Budget Debate: Public Safety Concerns

Washtenaw County board of commissioners meeting (Nov. 6, 2013): At another nearly six-hour meeting, county commissioners handled a full agenda with several major action items, including the 2014-2017 budget.

From left: Washtenaw County commissioners Yousef Rabhi (D-District 8), Andy LaBarre (D-District 7) and Ronnie Peterson (D-District 6). (Photos by the writer.)

Following about three hours of debate and some minor amendments, commissioners gave initial approval to the proposed four-year general fund budget, for the years 2014-2017. The 7-2 vote came over the dissent of Dan Smith (R-District 2) and Ronnie Peterson (D-District 6), who cited concerns over a budget cycle extending for four years rather than two.

Much of the budget discussion focused on the sheriff’s operations. No layoffs are proposed, but 8.47 FTE positions would be kept unfilled. Most of those are in the sheriff’s office, which has a targeted budget reduction of $1.34 million. Sheriff Jerry Clayton, an elected official, attended the Nov. 6 meeting and addressed the board, telling commissioners that his office can’t continue to absorb budget cuts without affecting services. “For me not to tell you what I believe the impact on public safety is, if you make those cuts, would be negligent in my responsibility as the county sheriff.”

Board chair Yousef Rabhi (D-District 8) countered that every department head could make arguments against budget cuts. Noting that more revenues are needed, Rabhi said he hoped commissioners would support putting a countywide public safety millage on the ballot.

During public commentary after the budget debate, county prosecuting attorney Brian Mackie told commissioners that they had a difficult job, but that they were making it harder than it needed to be. He suggested looking for guidance in the state constitution, and relying on the experience of county administrator Verna McDaniel. Mackie also questioned whether commissioners were truly committed to public safety as a priority. He praised Clayton, noting that the sheriff is a respected figure with a national reputation. “He might know more about safety and criminal justice than you do,” Mackie said.

The budget must be given final approval by the end of the year, and only two more board meetings scheduled: On Nov. 20 and Dec. 4. The board will also hold a second public hearing on the budget on Nov. 20.

Several other agenda items related directly or indirectly to the county’s budget. On a 7-1 vote, the board gave final approval to an increase in the levy of the economic development and agricultural tax, known as Act 88 of 1913. The increase to the Act 88 millage is from 0.06 mills to 0.07 mills. Dan Smith (R-District 2) dissented and Rolland Sizemore Jr. (D-District 5) had left the meeting by the time the vote occurred, just after midnight. Smith questioned the constitutionality of the county levying this tax, as well as the legality of how the revenues are spent.

During public commentary, the board also heard from two people who objected to the tax levy, including Bill McMaster of Taxpayers United. McMaster, who helped lead the statewide campaign that resulted in passage of the Headlee Amendment in 1978, noted during public commentary that there’s a provision in the law allowing for legal action if taxes are raised without voter approval. It’s an action “which we will pursue,” he said.

The board also unanimously approved a tax-sharing agreement to allow a portion of county taxes to be captured by Pittsfield Township’s State Street corridor improvement authority (CIA). Pittsfield Township supervisor Mandy Grewal addressed commissioners during public commentary, thanking them for their support of the CIA. One opponent to the CIA – former township official Christina Lirones – spoke during two opportunities for public commentary, urging the board to opt out of the CIA.

Other items handled during the Nov. 6 meeting included (1) final approval to extend the coordinated funding approach for human services, as well as to authorize some changes in that funding model; (2) appointment of an advisory committee to propose options for county property on Platt Road; (3) final approval of a brownfield plan for Chelsea Milling Co. (Jiffy Mix); and (4) appointment of Ellen Rabinowitz as temporary health officer to replace Dick Fleece, who’s retiring at the end of 2013.

Communications during the meeting included public commentary from supporters of the Delonis Center homeless shelter in Ann Arbor, and concerns about state standards for permissible levels of 1,4-dioxane.

2014-2017 County Budget

The proposed four-year general fund budget, for the years 2014-2017, was on the agenda for initial approval.

County administrator Verna McDaniel had presented the budget to the board on Oct. 2, 2013. The $103,005,127 million budget for 2014 – which represents a slight decrease from the 2013 expenditures of $103,218,903 – includes putting a net total of 8.47 full-time-equivalent jobs on “hold vacant” status, as well as the net reduction of a 0.3 FTE position. The recommended budgets for the following years are $103,977,306 in 2015, $105,052,579 in 2016, and $106,590,681 in 2017. The budgets are based on an estimated 1% annual increase in property tax revenues. [.pdf of draft budget summary]

Most of the 8.47 FTEs that are proposed to be kept unfilled are in the sheriff’s office. Sheriff Jerry Clayton attended the Nov. 6 meeting and addressed the board, telling commissioners that his office can’t continue to absorb budget cuts without affecting services.

Aside from discussing the sheriff’s concerns, much of the board’s discussion focused on the issue of a four-year budget, which is being proposed for the first time as a way to improve long-term planning and stability. Ronnie Peterson in particular objected strongly to that approach, and prefers to maintain the current two-year budget process.

A public hearing was held on Oct. 15, 2013 but it was held after midnight and no one spoke. In a separate resolution on Nov. 6, the board set a second budget hearing for Nov. 20.

2014-2017 County Budget: Initial Public Commentary

During the first opportunity for public commentary, Doug Smith told commissioners that he’d asked them about a month ago to pass a resolution stating that no vacant county position would be filled until Jan. 1, 2014 unless approved by the board. Commissioners haven’t passed such a resolution, he noted. His suggestion was made so that the county would save money in the already-underfunded retirement accounts, Smith said. Every employee added to the current defined benefit pension plan will cost the county money for about 30 years, he noted.

In January 2014, Smith said, he plans to submit a Freedom of Information Act request to find out how many employees have been hired in the last quarter of 2013. He then plans to calculate the money that’s been wasted, and post that information on the Washtenaw Watchdogs website, for all constituents to see. The website has had more than 100,000 visits in its first four months, he said, and some of the most popular posts are ones about the county board wasting taxpayers’ money. He again urged commissioners to reconsider hiring anyone until the county’s defined contribution plan takes effect on Jan. 1.

2014-2017 County Budget: Board Discussion – Four-Year Budget

Conan Smith (D-District 9) began by saying he’s been getting a “full-court press” from the board leadership about the four-year budget, and he’s had some really intriguing conversations about it. He said he’s not been supportive of a four-year budget because the board hadn’t developed community impacts and outcomes to guide their budget decisions. The transition from an investment in activities to an investment in outcomes is the right direction, he said, and it needs to be clearly articulated with an achievable set of metrics.

The board doesn’t have a process by tradition or policy for continual engagement in the budget, he noted, so without having that process in place, he said, a four-year budget compromises future boards and doesn’t help achieve the community outcomes. So Smith wanted to see language about that community outcomes process in the budget document, to ensure that future boards will have clearly articulated ways for engaging in the county’s investment strategy.

Smith noted that it’s a long process to engage the county’s staff in implementing the board’s desired outcomes. He indicated he’s been criticized for wanting everything to happen right away, “which is absolutely true.” But he acknowledged that it might not be possible or healthy for the organization to implement this process quickly. A longer-term budget process would offer stability and predictability, and working on these other issues in a more incremental way might be less threatening and more palatable to staff who provide services to residents and who need to be engaged in the strategic planning process, which takes a lot of emotional and intellectual energy, he said.

In that context, C. Smith said he was being persuaded about the value of a longer-term budget.

Ronnie Peterson (D-District 6) noted that setting the budget is the most important job of the board, and he apologized to people who were attending the meeting for other reasons if he took more time talking about it. He agreed with C. Smith about concerns over the four-year budget, saying that he thought Washtenaw County would be the only one in the country to have such a long-term budget. The board had been surprised about the cost of the pension and retiree health care liabilities earlier this year, he said. He wondered what would happen to the four-year budget if they discovered there was additional debt that they don’t know about yet. [For background on the retiree liability issue, see Chronicle coverage: "County to Push Back Vote on Bond Proposal."]

Peterson noted that the county’s equalization office had reported that it’s not possible to know what the revenues are until several months into each year. So the county is spending money before it knows how much there is to spend, he said. The board has made some major changes over the years during the economic downturn, he noted, and they’ve asked employees to take unpaid furlough days to help cut costs. That was unprecedented, he said. He was concerned that potential furlough days were part of the proposed budget.

County administrator Verna McDaniel clarified that the furlough days remain in the previously approved labor contracts, but the proposed budget does not assume that those furlough days will be used.

Peterson also noted that revenues from Act 88 and the veterans relief millage are included in each of the four years of the budget. Those millages have to be approved by the board each year, he said, so he didn’t know how it was possible to base the budget on that. If any new board decides not to support those millages, it would impact the budget. He indicated that programs and services that are supported by those millages should be funded through general fund revenues.

Regarding the sheriff’s budget, Peterson asked for clarification about the labor contracts that are currently being negotiated. He also wondered about the contracts with local municipalities that pay the sheriff’s office for deputy services, and how the four-year budget would be affected by that.

McDaniel reported that the contracts with townships for sheriff deputies are part of the budget, under the revenue line item for fees. Those contracts bring in about $12 million in revenue annually, she said.

For the labor agreements, McDaniel said the current contracts for the Police Officers Association of Michigan union (POAM) expire at the end of 2014. The contracts for the Command Officers Association of Michigan union (COAM) expire at the end of 2015. Peterson wondered how the budget can account for the labor costs in the county’s contracts with the townships, if the labor agreements for POAM and COAM haven’t been settled. McDaniel said the labor costs have been projected, based on salary estimates and trends for fringe benefits. There’s been a 1% annual increase through 2016 calculated into the agreements with local municipalities who contract for sheriff deputy services.

Peterson wondered what would happen if those labor costs increase by more than 1%. McDaniel said that a police services steering committee, which includes representatives from the contracting municipalities, discusses this issue. The committee’s projections are aligned with the county’s budget projections, she said. Peterson was concerned that the amount could increase, and he cautioned that local communities might not have the budget flexibility to absorb the increases. There’s a lot of uncertainty over what the costs will be, he said, but he’s sure the increases would be higher than 1%.

Peterson then asked about what the county’s potential loss would be if voters don’t approve a replacement to the personal property tax next year. McDaniel acknowledged some uncertainty from the state on this issue, so that’s something to monitor. Budget projections include personal property tax revenue of $5.5 million in 2014, although there’s some uncertainty beyond that, because the tax will be phased out through 2022. As part of that change, a statewide voter referendum is slated for August 2014 to ask voters to authorize replacement funds from other state revenue sources. It’s unclear what will happen if that voter referendum fails.

McDaniel also said the budget assumes that the state will maintain the incentive program that replaced state-revenue sharing, for $5.5 million annually. This approach requires the county to meet certain state requirements. Under the previous state revenue-sharing approach, the county received about $6.8 million annually.

Peterson argued that there was too much uncertainty in a four-year budget, because it was too difficult to project how much revenue the county would receive. He was concerned about the amount of unfunded retiree liabilities. Commissioners are only elected to two-year terms – and that’s another factor, he said.

Andy LaBarre (D-District 7) said he took Peterson’s concerns seriously, saying that Peterson has a track record of fighting for his constituents and all residents of the county. LaBarre also agreed with C. Smith’s call to make the budget focused on outcomes – that’s critical. Being pro-active is one of the reasons why he ran for office, LaBarre said.

For the last six years, the county was forced to steer from iceberg to iceberg, LaBarre said, “and we hit each one.” He worries that the two-year budget process doesn’t provide enough time to plan for things that come up, anything from large economic forces to changes in state policy. He said he was excited to try something new, to set a four-year course. Each year, the board would meet its constitutional requirement to approve the next year’s budget and make adjustments – that provides a safety valve for the four-year budget framework. It’s not perfect, but it’s a step in the right direction, he said. The four-year budget helps focus on outcomes, not just spending money.

Yousef Rabhi (D-District 8) responded to some of the previous comments. He was excited about changes that will allow for fiscal stability and staff security, resulting in programs and services that residents can count on. “It’s an opportunity to revolutionize the way county government is done,” he said. He wants the board to be engaged in the budget every year, calling it a “living document.” It’s important that commissioners develop a calendar of events for each year of the four-year budget, he said, focusing on board priorities and community outcomes. He offered to work with administration to build that into the budget resolution.

From left: Corporation counsel Curtis Hedger, board chair Yousef Rabhi (D-District 8), and Felicia Brabec (D-District 4), chair of the board’s ways & means committee.

Rabhi also pointed out that commissioners are part-time, and they need additional support staff to help them focus on these community outcomes. They can’t do it alone.

Already, the board has to adjust the budget every year based on the outcome of the equalization report, Rabhi noted. Why not have a process in place so that the board is better engaged in that process? He believed a four-year budget can be transformative. Washtenaw County government and residents believe in innovation and in being cutting edge. “That’s what this four-year budget is all about,” he said. Rabhi alluded to an interview he’d recently heard with California governor Jerry Brown, who said that society is like an organism with a certain kind of DNA. Washtenaw County needs to build the DNA for change to happen – that’s the potential that a four-year budget represents, he said.

Conan Smith referred to Peterson’s remarks about the uncertainty of Act 88 and veterans relief millages, and advocated to see whether the staff who are currently supported by those millage revenues could be funded through other sources instead. He wasn’t sure it was possible, but he wanted to look into it. The current approach puts undue stress on staff, he said.

C. Smith added that he hadn’t anticipated voting on the budget that night, but he had some issues he wanted to bring forward for discussion.

Dan Smith (R-District 2) also expressed concerns about a four-year budget. His preference is to adopt a two-year budget, then call the next two years a proposal or projection. He was interested in hearing C. Smith’s ideas for being more actively engaged in the budget process, although he didn’t support making dramatic changes to the budget after it’s adopted. If the budget is not relatively stable, he noted, there’s no point in doing longer-term budgets.

2014-2017 County Budget: Board Discussion – Amendment (Employees Per Capita)

The budget document, in a section on financial trends, included an indicator of employees per capita. C. Smith noted that the document indicates that the trend is positive if there are fewer employees per capita. “I don’t believe that that’s necessarily the case,” he said. In delivering services to residents, having fewer people to do that doesn’t make sense, he said. This data has been in the budget document for years, he noted, but it doesn’t relate to the way the county does business. The administration has indicated that this indicator not used to determine staffing levels. He wanted to see it removed from the budget book, and he made a motion to do that.

County administrator Verna McDaniel said it’s one of many trends that’s recommended by the International City/County Management Association (ICMA), but only if an organization finds it useful. She said that C. Smith was correct – the administration doesn’t use it to determine staffing levels.

C. Smith said that including it sends the wrong message to the community.

Outcome: Commissioners unanimously voted to remove the employees-per-capita section from the budget document.

2014-2017 County Budget: Board Discussion – Amendment (Organizational Survey)

C. Smith noted that the county previously used an organizational capabilities survey to gauge employee attitudes. The survey was perviously done every two years, but for budgetary reasons it hasn’t been done since 2008. He called it a fantastic tool that wasn’t too expensive to implement – between $10,000 and $50,000 each year.

Kelly Belknap, the county’s finance director, indicated the cost had been about $50,000 for the first year, and about $35,000 each time after that. She wasn’t sure how much work it would take to restart the survey, or what the current costs would be.

C. Smith thought it was a manageable amount, and he wanted to add a line in the budget document that stated the county would do these surveys again. After some additional back-and-forth with administration, he suggested waiting until the Nov. 20 meeting to figure out how this might be incorporated into the budget.

Outcome: No formal action was taken on this proposal.

2014-2017 County Budget: Board Discussion – Amendment (Affordable Care Act)

Yousef Rabhi said he still wasn’t comfortable with an item added to the budget policy regarding the Affordable Care Act. He was referring to this item, which had also been discussed at the board’s Oct. 2, 2013 meeting:

16. To be in compliance with federal health care reform and the Affordable Care Act effective 1-1-14, the Board of Commissioners reaffirms Resolution #13-TBD that part time employees are not permitted to work more than 25 hours per week. Any part time employee hired, shall not work more than 25 hours per week.

Rabhi didn’t feel this approach was in the spirit of the federal legislation, nor was it the right thing to do for county employees. Conan Smith agreed, noting that the board has discussed issues like a living wage and having health insurance as a right. Health care is important, he said, and the county shouldn’t be trying to figure out how not to give people health insurance.

Diane Heidt, the county’s human resources and labor relations director, said the intent is to alert departments about this potential issue as a liability that could affect their budgets, if employees work more than 30 hours per week. Starting in 2015, the Affordable Care Act will require the county to offer health insurance to anyone who works 30 hours or more per week during a specified period. It doesn’t mean that the employee has to buy the health insurance, Heidt explained, but the county must offer it. This will affect primarily the parks & recreation staff, sheriff’s office, the water resources commissioner, and the community support & treatment services (CSTS) unit – units that use more part-time employees.

After additional discussion, C. Smith moved to delete this item from the budget document, noting that it wouldn’t be an issue until 2015. That will give the county more time to figure out how to address it, he said.

Rabhi said he wanted to have a broader conversation about the county’s part-time employees, not just focusing on health care.

Outcome: Commissioners unanimously voted to eliminate the policy item regarding the Affordable Care Act.

2014-2017 County Budget: Board Discussion – Fund Balance Reserves

Conan Smith alerted commissioners that he plans to bring an amendment forward at the Nov. 20 meeting regarding the fund balance reserves. He referred to this item in the budget document:

12. The Board of Commissioners commits to long-term budget flexibility and sustainability, and an adequate level of cash flow with its attention to fund balance. A healthy fund balance is an essential ingredient and the following was considered to determine an appropriate level as a target: an appropriate level to fund at least 60 days of operations, to help offset negative cash flow (primarily from the seven month delay in property tax collections after incurred expenses), and to assist buffering any unexpected downturns. Therefore, the Board shall plan future budgets to meet the goal of a Reserve for Subsequent Years representing at least 20.0% of General Fund expenditures, net of indirect costs. To accomplish this any excess property tax revenue above projected budget (assumptions), but excluding the fiscal years that have structural salary increases tied to property tax revenue growth per labor agreements, as well as any year-end surplus of which 70% will be contributed to fund balance until the reserve goal is met and 30% to be determined by Board of Commissioner authorization.

He said he’s talked with the administration about this, and has come to agree with them about the 20% target. [The existing target is 8%.] One strategy for dealing with the county’s annual cash flow challenge is to increase fund reserves, he noted. Another strategy is to borrow internally from other county funds, and a third strategy is to issue tax anticipation notes, which results in an additional borrowing cost.

The easiest approach by far is to increase the fund reserves, he said. However, he’s reluctant to lock in a formula of allocating funds to that. He thought the allocation of surplus revenue should happen through a process with a thorough board debate.

C. Smith said he planned to work with administration to bring forward a proposal on Nov. 20.

2014-2017 County Budget: Board Discussion – Amendment (Revenue Increase)

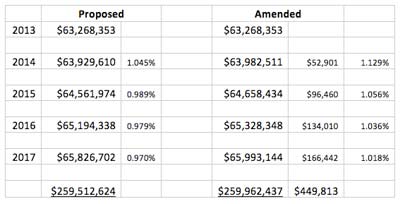

Dan Smith proposed adjusting the revenue line item for general fund taxes and penalties to increase the projected revenues by $449,813 over the four-year period from 2014-2017.

He further proposed allocating the increased revenues in this way: (1) $100,000 each year to the sheriff’s office; (2) change the “Other Services & Charges for the Board of Commissioners” to add $26,230 for dues to the Michigan Association of Counties (MAC) and to cut the convention and conferences line item by half – to $12,275.

D. Smith explained that he had tried to come up with a way to address concerns about the public safety budget, as well as some interest by other commissioners in restoring the county’s membership in MAC. The projected increases in revenues are tweaked slightly to achieve the extra revenues that can then be allocated toward the sheriff’s budget and MAC.

Conan Smith called the proposed increase in projected revenues “negligible,” saying that it isn’t any more or less accurate than what’s currently projected. That’s not the issue. But he worried about the precedent of the board making this kind of change, rather than the professional finance staff. C. Smith also said he didn’t support joining MAC, saying he didn’t think the county got $26,230 worth of good service out of that organization. He didn’t think MAC was an effective advocate or an articulate representative for the values of Washtenaw County.

In response to a question from C. Smith, D. Smith said he’s previously mentioned concerns about a reduction to the sheriff’s department budget. That reduction makes it difficult for pro-active policing to be done, he said. The sheriff’s office has already been cut in previous budget cycles, he noted, and the proposed cuts will have a very adverse effect on public safety across the county.

D. Smith indicated that he’d be receptive if C. Smith wanted to propose an amendment to his amendment, eliminating the proposed restoration of MAC dues.

C. Smith said he was intrigued by D. Smith’s proposal, but wanted to postpone it until Nov. 20 in order to have time to talk with the sheriff.

Outcome: On a voice vote, the board voted to postpone action on D. Smith’s proposed amendment until the Nov. 20 meeting. Yousef Rabhi (D-District 8) voted against postponement.

2014-2017 County Budget: Board Discussion – Amendment (Coordinated Funding)

Dan Smith put forward an amendment to decrease funding to the line item for coordinated funding from $1.015 million annually to $915,000. The $100,000 cut would be allocated to the sheriff’s office. Coordinated funding supports local nonprofits that provide human services, through a partnership with the city of Ann Arbor, Washtenaw Urban County, United Way of Washtenaw County, and the Ann Arbor Area Community Foundation. The program is administered by the county’s office of community & economic development (OCED).

In introducing this amendment, D. Smith said he hears from people that public safety is one of the top concerns, and the board has also stated that public safety is a priority. He has great concerns about the proposed reductions to the sheriff’s department.

Outcome: D. Smith’s motion did not receive a second, so it died for lack of support.

2014-2017 County Budget: Board Discussion – Sheriff’s Office

Rolland Sizemore Jr. (D-District 5) asked county administrator Verna McDaniel if it was true that the sheriff’s department has a $500,000 automatic budget reduction each year. McDaniel said that during the first year that sheriff Jerry Clayton was in office (2009), his budget was cut by $500,000. But she contended it hasn’t been reduced by that amount in subsequent years.

Sizemore noted that the initial $500,000 cut occurred under the previous county administrator (Bob Guenzel). He wondered if that same amount was cut each year. McDaniel described that initial $500,000 as a structural cut. She noted that since 2008, the county has needed to cut budgets and the sheriff has cooperated. Because the $500,000 was structural, it carries through to subsequent years, she said.

McDaniel confirmed that the administration is asking for a reduction in eight positions from the sheriff’s department, but she stated that those positions are currently vacant. Sizemore said he wouldn’t support that reduction.

Ronnie Peterson wondered what the effect would be on cutting those positions, and the impact it would have on public safety. He said he’d be interested in hearing from the sheriff.

Sheriff Jerry Clayton told commissioners that a couple of things about the budget deeply concerned him. He said he understands the broader budget context, and the role that his office plays. They’ve stepped up in finding reductions and increasing revenue. But at this point, continued cuts will greatly impact the ability of his office to provide services and to manage the police services contracts with other municipalities.

The administration’s assertion that the proposed cut of eight positions won’t have an impact is not true, Clayton said. It’s true that the positions are currently vacant, for a variety of reasons – including retirements and people quitting – but there are plans to fill those spots. He noted that a previous board of commissioners had approved a jail expansion. His office had been asked to conduct a staffing study, which determined that it would take 36 correction officers to staff the facility. The county board had approved that, and a hiring process has been ongoing. The sheriff’s office has over 420 employees, Clayton said, including full-time, part-time and seasonal workers. Given that number, there will always be a certain amount of turnover. There will always be vacant positions, he said. When the office is fully staffed, they can realize the level of services that are needed, Clayton said.

Clayton also addressed the question of the $500,000 annual reduction. He said when he came into office, he had agreed to it with the prior county administrator. But there was no agreement that it would be in perpetuity, Clayton said, “at least not in my mind. My mistake was in not getting it in writing.” At this point, his office can’t meet the proposed expenditure target, he said, so that puts them in a position of being over budget or reducing the services they provide.

Clayton referred to a letter he’d written to McDaniel, and cc-ed to the board leadership, in response to the budget proposal. The proposed budget reduction of $1.34 million for the sheriff’s office would significantly compromise public safety, he said. Although he could “grudgingly” agree to putting the eight positions on hold vacant status, he said, in exchange he wanted the administration to start eliminating the $500,000 automatic lump sum reduction that’s built into the sheriff’s office budget. He also hoped to be able to fill those vacant positions, if the county’s economic circumstances improve.

Clayton noted that some parts of the county government have been “held harmless” or have even seen increases. It’s not for him to judge whether that’s appropriate, he said, but it is his role to ask how the board can agree to reductions that will impact public safety, while stating that public safety is a priority.

Even local governments that have their own public safety departments still rely on the sheriff’s office as an additional public safety net, he said. As an example, he cited the recent murder of an Eastern Michigan University student. The sheriff’s office is involved in providing increased security in that area, and in helping coordinate other public safety entities. He gave another example of assisting a recent Ann Arbor investigation. “Because we’re a countywide jurisdiction, we’re able to connect the dots.” Criminals and crime don’t have jurisdictional boundaries, so public safety in Washtenaw County affects everyone, Clayton said. The county has a well-deserved reputation as a great place to live, in part because it’s a very safe and secure community. “That does not happen by accident,” he said. It requires a commitment to public safety.

As a countywide elected official, Clayton said it’s his responsibility to inform the board – which makes budget decisions – that if they continue along this path, they won’t be able to sustain public safety in a manner that residents are used to, and Washtenaw County might become a community that’s considered unsafe. There might be some areas that are insulated, “but we all know if there’s a part of Washtenaw County that’s considered unsafe, it affects us all.”

Yousef Rabhi thanked Clayton, but said he wanted to push back a little. He said he prioritized public safety and thinks it’s important. But he thinks a lot of things that the county does are important. The county doesn’t have the funding to do everything it used to do, he said, and there are tough decisions to make. If every department head had the chance to come forward, they’d give the same impassioned plea that the sheriff gave, Rabhi said, and the board needs to understand that fully.

The only way to sustain services in all areas is to get more revenue, Rabhi said. If the county prioritizes public safety, as it should, then residents should support a public safety millage to support the sheriff’s operations, he said. The county government has its hands tied by the state, Rabhi noted, and revenue streams are declining. There are few options, so he hoped commissioners would support putting a new millage on the ballot. Meanwhile, the board needs to make responsible budget cuts to balance its budget.

Clayton responded, saying it’s the board’s prerogative whether to invite every department head to talk with them. As for his own remarks, “it’s not an impassioned plea – I’m just stating the facts,” he said. Oftentimes the board doesn’t hear from people who are affected by budget cuts. It’s not possible to gauge the impact of budget cuts and outcomes if the board doesn’t have all the information from people who are affected, Clayton said. Nonprofit leaders come to the board and make those impassioned pleas, he added, “and you make decisions based on that. So don’t single me out. You asked me. I’m telling you what the impact is. For me not to tell you what I believe the impact on public safety is, if you make those cuts, would be negligent in my responsibility as the county sheriff.”

Sizemore thanked Clayton for coming, and said he’d like to be included in any future communication about the sheriff’s office budget.

Conan Smith said he was glad they were having this conversation, but was sorry that it’s happening in November. The board couldn’t have a better partner than the sheriff’s office in thinking through how to invest strategically. Clayton had actually inspired a lot of the processes that the board is now going through, Smith said, and Clayton’s team has played a leadership role. But Rabhi is right, Smith added, in that any department head could make a case for why their activities are important, and the county doesn’t have a rubric for evaluating why one activity is more important than another. “We’re trying to get there,” he said.

Clayton replied that he didn’t say public safety was more important than anything else – as he wasn’t making comparisons. His point was that it’s a priority to the county, but it’s still up to the board to decide how to prioritize the value of public safety, in terms of budgeting. If the board ends up cutting the sheriff’s budget, “we’ll live with it,” Clayton said. But he wanted the board and the public to know what’s likely to happen if cuts are made.

Clayton then gave some examples of how the sheriff’s office has collaborated to reduce expenses. Four SWAT teams supported by different governmental units were combined into one team, which reduced costs. Partnering with the city of Ann Arbor on dispatch operations saved the city almost $500,000, he said. He noted that previous discussions have connected economic development to the community’s sense of safety.

Conan Smith asked whether Clayton had talked to the administration about how the county can reduce expenses by decreasing the demand for the sheriff’s office services. Has the discussion occurred about where the county should be strategically investing to make that happen? Clayton said they’re working on that, but it’s a long-term approach that requires resources to achieve. Part of the office’s community engagement strategy is getting into the neighborhoods and working with residents to address root cause problems that change the dynamics of the community. That includes partnering with schools and human service agencies of all kinds, he said. Short of not getting re-elected, Clayton joked, he said he’d love to work himself out of a job.

Conan Smith then shifted to the issue of labor contract negotiations with POAM and COAM. The last contract with the sheriff’s deputies was “more lucrative” than what was implemented with other labor units, C. Smith said. Does this budget anticipate parity with other labor unions? he asked.

Clayton reminded the board that the POAM and COAM agreements were negotiated first, before other units. He assumed that the administration had an overall target of concessions for all units. The POAM came to the table seeing what they could get, and they reached an agreement that was ratified by the board. As subsequent negotiations took place, it’s not fair to tell POAM that they didn’t step up, Clayton said. “They stepped up to what you asked. If you’d asked for more, then they could have had those negotiations.”

That said, Clayton reported that POAM and COAM are aware that all of these things are connected, including the impact on police services contracts with other municipalities. They understand that there’s a balance, he said.

Regarding the police services contracts, C. Smith wondered if the county has optimized that delivery of service, in terms of reducing the impact of those contracts on general fund allocations to public safety. The price point to municipalities can’t be so high that it’s unaffordable, he said, but he indicated there’s more that could be done – like multi-jurisdictional contracting, and innovative policing approaches.

Clayton said that multi-jurisdictional contracting is not something that the sheriff’s office can decide – that’s up to the different local governments. In terms of optimizing staffing, he noted that there’s been a lot of consolidation already. He addressed a complaint he’s heard about the sheriff’s office being top-heavy with management. When he took office, he was asked whether the sheriff’s office could assume responsibility for community corrections. It made sense so that happened, but a manager came with it. The same thing happened with emergency services, and a director came with that transition.

Clayton also said he’s had some conversations with local government officials who pay for police services, and he’d told them that the contract language might have to be revisited. That’s because if staffing is reduced, he’s not sure his office can meet the staffing levels that are laid out in the police services contracts. He didn’t want to set expectations at a level that he couldn’t meet.

Conan Smith said he was very supportive of a public safety millage. It would address the financial challenge as well as the policy tension that exists. Speaking as an Ann Arbor resident, C. Smith said he knows the sheriff’s office works with the city, but it’s much more palatable to invest in other communities’ public safety using the county’s general fund if there’s been a vote by residents to do that.

C. Smith noted that Dan Smith had raised the possibility of allocating an additional $100,000 to the sheriff’s department. How would Clayton use those funds, if available? Clayton replied that he’d restore the lost FTEs to put boots on the ground and staff in the jail. When staffing levels are lowered, his office becomes a reactive organization, he said.

Andy LaBarre asked Clayton how the board can deal with the disparity of views regarding the $500,000 budget cut that began in 2009. LaBarre didn’t think it was good to have a countywide elected sheriff and the county administrator on different pages regarding that issue. Clayton reiterated that it was an agreement made with the previous administrator, and that his assumption had been that it was just for a single two-year budget cycle – saying that’s how it had been presented to him. It was never his understanding that the cut was structural, so his question is whether the office can sustain that ongoing cut as well as additional reductions that are being requested.

The options are to reduce services, Clayton said, or to work with the administration over the next four years and restore that $500,000 to the budget – $125,000 each year. He realized that it couldn’t happen immediately.

LaBarre agreed with C. Smith about the importance of social services and human services, and he acknowledged that the sheriff’s office has worked on these issues – in particular, Derrick Jackson, director of community engagement for the sheriff’s office, has been integral for that, LaBarre noted. He hoped a solution could be worked out as quickly as possible regarding the structural budget question.

Clayton replied that his office will always remain a partner in this process, even if they don’t agree on the outcome.

2014-2017 County Budget: Board Discussion – Amendment (Legal Fees)

Dan Smith pointed to an appropriation in the budget document of $100,000 to cover “litigation matters involving the County as Plaintiff, to be overseen by the County Administrator.” He said he’s not a fan of lawsuits, noting the only people who really come out ahead are lawyers on both sides.

He didn’t want to see a recurrence of a recent situation when taxpayer dollars were spent on outside counsel. [This was likely an allusion to the county engaging outside legal counsel after being sued over the board's resolution opposing the state's Stand Your Ground law.]

D. Smith thought the county board meets regularly enough to appropriate funds when necessary, and the corporation counsel is competent to deal with matters until the board can act. He moved for that item to be stricken from the budget document.

Responding to a question from Conan Smith, corporation counsel Curtis Hedger said the need to use these funds doesn’t occur frequently. The item gives the administration some flexibility.

C. Smith thought that if the county is the plaintiff, that it ought to be a board discussion about whether to sue, or it should at least be a discussion for the board leadership.

Hedger said if something came up during the summer months when the board meets less frequently, this item would allow the administration to address it. Generally the cases are enforcement-related, tied to building code or soil erosion violations, for example. The intent is to give the administration some flexibility, Hedger said.

Alicia Ping (R-District 3) asked why enforcement couldn’t be handled through civil infractions. Hedger reminded the board that they just recently passed an ordinance allowing for civil infractions, but the ability to issue civil infractions for specific violations isn’t yet in place. In the future, having the ability to issue civil infractions will likely allow the county to avoid suing, he said.

Responding to a query from C. Smith, county administrator Verna McDaniel noted that she is authorized to make expenditures up to $100,000 for contracts without board approval.

In that case, C. Smith felt this item was already taken care of in the county’s existing policies.

Yousef Rabhi didn’t understand why they would remove the item, if it doesn’t matter one way or another. Why not just leave it in? He asked Hedger about the policy and process for litigating. Hedger replied that the county sues so infrequently that there isn’t a policy. Usually, the county is the defendant.

Rabhi then said he felt it was important to keep the item in place, to show that the board approves spending up to that amount on litigation. He thought that removing the language would hamstring the county’s ability to be legally nimble. He didn’t think the amendment was productive or made sense.

Rabhi noted that being a plaintiff doesn’t just mean the county is suing. It could also mean that the county joins in with other entities to take legal action, for public health and environmental protection – for example, seeking reparations for an oil spill on the Huron River. The board could still allocate money to fight it, he acknowledged, but it’s harder to stomach doing that if there isn’t a line item for it. “Things come up, folks, and we need to have the dollars budgeted to help to bring justice to people of Washtenaw County,” Rabhi said.

C. Smith said he looked at it as an encumbrance that gets baked into the budget. It’s money that’s not being allocated somewhere else. He noted that the office of corporation counsel has a $2.4 million budget. Was the $100,000 part of that amount? Financial analyst Tina Gavalier clarified that there actually is no line item encumbering these funds. If used, the amount would be taken from the general fund reserves. “In which case, I’m agnostic,” C. Smith said.

From left: Commissioner Dan Smith (R-District 2) and Curtis Hedger, the county’s corporation counsel.

Andy LaBarre wondered why it couldn’t be made a smaller amount, like $10,000. Hedger replied that it’s just been part of the budget document for a long time at that amount. Hedger wanted to make sure there’s enough to cover any potential litigation, because it varies from year to year.

D. Smith said this amendment wasn’t trying to undermine public health and safety. Rather, it’s a way to ensure that if the county is going to engage in significant litigation as a plaintiff, that it’s a board decision. It’s already been established that smaller amounts can be handled at the administrator’s discretion.

After further discussion, Hedger indicated he’d be willing to develop a policy on this issue for the board to review. If the item is removed from the budget document, it wouldn’t necessarily hamper his ability to initiate litigation, he said. If something happens that’s a true public safety issue, he’d move ahead anyway and “I’ll worry about where the money’s coming from later.”

Outcome: The amendment failed on a 4-5 vote. Supporting the amendment were Dan Smith, Alicia Ping, Ronnie Peterson, and Kent Martinez-Kratz. Voting against the amendment were Yousef Rabhi, Rolland Sizemore Jr., Conan Smith, Felicia Brabec, and Andy LaBarre.

2014-2017 County Budget: Board Discussion – Motion to Postpone

Dan Smith moved to postpone an initial vote on the budget until the board’s Nov. 20 meeting. There are several things that commissioners have said they’d like to work out, he noted, and one amendment had been postponed already.

Outcome on postponement: The motion failed on a 2-7 vote, with support only from Dan Smith and Ronnie Peterson.

2014-2017 County Budget: Board Discussion – Final Deliberations

Discussion continued. Alicia Ping identified an item in the budget document that was unclear:

13. The Board of Commissioners authorizes the County Administrator to continue the necessary match. The summary shall separately specify any proposed match in excess of the minimum required.

Verna McDaniel indicated that it was inadvertently included, and should be removed. No amendment was necessary to do that.

Ronnie Peterson said he wanted to support his colleagues, but he wouldn’t follow them over a cliff. He spoke at length, restating his concerns about a four-year budget. He noted that the board’s main responsibility is to set the budget, so if they do a four-year budget now, what are they being paid to do in the coming years? Anyone who votes for a four-year budget should cut their salaries in half, he said, because they’re delegating away their responsibility. He was upset that they were getting ready to vote, even though he said his concerns hadn’t been addressed.

Andy LaBarre responded to some of the concerns raised by Peterson. He noted that the budget assumes the status quo in terms of state and federal funding. Rather than paying off its pension liabilities at one time through bonding, the county has decided to handle those obligations on a year-by-year basis “in a somewhat blind manner,” he said, because the annual actuarial payment can’t be determined in advance. LaBarre said the scariest thing for him in not doing a four-year budget is to see the kinds of deeper cuts they’d have to make if they didn’t take this approach.

At the request of LaBarre, county finance director Kelly Belknap reviewed that approach. She noted that with the two-year budget approach, the county would have needed to make cuts of $2.6 million in 2014 and another $3.9 million in 2015. But if structural reductions are front-loaded in 2014, over the four-year budget period the overall amount of cuts will be reduced, she said. [The budget presented to the board on Oct. 2, 2013 identified $4.13 million in operating cost reductions. Those include: (1) $2.89 million in proposed departmental reductions; (2) $688,000 in estimated increased revenues from fees and services; (3) $450,000 in reductions to county infrastructure allocations; and (4) $100,000 in cuts to “outside agency” allocations.]

LaBarre said that’s the reason he’ll be supporting the four-year budget.

Felicia Brabec thanked commissioners for their input, and supported the four-year approach, saying it allows for strategic, long-term decisions. She felt it would be transformative and was the prudent thing to do. It’s a big change, and will entail a lot more work. In contrast to Peterson’s belief that salaries should be cut, she thought it made more sense for salaries to be doubled, because of the extra work.

Dan Smith called the question, a procedural move intended to force a vote. The vote on calling the question was unanimous.

Outcome on 2014-2017 budget as amended: Initial approval of the 2014-2017 budget was given on a 7-2 vote, over the dissent of Dan Smith and Ronnie Peterson.

2014-2017 County Budget: Final Public Commentary

Brian Mackie introduced himself by giving his Ann Arbor address, saying that makes him a resident of Washtenaw County. He noted that he’s also an elected official, and “I hope that doesn’t disqualify me from speaking.” [Mackie is the county's prosecuting attorney.] The board has been talking about the budget since January, he observed, and now it seems the discussions are getting more pointed and serious. It’s a difficult job, he said, “but I would suggest to you that you are making this much harder than it needs to be.”

There are a couple of places to look for guidance, he said. One is the state constitution. Mackie recalled how earlier this year at a budget retreat, one commissioner had said he didn’t give a crap about what the state says about mandates. [That commissioner was Conan Smith (D-District 9), who made this statement at a March 7, 2013 budget retreat: “I don’t give a crap about what the state tells me to do anymore; they clearly don’t have the prosperity of my community in mind.” He was referring to state mandates, arguing that state-mandated service levels should be interpreted at the “absolute possible minimum.”] Mackie pointed out that county government is a unit of state government. It’s how services are delivered to citizens, and it’s essential in our scheme of government, he said.

Mackie also said that the board should rely on the county’s “excellent administrator,” Verna McDaniel. She’s been working in county government for a long time, he noted, and knows what she’s doing. He didn’t believe there was tension between the sheriff and administrator. There’s a difference of opinion, he added, and he thought McDaniel was trying to carry out the wishes of the board. “Because frankly, I don’t believe public [safety], in spite what is said, is really backed by the Washtenaw County board of commissioners. Some of you certainly do. Some of you do not.” He also urged the board to listen to the sheriff. He indicated that the sheriff hadn’t been treated as well as others who’ve come before the board. Sheriff Jerry Clayton has a national reputation, Mackie noted. “He’s not only a good sheriff for Washtenaw County, he’s not only better than his predecessor in many ways, but he’s a national figure,” Mackie said. Clayton is called upon to train sheriffs nationwide. “He might know more about safety and criminal justice than you do,” Mackie told the board.

Mackie also talked about public safety in terms of working with the mentally ill, which he said was near and dear to the hearts of many commissioners. He encouraged them to listen to 911 calls. In a given hour, the sheriff’s dispatchers get calls from Ann Arbor three times an hour about a suicidal subject, he said. People call 911 because they’re desperate and they need help keeping someone alive. “So think about that, please,” he concluded.

Third-Quarter Budget Update

County administrator Verna McDaniel and the finance staff delivered a third-quarter 2013 budget update during the Nov. 6 meeting. The administration is projecting a budget surplus of $1,079,748.

The expected surplus is higher than the one projected earlier this year. During a second-quarter 2013 budget update that the county’s financial staff delivered on Aug. 7, 2013, a $245,814 general fund surplus was projected for the year.

The surplus is attributed in part to higher-than-expected general fund revenues of $103,805,884 – compared to $99,722,141 in the 2013 budget that county commissioners approved late last year. Total expenditures are expected to reach $102,726,136.

The surplus means that the county will not need to tap its fund balance in 2013 in order to balance the budget, as it had originally planned to do. By the end of 2013, the general fund’s fund balance is projected to stand at $17,867,835 or 17.3% of general fund expenditures and transfers out.

There are three areas that staff will be monitoring, which could affect the budget: (1) fringe benefit projections; (2) personal property tax reform; and (3) the impact of federal sequestration. [.pdf of third-quarter budget update presentation]

Third-Quarter Budget Update: Board Discussion

Alicia Ping (R-District 3) asked about a projected $65,000 over-expenditure in the 14A District Court. She wondered how that happened. Finance analyst Tina Gavalier replied that it’s primarily caused by overtime costs due staff shortages and staff medical leave. She noted that earlier this year, a $100,000 over-expenditure had been expected – so the $65,000 is actually an improvement, she said.

Gavalier said the District Court has a budgeted lump sum reduction of $109,000 for 2013. One could argue, she said, that the court is meeting part of its lump sum reduction by having lower-than-projected over-expenditures. Ping wondered how overspending can result in a credit to the court’s lump sum reduction. Gavalier replied that the lump sum reduction was budgeted as an over-expenditure.

County administrator Verna McDaniel said the administration is working with the court to help identify ways to reduce expenditures. This has been ongoing over the last two years, she said. The court administration has been cooperative, she added.

Ping said she thought the courts had agreed to a $200,000 lump sum reduction. McDaniel clarified that Ping was referring to the Washtenaw Trial Court, not the District Court.

Ping asked whether the county would need to notify both courts, if the board wanted to give notice of an intent to eliminate the lump sum budgeting approach. McDaniel pointed out that there will be a new chief judge as of January 2014. [David S. Swartz was recently named chief judge of the Washtenaw County Trial Court, effective Jan. 1, 2014. The appointment was made by the Michigan Supreme Court. Swartz will replace current chief judge Donald Shelton, who has served in that position for four years.]

McDaniel said there might be some “different ways” to work things out with the new court leadership, and indicated that she’d like some time to give that a chance. [For more background on the lump sum agreement, see Chronicle coverage: "County to Keep Trial Court Budget Agreement."]

Conan Smith (D-District 9) asked about the projection for the end-of-year fund balance. Gavalier replied that assuming their projections are correct, the fund balance would be $17,867,835 as of Dec. 31, or 17.3% of general fund expenditures and transfers out.

Outcome: This was not a voting item.

Act 88 Tax Hike & Policy

Two items related to a tax to support economic development and agriculture were on the Nov. 6 agenda.

The board was asked to give final approval to an increase in the levy of the economic development and agricultural tax, known as Act 88 of 1913. The increase to the Act 88 millage is from 0.06 mills to 0.07 mills.

The millage will be levied in December 2013 and raise an estimated $972,635. Initial approval to the increase had been given by the board on Oct. 16, 2013. The funds will be allocated to the following groups:

- $408,135: Washtenaw County office of community & economic development (OCED)

- $200,000: Ann Arbor SPARK

- $100,000: Eastern Leaders Group

- $52,000: Promotion of Heritage Tourism in Washtenaw County

- $50,000: SPARK East

- $50,000: Detroit Region Aerotropolis

- $82,500: Washtenaw County 4-H

- $15,000: Washtenaw County 4-H Youth Show

- $15,000: MSU Extension for food systems-related economic development activities

The initial approval had allocated $423,135 to OCED. Based on a recommendation from OCED, an amendment approved unanimously on Nov. 6 shifted $15,000 from that allocation to fund food systems-related economic development. A second amendment, also passed unanimously, corrected the original resolution, which had stated that the millage would only be assessed against real property in Washtenaw County. The amendment clarified that the millage will be assessed against all taxable property located in the county.

The county’s position is that it is authorized to collect up to 0.5 mills under Act 88 without seeking voter approval. That’s because the state legislation that enables the county to levy this type of tax, which predates the state’s Headlee Amendment.

Also on Nov. 6, the board was asked to give final approval to a new policy for allocating Act 88 revenues, drafted by Conan Smith (D-District 9) and given initial approval on Oct. 16. [.pdf of Act 88 policy] The policy includes creating an Act 88 advisory committee to make recommendations to the board and prepare an annual report that assesses how Act 88 expenditures have contributed toward progress of goals adopted by the board.

The policy allows the committee to distribute up to 10% of annual Act 88 revenues without seeking board approval. The policy also allocates up to 30% of revenues to the county office of community & economic development, which administers Act 88 funding.

Act 88 Tax Hike & Policy: Public Commentary

Doug Smith pointed out that Act 88 only authorizes three activities. Two activities are advertisement, and the third is support of exhibitions of county products. He thought there was some confusion about the phrase that talks about increasing trade for county products. If you look at the structure of the sentence, that phrase refers to the purpose of supporting exhibitions of products, he said. “It’s not a standalone phrase.” The act doesn’t say anything about economic development, or giving money to startups or support of new companies, or subsidizing training programs. These economic development uses aren’t authorized by Act 88, he said.

Regarding the board’s Act 88 policy, Smith noted that it uses the language of the law. The problem is that the contract that the county has with Ann Arbor SPARK doesn’t use the same language – it uses language of economic development. In addition, there’s no requirement for any kind of reporting for what the money will be spent on by SPARK. It all goes into one pot, he said, so the county can’t tell whether the spending complies with the law. The same is true for the $50,000 membership to the Detroit Region Aerotropolis, Smith said. What is that money being spent on? He asked commissioners not to use the Act 88 millage to support economic development.

Bill McMaster of Taxpayers United told commissioners that he’d helped Dick Headlee with the statewide campaigns in 1976, 1977 and 1978 that ultimately resulted in what’s known as the Headlee Amendment. The first year they tried, in 1976, the proposal only got 40% of the vote. In 1978, it received 58% of the vote statewide.

The people who voted were looking for tax limitation, he said. One of the real surprises that’s emerged since then is the “innovative use” of past legislation in an attempt to get around the Headlee Amendment, he said. The state constitution reigns supreme, McMaster said. When you refer to a 100-year-old bill, it’s “much subservient” to the constitution, he noted, because it’s a piece of legislation and in no way equates to the power of the constitution. He called the county’s attempt to levy a $1 million tax on Washtenaw County residents – without a vote of the people – an “ambush.” He urged the board not to pass the Act 88 levy or the policy. It’s not constitutional without a vote of the people, he said.

McMaster concluded by saying that part of the Headlee Amendment has a provision for a lawsuit, starting in the court of appeals “which we will pursue.”

Act 88 Tax Hike: Board Discussion – Move to Table

Dan Smith said he might have a lot to say about this item, but he first wanted to “consider something else I have in mind,” so he moved to table the resolution.

Outcome: The motion to table failed on a voice vote.

Act 88 Tax Hike: Board Discussion – Constitutional?

As he has on previous occasions, Dan Smith raised questions about whether levying this kind of tax is constitutional, because it would exceed constitutional limits on the amount of property tax that can be levied without voter approval. He also questioned whether the language of the Act 88 statute allows the kind of general interpretation the county is using to define eligible uses of funds generated by the levy. Those eligible uses are laid out in a long run-on sentence that’s difficult to parse, he noted, but if you read it very carefully, the use of the funds is quite limited.

The law states:

AN ACT empowering the board of supervisors of any of the several counties of the state of Michigan to levy a special tax, or by appropriating from the general fund for the purpose of advertising the agricultural advantages of the state or for displaying the products and industries of any county in the state at domestic or foreign expositions, for the purpose of encouraging immigration and increasing trade in the products of the state, and advertising the state and any portion thereof for tourists and resorters, and to permit the boards of supervisors out of any sum so raised, or out of the general fund, to contribute all or any portion of the same to any development board or bureau to be by said board or bureau expended for the purposes herein named.

“So not only are we quite likely levying these funds unconstitutionally,” Smith said, “once we levy them unconstitutionally, we then go and spend them illegally.”

Smith has been advocating for written clarification from the county’s corporation counsel, Curtis Hedger, that would explicitly state the county’s position on the legality of this levy. That hasn’t happened, Smith said.

Hedger maintains that he can provide that kind of written legal opinion only under direction from the entire board. Smith questioned whether it takes a vote of the board to request a legal opinion. Another Michigan county has a policy that interprets MCL 49.155 in such a way that a commissioner could apply on behalf of the entire board for a legal opinion, Smith reported.

MCL 49.155 states:

The prosecuting attorney, or county corporation counsel in a county which has employed an attorney in lieu of the prosecuting attorney to represent the county in civil matters, shall give opinions, in cases where this state, a county, or a county officer may be a party or interested, when required by a civil officer in the discharge of the officer’s respective official duties relating to an interest of the state or county.

Smith said he’s not even really looking for a legal opinion. He just wants additional clarification regarding the Act 88 levy specifically, similar to what’s provided in other cover memos. It’s certainly unclear whether this levy is 100% legal, he said. He noted that on the issue of the State Street corridor improvement authority, he didn’t have concerns about its legality. His concerns with the CIA were policy-related, he noted.

But for Act 88, he can’t get past the legal concerns in order to discuss the policy. The board is essentially saying “Sue us and we’ll let the court sort this out,” Smith said. That’s not the right approach. Taxpayers are forced to pay this tax under threat of foreclosure – if they don’t pay their taxes, the county can foreclose on their property. “That is a very very heavy threat from government to tax somebody,” he said, so the board should be very sure, beyond a shadow of a doubt, that it’s legal.

He concluded by saying he can’t support the way the county is levying this tax, and he can’t support the way the money is spent after it’s collected.

Conan Smith said he appreciated D. Smith’s passion on this issue. He noted that last year, the state legislature took up a proposal to eliminate Act 88. There was a robust discussion and public hearings, but the legislature ultimately took no action and left it in place. He said he’s comfortable that if the state legislature is satisfied that Act 88 comports with the constitution, then that’s the case “until a court determines otherwise.” He agreed that the bar is high in taking the government to court, but his priority isn’t in determining the constitutionality of this law. His priority is in investing in the economic outcomes that these dollars can provide for county residents.

C. Smith called the language of the Act 88 law “one of the worst run-on sentences” and that makes it tough to determine what exactly the funds can be used for. It’s reasonably arguable that increasing trade in the county is a central tenet of the act, he said, and that affords some leeway in interpreting how those funds are used, including making the kinds of investments that the county is considering.

C. Smith agreed with Doug Smith’s point during public commentary that there aren’t controls in place to see exactly how some organizations are spending the Act 88 funds that the county provides. However, in looking at each organization’s strategic plan, you can make a “reasonable inference” that the funds are being invested in a way that comports with Act 88. He said he appreciates the complexity of this issue, and that as a pre-Headlee statute its applicability is “somewhat convoluted.” However, he’s comfortable that the board has the authority to do this and he’d support the resolution, even though he would prefer to levy an even higher rate.

Andy LaBarre asked Hedger what it would entail, in terms of time and effort, to produce a legal opinion. Hedger replied that it would take some time to write up an opinion, but that he’d already done the research. One challenge is that there’s not much guidance as far as case law, because it hasn’t been challenged in court. There’s a lot of statutory interpretation that would be required, and that would take some time to figure out how to make it as clear as possible, Hedger said.

Hedger noted that any opinion wouldn’t apply just to Act 88. It would also apply to the veterans relief millage that the county levies, as well as some other levies.

Ronnie Peterson cautioned that getting a legal opinion “opens up a big door.” He noted that Bill McMaster of Taxpayers United might get a legal opinion, “but it won’t be from us.” The ramifications would be very challenging, Peterson said, and the board needs to consider that as they deliberate on a four-year budget.

Outcome: On a 7-1 vote, the board gave final approval to an increase in the Act 88 levy. Dan Smith (R-District 2) dissented and Rolland Sizemore Jr. (D-District 5) had left the meeting by the time the vote occurred, just after midnight.

Act 88 Policy: Board Discussion

Regarding the Act 88 policy, Dan Smith said he had several concerns about it. As an example, he highlighted the policy that would allow the advisory committee to distribute up to 10% of annual Act 88 revenues without seeking board approval. He noted that Act 88 authorizes only the board to direct how revenues are spent: The wording in the statute is very specific, he said.

Corporation counsel Curtis Hedger responded that by approving this policy, the board would be providing that direction – in essence, delegating it to the advisory committee. It’s one step removed, Hedger said, but it’s “not just coming out of the blue.”

Alicia Ping wondered why the amount of 10% was designated. Conan Smith replied that there are “leveraging opportunities that rise up with relative immediacy,” like matching grants or event sponsorship. Some of these things don’t warrant board approval, he said. Small amounts are spent regularly through the county administrator’s discretion, he noted. The committee could also give money directly to an organization, if it sees fit to do that and if the organization provides programs or services that fit with the Act 88 allowed uses.

Ping wondered if the full board would get a report on how that 10% would be allocated. C. Smith pointed out that the policy includes a requirement for an annual report about how all Act 88 expenditures were made, and assessing whether those investments were effective.

Yousef Rabhi said every agency that’s funded with public dollars should be accountable for how those dollars are spent. There’s been some citizen feedback that some of the agencies funded by the county don’t have enough accountability, he said. “We need to make sure that they are accountable for public dollars that we allocate to them.” This policy helps accomplish that, Rabhi concluded.

Outcome: The Act 88 policy was unanimously approved. Rolland Sizemore Jr. had left the meeting and did not vote.

Act 88 Policy: Request for Legal Opinion

In introducing this item, Dan Smith said he believed the Act 88 statute is constitutional, but that the county isn’t using it constitutionally because the county is already at its maximum allowable levy. One reason why the state legislature didn’t repeal Act 88 is that the law is constitutional for counties that haven’t reached their maximum allowable levy amount, he said.

It’s critical to sort this out, he added, because if these levies are legal, then about three-quarters of a billion dollars could be raised across the state to fix roads – raised locally and controlled locally. Everyone who drives on roads knows that this needs to be done, he said. “If this is a solution that can be used across the state, we need to make people aware of it.” If it’s not, “we need to know that too.”

He brought forward a resolution directing corporation counsel to provide an opinion on taxes levied in excess of constitutional limits without a vote of the people.

Outcome: The motion died for lack of a second.

Pittsfield Township State Street CIA

On the Nov. 6 agenda was a resolution for final approval of a tax-sharing agreement with Pittsfield Township and the State Street corridor improvement authority (CIA), which is overseen by an appointed board. [.pdf of agreement] An initial vote had been taken on Oct. 16, 2013, over dissent by Dan Smith (R-District 2).

The resolution authorizes the county administrator to sign the tax-sharing agreement, which would allow the CIA to capture 50% of any county taxes levied on new development within the corridor boundaries, not to exceed $3,850,464 over a 20-year period, through 2033. The purpose is to provide a funding mechanism for improvements to the State Street corridor roughly between the I-94 interchange and Michigan Avenue, as outlined in the CIA development and tax increment financing plan. [.pdf of TIF plan]

The Pittsfield Township board of trustees held a public hearing on the CIA at its Oct. 9, 2013 meeting. That started the clock on a 60-day period during which any taxing entities within the corridor can “opt out” of participation. The Washtenaw County parks & recreation commission voted to support participation in the CIA at its Oct. 8, 2013 meeting. Other local taxing entities in the corridor are Washtenaw Community College, the Huron Clinton Metro Authority, and the Saline and Ann Arbor district libraries. The Ann Arbor District Library board voted to approve its own tax-sharing agreement at a meeting on Nov. 11, 2013. At its Nov. 12 meeting, the Saline library board voted to opt out of the CIA. The metroparks board also decided to opt out, with a vote at its Nov. 14 meeting. No action has been taken by the WCC board of trustees, which next meets on Nov. 26.

On Oct. 16, Dan Smith had moved a substitute resolution. It stated that the county would not participate in the CIA. [.pdf of D. Smith's substitute resolution] He said he supported the road improvement project, but objected to the TIF funding mechanism. He noted that the county had the ability to invest directly in the project using general fund money. He also pointed out that if the county participated in the CIA, the county would have no control over how its portion of the captured taxes are spent. In addition, the decision not to participate would not necessarily be permanent, he said, because the county board could rescind this resolution at any point.

The Oct. 16 vote on D. Smith’s opt-out resolution failed on a 2-7 vote, with support only from D. Smith and C. Smith.

Pittsfield Township State Street CIA: Public Commentary

Mandy Grewal addressed the board during public commentary, thanking them for their support of the CIA. She introduced several other township officials who attended the meeting but who did not formally address commissioners, including treasurer Patricia Scribner; CIA board member Claudia Kretschmer of Gym America; Craig Lyon, the township’s director of utilities and municipal services; and consultant Dick Carlisle. She indicated that county commissioner Felicia Brabec would soon be appointed to the CIA board. She hoped that the county commissioners would support the CIA.

Christina Lirones introduced herself as a Pittsfield Township resident and former township clerk, treasurer and chair of the planning commission. She’s very opposed to the CIA proposal and she hoped the board would opt out. The township held a public hearing on Oct. 9, and she noted that she’d emailed commissioners a copy of the statement she’d made at that meeting. [.pdf of Lirones' statement at Oct. 9 township public hearing] There are other ways that road improvements could be funded, she said, and past township administrations avoided these kinds of TIF funding arrangements. As someone who supports county services and who voted for the county parks millage, Lirones said she’s deeply concerned that tax dollars that should support residents and parks will be diverted in part for road expansion. In most sections, the road already has three lanes or more, she noted, and it’s in much better shape than many other county roads. That part of the township would increase in value, regardless of the road expansion.

The CIA TIF is being rushed through, Lirones contended, in order to get it on the tax rolls this year. There’s no benefit to the county, she argued, only the loss of tax revenue. Businesses that move to the corridor already receive tax abatements from the current township board, she said, and a TIF would cut revenues further. In the past, developers have funded road improvements based on projected traffic counts, but the CIA TIF would reverse this policy and shift the expense onto taxpayers. It’s unfair to responsible developers who’ve paid for this in the past, she argued, and it’s unfair to residents and taxpayers. It’s also unfair to taxing entities that are giving up their tax revenues. She said the residents who live on State Street were not invited to serve on the CIA board and they don’t support this project. She said she and her husband were the only members of the public who attended all the meetings related to the CIA, which she characterized as poorly noticed and held during the day.

Lirones spoke again at the second opportunity for public commentary later in the evening, after the board’s budget discussion. She noted that the CIA tax-sharing agreement limits the amount of tax capture to $3.8 million from Washtenaw County tax revenues. At first, she said, she thought perhaps it’s a small amount of money for the county. But it turns out that based on their budget discussion, the county is in some dire financial straits, she said, so the $3.8 million is a significant amount that would be lost to the county operating budget. It’s money that the sheriff’s department and human services could use, she said. Lirones hoped the board would decide to opt out. She restated many of the reasons she’d previously mentioned for opposing the CIA, including the fact that the corridor is already being developed even without the road improvements. It’s important for tax dollars to be used for their original intent. “I’m afraid it’s only the first in a series of tax increment finance and capture districts,” she concluded.

Pittsfield Township State Street CIA: Board Discussion

There was minimal discussion before the final vote on Nov. 6. Dan Smith pointed out that the board was voting on the tax-sharing agreement. It states that the amount of tax capture will be 50%, not the full 100% that would be allowed by law. Procedurally, it was not an “opt-in” vote, he noted.