County Board Eyes Slate of Revenue Options

Washtenaw County board of commissioners working session (Aug. 8, 2013): A range of ways to bring in additional revenues – including increases to existing taxes, or new millages requiring voter approval – are being explored by county commissioners. They’re working to overcome a nearly $4 million budget deficit in 2014 without further cuts to programs and services.

Yousef Rabhi, right, chair of the Washtenaw County board of commissioners, talks with Shamar Herron, workforce development manager in the county’s office of community & economic development, at the county board’s Aug. 8, 2013 working session. (Photos by the writer.)

A memo prepared by Conan Smith (D-District 9) outlined six options for generating more tax revenue. Three of those options would not require voter approval, because the Michigan statutes that authorize the millages predate the state’s Headlee Amendment. The board already levies two of these types of taxes – for indigent veterans services, and agriculture/economic development – but doesn’t yet levy the full amount allowed by law. The third tax in this category, which the county doesn’t levy now, would pay for road repair.

Other approaches would need voter approval. A Headlee override – allowing the board to raise its operating millage to the cap of 5.5 mills, from the current rate of 4.5493 mills – would result in an additional $13.5 million in tax revenues next year. The rate of 5.5 mills has been rolled back over the years by the Headlee Amendment, which was designed to prevent property tax revenues from increasing faster than the rate of inflation.

Commissioners also discussed the possibility of putting a millage proposal on the ballot for specific purposes, like public safety. Sheriff Jerry Clayton attended the working session and stressed the importance of funding for public safety.

A targeted millage could also pay for annual contributions toward the county’s unfunded pension and retiree healthcare obligations. But that strategy would not eliminate the entire amount of unfunded liabilities, estimated at nearly $300 million. A controversial bond proposal intended to eliminate those obligations was halted in early July. [See Chronicle coverage: "County to Push Back Vote on Bond Proposal."] However, on Aug. 8 some commissioners indicated that bonding was not off the table, and could still be considered. Michigan’s Public Act 329 of 2012, which enables municipalities to issue bonds for these kinds of obligations, has a sunset of Dec. 31, 2014.

In other possible revenue strategies, Conan Smith also advocated to use some of the general fund’s roughly $16 million fund balance, to support one-time investments like capital expenditures or to replenish fund balances in specific departments. He had made a similar proposal at the board’s Aug. 7, 2013 meeting, but did not win support for it from the majority of commissioners.

At their working session, several commissioners expressed general support for seeking some kind of voter-approved tax, either a Headlee override or a targeted millage. There seemed to be less support for tapping the general fund’s fund balance. Yousef Rabhi (D-District 8) described the fund balance approach as “a short-term energy pill. It’ll get us a couple feet down the road, but it won’t give us the miles that we need.”

It’s unlikely that a millage proposal would be put on the November ballot. To do so, the board would need to take action this month, which would require calling a special meeting. The board’s next scheduled meeting is Sept. 4.

The Aug. 8 working session also included a presentation by Mary Jo Callan, director of the county’s office of community and economic development, about current and proposed initiatives related to economic development. The session was attended by Ann Arbor SPARK executives, including CEO Paul Krutko.

This report focuses on the board’s budget discussion.

Sheriff’s Perspective

Andy LaBarre (D-District 7), who chairs the board’s working sessions, told commissioners that he had invited all of the other county elected officials to the Aug. 8 session, but most were not able to attend. Only sheriff Jerry Clayton was on hand, and he joked that he was designated the “sacrificial lamb” by the other electeds. [In addition to Clayton, officials elected to a countywide position are Brian Mackie, the prosecuting attorney; treasurer Catherine McClary; clerk/register of deeds Larry Kestenbaum; and Evan Pratt, water resources commissioner. All are Democrats.]

Clayton told commissioners that although he and other electeds don’t make the final decision about the county’s budget, they are all following the board’s discussions with great interest, because their operations will be affected. Referencing the presentation earlier in the session by Mary Jo Callan, Clayton said he was glad to see the connection drawn between public safety and economic development. Everyone knows that businesses are less likely to locate in communities where there are challenges with public safety, he said. He appreciated that the board recognized this connection, and that commissioners supported public safety in the budget.

Washtenaw County sheriff Jerry Clayton, seated, talks with county commissioner Dan Smith (R-District 2) during a break at the May 16, 2013 county board retreat.

As the board developed the next budget, Clayton hoped they wouldn’t make decisions purely from a financial perspective. It’s important to consider the impact of budget decisions, he said, in terms of the services that the county provides and the people who receive those services. Clayton expressed concern about focusing on short-term outcomes. He noted that some commissioners have talked about positioning the county for the future and thinking strategically, and he supported that approach.

Clayton didn’t want to see the county “spending dollars chasing pennies” – making short-term financial decisions that don’t consider the long-term community impact. As an example, he cited the board’s discussion at its meeting the previous night, on Aug. 7, 2013, about returning money to the fund balances of some departments. He clarified that the sheriff’s office does not have a fund balance, though he wished it did. The community corrections unit, which was transferred from the trial court to the sheriff’s office a few years ago, does have a fund balance. [The discussion at the Aug. 7 board meeting had not made that distinction.]

He noted that the board’s discussion had included some statements that the sheriff’s office and community corrections unit had chosen to use the fund balance to help balance their budget in 2012 and 2013. He argued that this wasn’t the case. His office had presented a budget proposal to fund the level of staffing that was appropriate to meet community needs, Clayton said. However, the county administration set the budget at a lower level, and told his office that the community corrections fund balance could be used to make up the difference. He noted that the county administration doesn’t use the general fund’s fund balance in that way, because from a strategic standpoint, a reserve is needed for unforeseen circumstances.

Using the community corrections fund balance wasn’t something his staff chose to do, Clayton stressed. But they understood the impact on the community if services aren’t provided. It costs about $10 a day to monitor someone on probation, he noted. A recent study showed that for one day in jail, it costs about $85. Clayton said his staff had done its own research and estimates the cost is closer to $130 a day.

The local courts have confidence in the community corrections program, Clayton said, noting that it’s administered by Renee Wilson. “The judges don’t hesitate to send people to community corrections in lieu of sending them to jail, which saves significant dollars,” he said. This is just one example of how a county program impacts the budget indirectly, he noted.

Clayton said he has supported the county’s struggles around the budget, and the sheriff’s office has taken reductions. He’s prepared to take more reduction in the coming budget, he added, but “we’re in the bone, we’re deep in the muscle.” If the budget is cut beyond a certain point, then his office will have to start incurring overtime costs to meet the community’s needs, which will cause them to go over budget. He hoped his office would at least have the opportunity to talk to the board about how any cuts might impact public safety services. “At the end of the day, we know that we’re all in this together,” he said.

The board has established budget priorities, Clayton noted, and the budget for each unit should be evaluated based on those priorities. “Fairness doesn’t mean we’re all going to have the same outcome,” he said. But since he took office in early 2009, there have been a higher level of reductions for the sheriff’s office than in other units, he contended. As long as the board makes its decisions based on the priorities that it has set, and as long as commissioners are open to feedback, “then I think we can move forward in partnership,” he concluded.

Responding to Clayton’s comments, LaBarre said he worried about cutting the sheriff’s office down to a point where it becomes solely reactive.

Felicia Brabec (D-District 4) thanked Clayton, and said she agreed with the need to make budget decisions that reflect the board’s priorities.

Dan Smith (R-District 2) pointed to Clayton’s comments about the board recognizing the importance of having safe communities throughout the county. Crime does not respect municipal boundaries, Smith noted, and having businesses and homes that are safe countywide affects everyone. This board has recognized that for a long time, he said.

Board Discussion: Budget Options

Andy LaBarre (D-District 7) began the main budget discussion by saying this was a chance to assess where the board stood and to get reactions from commissioners. He noted that Conan Smith (D-District 9) had distributed a memo that outlined various budget options for the county, as well as a flow chart showing what needs to happen if the county moves forward with any of the options. [.pdf of options flow chart] [.pdf of budget options memo]

Smith’s memo described four alternatives:

- Issuing bonds to cover the county’s unfunded pension and retiree healthcare obligations – for the Washtenaw County Employees’ Retirement System (WCERS) and Voluntary Employees Beneficiary Association (VEBA).

- Seeking a Headlee override from voters, to raise the cap on the county’s general fund tax rate.

- Pursuing a voter-approved tax for a specific purpose, such as public safety or human services.

- Cutting expenditures.

Conan Smith characterized the flow chart as a decision matrix, so that people can understand what steps are needed to make any of the decisions. The chart includes decisions points for both the board and voters, and what would happen at each of those points, depending on the decision that’s made.

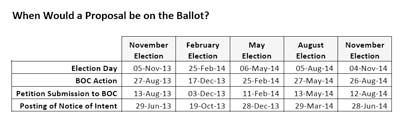

The memo that provides more information about various revenue options also includes a chart listing each non-special election date through November 2014, and the deadlines for getting millage proposals on the ballot.

A mill is $1 per $1,000 of a property’s taxable value. Based on the county’s 2013 total taxable value of $14.21 billion, a levy of 1 mill would generate $14.21 million. A millage can be placed on the ballot in increments of one-tenth of a mill. The lowest amount – one-tenth of a mill – would generate $1.421 million.

Smith noted that due to various exemptions and deductions throughout the county – such as tax capture by downtown development authorities or brownfield tax increment finance districts – revenue to the county from a millage could drop by as much as 18%, depending on the jurisdiction.

Several options for millages could be considered by the board, Smith said. Those include:

- Headlee override: The county was originally allowed to levy up to 5.5 mills, but rollbacks due to the state’s Headlee Amendment have reduced that amount to 4.5493 mills. An override, if approved by voters, would allow the county to levy the original 5.5 mills, bringing in an additional $13.5 million in tax revenue in 2014. Smith pointed out that the board wouldn’t necessarily levy the full 5.5 mills, but an override would give commissioners the option to do that.

- Act 88 (agriculture & economic development): The county is allowed to levy up to 0.5 mills under Public Act 88 of 1913, but currently levies a small percentage of that – 0.06 mills, which will bring in $696,000 this year. It’s used for programs run by the county’s office of community development, and to fund the county’s MSU extension office. Act 88 does not require voter approval. It was originally authorized by the county in 2009 at a rate of 0.04 mills, and was increased to 0.043 mills in 2010 and 0.05 in 2011. Last year, Smith proposed increasing the rate to 0.06 mills and after a heated debate, the board approved the increase on a 6-5 vote. [See Chronicle coverage: "County Board Debates, OKs Act 88 Tax Hike."]

- Veterans Relief: The county currently levies 0.0286 mills for services to indigent veterans, administered by the county’s department of veterans affairs. The maximum allowable tax of this kind is 0.1 mills, which would bring in about $1.42 million annually. Smith’s memo suggests that the amount could be used to support other programs, such as early childhood education for the children of low-income veterans. This tax does not require a vote of the public.

- Act 283 (county roads): The county has previously discussed levying up to 1 mill to fund county roads, bridges and culverts. It has never taken action to levy this millage, which does not require voter approval.

- Conservation District: If approved by voters, the county could levy up to 1 mill for a countywide conservation district, or up to $14.2 million. Smith’s memo indicates that the current conservation district gets $30,000 from the general fund each year. Additional funds could be used to support the budget for the water resources commissioner, which gets $1.887 million from the general fund, or the public works line item, which receives $77,666 from the general fund.

- Additional targeted millages: The board also has the option of putting a millage on the ballot to support specific programs or other expenses. Possible millages might cover: (1) the county’s unfunded pension and retiree healthcare obligations; (2) public safety services; (3) human services or outside agency funding; (4) early childhood education or “college promise” programs; or (5) land bank and blight elimination programs.

Smith described his memo as a brainstorming document. He noted that one thing the memo doesn’t include as an option is the use of fund balance. The county maintains a “remarkably strong” fund balance, he said. “We’re sitting on $16 million of fund balance right now, as of 2012, which is more than we anticipated having.” In the previous budget cycle, part of the board’s conversation centered on how much of a fund balance does the county need, he noted.

It’s true that if the county has a higher fund balance, it supports the chance of getting a better bond rating, Smith said. “But what does that higher bond rating actually deliver you? This tiny incremental change in the interest rate on your bonds.” So unless the county wants to issue a major bond proposal, Smith said, then moving from double-A to triple-A doesn’t really gain much.

Smith recalled that John Axe, bond counsel for the county, said that a fund balance of at least 10% of general fund revenues is needed in order to keep the double-A rating. For Washtenaw County, that would be about $10 million. So there’s about $6 million of fund balance that could be used for programs and services, Smith said. It wouldn’t be wise to use it for structural activities, like staffing, he said, but it would be appropriate for one-time investments like capital expenditures. He wanted to put that on the table as a possible option when tackling the budget.

Yousef Rabhi (D-District 8) noted that the board has talked about the importance of not forgetting about the county’s unfunded liabilities for pensions and retiree healthcare. The fact that the board considers this one of its top priorities is unique in the state and nation, he said, and they realize that they need to find a way to fund it.

For him, it was clear that the voters should be asked to weigh in, Rabhi said. This isn’t an issue that the current board created, he contended, but they have a responsibility to address it. “If we don’t, Washtenaw County will not be a county that can provide the services that we’ve traditionally provided,” he said. It’s not acceptable to go back on the county’s promises to employees who have dedicated their lives to this organization.

The board needs to think seriously about asking voters for a Headlee override, Rabhi said. He argued that spending the fund balance won’t solve the problem. “Fund balance is a short-term energy pill. It’ll get us a couple feet down the road, but it won’t give us the miles that we need. We can’t do it with fund balance.”

As for bonding, it remains on the table as an option, Rabhi said. But the board should also give voters the option of taking a different route, he added.

Dan Smith (R-District 2) reminded commissioners that the county currently has a policy that allows the administration to borrow from other county departments to meet the general fund’s cash flow needs. One of the reasons to have a healthy fund balance is to eliminate the need for inter-departmental borrowing, he said, so that there’s enough money to meet payroll before the July tax revenues come in.

A healthy fund balance also allows the county to react methodically to circumstances as things change, D. Smith noted, and take a long-term approach to making decisions.

D. Smith also addressed the theory behind the Headlee Amendment. The idea is that a property owner’s taxes increase in line with inflation, which presumably matches an increase in expenses, he noted. From the county’s perspective, when property tax revenues are high, the additional revenues could be set aside in the fund balance so that when a downturn hits, the county has an extremely healthy fund balance that it can use to get through a period of lower tax revenues.

But that’s not what happened – not in Washtenaw County or probably any other Michigan municipality, D. Smith said. “The tendency is that when you have more money, you spend it, not save it,” he noted. A lot of programs were added over the past 15 years that the county no longer can afford, he said.

D. Smith acknowledged that the theory behind Headlee “doesn’t actually play out in practice nearly as nicely as we would like.”

Regarding the possibility of levying a millage under Act 283 to fix roads, D. Smith said the poor condition of roads is something he hears about from constituents. He’s frustrated at waiting for a solution from Lansing, but he balances that with the outcome of a recent vote in his district, when voters in the Whitmore Lake school district rejected a millage by a 2-to-1 margin. People in his district are paying a lot of taxes, and are challenging him to find ways to meet their needs without increasing taxes.

Rolland Sizemore Jr. (D-District 5) responded to D. Smith’s remarks: “Dan, when you figure that out, you let everybody know where you can get all this work done without spending any money. I know you’re a Republican, but that’s gonna be a hard one to pull off.”

As the board’s liaison to the Washtenaw County road commission, Sizemore noted that he serves on a committee that’s exploring the possibility of a millage for road repair.

Sizemore also suggested looking at non-mandated programs that the county funds, which offer services that might be duplicated by other organizations. There might be ways to get rid of some of those non-mandated services, he said, and shift the funding to other programs in the county. He called for public forums so that residents could let the board know their priorities. Such forums would also provide the opportunity to educate the public about the county’s budget, and the impact if certain programs are cut, he said.

Alicia Ping (R-District 3) observed that the board had spent a lot of time this year focused on the bonding proposal, and it’s now behind in pursuing other possible options. She’s opposed to touching the fund balance, and feels that paying down the county’s unfunded pension liabilities should be a priority. Ping agreed with Sizemore about looking at non-mandated programs. Funding for those kinds of programs should be put on the ballot for residents to decide if it’s a priority.

She said she didn’t have any solutions, but felt that “no matter what happens, we’re going to have to put something on the ballot, sooner rather than later.” She described a Headlee override as “kind of a band-aid,” but supported the idea of putting other millages on the ballot so that voters can weigh in.

LaBarre agreed with the need to address the unfunded pension and healthcare liabilities. “I would wager that every one of us – all nine of us – are committed to doing that. We haven’t taken a public vote to say we are, but that’s certainly the sense I get.”

At the same time, he said, “I don’t want to cut Washtenaw County to a skeletal organization.” He added that he doesn’t want it to be a rural county that provides “bare-bones” services. The government here does more than that, LaBarre added, “and I think generally, the citizenry supports that” – either directly, by voting in support of millages, or indirectly by electing commissioners who share those priorities.

LaBarre said he initially thought that bonding was a good solution, but now he has doubts about that. There are risks with bonding that might result in the county losing more than it gains. With a millage, on the other hand, the board gets the buy-in of residents and a relatively stable source of funding, he observed.

Commissioners do their jobs on a part-time basis, LaBarre noted, either in addition to their day jobs or in one case as a retiree. He said he’s not an expert, but everyone is trying to do their best and do what’s right. Having this discussion is important, LaBarre said, and he agreed that the board should get some options out to voters and make their case for supporting those options.

In the short-term, however, the administration is moving forward to develop a four-year budget that assumes that bonding is off the table, LaBarre said.

Kent Martinez-Kratz (D-District 1) spoke next, saying that he thought the county needed a bit more reduction in expenses. It’s also appropriate to consider the definition of a healthy fund balance, he said. For a year or two, he felt the county could reduce the current fund balance by one or two percent. He noted that he works for an institution that for 20 years has had a 3% fund balance, “and we still row the boat every year.” [Martinez-Kratz is a special education teacher with Jackson Public Schools.]

The county will see some significant savings, thanks to the long-term labor agreements it reached with unions earlier this year, Martinez-Kratz noted. But there are still a couple of rough years to get through, he added. So he’d like to trim a bit out of the structural costs, and use some money out of the fund balance.

Rabhi spoke again, noting that residents of Washtenaw County are attuned to what’s happening. They understand what the unfunded liabilities mean to the budget, he said, and the potential that addressing those liabilities can have on future budgets. More education needs to happen, he added, and now is the time to do it because so much education and engagement have already taken place.

For most of this year, there were only two options on the table, Rabhi said: bonding, or budget cuts. There are other options, but those are limited to millages. State revenues are decreasing while the county’s cost of providing services is increasing, and the unfunded liabilities continue to put pressure on the budget, he said. If the board does nothing, in the long term the county won’t even be able to provide an adequate level of mandated services.

Rabhi talked about the need to put the county back on track to being an entity that provides first-class services to its residents. “I’m 25 years old,” he said. “I’m going to be in this community for a long time. I want Washtenaw County to be here for a long time, and to take care of my fellow citizens.”

Balancing the budget by just cutting services doesn’t seem like a productive way to help people, he said. He asked other commissioners and residents to think about the long-term health of the county.

It’s short-sighted to think about using the fund balance as an option, Rabhi said, because it’s not a long-term solution. It can be part of the equation, but “we need to be thinking bigger.” Talking about a millage is important, he said. These are tough issues, and it would be easy to put off making decisions. “That’s not the option we’re taking. We’re taking the hard road, we’re taking the long road of fixing this problem.” It’s going to take the time and energy of every commissioner and the community, he said.

Rabhi concluded by stressing the importance of allowing voters to weigh in on a possible millage.

Felicia Brabec (D-District 4) noted that the upcoming budget will include cuts, but those cuts need to be balanced by looking at the services that the county provides. Those services are why some people moved here. She was glad that the board is tackling the issue of unfunded liabilities, although “it feels like a Goliath.” She found the idea of a Headlee override “enticing” and definitely worth exploring, and liked the idea of looking at other potential millages too. “The one that seems to provide the revenue without some of the drawbacks and specificity … is a Headlee override.” She said she’s open to other options as well.

Conan Smith (D-District 9), left, talks with Pete Simms of the county clerk’s office at a May 16, 2013 county board retreat.

Conan Smith said he wanted to clarify an issue regarding the unfunded liabilities. There’s only one way to take care of the full amount, and that’s by bonding to cover it, he said. To make it disappear, the county would need the full amount as a lump sum. “Otherwise, what we’re talking about is the annually required contribution toward that unfunded liability and toward the benefits that we have to provide,” he said.

For many years, the county handled the annual contributions as part of the regular budget process. But when the board voted earlier this year to close the defined benefit plans as part of the long-term labor agreements, that action ratcheted up the amount of the annual required contribution. “That’s what we’re grappling with,” he said. Rabhi had stated that the board didn’t cause this situation, C. Smith noted. “Well, in fact, we did cause this.”

C. Smith noted that he’d supported closing the retiree health care plan, but he said he had disagreed with closing the pension plan. He had wanted to close only the VEBA, because those costs are so variable.

To decrease the required annual contribution, C. Smith said the board could consider re-opening the pension plan and bringing those employees “back into the fold.” Then, the employees’ contributions to the plan would lower the county’s required contribution from the general fund.

So the board’s three options are to find new revenues, cut costs, or transform the retirement system, he said.

Returning to the topic of using the county’s fund balance, C. Smith argued that budget reductions are not inevitable. Every budget cycle, the county makes millions of dollars worth of one-time investments in non-structural, single-purpose expenditures. “That’s a completely legitimate use of fund balance in a down economy,” he said. That’s especially true if those fund balance investments are designed to rebuild the local economy and bring in more tax revenues, he added. He gave some examples of such investments – neighborhood stabilization programs, or workforce development programs to help people find jobs so that they’ll have more discretionary spending.

He also suggested the possibility of using the county’s pension funds to invest in local businesses so that they grow and employ more people. “That’s a budget-neutral approach – that doesn’t take any additional tax money at all,” he said. The board should be thinking of strategies like this as the budget is developed.

“So it doesn’t have to be a cuts-only budget, and it doesn’t have to be a budget that’s framed around paucity,” C. Smith said. “We can be strategic about rebuilding prosperity in the community.”

C. Smith said he doesn’t want to use general fund revenue to pay for the roughly $3 million in additional required pension and retiree health care contributions. He’d still like to pursue the bonding option, “but you’re going to get my support for any strategy that stops us from snagging general fund money for that.”

The Headlee override “is like a dream for a public official,” C. Smith said, because it provides maximum flexibility for how the tax dollars can be spent. But it’s also the hardest thing to sell to voters, he added, “because it’s so vague.” Unlike a targeted millage, the additional operating revenue wouldn’t be dedicated to a specific purpose. The Michigan Municipal League and Michigan Townships Association have found that millages are most likely to pass if the tax is tied to a specific use, he said, like the public safety millage passed earlier this month in Ypsilanti Township.

C. Smith said he was becoming more inclined to support a millage for public safety. Public safety services represent 45% of the general fund budget, including about $11 million for the sheriff’s road patrol. “It is a tangible benefit to the community,” he said. “It’s something that any citizen out there can understand.” He noted that it’s been a contentious issue in the past, and that officials with other local municipalities would like to see the matter settled. If the county were to provide a secure revenue source for public safety, it would stabilize the budgets of other municipalities and also would provide increased flexibility for the general fund.

Present: Felicia Brabec, Andy LaBarre, Kent Martinez-Kratz, Alicia Ping, Yousef Rabhi, Rolland Sizemore Jr., Conan Smith, Dan Smith.

Absent: Ronnie Peterson.

Next regular board meeting: Wednesday, Sept. 4, 2013 at 6:30 p.m. at the county administration building, 220 N. Main St. in Ann Arbor. The ways & means committee meets first, followed immediately by the regular board meeting. [Check Chronicle event listings to confirm date.] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public commentary is held at the beginning of each meeting, and no advance sign-up is required.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Washtenaw County board of commissioners. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

Mary …

Thanks again for great reporting. While I have been following the budget/revenue/bonding discussion, this is the first time I have read anything about millage changes/increases by the Commissioners. MOST interesting information.

Sincerely, Ruth Ann

“Smith’s memo described four alternatives:”

“[C. Smith] noted that one thing the memo doesn’t include as an option is the use of fund balance.”

I’ve suggested a fifth: wait and see, which might, in effect, require the use of the fund balance. As deflation plays out over the next several years, a deficit might materialize for 2014 or it might not, while 2015 and beyond will be more like 2008-9 magnified.

“[Ping] said she didn’t have any solutions, but felt that ‘no matter what happens, we’re going to have to put something on the ballot, sooner rather than later.’”

Deflation will change the considerations beyond what the commissioners are considering. Deflation will also increase the relative value of those reserved dollars, assuming that the county protects them in US treasuries or other liquid accounts that won’t be loosing value.

Property values are again peaking, possibly rising for a few more months (or maybe longer here in the Ann Arbor area). The revenue implications might be such that getting through 2014 without a deficit (possibly with some fund balance reduction) is a good possibility. After that, as housing prices fall and revenues decline (maybe not until 2016?), the county will be faced with becoming a “skeletal organization” much like every other local government in the state will be by that time.

“A healthy fund balance also allows the county to react methodically to circumstances as things change, D. Smith noted, and take a long-term approach to making decisions.”

This reflects the thinking that (I’m guessing) led to the decision to budget on a four-year timeline. The pitfall is that it doesn’t consider the possibility (inevitability, really) of deflation.

“D. Smith acknowledged that the theory behind Headlee ‘doesn’t actually play out in practice nearly as nicely as we would like.’”

Largely, I suspect, because it also wasn’t developed with the possibility of deflation in mind.

At this point, I suggest that the county abandon it’s four-year budgeting efforts as soon as possible and go to a two-year budget period in order to react more agilely to the changing financial and economic circumstances of deflation.

As for road maintenance, the sooner the county begins to prioritize the necessity of each road, the better. It won’t be able to maintain them for more than a few years, most likely, and citizens won’t be able to afford fuel not long after that. It’s probably the best area in which to avoid wasted investment.

@2: “US treasuries”

Make that short-term US treasuries.

Your statement, “Clayton told commissioners that although he and other electeds don’t make the final decision about the county’s budget, they are all following the board’s discussions with great interest, because their operations will be affected.” doesn’t quite compute. The BOC is also elected. I think you meant the other county-wide elected officials who are also heads of departments.

I love it when Steve goes into prophet mode. I’d just like to note that 10-year treasuries are going up in interest rate (down in price) and that China and India have slowed their investment in Treasuries.

When Bob Guenzel offered county employees 3% raises each year for 5 years, I asked him how this would work if we went into a deflationary period. His answer was “Not in my lifetime”. That was about 2004.

Yes to NO for a four-year budget. How can you project for that long a time?

@5: My “prophet mode” is just a matter of summarizing the many months (financial)/years (fossil fuels) of gathering information on such matters in order to keep my posts on them from being much longer than they already are. Of course, there’s a big, implied “IF” that goes in front of all of it. On the other hand, that “if” gets smaller and smaller each day as past projections by the experts I follow play out accurately.

“He also suggested the possibility of using the county’s pension funds to invest in local businesses so that they grow and employ more people. “That’s a budget-neutral approach – that doesn’t take any additional tax money at all,” he said. The board should be thinking of strategies like this as the budget is developed.”

Lord only knows what ‘local businesses’ the financial astute Mr. Smith would suggest the County invest in. Just the sort of thing the Detroit Pension Board was famous for, all of which is documented via Free Press and Detroit News investigative reporting. The last person on the planet we need to get financial management tips from is Mr. Smith.

@7: The City of Ann Arbor has a property assessed clean energy (PACE) program that the county could emulate:

[link 1]

[link 2]

[link 3]

Doing it so that businesses “grow and employ more people” isn’t the goal of the program. The intention is to spend less on energy, pollute less, and keep more financial assets in the community, all of which in turn help keep the businesses viable. Employment increases would likely occur in the energy-efficiency services industry, though.

Maybe the county could help get the state to allow a residential version of the program as well.

Here’s one for you, Vivienne. The stock market’s looking pretty volatile this afternoon. Tomorrow’s drop should be a doozy (a third wave of a third wave of a fifth wave in the S&P, I believe). The professionals are moving to the short side.

I had to CHOKE over the comments regarding the Sheriff’s Department.

How many “Patrol” deputies are there?

How many are paid for by the contracting municipalities?

How many are paid for by the County?

“LaBarre said he worried about cutting the sheriff’s office down to a point where it becomes solely reactive.” I’ve got news for you, Andy.Except for what the contracting units provide IT’S ALREADY THERE!

“Dan Smith (R-District 2) pointed to Clayton’s comments about the board recognizing the importance of having safe communities throughout the county. Crime does not respect municipal boundaries, Smith noted, and having businesses and homes that are safe countywide affects everyone. This board has recognized that for a long time, he said.”

The markets actually went up August 22 Steve. They did drop a week later but now back up to the same level as when you posted on August 21.

@11: Well, at least one person is paying attention.

I had thought that the fourth wave was complete on the 21st, but it continued through the 23rd. The fifth wave (down) was from then through the 27th. That completed the first wave of one higher degree since the August 2nd top. The upward retracement since then is the second wave. When it’s done (and it may be at this point, though there’s a gap in the S&P from August 14th around 1685.39 that could get filled), the third (downward) wave will be larger and swifter than the wave one down.

Setting aside my ability to accurately interpret the wave pattern in real time (or lack thereof), my intention has been to draw attention to something that most people are simply complacent about. The stock market has topped and will drop on the order of 75% from here. Most supposed wealth will simply disappear. There’s still some time to protect some of it and put it to actual use in some increased level of self-sufficiency at both the individual and community levels. That so few people are aware of what’s happening and willing to talk about it doesn’t bode well for us.

There’s time this fall to plant some fruit and nut trees, buy some compost, and build the soil in order to begin the shift from consumer to producer.

The committed lawn mowers and new car buyers will probably have the hardest time with the end of growth and abundant fossil fuels. And a lot of them will be angry about it. We’re nowhere near prepared for that.