Survey: Majority Favorable on Transit Tax

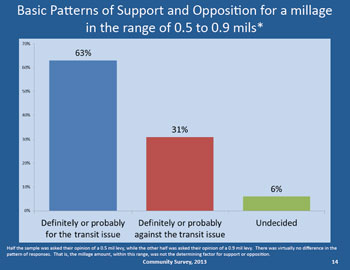

Results of a survey of 841 registered voters in the city of Ann Arbor, the city of Ypsilanti and Ypsilanti Township show a 63% positive reaction to a possible additional transit tax in those communities. Those three jurisdictions are the members of the Ann Arbor Area Transportation Authority. [.pdf of Feb. 7, 2014 press release] [.pdf of survey questions]

Chart 1: AAATA Millage Vote Survey. Of the 841 registered voters surveyed, 63% said they would definitely or probably vote for an additional transit tax, while 31% said they definitely or probably would vote against an additional transit tax. Half the respondents were asked about a tax at the rate of 0.5 mills while the other half were asked about a 0.9 mill tax. There was not a significant difference in the two groups. The amount of the potential millage request in 2014 is 0.7 mills.

The AAATA’s release of partial survey results on Feb. 7 comes about two weeks before the next monthly meeting of its board of directors, on Feb. 20. At that meeting, the board will almost certainly consider whether to place a millage on the ballot – either for May 6 or later in the fall of this year.

The purpose of the potential millage – which would be the first one ever levied by the AAATA – would be to fund a 5-year plan of service improvements, approved by the AAATA board at its Jan. 16, 2014 meeting. The millage itself would last for five years.

Generally, those improvements include increased frequency during peak hours, extended service in the evenings, and additional service on weekends. Some looped routes are being replaced with out-and-back type route configurations. The plan does not include operation of rail-based services. The AAATA has calculated that the improvements in service add up to 90,000 additional service hours per year, compared to the current service levels, which is a 44% increase.

If a millage were approved in May, those improvements that involve extending the hours of service later in the evening and the weekend could begin to be implemented by late 2014. However, increases in frequency along routes, which would require acquisition of additional buses, would take longer.

The AAATA refers to the plan in its communications as the 5YTIP. The AAATA has calculated that the additional tax required to fund the 5YTIP is 0.7 mills. A draft five-year plan was presented to the public in a series of 13 meetings in the fall of 2013. Changes to the five-year plan made in response to public feedback were included in the board’s information packet for the Jan. 16 meeting. [.pdf of memo and 5-year improvement plan] [.pdf of presentation made to the board on Jan. 16]

The dedicated transit tax already paid by property owners in Ann Arbor and Ypsilanti is levied by each city and passed through to the AAATA. Those taxes would stay in place if voters in the AAATA’s three-jurisdiction area approved a 0.7 mill tax. For Ann Arbor, the rate for the existing millage is 2.056 mills, which is expected to generate a little over $10 million by 2019, the fifth year of the transportation improvement plan. For the city of Ypsilanti, the rate for the existing transit millage is 0.9789, which is expected to generate about $314,000 in 2019. For the owner of an Ann Arbor house with a market value of $200,000 and taxable value of $100,000, a 0.7 mill tax translates into $70 annually, which would be paid in addition to the existing transit millage. The total Ann Arbor transit tax paid on a taxable value of $100,000 would be about $270 a year.

The transit improvement program also calls for an additional $1,087,344 to come from purchase-of-service agreements (POSAs), based on increased service hours in Pittsfield, Saline, and Superior townships.

A subset of a financial task force that had formed during an effort in 2012 to expand the AAATA to a countywide authority has concluded that the 0.7 mill would be adequate to fund the planned additional services. At the most recent meeting of the Ann Arbor Downtown Development Authority, on Feb. 5, DDA board member Bob Guenzel stated that he had continued to participate on that task force, and reported that the group had forwarded its finding on the currently contemplated 0.7 millage to the AAATA.

Besides Guenzel, who is former Washtenaw County administrator, the current configuration of that group includes Mary Jo Callan (director of the Washtenaw County office of community and economic development), Norman Herbert (former treasurer of the University of Michigan), Paul Krutko (CEO of Ann Arbor SPARK), and Mark Perry (director of real estate services, Masco Corp.) and Steve Manchester.

The survey on voter attitudes toward a millage was conducted for the AAATA by CJI Research with a mixed methodology – of telephone contacts, and a mail invitation to respond online – during October and November of 2013. The sample of respondents was divided into two groups – those who were asked about their attitudes toward an additional 0.5-mill tax and those who were asked about their attitudes toward an additional 0.9-mill tax. According to CJI, the groups showed virtually no difference in the distribution of responses.

Of the 841 registered voters surveyed, 63% said they would definitely or probably vote for an additional transit tax, while 31% said they definitely or probably would vote against an additional transit tax.

The Feb. 7, 2014 press release issued by the AAATA highlighted three of its conclusions from the survey results: (1) that the AAATA is highly regarded by voters in the three member jurisdictions; (2) residents in Ann Arbor, Ypsilanti and Ypsilanti Township are supportive of transit service expansion even if it means a new tax; and (3) among survey respondents, the best reasons to support a transit expansion are to help retain and attract jobs, generate economic activity by taking customers and workers to area retailers and other employers, and to improve service for seniors and the disabled. The margin of error for the survey was no more than 3.4%, according to the press release.

At the Jan. 16 AAATA board meeting, board chair Charles Griffith indicated that he felt the board would be taking the next step on implementing the program very soon. That indicates a probable vote on the millage question at the next board meeting, on Feb. 20. If the board voted then to put a millage question on the ballot, that would be in time to meet the Feb. 25 deadline for a millage request to be placed on the May 6, 2014 ballot.

A new millage would be decided by a majority vote of all three member jurisdictions of the AAATA. The two Ypsilanti jurisdictions were added as members of the AAATA just last year. The Ann Arbor city council voted to approve changes to the AAATA’s articles of incorporation – to admit the city and the township of Ypsilanti as members – at its June 3, 2013 and Nov. 18, 2013 meetings, respectively.

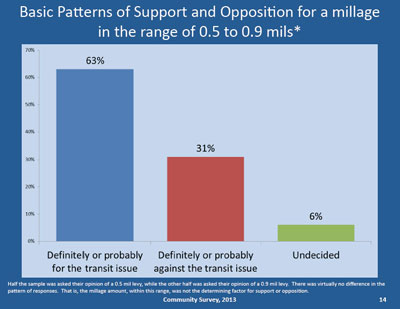

This most recent survey conducted by CJI is the third biennial study the AAATA has commissioned, starting in 2009. The 63% positive attitude in this most recent survey – confined to just the three member jurisdictions of the AAATA – is somewhat stronger than the support measured among residents countywide in 2009 and 2011. Results from all survey years are shown in Chart 1 and Chart 2 below:

Chart 1: AAATA Millage Vote Survey. Of the 841 registered voters surveyed in the cities of Ypsilanti and Ann Arbor and Ypsilanti Township, 63% said they would definitely or probably vote for an additional transit tax, while 31% said they definitely or probably would vote against an additional transit tax.

Chart 2: Millage Vote 2009 and 2011 Surveys. Asked early in the survey if they would support a 1 mill tax for countywide transit, 54% of survey respondents countywide said they definitely or probably would. Asked later in the survey, a combined 59% of voters said they’d probably or definitely vote for a 1 mill transit tax.

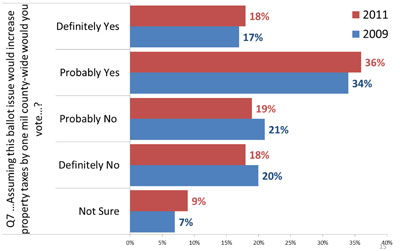

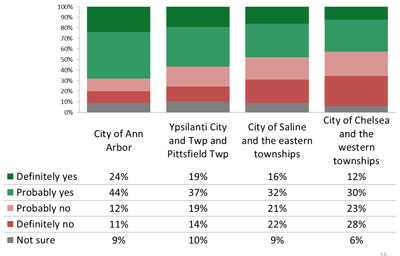

The geographic distribution of support for the most recent survey showed strongest support in the city of Ann Arbor (66% definitely/probably yes), followed closely by the city of Ypsilanti (65% definitely/probably yes), followed by Ypsilanti Township (57% definitely/probably yes). Opposition was flipped from support, with 28% of city of Ann Arbor voters saying they’d definitely/probably vote no, 31% of city of Ypsilanti voters definitely/probably voting no, and 36% of Ypsilanti Township voters definitely/probably voting no. The city of Ypsilanti had the fewest number of undecided voters: 4%. Those results are shown in Chart 3:

Chart 3: Millage Vote Geographic Distribution 2013 Stacked bars indicate by geographic location those who said they’d definitely or probably vote yes on a transit tax (blue), definitely or probably vote no (red) or didn’t know (yellow). (Data from the AAATA, chart by The Chronicle)

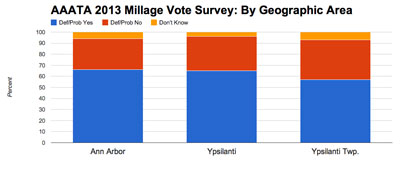

That’s similar to the support measured in those same specific areas two years ago. In 2011, support for a transit tax was strongest within the city of Ann Arbor, with 24% saying they would definitely vote yes and another 44% saying they’d probably vote yes, for a total of 68%. In that year, the two Ypsilanti-area jurisdictions were grouped with Pittsfield Township. About 56% of Ypsilanti-area plus Pittsfield said they would definitely or probably support a millage. Those results from past years are shown in Chart 4:

Chart 4: Millage Vote Geographic Distribution 2011. The light and dark green areas reflecting definite or probable yes votes on a transit tax diminish the further away that respondents were from Ann Arbor and Ypsilanti.

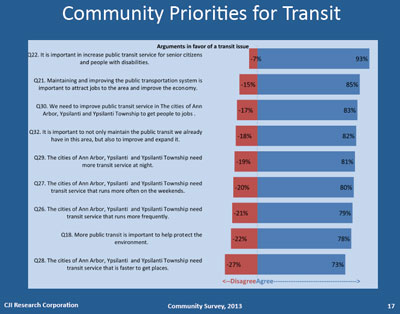

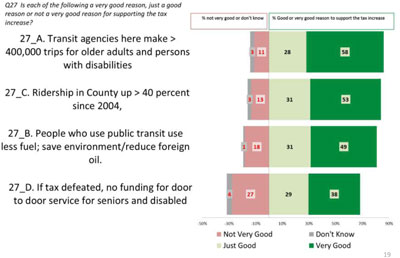

All the surveys attempted to measure how effective respondents think arguments are – for and against a transit tax. This year’s survey results were in at least some ways consistent with previous years’ surveys: Additional service for seniors and those with disabilities is seen as a persuasive argument to support a transit tax. Those results are presented in Chart 5 and Chart 6 below.

Chart 5: Arguments for Public Transit – Fall 2013 Survey. Perceived as the best argument for supporting a transit tax was the importance of transit service for seniors and those with disabilities. Perceived as less persuasive arguments were the ideas that the member jurisdictions need a faster way to get places and that transit is important to protect the environment.

Chart 6: Arguments for Public Transit – 2011 Survey. The idea that “If the tax is defeated, there will be no funding for door-to-door service for the disabled” was not one that survey respondents felt was a good argument to vote for a transit tax. It comes across negatively and people react negatively to it.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Ann Arbor Area Transportation Authority. Click this link for details: Subscribe to The Chronicle. And if you’re already on board The Chronicle bus, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

You pay a company to do a survey and the results are just what you want to hear, isn’t that a surprise?

If anyone knows anyone who took this survey let me know. I have to wonder if this is the kind of survey we so often have here in Ann Arbor – a carefully-worded survey sent to a select group of people in order to get the desired results. Heck, here in the First Ward we get asked to take city council members surveys that have been edited and/or written by you, Dave. So I am necessarily suspicious of any survey sent out.

I believe that this is a legitimate survey done by a professional company that understands survey methodology. In this age of surveymonkey instant polls, it is good to know that such substantive work is still being done.

As the article indicates, the same company has done surveys for AATA twice in the past. The results of those surveys are public and the lengthy reports contain a great deal of interpretation and analysis.

I’m interested to read this report and to see what percentages of people said Definitely and what percentage Probably. As the charts in this article indicate, in the past Definitely received a rather small percentage. The survey organization indicated that some uncertainty hangs on the Probably answers. In this partial release, AAATA has evidently combined these numbers and interpreted them favorably.

And yes, I know a couple of people who were surveyed and they were not “select”, at least in terms of favoring the millage.

I wonder what level of financial detail was provided in the survey since the “two groups” (.5 mill group and .9 mill group) “showed virtually no difference in the distribution of responses.”?

I would have thought the level of support would have fallen at least a certain amount with the group paying the 80% higher tax (.9 mill group vs. .5 mill group)?

I am suspicious, like Jeff Hayner, of the wording of this survey. I see a link to the press release. Can the Chronicle provide a link to the actual survey questions? [Added after-the-fact: .pdf of survey questions]

Also – and I admit this is a quibble – in two of the charts, “mills” is misspelled “mils”. Pardon me if these small errors don’t thrill me with confidence about the rest of the survey. (“Mill” comes from the Latin for thousand. There are 1,000 mills in a dollar. Similarly, “cent” comes from the Latin for hundred. There are a hundred cents [pennies] in a dollar.)

How about putting the claim that a majority of Ann Arbor and Ypsilanit residents really favor increasing their taxes to expand AAATA operations to the test by writing the millage proposal in a way that makes it optional to submit to higher taxation? That could be implemented by making taxation an affirmative choice where one voluntarily agrees to higher taxes or allows people opposed to expanded transit to opt out of the higher taxes. That would be fair and show if a real desire for more subsidized public transit is really warranted or not. Everyone who really supported public transit would choose to pay the higher taxes.

Re: [5] A quibble about the quibble. It’s the same chart, included twice to save scrolling.

Re: [5] “Can the Chronicle provide a link to the actual survey questions?” That’s a reasonable request, of course, and we’ll upload the text of the questions as soon as we have it. Tuesday, Feb. 11 at 3 p.m. is the date of the AAATA’s planning and development committee meeting (at 2700 S. Industrial Highway). I’d guess no later than by then the question text would be available.

Don’t we really have case of abstract good intentions and ignorance ruling with this survey?

Do Ann Arbor voters know the true facts about how AAATA is run and what their financial results are? I do not think so. Would people be in favor of increasing taxes for everyone in Ann Arbor if they knew that AAATA’s financial statements show that year after year they run large operating deficits that must be closed with public money from taxation. This financial performance shows that the public business AAATA operates is not economically viable and does not promise to be economically viable anytime in the foreseeable future. Would people be in favor of increasing their taxes for AAATA if they knew that bus riders only pay about 25% of the costs of their ride? Do they know that the Ann Arbor Public is massively subsidizing transportation expenses for well-off socially priviledge UM Students, UM employees, and Downtown Yuppie Professionals. These people form the bulk of the bus system ridership.

Why does the Ann Arbor News and other media outlets not report on these very important parts of the local transit services story? If they did, AAATA would have absolutely no chance of passing a new millage to raise taxes for their public business.

Re: [8] optional taxation

Roger, from just a technical point of view, I don’t see how your proposal could be implemented for a public transportation system, where funding is decided in a referendum of all voters in a jurisdiction. One challenge is that it seems like it would require abandoning the principle of a secret ballot. What you’re proposing is that someone’s vote for or against the proposal would necessarily be visible – so that the tax bills could be adjusted accordingly. A second challenge is that the amount of the millage would be somewhat contingent on how many people supported it. A third challenge is that only real property tax payers would effectively be enfranchised – which on reflection some people might not identify as a challenge, but rather exactly the desired outcome.

Leaving those technical issues aside, I think what you might be imagining conceptually is something more along the lines of a private transportation co-op. I think it’s a notion that might become increasingly feasible if the brave new world of self-driving cars is realized over the next few years. One of the barriers to cooperative car ownership is geographic proximity of willing members. That’s a challenge that self-driving cars could meet – because you could summon a vehicle from the co-op’s fleet. Imagine, for example, that 500 households band together to purchase and operate a fleet of 50 self-driving automobiles. Whether membership in a co-op that owns a fleet of self-driving cars would be price competitive with owning your own standard car is an open question. One thing that might swing the balance is the fact that a member of a co-op could conceivably live in a place that has no parking availability. When you arrive back home, you send the car to its “home base.” Of course, a viable co-op would need some members who had available parking.

@8: Calling the AAATA a business doesn’t make it one, nor is “public business” anything but an oxymoron, and “optional taxation”. Are those some new talk radio anti-government inventions or your very own creations?

Here’s the survey phone script with the questions: [.pdf of survey text questions]

The question that I think Larry Baird might have been particularly interested in was this one.

I think the ballot language for a potential millage request can be expected to be substantially similar to the Nov. 4, 2008 language for Delhi Township for the CATA millage:

I missed yet another oxymoron in #6: “subsidized pubic transit”. I’m probably being generous referring to them as just oxymorons, but I don’t know anything particularly constructive to do beyond just calling attention to them. Kuhlman has something going on in his head with regard to all this, and I’ll leave it to him to explain further if he chooses.

Re: [13]

Steve, I think you could somewhat more generously conclude simply that Kuhlman would like people to be mindful of a potential “tyranny of the majority.” And that’s a reasonable request, I think. When I read Kuhlman’s remarks, it prompts me to consider not just those who might not be willing to pay the transit millage but also those who might not be able to. Consider a senior citizen property owner, Fred – someone whom this additional millage is specifically supposed to help. Maybe the additional $70 a year would be a hardship for Fred. Just because a majority might be willing and able to pay the extra $70, doesn’t mean that they should dismiss those in the minority as all simply unwilling. Granted, Kuhlman doesn’t sound willing. But some of those in the minority may not be able. I think it’s fair to ask that folks weigh that as they decide whether to vote to support this millage. Maybe the balance test that people apply is that they find it hard to imagine that $70 could really be a hardship, or that Fred is likely to get additional benefits that mitigate the hardship.

Dave, thanks for tracking down the phone survey. According to the survey,

“some people say (this)… and some people say (that)..”

Who are these “some people”?

The lead up sentences to the actual questions can greatly influence the answers provided. Therefore they should stick to the facts and choose adjectives very carefully.

The lead up to Q18 to Q32 is misleading “reasons people may have to oppose..” since it contains reasons people would have to support the tax. Also, no mention of current funding model and other relevant facts a voter would need prior to making a fully informed decision.

I hope the AAATA board does not get false read here.

Re: (14) If I may add, “Fred” is on a fixed income and the new AAATA tax is only one of many new taxes recently passed or on the drawing board.

The $70 may not push him over the top but when added to everything else, no one can deny that the “cost of living” in the city has excluded lower income households and a growing portion of middle income households as well.

The irony of this tax is that it acknowledges the problem (busing workers in from outside the city) while also adding to it.

You’re making a (valid) case that Roger didn’t, Dave. (I apologize for referring to you by your last name, Roger—I generally communicate on a first-name basis, and this exception was probably due to not having appreciation for what I interpreted as misleading rhetoric.) And it might even be in line with Roger’s reasoning to say that Fred’s dilemma is due to having chosen a home that’s more expensive than he can afford to pay taxes on in a community that supports public services and amenities such as parks and transit. But since we can’t undo Fred’s choice, and we’re a community that votes on such matters, I think the best financial option is for Fred to embrace the transit system and *use it* in order to get the maximum benefit from his contribution, even if it means selling a car (or two), and that applies even today regardless of any future millage expansion). Simultaneously, he could campaign against the new millage.

That said, I’d rather that Roger or anyone else speak for themselves first, rather than for Fred. (Or is Fred really Roger?) I think that would be a better starting point. However, I’m open to considering the Fred scenario, and I’ll discuss it without bringing in any

Along those lines, the “doesn’t mean that they dismiss those in the minority as all simply unwilling” sentiment is also a misrepresentation of the thoughts of others. (A false premise? Baseless assumption? Straw man? I’m not sure what logical fallacy term applies.) Or did I miss where someone argued unwillingness in that regard? (A ‘find’ for it on this page turned up no cases.)

Re: the lead up to Q18-Q32

Larry, I think you’re right about that intro being problematic. It looks to me like the prompt is missing something along the lines of “or to support.” There’s a chance that this script does not perfectly match the CATI screens used by the interviewers. That’s because a basic draft could have been auto-generated from the CATI system and then further formatted by hand. The repeated phrase in Q9 “9. To provide To provide funding” that I quoted out above is in the original document provided to The Chronicle by AAATA, and that might also be an artifact of post-hoc formatting after extraction from the CATI system. Or it could be that the phone interviewers saw that phrase repeated on their screens and dealt with it (or not) as they administered the survey instrument.

I would add that this collection of items seems like it’s trying to measure possibly two different things: (1) Does this sentiment strongly or weakly align with your own thinking? or (2) Do you think this is a strong argument that someone else could make?

Take this item, for example:

On the interpretation summarized by (1), I’d say, “strongly disagree” because if I’m honest I can afford to pay more in taxes right now. But on the interpretation summarized by (2) I’d say “don’t know” – because if someone else says that (and I’m just going to take it at face value), then it would have a very mildly negative impact on my inclination to support an additional transit tax.

There are “push poll” qualities about this poll that make me uncomfortable both with its use as a marketing tool and with its value as a true test of public will. Q 5, for example, makes the interviewee state that they don’t want to provide more services for seniors if they want to say no. There is a “shaming” element to that. Q 9 is repeated as Q 33 (the crucial question about whether you would vote for the millage), after a long series of questions about the benefits. Many of those questions also have a “shaming” quality to them. Many are also phrased as selling points, describing benefits and favorable results.

The polling company has used this device before – asking the question twice, and they have in the past boosted the number of positive responses in the second question.

Aside from the point that this is manipulative, I wonder how well the opinion will stick after a full public discussion and in the privacy of the voting booth. Many may say “probably will vote yes” just to seem a nice person, especially after all those push type questions. Therefore in my opinion the AAATA board may be receiving an overly optimistic assessment. As those of us who have participated in campaigns know, it isn’t just whether people like you but whether they are motivated to go to the polls. The “probably” voters may not make that effort if they are at all conflicted.

In the end, the only poll that counts is the one at the voting booth. I hope that we get past that before long so the future of this program will be clear.

Re: “Q 5, for example, makes the interviewee state that they don’t want to provide more services for seniors if they want to say no.”

I don’t think that’s an accurate characterization of the item – because people are picking from “more services” or “can’t afford” as labels for the two statements. They’re simply not required to state anything other than those two labels.

The response options are as follows:

That indicates the phone interviewers were supposed to read the prompt and choices as follows: “… Which view to you agree with more? More services or Can’t afford?” And if someone volunteers “Some of both” then that gets coded as choice 3. If they say they don’t know, then that gets coded as 9.

That said, I think this item would be better as a straight-up agree/disagree (strongly and somewhat), with a gate question: “As the Baby Boom generation grows older, do you think cities and townships need to provide more public services for seniors?” If the answer is no, then the follow-up would be skipped, which would be this: “Do you agree or disagree with this statement: Raising taxes is the right way for cities and townships to approach funding increased services for seniors. Do you strongly agree, somewhat agree, somewhat disagree or strongly disagree?”

Dave, sorry I wasn’t more precise. I was trying to conserve lines. But I still think the way it is stated is coercive.

Regarding the ballot language: This statement [link] from the Financial Task Force review (which includes SPARK executive Paul Krutko) contains this recommendation:

I’ll leave it to others to comment on the implications of this.

Re: (12). That 2008 ballot language was for approval of an additional millage on top of what CATA already was authorized to collect. In 2010, CATA sought (and received) approval of a millage renewal that folded in the additional millage and sought a Headlee override.

Here’s how the request appeared on the

August 3, 2010 ballot:

“Shall the public transportation authority, the Capital Area Transportation Authority (CATA), for continued service, as provided for by Public Act 55 of 1963, as amended, effective with calendar year 2011 replace both (i) an existing tax levy of 2.22 mills (approved by the voters in 2004 and authorized through 2010 and currently in the amount of 2.1838 mills pursuant to reductions caused by the operation of the provisions of the Headlee Act) and (ii) an existing tax levy of 0.787 mills (approved by the voters in 2008 and authorized through 2012), with (i) a renewal of 2.9708 mills (that being $2.9708 per thousand dollars of taxable value), and (ii) an increase of 0.0362 mills (that being $0.0362 per thousand dollars of taxable value) on real and personal property located within the City of Lansing, City of East Lansing, Meridian Township, Lansing Township, and Delhi Township for the years 2011 through 2015 inclusive, which is a period of five years? The purpose of the increase of 0.0362 mills is to offset the reductions caused by the operation of the provisions of the Headlee Act. If approved and levied, this millage would generate approximately $18,001,980 in its first year.”

The AAATA millage will be the first millage our transit authority has every levied under its PA 55 powers. In the past it has relied on the city transit taxes collected by Ann Arbor and Ypsilanti, with additional local funding from purchase of services contracts with other communities.

The important contrast between the 3.05 mills CATA collects and the millage proposed by AAATA, is that the CATA millage is uniformly applied across all member communities, while the AAATA millage will result in different levels of participation by different communities. Ann Arbor will pay a total of 2.75 mills, Ypsi will pay about 1.6 mills and Ypsilanti Township will pay only 0.7 mill.

Each AAATA community will receive service that reflects the level of financial contribution. Unlike CATA, our transit operation will offer differing levels of service and receive differing levels of financial support. I think an important consideration in deciding how to vote on this millage is the question of whether we should have multi-tiered participation in our regional transit system.

Thanks for the phone script!

Dave, will the AAATA be making public the results on all of its survey questions? The ones on development and growth are particularly important for issues other than transit.

Re: “Dave, will the AAATA be making public the results on all of its survey questions?”

For similar surveys in the past, I think the full-on report of results has included a question-by-question breakdown for frequencies of responses including additional x-tabs of some of the questions. I don’t think it’s a even a question of whether that will be made public, but rather a question of timing. I’d guess sometime after the AAATA’s planning and development committee meeting has met and reviewed the results – on Feb. 11 (tomorrow) – a full report will be disseminated to the public.

Re: making public survey results

Also, here’s the draft of the PDC slide deck presentation: [link] That includes some results of some of the other questions, besides attitudes towards a millage. I’d anticipate that the full report should include all of that, including a breakdown by geography.

This phrasing: This would amount to an additional tax of [$50/$90 per year for the owner of a typical home in this area].

Seems problematic to me as well; if this same survey is given to Ypsi township, Ypsi city, and Ann Arbor city residents, $50 a year on a .7 mill tax is NOT going to be typical at ALL in all 3 of those regions. At ALL.

I also don’t see why it’s so OK to have leading questions but never an inclusion of current facts. For instance, no mention of the CURRENT millage amounts AAAATA already gets, or the total number of dollars spent/received by them a year. While Ms. Armentrout is vaguely dissatisfied with this survey, I find it to be very obviously purposefully leading towards a desired result. And this does not surprise me in the least.

So let me get this straight–AAATA collects their current millage, uses hundreds of thousands of dollars pushing for a County-wide system, that fails to get support, pumps money into WALLY world support and plans and studies and now, because it isn’t able to produce a product Ann Arborites have been demanding for years (expanded evening and weekend hours, new routes, etc.)they want a new millage to acomplish what they could have financially had they not raided the cookie jar and wasted previous tax dollars on things that were not part of their core mission. Not sure what is worse, this phony push poll survey or local media (not the Chronicle) publishing this PR nonsense as ‘news’. Is this the same survey company that found support for the arts millage and the library expansion millage? Lol.

I was startled today at the Planning and Development committee meeting to hear that no questions were asked about AAATA until half through the interview. I think I heard the surveyor say that respondents didn’t even know it was about AAATA until they were asked that first question.

The questions instead were soft-ball about do you like Washtenaw County? Is the quality of life good here? Then later, do you know about AAATA? Do you respect the organization? The consultant went on at some length about how unusual the highly positive responses were to these questions.

I was glad that the PDC voted to send a resolution launching the May vote to the board. This is the right timing for many reasons and soon our community will have an answer. Members of Partners for Transit were there to cheer them on and promise support for the ballot measure.

Thank you for providing the millage information website via Twitter. http://therideyourway.org/

Here is one of the problems I have with all of this communication: it dumbs down and simplifies results to the point that the information is inaccurate. The page has a number of “facts” without reference to how they were obtained. This one was clearly from the results of the survey:

“66% of Ann Arbor’s registered voters have used public transit.”

But they do not have data to support that, since it has not been collected. Instead, they conducted a survey with a very limited sample of people (registered voters). One question was whether they or someone they knew have used public transit. This is not called out in this present article but I believe that I am correct that this is where the 66% figure is derived from.

I could point out a number of other instances of factual blurring like this, but this is not the place.

@20 Dave,

The reason that this question is push-poll is its asymmetry: while “aging baby boomers” is cited as a reason to support transit, no group (e.g., families, and those with fixed incomes) is cited as a reason to oppose the proposed millage increase.

Providing a concrete image of a sympathetic group (seniors) that might benefit from a tax increase, while not providing a sympathetic group that might be hurt by a tax increase, could be an accident. On the other hand, it could be intentional. Either way, the results of the pole are biased by this asymmetry.

If the asymmetry is intentional, it further de-legitimizes another unit of local government – and those officials associated with it.

The millage increase is on the May ballot now. Expected turnout will be about 11%. Six percent of the electorate will foist a big tax increase on everybody to buy a new fleet of white dinosaur buses that no doubt will have black curtains so people cannot see how empty they are.

This is the appetizer for a feast of local government tax increases coming up. AAPS will try for countywide millage so they can squander more on “special” education. The county’s retirement funding bonding ideas would require millage increases in the range of 35%. AADL will probably try for a conference center again. Why shouldn’t the city join in the party?

If people want to stop this lunacy they will have to form anti-tax groups, get some funding and organization, and work for electoral reforms requiring minimum turnout levels to pass millages.

If people think AAATA is not running a business what are they doing? They are providing transportation services and options. Other institutions doing this same thing are businesses. Just because the government provides the transportation services does not make it not a business. Most businesses to continue operating have to make a profit or break even. Public businesses should have to meet this same criteria or else they are bound to run inefficiently and wastefully and at higher costs than is acceptable.

Users of the bus system are only paying 25% of the direct costs of their transportation that is what is meant by subsidized public transit. That is not fair to non-users of the system that have to foot the cost plus pay for their own transportation themselves. It also indicates that AAATA is almost certainly not economically viable. Raise percent of cost paid by riders to a reasonable 75 or 80% level and bus ridership would probably dramatically collapse.

@Steve: You are really going to have to explain how a permissive or opt-out tax millage is an oxymoron. If we have a true democracy here in Ann Arbor, the citizenry should be able to design and vote on tax millages in any way it wants. The problem I see you having with these tax millage options is that if they were in place they would show many people would opt out in the opt out system and a majority would never sign up in the permissive system.

@Dave:

I don’t understand your objection about a permissive or opt-out tax millage. As with any other kind of millage it would be put to a secret ballot in which all voters in the jurisdiction could vote

Re: “I don’t understand your objection about a permissive or opt-out tax millage.”

Roger, the secret ballot is not just about the act of voting, but also the preservation of secrecy after the fact. Forever. On your proposal, it would be necessary to know how an individual taxpayer voted in order to bill that taxpayer properly for their taxes owed. And for that reason, I don’t think the idea deserves any further consideration.

“If people think AAATA is not running a business what are they doing? They are providing transportation services and options.”

I think you answered your own question accurately.

“You are really going to have to explain how a permissive or opt-out tax millage is an oxymoron.”

No, I’m not. I could say that you need to understand the definition of business, tax, etc., but you clearly don’t, and I accept that.

Mr. Kulman’s idea does not need an election to implement. If people simply send the AATA a check for whatever amount public transit is worth to them (over and above the current millage), his desire for voluntary new bus contributions is met with nary a ballot in sight, nor a record kept.

Having the voluntary contribution on your property tax bill is not necessary, and contrary to the point of taxation (which is to compel payment). I suppose it could be a vehicle for reminding of/soliciting for voluntary contributions, but as a mere information item there would be no records that the city would need to collect.

Of course, their are other issues with voluntary contributions (particularly the “Free Rider” problem), but Secret Ballot ain’t one of ‘em.