Ann Arbor 2012 Budget: Parks, Plans, People

Editor’s note: The Ann Arbor city council has held two retreats to discuss the city’s FY 2012 budget – one in early December 2010 and another in early January 2011. A summary of the material covered in those retreats is provided in previous Chronicle coverage: “Ann Arbor: Engaging the FY 2012 Budget.”

Leading up to the city administrator’s proposed budget in April, the city council is also holding a series of work sessions on the budget. Their typical scheduling pattern is for the weeks between council meetings. That was the case on Jan. 31, 2011 when the council held its budget work session on the community services area, which includes human services, parks and planning. Another session was held on Feb. 7, prior to the council’s regular meeting, regarding the 15th District Court. A report on the Feb. 14, 2011 session, which focused on police and fire, will follow.

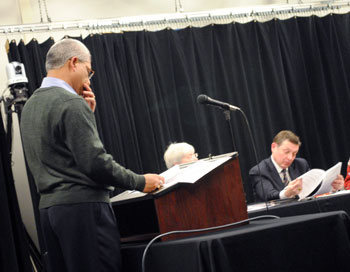

At the podium is community services area administrator Sumedh Bahl. Partially obscured by the podium is councilmember Marcia Higgins (Ward 4). Leafing through the budget impact sheets that the council had been given just prior to the meeting is Stephen Rapundalo (Ward 2). (Photo by the writer.)

The Ann Arbor city council’s budget work session on Jan. 31, 2011 covered a broad range of topics – from the city’s affordable housing stock, to planning and development, to parks and recreation (including golf courses), to human services funding. All these issues fall under the city’s community services area, which is led by Sumedh Bahl.

In a budget year where maintaining the same level of activity in every department is projected to result in a $2.4 million shortfall, city departments have been given reduction targets between 2.5% and 4%. Targets vary across departments depending on health care costs for employees in those departments.

So at their work session, councilmembers heard from heads of individual departments about the specific ways those targets might be met.

For example, Mary Jo Callan, who’s head of the city/county office of community development, told councilmembers that an unrealized $98,000 federal grant would pose an additional challenge. All other things being equal, Callan would meet the reduction target by reducing the city’s allocation to nonprofit human services agencies by $116,714 – from $1,275,744 to $1,159,030. The budget is planned in two-year cycles, even though it’s adopted just one year at a time, so Callan’s reduction strategy for next year’s FY 2013 budget would be to reduce the nonprofit allocation by an additional $48,700.

The planning department plans to meet its reduction target in part by charging the construction fund for 10% of the historic district coordinator’s time, factoring in projected revenue increases due to increased development activity, and leaving a rental housing inspector position vacant. The rental housing inspection activity would be maintained at appropriate levels by using construction inspectors for rental housing inspections as needed.

The city’s housing commission – which maintains more than 350 units of public housing throughout the city – is not proposing to meet reduction targets, but rather to hire what officials say are two crucially needed positions: a financial analyst and a facilities maintenance manager, which together are expected to cost an additional $154,000 per year.

Parks and recreation would meet their targets in part through savings derived from energy improvements that have been made to various recreational facilities over the past few years.

The council focused some of its session on the city’s golf courses, with a council consensus seeming to emerging that for the next two years, the council will be content to stick with the status quo – operating the Leslie Park and Huron Hills facilities as golf courses, and not changing them to other uses.

But the council was also asked to consider a question on which it could be harder to achieve consensus: Should the city continue to help fund park operations, as it has for the last four years, by tapping the city’s general fund reserve for $287,000 annually? The history of the issue dates back to the parks capital improvements and maintenance millage, which was approved in 2006, and which was followed by the council’s approval of its FY 2008 budget the next spring.

That history is rooted partly in a question that the city’s CFO, Tom Crawford, addressed in a straightforward fashion at the work session: What exactly does it mean for a department to have a budget reduction target of 2.5%?

In this report, we take a look at: (1) how the city’s financial staff define budget reduction targets; (2) how and why those targets vary across departments; (3) how reduction targets relate to the parks budget controversy of FY 2008 and the current $287,000 question; and (4) the range of work session topics discussed by the council.

What Is a Budget Reduction Target?

The city is currently in the middle of its 2011 fiscal year – which ends on June 30, 2011 – and is developing its FY 2012 budget. If the city’s chief financial officer has established a 2.5% budget reduction target, how does he check to see that the target has been met?

Percents are all about comparing numbers, so a natural inclination would be to compare this year with next year – that is, the FY 2011 budget expenses with the FY 2012 projected revenue. In more detail, you might think to calculate 2.5% of the FY 2011 expenses, subtract that number from the FY 2011 expenses and ask: Is that number equal to my FY 2012 budgeted revenue? Arithmetically:

[FY 2011 expense] — [FY 2011 expense]*.025 ?=? [FY 2012]

If that checks out, then from this year to next year, we’ve cut the budget by 2.5%, right?

But that’s not what a 2.5% budget reduction target means for the city. When the city’s financial staff calculate a reduction target of 2.5%, they’re not comparing this year’s expenses with next year’s projected revenue. They’re comparing next year’s projected expenses, with next year’s projected revenue.

At the Jan. 31, 2011 city council work session, the city’s CFO, Tom Crawford, explained this concept to council members as a stepwise process:

- Assume the same activities will be maintained next year at the same level they exist this year [staffing levels will remain the same; the same services will be provided; etc.].

- Project to next year how much it will cost to maintain that same level of activity. [If the cost of electricity is expected to increase by 10%, that's calculated in; if union contracts stipulate that there's a 1.5% salary increase, that's calculated in.]

- Compare next year’s projected cost with next year’s projected revenue. If cost exceeds revenue, that defines the percentage reduction the organization needs to achieve as a whole.

Arithmetically, the equation looks like this:

[FY 2012 expense] — [FY 2012 expense]*.025 ?=? [FY 2012 revenue]

By way of a made-up example, consider a perfectly balanced FY 2011 budget where expenses and revenues are $100,000. Let’s say that due to contractually obligated salary increases, overall inflation, and a rise in oil prices, it’s possible to project that the same activities/services the city obtained for $100,000 in FY 2011 will instead cost $101,000 in FY 2012. Let’s say that revenues are expected to drop in FY 2012 to $98,475. So the crucial question for the city is how to reduce $101,000 down to $98,475. On this scenario, measured in dollars, the city is looking for some way to trim $2,525. What’s that dollar target in terms of percent?

2,525/101,000 = .025

Let’s say on that scenario, the city does achieve its reduction target of 2.5%. That is, let’s say the city finds a way to cut expenses for FY 2012 down to $98,475. That would mean a reduction target of 2.5% has been met for FY 2012, even though comparing FY 2012 to FY 2011 would indicate only a 1.525% cut.

Different Reduction Targets for Different Departments

Part of the city’s specific labor strategy is to try to convince its unions to adopt a health care and pension plan that would cost the city less – by requiring greater contributions from employees. The public relations component of that strategy was reflected at the Feb. 7, 2011 city council meeting, when Stephen Rapundalo (Ward 2), chair of the city council’s budget committee, addressed his colleagues. He contrasted the level of health care benefits received by city union workers with benefits received by city non-union workers and by employees at institutions like the University of Michigan.

In addition to the public relations piece, the city’s labor strategy has a budgetary component. As early as the first budget retreat in December 2010, city administrator Roger Fraser and CFO Tom Crawford explained to councilmembers that this year they will align the city’s labor and budget strategies. What that means in terms of budget reduction targets is that different departments will be given different reduction targets, depending on how many employees in the department have adopted the city’s new benefits plan.

All departments have a baseline 2.5% target, with additional reductions assigned to departments depending on the extent to which employees in each department are still on the city’s old benefits plan.

In a hypothetical department where all employees were on the new heath and pension plan, the reduction target would be 2.5%. In a department with a large number of union employees who have not yet adopted the new health plan, the reduction target this year can be as high as 4%. The numbers extracted from budget impact sheets submitted by each department for the Jan. 31 work session illustrate how the percentage reduction targets vary across departments. The targets all fall between 2.5% and 4.0%:

Community Plan/Dev Planning Parks Projected FY 012 2,008,008 1,497,874 829,796 3,612,367 Reduction Dollars 55,521 55,182 29,613 92,083 Reduction Percent 2.76 3.68 3.57 2.55

-

Reduction Targets and the 2006 Parks Millage: $287,000

The city’s method for computing reduction targets based on next year’s projected expenses and next year’s projected revenues is not new this year – this is simply the way it’s been done. But that method of computing budget targets is inconsistent with the last-year-vs.-this-year comparison that many people are drawn to when they think about percentages. That inconsistency led to considerable controversy in early 2007 when the city council adopted its FY 2008 budget.

The controversy involved the combined parks maintenance and capital improvements millage that was approved by voters in November 2006. Before passage of the combined millage, the city levied two separate millages at 0.5 mill each – one for parks maintenance and the other for capital improvements. Now, within the combined millage, taxes are collected at a rate of 1.0 mill, but money is allocated to maintenance or capital improvements on a more flexible basis than the previous legally enforced 50-50 split that was expressed by the specialized purpose of each millage.

However, there’s not complete flexibility to allocate money to maintenance or capital improvements within the unified millage. Percentage allocation is guided by a city council resolution passed in October 2006. The resolution specifies a range of 60% to 80% for maintenance, with the remainder going to capital improvements.

Another part of that resolution was intended to address a fear expressed by some in the community at the time: Even though more money for parks might be generated through the new millage, the amount of money actually spent on parks could be reduced – if the city reduced funding for parks from its general fund. So the intent of the resolution was to allay that fear. In relevant part, the October 2006 resolution reads:

4. If future reductions are necessary in the City’s general fund budget, during any of the six years of this millage, beginning with Fiscal Year 2007-2008, the general fund budget supporting the parks and recreation system for that year will be reduced by a percentage no greater than the average percentage reduction of the total City general fund budget;

5. If future increases occur in the City’s general fund budget during any of the six years of this millage, beginning with Fiscal Year 2007-2008, the general fund budget supporting the parks and recreation system for that year will be increased at the same rate as the average percentage increase of the total City general fund budget;

By spring the following year – as the council was prepared to adopt the FY 2008 budget – objections were raised when general fund support for parks in the proposed FY 2008 budget was less than in FY 2007. Those who objected, including prominent leaders of two environmental groups, pointed to the increase in the overall general fund budget from the previous year, and contended that parks should enjoy the same increase, not a decrease. From a May 19, 2007 Ann Arbor News account, written by Tom Gantert:

Mike Garfield, director of the Ecology Center, and Doug Cowherd, chairman of the Sierra Club-Huron Valley Group, said the city should do what it said it would do in an October 2006 resolution. That resolution stated that if the city’s general fund budget increased, the parks system budget will be increased at the same rate as the average percentage of the total general fund budget.

According to the city, the general fund budget rose from $78.5 million to $80.3 million, an increase of 2 percent. Yet, the parks system budget dropped from $6.7 million to $6.0 million, a decrease of about 11 percent. To get to that 2 percent increase as the resolution states, the city would have to add about $763,000.

On the night the council adopted the FY 2008 budget, an attempted budget amendment – proposed by then-councilmember Bob Johnson – would have added $638,900 to the parks budget from the general fund reserve. But the amendment failed, receiving support only from councilmembers Johnson, Ron Suarez and Stephen Kunselman.

For that vote, the majority of councilmembers seemed persuaded that the intent and purpose of the October 2006 resolution was served by treating the parks budget targets – as they’ve been laid out in the first section of this article – the same as all other departments. At the time, an Ann Arbor News account from May 16, 2007 had Crawford explaining the apparent discrepancy this way:

But now chief financial officer Tom Crawford says the [October 2006] resolution was too simplistic and just looked at overall budget figures and didn’t follow the city budget methodology in place for several years.

For example, because the parks system doesn’t have as many employees as other departments, its budget doesn’t increase as much for rising expenses such as employee health care.

Because of problems in the ordinance language like that, Crawford said the parks would be getting more money than other larger departments that are paying for such benefits.

Crawford said the parks department was treated the same as the other departments in the city.

But later, in October 2007, Johnson brought the issue back to the council with a smaller number to be added to the parks budget from the general fund reserve – $287,000. And that resolution was passed by the council.

Originally the general fund supplement to the parks budget was supposed to be a non-recurring item from the general fund reserve in FY 2008 and FY 2009. But it recurred in the FY 2010 and FY 2011 budgets, as well.

So at the Jan. 31, 2011 council work session, community services area administrator Sumedh Bahl asked the council for guidance: Should the city simply set the parks budget at $287,000 higher, continue to tap the general fund reserve, or discontinue the supplement? Mayor John Hieftje wanted to know if the city’s park advisory commission had become more versed in how the budget targets work. Crawford told the mayor he thinks PAC understands it.

Stephen Rapundalo said this is not the first time over the years when the council has talked about tapping the reserve fund balance for recurring operational needs – it needs to stop, he said, because the council was just “kicking the can down the road.”

But Crawford was keen to stress that in general the council has been disciplined about not tapping the general fund reserve for operational expenses. The parks supplement was an old decision, he said, and now it’s time to check and see where the council’s consensus is on the question.

Marcia Higgins (Ward 4) indicated that it is a decision the council would make during the budget process. Stephen Kunselman (Ward 3) wondered how that would be achieved: Do they do that by resolution? The answer was unclear.

Christopher Taylor (Ward 3) noted that out of a $7.8 million community services budget, $287,000 is a relatively small order of magnitude. Rapundalo cautioned that the right number to compare the $287,000 against is just the parks portion – around $3.6 million.

Kunselman inquired when the parks maintenance and capital improvements millage is up for renewal, and Colin Smith, the city’s manager of parks and recreation, clarified that it would be on the November 2012 ballot.

Concerning the differing viewpoints on the intent of the October 2006 resolution, city administrator Roger Fraser seemed conciliatory. It was a matter of interpretation, he said, and both groups had made good arguments about whether the budget complied with the intent of voters.

Budget Impact Sheets

The Jan. 31, 2011 budget work session was oriented around budget impact sheets for each department. The city of Ann Arbor is maintaining a separate page in its online budget guide as a repository for the impact sheets. [.pdf of combined budget impact sheets from Jan. 31, 2011] The impact sheets include in detail all the items identified for savings or additional revenue, as well as any items that would increase costs.

Budget Impact Sheets: Planning and Development

Among the ways that the city’s planning and development services departments are meeting their reduction targets, Sumedh Bahl highlighted the following: making sure that staff time is being billed appropriately to other departments; and an additional $3,000 in revenue from already-implemented fee increases in the city’s historic preservation program.

Tony Derezinski (Ward 2) said he liked the additional $10,00o in revenue from increased development activity. He wanted to know if there were more development proposals in the pipeline? Yes, answered Bahl.

In the course of questioning, Bahl went on to explain that part of their plan to meet reduction targets is to leave an inspector position vacant and to use construction inspectors for rental housing inspections. Increased efficiency in rental housing inspections is expected to yield an additional $50,000 in revenue.

In response to councilmember questions, Bahl said that regionalization of inspections – using inspectors from surrounding municipalities – is a future possibility. The city is also looking into the establishment of an administrative hearing bureau (AHB), which would help expedite dealing with nuisance properties, Bahl said. That might take around a year to establish, he said.

[Stephen Kunselman (Ward 3) has, over the last several months, pointed out specific properties in his ward that he says have become nuisances, and are contributing to blight. At the budget retreats, he has also urged that the council and staff think about ways to address the problem – money for demolition can be clawed back through a lien, for example. Establishment of an AHB is one mechanism that the state's Home Rule Cities Act makes available for dealing with such properties. The city of Ypsilanti established an AHB last year.]

Stephen Rapundalo (Ward 2) noted that he’d made a request at one of the budget retreats for a cost/benefit analysis of doing mandatory home inspections upon sale of a property. It’s something that would generate some amount of additional revenue. Is that on the list? he asked. Bahl confirmed that looking at the issue was at the top of his list.

Budget Impact Sheets: Housing Commission

The Ann Arbor Housing Commission oversees around 350 affordable housing units across the city. The housing commission’s impact sheet did not propose to meet the reduction target. Instead, it called for hiring two new positions: a facility maintenance manager and a financial analyst.

Bahl explained that the facility maintenance position is vacant. The job includes overseeing the maintenance of buildings, plus the mechanicals like boilers and furnaces. Bahl stressed the need to maintain equipment as a way to extend its life, which delays capital expenses.

Bahl recalled his recent experience as head of the city’s drinking water facilities. [Bahl assumed the leadership of the community services area last year when Jayne Miller left the city for another position. Before that, Bahl was head of the drinking water facilities.] His focus was always on maintenance, he said. By way of example, he described for the council how they had gas engines from 1965 and pumps from 1949 that were still in service. That’s how you prolong the life of equipment – by having a good maintenance program.

[The request for two positions for the housing commission comes in the context of a wholesale replacement of the housing commission's board last year. Additional Chronicle coverage: "Housing Commission Reorganizes," and "Investments: Housing, Bridges, Transit." Last year, the council agreed to a $138,000 allocation to the housing commission to help transition it into an operation that is less dependent on the federal HUD program. The transition included making full-time positions of the executive director and deputy director of the housing commission.]

Mayor John Hieftje asked Tony Derezinski (Ward 2) – the city council’s liaison to the housing commission – if funding would be available to perform the maintenance, if the maintenance manager position were funded.

Derezinski explained that maintenance was part of needs assessment that had been done [by Schumaker & Company]. The commission is currently “backhoeing” a lot of the deferred maintenance, he said. It’s things like changing filters. [There is also currently an open request for proposals (RFP), with a Feb. 25 deadline, to bid on replacing furnaces at many of the housing commission properties.] They need the management position to organize the staff to do it the regular maintenance.

City administrator Roger Fraser said that $330,000 had been spent on furnaces and boilers in the last year. There are two resident managers who work with people in facilities to do some maintenance, he said, but they don’t have time to look at the capital side.

Fraser reminded the council that in last year’s budget, they’d approved additional money for the housing commission – over $130,000 – but this current request is “not a repeat of that money.” For some of the capital investments necessary, Fraser said, the commission had received grants. [To match those grants, the housing commission has recently asked the Ann Arbor Downtown Development Authority for support, but the DDA has not yet acted on the request.]

About the maintenance issues, Derezinski compared it to opening a drawer and finding more snakes. He said the maintenance issues in the housing units are reflected in the complaints you hear at the housing commission’s board meetings. Two years ago, he said, there were a dozen people at every meeting, but that’s decreasing. The staff is now “on top of it.”

Stephen Rapundalo (Ward 2) inquired whether maintenance could be done by third party. If you have a schedule for changing filters, could they call up someone in the phone book and have them perform that task? he wondered. Bahl allowed that some tasks could be outsourced to a third party – they take a combined approach. Some maintenance is done by staff, and some is done by contracted sources – for example, for chillers that require a worker with specialized training. But Bahl said that someone has to monitor and manage everything.

Kunselman noted that as part of the reorganization last year, the commission had eliminated two union positions for maintenance. Kunselman wanted to know how that was consistent with needing a maintenance manager. The part of the maintenance that has been outsourced, instead of using union positions, Bahl said, is done when the units turn over to a new occupant. The commission still needs someone to make sure that all the regular maintenance work is getting done.

Earlier in the work session, Sandi Smith (Ward 1) drew out the fact that there is currently $118,000 in the Ann Arbor housing trust fund. Kunselman wanted to know if that included the Burton Commons project. Mary Jo Callan, head of the combined city/county office of community development, explained that four years ago the commission had committed funds the Burton Commons housing project. Two years ago, she said, the city told “wanted-to-be developers” it could not continue the commitment. So, where’s the money? Kunselman wanted to know. Fraser explained that it was put in back in the trust fund, and it’s been used. Smith inquired about future payments that are due to the fund by developments – specifically, the one at Plymouth Green. Wendy Rampson, head of planning for the city, explained that based on the Plymouth Green development agreement, two payments of $15,000 had been made and there would be two more, at $15,000 each for next two years.

Smith noted that Avalon Housing is a nonprofit organization in town similar to the housing commission, and Avalon Housing has divested itself of smaller, single-unit housing. Did the needs assessment for the housing commission include consideration of the type of housing stock? She pointed out that it could be a question of replacing 100 furnaces versus one.

Derezinski said that the furnaces that had been replaced were in smaller units. He also said that the question of an appropriate mix of housing stock was receiving attention from the commission. They’d looked at the mix in the Grand Rapids housing commission’s collection of housing, for example.

Fraser wrapped up the discussion of the housing commission by noting that he’d been in public service long enough to see the federal government essentially get out of the business of domestic spending on housing. A lot of the housing we’re dealing with now, he said, dates to the late ’60s and ’70s. The units had 30-year mortgages to guarantee affordability. Fraser noted that the council had previously discussed multi-family units going to market rate. The pressure has rolled downhill to the smallest units of government closest to the people, he said, and the dilemma is only going to get worse.

Fraser pointed to President Obama’s remarks during his state of the union speech, and the new leadership in the U.S. Senate and House, as well as Michigan’s own legislature – all of them have been targeting domestic spending for cuts, he said, and we’ll have to live with it.

Budget Impact Sheets: Community Development

Mary Jo Callan, the director of the combined city/county office of community development, delivered a grim picture for human services allocations to nonprofits. She would meet the budget reduction target in FY 2012 by reducing allocation to nonprofits that provide human services by $116,714 – from $1,275,744 to $1,159,030. Callan’s strategy to meet the target for next year’s FY 2013 budget would be to reduce the nonprofit allocation by an additional $48,700.

Councilmembers appeared slow to grasp the full significance of the numbers on the budget impact sheets. Margie Teall (Ward 4) asked: How did you come up with that number? Where will it hit?

Callan explained that she did not yet know which specific nonprofits would be affected. She said that her department is in the process of gearing up for the new coordinated funding process, beginning July 1, 2011.

Carsten Hohnke (Ward 5) remarked that it was a significant percentage cut, with Teall chiming in that it was greater than 2.5%.

Callan explained that her department had anticipated receiving a $98,000 federal grant from HUD the previous year, to cover administrative costs incurred from city finance and administrative staff. The grant had not materialized – HUD requires documentation that is fairly specific, she said. In a followup email in response to a Chronicle query, Callan described the documentation issue in more detail:

The documentation requires not only the amount of time spent on a specific grant (e.g. CDBG, HOME, CDBG-R, NSP), but also the specific project worked on (e.g. single family demolition, 701 Miller rehab, human services). Community Development has our whole finance and time tracking system set-up to accommodate this documentation threshold, since the vast majority of our funding comes from these sources. City finance and administrative staff however, do not track their time in this detailed way, since the vast majority of their work relates to the general fund.

Stephen Rapundalo (Ward 2) mistakenly concluded from Callan’s remarks that the $116,000 reduction did not mean reduction in nonprofit allocations after all – the reduction would be $116,000 minus the $98,000, he ventured. That would make it more palatable in terms of actual service agency cuts, he concluded.

But Callan clarified that they would not be subtracting $98,000 from anything. Rapundalo sought to clarify why support to nonprofits would be reduced if the $98,000 was originally intended to support administrative staff.

City administrator Roger Fraser sought to bring some clarity to the situation by saying that if administrative staff is reduced, the city loses capacity to administer the program. The office of community development had tried to keep the allocations to nonprofit agencies stable, he said. The city’s recommendation is consider the trade-off: What does it take to run the operation, and how much direct support to nonprofits can be provided? The city is trying to figure out how to pay for staff to run the program at the same level, while continuing to provide direct support to programs.

Rapundalo ventured that the budget impact sheet was not a specific proposal for allocating the cut between administrative staff and direct support to programs. Fraser replied that the city was suggesting a balancing act: “These are the adjustments we think are necessary.” Marcia Higgins (Ward 4) zeroed in on the significance of the numbers the council had been given: “So it really is a direct reduction?” Yes, said Callan. She continued by saying her department is a lean organization: “We don’t bring this to you lightly.”

Hohnke summarized the situation by saying that one way the city had been working to maintain funding was to identify federal funding opportunities – the proposed cut reflects the fact that federal funding didn’t materialize.

Christopher Taylor (Ward 3) characterized the situation as Callan believing the department is as lean as it can go and it has gotten what revenue is gettable – the only way to meet it is to reduce funding to human services agencies.

Fraser stressed that there was no effort yet to balance the choices in human services funding against other choices in the city’s organization. The office of community development was asked to meet the reduction targets just like every other department, and it was presented in “raw form.” In the proposed budget in April, he said, they might propose a different scenario, but the impact sheet simply recognizes that $98,000 is gone.

Budget Impact Sheets: Parks and Recreation – Basics

Among the dollars identified at the work session by Sumedh Bahl for savings in parks and recreation was $65,083 in energy savings due to improvements done at facilities. He also pointed to $10,000 saved in materials and supplies used for upkeep in facilities. Upgrades in facilities means that for a certain time, there’ll be a reduction in maintenance costs, he said. Additional budget savings would result from adjusting water charges to reflect what actual usage is. And they’re eliminating some software licenses. Some of the software, Bahl said, isn’t used by the staff that much, “so we’re taking it away from them.”

Bahl also pointed to an additional $52,000 in anticipated revenue, starting in FY 2013, from new kayaking and tubing, resulting from the planned construction of the Argo Dam bypass, which was recommended by the city’s park advisory commission and approved by the city council last year.

Mayor John Hieftje wondered about a proposed increase in fees at the city’s outdoor pools for FY 2013 – $4 to $5 for adults and $3.50 to $4 for youth and seniors – which the budget impact sheet showed would generate an additional $40,000 in revenue in FY 2013. He noted that historically, fee increases had caused revenue to drop. Bahl said he felt the prices would still be pretty competitive.

Colin Smith, manager of the city’s parks and recreation program, allowed that fee increases leading to less patronage and lower revenues had happened – but that was a number of years ago, he said. At that time, he said, the increase had been for season passes and it was extraordinary. During the last fee adjustment cycle, the prices on season passes were raised by 10% and the city didn’t get any “hard feedback” on that, he said.

Marcia Higgins (Ward 4) wanted to know: What’s “hard feedback”? Smith explained that this meant negative public input about the increase.

But Higgins noted that this is the first year that the city would see the impact of the 10% fee increase – this spring. She clarified that these are additional fee increases planned for the following year. Smith confirmed that’s the case – he didn’t want to implement two kinds of fee increases at once.

Budget Impact Sheets: Parks and Recreation – Huron Hills

Included in the materials provided to city councilmembers was a memo that outlined various options for Huron Hills golf course. [The city also owns the Leslie Park golf course.]

[Last year the city issued an RFP to privatize of some the operations at the course, but ultimately decided not to accept either of the proposals that were made – one from Miles of Golf and the other from a citizen group that envisioned turning the course operations over to a nonprofit.]

Bahl summarized the result of the implementation of recommendations made by a consultant – Golf Convergence, hired by the city in 2007 – to improve patronage at the city’s two golf courses. All of the recommendations have now been implemented:

Rounds Played Season Huron Leslie 2007 13,913 21,857 2008 15,558 27,078 2009 21,150 30,973 2010 22,500 32,000

-

Bahl noted that there’d been a dramatic improvement in the number of rounds played, but there are signs that it’s flattening out.

A memo provided to the council outlines the financial impact of various options for use of the Huron Hills land, including continuing to operate the golf course. In summary strokes, the options for Huron Hills and their costs over the next four years would be:

- Golf course: $162,000-187,000 annually

- Walking trails: $68,000-$309,000 annually

- Naturalization: at least $500,000 annually, falling to around $100,000 after seven years

- Soccer fields: no cost estimate

- Disc golf: no cost estimate

- Farming: no cost estimate

There’s a wide range of cost estimates for the walking trails option. By way of explanation, Bahl noted that for non-golf scenarios at Huron Hills, it’s necessary to include the “legacy costs” for two people currently employed at Huron Hills, both in union positions – one AFSCME and one Teamster. By union contract, he said, those employees cannot be laid off if the city has any temporary, seasonal, or contract worker employed at the city. And the city relies heavily on these types of workers, so laying off the two union workers at Huron Hills is not a realistic option. The net cost to the city of replacing seasonal workers with the Huron Hill’s workers would be around $175,000, Bahl said. Also in the mix is $42,000 in municipal service charges and $24,000 in IT charges that the golf enterprise fund accounting currently pays from the enterprise fund into the general fund.

The lower range of cost reflects a scenario in which the two Huron Hill’s union workers can be placed elsewhere in the city, while the higher cost in the range is a scenario where neither worker can be placed elsewhere.

Colin Smith, manager of the city’s parks and recreation program, stressed that under the walking trails option, the result would not be a natural area, but rather an “unkept golf course.” Converting it to a natural area would require considerably more investment – listed out as a separate option. Stephen Kunselman (Ward 3) confirmed with Smith that under the walking trails option, there was money factored in for mowing of the 8th and 9th hole areas that are used for sledding in the winter. Sabra Briere (Ward 1) drew out the fact that there is not money in that option for mowing areas where people might cross-country ski.

Marcia Higgins (Ward 4) wondered why the parks capital improvements and maintenance millage could not be used for non-golf options. Smith’s answer was that because maintenance would be mowing, which must be paid out of the city’s general fund.

Commenting on the legacy costs, mayor John Hieftje noted that if positions elsewhere in the city opened up, they could be held open for the Huron Hills workers. City administrator Roger Fraser allowed that this would be the city’s strategy, but could not guarantee that positions would open up.

Christopher Taylor (Ward 3) noted that the walking trails options outlined a range of possibility, but he wanted to know what the range of likelihood is. Bahl told Taylor that chances of finding an opening for the AFSCME employee are better, because of the relatively large pool of such workers. On the Teamster side, the pool is smaller. Summarizing the city’s best realistic estimate for the legacy costs for non-golf options, Colin Smith said it’d be $150,000 and above in the first couple of years.

Higgins stated that the city had committed to five years before evaluating the success of the Golf Convergence recommendations – when does that end? she wondered. Colin Smith clarified that the five-year evaluation period ends in 2013 – there are two years left.

City administrator Roger Fraser weighed in, saying the staff was not suggesting the council had to implement changes before two more years is up. It’s a matter of considering what a sustainable approach to city services is. When the city talks about community engagement to solve problems for the city’s future, the different scenarios for Huron Hills should be a part of the discussion, he concluded.

There seemed to be little enthusiasm from councilmembers at the work session for contemplating anything but a golf course at Huron Hills for the next two years.