An Oct. 24, 2013 meeting of the Ann Arbor city council’s audit committee featured just one item – a review of the draft audit report prepared by auditor Mark Kettner of Rehmann Robson, working with city staff. And overall the report on the fiscal year concluding on June 30, 2013 provided $2.4 million of good news for the city’s general fund.

Oct. 24, 2013 Ann Arbor city council audit committee meeting. From left: auditor Mark Kettner (Rehmann Robson), Margie Teall (Ward 4), city chief financial officer Tom Crawford, Sumi Kailasapathy (Ward 1), Sally Petersen (Ward 2) and Stephen Kunselman (Ward 3). Arriving after this photo was taken was Chuck Warpehoski (Ward 5).

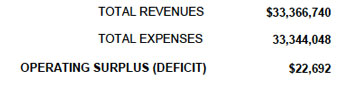

Highlights from that draft FY 2013 report, which has now been issued in final form to the city, include an increase to the general fund balance from about $15.4 million to about $16.2 million. The $800,000 increase contrasts to the planned use of roughly $1.6 million from the general fund balance in the FY 2013 budget. About $200,000 of the increase was in the “unassigned” fund balance. The rest of it fell into restricted categories, CFO Tom Crawford explained at the meeting.

The result of the audit, in the new GASB terminology, was an “unmodified” opinion – which corresponds to the older “unqualified” opinion. In sum, that means it was a “clean” audit. The concerns identified last year had been addressed to the auditor’s satisfaction.

Members of the audit committee were enthusiastic about the $2.4 million better-than-budget performance for the city’s general fund, which had expenditures budgeted for $74,548,522 in FY 2013.

However, Crawford cautioned that he is “not crazy about the versus-budget comparison” because actual expenses will generally be less than budget anyway. He also pointed out during the meeting that just $1.3 million of the $2.4 million better performance are recurring items – things that he would expect to continue going forward.

While the year-end audit provided some good news, Crawford said he recommended that the city try to have about $1 million to $1.5 million of “good news” each year, because the city needs fund balance to pay for non-recurring items.

Crawford and Rehmann auditor Mark Kettner walked the committee through some of the highlights that still, on balance, had led to the good news. Revenue for services was almost $400,000 less than budgeted, due in part to lower-than-budgeted fire inspection fee revenue. Fines and forfeitures – including parking tickets – were $300,000 less than budgeted. And investment income was off by $400,000. But state shared revenue came in at $500,000 better than budgeted. [These figures come from page 36 of the final audit report.]

“The general fund had pretty much a year like you’d hope it would,” Crawford said. The year ended with an unassigned fund balance of roughly $14 million, or about 18% of expenditures – and 18-20% of expenditures is where the fund balance should be, he said. “So we’re really in a good spot.”

Challenges facing the city this coming year include the implementation of the new GASB 68 accounting standard starting in FY 2015, which begins July 1, 2014. That standard requires that most changes to the net pension liability will be included immediately on the balance sheet – instead of being amortized over a long time period. The GASB 68 standard must be implemented for an organization’s financial statements for fiscal years beginning after June 15, 2014.

Crawford prepped the committee to see a probable drop in the pension plans funded ratio – from about 82% to 80% – because of the five-year window used to book losses. The last of the losses in 2008-09 will be on the books this year, but after that the city would expect to see improvement every year, Crawford said. This most recent year, the pension fund had an 11% return, which is four points better than the 7% return the fund assumes for planning purposes.

Two of the city’s funds were highlighted by Crawford at the Oct. 24 meeting as having potential difficulties associated with the GASB 68 standard – solid waste and the public market (farmers market). For the public market fund, Crawford floated the idea to the audit committee that it could be folded back into the city’s general fund, on analogy with the golf fund. Starting this year (FY 2014) the golf fund has been returned to general fund accounting.

The consensus on the audit committee was that the full city council should receive a brief presentation on the audit report – either at an upcoming working session or a regular meeting. [.pdf of final audit report released on Nov. 15, 2013]

Prior to new committee assignments to be made by the post-election composition of the city council, the audit committee consists of: Margie Teall (Ward 4), Sumi Kailasapathy (Ward 1), Sally Petersen (Ward 2), Stephen Kunselman (Ward 3), and Chuck Warpehoski (Ward 5).

This report includes additional description of the Oct. 24, 2013 city council audit committee meeting. [Full Story]