Does It Take a Millage?

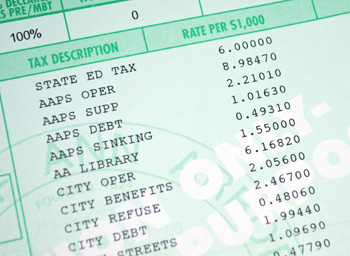

An Ann Arbor summer tax bill, showing some of the assessments for Ann Arbor schools. For Ann Arbor Public Schools (AAPS), the millage rates reflect half the amount collected annually.

Among Michigan’s public educators, the 2010-11 fiscal year is being called “The Cliff.” Based on a grim downward trajectory of funding from the state, decreasing revenues from local property taxes and expenses like health care continuing to climb, that’s the year many districts are expected to plummet over the edge into the red.

Robert Allen, deputy superintendent of the Ann Arbor Public Schools, described this scenario at a sparsely attended forum last Thursday at Huron High School, where he and superintendent Todd Roberts made a pitch for voters to support a proposed countywide millage on the Nov. 3 ballot. They didn’t claim that AAPS would be among those districts falling off the cliff, but they did say their district faces a $15 million deficit that year. Without new revenue from the millage, they contend that the district would need to make dramatic cuts, and that those cuts would almost certainly affect students in the classroom. Michigan’s financial crisis is hitting hard, they say.

“As the state goes, so goes our funding,” Allen told the group on Thursday.

The state isn’t going so well.

But opponents argue that school districts haven’t done enough to cut costs, and that taxpayers can’t absorb the added burden of another millage. Beyond that, people on both sides say there’s an urgent need to reform the way schools are funded in Michigan, regardless of the success or failure of the Nov. 3 millage vote.

This Chronicle report looks at how Michigan funds K-12 public schools, why local school districts say they need a special enhancement millage and why critics say they don’t, and what that proposed millage would entail. Ann Arbor Public Schools is the largest of Washtenaw County’s 10 school districts, and would receive over a third of the $30 million collected from the millage annually – we’ll focus our coverage on that district.

Background: How Michigan Funds Public Schools

The state controls revenues for local school districts in two ways. First, it collects taxes directly from residential and non-residential property owners – 6 mills each, annually – and pools that money into the state’s School Aid Fund (SAF), which also includes revenues from sales and income taxes, state lottery revenue and other sources. Out of this fund, the state pays local school districts a per-pupil allotment – a variable amount set by the state legislature that can increase or decrease each year.

In addition, state law controls the amount of taxes that school districts can levy directly – those that are not pooled into the SAF. Beyond the 6 mills that go into the SAF, for example, there’s an additional tax on non-residential property owners, but the state caps that tax at 18 mills.

Both the funding from non-SAF local property taxes and from the total School Aid Fund are factored into an amount called the per-pupil “foundation allowance.” This amount varies by district – Ann Arbor’s per-pupil funding was originally expected to be $9,723 for the current fiscal year, which began July 1. With about 16,500 students in the Ann Arbor district, its per-pupil foundation allowance would be roughly $160.5 million – the bulk of the district’s projected $192 million budget for this fiscal year. (Other revenues come from the district’s share of a countywide special education millage and from federal grants.)

The current system stems from the 1994 passage of Proposal A. The goal of that ballot initiative was to create more equitable funding across all districts and to keep property taxes from escalating dramatically. Proposal A took away, to a significant degree, local control over school funding, though districts can still request voter approval to levy local millages for building construction, repairs, and maintenance. Ann Arbor has done that, most notably to fund the construction of Skyline High School.

Proposal A also created “hold-harmless” districts – Ann Arbor is one of only 44 districts statewide that are classified in this way. When Prop A took effect, these districts were receiving revenues higher than a $6,500 per-pupil base level set by the state at that time. Rather than have their funding lowered, the “hold harmless” districts were allowed to levy an additional millage to make up the gap. For Ann Arbor, that amount is $1,234 per pupil, or 4.42 mills. (The millage rate varies depending on property values, in order to generate a fixed amount of $1,234 per pupil.)

Another issue is this: As revenues from property taxes, sales taxes and other funding sources have decreased because of the state’s economy, the School Aid Fund has been shrinking. This year, the state is projecting a $1 billion deficit in the fund – that’s one reason why the legislature cut state funding for schools by $165 per pupil earlier this month. (The legislation authorizing that cut hasn’t yet been signed by Gov. Jennifer Granholm, however.) And depending on the amount of revenues coming into the School Aid Fund over the next few months, the state might make additional per-pupil cuts early next year.

The upshot? Districts can’t be sure exactly how much money they’ll receive from the state for their current fiscal year, which began July 1. For AAPS, the $165-per-pupil cut means a loss of about $2.7 million, bringing its per-pupil foundation allowance down to $9,558. The school board passed a balanced budget in June, which included tapping their fund balance (the district’s equivalent of a savings account) for nearly $2 million, to help resolve a $7.1 million deficit. But they’ll likely have to make additional cuts in light of the state’s decision to decrease per-pupil funding.

In the past, shortfalls in the School Aid Fund have been plugged by transferring revenues from the state’s general fund. But because the general fund has also faced staggering deficits, lawmakers have been using federal stimulus money in the past two years to shore up the School Aid Fund. Last year, AAPS got about $6 million in stimulus funds to cover what would have otherwise been a $365 per-pupil cut. The district has received another $3 million in stimulus dollars earmarked for special education, and about $1 million for Title 1 programs, which provide reduced and free lunches to low-income children.

Stimulus funds aren’t expected to be available beyond 2010-11, and the state still hasn’t determined how they’ll use those funds for schools in the current fiscal year.

What Ann Arbor Taxpayers Pay for Schools

In addition to the state school tax of 6 mills from residential property owners and 6 mills from owners of commercial and rental property, or of property that isn’t a taxpayer’s primary residence, there are four other school-related millages for the Ann Arbor district:

- 17.97 mills for operating funds – a “non-homestead” tax paid by owners of non-residential property.

- 4.4201 mills for the supplemental “hold harmless” tax.

- 2.0325 mills for debt repayment on school bonds.

- 0.9861 mill for a “sinking” fund, which can be used for school construction, renovations or repairs. The fund was initially approved, in part, to build the new Skyline High School.

Voters renewed the AAPS sinking fund, supplemental and non-homestead operating millages last year.

The Washtenaw Intermediate School District also collects two taxes countywide: 1) an operating millage of 0.0984 mill, and 2) a special education millage of 3.8761 mill.

In total, Ann Arbor homeowners pay just over 17 mills in school taxes. A mill equals $1 for every $1,000 in a property’s taxable value, which usually is considered roughly half of the market value. So owners of a home with a market value of $200,000 are paying about $1,700 annually in school taxes now, and would add another $200 to that if the millage on November’s ballot is passed.

In their public forum on the millage, AAPS school officials noted that since Proposal A passed in 1994, local taxpayers have seen their school millage rates fall. [Link to chart of school millages paid by Ann Arbor residents from 1994 to 2009.]

Brit Satchwell, second from the right, is president of the 1,200-member Ann Arbor Education Association, the teachers' union for the Ann Arbor Public Schools. He set up a booth at the Oct. 17 Ann Arbor Farmers Market, handing out yard signs and pins in support of the proposed countywide schools millage, and talking with residents about it. (Photo by the writer.)

How the Proposed Millage Would Work

Individual school districts are prohibited by state law from levying additional millages for operations. However, under the umbrella of the Washtenaw Intermediate School District – an entity set up in the early 1960s to provide services to all 10 public school districts in the county – an operating millage can be levied and distributed equally, with each district receiving the same per-pupil amount.

The Nov. 3 ballot proposal calls for collecting 2 mill countywide each year for five years, starting in 2010. The millage is projected to raise $30 million annually, to be divided among the 10 districts. The WISD would not receive funding from this millage, nor would any percentage of the millage go to the state.

Here’s what voters will see on the ballot:

PROPOSAL I

REGIONAL ENHANCEMENT MILLAGE PROPOSAL

Pursuant to state law, the revenue raised by the proposed millage will be collected by the intermediate school district and distributed to local public school districts based on pupil membership count.

Shall the limitation on the amount of taxes which may be assessed against all property in Washtenaw Intermediate School District, Michigan, be increased by 2 mills ($2.00 on each $1,000 of taxable valuation) for a period of 5 years, 2009 to 2013, inclusive, to provide operating funds to enhance other state and local funding for local school district operating purposes; the estimate of the revenue the intermediate school district will collect if the millage is approved and levied in 2009 is approximately $30,000,000?

Each district in the county is projected to receive the following amount annually, based on the number of students in their districts:

- Ann Arbor: $11,209,169

- Chelsea: $1,805,447

- Dexter: $2,477,564

- Lincoln: $3,261,427

- Manchester: $865,953

- Milan: $1,778,896

- Saline: $3,748,612

- Whitmore Lake: $841,030

- Willow Run: $1,358,160

- Ypsilanti: $2,663,743

In lobbying for the millage, Glenn Nelson – an AAPS school board member – notes that many taxpayers will be eligible for a state property tax credit and a federal property tax deduction, offsetting a portion of the increase in taxes. Countywide, he calculates that the millage will only cost taxpayers $21.2 million annually, because of the available credit and deduction, while generating $30 million for schools. That calculation assumes that all taxpayers eligible for the credit and deduction actually file for it.

Why Districts Say They Need This Millage

In making the case for an additional millage, school officials acknowledge that it’s a difficult economic climate for residents, and a tough time to be asking for a new tax. They also say they have no alternative.

All districts contend that they’ve already been cutting expenses and consolidating services, as revenues from the state have fallen. Ann Arbor Public Schools has cut $16 million from its budget over the past four years, according to administrators. Those moves included eliminating 66 jobs, restructuring the district’s middle school program to save $2.3 million annually, increasing class sizes, and cutting back on custodial services, among other things.

Officials also point to countywide efforts, including those coordinated by the Washtenaw Intermediate School District. [.PDF link to list of consolidated school services in Washtenaw County]

But costs continue to escalate while revenues fall, they say – even with the millage, AAPS expects to face a $4 million deficit in 2010-11.

Todd Roberts, superintendent of Ann Arbor Public Schools, at an Oct. 15 forum on the proposed countywide schools millage. (Photo by the writer.)

Personnel costs

The biggest portion of any district’s operating budget is personnel. At the AAPS millage forum on Thursday, Robert Allen, AAPS deputy superintendent, noted that 85% of the district’s operating budget goes toward personnel costs – salaries and benefits – and that a $15 million budget shortfall equated to about 220 jobs.

The Ann Arbor Education Association – the teachers union, and the largest of the district’s nine bargaining units – has already made some concessions, earlier this fall agreeing to a salary freeze for the first time in its history for the 2009-10 school year. The new contract contained changes in health care benefits too, including an increase in prescription co-pays for teachers, but also a 15% increase in the amount that the district pays for a teacher’s health insurance, to $12,582. And so-called step increases – automatic pay raises that teachers receive each year for their first 12 years of service – remain in place.

At Thursday’s forum, one of the people attending asked superintendent Todd Roberts how he’d respond to those who think teacher salaries are too high. Roberts defended the salaries that AAPS pays, saying that “our teachers are not anywhere near the top” compared to other districts statewide. What’s more, he said, the district needs to pay a decent wage in order to attract and retain high-quality teachers.

Pay is linked to education and time of service. The average AAPS teacher’s salary is about $72,000. First-year teachers with a bachelor’s degree earn $39,540 – the top of the pay scale for teachers with a bachelor’s degree is $66,975. Teachers with masters degrees start at $44,539 and top out at $79,899. Beginning teachers with a Ph.D. earn $49,919 – the top of the scale for them is $87,774.

Maintaining a quality education

The need to keep the quality of Ann Arbor’s public education high – and the role of the proposed millage in doing that – is an argument made by school officials and others who support the millage.

Steve Norton, a leader of the Ann Arbor Citizens Millage Committee, which supports the millage, told The Chronicle that there are two choices: Bring in additional revenues through the millage, or dismantle the school system as we know it. An additional investment now, he said, will buy time for public school advocates to lobby for substantive changes at the state level. It’s a millage they might not need long-term, Norton said, but if they don’t get the funding now, the district will suffer.

School officials give a range of actions that would be necessary if they’re forced to slice $15 million from next year’s budget. Layoffs would be necessary, meaning that with fewer teachers, class sizes would increase. High schools would likely cut their 7th hour of classes, and “enhancement” programs like art, music and sports could be at risk.

In stating that the quality of Ann Arbor’s public schools is threatened, Norton, Roberts and others make an economic development argument as well. Education is a pillar of the local economy, Roberts said, pointing to its inclusion in the Ann Arbor Region Success initiative, a countywide strategic planning effort of business and community leaders. From that group’s report:

High quality education systems (from early childhood through post-secondary) are needed to develop skilled workers and attract companies and talent thinking of moving to our region. Companies thinking of expanding or relocating to our region need to know that their children can get the best education possible whether they live in our villages or urban core. This is one of the key factors that site selectors assess when recommending sites for expansion and relocation. High school graduation rates are good in most areas of the county but we need to consistently achieve high attainment levels in all school districts. [.PDF file of entire report.]

Karen Cross, a current former AAPS school board member, told The Chronicle that when people hear what’s at stake, they’re generally receptive to the millage. But that’s not always the case.

An anti-millage sign on East Huron River Drive earlier this year near the home of Ted Annis, a member of the Citizens for Responsible School Spending, which opposes the millage. (Photo by the writer.)

What Opponents Say

Critics of the millage proposal make two main arguments: 1) Districts haven’t made sufficient structural changes to lower their expenses, and 2) residents are in no position to absorb additional taxes in the current economic climate. The 17 mills that residents of Ann Arbor already pay should be sufficient, they say.

In Ann Arbor, some opponents also criticize the “redistribution of wealth” aspect of the millage. Because of how the money is collected and redistributed, Ann Arbor taxpayers will be paying more than will be returned to the Ann Arbor school district. That’s true: AAPS will only receive an estimated $11 million from the enhancement millage, though taxes from the district will generate about $16 million. The $5 million that’s not returned to AAPS will go to other districts in Washenaw County. (AAPS is already a “donor” district for the School Aid Fund, with local taxpayers paying more than the district receives back in state aid.)

Several groups have organized to defeat the millage, but taking the lead is the Citizens for Responsible School Spending, spearheaded by former AAPS board member Kathy Griswold and Ted Annis, a technology entrepreneur who’s on the board of the Ann Arbor Transportation Authority.

“Fear-mongering”

Speaking to The Chronicle just before a meeting of CRSS on Sunday afternoon, Griswold characterizes the rhetoric of millage advocates as misleading and fear-mongering, likening it to the tactics that former president George W. Bush used to drum up support for the war in Iraq. She says the per-pupil amounts are misleading, too, and that per-pupil funding for AAPS is much higher – over $12,000 per pupil, not the $9,723 figure that’s quoted by the district. She calculates that amount by taking the district’s most recent audited financials (from the 2007-08 fiscal year) with general fund revenues of $192 million, dividing that by the number of students in the district, and adding another $1,500 per pupil from revenues of the sinking fund and bond millages. [Link to AAPS financial reports]

Kathy Griswold, foreground, attended an Oct. 15 millage forum at Huron High School's Little Theater. She is a former AAPS school board member and a leader of the Citizens for Responsible School Spending, which opposes the millage. (Photo by the writer.)

Griswold says that though the district has cut costs, the overall operating budget isn’t decreasing – the cuts merely mean that the budget is staying flat or increasing less than it otherwise would, she says.

Griswold also takes issue with the approach that public school officials take in pitching the millage to the public. There’s been a strong effort to get the vote out in Ann Arbor, she said, with the implication being that if Ann Arbor voters weigh in heavily in favor of the millage, then it won’t matter if it’s defeated by voters in the rest of the county. If a majority of the total votes approve the millage, every taxpayer will be assessed – even if it was defeated in their district. “That seems like taxation without representation,” she said.

The Washtenaw County Republican Executive Committee also is opposing the millage, and announced the decision on its website: “While the Committee was unanimously supportive of education, they felt the struggling homeowners and businesses in our difficult economy do not need an additional burden. Following a presentation and a question and answer period with the Superintendents from the Ann Arbor, Chelsea and Saline school districts, the Committee felt that cost cutting measures that the districts had not implemented and were still available were the better approach.”

Getting the Word Out

Citizens for Responsible Spending is planning a community forum sometime this week . They’re also providing the research they’ve done to several other anti-millage groups, including the Citizens for a Responsible Washtenaw, backed by McKinley CEO Albert Berriz. That group is expected to send a mailing to all Ann Arbor residents who’ve requested absentee ballots.

AAPS has already mailed informational brochures to 37,000 residents in the district, outlining details of the millage. The Ann Arbor Citizens Millage Committee sent a mailing, too, funded by private donors and explicitly advocating for the millage. Todd Roberts and Robert Allen held a forum last Thursday, and are holding another one tonight at Pioneer High School’s Little Theater, starting at 7 p.m. And representatives from the Ann Arbor Citizens Millage Committee have been speaking at PTO meetings and other gatherings in the district for the past several weeks.

Citing advocacy for the millage in schools, Citizens for Responsible Spending has raised the issue of possible Michigan Campaign Finance Act violations on the part of the Ann Arbor schools, a charge that Todd Roberts dismisses. In an email to Roberts and Norm Herbert, co-chair of the Ann Arbor Citizens Millage Committee, Annis and Griswold cite concerns over the use of school property for advocacy of the millage, and of advocacy in the AAPS brochure mailed to residents. Roberts told The Chronicle that the AAPS mailing was informational only, and that while other school officials are prohibited from using school resources to advocate for the millage, it is within his right as superintendent to do so. Griswold said that her group is still looking into the issue.

Advocates on both sides are meeting with the editorial board of AnnArbor.com, which plans to take a position on the millage. The editorial board – anchored by AnnArbor.com CEO Matt Kraner, executive vice president Laurel Champion and Tony Dearing, chief content officer – has been expanded to include some community members. McKinley’s Albert Berriz is a member of the board, but has recused himself from this issue, according to Dearing.

What’s Next?

Many districts are grappling with a financial crisis, even before the year of “The Cliff.” In Washtenaw County, Willow Run and Ypsilanti school districts are operating under a deficit – by law, those districts are required to file deficit elimination plans with the state, outlining how they plan to resolve the situation. Willow Run has been running a deficit for years; Ypsilanti had a $3.7 million deficit in its current budget, and the district has until Dec. 15 to submit a deficit elimination plan. [.PDF link to list of all Michigan school districts that filed a deficit elimination plan for fiscal 2008]

The numbers aren’t yet in on how many districts statewide are currently running a deficit, but there will be more, said David Martell, executive director of the Michigan School Business Officials, a Lansing-based group.

Tackling the problem is difficult, Martell said, because school administrators don’t have authority to make unilateral decisions about spending. If superintendents could make across-the-board cuts on the expense side, “then we wouldn’t be having these discussions,” he said. Multiple factors prevent that from happening, he added, including the authority of community-elected boards that are ultimately responsible for making tough budget decisions, but whose members might not be willing to take the political heat.

Many school officials and others point to the state as the primary cause of the current financial crisis in public education, and the main target for reform. Steve Norton of the Ann Arbor Citizens Millage Committee suggested that implementing a graduated income tax or expanding the sales tax to include the service sector would bring in new revenues to support public schools and, more broadly, to help address Michigan’s own structural deficit.

Roberts cited retirement costs – managed by the Michigan Public School Employees’ Retirement System – as being a critical personnel issue that needs to be addressed, and one that local districts don’t control. The state sets the rate that districts must pay to cover retirement costs for its employees, and it’s not a sustainable system, he said. [Link to an April 2009 Education Report article about the impact of retirement costs on Michigan's public school districts.]

Term limits for legislators are another huge obstacle to addressing reform at the state level, advocates of public education say, but they believe the current crisis will prompt change – if only because there’s no other choice.

“This really is a tipping point,” Norton said.

Links to Millage-Related Information

-

Some of the groups against the proposed millage

- Citizens for Responsible School Spending

- Coalition for Taxpayer Relief [Link to campaign finance filing]

- Washtenaw County Taxpayers Association

Some groups supporting the millage

- Ann Arbor Citizens Millage Committee [Link to campaign finance filing]

- Ann Arbor Public Schools Educational Foundation

- Friends of Education [Link to campaign finance filing]

- Washtenaw Intermediate School District

From the schools

Some of the county’s 10 districts have posted information regarding the millage on their websites (most of the other districts link to the WISD site):

I note that the period during which the millage would be collected is only 5 years. That contrasts to many city millages that have lately been for much longer periods. This relatively short period allows for a “bridge” effect that would allow for re-evaluation of need and other funding mechanisms, perhaps at the state level, as conditions change.

Thanks for all the very clear information on school funding.

The best comment I’ve seen yet with regards to this foolish WISD millage proposal is this one posted by “ChuckL” – (he referred to just the “bad teachers, I’ve modified it to be a bit broader)

“(W)e are proposing to raise taxes on people losing their health care, losing their retirement funds, losing their homes” so that teachers and other public school employees “can keep their health care, retirement benefits and homes.”

The local school boards that insisted on having the WISD put this abomination on the ballot are completely tome deaf to the damage this huge tax increase will cause among the survivors of our multi-year Michigan depression.

Those taxpayers that are just hanging on to their properties will be pushed over into foreclosure and abandonment, and the accelerating losses in general property tax revenue will unfortunately offset a fair portion of any gain coming from this additional tax burden.

that’s “tone” deaf (not “tome” deaf :)

More here.

Despite all of the accolades districts such as Ann Arbor, Saline, and Dexter receive, it is Monroe County who has taken the lead in stabilizing school funding. Since 1997, Monroe County has had an enhancement millage in place. They have chosen not to let Lansing decide how much education is good enough; in Monroe County the students come first. They recognized that investment in public education is neccesary to the growth and vitality of a region…

I moved to the area in 1998. Having grown up in west-coast “tax revolt” states, I never knew what is was like to have schools with extensive music and arts programs, high-tech classrooms, teachers who were well-equipped and educated, and available to students. I knew right away that I wanted my children to grow up in Washtenaw County in order to take full advantage of a region that so values education.

If we allow our educational system to fade into mediocrity, to allow funding to simply be the “lowest common denominator”, we forever diminish the opportunities for 13 years worth of students. What’s a few more bucks?

Bill Shaw,

You’re being played for a fool. You don’t get improved performance out of your tax dollar investment in education by not attaching conditions to increases in funding. The system we have insulates bad teachers and administrators from removal and lets them glide to retirement. Bad teachers make almost the same amount of money good teachers make. We also have a system that gave us a white elephant called Skyline High School; the incremental operating cost of this school could have been used to pay teachers instead. So, where is the accountability for the Skyline debacle? The public is stuck with the consequences of a bad decision with no assurance any system has been put into place to prevent another bad decision from being made in the future. The problem with the Skyline debacle was a gullible public unwilling to challenge the smoke and mirrors arguments of the administration. The superintendent who rammed the millage through to pay for Skyline left before the project could be completed; he did not want to be around to answer for the cost overruns that occurred on his watch.

This fiscal crisis is an opportunity to demand changes that will result in a better, more efficient school system in Washtenaw County. If voters are stupid, they will approve this increase with no strings attached and the money will be wasted. If voters are smart, they will reject this sucker check and force the administration to do a better job of explaining how they will make structural changes to improve the efficiency of how school dollars are used; then a millage increase might actually make sense.

As I have stated elsewhere, the WISD is asking people who are losing their health care, losing their retirement, losing their homes to pay more tax to help school employees keep their health care, retirement and homes; not fair. Especially not fair when the public gets no commitment to improve performance for the huge sacrifice being demanded. Vote this turkey down! You can be rest assured the WISD will be back if the 2 mill increase is voted down; make them do the hard work of earning the right to ask for an increase.

Please, we cannot afford another millage. Pay freeze is not considered a concession when teachers have received 4 or 5% raises for the past few years. Our school board negotiated a contract we cannot afford and why is that?

16 million taxes in and only 11 million going back to our school and the other 5 million to other schools? Tax payers in Ann Arbor will not enter into a deal like this. What our homeless shelter could do with 5 million dollars. Keep our money in our community.

Purchasing insurance directly from BCBSM instead of through the MEA would save $1600 per teacher. Why does the MEA have such a strong hold over the school board?

Kathy Griswold is an honorable person and former school board member. She has nothing to gain for taking this stance and fighting this millage. She is brave to go against the teachers union, school boards and the thug tactics the MEA uses to scare teachers and parents.

The parents in this town should listen to her and for once, question their school board’s decisions. Why do you think the MEA has spent 2 million on this campaign? It is not about the kids!!!

Great comprehensive look at the issue guys.

Opposing this initiative is penny wise and pound foolish (and to call it a “huge tax increase” is intellectually dishonest).

Excellent schools are one of the primary reasons why Washtenaw County property values have fallen much less than other counties in Michigan. Continuing teacher layoffs – which is exactly what will happen if this millage is defeated – will just about guarantee a continued fall in housing prices and an exodus to private schools.

You can vote no if you want, but if you do realize any money you save is coming right out of your home’s value.

Jim,

Ann Arbor is doing well relative to the Detroit Metro area due to the fact the main industry here is UofM versus bankrupting Auto companies. UofM has not subjected its workforce to mass layoffs the the way the auto industry has and as a result, home values in Washtenaw County have not been affected as much as the Detroit Metro area. Yes, good schools help raise home values; but consider the fact that in Ann Arbor if you do not have an undergraduate degree, it’s probably due to the fact you are still working on it. The children who go to school here come from families where the parents went to college; the local school system will do exceptionally well based on that fact alone. Just throwing money at the schools without expecting improvements in exchange is foolish and detrimental to the long term health of the school system. Our kids deserve better; vote no on the 2 mill increase.

Chuck,

Your premise that we’re “throwing money” at schools is rebutted by the facts in the story.

An Ann Arbor taxpayer paid 13.4 mills in total homestead tax in 1994 and now pays 7.4 mills. The tax rate has gone DOWN considerably as home values rose.

Now home values have shrunk and due to the way schools are funded in Michigan, revenue has also shrunk.

This millage is needed to MAINTAIN funding levels, not increase them.

Anyone who doesn’t understand that really shouldn’t be commenting on this issue. This is NOT an increase in school funding, it’s to prevent a massive shortfall.

I am also voting NO on this expensive millage. 2 mills is simply too much to ask for during these times, and I believe that if it passes, it will be the straw that breaks the camel’s back. Any subsequent parks renewal millages, public safety millages, etc. will likley fail because the system simply can’t sustain that much taxation. It will only take one new higher tax bill for residents to fully realize the hit and instantly say “enough is enough.” In other words, the school system will benefit to the detriment of others.

My property value also goes down due to higher relative taxes when potential purchasers can’t afford to buy my house. At this rate, monthly tax escrows will easily exceed mortgage payments for many residents. Also, the fact that at solid percentage of my city school taxes, if this millage passes, will be funneled to other school districts is very troubling. I believe my tax dollars already subsidize enough governments outside city limits.

Finally, I simply have not seen enough strategic cuts within the public school system to warrant this tax. It is very insincere when I read comments from teachers on AA.com saying that they have sacrificed enough because they have given up pay raises for the next couple years, rationalizing this as akin to pay and benefit cuts that the rest of the public and private sector have been taking for several years now.

This is an excellent summary, thanks. The news this morning is that Governor Granholm has vetoed school aid to the hold harmless districts, including Ann Arbor. Proving that the discussion really needs to be happening at the state level. You can read about it in this Free Press article.

The problem with your argument, Brian, is that taxes have been going down in Washtenaw County as property values go down.

My property taxes are down more than $1,000 since 2006.

Any argument that “higher” property taxes will hurt property values fails because even if this millage passes, most folks in the county will still be paying less in taxes than they did in 2006.

Thanks for the link to the Free Press article. That report states that the Ann Arbor district would lose $3.7 million in state aid for the current fiscal year, which began on July 1. I’ve asked for confirmation from the district on that amount, and the impact it would have on this year’s budget.

Just because your taxes have gone down doesn’t mean everyone else’s has. Do you live in city limits, where the taxable value – assessed value differential still has a gap to close for many, or do you live in one of the townships that generally has a much lower tax burden to start with? The perspective differs dramatically, so please don’t generalize to support your argument.

And, my above argument was multi-faceted, though you chose to focus on only aspect to support your own perspective.

Tax rates may have gone down, but spending didn’t. In 93-94, the allocation per pupil was $7,574. It rose to $9,234 in 02-03. More than 80% of that (closer to 90%) is on personnel. Raising taxes in this time is a bad idea. Everyone looks to raise taxes… more people leave (and it becomes even harder for new people to come to the area)… There’s an exodus from Michigan right now and you simply must choose a different way of solving the issue. Akron, OH spends $6075.00 per pupil and is voted on of the best districts in the nation. Money doesn’t solve education problems. Money can solve family problems, which directly impacts education.

ChuckL makes a key point that I think does not get enough attention. What drives many of us crazy when the schools ask for more money is that we know from first hand experience (several children in the AAPS) that there are ineffective teachers who do not deserve to be on staff. At my company, these types of people get fired. But, that’s not possible in the AAPS.

I think our top teachers are probably *underpaid* — whether the averages are about right, I am not sure. But I sure have a hard time sending more money to a system which props up a goodly number of undeserving staff.

Paying teachers based on merit is more than a local issue, I know.

If that figure for Akron is true, it’s certainly admirable, but it’s also the exception. Washtenaw County spending-per-pupil isn’t all that high.

There are 24 states where the average amount spent per pupil is more than $10,000: link

I’d prefer my state maintains its small funding lead on Louisiana and Arkansas when it comes to education. Taxes are lower in both those states, of course, and so are property values.

And, Brian, it’s unfortunate if your taxes haven’t gone down, but that’s the exception. Most people’s taxes have decreased (it’s the way our property tax system is structured).

ChuckL,

As one of those U of M types referred to in comment 9, I would agree that one of the big reasons I chose to come to Michigan and live in Ann Arbor was the good reputation of AAPS on a national scale. Rightly or wrongly, one of those determinants of reputation is per pupil spending. Another is extracurricular options outside of the three R’s. Another is college placement history. Only one is test scores, which will probably be least affected by funding cuts. Make fun of us college educated, liberal gownies all you want, but ultimately when recruiting for individuals with specialized skills, the U is already at a disadvantage salary wise to coastal universities. What it offers is a college town feel with a lower cost of living and a good public school system, obviating the need for additional out of pocket costs for a private school. Remove the public school from the list of acceptable educational choices means reducing the talent pool at the the U, with subsequent reductions in research funding and spending. Football and hockey can only take the U so far.

Great reporting, Mary. Thanks for the unbiased review.

I guess I’m in the “no” column at this time. Like many of the commentators, it is the unions that are my hangup.

It seems to me that they have not hit the right balanced between a “group” mentality and that of individual merit. They seem to be stuck in an era where the minimum was good enough and that is easily addressed with group standards. The pay is set by referencing the best and is then allocated equally down the quality scale.

If someone wants to move me to the “yes” column they are going to have to show me that the union is willing to do some serious quality control. I want to be assured that I’m getting what I pay for. Do that and I will move to support whatever it takes to get an excellent school system.

Here’s a copy of an email sent out yesterday by McKinley CEO Albert Berriz, opposing the millage: Link to .PDF file

Sadly, there’s no direct link between school spending and success. If it were a link, you’d expect let’s say NJ (who averaged 13k per pupil) to have a much better system than NY, MI, or others. The old adage of the more you spend the more you get has been proven inaccurate. Even worse is when you see school boards graduating people who are unable to pass proficiency tests, just to keep statistics high (NJ is again the example which used to graduate 15,000 people a year in this manner).

We cannot raise taxes. Not for anything right now. Simply not for anything.

Families have lost incomes. They have property values that have plummeted, and again, many are leaving Michigan to find work. If you really want to help families, you don’t raise taxes. Families have sacrificed enough.

Drastic times call for new initiatives and measures. Raising taxes is an old response, which history shows, doesn’t solve a problem. Time to get creative.

“…suggested that implementing a graduated income tax or expanding the sales tax … to help address Michigan’s own structural deficit.”

Near the end of this detailed piece, we at last reach the heart of the funding problem. While sales taxes are regressive in nature, the implementation of a steep, graduated income tax will heal the state’s current budget problems quite nicely, including support for education. Michigan’s longtime fixed tax structure lets the rich off the hook for what they should be paying, hurts the working poor who should be paying less, and crushes state services (via lowered revenues) during a bad economy when they’re most needed.

During the 1950s and 60s by contrast, U.S. federal graduated taxation on the rich, at a historical high point, was significant in underwriting postwar benefits for the middle class (for example, does anyone remember low-cost university education?). A return to heavy federal taxation of the wealthy, combined with the initiation of a similar tax structure by Lansing, would promote a more socially fair redistribution of the funds which we very desperately need. Under a steep, graduated plan, many of us will end up paying less in state & federal taxes than we do now, while getting more in return for each dollar paid.

Rhetorically speaking, why not tax $900,000 from a $1 million Wall Street bonus and distribute it to the states as funding for education, services, and infrastructure? Why leave such sums with someone who doesn’t know what to do with all of their money?

“Time to get creative.”

True whether the millage passes or not. We’re still early in what will likely be a relentless decline (with perhaps brief pauses) in our economic system, which impacts so many aspects of our lives. We will face similar decisions repeatedly in the coming years. That’s not an argument for voting no, just an attempt to put this into context. Decisions about investments in our community can be made with that context in mind. I think that we’re generally still thinking too narrowly.

For some context on how energy supplies do and will impact our economic situation, I encourage everyone to watch this video: link

Our economic engine will no longer be able to rev as high as in the past. We’ll need to figure out ways to move forward without unnecessary acceleration (like building a new high school. I’m curious how the supporters of that millage will split on this one. An evaluation of that decision some time in the next year or so might be instructive.)

If we heavily tax the wealthy, then I will quickly leave when I become wealthy. As did many of the others, which of course was great for economies in the Caribbean, South America, Switzerland, and other areas open to receiving tax shelters of wealth.

Punishing those with money is not the answer.

Tax, if anything, needs to be fair. Don’t force the rich to do for others.

If anything, tax needs to be fair, and flat. But again, more money isn’t the answer.

Gary Salton – well said. It is nice to hear that concessions were made earlier this year, that’s a step towards more flexibility. But not all teachers were created equal, and we shouldn’t treat them as if they were.

Fred…

“more money isn’t the answer” Really?

I work in the private sector and I know you can’t grow unless you invest.

School budgets continue to get cut, yet we continue to expect more from schools by paying less. Its rather odd.

I acknowledge that taxes need to be fair (though not flat), but at some point we can’t continue to divest resources from our public infrastructure and expect to grow in any meaningful way.

@Richard….

Yes, really.

There have been fascinating studies of the price per student to results. And the bottom line, more money is not the answer.

I would certainly be interested in looking at some of the studies you reference.

Please share…

“Rhetorically speaking, why not tax $900,000 from a $1 million Wall Street bonus and distribute it to the states as funding for education, services, and infrastructure? Why leave such sums with someone who doesn’t know what to do with all of their money?” – By Yet Another

Only a person who never has nor ever intends to earn $1 Million would write such a thing as this.

FP writes: “If we heavily tax the wealthy, then I will quickly leave when I become wealthy.”

Michigan’s flat rate income tax is much more wealth-friendly than all the other urban states with graduated income taxes. The wealthy can afford to live where ever they want. So why haven’t we seen an influx of millionaires?

Indeed, the wealthy seem to be attracted to high-tax states like Massachusetts, New York, Illinois, and California.

The fact is that tax rates play very little role in choices about where to live or do business. That’s why tax abatements have been so ineffective at attracting new jobs.

@Richard…

[Link to Forbes] is a good easy to read chart. Very easy to find more studies on many of the education sites and journals around.

By Yet Another is right. We desperately need a graduated income tax on the state level to raise the money that provides the infrastructure we as citizens expect in a first world country. The self-proclaimed conservatives trashed our economy with expensive wars and tax cuts for high income individuals while they bleated about how immoral all taxes are. Taxes are the dues we pay to get the services we want and need. Good schools are one of those services.

Karen–there is enough blame to go around. Let’s not get into a “blame game” and try to figure out how to fix the problem.

Personally, I’m against a graduated income tax. Look around. There is not enough left in Michigan to hold onto people for whom money gives options. If your goal is clearing the state of people who can command high incomes, installing a tax would seem a good way to do it. A better course would be to figure a way to get them to invest here and create the jobs we need.

How about some really creative options. For example, do we really need the Upper Peninsula?

“If we heavily tax the wealthy, then I will quickly leave when I become wealthy. …If anything, tax needs to be fair, and flat. But again, more money isn’t the answer.”

As the wealthy themselves would be most happy to tell you, more money is the answer! They love that answer. Michigan income tax notwithstanding, they will also tell you that ‘flat’ is not the answer: they deserve more, much more; the rest of us less, far less. For them, the growing U.S. income disparity is more filling while less flattening.

I agree with the wealthy that more money is a good answer. So, let’s take a big chunk from their stash to spread among the population. This worked for Robin Hood. Today it works reasonably well for Western Europe, whose economies — in comparison to ours — have greater stability, far more services and much less severe poverty. They don’t even choose to spend all their tax money on shooting at foreigners or covering the bad bets of failed Wall Street gamblers. Amazingly, they’ve institutionalized well-funded public education for all. (Not to mention allocating lots of funds for a few other odds & ends like extensive mass transit, affordable housing and fully-covered, universal health care.)

On tax matters, I’m a traditionalist in the sense that I’d like to see the income tax returned to its progressive-era roots, namely as a luxury tax imposed on people who really don’t need anywhere near all that money. Then reinstitute the steep, graduated tax structure we had under the Republican leadership of President Eisenhower (what a socialist! — no wonder free-market hero Joe McCarthy went after his administration!) The residents of Michigan should rebuild the state-level taxation structure along similar lines. This will put some real money in the public till during both good times and bad.

A number of years ago, when a reporter questioned Madonna about her $47 million annual income, she defensively stood her ground and quipped, “I worked hard for that money.” Unless an attempt at ironic satire, such comments come across as a tad sociopathic, although hardly unique at all among the well-to-do set. Wouldn’t a sane, caring nation want to tax the daylights out of her $47 million personal haul, so that teachers and maintenance staff at our public schools can work hard for it instead?

Should you someday leave the country for reasons of green, and select Europe as your destination, pay a visit to Amsterdam. There you might find John Sinclair, who is said to hang out, in part, also for reasons of green (different variety). Discuss your similarities & differences together in a street cafe under a gentle, smoky haze. …It’s allll good.

Fred,

The chart you link to is Fortune’s list of “Best Bang for Your Education Buck”, not any proof that – on the whole – more money doesn’t lead to better outcomes in higher education.

Best bang for your buck is nice, but it doesn’t really prove anything more than the fact that SOME school districts can achieve high results with less money. Again, that’s great, but it doesn’t mean anything more to me than that those schools should be studied and the lessons applied elsewhere.

Jim — was just an example, a quick search on google will find you many studies. There are many. And 60 minutes even did a whole educational broadcast a season or so back. The example does show you prices per student and the ROI in terms of college prep scores. Which if anything, should help you ask… what kind of bang are you getting? Why would you put more money in a place where people with less do a lot more?

Yet Another — I’m hoping you’re sarcastic. If not, I truly have no response to you other than when you make this an us vs. them attitude, and classify another based on wealth, you’ve made a big mistake in logic.

Fred,

I hear what you’re saying, but let me offer a couple of thoughts. I’d never suggest funding is a cure-all, particularly for very troubled districts where problems are much more societal than educational. It’s problematic to try and analyze a thesis that states “More money is better” or “Money isn’t a major factor in educational achievement,” because school districts vary so much.

In your average American suburban situation – the kind of school districts that make up Washtenaw County, albeit ranging on a spectrum – I think more school funding probably means higher test scores and a better education. Can I prove that? No. Is there a study on the topic? Not that I can find.

But I’m very familiar, for instance, with the top New Jersey schools on that Fortune list, and they’re all affluent suburbs that spent more than $10,000 per student (and in 2004 no less).

ref 34: Yet Another: I don’t blame you for masking your name. Its a good strategy given your message. I wouldn’t want to be associated with it either.

Jim Carty stated, “But I’m very familiar, for instance, with the top New Jersey schools on that Fortune list, and they’re all affluent suburbs that spent more than $10,000 per student (and in 2004 no less).” I would point out that correlation is not necessarily causation. Secondly, we are not an affluent suburb, we are a city with nearly 120,000 people. Thirdly, you miss the fact that a lot of waste has built up in the system over the years and we now have a chance to purge this waste by not blindly approving this millage. The school system will be back for another attempt at a millage increase if this one fails; but next time they will have to do a better job of providing a better value proposition to voters. It is foolish to simply approve a millage increase without getting something substantial in return.

I’m voting No on the millage and encouraging others to do the same. Fred is absolutely correct in stating that there is no correlation between additional funding and increased educational outcomes. Those concerned about their childrens education need to spend more time with their children. Parental involvement is the single most important factor that leads to improved scholastic performance. Public libraries are free. Parents need to raise their expectations and ensure that their kids can read and write well by ensuring that they read and write often. Turn off the TV and the video games and discuss newspaper articles and books. Teach your kids to be active, involved citizens by writing cogent letters to their elected representatives. Don’t expect that by giving more tax dollars to local schools that you will accomplish anything other than the hiring of more administrators who won’t impact educational instruction.

EOS, I really like what you said…

Something to think about… Private schools generally have 1 administrator every 10 – 20 teachers. In public schools, administrators can outnumber teachers.

Fred, do you have any numbers to back up your claim that admins can outnumber teachers in public schools, or is it just an impression?

I’d like to chime in briefly on the question of where many of the “facts” we’ve seen repeated come from. While there are many issues in this campaign to which I’d like to speak, I would like to take exception to one in particular:

In comment #7, “Ann Arbor Girl” asserts “Why do you think the MEA has spent 2 million on this campaign?” I am astounded by the sheer audacity of this falsehood.

I’m campaign manager for the Ann Arbor Citizens Millage Committee, which is responsible for the millage campaign in the AAPS district. I can assure everyone, as our campaign finance filings will soon confirm, that our budget is about a hundred times smaller than that, and has mostly been built from small individual contributions from the community (mostly not teachers, by the way).

No one, at least not on the “vote yes” side, has access to even a tiny fraction of the dollar amount “Ann Arbor Girl” claims has been spent.

This kind of – well, to be blunt – fabrication cheapens the entire debate and shows a casual disregard for the serious issues on both sides of this question which which our community must grapple.

Holding to a principled position is honorable; making things up, is not.

In Michigan in 2006, there were 100,638 teachers. The public schools employed 209,835. Data from nces.ed.gov.

Fred,

That stat doesn’t come close to backing up your contention that administrators outnumber teachers. In fact, it probably proves the contention is not true. Every non-teaching employee is not an administrator (nurses, para-professionals, bus drivers, janitors, for example).

And, Chuck, whether you want to call Ann Arbor an affluent small city or an affluent suburb (I’d argue it’s a mixture of both), it’s really secondary to the overall debate.

Bottom line here? Taxes are generally down in Washtenaw County over the last few years and unless this millage is passed there will be large layoffs of teachers and staff. If that happens, your home values will decrease further. A vote for the millage will strengthen home values and most people will still be paying less in taxes than they were three or four years ago.

A vote against it will save you a few dollars now and cost your a lot of dollars in the long run in terms of home values, job creation and competitive students.

“Something to think about… Private schools generally have 1 administrator [for] every 10 – 20 teachers. In public schools, administrators can outnumber teachers.”

Mr. Posner I am not arguing against your stated position because I am not convinced how I will be voting, and may end up casting my vote along with you; however you offered something to think about. The above MAY be a true statement IF by administrator you mean just that. Not a coach, not a groundskeeper, not a cafeteria worker, not a secretary, not after-school counselors, nothing.

When asked for numbers to corroborate your assertions, you offer:

“In Michigan in 2006, there were 100,638 teachers. The public schools employed 209,835.”

Mr. Posner you are not trying to say that Michigan hired more than 109,000 administrators, are you? I read this as 109,000 employees, the majority of which are NOT administrators. This isn’t a way to get your (our?) point across. I am very aware of the fact that school districts can get top heavy with bureaucratic staff and I am NOT content with school administrators who have no educational (time in the classroom) experience. I, like you, do not want to add to the school’s administration but I do want an excellent education for our children.

So confronted with the vast disparity in your numbers I tested your private school assertion against Greenhills and found that their website references 74 teaching faculty. (Do any serve administrative functions too? It does not say.) Their directory of faculty and staff lists a total of 120 people, telling us that there are at least 46 people there who are not faculty. That ratio is 1 staff (not just administrator, mind you) for every 1.6 teachers.

I would also not directly compare this to the teacher / employee ratio for the state as I have to imagine that every groundskeeper, janitor, part-time employee, bus driver, etc., who may work at Greenhills is not necessarily listed in their on-line directory.

I tried then to imagine a school with a 1 to 10 ratio (forget 1 to 20) of staff to teachers and had a hard time doing it. Using some of Greenhills numbers, with 74 teachers teaching 500 students could they really run the facility with only 8 other people? Hard to imagine. Now if it were 4 to 8 administrators with a supporting staff I could see that.

Mr. Posner let’s keep the discussion honest.

Thanks for the website, Fred. I went to the Ann Arbor Public Schools page and learned that this district has approximately 3008 FTE, of which 1061 are teachers. But there are only 219 administrators and administrative support staff (including both district and school). Then there is a figure of 1, 319 “other support staff”, which is probably where the school bus drivers and janitors fall in. The rest are instructional aides, library/media specialists, student support staff, and guidance counselors.

Statistics are useful but require some analysis and precision before being used to draw conclusions.

Incidentally, that same database does list the private schools in Washtenaw County with some enrollment figures but does not have the staffing information.

I did a quick search. Sorry that my personal time does not allow me to do exhaustive details for you… however, I am an education minor and have studied this. Especially the financing and the mis-perception that additional money improves education. Please, FOIA the information yourself and get the numbers. As far as honesty, try using your real name.

Thanks Vivienne,

Teachers are sometimes over reported when an administrator also has a class or classroom time. In that case, school boards often classify that person as a teacher, when their full-time job is mostly administrative. It gets very messy… which is of course, what one expects in a bureaucracy. Much like other stats… such as NJ high school graduation rates (which are high) do not take into account the number of NJ students receiving diplomas that cannot read or pass a high school proficiency test (which had been estimated by the Black Alliance for Education Options at 11 – 15,000 per year baeo.org).

The fact that you only did a quick search doesn’t excuse your making a claim that’s manifestly false. This isn’t about getting “exhaustive details” wrong–you’re just wrong. It isn’t about your adversaries being anonymous (and anonymous or not, they provided facts to support their claim)–you’re just wrong. Man up and admit it.

Fred,

Elsewhere, on your personal blog, you’ve written this:

“My attitude is simple. Taxes are evil. The government continuously mismanages your money, and giving them more money makes you a bad parent. Unless you have looked at the receipts, you are raising a horrible child and should be ashamed of yourself. Stop it. Stop it. Stop it.

Vote no on every single tax increase. ”

Which forces me to ask: Are there any circumstances under which you’d vote for this millage? Even if, for example, you were definitively shown that it would result in better schools and educational outcomes and higher property values?

Because if not, if you’re just going to vote no on every single tax increase, regardless of the reasons behind it or a potentially real need, I think you should say that up front (because once you say that, your perspective and iffy stats must be viewed in a different light).

So as not to be wholly negative, I’ll say that I don’t in principle disagree with what Fred is saying. School districts are unfortunately in kind of an arms race about some things that are of unproven efficacy, such as more and more and more technology, and there is an increasingly vast amount of reporting and bookkeeping and tracking mandated by various agencies (do you think those administrators just twiddle their thumbs all day?). This stuff costs money, and it’s not illegitimate to be skeptical about its value to the community. But it’s also largely not something the districts can control. So when the districts are being squeezed from above by requirements and from below by funding cuts, it seems reasonable to be for a community to determine that this is one of our major assets (both ethically and economically–as Jim has done a great job of arguing) and want to support it. It’s not some kind of redistributionist plot (not that there’s anything wrong with that).

Vivienne,

If you think this is only a 5 year millage, Think Again!! Once this millage is passed it will be renewed forever. It is much easier to “renew” an existing millage. Every millage that has come up for renewal in the past 25 years, has been renewed! So think long-term. Once it passes, it’s money in the bank forever!

But each time it is a decision by the voters.

We moved into the district two years ago after leaving Michigan in ’84 after grad school. We were astonished to see how much of our taxes went to Washtenaw Community College, but that’s another topic…

I don’t look at it as 2 mills, I look at it as a substantial dollar and percentage increase. In the two years we’ve lived here I’ve seen a new High School open that’s like a ghost town, renovations to Huron High School offices, and new athletic fields at Huron – all in a devasting economy. I see my son’s report card mailed home in a 10 x 12 (or larger?) envelope – an envelope that costs a lot more than a standard #10 and also costs a lot more to mail. If Huron High School has 2,300 students, and they mail that envelope 4 times per year, with $1.05 postage on it, that’s $5,612 in postage costs alone that is wasted at one school. Just a small example of wasted money.

In all industries, health care goes up and the EMPLOYEE has to pay more of it. Teachers too. That’s an increased SHARE of the costs, not just absorbing your old percentage of the total costs. In private industry, we have to work harder as employees get cut, more hours per week for no more pay. That’s the way things are right now.

I’m a PROPONENT of schools, and moved here for the best schools, but I will not support a blanket large increase like this without seeing belt tightening at the schools – and without them explaining how they are tightening their belts and having accountability for how they are going to spend the funds.

Rick, Thanks for your comments. It is exactly the lack of accountability that is at the heart of the problems with this proposed WISD millage. There is a disconnect between the unelected bureaucracy collecting the tax (WISD) and the local elected school boards receiving the money.

The school districts have completely failed to show how they have taken the difficult and even painful financial choices that must be made BEFORE coming back to the voters in such a lousy economy.

More at [link]

I would like to point out that if we reject this increase, WISD will be back in a few months with another proposed increase. But at lease they will have to do a better job of improving the value proposition. It is foolish to vote for this increase this time even if you think the schools need the money.

Vote no on every single tax increase. ”

Which forces me to ask: Are there any circumstances under which you’d vote for this millage? Et voila! I’m certain there are a fair number of principled people commenting here and at other local news sites that they pay too much tax and will vote not this time, but who support public education and the basic tenants of representative democracy. And then you have extremist individualist — libertarians and others of that ilk — who rely blindly upon an ideology of selfishness. It says a lot that the loudest and most fervent opponents of the millage are these folks and a fantastically wealthy and powerful real-estate estate company making a naked, self-interested power grab.

The thing is, Rick, within context it’s not a substantial increase for most people in Washtenaw County, who are paying lower taxes now then they were three years ago due to falling home values. It’s just a vote to make up some – only some – of the decreased tax revenue.

Selling it as a big tax “hike” and the district somehow not making sacrifices ignores the math. To put it in simple (and not-to-scale) terms, if you were giving $100 annually in tax money to the district three or four years ago, and you are now giving $90 a year, and this millage increases that figure to $95, you’re still paying less taxes than you were.

I know I will be if this millage passes. I’ve done the math.

Most people, of course, don’t even look at that tax bills and compare what they’re paying year-to-year.

The district has laid off teachers and staff, it’s not like it hasn’t made sacrifices. The biggest reason I moved to Dexter instead of Ann Arbor, btw? I wasn’t going to send my kids to a mega high school like Pioneer or Huron. The opening of Skyline makes the district more attractive to me and other people I’ve talked to.

Again, voting this millage down is going to lead to staff layoffs. It’s a lock.

And when that happens, your property values will get hit again.

You’ll pay either way.

As I understand the process, if the millage is rejected in November then the process to bring it back again would have to start over at the beginning. That is, each of the local school districts would have to consider and approve identical resolutions once again requesting that the WISD put a new millage request on the ballot.

Should the millage be rejected by the voters and the elected school boards decide to go after it again, that would be a good reason to aggressively pursue the replacement of those elected officials.

Jim Carty – “Selling it as a big tax “hike” and the district somehow not making sacrifices ignores the math. To put it in simple (and not-to-scale) terms, if you were giving $100 annually in tax money to the district three or four years ago, and you are now giving $90 a year, and this millage increases that figure to $95, you’re still paying less taxes than you were.”

I’m fascinated by the duality of Jim’s argument.

On one side he’s argued that the schools HAVE BEEN HARD IT by Michigan’s economic depression and Lansing’s budget foibles, so we need to step in and help them out.

On the other hand, he now says that we taxpayers are BENEFITTING TOO MUCH from Michigan’s economic depression and the associated collapse in our property values (and alleged decrease in property taxes on a dollar basis), so we need to stop being greedy and give back some of that decrease to the schools.

Jim, you must be a renter who’s never actually owned a home or business and never paid property taxes. That’s the only real world circumstance in which you’re argument makes any sense.

Your argument appears to be built on the assumption that every variable other than tax rates has remained the same, despite the economic mess; that household income levels haven’t collapsed, that unemployment rates haven’t skyrocketed, and that foreclosures and property abandonments haven’t ballooned in the last few years.

Your argument also fails to take into account that this is a five year millage, with options to renew forever once it’s passed. While property values are still collapsing (likely down another 15%+ for 2010), they will eventually begin to rise, and your depression-related drop in taxes will quickly vanish – but the WISD millage will be forever.

Why is it that when school population was at it’s highest the budget was 30 million less? If you go to the schools website and look at the budgets, you’ll see that school population has been decreasing, yet the budget is much higher than it was several years ago.

Example:

In the 2009/10 approved budget, the total available money is ~ $220 million.

In the 2002/03 approved budget, the total available money is ~ $177 million.

School population in 02/03 was higher and they were projecting an upward trend. School population is now lower, and has been dropping for several years.

Cost per pupil in 2006: $10,693.86

Cost per pupil in 2008: $11,397.62

They can say they are tightening belts — they are spending more.

They can say they are reducing budgets — they are spending $50 million more now than 6 years ago, and have fewer students.

Yes, I wrote I’m opposed to taxes and urge people to vote no on new taxes. Read the entire piece though… where basically, it was that money is not accounted for before requesting more. I also do not believe in the income tax as a proper source of revenue. This method would work much better in a college town with football games, art fairs, etc. Attract people here, have them spend money on food, hotels, etc. and help the community with taxes. Yes, it will require some change. But, that change can help. Income and property taxes will ultimately fail as population leaves and property values decline. In that model, taxes are constantly raised to keep funding. Not to mention, as the population decreases, federal funding will also fall.

Here, they are considering raising taxes to bring in revenue however, why is the spending higher now than even 3 – 4 years ago?

Source: Ann Arbor Public Schools 2009/10 budget

(in my last I omitted that a sales tax works better than income tax)

I agree with Steve Bean — “Time to get creative.” — and others who suggest belt-tightening. After losing my job, I took both of my children out of the public schools and we started home-based education. (If you think the public schools are so great…show up in the classroom several times a year without first announcing your presence at the main office!)

My daughter re-entered school (high school) this year. I can tell you that everything from colorful sticky note pads, to well-heated buildings, catches my attention in the schools. There was an entire 8-1/2″ x 1″ glossy page with four photos of children being educated, in a folder we received from the school. Was that necessary? It’s the little things I see that make me wonder about the big things.

Try having your income drop by 50% over a four-year period. Then, every excess you see in the schools offends. And a 2%-2.5% loss of funding in the public school budget seems eminently resolvable without a millage.

That’s 8-1/2 x 11…

Yes, it takes a millage, village….

Alan: If you think “the loudest and most fervent opponents of the millage are these folks and a fantastically wealthy and powerful real-estate estate company making a naked, self-interested power grab”…. think again!! Who are the biggest donors to the supporters of this millage?? The Unions! The teachers union, the administrators union, the federation of the WIS employees.

Let’s not kid ourselves, this is a union grab of money for benefits and pensions. That’s why there is NO plan to re-structure, or do business another way. They just want the money to keep the status quo..same old…same old. No new programs, no inovative solutions, just money to keep funding their benefits, etc. Inflated benefit packages, annual step increases(automatic raises written into the contract, even when they take 0% raises, that’s on top of the automatic step increases) not based on merit, inability to fire bad teachers, etc.

Take health insurance for example. The Detroit News just did an article estimating that Districts spend ~$16,000 per teacher for health benefits alone. Who is the major health insurance company for teachers? MESSA. Who operates MESSA? the MEA! To the tune of a 10% surcharge to “administer” the health insurance. This is a major money maker for the MEA, who has a $350 million, yes million, surplus. You want to bash health insurance companies, you have to look no farther than the MEA.

Last year Chelsea finally broke the cycle. They actually bid out their health insurance, settled on a BCBS plan, and saved the distrcit 10%. Why is Ann Arbor not doing the same thing??? Using the above numbers, 10% of $16,000 is $1,600 per teacher… at approx 1200 teachers in Ann Arbor, that’s $1.9 million dollars that could be saved by bidding out health insurance. Not reducing benefits, not taking away benefits, just using a different carrier!

If you want to talk about a “self-interested power grab” you have to look no farther than the teacher’s union. They have been using fear mongering, “we’re going to fire 200 teachers” to acheive their goal. There’s never any talk about re-opening contracts, which Brighton did when it’s millage failed. There’s no talk about doing business another way. No, all the talk is about teacher cuts, and program cuts. They’re holding our children hostages in their quest to maintain the status quo, and they’re using our school district to spread their fear.

I am against the 2 mill proposal and will vote No.

With three kids in AAP (Pioneer, Tappan and Patengill), it is clear to me that raising taxes in support of a flawed school board with bloated costs is not in the long term interest of my/our children. We support 6 high schools; that is 3 or 4 too many. Community High needs to consolidate into Huron, Pioneer or Skyline. Sell the bricks and mortar. My family is intimately involved in PTSO and the Pioneer Football Booster Club and we see how the BOE has pushed their problems back to the taxpayers by funding too many sports with too few dollars. A quick overview of Pioneer sports expenses uncovers that salary and benefits for all sport coaches is 72% of all Pioneer sports total revenue(YE 2008 Annual Report p.59) My personal professional business unit is able to keep their salary and benefits below 40%. The conclusion is that the costs to run the sports programs are 32% higher even with tens of thousands of dollars in unmet need collected from the community a spaghetti dinner, a pancake breakfast, a can drive, a car wash, a golf outing at a time. In addition, a peer high school in other state( my alma mater) spends less, funds more and pays administration, teachers and coaches better because of their courage and leadership. Of all the line items in the AAPS 2008 Budget, only one stood out as made up. YE 2008 p. 34. Line item: Parking Project/Vending Receipts. Estimated revenue equaled Revenue to the exact dollar. How can this be? Someone lunar landed on a number and clawed back to make it wash. How did kids eat snacks, drink sodas and how did the U of M parking concession have the exact same revenue forecast and revenue realization? $1,250,000 of magic revenue. How can we allow this? How much was it really? Did Plante & Moran audit or rubber stamp?

In my email today from Pattengill> I have the opportunity to spend $40 on “Sally Foster”, or $2.00 for a Root Beer Float for Howell Nature Camp or a couple of hundred dollars for the purchase of microwaves for the staff lounge. I am not making this up. The 2 millage adds hundreds of dollars to my property taxes.For what? Status quo? I’d rather buy the BOE a red pen to reduce costs, a pair of big boy pants to wear when renegotiating the parking concession, and calculator for the principals to all get together and buy sports, music and art equipment by using the power of the size of the student body across all the schools to buy the kids what they need. We enjoy no bulk break in prices when a dozen plus schools negotiate on their own.

Just read Mary’s great article and quickly through this interesting thread. Quick observation on Fred’s post at #16, where he notes that “Tax rates may have gone down, but spending didn’t. In 93-94, the allocation per pupil was $7,574. It rose to $9,234 in 02-03.” Measured in constant dollars, $7,574 would be equivalent to about $9,654, using the CPI to measure the relative value. In other words, actual per pupil spending dropped by just over $400. Niki’s anti-union ranting is amusing–talk about class struggle…

John,

Considering how many UAW jobs vaporized in Michigan between 1993 & 2003; I’d say it was a nice trick keeping funding within $400 of its 1993 level. Also, remember 93-94 is the year before Proposal A.

Late to the discussion, but just wanted to pass along a big THANK YOU to Mary for her excellent summary of this hot-button issue. This piece is a much needed resource amidst the many opinions and misinformation presently in circulation.

And @#65. ME: Great perspective. Well said.