Column: Let’s Get DDA Tax Capture Right

The Ann Arbor city council’s March 4, 2013 agenda includes a proposed change to the city ordinance (Chapter 7) governing the Ann Arbor Downtown Development Authority. I think most of those ordinance amendments have considerable merit, and warrant the council’s consideration. But it’s possible that the amendments themselves won’t receive their due consideration, because they’ll be dismissed as politically motivated.

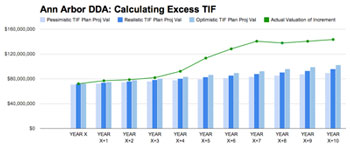

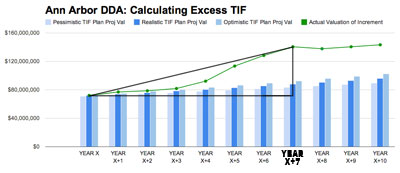

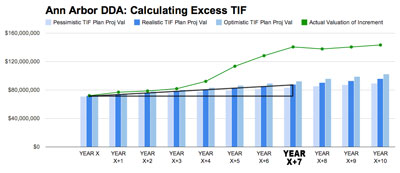

Ann Arbor DDA tax increment finance (TIF) capture: Actual valuation (green line) of the increment compared to projected valuation in the DDA TIF plan (blue bars correspond to one of three estimates – pessimistic, realistic, and optimistic).

The Chapter 7 amendments are being proposed by Stephen Kunselman (Ward 3), who’s been joined by Sumi Kailasapathy (Ward 1) in sponsoring them. Kailasapathy’s co-sponsorship might help only incrementally to buffer the proposal against criticism that they’re motivated by Kunselman’s personal political aspirations.

On that theory, Kunselman is proposing revisions to Chapter 7 in an effort to raise his profile – in anticipation of a possible mayoral candidacy in 2014, and to shore up support for his Ward 3 re-election campaign his year. Given that he took out petitions for the 2013 Democratic primary on Nov. 3, 2012 – before the Nov. 6 general election – and collected signatures outside the polls, it’s pretty clear that he’s eager to seek re-election to his council seat. And last time around, in 2011, he campaigned as much against the DDA as he did against either of his two opponents. Kunselman is quoted in the February 2013 issue of the Ann Arbor Observer saying that if mayor John Hieftje runs for re-election next year, he’ll run against Hieftje.

However, on the theory that these proposed amendments are all about Stephen Kunselman and not about good public policy, I figure it’s also reasonable to toss in another possibility. Perhaps Kunselman is trying to raise his profile enough to win local blog Damn Arbor’s current poll as “most attractive councilmember.” The poll includes Kunselman as one of just four nominated councilmembers. It’s not clear to me if the voting is meant to include sartorial choices, but if it does, Kunselman could objectively be considered a natty dresser.

All kidding aside, it would be easy and convenient to dismiss the Chapter 7 amendments as a political ploy, and save the work of understanding some gnarly tax calculations. [You'll have a head start on this if you've read my previous column on the issue: "Tax Capture is a Varsity Sport."]

But I think at least some of the proposed changes to Chapter 7 have considerable merit, independent of Kunselman’s political ambitions. Millions of dollars are at stake. As councilmembers give this proposal initial consideration on March 4, I hope they focus on the tax-related amendments.

The proposed Chapter 7 amendments can be divided into two kinds: (1) those that deal with the calculation of the tax increment finance (TIF) capture by the Ann Arbor DDA; and (2) everything else. For that reason, I think the city council should consider dividing the proposed amendments into separate questions for its consideration. This could pose a parliamentary challenge, because the subset of Robert’s Rules adopted by the Ann Arbor city council does not include “dividing the question” as a proper motion during debate. But even if the division isn’t achieved in a parliamentary fashion, councilmembers would be well served at least mentally to divide the proposed changes this way.

By grouping the Chapter 7 amendments on TIF capture for separate consideration, councilmembers would, I think, have a better chance at understanding the implications.

What are the implications? As proposed in the Chapter 7 amendments, the DDA would, in future years, potentially capture less through its TIF. Compared to the way the DDA currently interprets the ordinance, that potential for FY 2014 would translate into $713,221 less in total capture by the DDA. Of that total, the city of Ann Arbor’s share would be $429,409. The remainder would be distributed to other taxing authorities in the DDA district that have their taxes captured: Washtenaw County ($149,392), Washtenaw Community College ($94,257), and the Ann Arbor District Library ($40,163). For FY 2014, that would still leave the DDA with $3.96 million in TIF capture.

Those calculations are based on the city treasurer’s memo that accompanies the council’s March 4 agenda item. But even if the proposed Chapter 7 amendments were enacted, the city treasurer’s calculations show that for the following year, in FY 2015, the reduced amount captured by the DDA would be just $19,862. And it would leave the DDA with $4.77 million in TIF capture for FY 2015.

Why the difference? It’s because the proposed Chapter 7 amendments still don’t explicitly settle a point of unclarity in the ordinance language, which involves the method of TIF calculation.

It’s this method of TIF calculation that should receive most of the council’s attention as it considers the Chapter 7 amendments. Councilmembers should specifically be focused squarely on this question: Should the TIF calculation be based on a year-to-year method or on a cumulative method?

Pay No Attention to the Politics

Some of the proposed Chapter 7 amendments involve governance of the DDA. For example, if the amendments were enacted, then it would not be possible for an elected official to serve on the board of the DDA. Currently, mayor John Hieftje serves on the DDA board, something that’s allowed for in the state enabling statute for downtown development authorities. And in the past, Sandi Smith served as an elected member of the city council, while also serving on the DDA board. Despite Kunselman’s objections to it, the state statute on incompatible offices explicitly allows for simultaneous service on a city council and the board of a downtown development authority.

The Chapter 7 amendment on board membership wouldn’t take effect until after the November 2014 general election – so even if enacted, it would not require immediate removal of mayor John Hieftje from the board.

Another Chapter 7 amendment involves a policy on use of TIF funds inside the DDA TIF district. Currently, the DDA’s own policy for its housing fund allows the DDA to make expenditures on properties located up to a quarter mile outside the DDA TIF district. That’s based on the idea that investments in housing that are sufficiently near the downtown would have an indirect benefit to the downtown. For example, the DDA had pledged $500,000 in support of Avalon Housing‘s now defunct Near North affordable housing project, which was located on North Main Street, outside the district.

The Chapter 7 amendment would require TIF funds to be spent on projects that directly benefit properties inside the DDA TIF district.

Another Chapter 7 amendment would clarify that the DDA’s annual report has to be filed with the city clerk in early January of each year.

I don’t think it’s necessarily unfair to call this set of changes politically-motivated – but that doesn’t count as an argument against any of them. All these changes are at least worth the council’s consideration.

But if councilmembers have an hour to study and deliberate on all the Chapter 7 changes, then I think they should spend 59 minutes on the changes to the TIF calculations.

Chapter 7 TIF Calculations

I’ll begin with a quick overview of how TIF works generally, followed by the current text of Chapter 7, the history of this specific issue, and why the proposed ordinance changes don’t go far enough to provide clarity.

TIF Calculations: How TIF Works

Downtown development authorities in Michigan do not levy taxes of their own, but rather “capture” taxes levied by other entities within a specific geographic area – the TIF district. The “increment” in a tax increment finance (TIF) district refers to the difference between the initial value of a property and the value of a property after development. Among other things, Chapter 7 sets forth how the Ann Arbor DDA’s tax capture is confined to the initial increment on the value of a property after improvements are made, and does not include subsequent increases due to inflation.

TIF Calculations: Chapter 7 Text

In Chapter 7, three paragraphs bear directly on the way that the TIF calculation is supposed to be performed for the Ann Arbor DDA. I’ve added the paragraph numbering, to help keep things straight, and added italics to highlight some of the points I’ll be making. [.pdf of Ann Arbor city ordinance establishing the DDA]:

¶1 If the captured assessed valuation derived from new construction, and increase in value of property newly constructed or existing property improved subsequent thereto, grows at a rate faster than that anticipated in the tax increment plan, at least 50% of such additional amounts shall be divided among the taxing units in relation to their proportion of the current tax levies. If the captured assessed valuation derived from new construction grows at a rate of over twice that anticipated in the plan, all of such excess amounts over twice that anticipated shall be divided among the taxing units. Only after approval of the governmental units may these restrictions be removed.

¶2 After the then earliest dated bond issue of the downtown development authority is retired, the captured assessed valuation prior to the date of sale for that issue shall be returned to the rolls on the next succeeding tax levy.

¶3 Tax funds that are paid to the downtown development authority due to the captured assessed value shall first be used to pay the required amounts into the bond and interest redemption funds and the required reserves thereto. Thereafter, the funds shall be distributed as set forth above or shall be divided among the taxing units in relation to their proportion of the current tax levies.

Having reviewed old newspaper clippings from the early 1980s, when the DDA was first established, it seems almost certain that ¶1 was included for a specific reason. It was included to provide some assurance to other taxing authorities – in case the newly formed DDA were wildly successful in its mission of spurring private investment in the downtown area. The assurance given in ¶1 was that not just the DDA, but also the other taxing authorities would enjoy an immediate benefit of that possibly unanticipated success. Success is defined in terms of the projected value of the increment as expressed in the TIF plan.

The TIF plan is a foundational document for the DDA. Here’s an extract from the Ann Arbor DDA’s TIF plan from its 2003 renewal [.pdf of DDA TIF plan appendix]:

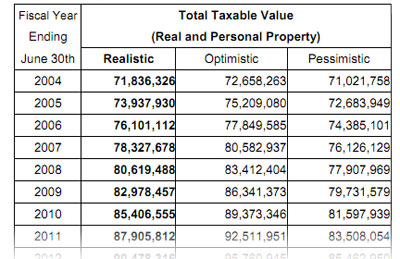

Extract from the Ann Arbor DDA’s TIF plan table. It shows the projected valuation of the increment on which the DDA’s TIF capture will be based.

The fact that three different estimates of anticipated growth are included in the TIF plan leaves room for disagreement about which estimate – realistic, pessimistic, or optimistic – should be used to calculate the redistribution described in ¶1. But the Ann Arbor DDA’s current legal position is that even under ¶1, no TIF funds need to be distributed to other taxing authorities, given the DDA’s current financial picture.

That legal position is based on ¶3, which the DDA interprets as meaning that no re-distribution to other taxing authorities needs to be made under ¶1, until the total amount of the DDA’s debt payments falls below the amount of its TIF capture. In the FY 2014 budget, adopted by the DDA board at its Feb. 6, 2013 meeting, about $6.5 million is slated for bond payments and interest. That clearly exceeds the amount of anticipated TIF capture in the FY 2014 budget – about $3.9 million. The DDA is able to make those debt payments, because about half of that $6.5 million is covered by revenues from the public parking system. The DDA administers the public parking system under contract with the city of Ann Arbor.

As a side note, I think it’s worth thinking about the text of ¶2 from the perspective of the early 1980s – because ¶2 seems to contemplate a much smaller-scale DDA for Ann Arbor than the one that now exists. It seems to contemplate a DDA that, for a specific project, itself issues bonds – based on the TIF from a specific increment in property values. But after the bond is paid off, then under ¶2, the DDA would no longer capture TIF on that increment. Of course, it could be argued that ¶2 simply doesn’t apply, because bonds for DDA projects are issued by the city of Ann Arbor, not the DDA itself. But by that same reasoning, it’s not clear how ¶3 would provide an argument against re-distribution of TIF to other entities.

In any case, the Chapter 7 amendments to be considered by the council on March 4 would render moot any legal arguments about how correctly to interpret ¶2 and ¶3. That’s because the proposed amendments would completely strike both ¶2 and ¶3.

TIF Calculations: History

I don’t think the proposed elimination of ¶2 and ¶3 from Chapter 7 can be dismissed as a political attack by Kunselman on the DDA.

This issue first arose back in the spring of 2011. The context was the year-long hard negotiations between the DDA and the city over terms of a new contract under which the DDA would manage the city’s parking system. The Chapter 7 issue emerged just as the DDA board was set to vote on the parking system contract at its May 2, 2011 meeting.

When the issue was identified by the city’s financial staff, the DDA board postponed voting on the new contract. The period of the postponement was used to analyze whether the DDA’s obligations under ¶1 could be met – at the same time the DDA was ratifying a new parking system contract, which required the DDA to pay the city of Ann Arbor 17.5% of gross parking revenues.

Initially, the DDA agreed that money was owed to other taxing authorities, not just for that year, but for previous years as well. And the DDA paid a combined roughly $473,000 to the Ann Arbor District Library, Washtenaw Community College and Washtenaw County in 2011. The city of Ann Arbor chose to waive its $712,000 share of the calculated excess.

Subsequently, the DDA reversed its legal position, based on ¶3, and contended that no money should have been returned at all. That decision came at a July 27, 2011 DDA board meeting.

The following spring, during the May 21, 2012 budget deliberations, Kunselman proposed an amendment to the city’s FY 2013 budget that stipulated specific interpretations of ¶3 and ¶1 in Chapter 7, with a recurring positive impact to the city of Ann Arbor’s general fund of about $200,000 a year. Kunselman wanted to use that general fund money to pay for additional firefighters.

Kunselman’s budget amendment last year got support only from two other councilmembers – Mike Anglin (Ward 5) and Jane Lumm (Ward 2). Some councilmembers didn’t feel like they’d had enough time to understand completely what the impact would be on the DDA’s financial picture. During those deliberations, for example, mayor John Hieftje raised the general specter of the DDA not being able to meet its own financial obligations, which would then become the city’s obligations.

Fair enough. Now there’s time. Let’s take enough time to understand what the impact would be on the DDA’s ability to meet its financial obligations. But let us also take time to understand why the proposed changes to Chapter 7 need to provide more clarity than they currently do.

As proposed, the Chapter 7 amendments leave open the possibility of a year-to-year method for calculating ¶1 TIF limits, instead of using a cumulative method. The proposed Chapter 7 amendments provide clarity only about which TIF plan projection to use – realistic, pessimistic or optimistic.

TIF Calculations: Realistic Projections

Beyond eliminating ¶2 and ¶3, the amendments to Chapter 7 to be considered by the council would alter ¶1. The most significant alteration would settle the question about which projections in the TIF plan to use for the ¶1 calculation – in favor of the “realistic” projection. The following language would be inserted:

The authority shall determine the difference between the actual captured value and the adopted tax increment financing plan capture value using the realistic tax base growth calculation identified in the plan for real and personal property for each tax year. Absent designation of a realistic tax base growth calculation in any adopted plan, the application of this section shall utilize the mean of all values illustrated by year.

If the actual captured value exceeds the “optimistic” projection, then it exceeds the “realistic” projection by even more. So compared to a method that uses the “optimistic” projections, a method using the “realistic” projections would result in the DDA redistributing more TIF back to the taxing authorities. It wasn’t accidental that when the DDA calculated the amounts it redistributed in 2011, it used the optimistic growth projections in the TIF plan.

TIF Calculations: Cumulative, Year-to-Year

Based on the proposed Chapter 7 revisions, the city treasurer’s memo includes the following calculations, presumably based on certain assumptions about when currently in-progress construction projects will be completed. The severe abbreviations are mine. In order in the table below are the city of Ann Arbor, Washtenaw County, Washtenaw Community College, and Ann Arbor District Library. The rate of the total millage levied by each entity is in parens:

Entity (mill) FY 2014 FY 2015 A2 (16.5720) $ 429,409 $ 11,958 WC (5.7654) $ 149,392 $ 4,160 WCC (3.6376) $ 94,257 $ 2,625 AADL (1.55) $ 40,163 $ 1,118 Total "Rebate" $ 713,221 $ 19,862 DDA Capture $3,964,457 $4,774,758

-

In FY 2014, there’s a sizable redistribution calculated. But in FY 2015, it’s almost inconsequential. Why is there a disparity between years? This relates to the fact that the language of ¶1 asks a tax analyst to determine whether the valuation of the increment “grows at a rate faster” than that in the TIF plan projection. And completely absent any context, that phrase could mean one of two things when the TIF is calculated:

- The analyst is supposed to compare the increment’s valuation this year to last year’s valuation, and ask: Was the rate of increase from last year to this year greater or less than the rate of increase forecast in the TIF plan?

- The analyst is supposed to compare the increment’s valuation this year to the valuation at the start of the DDA, and ask: Is the rate of increase for the whole period of the DDA up to this year greater or less than the rate of increase forecast in the TIF plan?

Graphically, here’s the situation. The green line is the actual valuation of the increment. The blue bars represent the three alternatives – realistic, pessimistic or optimistic.

The green line shows actual valuation. The blue bars depict the TIF plan projections for the increase in valuation, based on pessimistic, realistic, or optimistic projections. Year X is 2004. Data for the final two years was estimated. For other years, the figures are actual.

The proposed Chapter 7 revisions help provide some clarity on the question of which blue bar to use: Use the darkest blue bar – the one labeled “realistic.” But the Chapter 7 revisions don’t provide clarity on the question of a year-to-year versus cumulative method.

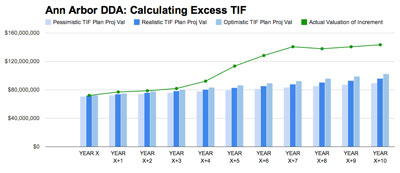

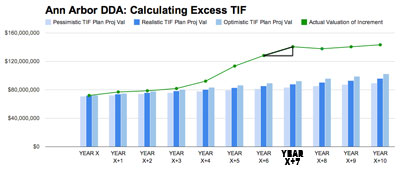

Let’s say it’s YEAR X+7 and we’re trying to calculate the right TIF. Graphically, here’s the question: Do we use the method in Chart A or in Chart B below? More simplistically, for YEAR X+7, do we use the little triangle to compute the rate of increase, or do we use the big triangle?

If we use the big triangle (cumulative approach), then the corresponding big triangle for the blue bars is this one:

It’s pretty easy to see that the triangle in Chart B shows a greater rate of growth than the triangle in Chart C. That is, the rate of growth for the actual valuation of the increment in Year X+7 (green line) is greater than the rate of growth indicated in the TIF plan (blue bars).

And in fact we don’t have to draw the triangles for the cumulative approach. Just look to see if the green line is above the blue bars. On the cumulative approach, if the green line is above the blue bars, then the DDA should distribute TIF back to other taxing authorities.

But on the “small triangle” analysis – the year-to-year approach – if the green line levels off or dips, as in YEAR X+8, then that would count as less of an increase than the steady gains forecast in the TIF plan. So in YEAR X+8, no distribution would be owed to the other taxing authorities. That’s despite the fact that the green line is clearly still above the blue bars. On the year-to-year approach, increases in the valuation that exceed expectation could yield an immediate benefit to other taxing authorities only in the same year a new development comes on line. Thereafter the DDA would, on this approach, capture taxes on the full amount of the increment.

That’s why the city treasurer’s calculations show a drop-off for the amount of redistributed TIF from FY 2014 to FY 2015. It’s the year-to-year method that is assumed. From the memo [emphasis added]:

The DDA will use the same method of calculation used in the determination of refunds for Fiscal Years 2003-11. This method contemplated a year to year actual rate of increase versus the rate of increase of the tax base growth estimate in the TIF plan, not the value of the difference between the actual capture versus the tax base growth estimates in the TIF plan.

That’s the part I think councilmembers need to challenge. I think there’s no question that the only rational way to handle this is to take the cumulative approach.

We know there was concern back in the early 1980s expressed by other taxing authorities – about the amount of TIF that might be captured by the new DDA. We know that this concern is almost certainly the reason ¶1 appears in the DDA ordinance at all. I think that any rational conversation back in the early 1980s must surely have been based on this basic intuition: If the green line is above the blue bars, then half the distance between them will be redistributed to the other taxing authorities. With this historical context, it’s not plausible to use a year-to-year method to calculate the TIF under Chapter 7.

In round back-of-the-napkin numbers, if these calculations were done correctly, the city of Ann Arbor could expect to see at least $250,000 added to its general fund every year, not just this next year.

Next Steps

While I’m championing a further ordinance revision that would commit to a cumulative approach for these calculations, I think it’s important to pause and ask for some additional specific data. It’s also important explicitly to solicit the view of the other taxing authorities involved.

I would suggest that any action by the council on March 4 include the following:

- Direct the city treasurer to estimate TIF redistribution to other taxing authorities and DDA tax capture for the next 10 years, using: (1) the cumulative approach; and (2) the year-to-year approach.

- Request that the DDA incorporate the city treasurer’s estimates under (1) into its 10-year planning spreadsheet and to make that spreadsheet public.

- Communicate the DDA’s 10-year plan and the city treasurer’s estimates to the Ann Arbor District Library, Washtenaw Community College, and Washtenaw County, with a request that the governing bodies of those entities comment on the information.

All this might entail postponing the ordinance revision, even though the council’s consideration this coming Monday will only be for a first reading. I think it would be reasonable to postpone the proposed ordinance change – in the interest of nailing down the correct approach to these calculations to everyone’s satisfaction.

It would not be reasonable to vote down these ordinance revisions based on the idea that they’re just political theater.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor city council. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

We’ll be seeing deflating property values for the next several years at least, which will throw an interesting twist in to all this.

Thanks for the shout-out. Based solely on the frequency of Kunselman being nominated relative to other city council persons, I feel confident saying that Stephen is considered one of the most attractive members of city council.

Pay attention to the politics. The mayor appointed every single member of the DDA board.

Steve, I’m curious on what basis you foresee shrinking property values over the next few years. I just received the assessment notice from the city for my home, and it increased by 7%. Is this an outlier? (My rental property did go down, by less than 1%).

Re (3) Incorrect. Leah Gunn was appointed by Liz Brater in approximately 1992. The Mayor has renewed her appointment, however.

Great data and analysis. Thanks.

@4: It’s not an outlier, Dan, just the end of the uptrend that’s petering out. As I explained in the email I sent to you and others, the social mood is once again turning, the markets will follow, and then other prices, real estate included (lagging by less than a year, I suspect). In other words, widespread deflation. The drop in 2008 was only the prelude.

To update you and others who might be interested in the current state of the markets, per Elliott Wave analysis the Dow appears to have topped and resumed its overall downward trend. (I say appears because it’s possible that it could rebound upward one more time, but it’s unlikely.) The S&P 500 and NASDAQ Composite are out ahead of it somewhat. All are poised for a big move downward.

Holding cash (as opposed to other financial assets) is the best option for most people over that time period. Short-term US Treasuries are an option as well, as interest rates are beginning to climb. Professional traders are already shifting into short positions (betting that the stock market will go down), leaving institutional and individual investors holding equities that have already reached their maximum price.

Bringing it back to your question and the subject of Dave’s column, the magnitude of the coming market decline would suggest that sale prices will drop drastically to less than half of current values–maybe much less than half. Valuations would need to follow, I suppose, but that process would probably lag behind somewhat.

What I’m suggesting with regard to Dave’s analysis is that years X+1 through X+3 (assuming X=2013) will see steadily decreasing valuations (followed by many years—if not decades—of sub-current levels). If this doesn’t seem realistic (to use the middle-range alternative), look at what’s going on in Europe and is headed here.

Having now slogged through this and really, really tried to understand it, I’d like to know the answer to this question: which method is likely to get us more taxes from all this downtown development that can be used for actual services instead of pumping up more development?

One thing ignored in the discussion of valuation is that it isn’t just the general operating fund that is being siphoned off by the DDA. It is also all the millages, including the road millage and the solid waste millage. So the expenses due to the downtown development fall to the rest of us.

I’m agnostic about Steve Bean’s projections but I hope that the fiscal integrity of the City of Ann Arbor is not being put on the green line for any overly optimistic scenario. I’ll never forget our county budget director’s projections “the best predictor of the future is the past” in the early 2000s. (It showed a straight-line increase of about 45 degrees.) The county went into a lot of debt which the current BOC is now struggling with while they eliminate departments.

An important function of city council — as stipulated by the city charter — is the vetting of mayoral appointments. The council is required to approve or reject mayoral appointments to boards and commissions. This process is critical to the checks and balances needed for governing our city.

Over the years, Council has ignored its obligation to vet mayoral appointments. The consequences of this failure are serious, as appointees must be independent of self-interest in matters that come before their board or commission. Politically speaking, they must not be beholden to a mayor, or simply chosen for appointment because they will vote a certain way instead of bringing an unbiased and independent view to the board’s deliberations. The appointment process as described in the Ann Arbor city charter helps prevent politically-motivated appointments. If observed, it will help ensure a fair and representative selection of citizens to serve on our boards and commissions.

A case in point is the DDA (Downtown Development Authority) whose members are appointed by the mayor. DDA is a major organization with significant power over the way our city addresses commercial development. Because Council has not vetted DDA appointments, DDA’s actions on behalf of Ann Arbor’s voters has caused considerable controversy.

DDA members — insulated from the vetting process — can bring an agenda to the table that is in conflict with the expressed needs and desires of the residents of Ann Arbor. DDA appointees have no term limits; and so as long as the mayor supports them, it is impossible to get rid of them when they do not represent the residents of Ann Arbor vs. special interest groups. The result is an arrogance by DDA members about their duties, responsibilities to the public, and even the (limited) mandate of the DDA itself.

For example, a couple years ago DDA member Joan Lowenstein advocated a scheme by which the DDA could create rate hikes for public parking without the council’s approval. She suggested — publicly — that the DDA could “shield” the city council from having to vote on measures that might be unpopular with the public. Following this public embarrassment, Ms. Lowenstein’s reappointment was approved by Council with descent from one member, Mr. Kunselman.

How can we fix this unfortunate situation? City council members should take their city charter mandate seriously and assume responsibility for mayoral appointments to boards and commissions. Let’s urge them to do so.

Mr. Zetlin,

The problem of the DDA will not be solved until the problem of city council is solved. If you want change, you have to change who is sitting in council’s seats.

By the way, Dave, the DDA has no authority to issue any bonds at all. Check out this section of Note 1 from the City of Ann Arbor Comprehensive Annual Financial Report, 2012:

“Downtown Development Authority (DDA). The DDA was created to finance rehabilitationand redevelopment in the downtown area. Commissioners of the DDA are appointed by the Mayor and approved by City Council. Development plans are approved by Council and Council must approve all modifications to the plan. The DDA’s primary source of funding is tax increment financing revenues. Bonds secured by those revenues are issued by the City on behalf of the DDA, which does not have the ability to issue debt…”

If some event is triggered by the retirement of a DDA bond, that thing will never happen. All bonds issued for DDA projects are actually City of Ann Arbor GENERAL OBLIGATION bonds. Bonds for DDA projects are issued by the City of Ann Arbor, backed by the full faith & credit (not to mention property tax revenues) of the City of Ann Arbor. The existence of “DDA bonds” is an urban myth akin to sitings of Elvis in Kalamazoo.

Even the CAFR has this wrong: go check out what revenue bonds the city has issued, and see if any apply to any DDA project (hint: there are none. Only water department bonds are revenue bonds, payable only from your water bill.). That is, go see if any bonds are revenue bonds “secured” by DDA revenues, rather than by the full faith and credit of the City of Ann Arbor.

BTW, did I mention that I saw Sasquatch down in West Park? He was carrying a briefcase full of “DDA” bonds.

Re: “… which method is likely to get us more taxes from all this downtown development that can be used for actual services?”

The cumulative method restricts the DDA’s TIF more than the year-to-year method. So the cumulative method returns more to the taxing jurisdictions than the year-to-year method. The city is among those taxing jurisdictions.

From the city treasurer, here’s a graph: [.jpg of chart showing DDA TIF capture using different methods]

And here’s the numbers for the next two years with each method:

Method: Year-to-Year Refunds City County WCC AADL Total Ref DDA TIF FY14 $429,409 $149,392 $94,257 $40,163 $713,221 $3,964,457 FY15 $11,958 $4,160 $2,625 $1,118 $19,862 $4,774,758 =============================== Method: Cumulative Refunds City County WCC AADL Total Ref DDA TIF FY14 $613,919 $213,583 $134,757 $57,421 $1,019,680 $3,657,998 FY15 $635,108 $211,673 $139,195 $58,539 $1,044,515 $3,773,043@6: ALERT–The S&P 500 has dropped below the initial lower trend line of the last upward sub-wave, as well as the 1558.47 most recent low, indicating that yesterday was the end of the upward rally. In other words, the stock market has topped.

(The apparent peak back in March that I referred to in #6 turned out to be the end of a lower sub-wave. Now that the first lower trend line has been broken through, yesterday’s peak looks much more probable to be the top.)

According to Elliot wave analysis, the steep decline today will likely continue below 1540 by the end of next week, then lower and lower over the next 1-3 years. This won’t be a “buying opportunity” but an extended downward corrective wave of the past century’s climb in stock prices. Upward corrections will occur, but they’ll be brief interruptions of the overall downward trend, not the beginning or resumption of a bull market, at least not for the next year or so.

The S&P is expected to drop below 100 and the Dow below 1000 by the ultimate bottom in a few years. Even if a different scenario plays out, the drop will very likely be greater than in 2008,

This is why I sent out an email several months ago to hundreds of community members (including some regular readers here), encouraging them to shift their investments from equities and other financial instruments to cash, in order to better weather this deflationary event.

I realize that this is off-topic and unusual, but this is an unprecedented event getting underway. I’m sharing this in an attempt to “be generous” to my community.