, Fifth and Division streetscape improvements, and the Library Lane parking garage project.

Pollay described the ordinance revision as eliminating the language now in the ordinance that relates to bond obligations. She then quoted out the relevant section. She characterized it as a pretty significant policy change, with respect to the DDA’s obligation to its debt service. [The DDA interprets the language to mean that it's entitled to full TIF capture as long as its total debt service requirements exceed the amount of TIF captured. However, on a different interpretation, the language simply means: Of the TIF that is received, first to be paid is debt service, followed by other distributions in support of the development plan for the purpose of the DDA's existence, followed by possible return of surplus TIF to the taxing jurisdictions.]

The final issue, Pollay said, has to do with governance. She observed that there are relatively few boards and commissions that have term limits – and other than the park advisory commission, she wasn’t aware of any. [The greenbelt advisory commission (GAC) also has term limits, a point highlighted at the commission's April 4, 2013 meeting.] The proposed ordinance revisions would impose term limits for the DDA board and would eliminate elected officials from future participation on the board, Pollay said. The ordinance revisions would also potentially allow the mayor to serve on the DDA board, she noted, but that would be on a year-to-year basis.

She summarized the changes by saying that: the TIF capture would be affected pretty dramatically; there would be no further connection between the DDA and debt service for the DDA’s projects; and term limits would be imposed on the board members. She noted that the council had approved the ordinance revisions at first reading, and the second reading would be coming at the council’s April 15 meeting. At that meeting there would be a public hearing as well, Pollay noted.

Chapter 7 Amendments: Board Remarks – Financial

Bob Guenzel asked if the Ann Arbor DDA and the city were clear with “the rest of the world” about how TIF capture is to be calculated. Pollay replied by saying that the DDA had received charts from the city staff. The text of the ordinance itself as put forward, she said, is from her perspective not any more clear. She felt that five years from now if the city or the DDA were to look at it, she’s not sure that it would be clear.

Pollay reported that she and Roger Hewitt had met with city staff for the better part of a week. And using the same language as in the ordinance revision, Hewitt had arrived at different numbers from the city staff. According to the city staff calculations, the revised ordinance would reduce the TIF revenue to the DDA by $931,000 for FY 2014 [compared to the amount the DDA would receive based on its interpretation of the current ordinance language.] Compared to what the DDA has budgeted for FY 2014, the TIF revenue would be $363,000 compared to what the DDA had budgeted. And going forward, there would be a cap, she said.

John Mouat ventured that there are several downtown development authorities in the state, so it might be possible to seek guidance on interpretation based on how other DDAs compute TIF. Pollay noted that each downtown development authority is created by its own community – so it’s not one-size-fits-all. “Our own TIF has been around for quite a while,” Pollay said. She said that the Ann Arbor DDA had been operating under a shared understanding – but now has learned that not everybody in the present agrees with what was done in the past.

Hewitt said that as treasurer, he felt he had a fiduciary responsibility at least to talk about what the impacts of the ordinance changes are. The first thing he found disturbing and disappointing is that in his time on the DDA board, it’s the first time that the council has decided to take action without any prior consultation with the DDA on the impact.

By way of background, the council has actually taken action previously that has affected the DDA budget – without consulting the DDA. In 2007 the council reached into the DDA’s already adopted budget and changed an item on the same night it approved the city’s budget as a whole. From the May 21, 2007 city council minutes [Fund 0003 is the TIF fund]:

[FY 2008 budget] Amendment 11

Resolved, that the Downtown Development Authority fund (0003) expenditure budget be decreased by $1,600,000 to reduce the appropriated reserves for future capital construction projects.

On a voice vote, the Mayor [John Hieftje] declared the motion carried with one dissenting vote made by Councilmember [Joan] Lowenstein.

At the April 4, 2013 meeting, Hewitt continued, calling the council’s action this time “unprecedented,” saying “We have essentially been out of the loop.” It’s difficult to understand exactly what the goal is of the ordinance changes, he contended.

The two things Hewitt found most troubling about the ordinance changes were: (1) the change in the financial basis on which the DDA did its planning; and (2) remaining unclarity in the ordinance, despite the changes.

Hewitt said over the last few years the DDA has undertaken $67 million worth of infrastructure improvements to the downtown. A very detailed financial plan had been put forth, he said, the basis of which he said is in the ordinance – that debt service will be paid off before there was any rebate of TIF back to the taxing authorities. [This is an interpretation of the ordinance language that relies crucially on a specific reading of the phrase "as set forth above." In context, the phrase has an interpretation that is arguably different from the one on which the DDA is relying.] By changing that language, Hewitt contended, the city had changed the financial basis on which the DDA had put that plan forward. He likened the situation to changing the rules after the money was spent.

The second part, he said, is the confusion about how the TIF should actually be calculated – based on the annual method or the cumulative method. Hewitt contended that he had taken the language in the proposed ordinance change and come up with some calculations, and had met with city treasurer Matt Horning and the city’s chief financial officer Tom Crawford. The two city staff members had taken the same language and come up with an entirely different way of calculating it. Russ Collins interjected to confirm that it was the city’s numbers that were presented to the council. Hewitt confirmed that was the case, and said that he was not trying to say who was right and who was wrong. He noted that there is no formula in the revised ordinance language to guide the calculation. If the ordinance is supposed to bring clarity to how that is done, it certainly falls far short of it, Hewitt contended. It’s still open to interpretation, he said.

If the ordinance is enacted, the DDA needs to reevaluate its 10-year budget and its 10-year plan, based on the revised ordinance. But without some clarity about how the calculation is done, Hewitt said, the DDA cannot make projections about how to adjust its long-range plan. Assuming the clarity can be achieved on how the calculations are done, Hewitt said he felt the DDA needs to reevaluate its budgets and its 10-year plan – based on a new reality. He felt that all the commitments in the DDA budget need to be examined. Everything would need to be put on the table. He felt there should be no “sacred cows” about what gets saved and what doesn’t.

What could be a small impact in the first two years could multiply to a larger impact in subsequent years, Hewitt contended. He felt the board’s operations committee needs to sit down and try to achieve some clarity, assuming that the ordinance is approved. And then the committee needs to reevaluate the DDA’s current budget and the 10-year plan, focusing on the DDA’s core mission: Infrastructure improvement to encourage economic development of the downtown. He said the DDA would be remiss in its financial responsibilities if it did not take up that challenge.

Chapter 7 Amendments: Board Remarks – Policy Issues

Joan Lowenstein said she’d noticed some things in watching the city council deliberations the other night. She indicated that she identified with councilmember Sabra Briere with respect to the math part, which is also not Lowenstein’s strong point, Lowenstein said. Then Lowenstein sought to clarify what she was trying to say about Briere – not that math is not Briere’s strong point, but rather that this is what Briere herself had said. The remark drew a laugh from board members. DDA board chair Leah Gunn noted that Briere was in the audience. [Briere did not appear to take any offense at Lowenstein's comments.]

It’s really the public policy part of the question that bears examining, Lowenstein said. She identified two public policy issues.

First, when she previously served on the city council, whenever an ordinance change was being considered, it was considered important to look at it much more strictly than you would if it were simply a resolution. That’s because ordinances are in a sense “written in stone” – or at least the digital equivalent of that, Lowenstein said. So when you’re making an ordinance change, she said, you’d better make awfully sure that this is something you really want to be there for a very long time.

And this ordinance change is based on calculations that nobody agrees on, Lowenstein said. Those calculations stem from the downtown development plan, which has an appendix, and the numbers in that appendix are estimates of what the growth will be in the downtown. So if the estimate for the first year is incorrect, she contended, then all the other estimates are also incorrect. So this ordinance is based on a “fallacy,” she concluded. And the calculations are based on fallacies. And that doesn’t make sense for an ordinance change.

On the second public policy issue, Lowenstein said, she felt that the original ordinance language that puts a kind of cap on the TIF capture was “misguided.” She had researched the history of the formation of the DDA. She contended that the only people who objected to the TIF capture were people who said: We really shouldn’t be taking money out of the schools. It was only the idea of taking school money that really got people stirred up, she contended. “Well, we don’t take school money anymore,” Lowenstein said. So the whole question about the DDA TIF capturing money that could be used for education is moot, she concluded.

As a matter of principle, if you’re looking at investment, whether it’s your own personal investment, or business investment, or in this case the city, Lowenstein continued, you don’t stop the investment at the point when you are doing well. After so much belt-tightening, she said, “we are now getting to the point where we can see that we are really doing well.” So this is not the time to stop investment, she said. The idea of a cap on something that continually increases your economy just doesn’t make sense, she contended.

Aside from all of the arcane mathematical questions about how you calculate things, Lowenstein felt fundamentally it’s a question of whether a cap is good public policy, and it’s clearly not, she contended.

Chapter 7 Amendments: Board Remarks – Positive DDA Impact

Roger Hewitt then offered a personal perspective on the history of downtown Ann Arbor. He has started working downtown shortly after the DDA was formed, he said. He’s been working downtown for nearly 30 years and has owned a business downtown for about 20 years. He felt there’s a tendency to look at the downtown now and think that it wasn’t that different 30 years ago – and that it won’t be that different 30 years from now. Having been here, he said, he could tell you that is simply not true. Thirty years ago the downtown was a rapidly declining retail area. It was in trouble. And it has now evolved into one of the most vibrant downtown areas – with dining and entertainment areas – that you can find in the country, or certainly in the Midwest.

Downtown Ann Arbor didn’t “just happen to” evolve, Hewitt said. If the DDA had not been there to build six new parking structures, to rebuild the sidewalks, and to reconstruct the two remaining parking structures, the downtown would not look the way it does now. The “city fathers and the city council” 30 years ago had the wisdom to recognize that there would need to be major infrastructure improvements, if the downtown was going to prosper in the long-term, Hewitt said. They had the wisdom to set money aside, knowing that there would always be a political demand to be able to use now what money you have now. But by putting that money aside, the DDA was able to invest in those infrastructure improvements that allow the transformation of the downtown.

Without parking to support people in stores and restaurants, Ann Arbor could not have evolved to what we have now, Hewitt said. He hoped that the current city government can look forward and say that we need to set money aside to be able to do those infrastructure improvements in the future – whatever they might be – so that “our children and grandchildren” can enjoy the kind of vibrant downtown that we have now. It doesn’t just happen, Hewitt said. You need to put money aside, to be able to do those sorts of improvements – whatever they look like in the future. You have to keep reinvesting, or you’re not going to have economic development, which seems to be everyone’s goal, he said.

So as soon as there is clarity from the city council, Hewitt said, the operations committee needs to focus on the budgetary changes that need to be made and what projects need to be removed or adjusted. The full board also needs to engage in a discussion on that.

Later in the conversation, Russ Collins adopted the framing of the issue that Roger Hewitt had used – comparing the time when the DDA was established in 1982 to now. Some back-and-forth between Hewitt and Collins established that in the early 1980s the city levied about $1.5 million worth of taxes in what is now the DDA district. And the parking system lost about $250,000 a year. So Collins put the net proceeds to the city of the DDA district in that era at about $1.25 million. According to Hewitt, the city today levies about $4.1 million worth of taxes a year in the DDA district, and receives about $3.1 million a year from gross parking revenues, not to mention the $508,000 for the police courts building. Collins called it a tenfold increase in revenue to the city compared to the time when there was no downtown development authority. That would not have happened, Hewitt said, if there had been no reinvestment in infrastructure.

During his remarks to the board, Ray Detter reported that some members of the downtown citizens advisory council (CAC) were bewildered by what he characterized as the negative attack on the DDA, because it seemed to some of the members to be irrational. The downtown requires special attention, he said. And the downtown development authority is especially equipped with a creative focus and the economic tools for strategic planning that allows for long-term community goals, Detter said.

Chapter 7 Amendments: Board Remarks – City-DDA Partners?

Mayor John Hieftje added that he shared Hewitt’s concerns about the budget, both long- and short-term. He said that one of the problems is that there is a “deficit in education” about what the DDA does. He felt that some of that lack of education had played out during the discussion by the city council and some of it has played out in the community. He also attributed part of the problem to the fact that there are some new councilmembers.

As the recession took place, and city governments across the state really found themselves in great difficulty, the city of Ann Arbor had made it through the recession with essentially the same millage rate as it had before, Hieftje said. Many cities across the state cannot say the same, he noted. He pointed out that in Grand Rapids, the income tax had been raised. [Ann Arbor does not have an income tax.]

But there was also a time during that period when the city needed some help, he noted, and the city had reached out the DDA. One of those times was when Washtenaw County had told the city that the 15th District Court had to move out of the county courthouse. So the city had embarked on a project to build a new police/courts building – and the DDA had “stepped up to the plate,” he said, and committed to that [in the form of an $8 million grant paid in roughly $508,000 million installments]. Implicit in that was an understanding, he felt, that the city would not turn around and change the DDA’s funding and its ability to uphold that commitment.

And then, he said, the city had reached out to the DDA and renegotiated the contract under which the DDA operates the public parking system – something that Hieftje said was not always an easy conversation. Implicit in that is the fact that the city and the DDA are partners, he said. Even though a lot was said on Monday night at the city council meeting, the partnership between the city and the DDA is something that hasn’t been explored enough, he said. The DDA has been an excellent partner for the city, Hieftje maintained – and the police/courts building, and the renegotiation of the parking agreement showed that. These were not actions that the DDA had to take, he contended. But implicit in all of that was the idea that the city would not then come back and pull the rug out from under the DDA.

Hieftje noted that he had a fiduciary obligation to both the DDA and the city – but he said he felt his greater priority was to the city budget. “We appreciate the help that the DDA has offered,” he said. Hieftje felt that more communication was needed to make sure that people are aware of the partnership between the city and the DDA. The commitments were made in good faith, Hieftje said. He hoped that the city would be able to uphold its side of the good-faith agreement.

Later in the conversation, Keith Orr picked up on Hieftje’s remarks, saying that the ordinance change had been a surprise to him. Although the relationship between the city and the DDA had included difficult discussions over the years, it’s been a relationship that has worked very well, he said. “Why are we fixing something that does not appear to be broken?”

Chapter 7 Amendments: Board Remarks – Board Composition

Bob Guenzel stressed how important the long-term fiscal stability had been for the DDA, and he did not think it was a good idea to change it. But he focused his remarks on the governance issues and the term limits. Guenzel noted that he had been involved with county government “for a while.” [An understatement – Guenzel worked at for the county for 37 years, including 15 years as county administrator.] He had observed that most boards and commissions do not have term limits. They have limits in the sense that every two or four years the appointing body can reappoint members. He noted that all the DDA board members were appointed with the approval of the city council. So the city council can limit a DDA term whenever they want to. It’s important also, he pointed out, to have a mix of people who are “seasoned,” and who can see the long-term, because they have been there from the beginning. He felt that there’s been a disadvantage of not having that seasoning in the state legislature, which now has term limits.

For a body such as the DDA, which is very focused on a specific mission, Guenzel thought it was very important to have folks who been a part of the mission, and who can carry that mission forward. He saw no reason to impose term limits on DDA board members.

Later in the conversation, John Mouat added that as a non-politically-connected sort of person, he wanted to express his gratitude, saying that he saw value in having people on the DDA board who know how things work at the city and county, and the machinations of it all. For those people who are not involved politically, he said, it’s difficult to understand how all the moving pieces work together. So he appreciated the elected officials being on the board. He also said he’d never had an experience where any of them had tried to coerce, or direct him in any way.

Monthly Parking Report

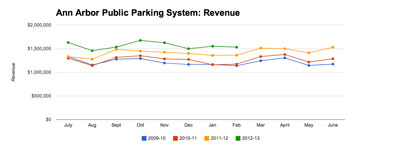

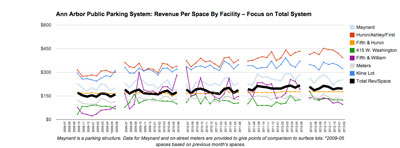

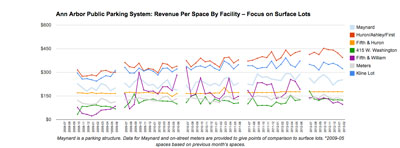

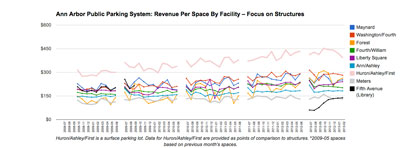

Roger Hewitt delivered the monthly parking report. The most recent monthly figures were for February 2012. He said that the operations committee is still working on getting more detailed reports on actual hours used. That will allow the DDA to get better insight into how the system is actually working.

Revenue for February 2013 was $1,532,504 compared to $1,362,989 last year – a 12.4% increase. That amount includes revenues from parking meters and from monthly permits. The number of hourly patrons in February 2013 was 172,385 compared to 174,492, or a drop of 1.2%.

The comparison was impacted by the fact that February 2012 was a leap year, with 29 days – something that Russ Collins highlighted. He contended that the reduced usage was almost entirely explained by a month with one less day. John Splitt also pointed out that it was colder this year.

Communications, Committee Reports

The board’s meeting included the usual range of reports from its standing committees and the downtown citizens advisory council.

Comm/Comm: Rail Station

Roger Hewitt told the board he’s part of a study committee that’s looking at station locations for north-south commuter rail service (WALLY). The committee had its first meeting, and a broad swath of the city is under consideration for a possible location – from Hill Street to Summit Street. [Initial reports from the Ann Arbor Transportation Authority indicate that a station stop along the track somewhere between Washington and Liberty streets is one strong possibility.] He noted that it’s an alternatives analysis, funded by money granted to the AATA from the federal government and the Michigan Dept. of Transportation. The study is in the preliminary information-gathering stage.

Comm/Comm: Bike House

John Mouat gave an update on the Bike House under construction in the Maynard parking structure. There’s a possibility that a soft launch to the facility will take place during bike-to-work week, which is May 13-19 this year.

Comm/Comm: Review of D1 Zoning

During his regular report from the downtown citizens advisory council (CAC), Ray Detter told the board that CAC supports the long-promised review of A2D2 zoning to make recommendations on revising the current D1 zoning district.

Comm/Comm: Ice-Skating Rink

During public commentary at the start of the meeting, Alan Haber noted that his group – which is advocating for an ice-skating rink to be installed on top of the Library Lane underground parking garage – had met with the DDA’s partnerships committee in the previous month. He reminded the board of the continuing effort to consider the space as a civic space – for community use, whether it is a commons or a park. Whatever the ultimate name of it is, he said, the idea is that the centrally located space should be developed for citizen use, for all the people, so that Ann Arbor has a central place, however you want to name it – a place that invites all the citizens as a whole.

While longer-term planning is going on – like the Connecting William Street project and the work being done by the park advisory commission’s subcommittee – Haber felt now is the opportunity for the Ann Arbor Downtown Development Authority to experiment with short-term uses that might draw the public to that space. The efforts to generate activity on top of the Library Lane parking structure should be integrated with programming efforts for Liberty Plaza, he said.

The concept for a temporary ice-skating rink took form last November, he told the board – as his group had found out about the possibility of using synthetic ice. Synthetic ice has been used in places where temperatures are not as cold as they used to be, or in the South, for recreational skating. So his group had developed a proposal based on that. And they are now dealing with a range of questions that their proposal has generated. How effective is the synthetic ice? How large a rink could be established?

Haber told the board that he expected his group would return to the next meeting of the partnerships committee with answers to several of those questions. He wanted to convey to the board that many people desire a central place in Ann Arbor that could begin to be called the heart of town.

Comm/Comm: Expand DDA Area, Sunday Parking Charges

Introducing himself as a recent candidate for representative of the 53rd District of the Michigan House, Thomas Partridge accused the DDA board of conducting its meetings as “shadow meetings” of the city council. He called on the city to reorganize the DDA’s charter to expand the downtown fiscal area – to include every important housing development within the city. The DDA should be given a new charter and a new purpose to provide adequate housing. He called Ann Arbor a segregated city that is not well-served by mayor John Hieftje and the Ann Arbor city council.

Partridge criticized the free parking that is provided on Sundays, saying that was giving away 1/7 of each week’s revenue, on the theory that people wouldn’t want to park on Sundays. A parking fee should be charged on Sundays, he said, even if it’s a reduced rate.

Present: Nader Nassif, Bob Guenzel, Roger Hewitt, John Hieftje, John Splitt, Leah Gunn, Russ Collins, Keith Orr, Joan Lowenstein, John Mouat.

Absent: Sandi Smith, Newcombe Clark.

Next board meeting: Noon on Wednesday, May 1, 2013, at the DDA offices, 150 S. Fifth Ave., Suite 301, Ann Arbor. [Check Chronicle event listings to confirm date]

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor Downtown Development Authority. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Great coverage. Thanks so much!

> The most recent monthly figures were for February 2012. He said that the operations committee is still working on getting more detailed reports on actual hours used.

I’ll be interested in that data when it comes out.

Oh Ed! I’m about to drop to the floor. One of my pet peeves is use of “data” as a singular. The data are many, always.

I’m losing that fight, along with many others.

While it’s true that the word “data” is plural in the Latin original, as currently used in the English language it seems to me it has become an uncountable noun, like “water.” This is certainly true in the information technology business. The quantum of data is the bit, but we don’t talk about one bit being a datum and two being data. We talk about bits of data the same way we talk about buckets of water.

But I will admit it grates on my ear. Kind of like when people tell me that UM has one of the biggest college stadiums in the country. But how far do you take it? Would you say that including Central, North, and South, UM has three campi?

There, their, they’re. You’ll be all right.

I know most people don’t care a bit, but in my training and career we did always refer to a body of individual points, observations, etc. as “those data” and occasionally the word datum was heard, though we were more likely to say “this point”. This is more about usage than about Latin.

In unrelated news, I note that the New York seems to be the last print publication that uses umlauts over double vowels, like zoölogy. It looks quaint.

Sorry, that was the New Yorker.

I guess what is really at issue here is the lack of accountability (and direct relationship) to those who actually pay the bill – voters.

I have always had questions about how DDA’s are supposed to function and what they do for a city other than capture taxes to use as they wish.

I am not sure this has gone as well as it could in Ann Arbor. I can say that I am far more clear about the how terrible the DDA game has gone in Ypsilanti where it French warfare and drama with people’s money in a town where there really really needs to be direct accountability to the voters for what money is spent and how.

I would be interested in each and every individual parking datum, along with the aggregate parking data, but I’m not holding my breath that it’s going to be released any time soon.

The DDA is performing admirably and is a huge reason why Ann Arbor is the envy of every Michigan Downtown. Term limits will defeat the very purpose of the board. The DDA and its board are separate because its work must take the long view of the districts future needs.

I am both profoundly amused and profoundly disquieted that the money people can’t get the figures to come out the same even though they are supposedly working from the same ordinance language and the same financial data.

This matter cries out for clarification. “It’s the money. Follow the money.”

No. 10: You mean like when Susan Pollay campaigned all over town a few years ago as a ‘downtown diva’ promoting R2D2 as the end all to our needs as a cit of the future.

The same zoning law that is now the cause of all our problems and must be placed in moratorium before further dire destructive and out of scale developments are built and ruin Ann Arbor.

And which city legal staff is scared to bejesus it will get our collective butts sued off?

You mean that admirable work on the long view? Baloney. If you are going to say the DDA is a marvel please back it up with some specific examples, because some of us are trying to pay attention, and not just line our pockets on the back of the taxpayers (WALLY.)

The DDA has little or nothing to do with the attractiveness of Ann Arbor (tell me I’m wrong and cite examples) and its board does business without a whit of thought about the average taxpayer in Ann Arbor, except to keep them in the dark … No. 9.

They are unelected, self dealing, sub rosa and renegade. Look at the top of the Library Lot and the open secret of a publicly guaranteed city center combined with a brand new library, paid for by …. wait for it …. the taxpayers. Which according to the results of the millage request wasn’t wanted by them.

Where does DDA director and downtown diva park her pubicly funded private car? Who pays for the parking? Why doesn’t she take the bus and stop contributing to the very vehicular traffic she is highly compensated for and spending $100s of millions of our money to make obsolete?

Wouldn’t that make sense? I like to see a cook eat her own fixings.

How come Ann Arbor doesn’t ask better questions and expect good answers?

Let’s hear Bob Guenzel (Delonis Center) provide examples of how the DDA is ‘focussed’ as he alleges.

Observatory,

Consider this. To weigh in on the specific ordinance amendments regulating tax capture – calculations that I’ve argued for two years are in fact the correct interpretation of the existing ordinance language – does not require any point of view on the merits of the Ann Arbor DDA or the quality of the people employed by the Ann Arbor DDA.

But it seems to me that you’re translating the specific policy issue on tax calculations into a referendum on the merit of DDAs generally, or on the Ann Arbor DDA specifically, and perhaps on those who serve on the board and are employed as staff of the DDA.

Frankly, I think that the Ann Arbor DDA, Leah Gunn, and Susan Pollay would win that referendum. So if the issue of the correct TIF calculations is cast in terms of that referendum, then the ordinance revisions lose. And that would be disappointing, in my view.

I think if the ordinance revisions are considered as an attempt to clarify the calculations – in a way that harmonizes all of the terms of the existing ordinance language and factors in the historical context of the DDA’s formation – then the only rational course (all due respect to the DDA’s legal counsel) is to adopt the ordinance revisions on tax calculations.

If you make the conversation one about the merit of DDAs generally, or about the people associated with the Ann Arbor DDA, then it decreases the chance that the tax calculations will be decided on a rational basis.

For a councilmember who might be on the fence, I don’t think it tilts them to a yes vote on the ordinance amendments to argue: The DDA is terrible, so screw them. I think what might persuade a councilmember who has not yet closed their mind on the issue is to point out how the existing words on the page lead to the unavoidable conclusion that the calculations as currently laid out in the ordinance: (1) regulate TIF revenue, as opposed to defining the way surplus should divided after the DDA satisfies debt obligations; and (2) can be rationally based only on the “cumulative” method.

Also, it’s not correct that ordinances are “written in stone”. If the proposed new ordinance passes, and if someone discovers a problem a week after its passage, an amendment to that new ordinance can be in effect within a month or so.

Amending ordinances is not rocket science. It’s not even computer science.

Re (13) Thanks Dave, that needed to be said. The Kunselman/Kailasapathy resolution is not an attack on the DDA. It is a few small modifications to the governing ordinance.

The resolution will not reduce the DDA’s revenues, when compared to its current revenues. It will only restrict how quickly the revenues can increase. More important, it seeks to clarify ordinance language that I think we can all agree is less than clear now.

The restrictions on DDA Board terms is also a moderate change. Other important commissions have similar term limits, such as the Planning Commission and the Parks Advisory Commission. I think allowing DDA Board members serve for up to 8 years provides a level of stability and continuity. At the same time, limiting the Board members to those two terms means that the DDA will be perceived as an entity, rather than an unchanging collection of personalities.

Dave’s comment that the DDA would win a referendum if put to a vote, presents an interesting question. Recently, we have seen downtown-centric ballot issues, such as the library bond and arts millage, go down in defeat. I wonder whether all of the tax paying residents of neighborhoods that are not near the downtown really appreciate the level of spending and importance our leaders place on the downtown. A ballot issue that presented the question of diverting taxes revenues from cash strapped governmental entities for the use of the DDA could easily go either way.

Here is a recent report by the Citizens Research Council about tax increment financing in Michigan. [link] It has much basic information about DDAs and other TIF authorities in Michigan and their legal underpinnings.

It also takes the question of dedicated millages and these authorities head-on. The article was evidently inspired by concern about the loss of revenues from a voter-approved dedicated millage to support the Detroit Zoo. A number of TIF authorities have claimed that income.

Some may not realize that our DDA also captures the income from dedicated millages within its district. So among others, they capture the roads, parks, Greenbelt, and AATA millages.

The article points out that capture of dedicated millages is different from capture of operating funds, and questions its constitutionality.

Like so many other issues, this one is complex. I hope that Council begins by implementing those very modest reforms proposed. As Dave Askins says, it shouldn’t be about whether the DDA is “bad”, but about what policy is good.

Re:#15. Although not all boards and commissions are listed in the ordinances, those I have been able to track – with term limits – are the Greenbelt Advisory Board and the Parks Advisory Commission. Planning Commission does not have term limits, for instance. Neither do the Ann Arbor Housing Commission, the Zoning Board of Appeals, the Public Art Commission, the Environmental Commission, the Design Review Board – or a slew of other boards and commissions not enshrined under Title I, Chapter 8 of the City Code.

Re (17) I based my statement about term limits for Planning Commission on remarks made when Ethel Potts was not reappointed to the Planning Commission. While there may not be a formal rule in the Planning Commission’s by-laws, I recall that Ms. Potts was not reappointed because she had served as many terms as were permitted.

It would be sad to learn that Ms. Potts was not reappointed to Planning Commission for some reason other than term limits. She brought so much institutional memory to that body, as well as just good old common sense.

There are no term limits for Planning Commission listed in the City Code.

“1:175. – Planning commission—Membership.

The planning commission shall consist of 9 members who shall be appointed by the mayor with the approval of the council. One member so appointed shall be a member of the council. In making appointments of members of the planning commission, the mayor shall appoint persons who, insofar as possible, represent different professions and occupations having an interest in the growth and development of the city. The term of office of each member of the planning commission, except the councilman member, shall be 3 years. The councilman member shall be appointed for a 1-year term. The terms of office of members of the commission shall begin on the first day of July nearest the date of their appointment. The terms of office of the first planning commission appointed hereunder shall be fixed by the mayor so that the terms of 3 members, including the councilman, will be for 1 year, 3 for 2 years, and 3 for 3 years. The councilman member shall cease to be a member of the commission if he ceases to be a member of the council. Members of the planning commission shall serve without compensation.”

Jack,

Are you suggesting that there could have been some other reason for not reappointing Eppie?

As policy, tax capture is bad, period.

1) Tax captured funds are pre-budgeted; i.e. tax capture does not require DDA projects to compete with all other city projects/operations for its funds. The uses proposed for captured funds will not go through the same level of public scrutiny and accountability to which non-captured, traditionally budgeted tax revenues are subjected. This guarantees that the captured funds are not going to their highest and best use,

2) As noted, re-directing dedicated millages at BEST undermines the integrity/credibility of local governments (e.g. people voted to fund parks, not the DDA). With tax capture, we cannot trust that taxes we pay for specific uses will, in fact be used for the things that we were told they would fund when we voted to pay these taxes; at worst, it undermines the integrity/credibility of local government, AND breaks the law, to boot.

The argument that “Since the legislature passed it, tax capture must be both good and legal” (actually used by Carsten Hohnke in our campaigns) is neither here nor there: If the legislature voted to allow people to put forks in their eyes, that would not make it good policy; if the legislature voted to mandate separate drinking fountains for blacks, that would not make it legal (BTW, PLEASE no one mention that putting a fork in your eye IS legal – apparently it might give ol’ “Blinky” Hohnke – and his remaining council allies – some bad ideas…)

3) It may be that the AA District Library board, e.g., thinks that the DDA can use captured library millage funds in support of the library’s mission better than the library board itself can use them. Fine. Let the library board appropriate its funds to the DDA through the board’s regular budgeting process. Using the library’s normal appropriation process – with individual members voting for or against – provides at least a patina of legitimacy to the transfer of funds to the DDA. Of course, an actual DDA millage would have ACTUAL legitimacy not conferred by the current back-door process.

The DDA’s functions may be needed or not needed – and may or may not need to be out from under the authority of the City Manager – but this funding mechanism is illegitimate, breeding cynicism about local government.

Regarding dedicated millages, there is now a package of bills in the House designed to hold harmless the millages for the DIA and the Detroit Zoo. [link to .pdf]

The applicability to Ann Arbor is absent, but the precedent is interesting.