Column: A New Agenda for the DDA

Sometime between May 7, 2014 and June 4, 2014, it looks to me like the Ann Arbor Downtown Development Authority board and executive director violated Michigan’s Open Meetings Act (OMA).

Streetlight locations are mapped in the joint Washtenaw County and city of Ann Arbor GIS system. Data available by clicking on icons includes ownership as well as the lighting technology used. Green indicates city ownership. Red indicates DTE ownership.

How? At its May 7 meeting, the board voted to postpone until June 4 a resolution authorizing a $101,733 payment to DTE to convert 212 non-LED streetlights in downtown Ann Arbor to LED technology. But the resolution did not appear on the board’s June 4 agenda.

Instead of voting on the previous month’s resolution – to approve it, reject it, postpone it again or table it – the board listened to an update from executive director Susan Pollay. Pollay told board members that they should assume that the issue is tabled – but possibly not permanently. That decision to table the resolution appears to have been made between board meetings.

The DDA board’s inaction on the funding means that the downtown LED conversion won’t happen in this year’s cycle – because the deadline to apply for a project this year is June 30. So for this year’s program, the city’s energy office will ask the city council – at its June 16 meeting – to authorize money to fund a different project that converts some lights outside the downtown. DTE does not necessarily offer the conversion program every year.

A decision on expending funds is an effectuation of public policy – thus a “decision” under Michigan’s OMA. Even though the decision by the DDA on the streetlight conversion allocation had the practical impact of not expending funds, that should still be analyzed as an effectuation of public policy. And that public policy decision appears to have taken place between board meetings, which is a violation of the core requirement of Michigan’s OMA: “All decisions of a public body shall be made at a meeting open to the public.”

As a practical matter, the only consequence of a court’s finding that the DDA violated the OMA would be to invalidate the DDA’s decision not to expend funds. Why bother to drag the DDA board into court over that? Invalidation of the decision not to expend funds would not force the DDA to go ahead and spend the funds. It would leave things exactly as they are now.

A more economical and time-effective way to address this specific issue would be for DDA board members to publicly recognize and acknowledge their commitment to abide by the OMA – by simply taking a vote on the LED conversion resolution from May 7 at their next meeting, on July 2. It’s surely just as important as the board’s scheduled social gathering at Bill’s Beer Garden on that same day.

That’s also the day when the DDA board’s annual meeting takes place. The annual meeting is when new board officers are elected and committees are appointed. So the annual meeting this year could be an occasion for the DDA to flip a switch, and light itself up with civic tech better than any LED. It would be a chance to re-establish itself as a public body that is committed to rigorous governance – based on strict adherence to its bylaws and the state statute that enables the existence of the DDA.

Presented below are some recommendations for specific actions the DDA board should consider, starting at its annual meeting. The recommended actions would provide an agenda for board work that needs to be done in the coming year.

Here’s a summary of those recommendations: establish strong committees; strictly follow the board bylaws or else change them; consult the archives; and create a development plan that meets state statutory criteria.

Establish Strong Committees

Many governing bodies establish committees to handle some of their work. One example of a public body with a reasonably well-functioning committee structure is the Ann Arbor Area Transportation Authority board of directors. The minutes of two standing AAATA board committees – with a record of votes by those committees to recommend resolutions to the full board for consideration – are part of board meeting information packets.

By comparison, the DDA’s committees are not as rigorous in their adherence to basic principles of governance.

Strong Committees: Current DDA Bylaws, Custom

DDA board bylaws describe one specific committee – the executive committee – which consists of the board chair, vice chair, treasurer and recording secretary. The most recent former board chair and the executive director are non-voting members of the executive committee.

The bylaws further describe other committees in terms of two types – board committees and advisory committees. Board committees are constrained in their membership to DDA board members. Advisory committees are not constrained in that way. The DDA currently has one board committee and one advisory committee – the operations committee and the partnerships committee, respectively.

The bylaws highlight the importance of the board’s committees like this:

As the work of the DDA is done primarily through Committee, it is expected that each Board member will actively serve on at least one committee, and will attend a minimum of 70% of the committee’s meetings per year as a condition of remaining on the DDA Board.

Based on the bylaws, one example of the work that is supposed to be done by committees is to make recommendations on funding requests for consideration by the full board:

Section 10 – Requests for Funding. The Board may not act upon a request for funding unless the request has been referred to a committee of the Board for review and recommendation. In the event that a committee has not made a recommendation to the Board within 60 days from the time that the request was first presented to the Board, the Board may, by majority vote, bring the proposal to the Board for consideration without benefit of the committee recommendation.

The committee vetting process described in Section 10 of the bylaws does not appear to have been followed at all for the May 7, 2014 streetlight conversion funding resolution. But it’s somewhat difficult to say for sure: It’s possible that the executive committee, which met just before the full board meeting on May 7, explicitly discussed and achieved a consensus that the streetlight conversion resolution should be recommended to the board for consideration. From the minutes of the May 7 executive committee meeting:

Committee actions and discussions

Other. Review of the board meeting agenda for the May 7, 2014 meeting.

The fact that no vote is recorded in the minutes doesn’t preclude the possibility that a consensus was achieved that the item should appear on the agenda. Indeed, based on minutes of DDA operations committee and partnerships committee meetings – as well as my own attendance at some of these meetings over the last half decade – the custom of DDA committees is not to express their recommendations in the form of votes. That leaves any action by a DDA committee subject to interpretation.

On the positive side, the minutes of the May 7, 2014 executive committee meeting reflect 100% attendance. So if committee members had been inclined to take a vote, they could have done so – because they clearly achieved a quorum. That’s not been the case for some recent meetings of DDA committees.

By way of background, the board’s bylaws set forth the definition of a quorum for committees:

A majority of the committee will constitute a quorum. A majority of the members present at the meeting at which a quorum is present shall be the action of the committee.

The minutes of the April 30, 2014 operations committee meeting show exactly half of the committee members present – thus not a quorum. In attendance at the meeting, according to the minutes, were: Robert Guenzel, Roger Hewitt, Joan Lowenstein, John Mouat, Keith Orr and John Splitt. Yet, according to the minutes of the meeting, the committee made a decision – to have the board vote at its next regular meeting, on May 7, to establish a project budget of $5 million for the Fourth & William parking garage renovation. From the April 30 committee meeting minutes [emphasis added]:

4th & William stair/elevator replacement. Mike Ortlieb, Josh Rozeboom, Carl Luckenbach presented design images. It was decided that a project approval resolution would be brought to the DDA. …

How did the operations committee wind up making a decision on that occasion without a quorum being present? Did operations committee members consciously flout a basic rule of governance? I think that’s pretty unlikely. Instead, I think two different factors may have contributed to the committee’s failure to adhere to rigorous standards of governance.

First, because DDA committees by custom don’t follow rigorous procedural requirements – like taking votes – it’s easy to lose sight of the fact that the meeting is not just a chat among friends at a social club, but rather a business meeting. So it’s easy to overlook basic considerations associated with a business meeting – like whether the committee even has a quorum for conducting business.

Second, when six out of 12 board members are present, that might feel intuitively like there’s surely a sufficient number of members for a committee to conduct business. But for the last couple of years, the result of the annual meeting committee appointments has been to appoint all DDA board members to both the operations and partnerships committees. That means that either of those committees needs at least seven members to conduct business. Why have all DDA board members been appointed to both committees in recent years? I think it’s because the board has lacked the leadership of a chair who is willing and capable of selecting only some board members for appointment to some committees and not for others.

An additional wrinkle for the partnerships committee membership is that it includes two members of the city council – appointed by the council – currently Margie Teall (Ward 4) and Jane Lumm (Ward 2). Based on its minutes, the DDA partnerships committee also appears to include other non-DDA board members as well, for example Charles Griffith, AAATA board chair, and Jason Morgan, director of government relations for Washtenaw Community College. It certainly makes sense for those two to be members of the partnerships committee – because both of the entities they represent have some of their taxes captured by the DDA.

But it’s not clear that the procedure in the DDA bylaws was followed to add those two people to the committee: “The chair shall select, with the advice and consent of the board members, the members of each advisory committee.” The DDA board has not, as far as I can tell, ever voted to admit Griffith or Morgan as members of the partnerships committee. It would be better to have documented the path to membership, in case anyone asks: How did Charles Griffith and Jason Morgan become members of the DDA partnerships committee? And why isn’t there representation from other taxing entities – like the Ann Arbor District Library and Washtenaw County?

Further, it’s hard to tell from the minutes who is actually a member of the partnerships committee. DDA board members who are absent are recorded as absent. But the custom for documenting non-DDA members who are absent seems to be not to mention them at all. The April 9, 2014 DDA partnerships committee minutes don’t mention Lumm, for example, when it seems like she should have been recorded as absent.

Knowing exactly who is a member of the partnerships committee is important for determining whether a quorum is present for conducting committee business. But that’s only important if the partnerships committee is conceived as an entity that conducts business – as opposed to serving as a casual social gathering with no actual governance function.

Strong Committees: Establish Five

At their annual meeting, set for July 2, 2014, DDA board members should elect a chair who is willing to select just a subset of DDA board members – say four to five members – who have interest and expertise to serve on the following five committees, which the board should establish.

Strong Committees: Establish a Parking Operations Committee

This “new” parking operations committee is needed in order for the DDA to develop a quantifiable understanding of how well Ann Arbor’s public parking system supports three different key user groups: (1) downtown employees; (2) retail/transactional customers and visitors; and (3) downtown residents.

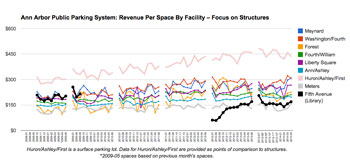

In April 2014, structures generally showed less revenue per space than in the previous month. One exception was Maynard, which showed a slight increase – possibly attributable to the opening of Knight’s restaurant at Liberty & Maynard that month. The Brown block surface lot – bounded by Ashley, First, Huron and Washington Streets, continued to be the top-performing facility in the public parking system on a revenue per space basis. (Chart by The Chronicle with data from the DDA.)

The only statistics the DDA board currently requests on a routine basis from its parking subcontractor – Republic Parking – are total revenues by facility (which includes revenue from monthly permit holders) and the total number of patrons by facility who pay by the hour.

Based on that data set, it’s easy to come up with folk theories about what causes perceived patterns and trends. But it’s difficult to assess quantitatively how well the parking system supports the needs of the three user groups.

Among other information, the DDA should start asking Republic Parking to provide data by facility on the number of hours parked by monthly permit holders and the number of hours parked by patrons who pay by the hour. Further, the board should request routine reports about on-street metered parking usage, translated into hours parked, geocoded for each meter. Zipcode data from credit cards used for the on-street metered transactions should be analyzed to get some insight into the origin of motorists who park in particular areas.

This committee should also study high- and low-tech ways to help motorists find open parking spaces quicker and more efficiently.

Strong Committees: Establish a Development Plan Committee

This “new” development plan committee would focus on future capital projects using tax increment revenue as well as the maintenance of parking facilities, which should ideally tap only parking revenue. This committee is needed because the DDA does not currently have a TIF (tax increment financing) plan that meets state statutory requirements.

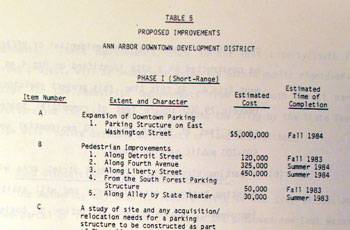

The state enabling legislation for DDAs includes a requirement for a development plan that lists out specific projects with estimated cost and timeframe for completion. The original Ann Arbor DDA TIF plan that was adopted in 1982 included such a development plan. But the 2003 revision to the plan replaced the development plan with a document that was vague with respect to specific projects, costs and timeframes. So this committee could expect to work through the year to draft a new development plan that meets the statutory criteria.

A 3-D model currently displayed on a table just outside the second-floor elevator landing of Ann Arbor city hall. It reflects the work of University of Michigan students in a course taught by Doug Kelbaugh, a professor of architecture and urban planning. This view is looking north, with the conceived development for the Brown block in the left of the frame.

This committee should also focus on developing packaged real estate transactions that would promote the public interest. For example, First Martin Corp. owns the Brown block, which the DDA leases to operate a surface parking lot. If the DDA would like to see that parcel developed into something more interesting than a surface parking lot, then a step in the right direction would be to stop leasing the lot from First Martin and accept the loss of those spaces in the public parking system.

A different First Martin property should be considered by the DDA as a possible purchase: the surface parking lot behind the Michigan Square building next to Liberty Plaza. Public ownership of that parcel would mean public control of the diagonal connection from the corner of Liberty and Division (Liberty Plaza) across to the Library Lane lot and South Fifth Avenue. Whatever the future of the Library Lane lot is, public control of the diagonal connection would increase the chances of success.

Strong Committees: Establish a Budget/Finance Committee

This “new” budget/finance committee would provide oversight and review of regular financial transactions and budgeting. One long-term challenge that this committee needs to confront are payments the DDA has obligated itself to make in support of the city’s police/courts facility, which entail roughly $500,000 in annual contributions through 2038. That’s five years past the life of the DDA, which is currently set to expire in 2033. It’s probably too soon to contemplate whether the DDA should be extended any longer than that. But the current board should at least consider in its financial planning how to incorporate the $2.5 million obligation that will be faced in 2033, without assuming any additional TIF revenue past 2033.

On a much shorter timeframe, this committee could consider converting the DDA’s check register to a digital, database format, so that it can be posted routinely to the DDA’s website, where it could more easily be subjected to public scrutiny. Other local public entities that are supported with tax dollars – including the city of Ann Arbor, Washtenaw County and the Ann Arbor District Library – disseminates this information through routine releases to the general public.

Strong Committees: Maintain a Partnerships Committee

For the last five years, the partnerships committee has handled miscellaneous topics – essentially those that DDA board members want to work on but that don’t fit naturally into the work of the one other board committee, the operations committee.

The partnerships committee has in some ways served as the “grant committee” – responding to requests from community partners for grant support. That’s why, for example, the Ann Arbor Housing Commission’s executive director Jennifer Hall has appeared before the partnerships committee requesting funds for capital improvements to AAHC properties.

Based on the current state of its TIF plan, I don’t think the DDA is in a position to make any grants of TIF dollars – because by statute, TIF money can be spent only pursuant to the TIF plan, and the DDA TIF plan doesn’t include any specific projects with cost estimates or timeframes. More on that below. To the extent that the DDA partnerships committee receives proposals for ways to spend TIF money, those proposals should be about altering the TIF plan to include a particular project.

I think the partnerships committee should continue to exist – mainly so that the DDA has a natural mechanism by which it can keep community stakeholders up to date on the work it is doing, and receive input from obvious stakeholders about what should be in the DDA’s development plan.

Strong Committees: Establish a Bylaws Committee

This committee would review the bylaws for clarity of language.

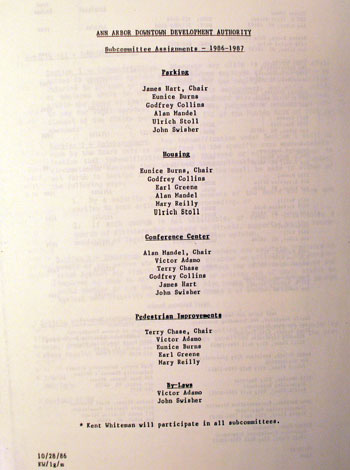

DDA board committee structure in 1986: five committees. (Document retrieved from the University of Michigan Bentley Library, the collection of papers from former DDA board member Eunice Burns.)

In several places the bylaws refer to “the corporation” – an apparent reference to the Ann Arbor DDA. In other places, reference is made to “the Authority.” It would be best to make uniform any reference to the entity throughout the bylaws. In other places, the bylaws are antiquated: “The recording secretary or a designee shall attend all meetings of the Board and record all votes and the minutes of all proceedings in a book to be kept for that purpose.”

But the bylaws committee needs to review the current bylaws also to ensure that they enforce rigorous governance procedures – by the board and by the committees. For example, one issue that would be worth clarifying in the bylaws is how the agenda for board meetings is set.

The current bylaws state: “Any member of the board may request any item to be placed on the agenda.” Of whom is the request made? Does that person or persons have the option of declining the request? Instead of describing what board members are allowed to do, a reasonable approach would be to describe exhaustively how an item can appear on a board meeting agenda. For example, the bylaws could be revised to read:

Items can be placed on a regular DDA board meeting agenda in any of three ways:

- through a majority vote of a DDA board or advisory committee.

- by an individual DDA board member.

- by the DDA executive director.

The method used to place an item on the board meeting agenda shall be specified on the agenda as follows. For committee-sponsored items, the name of the committee, the date of its vote and the voting tally placing the item on the agenda shall appear on the agenda with the item. For items sponsored by individual board members, the name of the board member sponsoring the item shall be included. For items sponsored by the executive director, the notation “Sponsored by DDA executive director” shall be included.

Follow the Bylaws, Or Change Them

According to the bylaws, it would require board action to establish new committees. That action could come at the board’s upcoming annual meeting on July 2. But who should appoint the members of the committees recommended above? If those appointments come at the annual meeting, then the short answer, according to the bylaws is: Any committee appointments should be made by current chair Sandi Smith – even after the election of a new chair.

By way of background, the prevailing DDA custom has been to elect the current vice chair to the position of chair. This year, that custom would elevate John Mouat to the position of chair. Mouat, a partner in the architectural firm of Mitchell & Mouat Architects, has served on the DDA board since first being appointed in 2007.

Regarding Mouat’s time of service on the DDA board, the city council resolution confirming Mouat’s reappointment in 2011 indicated a term ending in 2014 – this year. That would have made Mouat’s chairship contingent on being reappointed by the city council. But the term end date was an apparent mistake, because DDA board member terms are by statute supposed to last four years, not three.

Councilmember Stephen Kunselman has worked over the last month to push the city attorney’s office and clerk’s office for clarification of DDA board member term end dates. And as part of that effort, Kunselman retrieved some old DDA records from the early 1980s, held as part of the University of Michigan Bentley Library’s collection of papers from Eunice Burns, a former DDA board member and former city councilmember. Kunselman told me in a June 9 interview that he has not yet shared with the attorney’s office what he found in the archives. However, the city’s online Legistar records now show corrected term dates for five different DDA board members.

Mouat’s corrected current term ends in 2015. So if Mouat is elected chair, he would not be at the same risk that Gary Boren was in 2011. Boren was elected DDA board chair in July 2011, but then was not reappointed to the DDA board that year by mayor John Hieftje when his term expired – which meant that his service as chair of the DDA board lasted about one month.

In addition to electing the current vice chair to be the new chair, another custom of the DDA board’s annual meeting is for the newly elected chair immediately to assume office, appoint the membership of committees and to name the chairs of those committees. From the July 3, 2013 annual meeting minutes:

Ms. [Leah] Gunn ceremonially passed the meeting gavel to Ms. [Sandi] Smith. … Ms. Smith reviewed the members and chairs of the Operations Committee. Mr. [Roger] Hewitt, Mr. [John] Splitt & Mr. [Keith] Orr will serve as committee chairs, the remainder of the DDA board members will serve on the committee. … Ms. Smith reviewed the members and chairs of the Partnerships/ Economic Development Committee. Ms. Smith and Ms. [Joan] Lowenstein will serve as committee chairs, the remainder of the DDA board members will serve on the committee. …

That custom flouts the DDA board bylaws in two ways.

First, the board chair has the right to appoint the chair of the operations committee – because it is a board committee. However, an advisory committee like the partnerships committee is supposed to elect its own chair, according to the bylaws: “The advisory committees shall elect their own officers and establish rules governing their actions.”

Second, even though the annual meeting is an occasion for election of board officers, including the chair, the bylaws are explicit about the fact that the newly elected chair does not actually become chair until the end of the meeting: “The term of office shall be for one year and begin at the close of the annual meeting at which they are elected.”

So the July 2, 2014 meeting would be a good occasion for the DDA board to just follow the bylaws with regard to these two points. Assuming the existing committee structure, current board chair Sandi Smith should name any committee members she would like to appoint to the operations and partnerships committees and name a chair of the operations committee. But the partnerships committee should be left to elect its own chair.

If that process does not suit the board, then the board is free to change its bylaws – which is an argument for establishing a bylaws committee.

Consult the Archives

Stephen Kunselman’s visit to the Bentley Library was prompted by his interest in establishing the correct term end dates for DDA board members. In somewhat more detail, when the DDA was first established, the 12 members were supposed to have staggered term lengths. Under the statute, an equal number of members (3) were to have had one-year terms, two-year terms, three-year terms and four-year terms. After the initial appointments, all the terms are supposed to be four years long. The effect of the initial staggering is that in any given year, the board would potentially have a maximum of three new members join the board.

But Kunselman found more than just records showing board membership.

Leafing through the Bentley’s collection of Eunice Burns’ papers, Kunselman also noticed some old budget documents, which would have been relevant to an issue that was finally settled in November 2013 – the question of how the DDA’s TIF capture is regulated. The council finally concluded that nine-month debate about the DDA’s TIF capture on Nov. 18, 2013 – by revising the existing ordinance regulating DDA TIF to remove some of the perceived ambiguity.

The point of controversy involved the TIF plan projections of growth for the tax-increment value in the DDA district. In its original form, enacted when the DDA was founded in 1982, here’s how a key clause of the ordinance read [emphasis added]:

If the captured assessed valuation derived from new construction, and increase in value of property newly constructed or existing property improved subsequent thereto, grows at a rate faster than that anticipated in the tax increment plan, at least 50% of such additional amounts shall be divided among the taxing units in relation to their proportion of the current tax levies. …[.pdf of Ann Arbor city ordinance establishing DDA]

The life of the DDA’s tax increment finance capture would have ended after 30 years – in 2012. But in 2003, a new TIF plan was established with a new 30-year life. In the new plan, the projected annual percentage increase in value of the increment on which the DDA captures taxes was lower than in the original TIF plan.

The applicability of the ordinance to the DDA’s tax capture since 2003 was pointed out in 2011 by the city treasurer in an email he sent to DDA staff [emphasis added]:

It is a bit ambiguous, but I think the intent is that the DDA should not get any more tax revenue than was anticipated by the plan. From 1982 to 2002, the original plan had very high estimates of capture, and so this clause was far from being triggered. In the new plan, the estimates were reduced significantly. From 2003 until now, the capture has exceeded the plan. … We have had preliminary consultation with the attorney’s office, but have yet to obtain an opinion as to whether our interpretation is correct. [.pdf of Horning's May 2, 2011 email]

I think the city treasurer’s characterization – that the clause in question had never before been triggered – was widely accepted as plausible and true. But based on my own review of documents among Eunice Burns’ papers, it now looks to me like the clause was triggered in the very first year of the DDA’s existence, as well as in subsequent years.

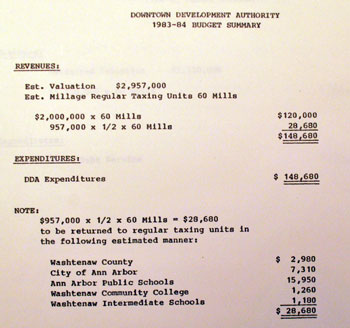

DDA FY 1984 draft budget summary from University of Michigan Bentley Library collection of paper contributed by Eunice Burns.

The projected valuation of the increment in the original TIF plan for the first year was $2,000,000. But a fiscal year 1984 draft budget put the actual expected valuation of the increment that first year at $2,957,000, which exceeded the projected amount by $957,000. The draft budget calculated a return to the other units from which the DDA captured taxes exactly as specified in the city ordinance – half the excess times the millage rate on which the DDA captured taxes. More precisely: ($957,000*0.5)*0.006 = $28,710. (The draft budget appears to incorporate an arithmetic error, and gives an amount $30 less than that.)

Based on subsequent documents, the actual valuation that first year turned out to be less than the value expected when the budget document was prepared.

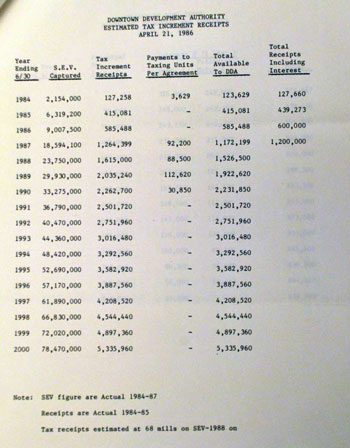

The actual valuation of the increment was $2,154,000 – which was less than expected in the draft budget, but still $154,000 more than anticipated in the TIF plan. A 1986 document from Burns’ archived papers show that the total amount of excess TIF returned to the other governmental units that first year was $3,629.

How did the DDA arrive at the $3,629 figure? I don’t know. In previously published columns on this topic, I’ve laid out the difference between a year-to-year approach and a cumulative approach to calculating the excess. But both methods yield $4,549 – which is more than a rounding error off from $3,629.

April 21, 1986 past valuations of increment with projections. In the first year, 1984, the valuation of the increment was $2,154,000 – which was less than expected in the draft budget, but still $154,000 more than anticipated in the TIF plan.

Further, the same 1986 document calculates a return of TIF revenue to other taxing units in 1987, 1988, 1989 and 1990 – but neither the cumulative nor the year-to-year method would indicate that any return was due.

The key here might be the column heading [emphasis added]: “Payments to Taxing Units Per Agreement.” Unless there was some other “agreement” between the taxing authorities, it would have been more natural to use the word “ordinance.” So that indicates the taxing authorities came to some agreement that superseded the ordinance. My initial foray into the Bentley archives didn’t turn up such an agreement.

If there was such an agreement, it could have conceivably been prompted over a dispute about how to interpret the so-called “debt clause” in the original TIF ordinance: “Tax funds that are paid to the downtown development authority due to the captured assessed value shall first be used to pay the required amounts into the bond and interest redemption funds and the required reserves thereto.”

The more recent wrangling between the city council and the DDA definitely featured a contention by the DDA that the “debt clause” should be interpreted to mean that so long as the DDA’s debt obligations exceeded TIF revenues, no TIF should be returned to the other taxing units. But as the documents from the Bentley archive make clear, back in the early years of the DDA, the debt obligations of the DDA were planned to exceed TIF revenues. It’s not clear from initial examination of the documents whether there’s evidence that the DDA paid excess TIF to other units in years when debt obligations exceeded TIF revenue.

A logical next step in pursuing this issue would be to look for the “agreement” to which the 1986 document’s column heading refers.

Develop a Development Plan

In describing the development plan committee that I think the DDA board should establish, I wrote above: “This committee is needed because the DDA does not currently have a TIF plan that meets statutory requirements.”

I want to explain that claim in more detail.

Downtown development authorities in Michigan do not levy taxes of their own, but rather “capture” taxes levied by other entities within a specific geographic area – the TIF district. The “increment” in a tax increment finance (TIF) district refers to the difference between the initial value of a property and the value of a property after development. The Ann Arbor DDA captures taxes from the city of Ann Arbor, Washtenaw County, Washtenaw Community College and the Ann Arbor District Library.

The state’s DDA statute makes clear that the tax increment financing plan is not optional. More specifically, it makes clear that no TIF revenue can be expended except to the extent that the expenditure is made pursuant to the tax increment financing plan. From the statute [emphasis added]:

125.1665 Transmitting and expending tax increments revenues; reversion of surplus funds; abolition of tax increment financing plan; conditions; annual report on status of tax increment financing account; contents; publication.

Sec. 15. (1) The municipal and county treasurers shall transmit to the authority tax increment revenues.

(2) The authority shall expend the tax increment revenues received for the development program only pursuant to the tax increment financing plan. …

The statute also lays out in explicit detail the components of the required tax increment financing plan. The required components of a tax increment financing plan include a development plan [emphasis added]:

125.1664 Tax increment financing plan; preparation and contents; limitation; public hearing; fiscal and economic implications; recommendations; agreements; modification of plan; catalyst development project.

Sec. 14. (1) When the authority determines that it is necessary for the achievement of the purposes of this act, the authority shall prepare and submit a tax increment financing plan to the governing body of the municipality. The plan shall include a development plan as provided in section 17, a detailed explanation of the tax increment procedure, the maximum amount of bonded indebtedness to be incurred, and the duration of the program, and shall be in compliance with section 15. …

And finally, the statute lays out in detail the required components of a development plan. The statute makes clear that the development plan is more than a set of guidelines, parameters and goals. From the statutory requirements, it’s clear that the development plan is meant to include a set of projects that can be described with enough specificity to identify a specific location, cost, and construction phasing – all of which is required to be included in the development plan [emphasis added]:

125.1667 Development plan; preparation; contents; improvements related to qualified facility.

Sec. 17. (1) When a board decides to finance a project in the downtown district by the use of revenue bonds as authorized in section 13 or tax increment financing as authorized in sections 14, 15, and 16, it shall prepare a development plan.

(2) The development plan shall contain all of the following:

(a) The designation of boundaries of the development area in relation to highways, streets, streams, or otherwise.

(b) The location and extent of existing streets and other public facilities within the development area, shall designate the location, character, and extent of the categories of public and private land uses then existing and proposed for the development area, including residential, recreational, commercial, industrial, educational, and other uses, and shall include a legal description of the development area.

(c) A description of existing improvements in the development area to be demolished, repaired, or altered, a description of any repairs and alterations, and an estimate of the time required for completion.

(d) The location, extent, character, and estimated cost of the improvements including rehabilitation contemplated for the development area and an estimate of the time required for completion.

(e) A statement of the construction or stages of construction planned, and the estimated time of completion of each stage.

…

The Ann Arbor Downtown Development Authority tax increment financing plan, modified in 2003, does include many of the required components of a development plan as specified in Sec. 17 (2). However, by any objective standard, some of those components are completely absent. Among those absent components are those described in Sec. 17 (2)(c), Sec. 17 (2)(d), and Sec. 17 (2)(e).

The Ann Arbor DDA’s 2003 tax increment financing plan includes a development plan that identifies eight general strategic areas for investment: identity, infrastructure, transportation, business encouragement, housing, development partnerships, community services, sustainability. These strategies and principles are outlined in a fair amount of detail, but nowhere with enough specificity to determine an exact location, cost estimate, or construction timeline explicitly required in the statute.

There is a sharp contrast between the tax increment financing plan that was originally adopted in 1982 and the revised 2003 plan. The 1982 plan includes a development plan that appears to have been drafted using the statute as a literal outline. [.pdf of 2003 renewal plan] [.pdf of original 1982 plan]

The lack of a statutorily compliant development plan has put the Ann Arbor DDA at a disadvantage over the last year in the politically-charged wrangling with the Ann Arbor city council. That wrangling grew out of the pursuit of a non-political issue raised by the city treasurer in 2011 – enforcement of the city’s ordinance that regulates DDA TIF capture.

By 2013, a majority on the council began to take an interest in seeing the TIF capture ordinance strictly enforced. The DDA’s initial response was to raise the specter of projects that the DDA would not be able to undertake – if the TIF ordinance were enforced in the way some councilmembers were suggesting. Pressed for examples, the initial response from the DDA appeared to be limited to a single specific project – the replacement of rusted-out streetlight poles on Main Street.

Subsequently, the DDA scrambled to compile a five-year plan of projects – a draft that the DDA board has since continued to revise over the past year. [.pdf of DDA 5-year capital plan as of May 2014] But the DDA board has not yet ratified that list of projects in a formal way. One formal way to ratify that five-year project list would be to incorporate it into the development plan component of the TIF plan.

An approach to the topic of the development plan from the perspective of the Downtown Area Citizens Advisory Council – a body that can be established to give input on the development plan to the DDA – is included in a comment I wrote earlier this year on a DDA board meeting report: [March 7, 2014 comment]

I imagine that some DDA board members will perceive the call for a statutorily-compliant development plan as mere pedantry – or else as a way to heap gratuitous criticism on the DDA. But in fact, a statutorily-compliant development plan could serve as a shield against unwelcome attempts to exert control by a city council eager to see the DDA pay for projects the DDA might not want to support. If the city council wants the DDA to pay for a project that the DDA does not want to fund, then this response should end the conversation:

We’re very sorry but that’s not a project included in our development plan and we cannot violate the statutory requirement that TIF expenditures be made pursuant to that plan.

With a compliant development plan to back its play, the DDA could have used that argument to avoid committing TIF funds for the police/courts facility back in 2008, or the Main Street light pole conversion project in 2013.

In the same way, the streetlight LED conversion project that the DDA board was asked to fund at its May 7 meeting – the resolution that ultimately prompted this column – could have been rejected just on the grounds that the project does not appear in the DDA’s development plan.

Instead, the argument made by board member Roger Hewitt was really just a complaint – that funding the streetlight conversion amounted to another instance of making a transfer payment to the city of Ann Arbor. That’s because the energy savings from the LED conversion would accrue to the city’s bottom line, not the DDA’s.

In its current state, however, I think the DDA’s “development plan” would preclude any TIF expenditure – because there are no specific projects listed with budgets or timelines.

In sum, I think the DDA’s independence as a governmental unit depends on its willingness to be fettered by the statutory requirements enabling its existence.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor Downtown Development Authority. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Thanks for the excellent analysis, Dave. Wouldn’t it be great if some combination of the mayor, other council members, current DDA board members, and citizens came up with even better suggestions than those that you propose?

I’d like to draw attention to one distinction that I think might be helpful in the process moving forward. In the following paragraph you correctly name chairperson Sandi Smith as the appropriate actor for a particular matter:

“So the July 2, 2014 meeting would be a good occasion for the DDA board to just follow the bylaws with regard to these two points. Assuming the existing committee structure, current board chair Sandi Smith should name any committee members she would like to appoint to the operations and partnerships committees and name a chair of the operations committee. But the partnerships committee should be left to elect its own chair.”

In contrast, it’s not possible for the “DDA board” (or “DDA committees”, for that matter, which you refer to elsewhere) to act without individual members making choices and themselves acting. The passive nature of your concluding sentence doesn’t convey that fact. For example, with regard to Smith potentially passing the gavel to Mouat (or some other newly elected chair) prematurely, it would ultimately fall to that person to decline it until the end of the meeting (even though some other member could act first to raise an objection in order to force the issue). Ostensibly leaving that decision to “the DDA board” overlooks that necessary individual choice wherein they each “just follow the bylaws” or not.

So, if a statutory requirement no longer exists, is that a cause for dissolution of the DDA? For example, is our business district in deteriorating condition? Is it still in need of correction? I think that any real estate agent will tell you that our downtown business district is doing just fine. My question is not “Does the DDA circumvent OMA?” or even “What have they done for historic preservation lately?” My question: ” Is the DDA still needed?”

“AN ACT to provide for the establishment of a downtown development authority; to prescribe its powers and duties; to correct and prevent deterioration in business districts; to encourage historic preservation; to authorize the acquisition and disposal of interests in real and personal property; to authorize the creation and implementation of development plans in the districts; to promote the economic growth of the districts; to create a board; to prescribe its powers and duties; to authorize the levy and collection of taxes; to authorize the issuance of bonds and other evidences of indebtedness; to authorize the use of tax increment financing; to reimburse downtown development authorities for certain losses of tax increment revenues; and to prescribe the powers and duties of certain state officials.”

I admit that I have only skimmed this column, but two questions come to mind from that cursory reading.

First, does the DDA Board’s failure to comply with the MCL 125.1667 development plan requirements constitute the statutory “for cause” basis for removing DDA Board members? Their collective failure to comply with the requirements of the enabling statute seems pretty significant to me.

Second, does granting TIF waivers to new developments, under the DDA’s recently adopted standards, equate to making an expenditure of TIF revenue that can be made “only pursuant to the tax increment financing plan” under MCL 125.1665(2)? In other words, can the DDA grant a TIF waiver to the hotel developer if the DDA’s development plan does not include a specific plan for that hotel?

I continue to appreciate the work and thought you put into these columns. Thank you.

Re: #3, the question that comes to mind for me is whether the current board (or staff) makeup includes the necessary skill set for the creation of a good development plan. Government and non-profit administration, small business/retail operation, real estate, law—are those likely to be adequate to plan for a very different future?

Now would be a great time for the DDA to take a year or so (while the stock market tumbles and the economy follows it down) to put together a plan, pay off debt, and otherwise hold onto their reserves. Well thought out investments and policies could actually make a difference for the local economy in the years that follow. I’d put the transition to DDA district-wide rooftop solar electricity generation and distributed storage at the top of the list (with a concurrent requirement for efficient machinery, lighting, etc.).

Jack, you ask: “First, does the DDA Board’s failure to comply with the MCL 125.1667 development plan requirements constitute the statutory “for cause” basis for removing DDA Board members?”

This “failure” is not the responsibility solely of the DDA – because the development plan I’ve analyzed in this column as deficient was approved by the city council of 2003. Ultimately, it’s the 2003 edition of the city council that I think did not exercise adequate oversight to ensure that the renewal plan it was authorizing met the basic statutory requirements. Granted the council of that era was likely keen to see a DDA that had as much flexibility as possible to provide the city with funds. So the development plan approved by the council in 2003 fit that goal of a flexible DDA.

So I don’t see how it makes any sense at all to contemplate throwing anyone off the current DDA board for a decision that the city council ultimately made 10 years ago. I think Sally Petersen got it right during a joint council DDA board committee meeting in fall 2013 when she said about a related topic that appeared to her that “… it’s just that the city council historically has not held the DDA accountable …” [.pdf of committee meeting transcript]

Rather than contemplating the elimination of the DDA as suggested in [2] or throwing people off the DDA board as suggested in [3], I think a positive role that could be played by city councilmembers would be to provide firm encouragement to the DDA to take some specific steps towards putting the DDA on a more rigorous foundation of governance. For example, part of the city council’s message to the DDA could be: “We’d like you to put together a development plan that meets the specific criteria in the statute – for which your recently created five-year planning document could provide a foundation. And when you do we’d like to approve its inclusion in the TIF plan.” That sort of message might inspire a DDA board to roll up its sleeves and get that task done.

On the other hand, if councilmembers’ first thought is to wonder how DDA board members can be thrown off the board, then the only message that some board members might hear is: “We will destroy you.”

Re (5) I agree with your point that it was the City Council of 2003 that had the ultimate responsibility for complying with the statutory requirements for a development plan. I cannot say for sure whether I would have noticed those requirements when asked to approve the extension of the DDA charter had I been a member of Council then.

I am not seeking to convey a message of destruction by asking whether Board members who fail to draft a development plan that complies with the statute could be removed. I think it would be helpful to know whether the DDA Board’s failure to accept a recommendation from Council to draft a development plan would be a material breach of their duties that potentially could cause removal.

My recollection of the conflict over the proper way to calculate the former limitation on the growth of the DDA’s TIF capture makes me believe that a polite request might not be enough to get the desired outcome. A polite request with the knowledge that a failure to act would be treated as a breach of their duties might be treated differently.

I often hear from residents who would like to dissolve the DDA. I happen to think the DDA still has the potential to be a constructive partner in shaping policy in out downtown.

As a followup to the question of who is ultimately responsible for ensuring compliance with the state statute, the statute itself empowers the state tax commission with some authority: “The state tax commission may institute proceedings to compel enforcement of this act.”

On Jan. 2, 2014, we forwarded a request to the state tax commission that it exercise its authority under the DDA Act – with respect to several issues, including the question of the development plan that does not include cost estimates or time frames for projects. [.pdf of Jan. 2, 2014 request of the tax commission]

The tax commission declined to act on the request to investigate and to collect more information, but also made clear that the commission was not thereby expressing a view that the Ann Arbor DDA was in compliance.

From the Jan. 22, 2014 letter from the state tax commission executive director, Kelli Sobel:

I think that one of the “arenas for such review” is the context provided by the regular business of the Ann Arbor city council. This is just a very long way of re-iterating the point that the city council could play a positive oversight role here. But to pick up Steve Bean’s point: The council as a group can’t play a role unless individual members of the council take specific action.

After reading this article, an obvious candidate for DDA membership – and for its chairmanship in particular – comes to mind, but appointing this candidate might compromise the ability of The Chron to cover the DDA sans conflict of interest.

While a summer evening, among companions, in a beer garden, is a glorious thing, for the DDA it may be best held out as a (privately funded) reward for properly taking care of business. It’s not obvious, from this article anyway, that this reward has been earned.

@2 Mr. Haynor,

I am flabbergasted to read that historic preservation is, quite explicitly, one of the charges of a DDA in the State of Michigan. Does anyone on the DDA realize this? As any regular reader of The Chron knows, there is no substitute for actually reading the statutes. Thank you for bringing this to light.

@4 Mr. Bean,

Points well made.

@6 Mr. Eaton

I applaud your call for greater council oversight of the DDA – as does the State Tax Tribunal, apparently. To take your point one step further, it strikes me that the issue is not the force current members of the DDA to do their jobs, but rather, to have on the DDA people who actually want to do them. If it takes a poke in the pants by council to get work done, better to replace current members with a coalition of the willing, rather than expend energy on poking the reluctant.

The work of the DDA could equally as well be done if it were a city department. This would require that we stop stealing money from WCC and the library, and stop diverting taxes voters approved for purpose “A” to unrelated purpose “B”, while the city still pays for all the bonds it issued to fund DDA projects. However, it would put the good work of the DDA directly under city council & the city manager, just like street paving, public safety, and parks – with whom the DDA would now compete for public funding. To me, this is a worth-while tradeoff.

@7 Mr. Askins,

Thank you for following up with the State Tax Tribunal. Have you raised this issue before? I don’t recall reading of it here.

Why haven’t I thought to ask this before?? Oh, well! Do the AADL taxes that I pay on my Scio Twp. property get TIFed off for the DDA, or, being a city entity, can the DDA only get TIF from taxes paid to the city?

Re: (emphasis added) “Oh, well! Do the AADL taxes that I pay on my Scio Twp. property get TIFed off for the DDA, or, being a city entity, can the DDA only get TIF from taxes paid to the city?”

This is a good chance to highlight the fact that the Ann Arbor DDA is just that – “a downtown development authority,” namely the DDA established by the city of Ann Arbor, which can capture some of the taxes in a defined area of downtown Ann Arbor. But your Scio Twp. library taxes do get TIFed by “the DDA” – because Scio Twp. also has a DDA.

Just to clarify what most readers probably already know, only properties in a defined area contribute TIF and only on new development.

Scio’s DDA, as far as I know, is essentially the Jackson Road corridor. It has been in place for a long time.

Right, I knew about the Scio DDA and should have been more explicit about which one in my question. Thanks for the quick turnaround!

Re: “Unless there was some other “agreement” between the taxing authorities, it would have been more natural to use the word “ordinance.” So that indicates the taxing authorities came to some agreement that superseded the ordinance. My initial foray into the Bentley archives didn’t turn up such an agreement.”

We made requests of the Ann Arbor DDA and the city of Ann Arbor under Michigan’s FOIA for the “agreement” to which the column heading refers. The DDA’s response was to indicate that the DDA had no responsive document in its possession. The city’s response appears to be a copy of the original 1982 TIF plan. Based on those responses, either there was no agreement among the taxing authorities – separate and apart from the original TIF plan and ordinance – or else no one has retained a copy.