Column: Is Public Education A Charity Case?

If you’re like me, then every January you think to yourself, “This year, I’m going to spread out my charitable giving over the course of twelve months. It would be so much better for my cash flow, and probably it would be better for the nonprofits as well.”

And then, come November and December, I realize that once again, I failed to spread out my giving – and I had better pull out my checkbook. Writing the bulk of these checks at the end of the year has a benefit, in that it allows me to look at all of my donations at once. But it also means that I’m in a rush and I don’t always take the time to reflect. So this is my opportunity.

Like many of you, we make donations to local, national, and international groups that focus on a wide range of issues. For us, those organizations do work related to health, the environment, politics, women’s issues, Jewish groups, social action, human services, and more.

Although I do give to some groups that, loosely speaking, fit the category of “education,” those entities do not make up a significant proportion of our donations. I confess to a certain ambivalence to giving to such groups – because, in many ways, I’m already a big contributor to public education. And it’s likely that you are, too.

In this column, I discuss the concept of donations – both voluntary (to charitable causes) and involuntary (through taxes). I talk about ways that most of us are already contributing, and provide some information that will help you give even more, if you’re so inclined.

When I sent an early draft of this piece to Steven Norton, an Ann Arbor resident and executive director of Michigan Parents for Schools, he shared this thought: “I’m not sure I agree that we are ‘donating’ to the schools, in the sense that this means an optional charitable contribution. I don’t feel like I’m donating when I help pay for police or fire services, or road maintenance.” He then referred to a quote by Oliver Wendell Holmes: “Taxes are the price we pay for a civilized society.”

His comments sent me straight to the dictionary – several dictionaries, in fact – looking for the distinction between donate and contribute. It wasn’t an easy search to find exactly what I was looking for.

For instance, the Merriam-Webster online dictionary defines donate as a verb that means “to give (money, food, clothes, etc.) in order to help a person or organization,” and “to make a gift of, especially: to contribute to a public or charitable cause.” That certainly implies a voluntary aspect. Yet a synonym for donate is contribute, “to give or supply in common with others.” In other words, contribute may or may not have a voluntary aspect.

Certainly, taxes are not voluntary, but they are contributions to a common cause. So in this column, when I use the term donor, donate or donation, I mean it in the sense of contributing to an important common good – public education.

The Property Tax Conundrum: I’m A Big Donor

I already give thousands of dollars to the vast educational enterprise that is Michigan’s public education system – as do many of you. Most of the sales tax I pay, a portion of my income tax, and the majority of my property taxes go to education. If you live in Ann Arbor, your tax bill includes line items for the State Education Tax, the Ann Arbor Public Schools, the Washtenaw Intermediate School District, and Washtenaw Community College.

More than 20 years ago – when I first became a homeowner – the taxes I paid for public schools actually went directly to the Ann Arbor Public Schools. In 1994, though, all of that changed with the passage of Proposal A.

The goal of that 1994 statewide ballot initiative was to create more equitable funding across all districts and to keep property taxes from escalating dramatically. But Proposal A took away most local control over school funding, though districts can still request voter approval to levy local millages for building construction, repairs, and maintenance – not, however, for operating expenses.

The state collects taxes directly from residential and non-residential property owners – 6 mills each, annually – and pools that money into the state’s School Aid Fund (SAF), which also includes revenues from sales and income taxes, state lottery revenue and other sources. Out of this fund, the state pays local school districts a per-pupil allotment – a variable amount set by the state legislature that can increase or decrease each year. In addition, state law controls the amount of taxes that school districts can levy directly – those that are not pooled into the SAF. Beyond the 6 mills that go into the SAF, for example, there’s an additional tax on non-residential property owners, but the state caps that tax at 18 mills.

Both the funding from non-SAF local property taxes and from the total School Aid Fund are factored into an amount called the per-pupil “foundation allowance.” This amount varies by district. Ann Arbor’s per-pupil funding for the current fiscal year, which began July 1, is $9,050 for each student. It accounts for most of the district’s revenues, with other revenues including the district’s share of a countywide special education millage and from federal grants. The per-pupil funding has been stagnant or falling for the last decade.

Because of Michigan’s complex system of funding public schools and the fact that Ann Arbor is a relatively affluent community, today Ann Arbor is – as AAPS board member Christine Stead is rightly fond of explaining – a “donor district.” That is, Ann Arbor taxpayers are paying more into the statewide system than the district receives back in state aid. Steve Norton of Michigan Parents for Schools told me that AAPS gets back from the state less than half – about 47% – of what local taxpayers actually pay to the state for education.

I find the “per-pupil” approach to funding to be particularly frustrating. It’s often an unfair way to allocate funding, because although incremental costs change with the addition or subtraction of kids to a school, many of the base costs don’t change. For instance, when Pfizer closed its large research operation in Ann Arbor several years ago, many families moved out of this community. The children in those families left AAPS schools – along with the per-pupil funding for those students. Although funding dropped because of those departures, the fixed costs for educating the thousands of remaining students didn’t decrease proportionately.

When it comes to per-pupil funding, my family has been an exceptionally big contributor. For the past 15-plus years, I’ve had 1, 2, or 3 kids enrolled in the public schools, and each of my kids has brought their per-pupil “foundation” allowance. So my family is a “donor” to public schools in two ways – as part of the larger property-taxed community, and as a family that has chosen to stay in the public school system.

In some ways, I don’t mind being a “donor” to the state’s public school system, which includes supporting districts that are much poorer than AAPS. For example, my taxes are supporting the Kalkaska schools [1] – and really, I don’t mind (too much) paying for that.

But I do mind that Ann Arbor taxpayers can no longer levy additional millages to pay for operating expenses for our own Ann Arbor Public Schools.

And as an aside, I also mind that my taxes are supporting the Education Achievement Authority, an entity that the state uses to take over schools that are designated as failing. For a longer and fairly neutral analysis of the EAA, I’d suggest reading this piece from the Michigan Policy Network. You’ll find a more critical view at the Inside the EAA website – which includes EAA documents obtained through the Michigan Freedom of Information Act by state legislators and others trying to counteract the authority’s secrecy.

The Parent Conundrum: I’m (Still) A Big Donor

But taxes aren’t the only way I contribute to local education. As a parent, I’m constantly being asked to donate to school-related activities. Certain expenses that I pay have directly or indirectly benefited my children. Those costs include paying $500 for my son to play high school basketball ($280 for the district’s registration fee and pay-to-play, plus other team-related costs), field trip expenses, and PTO dues.

I feel like I get milked dry by these costs – and it doesn’t make me want to jump up with donations for other activities. Over the past several years, I have spent thousands of dollars on school-related activities. Luckily, I can afford these expenses – and I understand that many families aren’t so fortunate.

Yes, I know. I signed up for having kids, and my kids are lucky to have these opportunities. So no, I’m not complaining. I’m just explaining why it is that when someone suggests I pay even more, I think: Wait a second – I’m already paying for the essentials, as a taxpayer, and as a parent who sends my kids to these schools. And I’m already paying for the extras – at least, those that involve my children. You want me to pay even more?

Must I Donate Again?

One way that we’re asked to pay even more is through donations to nonprofit foundations. Most of our local school districts, for example, have affiliated nonprofit educational foundations that solicit contributions. Historically, these foundations have been used for enrichment activities – not for core operating expenses.

Locally, that started to change in 2009 when a countywide operating millage – the only kind permitted under Proposal A – was defeated. (It passed in Ann Arbor, but failed in much of the rest of the county.) After that defeat, the Ann Arbor Public Schools Educational Foundation decided to try to take up the slack with its “A Million Reasons” campaign. The name came from the idea that if everyone who supported the millage just gave the foundation the same amount of money that they would have paid in new taxes, the district would be in good shape. But that didn’t happen – and the campaign fell short of its fundraising goal that was intended to help with the basics of public education.

“Oh no,” my friend Laurie said to me as we discussed this on my annual Thanksgiving trip to my hometown. Laurie is on the board of her local educational foundation. “That doesn’t make any sense. Taxes are meant to fund schools. Local school foundations should focus on the extras.”

Now in fairness to the AAPS Educational Foundation, Laurie lives in a state that funds schools more generously, and in a district that probably gets more than twice as much as Ann Arbor does, per pupil.

But I’ll admit to sharing Laurie’s squeamishness. And the idea of the foundation spending so much social capital to raise only one million dollars – when the Ann Arbor schools budget is around $180 million – was never persuasive to me.

On the other hand, when I shared this perspective with Steve Norton via email, he noted that “personal donations are a last resort when the normal course of public policy has failed completely to meet the needs of our communities.” While he agreed with my friend that education foundations should pay for the “extras,” he also pointed to California, where local education foundations often pay for basics like salaries of whole programs – such as gym, music and art. The cause for California’s situation is similar to Michigan, he noted: a state tax system that was changed to strangulate public services. (In the case of California, their crisis was prompted by Prop 13.) “I hope we never get to that point,” Norton wrote to me, “but we are certainly headed in that direction.”

To me, the idea of asking educational foundations to make up a shortfall in public funding is a tough sell. However, the ideal that schools should be publicly funded is being challenged – and that’s still my ideal, and my values. And charitable giving is all about reflecting your ideals and values.

Multiple Ways to Give Even More

None of this is meant to imply that you shouldn’t donate to public schools, or to the broader educational enterprise. It is possible to donate directly to your local school district, without an educational foundation as an intermediary. The Ann Arbor Public Schools system has a donation policy, and probably most other local school districts do as well.

Many music teachers, for instance, will happily provide a new home for a serviceable instrument. (We donated my husband’s cello, which he stopped playing many, many years ago. His mother had maintained it in meticulous condition, hoping against hope that a grandchild would pick it up. They didn’t.)

The basic rule of thumb is, if you are interested in donating an item to a school, check with the building administrator to make sure it would be useful. And, of course, the schools also will gladly accept direct financial support – last year, for example, the Argus Planetarium at Pioneer High was renovated using a direct donation.

Or if you want to donate to one of the local educational foundations, here are links to several in Washtenaw County: the Ann Arbor Public Schools Educational Foundation; the Chelsea Education Foundation; the Educational Foundation of Dexter; the Manchester Community Schools Foundation; the Foundation for Saline Area Schools; the Whitmore Lake Foundation for Educational Excellence; and the Ypsilanti Community Schools Foundation.

Nearly every school – maybe every school – has a parent-teacher organization (PTO), and generally they are also 501(c)3 nonprofits. So if you want to support your local school, you can give directly to the PTO. The PTO directs its funds to the programs or activities that the parents and teachers want to support. Some of the PTOs have very elaborate fundraising activities. The Burns Park Run, for example, raises money to support the Burns Park Elementary PTO programs, and Ann Arbor Open has turned Scrip into a high art form. Even if they don’t have organized fundraising efforts, all PTOs can use your support.

Perhaps you have a special place in your heart for the arts, or for environmental issues. Most of the schools have special funds (or a special nonprofit – yes, many of these are auxiliary groups with nonprofit status) to fund music, theater, athletics, and more. And the Ann Arbor Area Community Foundation has an environmental education fund that is meant to support the Ann Arbor schools.

Finally, there are many organizations that support kids and families, in ways both academically-related and in fighting poverty. For instance, groups like Peace Neighborhood Center, Avalon Housing, and Community Action Network support low-income families in particular neighborhoods with after-school tutoring. The Student Advocacy Center fights for kids at risk of, or threatened with, suspension and expulsion. And other organizations, like 826 Michigan, bring after-school tutoring to the masses. (A special shout-out to 826 Michigan for pairing up with the Ypsilanti cafe Beezy’s, which is open for breakfast and lunch, and then provides a space for 826 Michigan’s after-school tutoring.)

I don’t mean to give an exhaustive list, but rather to share some examples. Please do add to these ideas in the comments section.

Giving, Getting, and Governing

I’ve explained how I’m already a big contributor to the schools. But it’s not just that we give a lot. We get a lot, too – and so do residents who don’t have kids. I don’t mean that in a high-level, theoretical “we-want-good-schools” way. I mean that in an economic sense. That’s because perceptions of schools are major drivers of property values, and property values affect much more than schools.

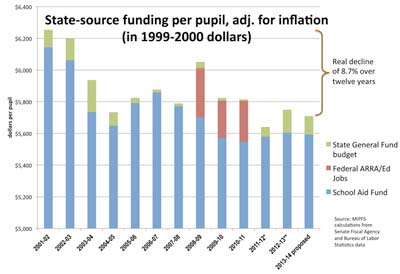

So in the next few days, we will give to some school-related causes, and you might too. But remember – the bulk of school funding comes through the state, and that funding has been slashed over and over again in the past decade.

Perhaps the most effective donation you can make is your donation of time and effort to convince legislators to provide more funding to public schools. That’s how public schools get funding, and where reform will need to occur if we want the current situation to improve.

Keeping our public schools both public and nonprofit, at this point, requires a lot of advocacy. In my opinion, two excellent sources of information are Michigan Parents for Schools and the Tri-County Alliance for Public Education.

I’ve been writing about year-end donations, and when the year ends, a lot of people turn to New Year’s resolutions, too. While you are making your list of resolutions, I hope you’ll make room for one more thing: advocating for public, nonprofit schools. I hope you’ll advocate for schools that are for children, not for corporations or for-profit charter chains. And I hope you’ll advocate for adequate funding.

Whether you’re a donor, an advocate, or both, this I believe: together, we can make a difference.

Notes

[1] I’m not picking on the Kalkaska schools. Kalkaska became the poster child for school funding reform when it closed its doors early in the spring of 1993 after the latest of several attempts at passing an operating millage failed. [For more background, read this March 6, 1993 article in the Ludington Daily News.] Proposal A was the product of efforts to equalize school funding regardless of local tax base, coupled with then-Gov. John Engler’s promise to reduce property taxes.

Ruth Kraut is an Ann Arbor resident and parent of three children who have all attended the Ann Arbor Public Schools. She writes at Ann Arbor Schools Musings (a2schoolsmuse.blogspot.com) about education issues in Ann Arbor, Washtenaw County, and Michigan.

The Chronicle relies in part on regular voluntary subscriptions to support our local reporting and columnists. Check out this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

You appear to say that each school has a separate PTO. So which school(s) does the PTO Thrift shop support? A lightbulb went off for me this fall that I want to concentrate my donations of goods to them. Didn’t a (?) PTO recently keep one of the school transportation programs going?

Vivienne, that is a great question. According to the PTO Thrift Shop web site, “Our mission is to donate the proceeds from our resale shop to the Parent-Teacher Organizations organized and operated to support the Ann Arbor Public Schools, and other 501(c)3 organizations whose sole purposes include operating exclusively for the benefit of the Ann Arbor Public Schools in support of enrichment and extra-curricular programs for students. The Ann Arbor PTO Thrift Shop is a non-profit 501(c)3 organization.”

In fact, they have numerous different ways to support PTOs. For instance, I think that some of the PTOs have volunteers work at the shop and the school’s PTO gets paid based on the number of volunteer hours. They also have special donation days for different PTOs where you use “tokens” to “vote” for various schools. And they make direct donations.

That’s also a good point because you can donate household goods and clothing to them, to sell in support of the local schools.

There is more information on their web site: [link]

Thanks for all the info, esp. info the on the PTO thrift shop! Rock on in 2014, my sister in education :)

Ruth, this is an excellent and important piece, thank you for writing it. I’ve recently been researching our schools foundation here in Ypsi because even though I don’t have kids, I agree that supporting our schools (and raising their perceived value) is one of the best ways to support my community in general.

In the realm of supportive/”extra” educational services, I would add the public library system as another worthy cause and a way to support public education (full disclosure: I work at a library.) I know in Ypsi, our library provides arts and music programs for free to kids who are not getting it at school because the secondary ed. arts budget is precisely zero.

Finally, while these are all worthy causes, it’s upsetting that even $1M feels like a drop in the bucket, particularly when you realize that you will need to raise it again next year because our schools are being systematically underfunded. When the state has to create an EAA because so many school systems are failing, and an EFM system because so many cities are failing, it seems a good indicator that we have a big problem on our hands, and that it’s time making real change in how we fund our local entities.

In a way, a person might think it would be liberating to not have as much of the money coming in to schools coming from the state. I think, the schools, in particular AAPS, should think about not trying to get those last dollars the state has imposed for meeting certain criteria, and tell them, forget it.

Our experience with our particular school in first and second grades was not a great one, largely because of a student cohort issue which was compounded by ineffective school administration. Our choices were to engage with school administration and PTO even more, school of choice lottery, sell our house and move into a different elementary school district, or move to a private elementary school. Choice 1 was a long term time commitment with an uncertain outcome, and as time was of essence, not practical for us. Choice 2 didn’t pan out as we didn’t win the lottery. Choice 3 was a substantial financial penalty and disruption in day to day life. Choice 4 was a similar penalty if limited to elementary school only, but without the disruption of moving to a new neighborhood, so that’s the one we chose.

Although I still support good public schools as an ideal and do not believe that a voucher system is a good idea, and support the AAPS indirectly through my property taxes, our education donations will be made to our current private school for now. I can only hope that AAPS will realize that the issues in our elementary school district were not ours alone, and that several families pulled their children out the same year that we did, for similar reasons. We plan to return for middle school and high school.

I think more transparency from the school district would be helpful during these money struggles. For instance, while there is a general acknowledgement there are increased class sizes, very deliberately, the specific numbers in all and any class will not be released to parents this year. Just today Tim Skubick complained about Rick Snyder’s lack of transparency. It’s demoralizing to see that your own home district isn’t being transparent either.

I am a Board Member of the Ann Arbor PTO Thriftshop, and I will pass on some information since we are mentioned here in the comments.

The Ann Arbor PTO Thriftshop provides funding to every single school through each school’s PTO organization. Our capable and caring executive director Ann Farnham made it her first matter of business to involve every school in the basic fundraising relationship with the shop. The schools have opportunities to earn money for their PTO’s by first assigning a member of their PTO council as a PTO Thriftshop representative. These reps support the advertising efforts of the shop by getting the word out to the school community about our hours, services, and programs, and also by running ads for the shop in school publications like weekly newsletters or event programs. The more they can promote the shop, the more the school can earn. There are other opportunities for earning throughout the year.

We switched from volunteers to paid staff a few years back, which led to great success in daily workflow and expansion of our business. We have recently begun to provide limited volunteer opportunities for community service, as there is a need in the community for such opportunities for both high school and college students to fulfill various service obligations.

In our most recent year of giving, 2013, we gave just under $300,000 ($297,244.33) to the Ann Arbor Public Schools via the PTO’s, or to pay for threatened services that would benefit the students directly, like restoring the middle-school late busing, and partnering with Comerica Bank to fund School Messenger. $100,000 of that each year is to a transportation fund. This fund is used for transportation activities of the PTO’s choosing, which we have seen from detailed use reporting often helps the schools waive fees for those families that could not otherwise afford the additional field trip expenses they are asked to pay. I should note that, in keeping with the context of the article, no PTO Thriftshop monies are given to the General Fund of AAPS. Our mission is to promote and enhance student enrichment activities. We believe the best way to do that is to get the money to the PTO’s, where parents, teachers and administrators can work together to distribute it equitably in their school.

Continued growth in donations (thank you Ms. Armentrout and others for thinking of us), and corresponding growth in sales has us planning to increase our giving this year to above the $300,000 mark. I would also like to point out that the year 2014 marks the 20-year anniversary of the founding of the Ann Arbor PTO Thriftshop. I encourage everyone in the community to donate and shop at the PTO Thriftshop, not only is it an environmentally sound practice to reuse and recycle, it makes good fiscal sense for you and the schools. And since we are a 501(c)3 you can make a targeted and tax-deductible cash donation, to the transportation fund, through our website [link]. There are a few days left in the tax year for those of you that itemize (hint,hint).

I would also point out that we practice complete transparency in our operations and giving; if anyone would like to learn more about the shop they can contact me or our executive director via our website for additional information. Thanks for your continued support!

Ruth – Thank you for everything you do for education in our community and for this informative, thoughtful piece. I’d like to offer two additional thoughts.

Thank you for asking about additional nonprofits. The Family Learning Institute (where I serve as Development Director) provides one-on-one, year-long, after-school tutoring and mentoring in reading, writing, math, and skills for academic and life success to over 100 children from households with low incomes. FLI relies entirely on donations in order to keep its services free of charge. Over 100 adult volunteers from the community make a year-long commitment to these students. FLI also offers summer programs, family literacy programs, and is launching formal partnerships with the schools to provide on site the kind of one-on-one after-school supplemental programs they are not funded or equipped to provide. To learn more, see [link].

Second, another way the PTO Thrift Shop helps PTOs (and other school organizations) is through giving a generous donation each time they post a thrift shop advert on an event brochure or website. It’s an easy way for PTOs to raise money, and explains why you always see their advert on the back of programs.

Re (8) Jeff, thank you and your fellow board members for this great work. I had a vague memory of the transportation aid and am happy to have it firmed up. This has been very – educational.