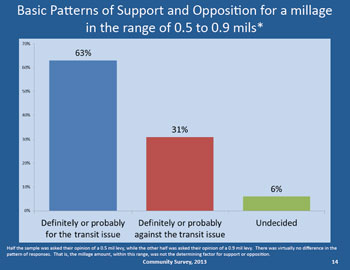

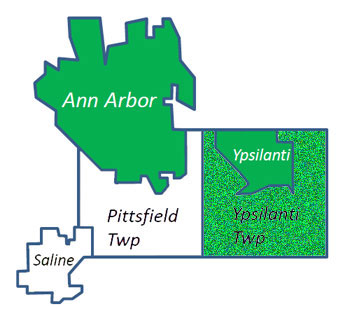

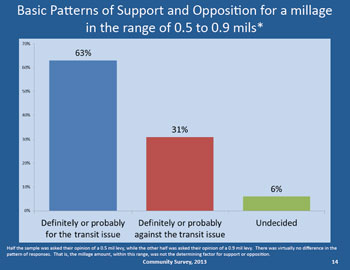

Results of a survey of 841 registered voters in the city of Ann Arbor, the city of Ypsilanti and Ypsilanti Township show a 63% positive reaction to a possible additional transit tax in those communities. Those three jurisdictions are the members of the Ann Arbor Area Transportation Authority. [.pdf of Feb. 7, 2014 press release] [.pdf of survey questions]

Chart 1: AAATA Millage Vote Survey. Of the 841 registered voters surveyed, 63% said they would definitely or probably vote for an additional transit tax, while 31% said they definitely or probably would vote against an additional transit tax. Half the respondents were asked about a tax at the rate of 0.5 mills while the other half were asked about a 0.9 mill tax. There was not a significant difference in the two groups. The amount of the potential millage request in 2014 is 0.7 mills.

The AAATA’s release of partial survey results on Feb. 7 comes about two weeks before the next monthly meeting of its board of directors, on Feb. 20. At that meeting, the board will almost certainly consider whether to place a millage on the ballot – either for May 6 or later in the fall of this year.

The purpose of the potential millage – which would be the first one ever levied by the AAATA – would be to fund a 5-year plan of service improvements, approved by the AAATA board at its Jan. 16, 2014 meeting. The millage itself would last for five years.

Generally, those improvements include increased frequency during peak hours, extended service in the evenings, and additional service on weekends. Some looped routes are being replaced with out-and-back type route configurations. The plan does not include operation of rail-based services. The AAATA has calculated that the improvements in service add up to 90,000 additional service hours per year, compared to the current service levels, which is a 44% increase.

If a millage were approved in May, those improvements that involve extending the hours of service later in the evening and the weekend could begin to be implemented by late 2014. However, increases in frequency along routes, which would require acquisition of additional buses, would take longer.

The AAATA refers to the plan in its communications as the 5YTIP. The AAATA has calculated that the additional tax required to fund the 5YTIP is 0.7 mills. A draft five-year plan was presented to the public in a series of 13 meetings in the fall of 2013. Changes to the five-year plan made in response to public feedback were included in the board’s information packet for the Jan. 16 meeting. [.pdf of memo and 5-year improvement plan] [.pdf of presentation made to the board on Jan. 16]

The dedicated transit tax already paid by property owners in Ann Arbor and Ypsilanti is levied by each city and passed through to the AAATA. Those taxes would stay in place if voters in the AAATA’s three-jurisdiction area approved a 0.7 mill tax. For Ann Arbor, the rate for the existing millage is 2.056 mills, which is expected to generate a little over $10 million by 2019, the fifth year of the transportation improvement plan. For the city of Ypsilanti, the rate for the existing transit millage is 0.9789, which is expected to generate about $314,000 in 2019. For the owner of an Ann Arbor house with a market value of $200,000 and taxable value of $100,000, a 0.7 mill tax translates into $70 annually, which would be paid in addition to the existing transit millage. The total Ann Arbor transit tax paid on a taxable value of $100,000 would be about $270 a year.

The transit improvement program also calls for an additional $1,087,344 to come from purchase-of-service agreements (POSAs), based on increased service hours in Pittsfield, Saline, and Superior townships.

A subset of a financial task force that had formed during an effort in 2012 to expand the AAATA to a countywide authority has concluded that the 0.7 mill would be adequate to fund the planned additional services. At the most recent meeting of the Ann Arbor Downtown Development Authority, on Feb. 5, DDA board member Bob Guenzel stated that he had continued to participate on that task force, and reported that the group had forwarded its finding on the currently contemplated 0.7 millage to the AAATA.

Besides Guenzel, who is former Washtenaw County administrator, the current configuration of that group includes Mary Jo Callan (director of the Washtenaw County office of community and economic development), Norman Herbert (former treasurer of the University of Michigan), Paul Krutko (CEO of Ann Arbor SPARK), and Mark Perry (director of real estate services, Masco Corp.) and Steve Manchester.

The survey on voter attitudes toward a millage was conducted for the AAATA by CJI Research with a mixed methodology – of telephone contacts, and a mail invitation to respond online – during October and November of 2013. The sample of respondents was divided into two groups – those who were asked about their attitudes toward an additional 0.5-mill tax and those who were asked about their attitudes toward an additional 0.9-mill tax. According to CJI, the groups showed virtually no difference in the distribution of responses.

Of the 841 registered voters surveyed, 63% said they would definitely or probably vote for an additional transit tax, while 31% said they definitely or probably would vote against an additional transit tax.

The Feb. 7, 2014 press release issued by the AAATA highlighted three of its conclusions from the survey results: (1) that the AAATA is highly regarded by voters in the three member jurisdictions; (2) residents in Ann Arbor, Ypsilanti and Ypsilanti Township are supportive of transit service expansion even if it means a new tax; and (3) among survey respondents, the best reasons to support a transit expansion are to help retain and attract jobs, generate economic activity by taking customers and workers to area retailers and other employers, and to improve service for seniors and the disabled. The margin of error for the survey was no more than 3.4%, according to the press release. [Full Story]