FY 2015 Budget Preview: Cops, Trees

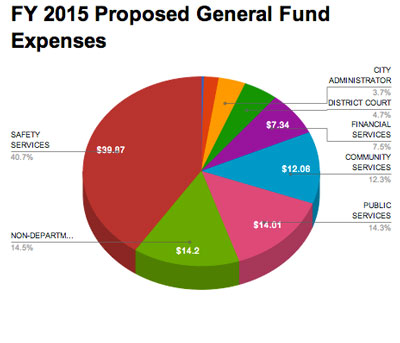

Ann Arbor city administrator Steve Powers’ proposed general fund budget for fiscal year 2015, which starts on July 1, 2014, will approach $100 million.

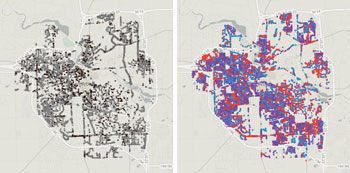

Left: Stumps (black) and vacant sites (gray). Right: Maples (purple), Crabapples (red) and oaks (blue). Maps by The Chronicle from the city’s 2009 tree inventory. The city administrator’s proposed FY 2015 budget includes a one-time $1 million expense to address the backlog in pruning and removal of trees that are dead or in poor condition.

Funded as part of the FY 2015 budget are five new full-time employees, four of them in public safety: one additional firefighter; three additional police officers; and an additional rental housing inspection position. The additional positions were all presented as possibilities at a Feb. 10 city council work session. The additional police positions will bring the total number of sworn officers in the city of Ann Arbor to 122.

Not previewed as a possibility at that February work session is a one-time expense of $1 million to address a backlog in critical pruning and removal of trees that are in the public right of way. The allocation comes in the context of the development of an urban forestry management plan.

The $1 million one-time expense for street trees brings the total of non-recurring expenses in the FY 2015 general fund budget to about $2.8 million. Other one-time expenses budgeted for FY 2015 are: $80,000 to cover transitional costs for art administration; $606,000 for repairs and maintenance of the city’s hydroelectric dams; $100,000 for consultants to assist with completing the downtown zoning amendments and sign inventory; $300,000 for demolition of city-owned buildings at 415 W. Washington; $200,000 for a corridor studies; and $209,000 in operational support for the Ann Arbor Housing Commission’s (AAHC) transition to a rental assistance demonstration program.

The housing commission also accounts for the bulk of a $13.8 million (17%) increase in general fund recurring expenditures compared to last year. That’s due to an accounting change that recognizes 22 AAHC employees as city employees. By recognizing revenue and expenses for AAHC employee compensation through the general fund, the AAHC can avoid the negative impact of a new accounting rule. The GASB 68 rule requires unfunded pension fund liabilities to be recorded in the financial statements for proprietary funds (like the AAHC) but not for governmental funds like the general fund.

Also included in the FY 2015 budget proposal is about $3,000 for a pilot program for closed captioning of public meeting broadcasts on the Community Television Network. According to city of Ann Arbor communications manager Lisa Wondrash, the cable commission meeting recommended approval of the money at its Feb. 25 meeting, and she notified the commission on disability issues about the pilot on April 16. The pilot will begin with meetings of the city’s commission on disability issues, with a goal of testing out a closed captioning system in July this year.

The $98.1 million of general fund expenditures in FY 2015 will include $95.3 million in recurring expenditures and $2.8 million in one-time expenses.

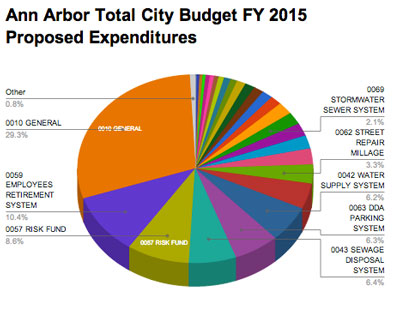

When the general fund is added in with the rest of the city’s budget – the street fund, water fund, sewer fund, parking fund, and the like – the total expenses proposed for FY 2015 come to $334,434,101.

Powers will present the proposed budget to the city council at its April 21 meeting, the second meeting this month. The council will need to adopt the budget, with any changes, at its May 19 meeting, also the second meeting of the month. That timeframe is specified in the city charter.

The Chronicle sat down with Powers and city CFO Tom Crawford for a conversation about the FY 2015 budget. That conversation is presented here as a Q&A. Within the context of the budget, other issues discussed include state funding, long-term planning, affordable housing, animal control, and fund balance policy. [.pdf of April 21, 2014 pre-dated memo from Powers to city council]

Public Safety

Q: On the topic of safety services, the budget includes an additional 1 full-time position for fire safety and three new FTEs for police. What will the duties be for the fire safety position?

Steve Powers: Nothing different or unique. It will be an additional body to deploy for fire suppression. It will be a firefighter, not a fire inspector.

Q: Last year, the city council asked the Ann Arbor Downtown Development Authority to consider funding three beat cops for downtown. Is the intent to deploy the three police positions in FY 2015 to the downtown? Is there a relationship between the request to the DDA and these three new positions?

SP: Chief Seto is recommending, and I’m supporting his recommendations, that the positions be allocated this way: Two to the community engagement unit, and one to traffic enforcement. Community engagement includes downtown foot and bicycle patrols, but also in business districts outside the downtown area, as well as other neighborhood and community events and working with Ann Arbor Public Schools. So there’s not a direct connection to adding three officers to the downtown, but two of the three will be available for downtown.

The traffic enforcement position is related to the concern that the chief and I have been hearing, that councilmembers have been hearing, about speeding and other traffic-related violations, in addition to pedestrian safety. So it’s for traffic enforcement generally, more so than just focused on pedestrian issues.

Public Housing Commission

Q: The proposed FY 2015 includes a transfer of employees from the Ann Arbor Housing Commission and public market fund, which increases the total number of city employees paid for out of the general fund. Can you talk about how that will work?

Tom Crawford: We are not adding new employees. This is the inclusion of the Ann Arbor Housing Commission FTEs, which previously were not included at all in the count of city employees. Legally, the housing commission is distant enough that we have not included their FTEs historically. With this change, we are rolling them into the general fund. That’s being driven by GASB 68. If they remained employees of the housing commission, then the commission would incur a pension expense which would be higher and much more volatile, and it wouldn’t be reflective of how we’re funding the pension – because we are funding it. By doing this, they would incur an expense related to the funding level.

The public market fund is moved into the general fund for multiple reasons. Pension accounting was one of them, but the market fund also has not been making money. The pension expense was going to make it worse.

Steve Powers: A different accounting rule is advising local governments to close enterprise funds that really aren’t enterprises – that require ongoing subsidy. The public market and golf funds are examples that under GASB aren’t really enterprise funds.

Perceptions of Public Safety Spending

By way of background, the city’s total budget for FY 2015 is proposed to be about $334 million, of which the general fund makes up $98.1 million. As a percentage of the general fund, public safety spending over the last couple of years has been around 49%. Despite the hiring of four additional public safety positions (1 firefighter, 3 police officers) for FY 2015, that percentage will drop to around 40% – because of the way Ann Arbor Housing Commission employees are accounted for, starting this year.

Q: Including the AAHC and market fund employees in the general fund results in an $11 million increase to the general fund. Because of that, the percentage of general fund expenditures for safety services – police and fire – drops from about 50% to about 40%. What’s your strategy for explaining that to people who might think it represents a decrease in spending for police and fire services?

Tom Crawford: That’s something that’s crossed our minds. I think we answer that with an apples-to-apples comparison. These expenditures [from the AAHC] have 100% offsetting revenues that fluctuate with the expenses – as does the pass-through that the city sends to the AAATA. So we’ll just explain that it’s just a pass-through for the housing commission. Historically in our budget presentations, we adjust numbers to be comparable. The question will come up.

Steve Powers: Tom and I started briefing the committees of council about GASB 68 about a year and a half ago, and with all of council this January at the first budget work session. So they have an understanding that it’s not a change in city priorities. It’s a change in how we have to account for existing expenditures for existing city services. We had a similar question when we brought the golf fund back into the general fund. The numbers didn’t change – it was still the same general fund support for golf. It was just showing it differently in our books.

Why Trees?

By way of background, city urban forest and natural resources planning coordinator Kerry Gray has been working on a management plan for the city’s urban forest. Gray updated the park advisory commission on the work at PAC’s Feb. 25, 2014 meeting. [.pdf of Gray's presentation] Then on April 15, PAC recommended approval of the plan, which will now be forwarded to the city council. [.pdf of Urban & Community Forest Management Plan]

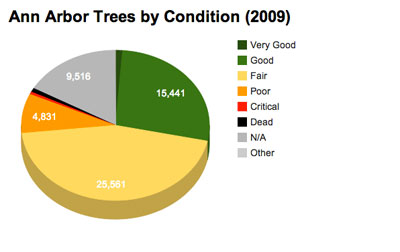

The city manages 43,240 street trees and about 6,900 park trees in mowed areas. A tree inventory conducted in 2009 didn’t include natural areas, so there are thousands of trees that aren’t counted. The urban forest includes over 200 species, representing 82 genera.

At the Feb. 25 PAC meeting, Gray described a range of benefits provided by the urban forest, estimating that the benefits in stormwater management, air quality, energy conservation and quality of life total $4.6 million annually. As an example, studies show that people tend to spend more money in shopping areas that have more trees, she said.

Over the last decade, the urban forest has faced two major challenges, Gray told PAC: the emerald ash borer, and budget reductions. The city lost over 10,000 ash trees, and had to focus its constrained resources on removing those trees. That resulted in deferred maintenance for other aspects of the urban forest, she said.

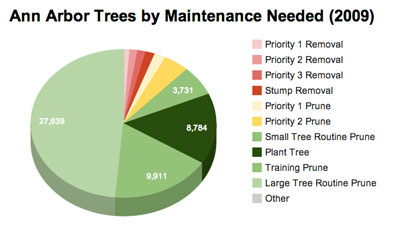

That deferred maintenance didn’t affect park trees, because the parks millage provided funding, she said. But for street trees, she reported a significant backlog issue. As of July 1, 2013 – the start of the city’s current fiscal year – there was a backlog of 1,412 street trees that needed removal; 3,110 trees that needed priority pruning; 38,471 trees that needed routine pruning; and 1,371 stump removals. The figure for routine pruning includes “training prunes,” which are done on young, newly planted trees to help them develop proper form and structure. Gray reported that the city removes about 550 trees each year, and plants about 1,000 trees annually. No routine pruning cycle or proactive maintenance occurs at this time, she said.

To address these challenges, the city began developing its first-ever urban and community forest management plan. The planning process and public outreach, using the consultant Smith Group JJR, included staff, a working group, an advisory committee, stakeholder groups and the general public, as well as feedback from an online survey.

The plan was finalized in April, followed by review by both the environmental and park advisory commissions at their April meetings. Each of those commissions has been asked to pass resolutions recommending that the city council adopt the plan. It’s expected to be on the council’s agenda in June or July.

Last year, at its July 15, 2013 meeting, the city council approved a two-year $509,125 contract with Margolis Companies Inc. to plant 750 trees in FY 2014 and 1,000 trees in FY 2015. The work is to be paid for from the city’s stormwater fund and reimbursed with a state revolving fund (SRF) loan that has been obtained through the Washtenaw County water resources commissioner’s office.

City administrator Steve Powers responded to a Chronicle query about the nature of the work to be funded with the $1 million by explaining that there are currently 5,239 sites classified in the tree inventory as places where trees need to be planted. Of those sites, 350 will be planted this spring and 1,000 of the sites will be planted in FY 2015 – which means fall 2014 and spring 2015 of the calendar year.

The $1 million in the FY 2015 budget designated for street tree maintenance will eliminate the backlog of Priority 1 and Priority 2 removals, according to Powers. In the Priority 3 removal category, it will also remove the backlog for trees greater than 12-inches in diameter (measured at breast height). It will also support the pruning of trees in the Priority 1 prune category, eliminating the backlog in that category.

Q: The budget includes a new non-recurring budget line of $1 million for street trees.

Steve Powers: This is the second year of a two-year budget. We try very hard not to deviate from that second year of the two-year plan. For FY 2015, the significant changes are the three police officers and the firefighter positions – those changes were shared with the council at a February work session. As we moved through 2014 after that budget work session, it became clear that we should be addressing the street trees. We have a draft urban forestry management plan, and it was recommended to me – and I concur – that we should use $1 million of our fund balance to eliminate the backlog of priority tree removals and high-need pruning.

Map of selected tree variety by The Chronicle from city of Ann Arbor 2009 survey. Image links to dynamic map hosted on geocommons.com

Ann Arbor trees in public right of way by their condition. Chart by The Chronicle with data from 2009 city of Ann Arbor inventory.

Ann Arbor trees in public right of way by their type of maintenance needed. Chart by The Chronicle with data from 2009 city of Ann Arbor inventory.

Q: So it sounds like the decision is driven by a need, rather than the availability of funds that weren’t previously anticipated.

Steve Powers: Over the past two years, the council has been setting priority areas.

I’ve been pushing the city’s service areas to think about how to align our resources with those priority areas. One of the priority areas is fiscal stability and budget discipline. So there’s a tension between maintaining that two-year financial plan integrity, and the infrastructure priority area that says we need to do more maintenance of the city’s infrastructure. Street trees are a vital part of our stormwater management infrastructure, as well as just the fact that we’re a tree city, and the tree canopy and the trees themselves are an important part of our community. So the funding for street trees was because of an identified need, and the result of services areas looking for ways to move forward on council priorities.

Third, we don’t have an identified funding source for the street tree backlog. That’s unlike streets and roads, where we have a dedicated street millage and we get Act 51 gas tax revenues from the states. So from a policy perspective, while those two sources might not be enough, we do have identified specific revenue sources for streets. We don’t have that for the trees. So this [budget allocation] was seen as a way to reduce a significant backlog. It’s a one-time, non-recurring need. It will address Priority 1 and 2 removals – diseased, dead heavy branches or trees that are greater than a foot in diameter.

Tom Crawford: The street trees used to be the responsibility of the general fund. A few years ago, that responsibility was transferred to the stormwater fund – recognizing that street trees were part of stormwater management.

SP: And to help out the general fund.

TC: At the time of the transfer, we had not recovered from the impact of the emerald ash borer, Dutch elm disease, and the financial cutbacks that we’d had. This is actually taking that deferred maintenance that was given to the stormwater fund, and making it whole. So going forward, that stormwater fund has to maintain that asset.

Q: Are there any other areas that might have similar needs, and that would require tapping the fund balance?

SP: After this winter, one could certainly say that we have some needs. I’m not recommending that the city of Ann Arbor – beyond what citizens have already chosen to do through the street millage – take on the responsibility. That really should be the state of Michigan’s responsibility, through the gas tax. The trees are our responsibility. The city chose to move an important part of our living infrastructure from the general fund to the stormwater fund, without at that time transferring the resources necessary to maintain that infrastructure.

Q: So there’s not a parallel situation with any other city infrastructure, that doesn’t have a dedicated funding source?

SP: I don’t think so. One might argue parks, but we have park millages. If the discussion is about other priorities – like energy or sustainability – this is a one-time transfer of fund balance to meet a one-time need. This is not to add on an ongoing basis $1 million of additional foresters or contract services. It’s a one-time use of fund balance for deferred maintenance.

Q: If the council had exercised the city’s right of first refusal to buy the Edwards Brothers property, would this $1 million funding for street trees have been available from the fund balance?

TC: That’s speculative. With that, it would have depended on how things transpired. If we got it, what if we sold it? Would we have made money or lost money? There’s many scenarios that could have come out of it, so to tie that to the street tree funding, you’d have to pick a scenario. If we lost money, that would probably not have put us in a position – from a fund balance perspective – to have as much discretion as we have now.

Washtenaw County Context, Fund Balance

Q: What’s the status of the city’s fund balance now, in terms of the city’s policy?

Tom Crawford: The official policy is to have a fund balance that’s in the range of 8% to 12% of the general fund expenditures. I generally recommend more in the 15% to 18% range, but that could get more confusing with the addition of the housing commission employees. After the $1 million on street trees, the fund balance would be around 12%, which is still a good fund balance.

Steve Powers: Tom would like it higher, as I would want the city’s chief financial officer to be advocating. I look at it as we do have needs. Our current financial condition is improving. The city’s tax base is growing. The state’s economy is improving. So the judgment is that with an improving economy, a 12% fund balance is prudent and a good balancing of maintaining that fiscal discipline and meeting an unmet deferred maintenance need. I was walking to work today and we had a tree down across Packard, right by Forsythe Park and the hardware store. It’s a need that’s been documented very well in the urban forest management plan.

Q: The fund balance level is one that Washtenaw County also has discussed. The argument for a higher fund balance is that it helps achieve higher credit ratings.

TC: I think the council has less financial flexibility than it’s had historically, as a result of the changing laws and economics. My recommendation [regarding the fund balance level] stems from a desire for them to have more flexibility, in the event of another downturn. Credit rating agencies look at the amount of fund balance as one factor. But for us to aggregate just fund balance is not necessarily the way to get a good bond rating. And by the way, we do have a very good rating.

SP: We’re AA+. We’ve looked at going triple A, but…

TC: That’s a lot of resources to tie up to move to triple A, with a very small benefit.

SP: Another reason why I’m comfortable with a 12% fund balance is that council has been very supportive of staff’s recommendation to have recurring expenditures be funded by recurring revenues. The four additional FTEs, for example, are funded by recurring revenues that Tom and his team have very conservatively estimated are going to continue. I’m very, very confident that the recurring expenditures we’re adding to the 2015 budget are going to continue to be funded through recurring revenues. Council has also been very supportive of staff recommendations for one-time or non-recurring expenditures to be funded by non-recurring revenues. That is, to use non-recurring revenues – if we got a windfall of some kind – on a one-time expenditure, rather than building it into the base budget.

Some organizations are nowhere near as disciplined, when it comes to their actual budget policies and practices. If you’re not tight on those, an administrator or CFO might very well want to see the fund balance up near 20-25%. For some managers, their goal is to have a year in the bank. I’ve always felt that if you’re putting that much away, maybe you should look at returning it to taxpayers or putting it into services or capital items.

Q: Washtenaw County has moved to a four-year budget, to help with longer-term planning. Is that something the city has considered?

TC: We do a five-year projection, in the context of our two-year plan. We update it every year. I need to keep that radar acute, because if something long-term pops up in an off year, we need to know it – we won’t wait for the next two-year cycle. Earlier [in this interview] we mentioned staff reductions. One of the reasons we started doing two-year budgets was that it allowed time for us to get into the bigger picture stuff. In the second year, the operations staff don’t have to be as engaged as when we do the full two-year budget. In part, that allows the organization to be more productive and get more services done and planned.

Regarding a four-year budget, for us there’s a trade-off of the efficiency of the budget versus the accuracy. In my personal view, going out three or four years, our radar capability is not sufficient for it to be worthwhile. We ought to look at it as a parameter, as we do our two-year process. But I’m personally not a huge fan of planning that far out. It’s a lot more work, and is more of a vision. We’re in an environment that moves enough that we all really need to buckle down every two years and go through the budget process – whether we like it or not – to stay focused.

SP: We also have a six-year capital improvements process. We’ve unlinked the budget and the CIP, and focused on what is needed. The planning commission owns that, then Tom and his team slide in available resources. Ultimately, the council does the final balancing of the needs and the resources.

TC: We have to look at it annually. The city has so much infrastructure that we do have to look at it frequently, because things could change.

SP: There are also some of our operations – specifically, the wastewater and water treatment plants – that are looking three to five years ahead. Compared to the county, we have different organizational challenges. The county board’s only real authority over the elected constitutional officers is the budget. [In addition to the elected county board of commissioners, elected county officers are the sheriff, prosecuting attorney, clerk/register of deeds, and water resources commissioner.] That’s different from a city, where the departments are all clearly accountable to the city administrator, who is accountable to the city council, which is ultimately responsible for the budget and for deciding what services to provide.

Also, planning out for four years for some of the city’s operations – like the police, for example – could be a little difficult. It might be a useful exercise, but I’m not sure how practical it would be.

But we certainly do multi-year planning with financial projections. Now that we have some money for affordable housing, for example, we’re developing a plan for that.

Q: The issue of addressing homelessness has been discussed recently at the county board and city council. The county hopes to update the 10-year Blueprint to End Homelessness. Affordable housing is obviously a big piece of that. What’s the city’s role and strategy for addressing this issue?

SP: The blueprint is an important planning document. I think the city needs to drill down and develop plans that make sense for Ann Arbor, though it’s a regional issue. With the funding that’s available from the sale of the old Y lot, there’s some money to work with. So it’s important to develop a plan that includes specific actions that make sense for Ann Arbor but that are part of a larger plan. For the city, an important part of affordable housing is the housing commission, and much of the city’s financial and policy support has been toward the housing commission for the past two years. I expect this larger affordable housing priority will generate more momentum, as it’s become a clear priority area identified by council.

I’m anxious – and I believe council is as well – for the results of the updated needs assessment. While we know that affordable housing is a need and a problem, I think having more detailed information will help us, particularly as transit will be part of the review – the connectivity between housing and transit. Council has also talked about workforce housing, although it hasn’t crystallized into anything yet. We spent a lot of time talking about the 30% of AMI [area median income]. The city and region has some challenges at the upper end of that spectrum.

So we’ll be looking at affordable housing as a priority in the next two-year budget cycle.

Q: How much is in the current budget for animal control?

SP: $28,000 for FY 2015 – the same as in FY 2014. I’m still working through the contractual relationship between the Humane Society [of Huron Valley], Washtenaw County and the city. At this point, the $28,000 is a contractual obligation with the county.

Q: The county is beating the drum to get more funding from other communities that haven’t historically contributed as much to animal control. What’s your perspective on that, and do you see the city’s contribution increasing in future years?

SP: I’m hearing those drumbeats. We are working through invoices from the Humane Society for specific services, for specific sheltering of animals. There were some factual errors in the invoices from January and February, and we’ve just received March. I anticipate that the amount [of $28,000] will change, but it’s not at a point where I was comfortable including anything more for the FY 2015 budget. There may be the need for an amendment later, but at this point it’s $28,000. I need to bring a recommendation to council that will be separate from the budget.

It’s kind of an odd relationship where the Humane Society and the county negotiated an agreement that includes provisions pertaining to other local governments without other local governments being at the table. The Humane Society is receiving a half million dollars from the county, and part of the review has been our attorneys looking at the county attorney’s opinion of the 1919 dog law. It’s taken a while and I need to bring closure to it, one way or the other.

Overall Health, Role of State

Q: Can you talk in broader terms about the highlights of the FY 2015 budget? What would you like the public to be aware of? What’s the financial status of the city, coming out of some difficult years financially?

Tom Crawford: I think the city is financially healthy. Different people may measure health in different ways, but I am cautious about the future. We still operate in an environment where the funding of local government is still restrained. We see our revenues going up in the 1.5% to 1.75% range. And given general inflation trends of 2.5% to 3%, that’s upside down. And while that doesn’t sound like a lot, when the organization has reduced its FTEs by 30% and then you look forward, it’s meaningful and it could affect the ability of the city to deliver services.

I remain frustrated that the state hasn’t spent more time than it has figuring out a better way to fund local governments, though it has spent some talking about it.

Steve Powers: You’re a lot more optimistic than I am on that.

TC: They’re talking about it – I haven’t said they’ve done anything yet. I worry about that going forward. It’s a structural problem that needs to be fixed. Locally, I think we’ve done a lot to remain healthy in this environment of resource constraint and reduction.

SP: The state economy is improving, and we’re seeing that in increased sales tax revenue.

TC: We’re not assuming an increase in gas tax. It’s a difficult thing to project, but it has been a weak source of revenue.

Q: What are your assumptions about personal property tax revenue?

TC: We have incorporated the status of the legislation, although that doesn’t affect 2015, as I recall. My long-term projections assume that it will pass in November. We lose money from this deal, but for this community, personal property tax revenue is not a game-changer in terms of finances. For some other communities, it’s huge.

Q: So in general, it sounds like you’re optimistic but still very cautious.

TC: I’m pleased with where we are financially, but I’d like the city to have more money. Given the environment we’ve been through, we are in good financial condition.

SP: As a small example, we put more toward our VEBA than is required. The amount is tied to our growth in revenue, so we’re dedicating a portion of our revenue growth to our payment on that liability. [VEBA stands for Voluntary Employees Beneficiary Association – a pension plan.]

Q: That seems like an unusual approach.

TC: It has been unusual. We talked about it with council in February, and had our actuaries come in. Actuaries tell you what you need to put in. It’s about $80,000 this year. The policy recognizes that this is a liability that needs to be paid down, and so as resources become available, the policy commits the city to paying it down before the money is freed up for other uses. It’s just like a debt, and we’re paying it down.

This particular approach works for us. It all works together. The way we budget is based on the resources we have available, and so this policy dovetails with the way we operate.

SP: Tom is like the Lorax for the numbers. He speaks for our city’s financial condition. He’s concerned about the city’s ability to deliver services, but there are others who have that as their primary responsibility.

Q: If you could set aside your CFO role, what ambition would you have for the city that isn’t necessarily related to the city’s finances?

TC: I don’t set aside my CFO hat. That would be getting too close to policymakers – that’s their job.

SP: Tom has helped me better understand what the city might do in terms of engagement with the community on priorities. We’ve brought this up in earlier council planning sessions. Some of the feedback from the council’s priority-setting was that it wasn’t really robust enough. Tom has helped strategize about how to engage the community and council in aligning what they’d like to see for the city with the financial resources.

TC: I love strategy. Strategy and engagement have been my objectives, to support council’s goals and priority-setting, as well as Steve’s. The budget is just a plan, and it needs direction. The priority setting that they’re doing is helpful.

Q: Are both of you involved in advocacy at the state level, in terms of funding for local government?

TC: We have a lobbyist in Lansing – and we use them.

SP: The Michigan Municipal League is talking about it, but there isn’t much discussion in Lansing.

TC: There are a lot of issues the state has been tackling – whether you agree with them or not, they’re tackling issues. But this [funding of local government] needs to be one on their radar. Not just because I’m in local government, but because I’m a long-term resident. There are multiple areas of government that need to be addressed, not just the state issues.

Q: What’s are some issues that you’d like state legislators to deal with?

SP: One thing would be changing the sales tax allocations, so that the areas where the sales are generated actually receive the tax revenues. I would bet that we’re a donor.

Q: Back to the city’s FY 2015 budget. Is there anything else you’d like to highlight?

SP: We go through a very in-depth review every two years. This is the second year, looking at what has changed in our revenue projections. What are some truly significant service needs? But these are tweaks. Some people will have wanted us to do more, but that’s not the direction I gave to staff for this budget. We followed that two-year discipline.

Second is that we followed the discipline of recurring revenues for new positions. We’re not deficit spending. And I don’t think it’s a contradiction, but the budget is also recognizing council priority areas – most notably the infrastructure item – by saying we’ll put $1 million of the balance toward street trees. That’s significant. And while $1 million is a lot of money, our total expenditures – including some capital items – is $334 million. The general fund expenditures are $98 million.

TC: I wouldn’t lose sight of affordable housing. We’ve sold the Y lot and affordable housing is getting some recurring funding to do the RAD conversion. Those are getting addressed in this fiscal year, and those are resources that weren’t in the original two-year plan. So there’s been significant assistance given to affordable housing in this two-year period.

Q: Any other highlights?

SP: There are a few smaller items, trying to respond to council priority areas. There’s $100,000 for a one-time inventory of existing signs and for developing the text amendments for D1 and D2 zoning. We’re also providing $209,000 from the general fund to the housing commission.

Economic health is an example of a council priority where we’re waiting for the first year of the two-year budget cycle to drill down. We’re going through a redevelopment readiness review by the Michigan Economic Development Corporation. There may be some recommendations from that that would suggest some resources.

We’re certainly becoming more active at looking at selling city-owned property. To do that well requires resources.

Another priority area that the council added in December is community health and quality of life. That doesn’t have much to it yet.

Q: In terms of economic health, does that mean the financial benefit to the city from selling, or the benefit to the tax base from private development of that property?

SP: Both. Going back to how local government is funded in Michigan, for Michigan cities, unless you’re growing your tax base, you’re declining – because cities can’t rely on the state of Michigan through revenue-sharing or grants or other forms of aid. You need to be growing your tax base. And because of constraints on the growth from Proposal A and Headlee on existing value, the way to grow your tax base is to add taxable value. Even that is restrained, but certainly you get more return to your budget through adding value.

The citizens are still expecting services. And while the mountain was reduced [a reference to the 30% cut in city staff over the past few years] without too much impact on services and infrastructure, that is still a reduction. This is probably another hour discussion, but we believe – the city’s management team believes – that there’s not much more we can do to enhance or add new services without revenue. There’s not much more we can do on the expense side. There may be a few tweaks. But really, to meet the citizens’ service expectations – which aren’t decreasing – we need to increase our revenues.

Although Ann Arbor is somewhat unusual in Michigan in that we seem to not mind taxing ourselves, there are still limits on how much the citizens are willing to pay in taxes. What’s left is increasing our tax base. We have some properties that are underutilized. What is a higher and better use is ultimately for council to decide, but it’s certainly the responsibility of staff to present those options to council and the community, rather than just leaving these properties on the shelf.

Q: There are several possible millage proposals that have been discussed, in addition to the transit tax that’s on the May 6 ballot. Other ideas that have been floated are countywide millages for public safety or human services. Are there city-specific tax proposals that you think would be viable? Or is that a non-starter?

TC: We always look at working within our resources first. There is not a concerted effort to look for more taxes that I’m aware of – not that I’m actively working on, I can tell you.

SP: Nor me.

TC: It wouldn’t surprise me if something comes up on human services. I’m not going to say it doesn’t get mentioned. But we come with the presumption that the citizens are giving us this much, and we deliver services within that.

SP: With that comes the presumption that the taxes we have will be renewed. We take that very seriously.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor city council. We sit on the hard bench so that you don’t have to. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Congratulations on this excellent article. Two things stand out: that you sat down with these two top officials for an in-depth interview, and your excellent graphics. They make what must have been simply columns of numbers much more accessible for the rest of us.

I am very encouraged by the way our (relatively) new City Administrator is handling these issues. It seems that the city is on a good course again after some disastrous years.

I second Vivienne’s appreciation for this piece.

“As an example, studies show that people tend to spend more money in shopping areas that have more trees, she said.”

That’s an unfortunate framing of the phenomenon. Trees also give us cleaner air and more physical comfort when in their proximity in addition to the positive emotional feeling of their visual presence. Maybe someday we’ll also get more food from them as well here in the city.

I’d like to see the city pursue more local solar energy generation. Prices for photovoltaic modules are dropping, and there’s a window of opportunity to tap into the savings produced through a well considered policy of property tax incentives, maybe rolled into the PACE program.

Thanks for the deep dive, but I don’t see anything about the $600,000 expense from the general fund about the maintenance of the hydropower dams, the biggest expense after the street tree work. Do you know why this requires general fund money?

Re: maintenance of the hydropower dams

Laura, I’m not yet sure what all that covers. Late last year, the council approved a contract for a “drainage blanket” at Barton: [link] That appears to have been prompted in part by direction from FERC. The drainage blanket was split between water fund and general fund. I take your question to be more about source of the money than about what work it will cover, but I have inquired about both topics. It’s possible that will be clarified during the budget presentation at tonight’s meeting.