County Board Continues Weighing Road Tax

Washtenaw County board of commissioners meeting (May 7, 2014): Two topics dominated a four-hour meeting: possible funding options for road repair, and an update on how the community is addressing homelessness.

From left: Washtenaw County corporation counsel Curtis Hedger and commissioner Dan Smith (R-District 2). (Photos by the writer.)

Following a lengthy discussion, commissioners voted to set a public hearing about a possible countywide road millage. The hearing will be held at their meeting on May 21 so that the public can give input on a proposal to levy up to 1 mill for roads in 2014. The tax would be levied under Act 283 of 1909.

No final decision is expected at the May 21 meeting about levying a tax – although a resolution to levy a 1-mill tax is on the May 21 agenda for initial consideration.

Commissioners all appeared to support finding a way to secure more road funding, but some voiced concern about process and timing – especially because a tax under Act 283 would be levied without voter approval.

The May 7 discussion began when Dan Smith (R-District 2) brought forward a resolution that would authorize levying a 1 mill tax – under Act 283 – in December 2014. It would generate $14.34 million “to repair 2013–14 winter damage to the roads, streets and paths in Washtenaw County.” The board ultimately voted to postpone the resolution until May 21 over dissent from Alicia Ping (R-District 3).

During the wide-ranging discussion, Ronnie Peterson (D-District 6) expressed concern that the public hadn’t yet been informed about the Act 283 proposal. At the request of board chair Yousef Rabhi (D-District 8), Roy Townsend – managing director of the county road commission – had prepared a list of road projects that could be funded by an Act 283 millage, which was distributed at the May 7 meeting. Townsend and two of the three road commissioners – Barb Fuller and Bill McFarlane – attended the May 7 meeting, and Townsend fielded questions from the board.

Corporation counsel Curtis Hedger cautioned that Act 283 lays out a specific process, which calls for a presentation of proposed road projects at a meeting in late September or October, prior to the December levy. Responding to those concerns, Dan Smith noted that options might include passing a resolution this month or in June to indicate the board’s intent to levy the tax, then possibly using money from the general fund’s fund balance to pay for road work this summer. The fund balance would be reimbursed when the tax revenues are collected in December. Hedger pointed out a risk in that approach: If someone sues the county and a court issues an injunction, then the county might be unable to levy the tax – after already spending general fund dollars.

Conan Smith (D-District 9) supported the Act 283 tax. “I’m almost of a mindset of ‘Let’s do it’ – and if someone wants to sue us over it, you know, then when they file a lawsuit we can reconsider,” he said. Smith preferred the Act 283 levy over a ballot initiative that voters would be asked to approve, saying there are other funding proposals he’d rather put on the ballot – for public safety and human services.

The board discussion on this issue will continue at the May 21 meeting.

In other road-related items on the May 7 agenda, the board voted to accept the recommendations of a subcommittee that was appointed last year to explore options enabled by state legislators. The subcommittee had recommended not to make the road commission part of county operations, and not to make the job of road commissioner an elected position.

The May 7 meeting also included an update about the community’s approach to addressing homelessness. The briefing was in response to a board directive given to staff on April 2, 2014 to develop a plan for updating the county’s Blueprint to End Homelessness. The blueprint was adopted in 2004. The process of updating that plan is to be completed by Oct. 1, 2014.

Responding to information that there’s been an increase in people from outside of Washtenaw County coming to the Delonis Center shelter in Ann Arbor, Conan Smith cautioned against making that kind of distinction, saying it “dehumanized” people who are seeking help, regardless of where they’re from.

Mary Jo Callan, director of the county’s office of community & economic development, told Smith that his point was well taken. But she noted that unless the state asks other communities to provide something close to the level of support that Washtenaw County provides, “then it’s an issue of volume. I’m sorry, but it’s not about dehumanizing.” Ellen Schulmeister, executive director of the Shelter Association of Washtenaw County, noted that 96% of the shelter’s budget comes from local public funding, and the shelter was built for people who became homeless in Washtenaw County. She said it was her job “to hold that line.”

During the May 7 meeting, commissioners also gave initial approval to allocate funding to local nonprofits as part of a coordinated funding approach for human services, in partnership with several other local funders. The county is one of the original five partners in the coordinated funding approach. Other partners are city of Ann Arbor, United Way of Washtenaw County, Washtenaw Urban County, and the Ann Arbor Area Community Foundation.

This year, 105 applications were submitted by 50 local organizations totaling $8,732,389 in requested funding, according to a staff memo. A review committee recommended that 57 programs receive a total of $4,321,494 in available funding. Of that amount, the county is providing $1.015 million. Among the organizations that are being funded in this cycle are Corner Health Center, Interfaith Hospitality Network of Washtenaw County, Child Care Network, Catholic Social Services of Washtenaw, Food Gatherers and Legal Services of South Central Michigan. Several nonprofit leaders spoke during public commentary in support of this process, as did Ann Arbor city administrator Steve Powers.

In other action, the board appointed Ellen Rabinowitz as health officer for the Washtenaw public health department; passed a resolution calling for an increase in Michigan’s minimum wage to $10.10 per hour; and received a first-quarter budget update from the county’s finance staff. First-quarter projections tend to be conservative, because they’re based on only three months of the year, with limited evidence of budget trends. At this point, the 2014 general fund is projected to have a $70,230 shortfall by year’s end – with total revenues of $103,404,537 and total expenditures of $103,474,767. There is no planned use of fund balance for this year’s budget.

Road Funding

The May 7 agenda included a discussion item for road funding options, but there was originally no resolution on the published agenda. At the end of the ways & means committee meeting, Dan Smith (R-District 2) noted that the board has discussed road commission issues for years. He said he continuously hears from residents that they’re sick of the terrible roads, and they’re tired of hearing explanations about why the roads are so bad. People seem willing to raise their taxes to do it, Smith said. He’d even heard support from “an old Dutchman” at his church, which Smith characterized as the strongest endorsement for increasing taxes that he’ll ever get.

Smith thought the board needed to act on this issue, pointing to the impact that an unusually harsh winter has had on the roads. So he put forward a resolution to levy a 1-mill tax authorized under Act 283 of 1909.

Act 283 requires the road commission to submit a plan of recommended road repairs and the cost to undertake the projects. The law allows the county board to levy a millage to cover those costs, without voter approval. [.pdf of relevant section from Act 283, including summary by Lew Kidder of Scio Township.] Because the law is more than a century old and pre-dates the state’s Headlee amendment, there’s some uncertainty about the ability of county governments to use it.

Commissioners have previously held several discussions about the possibility of additional funding sources for road repair – most recently at a lengthy working session on April 17, 2014. In addition to a possible Act 283 levy, another option that’s been discussed is to put a countywide road millage on the Nov. 5, 2014 ballot for voter approval. A draft resolution circulated at the working session called for a four-year, 0.5 mill tax – from 2014-2017 – that would raise $7.15 million in its first year.

The resolution brought forward by Dan Smith on May 7 would authorize levying a 1 mill tax under Act 283 in December 2014. It would generate $14.34 million “to repair 2013–14 winter damage to the roads, streets and paths in Washtenaw County.” [.pdf of draft resolution]

Smith’s resolution would earmark 50% of the gross revenues to be used in the municipality in which the revenue was generated. Beyond that, 10% would be used for non-motorized transportation needs – like bike lanes and pedestrian paths – with the remainder to be allocated “based on use, need, and impact to the traveling public.”

The resolution also addresses concerns about the potential legal issues related to Act 283. From the draft resolution:

FURTHERMORE, BE IT RESOLVED that Washtenaw County Corporation Counsel is directed to provide an exhaustive formal written opinion, by September 30, 2014, which clearly and convincingly details the exact mechanism under which Act 283 of 1909 taxes may be levied in excess of Article IX, Section 6 constitutional limits without a vote of the people; and that the Washtenaw County Board of Commissioners waives any attorney/client privilege concerning this opinion.

FURTHERMORE, BE IT RESOLVED that the Washtenaw County Board of Commissioners asks the county’s legislative delegation, State Senators Randy Richardville and Rebekah Warren and State Representatives Gretchen Driskell, Jeff Irwin, David Rutledge and Adam Zemke, to request an Attorney General opinion regarding the ability for counties to levy a tax under Act 283 of 1909 in excess of Article IX, Section 6 constitutional limits without a vote of the people.

Road Funding: Board Discussion

Yousef Rabhi (D-District 8) reported that he’d met with the road commission earlier that week. He noted that the road commission had prepared a list of possible projects that could be funded under Act 283. The project list had been prepared based on levying 0.4 mills. [.xls spreadsheet of proposed road projects based on 0.4 mill tax] [.xls spreadsheet of possible amounts raised by jurisdiction] [.pdf map showing location of proposed projects]

Rabhi said if the board decided to levy the full mill, there would be more projects that could be added to the list.

However, Rabhi said he’d spoken with the county’s corporation counsel, Curtis Hedger, and now had concerns that Act 283 might not be the right approach to get road projects done this year. It might work for next year, Rabhi noted, “but unless we find a creative way of financing this, I think it’s going to be difficult for us to put the dollars levied to road projects in 2014, just because of limitations in the law.”

Yousef asked Hedger when the county could collect the tax under Act 283. Hedger replied, saying he understood there’s some urgency to get money to fix roads. Hedger cautioned that Act 283 lays out a specific process, which calls for a presentation of proposed road projects at a meeting in late September or October, prior to the December levy. It’s meant to be an annual levy, with the road commission determining the projects that need to be done and how much it would cost to do the work. That project list is given to the county clerk, who passes it along to the county board for consideration at an “annual meeting of the board of supervisors.” Hedger noted that Act 283 defines the annual meeting as one that takes place after Sept. 14 and before Oct. 16. Three county board meetings are scheduled during that period this year, he noted.

However, Hedger thought it’s premature to look at levying a millage under Act 283 right now, because the process needs to be followed. The county can’t put the levy on the summer tax bills, he added. Right now, the county levies its general operating millage in July, and every other county tax in December. The state statute allows certain smaller levies to be put on the July tax bill, but not one as large as the Act 283 levy, he said.

Rabhi said he supports what Dan Smith is trying to do, and he knows the road commission is working hard to address the condition of the roads. But no effort, however well-meaning, can overcome the force of nature combined with the force of Lansing, he said, “or the unforce of Lansing.” The situation demands creative thinking, Rabhi said, and there are at least two options. One is levying a millage under Act 283, and the other is asking voters to approve a millage for roads.

Rabhi called the Act 283 levy a “stopgap, Band-aid approach.” If used properly, it can help, he added, but he didn’t know if it would be possible to use it in 2014.

Alicia Ping (R-District 3) chaired the board’s subcommittee on possible road commission restructuring.

Responding to those concerns, Dan Smith noted that options might include passing a resolution this month or in June to indicate the board’s intent to levy the Act 283 tax, then possibly using money from the general fund’s fund balance to pay for road work this summer. The fund balance would be reimbursed when the tax revenues are collected in December.

Rabhi asked Hedger if it would be possible to use general fund dollars for road work, then get reimbursed later from Act 283 revenues. Hedger replied that general fund dollars can be used for anything. The reimbursement aspect is trickier, he said, because the statute states that the Act 283 revenues must be used “exclusively for the purposes herein mentioned.” So if the money is fronted from the general fund, the Act 283 revenues wouldn’t technically be used for the purposes of road project – they’d be reimbursing the county.

The bigger issue, though, is if the county paid for the work out of the general fund, but then is sued later in the year and given an injunction that would prevent levying the Act 283 tax, Hedger said. “Then we would have spent the money, and you have no way to recoup it.” He noted that as the county’s attorney, he’s paid to be a pessimist and to explain the potential downsides.

Rabhi then asked if the road commission would be comfortable spending money this year with the understanding that a millage would be levied in December. Hedger noted that the same risks would be involved for the road commission.

Ronnie Peterson (D-District 6) asked whether an Act 283 millage would be subject to a voter referendum, if citizens decide to do a petition against it. Hedger said it’s not mentioned in the act, so he didn’t think it would be subject to a referendum.

Peterson wondered what would be wrong with putting a millage proposal on the ballot. Let the citizens decide, he said. Peterson complained that the board didn’t support his progressive agenda, and had cut programs like Head Start – yet he was expected to support a road millage. He said he wasn’t necessarily against the road tax, but thought residents should be allowed to weigh in.

Peterson also wondered why the road commission couldn’t issue bonds to cover the work. He said he’d support postponement until the May 21 meeting, so that these questions could be addressed, and so Hedger can put some of these things in writing.

Conan Smith (D-District 9) directed a series of questions to Roy Townsend, managing director of the road commission. He asked about the flexibility of funding that the road commission uses, including formula funding from Act 51. Are those funds discretionary? Townsend replied that the road commission receives Act 51 funding each month from the state, which varies between about $1.1 million to $1.8 million. Townsend indicated that there’s some flexibility in spending those funds. It depends on what priorities are for the townships, and how much township funding is available.

If the road commission gets direction in May or June, Townsend said, there’s still time to do more road work this season.

Conan Smith suggested working with the road commission on projects for 2015 that could be paid with an Act 283 levy in December of 2014. That approach might free up funds this year for other projects that can be funded with non-Act 283 revenues.

Townsend hoped there’d be a way to figure out how to make more revenues available. He reported getting a call from a resident who lived on Willis Road, who had collected pieces of the road in a wheel barrel – because the road was disintegrating – and wanted the road commission to pick it up.

Conan Smith noted that Act 283 isn’t the best vehicle for road funding, but it’s an option. “I’m almost of a mindset of ‘Let’s do it’ – and if someone wants to sue us over it, you know, then when they file a lawsuit we can reconsider. But know that if you file a lawsuit, there isn’t money for the project anymore.” There’s a sense of urgency that the county board needs to meet, he said.

Responding to Peterson’s question about putting a road tax before voters, C. Smith noted that the earliest the board could get to the ballot would be August – if they voted on it that night – and after that, it would be in November. And there’s no guarantee that voters would approve it, he noted.

The other issue, C. Smith said, is that he has other priorities that can only be funded by going to the ballot. The sheriff has repeatedly articulated challenges regarding public safety, Smith said, and the only mechanism for funding that is to put a millage proposal on the ballot. Human service needs are another area that could be funded with a ballot initiative. With roads, the county has the option of going to the ballot, but also has another means of funding – Act 283. “I’d like to use the other means [for road funding], and save the ballot for those issues that I really, really deeply care about,” Smith said.

C. Smith thanked Dan Smith for bringing forward this proposal, and for designating 10% of the funds raised through Act 283 to work on the non-motorized transportation network. “If you’re a biker or a walker, you know that network is as messed up as the road system is,” C. Smith said.

C. Smith said he was comfortable taking an initial vote on this resolution that night at the ways & means committee meeting, with a final vote on May 21. If everyone else wanted to postpone, that was fine with him too.

Andy LaBarre (D-District 7) said he’d been in Lansing the previous day, and had spoken to both of the state senators who represent parts of Washtenaw County. One of those was Sen. Randy Richardville (R-District 17), who is the senate majority leader. Richardville had indicated support for a plan that’s being worked on in Lansing, that might allocate up to $2 billion for a more comprehensive fix to repair roads in Michigan. LaBarre didn’t think it would hurt to wait a few weeks to see what the state legislature would do. “I have zero faith in them as an institution – that’s probably by this point a relatively bipartisan statement – but here’s the deal: They are the only ones, short of the feds, that can dedicate enough resources to actually do this in a way that’s comprehensive.”

LaBarre also wanted to wait so that the other issues raised during the May 7 discussion could be addressed. He wanted to be in a position to defend the board’s decision, if they levied Act 283, to show they did it in the most prudent, thought-out way.

Dan Smith said he was comfortable with the options discussed – postponement or initial approval. As far as seeing what state legislators might do, “I’m greatly tired of waiting for Lansing,” he said. State lawmakers have been talking about it a long time, he noted, and if the county board wants to do anything about its infrastructure, they need to do it themselves. If the state steps in later, “so much the better for transportation infrastructure in Washtenaw County.”

He stressed that an Act 283 levy would raise revenues for projects in cities as well as townships. He also supported putting a tax proposal before voters, but he understood the concerns that Conan Smith had raised.

Road Funding: Board Discussion – Postponement

Peterson moved to postpone the Act 283 resolution until the May 21 ways & means committee meeting, for an initial vote. He stressed the need for some kind of public process – particularly since it’s an election year. [All nine county commissioner seats are up for election in 2014.]

There was no additional discussion.

Outcome: On a 7-1 vote, commissioners postponed the resolution until May 21. Dissenting was Alicia Ping (R-District 3). Rolland Sizemore Jr. (D-District 5) was out of the room when the vote was taken.

Road Funding: Board Discussion – Public Hearing

Yousef Rabhi proposed scheduling a public hearing to get feedback on road funding proposals. Dan Smith moved to schedule a public hearing for the board’s May 21 meeting.

Ronnie Peterson wondered what the voters would be responding to: Would the road commission have a plan prepared before then? He also wanted a document from corporation counsel Curtis Hedger, laying out the legal issues. He thought the public should have access to the same information that commissioners have.

Rabhi said the plan that was prepared by the road commission – based on an Act 283 levy of 0.4 mills – had been approved by the road commission board. Rabhi said he appreciated Peterson’s comments, because the resolution for funding proposes a 1-mill tax.

Dan Smith noted that a public hearing isn’t required, but he was in favor of having one anyway. He thought that by the time the May 21 agenda was posted, there would be sufficient information available to the public. He wasn’t too worried about the board eventually deciding to levy less than 1 mill – he didn’t think any citizens would object to a lower levy.

Felicia Brabec wanted time to talk with township officials in the district she presents.

Rabhi noted that the board already has a plan from the road commission for projects that could be funded with Act 283 revenues. But it was confusing, given the different amounts mentioned in the road commission’s plan and Dan Smith’s resolution, so he wouldn’t support scheduling a public hearing yet.

Alicia Ping pointed out that the allocations outlined in the resolution: Of the 1 mill levy, 50% of the revenues would go back to the individual jurisdictions – townships, villages and cities – and 10% would be designated for non-motorized transportation. That brings the amount close to the 0.4 mills mentioned in the road commission plan, she said.

Dan Smith pointed out that a public hearing would be a generic public hearing about levying 1 mill under Act 283. He thought there would be more than enough information in the board packet.

Hedger suggested that the wording of the public hearing notice could be for a levy of “up to 1 mill.” Conan Smith offered that wording as a friendly amendment.

Outcome: On a 5-3 vote, commissioners approved setting a public hearing for an Act 283 levy at the May 21 meeting. Dissenting were Felicia Brabec, Ronnie Peterson and Yousef Rabhi. Rolland Sizemore Jr. was out of the room when the vote was taken.

Road Funding: Public Commentary

During the evening’s second opportunity for public commentary, Jeff Hayner of Ann Arbor spoke to the board. He said he’d been watching the proceedings from home and thought he’d come to the meeting to say a few words. He’d been surprised to see a public hearing scheduled for May 21 on the Act 283 millage. He noted that a road millage had recently passed in Grand Rapids, and that the previous day, on May 6, a new transit tax had been passed by voters in Ann Arbor, Ypsilanti and Ypsilanti Township. “Now we’re paying more for buses than we pay for the roads they ride on,” Hayner said. “And it got me thinking, you know? The taxpayers’ corpse isn’t even cold yet, and you guys are reaching into their pockets for more.”

He didn’t think it was right that a tax proposal wouldn’t be put before voters for approval. He thought the state’s Headlee Amendment was put in place to give taxpayers a voice. He didn’t think it was right that taxes would be doubled. Hayner pointed out that advocates for a public transit millage had years to prepare, and even that didn’t seem like enough time for a decent conversation, he said. He urged commissioners to take more time so that they could hear from people about the possible road tax.

Road Funding: Subcommittee Recommendations

In another road-related item, the May 7 agenda included a resolution to accept the recommendations of a subcommittee that was appointed last year to explore options enabled by state legislators. The subcommittee had recommended not to make the road commission part of county operations, and not to make the job of road commissioner an elected position.

State legislation enacted in 2012 allowed for: (1) a county board of commissioners to exercise the powers and duties of a road commission; and (2) the functions of a road commission to be transferred to the county board. A sunset clause means that the laws expire on Jan. 1, 2015. That deadline prompted the county board to examine these options.

Outcome: The resolution passed, initially without dissent. Rolland Sizemore Jr. (D-District 5) was not in the room when the vote was taken. A few minutes after the vote, Conan Smith (D-District 9) spoke with Pete Simms, a member of the county clerk’s staff who takes minutes for the board. The communication was inaudible to the public, but board chair Yousef Rabhi subsequently announced that Smith had indicated his intention to vote against the resolution.

The following night, on May 8, the board’s working session included a discussion of another restructuring option: Expanding the road commission board. See Chronicle coverage: “County Debates Expanded Road Commission.”

Road Funding: Letter to State Legislature

Dan Smith (R-District 2) drafted a letter to be sent to the state House Transportation & Infrastructure Committee, urging passage of House Bills 5117 and 5118, which would remove the sunset clause from state legislation that had been enacted in 2012 regarding the possible restructuring of road commissions. [.pdf of letter]

From the letter:

Washtenaw County’s roads are a critical public asset; stewarding this infrastructure is the responsibility of an independent entity, with negligible input or funding from the elected Board of Commissioners. Eliminating the sunset would provide the board with more options for managing roads, including the possibility of additional locally-generated revenue. We urge passage of HB 5117 and HB 5118.

Yousef Rabhi, Alicia Ping and Kent Martinez-Kratz asked that their names not be included as signatories. After consulting with corporation counsel Curtis Hedger during the meeting, Rabhi told commissioners that if anyone else wanted their names removed from the letter, they should let Smith know.

Outcome: It was not a voting item.

Coordinated Funding

Commissioners were asked to give initial approval to allocate funding to local nonprofits as part of a coordinated funding approach for human services, in partnership with several other local funders.

Community activist Lefiest Galimore and Eileen Spring, president and CEO of the nonprofit Food Gatherers.

The county is one of the original five partners in the coordinated funding approach. Other partners are city of Ann Arbor, United Way of Washtenaw County, Washtenaw Urban County, and the Ann Arbor Area Community Foundation. It began as a pilot program in 2010.

This year, 105 applications were submitted by 50 local organizations totaling $8,732,389 in requested funding, according to a staff memo. A review committee recommended that 57 programs receive a total of $4,321,494 in available funding. Of that amount, the county is providing $1.015 million. [.pdf of staff memo and list of funding allocations]

Among the organizations that are being funded in this cycle are Corner Health Center, Interfaith Hospitality Network of Washtenaw County, Child Care Network, Catholic Social Services of Washtenaw, Food Gatherers and Legal Services of South Central Michigan. Several nonprofit leaders spoke during public commentary in support of this process, as did Ann Arbor city administrator Steve Powers.

The coordinated funding process has three parts: planning/coordination, program operations, and capacity-building. The approach targets six priority areas, and identifies lead agencies for each area: (1) housing and homelessness – Washtenaw Housing Alliance; (2) aging – Blueprint for Aging; (3) school-aged youth – Washtenaw Alliance for Children and Youth; (4) children birth to six – Success by Six; (5) health – Washtenaw Health Plan; and (6) hunger relief – Food Gatherers.

In 2012, TCC Group – a consulting firm based in Philadelphia – was hired to evaluate the process. As a result of that review, several changes were recommended and later authorized as part of the county board’s overall coordinated funding resolution, passed on Nov. 6, 2013. The changes were described in a staff memo:

The County’s Human Services and Children’s Well-being funding will continue to focus on critical services for early childhood, aging, housing/homelessness, safety net health, school-aged children and youth, and food security/hunger relief. Under this proposal, this funding will not necessarily be allocated to these six priority areas in proportional amounts consistent with historic trends. Allocations to these six priority areas will be based on identified community-level outcomes, the strategies that align with them, and how each are prioritized.

Under this proposal, the application pre-screening process will be broadened to better accommodate smaller non-profit organizations. New types of financial documentation will allow smaller agencies to illustrate their viability in the absence of an independent audit. Capacity-building grants would be available to target smaller agencies that need to improve their governance or financial structure to be eligible for the application process, with the goal of expanding the opportunities for all agencies providing human services in the County in an equitable fashion.

Funding for this cycle will start on July 1, 2014. In addition, the RNR Foundation – a family foundation that funded TCC Group’s evaluation of the coordinated funding approach – will now be an additional funder in this process.

Coordinated Funding: Public Commentary

Six people spoke during public commentary about coordinated funding and the county’s support for nonprofits. Several others who are involved in coordinated funding – as board members or executive directors of the nonprofits that receive funding – attended the meeting but did not formally address the county board.

Lefiest Galimore noted that he had previously shared his concerns with the board about the coordinated funding approach. The process eliminates African-American organizations out of the funding process, he said. He’s heard that the issue is a nonprofit’s capacity, but “that’s no longer an acceptable excuse,” he said. This is a problem that needs to be dealt with. People are trying to do good things but they can’t get funded, he said, so they’re taking money out of their own pockets. Some organizations are getting hundreds of thousands of dollars, Galimore said, but there’s no accountability. African-Americans account for 16% of the county’s population, but over 50% of people incarcerated at the county jail are African-Americans, he said, and the situation isn’t getting better.

Ann Arbor city administrator Steve Powers told commissioners he wanted them to understand that the Ann Arbor city council is fully committed to the coordinated funding process. On Nov. 7, 2013, the council endorsed the coordinated funding model, and council would be considering the city’s over $1.2 million general fund allocation for coordinated funding at its May 19 meeting. The process is bringing together the community, the public and private sector, and nonprofits to focus on outcomes that matter, he said.

Nicole Adelman, executive director of Interfaith Hospitality Network-Alpha House, told commissioners that she lives in Washtenaw County, and is also a board member of the Washtenaw Housing Alliance and the HIV-AIDS Resource Center. She thanked the board for supporting local human service agencies, and for spending time later in the meeting to talk about homelessness in Washtenaw County. She reminded everyone of the children and families that experience homelessness, who often aren’t talked about. There are 8 parents and 13 kids at the Alpha House shelter that night, she said. Any discussion about homelessness should include not just individual adults, but also children and families.

Speaking next was Debbie Jackson, director of community impact for community impact for the United Way of Washtenaw County, one of the coordinated funding partners. She noted that together, the six partners leverage about $12.5 million for human services. On May 5, the United Way board had approved the recommendations that county commissioners were now considering. United Way’s commitment to the process this year is $1.8 million, she noted. She thanked commissioners and others in the community for their support.

Carole McCabe, executive director of Avalon Housing, thanked the board for their interest in homelessness, calling it an urgent priority for the community. She reminded them that Avalon’s work to provide permanent supportive housing is an effective solution to homelessness. They operate 260 apartments at 20 different sites around Ann Arbor, providing housing to 160 adults, about 100 families and 150 children. She described the range of services that Avalon provides, and noted that Avalon is a founding member of the Washtenaw Housing Alliance.

Chris Levleit, operations director for Michigan Ability Partners, described the work of that nonprofit in providing housing stability for veterans and others with disabilities. She encouraged commissioners to continue providing support to address homelessness.

Coordinated Funding: Board Discussion

Ronnie Peterson (D-District 6) said the board had passed a resolution to set up a committee to look at human services funding, and he wondered what the status was for that committee. He said the vote had occurred during the board’s budget discussions last year, at the same time that the board had voted to establish a committee to handle Act 88 allocations.

No one else on the board indicated that they recalled such a resolution, nor did county administrator Verna McDaniel. Peterson hoped someone could research that by the next board meeting. Yousef Rabhi (D-District 8), who serves as board chair, promised to follow up with Peterson.

Peterson spoke at length about the need for supporting human services nonprofits and the residents they serve – especially those struggling with homelessness. He noted that the eastern part of the county, including the Ypsilanti area that he represents, is one of the few places that has affordable housing. The county needs to be involved in addressing some of these unmet needs, he said, and in providing a better “front door” to the county’s own human service agencies.

Andy LaBarre (D-District 7) thanked the representatives from local nonprofits who were attending the meeting, saying he also interacted with many of them during his “day job.” [LaBarre is vice president for government relations at the Ann Arbor/Ypsilanti Regional Chamber.] He thanked them for their work in the community.

Rabhi also thanked the nonprofit leaders, noting that they help leverage public dollars for the public good.

Outcome: Felicia Brabec (D-District 4) recused herself from the funding allocation for Food Gatherers, noting that she serves on that nonprofit’s board. Otherwise, the coordinated funding allocations were endorsed unanimously. The board is expected to take a final vote to allocate funding on May 21.

Response to Homelessness

At their May 7 meeting, commissioners were briefed on possible responses to homelessness and a lack of affordable housing in this community. The briefing came in response to a board directive given to staff on April 2, 2014 to develop a plan for updating the county’s Blueprint to End Homelessness. The blueprint was adopted in 2004. The process of updating that plan is to be completed by Oct. 1, 2014.

The May 7 presentation was given by three different staff members: Mary Jo Callan, director of the county’s office of community and economic development; Ellen Schulmeister, executive director of the Shelter Association of Washtenaw County, which runs the Delonis Center homeless shelter; and Amanda Carlisle, director of the Washtenaw Housing Alliance. Several WHA board members also attended the May 7 meeting, including former county administrator Bob Guenzel, who serves as WHA board president, and attorney Dick Soble, the board’s secretary. [.pdf of presentation]

Schulmeister reviewed the contributing factors to homelessness, including untreated mental illness, increased poverty, a lack of affordable housing and more. She noted that 78% of the people who come to the shelter have income less than $500 per month, and 71% have no income.

The good news is that homelessness “just plain ends with housing,” she said, “and that’s an important phrase to remember.” The formula for success, she added, is permanent affordable housing plus supportive services. That includes “rapid rehousing,” where people who are homeless are quickly given housing with a short- to medium-term subsidy, coupled with supportive services.

This community has a long history of addressing the problem, including creation of the Blueprint to End Homelessness. That effort involved over 300 community members and organizations, including the private sector, sheriff’s office, University of Michigan and Eastern Michigan University. Carlisle reviewed the blueprint’s four main goals: prevention, housing with services, reforming the system of care, and engaging the community.

Carlisle also described some of the achievements since the blueprint was developed, and pointed commissioners to a more comprehensive report about these efforts that’s posted on WHA’s website. [.pdf of progress report] Highlights include work by Project Outreach Team (PORT) and the Justice Project Outreach Team (JPORT); the Housing Access for Washtenaw County (HAWC), which provides a single entry-point for people seeking services; creation of an endowment for permanent supporting housing; the FUSE (Frequent User Systems Engagement) project, a national pilot program that integrates services for high-risk adults; and creation of a street outreach court and rapid re-housing program, among several other initiatives.

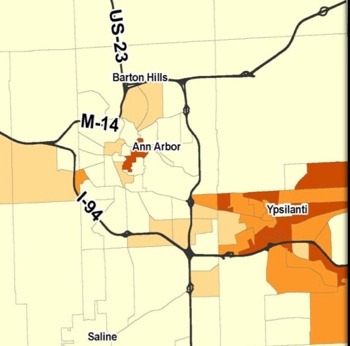

A map showing the percentage of households on public assistance, by census tract: Dark orange (over 30%), light orange (20-30%), tan (10-20%) and cream (0-10%).

Callan noted that a lot has happened in the last 10 years, but it’s no surprise that they haven’t come close to ending homelessness. In 2013, 4,542 people were homeless in Washtenaw County – a 25% increase since 2011. On any given night, 510 people experience homelessness in Washtenaw County. Callan also pointed out that the Delonis Center has seen a 38% increase in people using the shelter from outside of Washtenaw County, from 2012 to 2014.

Several organizations provide a total of 299 emergency shelter beds, but demand far exceeds available resources. Callan noted that the goal isn’t to add more shelter beds, because the solution to homelessness is housing. Temporary shelters are also the most expensive way to address homelessness, she said.

Callan reviewed the spectrum of affordable housing options in Washtenaw County, from temporary shelters and transitional housing to market-rate apartments, public housing, cooperatives, group homes, vouchers, and other options. She noted that during the recession, it was easier to find affordable housing to rent and easier to find landlords who were willing to reduce their rents. Now that the economy is recovering, affordable units are getting more difficult to find, Callan said.

Callan also reviewed the many barriers to helping people find housing. This is the costliest housing market in Michigan. There are only 18 units of affordable, available housing for every 100 of the lowest-income families. The fair market rent for a two-bedroom apartment in Ann Arbor is $942, compared to the average $784 statewide. Callan noted that there’s a $106 difference in rent for a two-bedroom apartment in Ann Arbor compared to Ypsilanti – less than a mile away. “That disparity grows bigger as you go further east,” she said.

To put the rent in context, Callan noted that you’d need to earn an hourly wage of $18.31 to afford a two-bedroom apartment renting at $942 a month. The living wage set by the county board is $13.65, while the federal minimum wage is $7.25. Residents who earn that federal minimum wage would have to work 100 hours a week to afford the two-bedroom apartment.

Callan noted that a growing number of residents are spending more than 30% of their income on housing costs, and there’s a growing income disparity.

Callan also highlighted the increased pressure on the county’s shelter system, with a 38% increase in the number of out-of-county people using the Delonis Center in Ann Arbor. It’s untenable for everyone to have Washtenaw County serve as the shelter for all of southeast Michigan, she said.

Schulmeister noted that the three-county region of Macomb, Oakland and Wayne have 14 shelters and a population of just over 4 million. Washtenaw County has 8 shelters for a population of 344,000. There are no shelters in Livingston County, and only two shelters in Jackson County, she noted. In the last year, 43% of the out-of-county people who used the Delonis Center came from Wayne County.

Callan laid out several options that the county and its partners have for addressing these issues:

- Restore funding for affordable housing projects, such as rapid rehousing, affordable housing development, and permanent supportive housing.

- Create and fund a mission-style shelter and/or a permanent warming center.

- Use county assets to advance affordable housing projects.

- Continue to stabilize existing providers, including PORT and local nonprofits.

- Provide funding for short-term motel/hotel stays to engage people in permanent housing programs.

As an example of costs, Callan explained that it would cost about $1.5 million annually to operate a “mission-style” shelter with a day center. That’s based on a 25,000-square-foot facility for overnight sleeping and daytime “warming” for 100 people. It assumes a staff of about 17 full-time employees but does not include capital costs or overhead like accounting.

By comparison, that same $1.5 million could provide rapid rehousing of about 200 people each year, or permanent supportive housing for 107 people. It could also pay for a new housing development with nine units, Callan noted. She again stressed that shelters are the most expensive option, and not a long-term solution. Schulmeister told commissioners that the goal is to turn over shelter beds by finding housing for people, not by kicking them out because they’ve “timed out” of the system.

Callan provided a list of advocacy options that the county board could pursue:

- Support waiver requests from HUD for an increase in the fair-market-rate allowance for Ann Arbor. The Ann Arbor housing commission has already started working on this issue.

- Advocate for a “local preference” option for individuals seeking shelter services. “Does it mean we’d turn away anyone who’s not from Washtenaw County? No, we have never done that,” Callan said. But Washtenaw County is doing more than its fair share, she said, so the state should either provide more funding or allow the county’s shelter services to prioritize working with people from Washtenaw County.

- Advocate for state enabling legislation to allow “voluntary inclusionary zoning.” This is more of a city or township issue, Callan said, that would allow jurisdictions to require a certain percentage of affordable housing units in any new development.

- Implement and support new source-of-income anti-discrimination policies at the county and state level. A lot of landlords automatically exclude any income that comes from a housing voucher, and there’s nothing to prevent that.

There are also several options for the county board to engage in working to overcome homelessness, Callan said. They could support the recommendations of a task force on sustainable revenue for supportive housing services, which will be making a presentation at the board’s May 22 working session. They could participate in the Continuum of Care, a broad-based community group that focuses on housing and homelessness. In September, there will be a bus tour of housing and homelessness providers, and later in the fall there will be a “community conversation” forum on these issues.

Response to Homelessness: Board Discussion

Yousef Rabhi (D-District 8) said he’d been hoping to see a specific timeline for how the Blueprint to End Homelessness will be updated. Amanda Carlisle of the Washtenaw Housing Alliance said the WHA board had been talking about that, and it’s something that will likely happen in the fall. Mary Jo Callan said the original blueprint was developed as a community-wide project, and the update would involve a broad community effort as well, led by the WHA.

Jason Morgan, director of government relations for Washtenaw Community College and a member of the county’s Community Action Board, and Mary Jo Callan, director of the county’s office of community & economic development.

Responding to another query from Rabhi, former county administrator Bob Guenzel – who serves as WHA’s board chair – said the county and the cities of Ann Arbor and Ypsilanti had authorized WHA to work on developing the blueprint 10 years ago. Then each of those three public bodies approved the blueprint. He said the WHA would appreciate that same kind of support for the update.

Rabhi hoped it would be possible to develop a more detailed timeline on how the update would occur, to ensure it would be done in 2014. Guenzel indicated that WHA has the same goal.

Conan Smith (D-District 9) said he was really disturbed by how homeless people are “dehumanized” if they come here from other communities. “They came here because we have high quality of life,” he said. He wanted to stop making that issue a part of the conversation regarding shelter services.

Ellen Schulmeister of the Shelter Association responded. She noted that 96% of the shelter’s budget comes from local public funding, and the shelter was built for people who became homeless in Washtenaw County. It was her job, as director, “to hold that line,” Schulmeister said. To do that, they established the location of a person’s last permanent residence as well as the reason for coming to this county. About 25% of the shelter’s spots were provided to out-of-county people. Anyone who was turned away who isn’t from Washtenaw County was given transportation to wherever they had connections, she said.

A lot of supportive services are funded based on the county’s boundaries, she noted. Many people had court cases in other counties, and didn’t have transportation to get there. There are many barriers to helping people who aren’t from this county, she said.

Conan Smith said he appreciated how Schulmeister framed the issue, calling it a “very hot-button thing” with some people objecting to their money being spent to support anyone who’s not from here. To him, that’s a poor attitude.

Schulmeister pointed out that the shelter is a limited resource. “So we have to make sure we’re taking care of the people in our community with the building that we have,” she said.

C. Smith replied that it’s a very difficult line to draw. What if someone works here but lives in Oakland County and becomes homeless there? Schulmeister said that if someone has a job in Washtenaw County, they’re considered a resident here. She told commissioners that other counties are shipping people to Washtenaw County for shelter services. “That’s not an appropriate way to treat people, either,” she said.

C. Smith told Schulmeister that she was taking the conversation too personally about the shelter. He was talking about a community attitude.

Mary Jo Callan told Smith that his point was well taken. But she noted that unless the state asks other communities to provide something close to the level of support that Washtenaw County provides, “then it’s an issue of volume. I’m sorry, but it’s not about dehumanizing.”

Smith responded: “What you’re saying is it’s a matter of triage. You’re saying a certain kind of person is a better kind of person to serve.”

“I’m not saying that,” Callan replied. “Your point is well taken, but I don’t think that’s what we’re saying.”

Smith acknowledged that it’s a huge challenge, and a comprehensive solution across the entire system is important. Regardless of where people come from, “homeless people have rights, and one of those rights to me is housing.” He hoped they wouldn’t get hung up on the distinction of where people came from. “I think we should just own the fact that we’re going to care for people because they need to be cared for.”

Smith said he thought an economic development strategy needs to be a key component of a solution to homelessness. People need an income in order to sustain their housing, he noted. He asked that Callan, Schulmeister and Carlisle give the same presentation to the county’s workforce development board. Smith said that the chamber of commerce and Ann Arbor SPARK need to understand their role in this effort, too.

Smith also wondered how many of the 4,500 homeless people would likely need supportive housing permanently. Carlisle said that an estimated 1,700 units of permanent supportive housing are needed. Callan added that an upcoming needs assessment will attempt to quantify the need.

Smith said the county wants to have a big role in addressing homelessness, because there are resources that the county can bring to bear on the issue – spanning everything from economic development to community corrections. “Please think holistically and reach out to all of our teams and engage them,” he said.

Felicia Brabec (D-District 4) indicated that she didn’t believe housing could end homelessness, because there are so many contributing factors to homelessness that also need to be addressed. If people don’t have the supportive services they need, they won’t be able to sustain their housing.

She pointed to the example of Utah, where officials decided it was more economical to providing housing to everyone who needs and wants it, as well as supportive services. She thought it was an inventive approach.

Andy LaBarre (D-District 7) invited Callan, Schulmeister and Carlisle to the board’s May 22 working session, to continue the discussion. He chairs the working sessions and sets the agenda.

Ronnie Peterson (D-District 6) wanted to talk more about partners who can help the county address this problem, including partnerships with surrounding counties.

Yousef Rabhi wrapped up the discussion by saying people should have a choice about where they live, but “if Washtenaw County is their only option, then we have failed them as a region.” The goal should be making sure that each individual can live in the community of their choice, for whatever reason, he said.

Outcome: This was not a voting item.

1st Quarter Budget Update

Tina Gavalier, the county’s finance analyst, delivered a financial report on the county’s general fund budget, for first three months of 2014 – from January through March. She noted that the first-quarter projections tend to be conservative, because they’re based on only three months of the year, with limited evidence of budget trends. [.pdf of Gavalier's presentation]

As the board had learned at its April 16, 2014 meeting, Gavalier reported that property tax revenues will be about $720,000 greater than originally projected. The budget had been adopted in late 2013 with an assumption that the tax base would increase by 1% in 2014. According to the equalization report delivered in April, the increase is higher – 2.02%.

Also showing a revenue surplus is the sheriff’s office, with a projected surplus of $111,000 primarily due to higher-than-expected local, state and federal reimbursements.

There are currently projected revenue shortfalls in several areas, including the clerk/register of deeds office ($403,000), district court ($89,000) and interest revenue ($71,000).

In total, there’s now a projected revenue surplus of $277,335 for the general fund, Gavalier said – with shortfalls being more than offset by the property tax surplus.

On the expense side, the sheriff’s office is about $564,000 over the amount budgeted for this year, due to higher-than-expected overtime costs, expenses for inmate food and medical expenses. For all other departments combined, so far expenses are projected to be about $54,000 over budget. Those amounts are partially offset by a projected surplus of about $239,000 in tax appeals and refunds – that is, it’s expected that those expenses will be less than budgeted. Gavalier noted that most of that tax appeal and refund activity will take place in the third quarter, so the amount of any surplus would be clearer then.

Gavalier noted that structural and non-structural adjustments made to the budget since it was passed in late 2013 total about $560,000 in increased expenses. Those include the addition of autism health care coverage, the board’s decision to hire a position for budget work, a “local government initiative” intern, a position in the sheriff’s office, and allocations to keep the homeless shelter’s warming center open in April.

In total, there are $347,565 in general fund over-expenditures as of March 31.

Based on the first-quarter report of revenues and expenses, the 2014 general fund is projected to have a $70,230 shortfall by year’s end – with total revenues of $103,404,537 and total expenditures of $103,474,767. There is no planned use of fund balance for this year’s budget.

Gavalier also reported on several items that will be monitored in the coming months:

- higher expenses in child care programs – for the trial court, children’s services detention, and the department of human services – due to increased caseloads and placements

- fringe benefits

- personal property tax reform

- Act 88 legislation repeal or reform

- annual actuarial valuations for pensions and retiree health care

- annual cost allocation plan

- state revenue-sharing

In the near future, Gavalier said, county administrator Verna McDaniel will present the board with recommendations for dealing with any projected deficits or surpluses. The next quarterly update will occur in August, with a budget affirmation process for 2015 through 2017 taking place this fall.

1st Quarter Budget Update: Board Discussion

Conan Smith (D-District 9) asked about the “local government initiative intern” line item. County administrator Verna McDaniel replied that it refers to a fellowship that’s being developed to help with budget-related work.

By way of background, at the board’s March 19, 2014 meeting, commissioners authorized McDaniel to hire a contract employee who will support budget-related work this year for the county board and administration. As county administrator, McDaniel has discretion to spend up to $50,000 on professional services contracts. She’s taking the approach of creating a fellowship, with the hopes of tapping students from institutions like the University of Michigan’s Ford School of Public Policy, for example.

Smith then asked how the current first quarter compares to other years. Gavalier noted that one of the main differences this year is that the budget doesn’t include the use of fund balance. In recent years, the budget has used reserves to help balance the general fund budget.

Dan Smith (R-District 2) asked about the shortfall in the clerk/register of deeds office. It had been primarily related to a decrease in revenues from document-processing, so he wondered if there was a corresponding decrease in expenses. If so, was the $403,000 a net or gross amount? Gavalier replied that revenues and expenses are looked at separately, because most departments don’t have enough general fund revenue to cover their general fund expenditures. She noted that the budgeted revenues for the clerk/register of deeds in 2014 was $700,000 higher than 2013.

Dan Smith said that his expectation would be to see expenses decrease, if fewer documents are being processed. Gavalier said she’d follow up with him on that.

Yousef Rabhi (D-District 8) asked about the budget for veterans relief. It seems that the department of veterans affairs regularly shows a shortfall, he said. If the county isn’t levying at a high enough rate to take care of veterans in Washtenaw County, the board should look at increasing that levy, he said. Rabhi asked Gavalier to comment on that.

By way of background, the board voted to levy a 0.0333 mill tax for indigent veterans services on Oct. 16, 2014. The rate of 1/30th of a mill was levied in December 2013 to fund services in 2014. It was expected to generate $463,160 in revenues. The previous rate, levied in December 2012, was 0.0286 mills – or 1/35th of a mill. It generated $390,340 in 2013.

The county’s position is that it is authorized to collect up to 1/10th of a mill without seeking voter approval. That’s because the state legislation that enables the county to levy this type of tax – the Veterans Relief Fund Act, Public Act 214 of 1899 – predates the state’s Headlee Amendment. The county first began levying this millage in 2008. Services are administered through the county’s department of veterans affairs.

Gavalier noted that the board has increased the rate in the past two years. Rabhi replied that it still might not be enough. It’s a priority to take care of veterans who have sacrificed so much, he said. Gavalier indicated it would be possible to discuss options, based on looking at the last two years and the first quarter of 2014. Rabhi noted that the levy is relatively small, which is good from a taxpayers’ perspective, but there’s a need to provide services for indigent veterans.

Switching topics, Conan Smith said he’d like to consider creating a “budget stabilization fund,” like the state has. The state has a “rainy day” fund with money set aside in case something goes wrong, he said. The county’s approach is to leave money in its fund balance, he noted. The target is to have a fund balance that’s 20% of the county’s general fund budget. Smith noted that since November 2013, the board has tapped the fund balance for about $500,000 for various reasons. “When we spend money without identifying a source, that means it comes out of fund balance,” he said. So if they really want to be deliberate in building up a strategic reserve, he thought they should consider creating a separate budget stabilization fund. He hoped the board could talk about that as part of its budget discussions.

Dan Smith said he liked the idea. The board could then as a body make decisions on allocating the funds toward specific activities. Alicia Ping (R-District 3) also supported creating some kind of designated fund reserve.

On another note, Rolland Sizemore Jr. (D-District 5) observed that last year, the administration and board had been on a path to borrow $350 million to cover employee pension and retiree health care costs. He thought they needed to discuss that issue too.

Outcome: This was not a voting item.

Rabinowitz Appointment

Ellen Rabinowitz was nominated for appointment as health officer for the Washtenaw public health department, after serving in that position on an interim basis since late last year. The appointment is effective May 19.

Rabinowitz will receive a salary of $126,098. That salary includes her role as executive director of the Washtenaw Health Plan, a job she’s held for 11 years.

A staff memo notes that the county will see a savings of $30,266 in personnel costs as a result of this appointment. The salary will be covered by the public health department (80%) and the Washtenaw Health Plan (20%). Fleece’s salary was covered in full by the public health department.

The county board appointed Rabinowitz as interim health officer on Nov. 6, 2013. The appointment was spurred by the retirement of former health officer Dick Fleece, effective Dec. 28, 2013.

The position is mandated by the state, and requires a graduate degree and 5 years of full-time public health administration. Responsibilities include overseeing the county’s public health department. [.pdf of Rabinowitz resume]

Outcome: The appointment was approved unanimously. Rabinowitz received a round of applause from commissioners and staff.

Support for Minimum Wage Increase

The May 7 agenda included a resolution calling for an increase in Michigan’s minimum wage to $10.10 per hour.

At the board’s April 2, 2014 meeting, board chair Yousef Rabhi (D-District 8) had indicated his intent to bring forward this resolution. Earlier that day, President Barack Obama had given a speech at the University of Michigan that focused on the need to raise the federal minimum wage to $10.10.

The resolution debated on May 7 includes a quote from Obama’s speech: “We believe our economy grows best not from the top down, but from the middle out, and from the bottom up paychecks and wages that allow you to support a family…Nobody who works full-time should be raising their family in poverty.” [.pdf of resolution]

The two resolved clauses state:

NOW THEREFORE BE IT RESOLVED that the Washtenaw County Board of Commissioners hereby voices support for the efforts of President Obama to increase the Federal Minimum Wage to $10.10 per hour.

BE IT FURTHER RESOLVED that the Washtenaw County Board of Commissioners supports the current efforts of legislators and citizen groups to increase Michigan’s minimum wage to $10.10 per hour.

There was no discussion on this item prior to the vote.

Outcome: The resolution passed, over dissent from Alicia Ping (R-District 3). Not voting yes was also Dan Smith (R-District 2), who stated “Present” for his vote. In the past, Smith has objected to the board weighing in on state-level issues. Rolland Sizemore Jr. (D-District 5) was not in the room when the vote was taken.

Resolutions of Appreciation

The May 7 meeting included three resolutions that showed appreciation in various ways:

- Declaring the week of May 11-17, 2014 as Police and Correction Officers Week, and designating May 15, 2014 as Peace Officers Memorial Day to honor all police and corrections officers who’ve lost their lives in the line of duty;

- Recognizing work of the county’s office of community & economic development as part of the 50th anniversary of the federal Economic Opportunity Act of 1964, when community action agencies were created, and declaring May 2014 as Community Action Month;

- Honoring Tyler Lukomski, a Chelsea resident, for achieving the rank of Eagle Scout.

Jason Morgan, director of government relations for Washtenaw Community College and a member of the county’s Community Action Board, accepted the resolution declaring May as Community Action Month. He thanked commissioners for including human services in their list of budget priorities, and for committing $1.15 million to coordinated funding.

Communications & Commentary

During the May 7 meeting there were multiple opportunities for communications from the administration and commissioners, as well as public commentary. In addition to issues reported earlier in this article, here are some other highlights.

Communications & Commentary: Environmental Issues

Yousef Rabhi (D-District 8) reported that he’d been in Lansing talking with Michigan Dept. of Environmental Quality staff about the Pall-Gelman 1,4 dioxane plume. He said it seems like there’s progress on that issue, although the timeline is much longer than he hoped. He said he’d continue to press on that.

Rabhi also said he’d met with residents from the west side of the county about the threat of oil extraction. A drilling permit has been applied for in Scio Township, and residents are afraid that the state will grant the permit. Residents might be coming to the county board to ask for support in delaying the permitting process, so that there could be more community input. He hoped to bring forward a resolution at the May 21 meeting.

Update: A resolution is now on the May 21 agenda. The two resolved clauses state:

BE IT THEREFORE RESOLVED, that Washtenaw County, Michigan:

1. Opposes said oil exploration and drilling, and any future oil exploration and drilling in this area and other areas within the boundaries of Washtenaw County; and

2. Respectfully requests that the Michigan Supervisor of Wells, as part of the Michigan Department of Environmental Quality, deny the permit application to drill the Wing 1-15 well as proposed; and

3. Hereby requests that the State of Michigan and federal legislators move to enact legislation and improve regulations to reduce the risks to public health, safety, welfare and the environment posed by the oil and gas industry, and re-commit to promoting and protecting quality of life, our economic well-being, and our environment through less reliance on non-renewable energy resources.

BE IT FURTHER RESOLVED, a copy of this resolution shall be transmitted as the County’s official comment on said oil drilling permit and application by the Clerk, to each elected official representing Washtenaw County in Lansing, the Office of the Governor, and the Michigan Department of Environmental Quality.

At its May 19, 2014 meeting, the Ann Arbor city council approved a similar resolution opposing oil exploration in Scio Township.

Present: Felicia Brabec, Andy LaBarre, Kent Martinez-Kratz, Ronnie Peterson, Alicia Ping, Yousef Rabhi, Rolland Sizemore Jr. (left early), Conan Smith, Dan Smith.

Next regular board meeting: Wednesday, May 21, 2014 at 6:30 p.m. at the county administration building, 220 N. Main St. in Ann Arbor. The ways & means committee meets first, followed immediately by the regular board meeting. [Check Chronicle event listings to confirm date.] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public commentary is held at the beginning of each meeting, and no advance sign-up is required.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Washtenaw County board of commissioners. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!