County Crafts Pro-Union Labor Strategy

Washtenaw County board of commissioners meeting (Feb. 6, 2013): In an evening capped by a nearly three-hour closed session to discuss labor negotiation strategies, a majority of county commissioners affirmed their support of union labor and pushed back against the state’s recent right-to-work legislation, which takes effect in March.

From left: Greg Dill, Washtenaw County sheriff Jerry Clayton, and Washtenaw County treasurer Catherine McClary. (Photos by the writer.)

On a 6-1 vote – over dissent by Republican Dan Smith – the county board passed a resolution directing the administration to negotiate new four-year contracts “to protect and extend each bargaining unit’s union security provisions.” The resolution also directs negotiations for a separate letter of understanding to cover a 10-year period. The letter would relate to agency fees paid by non-union members based on the idea that they benefit from the union’s representation of their interests during collective bargaining.

Unions represent 85% of the 1,321 employees in Washtenaw County government.

The resolution was brought forward by Andy LaBarre (D-District 7), one of three Ann Arbor commissioners on the nine-member board. Two commissioners – Ronnie Peterson (D-District 6) and Alicia Ping (R-District 3) – were absent.

Deliberations were relatively brief. Dan Smith, who said he found some of the language in the resolution offensive, also pressed for estimates on possible legal expenses, if the county is sued over these new labor agreements. Curtis Hedger, the county’s corporation counsel, was reluctant to speculate, indicating there are still too many unknowns. Diane Heidt, the county’s human resources and labor relations director, told commissioners that the 10-year letter of understanding would have a strong indemnification clause. The union would indemnify the employer for any legal challenges relative to the right-to-work agency shop issue.

The lengthy closed session at the end of the meeting reflected some urgency in negotiations, which must be completed before the new law takes effect in March.

Also at the Feb. 6 meeting, commissioners gave initial authorization to county treasurer Catherine McClary to borrow up to $40 million against the amount of delinquent property taxes in all of the county’s 80 taxing jurisdictions. It’s a standard practice to help the local jurisdictions manage their cash flow. The estimated amount of delinquent taxes is lower than in recent years, possibly reflecting a recovering economy.

McClary also gave the board a year-end report for 2012. Her office brought in $9.96 million during the year from the following sources: delinquent taxes and fees ($5.046 million), accommodation tax ($4.067 million), investment earnings ($755,681), dog licenses ($59,748) and tax searches ($31,760). McClary reported that the county’s investment portfolio totaled $156.08 million at the end of 2012. The non-cash portion of that amount is $147.855 million, which brought in an average weighted yield of 0.456%.

In other action, the board voted to amend an interlocal agreement that will create the Southeast Michigan Regional Energy Office Community Alliance. The new alliance – affiliated with the Michigan Suburbs Alliance, led by county commissioner Conan Smith – is being formed to set up a Property Assessed Clean Energy (PACE) program. The community alliance includes six partners: Washtenaw County, and the cities of Lathrup Village (in Oakland County); Sterling Heights and Roseville (in Macomb County); and Lincoln Park and Southgate (in Wayne County). No other communities in Washtenaw County are part of this alliance. The city of Ann Arbor has already set up its own PACE program.

Also during the Feb. 6 meeting, Yousef Rabhi (D-District 8) reported that he was working with community members and human services providers to establish a Washtenaw County ID card. It would provide a way for residents who don’t have a driver’s license or other photo ID to access services that require such an identification card, such as opening a bank account.

Felicia Brabec reported from the Sustainable Revenue for Supportive Housing Services Task Force, on which she serves. The group is looking at the possibility of an endowment campaign. It’s estimated that about $17 million would be needed “so it’s a big undertaking for us,” she said. That amount would support an additional 116 units of supportive housing throughout the county.

Right-to-Work Response

Washtenaw County commissioners considered a resolution related to Michigan’s new right-to-work legislation – including direction to renegotiate union contracts. The resolution was brought forward by Andy LaBarre (D-District 7), one of three Ann Arbor commissioners on the nine-member board. [.pdf of LaBarre's resolution]

From left: Washtenaw County sheriff Jerry Clayton and county commissioner Andy LaBarre (D-District 7) of Ann Arbor.

In addition to condemning the right-to-work law and urging the state legislature to pass SB 95 and SB 96 – bills that would repeal the law – LaBarre’s resolution also “directs the county administrator and the director of human resources to engage in expedited negotiations, as requested by the unions, with the goal of reaching four (4) year agreements to protect and extend each bargaining unit’s union security provisions, as well as enter into a letter of understanding separate from the existing collective bargaining agreements for a period of ten (10) years.” The letter would relate to agency fees paid by non-union members based on the idea that they benefit from the union’s representation of their interests during collective bargaining.

This is the same approach recently authorized by the Ann Arbor Transportation Authority’s board at its Jan. 17, 2013 meeting. [.pdf of AATA's letter of understanding. Also see Chronicle coverage: "AATA OK's Labor, Agency Fee Accords"]

LaBarre, who took office in early January, had previously indicated his interest in bringing forward a resolution opposing the right-to-work law. As chair of the board’s working sessions, he led a meeting on Jan. 3 with a lengthy discussion of that issue. [Chronicle coverage: "County Board Weighs Right-to-Work Response"]

The controversial right-to-work law was passed late last year by the Republican-controlled House and Senate, and signed by Republican Gov. Rick Snyder. The law, which takes effect in March, will make it illegal to require employees to support unions financially as a condition of their employment. It’s viewed by Democrats as a way to undercut support for labor organizations that have historically backed the Democratic Party. On the Washtenaw County board of commissioners, seven of the nine commissioners are Democrats, including LaBarre.

Unions represent 85% of the 1,321 employees in Washtenaw County government.

At the Feb. 6 meeting, Dan Smith asked that this item be pulled out from the consent agenda for separate consideration.

Right-to-Work Response: Public Commentary

One person – George Lawrence of Whitmore Lake – addressed the board during public commentary about this issue. He said he had been a union member for a long time, and had been forced to pay dues that went to a political party that he didn’t agree with all the time. That was all he wanted to say, Lawrence told commissioners. He also pointed out that the board had forgotten to say the Pledge of Allegiance at the start of their meeting.

Yousef Rabhi, chair of the board, responded to Lawrence’s comment about the pledge, noting that it is made at the start of the regular board meeting, which is held immediately following the ways & means committee meeting. Lawrence had made his public commentary during the ways & means committee meeting.

Right-to-Work Response: Board Discussion

LaBarre began the discussion by saying the resolution was his best attempt to confront this issue “that’s been put upon us.” He felt it was worthy of discussion and debate, but hoped the board would pass it and find some tangible benefits from it.

Washtenaw County commissioner Dan Smith (R-District 2, standing) with Curtis Hedger, the county’s corporation counsel.

Dan Smith asked Curtis Hedger, the county’s corporation counsel, to comment on the legality of the 10-year letter of understanding.

“I won’t comment on that tonight,” Hedger replied. If the board as a whole wants him to, Hedger said he’d be happy to look at the issue. There are a lot of areas that will be scrutinized about the state’s right-to-work law, he said, but he didn’t have an opinion on the issue that Smith raised right now.

Smith then asked Hedger what the cost might be if the county’s actions are challenged in court. If the board passes this resolution, Smith wondered what would happen if someone finds the 10-year letter of understanding or the new four-year union agreement illegal and sues the county. What would it cost to defend that? Would it be in the range of $50,000 or $100,000 or $1 million?

That’s hard to say, Hedger replied, because it would depend on the tenor of the lawsuit or how aggressively someone decided to pursue the case. He didn’t feel comfortable hazarding a guess. In cases that are more of a legal question, each side briefs the issue and it goes right to court, he explained. If the case doesn’t get appealed, it could be fairly inexpensive, he said. But if it’s a more complicated case that goes all the way to the Supreme Court, that could cost significantly more.

Hedger noted that lawsuits have already been filed in connection with the right-to-work law, and that Gov. Rick Snyder has asked the Michigan Supreme Court to get involved. So there might be answers fairly quickly on a lot of these issues, he said.

Smith suggested looking at a worst case scenario, with a lawsuit going all the way to the Michigan Supreme Court, against which the county must defend itself. What might the cost be for that?

Hedger again said he couldn’t speculate. It might be only $10,000 if only briefs are filed. When Smith expressed surprise at that amount, Hedger said it’s less costly since there would be no discovery phase in this situation. “This is just a legal issue, so it’s going to be in the nature of a declaratory judgment, I believe.” A declaratory judgment would simply state whether the legislation is legal. The biggest expense in any litigation is during the discovery phase, Hedger said.

Hedger added that if the case went all the way to the state Supreme Court, then it would likely be more than $10,000 but probably less than $100,000. He restated his opinion that it was “almost impossible” to try to guess. Smith summarized Hedger’s position by saying that the county is looking at an “unknown cost” to defend this. Hedger agreed, saying it would be true of any litigation that was speculative.

Diane Heidt, the county’s human resources and labor relations director, told commissioners that the 10-year letter of understanding would have a strong indemnification clause. The union would indemnify the employer for any legal challenges relative to the right-to-work agency shop issue.

Moving to a different issue, Smith characterized the language in the resolution as “over the top” and said it contained offensive rhetoric. He told commissioners that he had crafted two alternative versions of the resolution – one that eliminated the offensive rhetoric [.pdf of Dan Smith's alternative resolution #1], and another that removed language that was extraneous to county policy [.pdf of Dan Smith's alternative resolution #2]. “I’ve been quite clear that we need to stick to the county’s business, and I’ve shown a way we can do that,” he said.

Smith did not formally offer the resolutions for consideration.

LaBarre defended his own resolution, saying he agreed with the importance of sticking to the county’s business. He argued that “this is the county’s business,” due to the effect it would have on the workforce and on their ability to continue to provide excellent customer service for taxpayers, unionized and non-unionized. It’s “entirely within the scope of rational thinking,” LaBarre said, for one unit of government to weigh in on something that another unit has done that will change the original unit’s operations or affect its workforce.

LaBarre said he agreed with Smith’s general principle that the county board should not be overly eager to weigh in on issues at other levels of government. “But I think this is a special case,” he added, “and thus requires a response.”

Rolland Sizemore Jr. highlighted the resolution’s reference to reaching a new four-year agreement. Does that indicate that the county will be developing a four-year budget? County administrator Verna McDaniel replied that the county has had a five-year contract with its unions in the past, even though it “didn’t marry up with the budget.” So there is precedence for union contracts that don’t match the county’s two-year budget cycle, she said. The contracts can include clauses that will build in protections against any unforeseen budgetary changes, she said.

Outcome: On a 6-1 vote, commissioners passed the right-to-work resolution. Voting against the resolution was Dan Smith (R-District 2). Ronnie Peterson (D-District 6) and Alicia Ping (R-District 3) were absent.

The board later entered into a nearly three-hour closed session for the purpose of discussing labor negotiation strategy. They were joined by several senior staff members – including county administrator Verna McDaniel; finance director Kelly Belknap; and Diane Heidt, the county’s human resources and labor relations director. Also participating in the session was the county’s bond counsel, John Axe of Axe & Ecklund of Grosse Pointe Farms. The meeting adjourned at approximately 11:30 p.m., without additional action by the board.

Delinquent Tax Borrowing

Commissioners were asked to give initial authorization to the county treasurer to borrow up to $40 million against the amount of delinquent property taxes in all of the county’s 80 taxing jurisdictions. [.pdf of delinquent tax resolution]

After March 1, taxing jurisdictions – including cities, townships, schools systems and libraries, among others – turn their delinquent taxes over to the county, and are reimbursed for that amount. The county treasurer then assumes responsibility for collecting these delinquent taxes. This is a standard procedure that’s conducted annually at this time of year. The borrowed funds are used for cash flow purposes, to fund operations for the first half of the year.

County treasurer Catherine McClary told commissioners that although this process is conducted each year, “I don’t handle it just pro forma.” She reported that under the state’s General Property Tax Act, as county treasurer she is required to collect delinquent taxes. Section 87 of the act allows the county to set up a revolving fund – which was done several decades ago – so that the county can borrow the estimated amount of delinquent taxes, then pay in advance to all the taxing jurisdictions the amount that they would have collected if there had been no delinquent payments.

This year, the estimated amount of delinquent taxes is about $25 million, though McClary said she expects the amount to be lower than that. The exact amount won’t be determined until the middle or end of March. The notes will likely be issued in April or May, she said. “The earlier we can issue, the earlier we can advance” funds to the local units of government and the county’s general fund, she explained.

McClary also pointed out that the resolution limits the amount that can be borrowed to $40 million, down from a limit of $45 million last year.

Delinquent Tax Borrowing: Board Discussion

Dan Smith thanked McClary, saying the process really helped local municipalities with significantly smaller budgets to manage their cash flow. He noted that some municipalities actually purchase these delinquent tax bonds, citing Ann Arbor Township as an example. So these local entities are investing in the county, which is another reason to keep the county’s finances in order, he said, and to keep the county’s bond rating high. A higher bond rating means that the county can borrow at lower interest rates, he noted.

Smith also pointed out that interest rates on CDs are “abysmal” now and it looks like they’ll remain that way. He asked if there’s any way he could purchase a delinquent tax bond too, when they are issued?

McClary replied that in 1975, when she served as a county commissioner, she investigated whether delinquent tax bonds could be sold over-the-counter to the public. Bonds are traditionally issued in amounts of $5,000, she said, but at that time, the county was looking at issuing $1,000 bonds. Selling to the public proved to be an insurmountable problem, she explained, having to do with securities laws, regulations about broker-dealers, and the expense of splitting the bonds into smaller amounts.

When she became treasurer 16 years ago, McClary said, she looked at the county’s cash flow, and realized that the county could issue these delinquent tax bonds, advance the necessary amounts to the local units of government, then use the remaining cash on hand from the bonds to purchase the county’s own delinquent tax bonds through a broker-dealer and hold them in the county’s investment portfolio. It was a “win-win-win” for everyone, because the county was holding its own “very safe” securities. “Talk about buy local,” she joked.

In 2010 and 2011, the delinquent taxes were so high – because of the economic crisis – that she didn’t have the additional cash to buy back the securities. Last year, there was enough extra cash to purchase some but not all of the delinquent tax bonds. So she made an offer to the treasurers of other local units of government, as well as to some other county treasurers. The result was that Washtenaw County, Kalamazoo County and Ann Arbor Township split the purchase of Washtenaw County’s delinquent tax notes. “It was a fabulous way to go,” she said. This year, she’ll try to hold all the notes in Washtenaw County’s portfolio. “If I can’t, I’ve got some buyers.”

Smith said he was sorry he couldn’t buy any of the bonds himself. In his opinion, it would be one of the safest bonds he could purchase.

Outcome: Commissioners voted unanimously to give initial approval to the delinquent tax borrowing. A final vote is expected on Feb. 20.

Treasurer’s Report

During the Feb. 6 meeting, county treasurer Catherine McClary also gave the board a year-end report for 2012. [.pdf of 2012 treasurer's report]

She began with an overview of the importance of civic infrastructure, noting that it includes the elements of fiscal stability and the safety of public funds, as well as fair and equitable tax systems, honest elections, and the maintenance of accurate land and vital records. The equalization department, which reports to the board, as well as the elected positions of treasurer and clerk/register of deeds are responsible for these aspects of civic infrastructure, she explained.

These three units of county government are interlocking, McClary said. She gave an example from the housing sector. When someone buys or sells a home, the deed must be certified by the county treasurer’s office to attest that the taxes on that property are paid. The paperwork then goes to the register of deeds, where the deed gets recorded. If the treasurer’s office is behind on certifications, then the deed recording gets backed up. In another county in Michigan, she said, fraud occurred because deeds weren’t recorded quickly and the property was sold multiple times to different people.

After the deed is recorded, a copy is sent to the local assessors, who can then “uncap” the assessment, because the property has changed hands. The uncapping means that the taxable value can be raised to equal the assessed value. Determining the assessed value is part of the job of the county’s equalization department, McClary said. That assessment, in turn, is the basis on which each local treasurer levies taxes. Uncollected taxes come back to the county treasurer, “so it really is an interlocking cycle,” she said.

McClary also described in more detail the roles and responsibilities of the treasurer’s office, linking each area to the county’s guiding principles. Related to the principle of ensuring the county’s long-term fiscal stability, McClary pointed to the treasurer’s role of generating revenue by collecting taxes, noting that property taxes make up 61% of the county’s general fund. In addition to property taxes, the treasurer’s office handles other millages – for parks and natural areas, for example – and special assessments for drains, public works and road projects. All other revenue, from grants and other sources, flows through bank accounts that are managed and reconciled by the treasurer. In addition, the treasurer’s office invests surplus funds for the county.

The office also works to prevent foreclosures, McClary said – both mortgage foreclosures and tax foreclosures. These prevention programs have served as a model throughout the state, she said. In addition to an emphasis on prevention, the treasurer’s office will foreclose when necessary, she said, with the goal of returning the property to productive use, preserving neighborhoods, eradicating blight and enforcing local ordinances. She noted that the treasurer’s office and the city of Ypsilanti received a National Association of Counties (NACo) award for an open house project to market tax-foreclosed properties. She also pointed to the former Greek Orthodox church on Main Street in Ann Arbor, saying that the county made “nice excess proceeds” from selling that tax-foreclosed property.

McClary also noted that her office sometimes intervenes in bankruptcies. Although it’s is not mandated by state law, she said it’s a way to get the taxes paid for the public benefit. As an example, she cited a bankruptcy intervention last summer with a “well-known slum landlord” in Ypsilanti. McClary said her office was able to convince the bankruptcy judge and bankruptcy trustee to abandon 13 of the properties, and the county was able to recover over $400,000 in taxes. The properties were foreclosed and sold at public auction.

Delinquent taxes are an early indicator of foreclosures, she said. There was a time when the county averaged 12 foreclosures a year out of about 10,000 properties with delinquent taxes. But for the last four or five years, those numbers have been much higher, she said, although now delinquencies are decreasing.

Turning to financial data, McClary noted that her office brought in $9.96 million during the year from the following sources: delinquent taxes and fees ($5.046 million), accommodation tax ($4.067 million), investment earnings ($755,681), dog licenses ($59,748) and tax searches ($31,760).

She said the investment earnings in recent years have distressed her. In 2006, total revenues for her office were $11 million – not much off the roughly $10 million that were brought in during 2012. But in 2006, investment earnings accounted for about $6 million of the total revenues from her office, she noted – much higher than the $755,681 in 2012. However, now other categories – including the accommodations tax and dog licenses, which her office administers – have increased since then. That reflects the counter-cyclical nature of revenues from the treasurer’s office, McClary said.

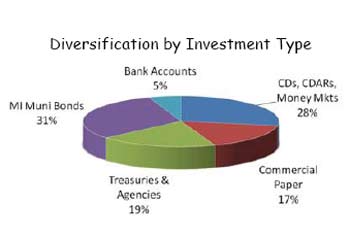

She highlighted the diversification of investments and maturity dates, which will put the county in a good position when interest rates rise – although she didn’t see that happening in the immediate future.

McClary also reported that the county’s investment portfolio totaled $156.08 million at the end of 2012. The non-cash portion of that amount is $147.855 million, which brought in an average weighted yield of 0.456%. Even though that’s low, she said, it performed well against the three-month Treasury benchmark, with a return of 0.05%.

McClary noted that at the end of 2012, a third of the county’s investment portfolio was in Michigan municipal bonds.

Treasurer’s Report: Board Discussion

Conan Smith thanked McClary for her attentiveness to both the rate of return as well as the need for financial security, saying it was hard to balance those two things, but he thought she did a great job of it. He was interested in knowing the relative difference in interest earnings, based on the maturity dates of the county’s holdings. He said he assumed she kept a blended portfolio.

McClary replied that although the county’s portfolio is blended, in general the county doesn’t get a better rate of return by holding longer-term investments. Rather, the different rates of return are more dependent on the different types of securities. In this market, municipal bonds deliver the highest rate of return, McClary said. She noted that in the current portfolio, CDs (certificates of deposit), CDARS (certificate of deposit account registry service), and commercial paper are making 1% or less. Federal agency investments vary, based on how long they’re held, she said – with returns ranging from 0.15% to 1.625%.

Dan Smith asked McClary to comment on the Wayne County airport bond, which was showing a 4% rate of return – the highest of the Michigan municipal bonds. He noted that the Washtenaw County tax notes, which mature on Dec. 1, 2013 – at the same time as the airport bond – have only an 0.85% return.

McClary replied that she had purchased the airport bond through a broker-dealer. In contrast, on the Washtenaw County tax notes she had entered into negotiated bidding. Because she was working with two other units of government on that deal – Kalamazoo County and Ann Arbor Township – “we needed to make sure everything was squeaky clean and fair in terms of setting the rate,” she said. They worked with an underwriter to come up with suggested rates, she explained, then she and the other two treasurers figured out “who wanted the long ones and who wanted the short ones” – a reference to maturity dates.

Andy LaBarre noted that he, McClary and others from the county had attended a recent community capital forum featuring economist Michael Shuman, sponsored by the county’s office of community & economic development. He asked McClary to speak about the secondary positive benefits of local investments, and why she’s taken that step of investing in Michigan municipal bonds.

McClary replied that everyone has likely thought about buying local on a personal level, whether it’s food or clothing or other items. Shuman had talked about three different areas, she said. One is whether the county might have a role in matching local businesses with capital. The second area would be making local investments from the county’s retirement fund. To do that, you’d need to look at the goal of the retirement fund and at what’s permissible under the law, she said. Shuman had also stressed that the investments wouldn’t be made in start-ups, she said, but rather in well-established firms that are looking to expand.

Another issue is how to define “local,” McClary said – is it Michigan, the Midwest or the U.S.? She said the county has had success in investing in Michigan municipal bonds, as long as they meet the criteria of safety and liquidity to meet the county’s cash needs.

McClary concluded her presentation by offering to answer any additional questions commissioners might have in the future regarding the treasurer’s office work.

Outcome: This was not a voting item.

Energy Alliance Accord

Commissioners were asked to approve amendments to an interlocal agreement to form the Southeast Michigan Regional Energy Office Community Alliance.

The history of this partnership dates back to 2010. The county board voted initially to join the Southeast Michigan Regional Energy Office (SEMREO) – a separate entity from the SEMREO Community Alliance – at its March 17, 2010 meeting. At the time, SEMREO was a division of the Michigan Suburbs Alliance, a Ferndale-based nonprofit that’s led by county commissioner Conan Smith. Smith abstained from the March 17, 2010 vote, following conflict-of-interest concerns raised by other commissioners. SEMREO later split off from the Michigan Suburbs Alliance as a separate organization, but Smith serves on its board of directors and as its treasurer.

Washtenaw County became involved in the SEMREO Community Alliance in 2011. On Aug. 3, 2011, the county board voted to join the SEMREO Community Alliance and approved the original interlocal agreement. According to Sam Offen – SEMREO director and co-director of the SEMREO Community Alliance – the alliance is being created in order to pursue certain grant funding that’s not available to municipalities directly. It includes six partners: Washtenaw County, and the cities of Lathrup Village (in Oakland County); Sterling Heights and Roseville (in Macomb County); and Lincoln Park and Southgate (in Wayne County). [.pdf of original interlocal agreement] Smith was absent from the Aug. 3, 2011 meeting when the Washtenaw County board voted to join the alliance.

Specifically, the community alliance will be setting up a Property Assessed Clean Energy (PACE) program, which is enabled by state legislation – the Property Assessed Clean Energy Act 270 of 2010. The program allows property owners to take out loans to make energy improvements that would be repaid through regular installments as part of their taxes. The city of Ann Arbor has already set up its own PACE program, and the city council is expected to vote soon on authorizing up to $1 million in bonds that would help owners of commercial property make energy improvements.

The interlocal agreement requires the approval of Gov. Rick Snyder. The state attorney general had reviewed the original agreement and requested some changes.

According to a staff memo, the amended interlocal agreement includes 13 changes, summarized in the county board’s resolution. [.pdf of interlocal agreement resolution] Changes include: (1) clarifying local government appointment and removal powers; (2) allowing video conferencing for quorum and voting; (3) allowing teleconferencing for participation, but not voting or quorum; (4) adding forms and rules for additional parties to join the alliance; and (5) clarifying the entity that determines how costs and expenses are to be distributed. A full copy of the amended interlocal agreement was not provided in the board’s Feb. 6 meeting packet. Offen emailed it to The Chronicle following the meeting. [.pdf of amended interlocal agreement]

Washtenaw County was the last of the six partners to authorize the amendments. In an email sent to commissioners on Feb. 1, Smith expressed some frustration about the process. [.pdf of Smith's email] From the email:

The Regional Energy Office requested the BOC address this on December 11, 2012. Understandably, we were not able to take it up in December or at our first meeting in January. I had expected staff to bring it to our last meeting but that did not happen. At the Working Session, I requested this be included on the BOC agenda, but again staff did not expeditiously prepare the very brief cover memo that is necessary. I communicated directly with staff in person and by email about this, but the memo was not provided until yesterday. I learned today that it has been included on the Ways & Means agenda rather than the Board agenda, despite our agreement at Working Session to send it to the BOC and the fact that this is not, at least in my opinion, a change in County policy.

I am very frustrated by this process. I feel I have been patient and supportive, but not received prompt attention to what is a minor ministerial matter. At this point, all the other communities have approved the amendments and Washtenaw is holding up the process. I would very much appreciate it if we can complete action on this item next week.

Energy Alliance Accord: Board Discussion

On Feb. 6, Smith was absent for the initial vote to amend the SEMREO Community Alliance interlocal agreement, arriving at the meeting after the vote had been taken. However, he asked the board if he could record affirmative votes for all items that he had missed – which included the SEMREO Community Alliance item. None of the other commissioners objected.

The item was voted on at both the ways & means committee meeting, and the regular board meeting that immediately followed. It had been added as a supplemental agenda item for the regular board meeting. Typically, resolutions are voted on initially at ways & means, then two weeks later at the regular board meeting – rather than on the same night.

Before the final board vote, Smith introduced Sam Offen, SEMREO director and co-director of the SEMREO Community Alliance, saying that Offen had been shepherding the interlocal agreement through the process in the attorney general’s office and the governor’s office. Smith described the process as “onerous.”

Smith noted that Washtenaw County was the last government entity to vote on approval of the revised agreement. He asked Offen if the agreement then had to get the governor’s signature. Yes, Offen replied. All of the changes that the board was adopting that night had already been approved by the attorney general.

Outcome: Without further discussion and in separate votes, commissioners unanimously gave both initial and final approval to the amendments for the interlocal agreement.

After-School Program Grant

Washtenaw County commissioners were asked to give final authorization to apply for a $20,000 grant to fund expansion of an after-school program called “Telling It” in the West Willow and MacArthur Boulevard housing developments, low-income neighborhoods on the county’s east side. Initial approval was received on Jan. 15, 2013. [.pdf of grant application]

According to a staff memo, the Telling It program focuses on developing creative writing and literacy skills for at-risk youth. It would support an effort to fight gang-related activity – specifically, the dozen or so “cliques” in the Ypsilanti/Willow Run area. The memo defines cliques as gangs “without by-laws, or a code of ethics, ultimately heightening the threat. Criminal behavior is viewed as a rite of passage as youth longing to belong to something in some areas where they are being offered very little positive influence during the school year. The sheriff’s office has recognized the need to provide after-school enrichment programs that are not purely sports based.”

One of the main concerns in West Willow is an underground culture of “fight clubs,” according to the sheriff’s office – where teenage boys promote fighting between teenage girls, with the fights videotaped and uploaded to YouTube.

The grant application is unusual in that it’s the first time a county unit has sought funding through the coordinated funding pilot program, which was designed to support human services more effectively in this community. The coordinated funding is a partnership of the county, the city of Ann Arbor, the United Way of Washtenaw County, the Washtenaw Urban County, and the Ann Arbor Area Community Foundation.

The process has three parts: planning/coordination, program operations, and capacity-building. The approach targets six priority areas, and identifies lead agencies for each area: (1) housing and homelessness – Washtenaw Housing Alliance; (2) aging – Blueprint for Aging; (3) school-aged youth – Washtenaw Alliance for Children and Youth; (4) children birth to six – Success by Six; (5) health – Washtenaw Health Plan; and (6) hunger relief – Food Gatherers.

The grant application for Telling It would help pay for four program facilitators, a program director, and a psychotherapist to serve as a training consultant. It would fall under the coordinated funding category of capacity building.

Commissioner Conan Smith had previously raised concerns about using the coordinated funding program, which was designed to support local nonprofits, to pay for a county-sponsored initiative. He felt the county should find a way to pay for it without using money that’s meant for outside agencies. However, he raised no objection at the Feb. 6 meeting.

After-School Grant Program: Board Discussion

Board chair Yousef Rabhi told commissioners that he has asked Mary Jo Callan – who leads the county’s office of community & economic development, which administers the coordinated funding program – to develop a policy that addresses whether county programs can apply for funding from the coordinated funding program.

Outcome: Commissioners unanimously gave final approval to the grant application.

Changes to Board Rules & Regulations

On the Feb. 6 agenda was an item to change the board rules and regulations that commissioners adopted at their Dec. 5, 2012 meeting. The proposal was to amend the list of boards, committees and commissions that are eligible for stipend payments, adding the Detroit Region Aerotropolis board to the list and removing the Southeast Michigan Regional Transit Authority (RTA). The stipend for service on the aerotropolis would be $100.

Commissioner Rolland Sizemore Jr. (D-District 5) had been appointed to serve on the aerotropolis at the county board’s Jan. 16, 2013 meeting. Sizemore’s appointment on Jan. 16 came in the context of the annual county commissioner appointments made at the start of each year. [.pdf of 2013 appointments listing]

The original list of eligible boards, committees and commissions for which stipends are paid was approved at the county board’s Dec. 5 meeting, but the aerotropolis had not been included in that list.

At that Dec. 5 meeting, commissioners had voted to alter their compensation to receive stipend payments based on the number of meetings that a commissioner is likely to attend for a particular appointment. One or two meetings per year would pay $50, three or four meetings would pay $100, and the amounts increase based on the number of meetings. Each commissioner typically has several appointments. In the past, commissioners had to request per diem payments for their work. Now, stipend payments will be made automatically, unless commissioners waive their stipends by giving written notice to the county clerk.

According to the county clerk’s office, Dan Smith (R-District 2) is the only commissioner who has waived all of his stipends. Felicia Brabec (D-District 4) waived the $150 stipend for the accommodations ordinance commission. She serves as an alternate for the AOC. Ronnie Peterson (D-District 6) does not receive any stipends because he was not appointed to any boards, committees or commissions.

Outcome: Without discussion, commissioners unanimously approved the change to the board’s rules & regulations.

Board Budget Calendar & Guidelines

On Jan. 16, the board had given initial approval to a timeline and guidelines for developing the county’s budgets through 2017, setting a goal for the county administrator to submit budget recommendations on Sept. 4, 2013 with final adoption by the board on Nov. 20, 2013. [.pdf of budget guidelines]

The item was up for final approval on Feb. 6. Dan Smith (R-District 2) moved to make a minor amendment related to policies and procedures [italics indicates added text, strikethrough indicates deletion]:

Department Heads are directed and Elected Officials are requested directed to review all programs for continuing relevance and priority as a County service, and discuss the possibility to delete or modify programs where possible with the County Administrator.

Outcome: Smith’s amendment passed unanimously, without discussion. The amended item was later passed as part of the board’s consent agenda.

Community & Economic Development Grants

Several items were on the agenda related to grants and programs administered by the county’s office of community & economic development (OCED). Those items included:

- the Michigan Works! system plan for 2013 [.pdf of 2013 MWSP]

- $20,000 in federal funding (Community Services Block Grant discretionary funds) to conduct a needs assessment of the New West Willow Neighborhood Association.

- $20,000 in federal funding (Community Services Block Grant discretionary funds) for tax preparation services to low-income customers, in partnership with Avalon Housing, Catholic Social Services of Washtenaw County, Housing Bureau for Seniors and Women’s Center of Southeastern Michigan.

- $299,821 in federal funding for the foster grandparent program, plus $104,208 in county matching funds. The program serves 80 limited-income individuals aged fifty-five and over, who’ll mentor children with special needs. The funds provide foster grandparents with a stipend, transportation, meals, uniforms, community involvement and training, and an annual physical exam.

- $46,900 in state funds to provide emergency heating deliverable fuels to about 45 households.

- $94,901 in state funds to help low-income families pay their home energy bills, and to provide emergency deliverable fuels to residents at or below 200% of the federal poverty limit.

Community & Economic Development Grants: Board Discussion

Dan Smith (R-District 2) pointed out that there were a number of agenda items related to OCED, and he wanted to thank OCED director Mary Jo Callan and her staff for all their work.

Felicia Brabec (D-District 4) asked about the needs assessment for the New West Willow Neighborhood Association and for the senior nutrition program – another item on the agenda for final approval on Feb. 6. She wondered if there would be funding available to implement the recommendations from the needs assessments.

Callan said the needs assessments are definitely planning activities. The point is to inform future investments, she noted. The staff can’t yet say if there will be money available to fund everything that needs funding, Callan added, but it’s useful to look at how their current funding is deployed and to make sure it’s doing the most good for the most people.

Regarding the New West Willow neighborhood assessment, there aren’t currently operating dollars to fund programs there, Callan said. But the county receives an annual allocation of federal Community Service Block Grant (CSBG) funding. The county is making sure they invest those dollars in the places that they know there’s need, she said.

Outcome: All items were approved unanimously by commissioners as part of the consent agenda.

Tech Agreement

County commissioners were asked to give initial approval to amend a three-way agreement with the Ann Arbor Transportation Authority and the city of Ann Arbor. The three-way accord – an interagency agreement for collaborative technology and services (IACTS) – is meant to provide a way to procure and maintain common technology platforms and services centrally.

The modification to the agreement allows for adding other entities into the agreement in a more streamlined way. It gives each founding member the ability to add new participants administratively, without modifying the agreement itself. The original IACTS was approved in May of 2011. [.pdf of IACTS amendment]

The Ann Arbor city council approved the amendment at its Feb. 4, 2013 meeting. According to city of Ann Arbor IT director Dan Rainey, responding to an emailed query, one of the entities interested in participating in the IACTS is the Washtenaw Intermediate School District. Also responding to an emailed query, Washtenaw County IT manager Andy Brush explained that certain IT services are already provided by Washtenaw County to various entities – like the city of Ypsilanti, Dexter’s fire department, and the 14B District Court – although they aren’t yet parties to the IACTS agreement.

Tech Agreement: Board Discussion

At the Feb. 6 meeting, Yousef Rabhi (D-District 8) highlighted this project as one of the county’s “shining stars” in terms of collaborative efforts. It’s an example of collaboration between the city and county, saving money and being “excellent stewards” of public dollars, he said, “and really making those public dollars go as far as possible.” He thanked the county’s infrastructure and IT staff for their work.

Outcome: Commissioners gave initial approval to the IACTS amendment. A final vote on this item is expected at the board’s Feb. 20 meeting.

Debt Refinancing for Township Sewers

Commissioners were asked to give initial approval to refinance debt for a sewer system in Lyndon and Sylvan townships, on the county’s west side. The action is intended to save about $110,000 in interest payments. [.pdf of bond resolution]

The resolution authorizes the sale of refunding bonds that would be used to pay the remaining principal on existing bonds that were sold in 2004. That year, the county sold $5.115 million in bonds to help the townships pay for the sewer. Of that amount, $2.225 million remains to be repaid. According to a staff memo, the project built sewers at Cavanaugh, Sugar Loaf, Cassidy, Crooked, and Cedar Lakes. It’s funded through special assessments on property around those lakes and payments by the Sugar Loaf Lake State Park and Cassidy Lake State Corrections Facility.

The staff memo also states that additional funds might be available from special assessment prepayments and connection fees paid by the state of Michigan. These funds might reduce the total refunding bond amount even more, and would increase the savings.

This sewer system is separate from a controversial water and wastewater treatment plant project in Sylvan Township. For more background on that project, see Chronicle coverage: “County Board OKs Sylvan Twp. Contract.”

Outcome: Without discussion, commissioners unanimously approved the debt refinancing. A final vote is expected on Feb. 20.

Miller Avenue Drain Project

Funding for a drain project along Miller Avenue in Ann Arbor – in the Allen Creek drainage district – was on the county board’s Feb. 6 agenda.

The request was to authorize the backing of up to $1.58 million in bonds for the project, which will repaid through a special assessment against the city of Ann Arbor.

The project is being handled by the office of the Washtenaw County water resources commissioner, led by Evan Pratt. It’s the first project brought forward by Pratt, who was elected in November 2012 and took office in January. Pratt attended the Feb. 6 meeting but did not formally address the board.

According to a staff memo, the funds will be used “to clean out, widen, deepen, straighten, tile, extend, or relocate along a highway, construct branches, relief drains, or connections to the Miller Avenue portion of the Allen Creek Drain to reduce downstream flooding and improve water quality to increase the public health benefit.”

There was no discussion on this item.

Outcome: Commissioners voted unanimously to give initial approval to the Miller Avenue Drain project. A final vote is expected on Feb. 20.

Communications & Commentary

During the evening there were multiple opportunities for communications from the administration and commissioners, as well as public commentary. Here are some highlights.

Communications & Commentary: County ID Card

Yousef Rabhi reported that he was working with community members and human services providers to develop a new program about a Washtenaw County ID card. The project is being overseen by a task force of the following members and entities:

- Yousef Rabhi, chair of the Washtenaw County board of commissioners

- Jerry Clayton, Washtenaw County sheriff

- Catherine McClary, Washtenaw County treasurer

- Larry Kestenbaum, Washtenaw County clerk

- Melody Cox, assistant to the county clerk/register of deeds

- Synod Community Services

- Washtenaw Interfaith Coalition for Immigrant Rights

- Shelter Association of Washtenaw County

- Casa Latina

- Law Enforcement Citizens Advisory Board

- Home of New Vision

It provides a way for residents who don’t have a driver’s license or other photo ID to access services that require such an identification card, Rabhi said. Actions and services that require a photo ID include renting an apartment, opening a bank account, and proving residency for things like library cards. People who are elderly, immigrants, ex-offenders, or homeless often face discrimination because they don’t have a photo ID, Rabhi said. It’s also important for law enforcement, he added, because sometimes immigrants don’t feel comfortable reporting crimes – they fear repercussions if police ask for their ID.

Funding this kind of program is a huge issue, Rahbi noted. It’s important to minimize the impact on the county, he said, but there are lots of opportunities for partnerships. People involved in this effort will be reaching out to local officials in the coming weeks, he said, and he hoped the program would move forward.

Communications & Commentary: Liaison Reports

Felicia Brabec reported from the Sustainable Revenue for Supportive Housing Services Task Force, on which she serves. The group is looking at the possibility of an endowment campaign. The nonprofit Washtenaw Housing Alliance is paying for a consultant (Hammond and Associates) – to explore how such a campaign might fare. It’s estimated that about $17 million would be needed “so it’s a big undertaking for us,” she said. That amount would support an additional 116 units of supportive housing. An existing endowment has $2 million, Brabec reported – $1 million from the Ann Arbor Area Community Foundation, and $1 million from St. Joseph Mercy Health System, in honor of Sister Yvonne Gellise.

Brabec also reported that TCC Group, the consultant hired to evaluate the county’s coordinated funding pilot program, has finished its work. She, Yousef Rabhi and Andy LaBarre were briefed on the initial findings and “overall it looks good,” she said. TCC representatives indicated that they haven’t seen this kind of public/private model being done anywhere else. The full report will be shared with other commissioners, policymakers and the public when it’s completed, she said.

Brabec also updated commissioners on the status of the Washtenaw Community Health Organization (WCHO), a partnership between Washtenaw County and the University of Michigan Health System. The organization has completed its relocation into county office that it’s leasing on Zeeb Road, she said. She thanked Greg Dill, the county’s director of infrastructure management, for his help in making that transition.

Communications & Commentary: Introductions

Several other elected officials attended the Feb. 6 meeting, in addition to county commissioners.

Felicia Brabec, chair of the board’s ways & means committee, noted that sheriff Jerry Clayton, county treasurer Catherine McClary, and Evan Pratt – the county’s water resources commissioner – were attending the meeting. Also in the audience was Brian Mackie, the county prosecuting attorney.

Dan Smith introduced Oakland County commissioner Phil Weipert. [Weipert, a Republican, represents District 8 in Oakland County, which includes the cities of South Lyon and Wixom, the village of Wixom, and the townships of Lyon and Milford.]

Communications & Commentary: Public Commentary

Thomas Partridge spoke at both opportunities for public commentary during the evening. He told commissioners he was there to advance the cause of the most vulnerable, and called for them to add to the agenda a funding plan to provide housing to everyone who was outside on this cold night. He said the “right-wing” Republicans in the Michigan legislature and the U.S. Congress have the “Sword of Damocles” hanging over the nation as the deadline approaches at the end of February, when he said the economy will be hit by the impact of sequestration. Partridge also called for the county board to put forward a resolution calling for gun and ammunition control.

Present: Felicia Brabec, Andy LaBarre, Kent Martinez-Kratz, Yousef Rabhi, Rolland Sizemore Jr., Conan Smith, Dan Smith.

Absent: Ronnie Peterson, Alicia Ping.

Next regular board meeting: Wednesday, Feb. 20, 2013 at 6:30 p.m. at the county administration building, 220 N. Main St. in Ann Arbor. The ways & means committee meets first, followed immediately by the regular board meeting. [Check Chronicle event listings to confirm date.] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public commentary is held at the beginning of each meeting, and no advance sign-up is required.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Washtenaw County board of commissioners. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

I would prefer to see the County Commissioners working on behalf of all the citizens of Washtenaw County instead of a select few.

County employees are part of “all the citizens.”

Strong unions are to the benefit of all citizens. Unions not only mean higher pay, but they also mean a happier workforce that is able to bargain effectively for safe working conditions.

Strong public employee unions make for safe democratic seat holders who further enrich public employee unions at contract renewal. It’s a virtuous circle. Both parties feed at the taxpayer trough.

For the rest of us, those without a seat at the trough, those lacking guaranteed jobs for life and cadillac health care and pensions, well, that’s who the gang pictured above is not representing.

Our role is to pay the bill. And if you don’t pay, they will take your home and pay your back taxes with the proceeds.

Based on the stated intent of the renegotiation, to “protect and extend … union security provisions,” renegotiating the union contracts early to “beat” the “right-to-work” law provides some value to the unions (though it is debatable whether or not there is any value to the members). The unions have asked for this, so they must perceive some value in doing it.

Therefore, it must result in some commensurate value to the county in the form of lower wages, or benefits, or work rules. Something of equal value. If not, the commissioners are simply shirking their fiduciary responsibility.

AATA and the County Commissioners are on board with this human rights issue but not a peep from the Ann Arbor Mayor and/or anyone on Ann Arbor City Council. Kudos to the the former, shame on the later.

Why isn’t the Washtenaw County Board of Commissioner for allowing workers to decide for themselves whether or not they want to pay dues and support a Union. Don’t they believe in the freedom of Choice?

Unions are strong when they act responsibly and do a good job for their members. Denying workers covered by a Union contract a choice whether they will support and pay for that Union is not a democratic and socially responsible practice.

Re (7) & (8). Unions are democratically established and maintained. It takes a majority vote of employees in a bargaining unit to form a union initially. After the union is established, it can be decertified by a majority of the then employed members of the bargaining unit. Employees have a choice, but that choice is expressed by majority vote.

Once certified as the exclusive bargaining agent for a unit of employee, a union has the legal duty to represent all employees in that unit. No employee can be forced to become a member of the union, but employees can be compelled to pay that portion of dues that is spent on activities directly related to bargaining and representation.

Just as taxpayers in a democracy cannot choose to withhold financially support for governmental actions with which they disagree (war for example), an employee should not be able to choose whether to contribute to the cost of the core functions of representation by a union.

Employees who work in settings that are represented by a union have a choice whether to continue that status. It merely takes a majority to remove the union. While a majority of workers support union representation, all employees receive the wages, benefits and job protection of the union contract and all should be required to contribute to the cost of obtaining those terms and conditions of employment.

Right to work is not about the freedom to choose whether to be a member. It is about undermining the financial support of unions so they become less effective. Non-union, or weak union workplaces have lower wages,fewer benefits and less job security. That is the real aim of the right to work advocates.