County Continues to Explore Road Funding

Washtenaw County board of commissioners meeting (May 21, 2014): The county board rejected a proposal to levy a 0.4-mill countywide road tax in December, but agreed to continue discussing funding options for road repair.

Former county commissioner Barbara Bergman, left, talks with Felicia Brabec (D-District 4) and Yousef Rabhi (D-District 8) before the board’s May 21, 2014 meeting. Bergman spoke during public commentary to oppose a possible road tax. (Photos by the writer.)

The vote on levying a millage was 2-6, with support only from Dan Smith (R-District 2) and Conan Smith (D-District 9). Alicia Ping (R-District 3) was absent. The tax would have been levied under Act 283 of 1909, which does not require voter approval.

Several commissioners spoke against levying this kind of tax at this time. Andy LaBarre (D-District 7) advocated for waiting to see whether the state provides more funding for roads. Ronnie Peterson (D-District 6) reported that the boards of Willow Run and Ypsilanti public schools are considering levying tax increases this summer of 2.8 mills and 1.2 mills, respectively. The state passed legislation that enables school districts to levy millages for debt retirement without voter approval. Noting that a new public transit millage had been approved by voters earlier this month – in Ypsilanti, Ypsilanti Township and Ann Arbor – Peterson said the communities that he represents would be hard-pressed to handle yet another tax increase.

Dan Smith argued that there are few funding options available to the county to pay for road repair, and that the need for additional revenues is critical because the roads are in such bad shape. He said he was well aware of the reasons why this was a bad plan – even a terrible one – but added that the only thing worse would be to do nothing. Conan Smith pointed out that because all of the board seats are up for election this year, residents will have a way to weigh in on this decision, albeit indirectly. “This is the most defensible moment that we have” to levy a tax that doesn’t require voter approval, he said.

The May 21 meeting also included a public hearing on the possible levy. And the board heard from people on the topic during general public commentary. In total, seven people spoke about the road funding issue. Former county commissioner Barbara Bergman, who is an Ann Arbor resident, argued against levying the tax, while former state Rep. Rick Olson of York Township urged commissioners to levy the full 1-mill amount allowed under Act 283. Another resident argued against any tax that isn’t approved by voters, calling it taxation without representation.

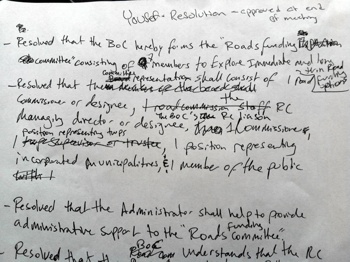

After the tax levy resolution was rejected, Yousef Rabhi (D-District 8) brought forward a resolution to create a seven-member road funding committee that would explore options – including Act 283, as well as other possible revenue sources like bonding or a voter-approved tax. The initial vote to form the committee passed on a 6-2 split, over dissent from Conan Smith and Dan Smith. A final vote is expected on June 4. If approved, members would be appointed at a later date, with the direction to provide a road funding plan to the board in the fall.

Commissioners also weighed in to oppose oil exploration and drilling in the county, prompted by a company’s permit application to the state to drill in Scio Township. The vote was 7-1, over dissent from Dan Smith. Two residents spoke during public commentary,urging the board to oppose oil drilling.

During deliberations, Dan Smith argued that the issue was outside of the county’s purview, because the county can’t regulate oil drilling. He noted that the easiest way to prevent oil drilling is for property owners not to sign leases with companies that seek to drill on their land. Other commissioners supported the resolution, citing environmental and public health concerns, including the proposed drilling location’s proximity to the Huron River.

In other action on May 21, commissioners took initial steps to: (1) put a 10-year countywide parks and recreation operations tax renewal on the Nov. 4 ballot, at 0.2353 mills; (2) create a board of health that would give advice on public health issues; and (3) approve an application for a $940,000 federal grant that the county would make on behalf of Ann Arbor SPARK, the local economic development agency. Funds would be used to help redevelop the former General Motors Willow Run Powertrain plant in Ypsilanti Township for use as a connected vehicle testing facility.

Given final approval on May 21 was this year’s allocation to local nonprofits through the coordinated funding process, in which the county participates.

The board also approved a process that will determine how the $3.9 million budget surplus from 2013 will be allocated. Conan Smith said he felt “personally let down” by the approach, because the county administrator has already recommended to keep that amount in the general fund’s unearmarked reserves. He thought it was “turning out to be little more than a rubber stamp of a decision that’s already been proposed by the administration.” Felicia Brabec (D-District 4), who’s leading this process, stressed that commissioners will be discussing and making the final decision – which might differ from the administration’s recommendation.

Road Tax

The May 21 agenda included a proposal to levy a 0.4-mill countywide road tax in December. The tax could be levied under Act 283 of 1909, which does not require voter approval. The board also held a public hearing on the issue, and heard from several people during public commentary.

Prompted in part by what many view as a chronic underfunding of roads in Michigan – combined with a particularly harsh winter – county commissioners have been discussing for months how to generate more revenues to repair the county’s road network.

At the board’s May 7, 2014 meeting, Dan Smith (R-District 2) brought forward a resolution that would have authorized a 1-mill tax to be levied December 2014 – under Act 283. A 1-mill tax would generate $14.34 million “to repair 2013–14 winter damage to the roads, streets and paths in Washtenaw County.”

On May 7, the board debated the issue at length but ultimately voted to postpone the resolution until May 21 over dissent from Alicia Ping (R-District 3).

On May 21, Dan Smith brought forward a revised resolution that addressed some concerns raised by corporation counsel Curtis Hedger during the May 7 meeting. The new resolution proposed an 0.4-mill levy and included a list of specific projects that the tax revenues would fund. [.pdf of May 21 resolution]

The resolved clauses stated:

NOW THEREFORE, BE IT RESOLVED that pursuant to the authorization of Public Act 283 of 1909 (MCLA 224.20), the Washtenaw County Board of Commissioners approves a millage of 0.4 mills to be levied against all real property in the County, which will generate approximately $5,—,— to be collected in December, 2014, for use in calendar years 2014 and 2015 to keep existing Washtenaw County public roads, streets, paths, bridges and culverts in reasonable repair, and in condition reasonably safe and fit for public travel; and that this levy be exempt from capture by TIF Districts or TIFAs to the greatest extent allowed by law.

FURTHERMORE, BE IT RESOLVED that the Washtenaw County Board of Commissioners agrees with Washtenaw County Road Commission’s initial determination, as attached hereto and made a part hereof, and levies said millage for the purposes therein.

FURTHERMORE, BE IT RESOLVED that the Washtenaw County Board of Road Commissioners is invited to present a revised determination in accordance with Act 283 of 1909 to the Board of Commissioners at its annual meeting on September 17, 2014 for an additional levy not to exceed 0.6 mills.

FURTHERMORE, BE IT RESOLVED that Washtenaw County Corporation Counsel is directed to provide an exhaustive formal written opinion, by September 17, 2014, which clearly and convincingly details the exact mechanism under which Act 283 of 1909 taxes may be levied in excess of Article IX, Section 6 constitutional limits without a vote of the people; and that the Washtenaw County Board of Commissioners waives any attorney/client privilege concerning this opinion.

FURTHERMORE, BE IT RESOLVED that the Washtenaw County Board of Commissioners asks the county’s legislative delegation, State Senators Randy Richardville and Rebekah Warren and State Representatives Gretchen Driskell, Jeff Irwin, David Rutledge and Adam Zemke, to request an Attorney General opinion regarding the ability for counties to levy a tax under Act 283 of 1909 in excess of Article IX, Section 6 constitutional limits without a vote of the people.

For additional Chronicle coverage on road-related issues, see: “County Board Continues Weighing Road Tax,” “County Board Debates Expanded Road Commission,” “County Board Sets Hearing on Road Tax,” “County Considers Road Funding Options,” “No Major Change Likely for Road Commission” and “Group Explores Road Commission’s Future.”

Road Tax: Public Commentary

During the first opportunity for public commentary – at the board’s ways & means committee meeting – committee chair Felicia Brabec (D-District 4) announced that the device used to time the speaking turns was broken. Instead, time would be marked by holding up handwritten cards, she said.

Yousef Rabhi (D-District 8) kept time manually for public commentary, as the boardroom’s timing device was broken.

Former county commissioner Barbara Bergman – a Democrat from Ann Arbor – urged commissioners not to levy a tax for roads. If they do, they’re sending a message to Lansing “that we are rich enough to take care of ourselves,” she said, and that the state doesn’t need to help meet the needs of its vulnerable citizens. But this is patently untrue, she said. There are huge unmet needs in Washtenaw County – for food, shelter, services for children and for adults who are returning to the community after incarceration.

Beyond the ethical considerations, Bergman said, the county doesn’t need to do this because “roads have very loud voices.” Officials at the local and state levels want to be re-elected, she noted, and she bet that funds could be found to repair the roads to ensure that motorists are happy. One way is for state legislators to adopt an equitable, progressive tax code for Michigan, she said. If that doesn’t happen, then local millages should be used to support those who are often invisible, she said. Mental health funds are about to be cut 30%, she noted, which means that services for 240 customers of the county’s Community Support & Treatment Services (CSTS) will be cut. Affordable housing and health insurance are also needed, Bergman said. “A millage to meet human services needs could pass a test with ethics,” she said. “A millage for roads cannot.”

Thomas Partridge spoke generally about the need to support the county’s most vulnerable, including affordable housing, public transportation, education and health care. Everyone needs adequate roads, he added, and if it’s left to Lansing, “we are left with potholes.” He also supported a progressive tax to generate more funds for local governments.

Rick Olson introduced himself as a York Township resident and former state representative of District 55. In 2011 he became very interested in transportation, he said, and generated a report on how much money would need to be spent to repair Michigan’s roads and bridges – $1.4 billion at that time. That was a figure used by the governor’s workgroup on infrastructure, on which Olson served. It led to a series of bipartisan bills that were introduced in January 2012, with the idea that $1.2 billion would be raised at the state level, he said, and the remainder raised through an optional county vehicle registration fee. Unfortunately, Olson said, the legislation wasn’t enacted. He said the amount needed has now been updated to just under $2.4 billion. Even if the legislature comes up with additional funding for roads, it likely won’t be enough, he said. Olson told commissioners that the county needs to invest a considerable amount, in addition to whatever the legislature does. He fully supported an Act 283 millage at the full 1-mill level.

A man who didn’t give his name said he opposed the road millage, especially if it were levied without a public vote. “Citing some law from 1909 doesn’t change the fact that this is taxation without representation,” he said. He told commissioners that 40% of county residents aren’t property owners, and wouldn’t pay the tax. “So once again, government is picking on a select group of people to pay for the benefit of all,” he said. “There is no word to describe this other than unfair.” Washtenaw County already has the highest average property tax in Michigan, he said. Prices are increasing, and people have to adjust their budgets accordingly. “We don’t have a golden pocket to reach into.” Yet government feels entitled to take more from its residents. He said he’s tired of his government telling him what they’re going to take, instead of listening to him tell them what they can have. “So I will organize, I will educate, I will motivate, and I will vote,” he said, so that government will be accountable for its budget and debts, just as the government holds him accountable.

Jim Bates of Ann Arbor Township asked if it would be possible for the county to assess a gas tax. He said he was just curious about that. [In Michigan, county governments don't have authority to levy a gas tax.]

Victor Dobrin said he’s been an Ypsilanti Township resident 23 years. [Dobrin is also a candidate for the District 5 seat on the county board.] The proposed road millage isn’t popular, he said. Government doesn’t always do what’s popular, but they look for the common good. He respected Olson’s opinion, however he thinks that solving any problem in society begins by defining the root cause. Government should take an engineering approach to problem solving. What is the root cause? Why are our roads crumbling? Is the proper work being done when roads are constructed or fixed? He noted that right now, you can see workers throwing shovels of asphalt into potholes, but that’s not going to solve the problem. It will result in wasting lots of money. The root cause is in the way that roads are engineered and built, he said.

Road Tax: Board Discussion

Andy LaBarre (D-District 7) responded to public commentary by thanking Barbara Bergman, noting that her comments reflect his own opinion. He also said the issue isn’t one of taxation without representation, as residents are represented by the county commissioners.

Rolland Sizemore Jr. (D-District 5) said he wouldn’t support a road tax. About a year ago, he said, he and Ken Schwartz – who was then a road commissioner – tried to get a group together to work on this issue, but Sizemore didn’t think that had happened. So he didn’t think enough work went into the current proposal, and he’d like to take more time to work on it.

Dan Smith (R-District 2) told commissioners he had modified his original resolution to address concerns that the county’s corporation counsel, Curtis Hedger, had laid out in a confidential memo to the board. The proposed millage is now 0.4 mills, rather than the full 1 mill. The resolution includes a list of proposed projects, and notes that this process is starting earlier than the board’s annual meeting because of the harsh winter.

Smith then formally withdrew his earlier resolution from May 7, and moved the new modified resolution for consideration.

Yousef Rabhi (D-District 8) thanked Smith for his work on this proposal. LaBarre echoed that thanks, but said he wanted to wait a bit to see what the state legislature does regarding road funding. The process required by Act 283 gives the board some breathing room, he said, “and hopefully it’s a moot issue.”

Kent Martinez-Kratz (D-District 1) agreed with Sizemore that the issue needed to be studied further. More funding is expected from the state, and a community in his district – Scio Township – recently approved a special assessment for roads, he noted. If the county levies a road tax, it would be a bit hard on those taxpayers, he added.

Martinez-Kratz wondered if Hedger had time to review Smith’s new resolution, to see if there were any concerns. Based on the previous memo from Hedger, levying an Act 283 millage wasn’t legal, Martinez-Kratz said. [The memo from Hedger was not released to the public.]

Regarding the list of projects from the road commission, Martinez-Kratz said not all communities would get funding, so some of his constituents think that’s inequitable.

Dan Smith (R-District 2), standing, consults with corporation counsel Curtis Hedger while Pete Simms of the county clerk’s office looks on.

Sizemore said that as the board’s liaison to the road commission, he’d be happy to work with county commissioners and road commissioners to come up with a plan. He didn’t think they could count on the state.

Ronnie Peterson (D-District 6) reminded the public that this effort was driven by the road commission, not by the county board – though he noted that Dan Smith has been an advocate for road funding.

Peterson said all local communities have the ability to address these road issues, and he wanted to work with communities within the county to help address their needs. But it’s the road commission that has responsibility, he said.

There isn’t any urgency to levy a tax now, Peterson continued. The board needs to be patient and see what comes out of Lansing, he said.

Peterson also noted that Ypsilanti and Ypsilanti Township, which he represents, already have high taxes. What’s more, the boards of Willow Run and Ypsilanti public schools are considering levying tax increases this summer of 2.8 mills and 1.2 mills, respectively. The state passed legislation that enables school districts to levy millages for capital improvement debt retirement without voter approval – which Peterson called a ridiculous law.

In addition, Ypsilanti and Ypsilanti Township will have another new millage, along with Ann Arbor, that was passed by voters earlier in May for public transit. In total, it’s “a huge increase in new taxes,” Peterson said. “And believe me – I’m no rock star conservative on taxes. I believe you pay for what you get.” However, Peterson said the communities that he represents – Ypsilanti, Ypsilanti Township and Superior Township – would be hard-pressed to handle yet another tax increase for roads.

Peterson indicated that he’d be interested in exploring the option of bonding to fund roads.

Dan Smith argued that there are few funding options available to the county to pay for road repair, and that the need for additional revenues is critical because the roads are in such bad shape. The proposed millage is only for 0.4 mills, he stressed – not the full 1 mill.

The easiest option is to do nothing, Smith said – to do more studies and plans, or wait for Lansing. “The reality is that the roads are terrible,” he said. Even if Lansing provides more funding – and he wasn’t hopeful about that – it won’t be enough for Washtenaw County. Smith pointed out that this would be an annual levy, and if there’s no need for it in 2015, the county wouldn’t levy it.

Smith also noted that the millage is tied to the road commission’s plan, which is similar to one that the road commission brought forward in the fall of 2013. There’s nothing surprising about it, he said.

Many communities don’t have the taxing ability to pay for maintenance of the county’s major roads that run through their jurisdiction, Smith said. The best example is the six miles of Austin Road in Bridgewater Township. It’s a major road in a township with the lowest taxable values in the county. So some communities just don’t have the capacity to deal with these major roads, he said.

Smith also didn’t think it was fair to require, for example, Northfield Township, Webster Township and Ann Arbor Township to take care of roads like Newport, North Territorial and Pontiac Trail – “roads that the much broader community uses,” he said. Some of these roads, like Newport, cross multiple jurisdictions. For these reasons, major roads should be taken care of by the county, Smith argued.

“This is a bad plan, for lots and lots of reasons,” Smith continued. “I would even say it might even be a terrible plan. The only thing that might be worse than this bad plan is to continue doing what we’ve been doing, which is absolutely nothing. The roads are crumbling underneath us.” There will not be a perfect plan, no matter how long they talk about it, he said.

There are two problems with a voter-approved levy, Smith said. First, it wouldn’t be on the ballot until November. Second, it would likely be for a larger amount and a longer period – like a half-mill for four years or more. The other problem is one that Conan Smith had raised during the May 7 discussion, Dan Smith noted – competing interests for millages that might go on the ballot. He pointed out that the parks & recreation operations millage renewal will be on the November 2014 ballot. Former commissioner Barbara Bergman had mentioned other possibilities for millages, he noted, such as funding for human services.

An Act 283 millage would be at a lower rate for only one year, Smith said. Even though he didn’t like it, “it is the least-bad option I think we have right now.”

Sizemore expressed frustration at not doing anything, then proposed sitting down with road commissioners and managing director Roy Townsend to figure out what to do.

Martinez-Kratz replied to Smith’s comments, saying that if it’s a bad or even terrible plan, then “it’s not worth spending taxpayers’ money on.”

Peterson asked if communities would have the ability to opt-out of an Act 283 levy. Hedger replied that there is no opt-out option.

Peterson then asked if any other local leaders – from city councils or township boards – had contacted the county in support of an Act 283 millage. He felt that if other elected officials were supportive, they’d be there tonight. All of the communication he’d received was urging him not to support an Act 283 millage, Peterson said. It’s difficult for him, especially during an election year, to take responsibility for a road tax when other elected officials aren’t also supporting it.

Conan Smith (D-District 9) asked how short the road commission was in terms of funding related to winter road maintenance. Townsend replied that the county had received some additional funding from the state to cover some of the winter overages, like salt usage, diesel fuel and overtime costs. “But what they didn’t really give us money for is to fix the roads,” he said.

Road conditions have continued to decline, Townsend said. He pointed to a handout he’d provided to commissioners, showing that Michigan ranks last among all 50 states in state highway expenditures per capita. The data was from 2011, but since then the state hasn’t increased its funding, he noted. Most states are putting in at least double the amount of per-capita funding for roads. For example, Pennsylvania’s per-capita spending was $557 compared to $135 in Michigan.

Townsend said the county’s infrastructure was in poor condition prior to this harsh winter, with deep freezes and thaws that made things even worse. Generally, the road commission uses about 400 tons of cold patch. This year, the commission used 1,400 tons – enough to fill about 300,000 potholes. These are temporary fixes, Townsend said.

Some of the projects on the plan that the road commission has presented to the board this year have been on previous plans presented since 2011, Townsend said – like work on North Territorial and Scio Church roads, among others. The plan would improve 44 miles of road, used by over 100,000 people every day. “So I think 100,000 people would probably appreciate that you could fix those 44 miles of road,” he said. The tax for an average $200,000 home would be just $40, he noted.

Townsend said that any state legislative action likely wouldn’t result in funding until 2015, so the roads would go through another winter. “And god help us what it’s going to look like next spring,” he said. There’s a short window for construction, he noted.

Conan Smith (D-District 9) said the upshot is that the roads are terrible, and they won’t get better as the county waits for legislative action from Lansing or for voters to weigh in this November. There’s an opportunity now, he said, with only a modest hit to taxpayers and an immediate benefit to the community.

C. Smith also responded to the public commentary about taxation without representation. That phrase emerged in a different context, he said. The people are represented in this process, he noted. The elected county commissioners have a duty to represent the interests of their constituents, to listen carefully to their needs. “This is a representative process by design,” he said.

Regarding the road tax issue, both sides have been well-articulated, C. Smith said. If there’s any time to do something like this without a vote of the people, it’s now – just a short time before an election. Because all of the board seats are up for election this year, Smith said, residents will have a way to weigh in on this decision, albeit indirectly. “This is the most defensible moment that we have” to levy a tax that doesn’t require voter approval, he said.

Felicia Brabec (D-District 4) spoke next, noting that the levy couldn’t occur until December, so there’s time to figure out what their other options are. She wants to take that time.

C. Smith asked Townsend how the finances would work with an Act 283 tax. Townsend explained that the road commission would want some kind of contractual agreement with the county before it bid out work this summer. It would be similar to how townships contract with the road commission, and then later reimburse the road commission for the work. It’s a legal question to be determined if Act 283 funds can be used for reimbursement, Townsend noted.

Dan Smith made a distinction between “funding” and “financing.” The funding mechanism would be through Act 283. If the board passed the road tax resolution that night, it would be a commitment to provide that funding when the tax is levied in December.

At this point, Dan Smith distributed another resolution – dated Oct. 15, 2014. According to Hedger, the board’s official vote to levy an Act 283 tax must occur in the fall, Smith noted. The draft resolution he distributed would ratify the funding decision regarding the 0.4 mills. The draft resolution also would give the board the option of levying an additional 0.6 mills. [.pdf of Oct. 15, 2014 draft resolution]

These decisions about funding are separate from how the county actually handles the financing, D. Smith explained. Sometimes the county issues tax anticipation notes – that’s what this would be, he said. There might be other options, like using the general fund’s fund balance or short-term borrowing. But the funding would still come through the Act 283 levy in December.

D. Smith also addressed Peterson’s comments about the lack of any other local leaders at the May 21 meeting. He said that one reason is because townships have no authority or responsibility for roads. It’s the county board that has the tools for funding and fixing the roads countywide. He acknowledged that some townships have been very aggressive in their road programs, and some municipalities have vastly better roads as a result.

At this point, Rabhi called the question – a procedural move designed to end discussion and move toward a vote. Commissioners unanimously approved calling the question.

Outcome on main resolution to levy an 0.4-mill tax under Act 283: The resolution failed on a 2-6 vote, with support only from Dan Smith and Conan Smith. Alicia Ping was absent.

Road Tax: Roads Funding Committee

Yousef Rabhi then proposed a resolution to create a roads funding committee. He read aloud the resolution that he’d written by hand during the previous deliberations.

The committee would consist of seven members: (1) a road commissioner or designee; (2) the road commission managing director or designee; (3) the county board’s road commission liaison; (4) one additional county commissioner; (5) a position representing townships; (6) a position representing incorporated municipalities; and (7) a member of the general public.

The county administrator would help provide administrative support to the committee. The resolution also stated that the road commission could present a road funding plan at the board’s annual meeting in the fall “as Act 283 of 1909 provides.”

Conan Smith said he appreciated the sentiment, but wouldn’t support it. The board just received recommendations from a previous committee that had worked on road commission issues, he noted – that happened on May 7, 2014. He noted that leaders of local government “made it abundantly clear at that point that they don’t think the county board of commissioners had a role to play in their road funding situation.”

There was a specific opportunity this year to intervene in funding, C. Smith said, because of the harsh winter. But he didn’t believe that road maintenance should be a higher priority than other things, like public safety, human services, public health and environmental health.

The board had just voted not to get involved by not levying an Act 283 tax, he said. “I think that should be the end of the conversation.”

Ronnie Peterson asked for an explanation about what the board had just voted on, and what Rabhi had subsequently proposed. Felicia Brabec explained that the board had rejected a resolution to levy the Act 283 tax. Now they were considering a proposal to form a road funding committee. Peterson said he just wanted the public to be clear about what had happened.

Andy LaBarre said that to him, the Act 283 issue was one of timing. None of these options are good, he added: “We’re choosing to pursue bad or less bad.” He felt the state legislature had the potential to shock everyone and do something proactive. If that doesn’t happen, it would be possible to consider the Act 283 levy this fall, he noted. If they do eventually levy the millage, it would help but wouldn’t be a comprehensive solution, LaBarre said.

Dan Smith noted that there are few mechanisms available for road funding – either levy a property tax under Act 283, or take a bond or millage proposal to the voters. The county can’t institute a gas tax or vehicle registration fee, he said. The board can spend the next six months talking about their options, but “barring some extraordinary action from Lansing, our options in six months are going to be exactly what they are now,” D. Smith said. And levying Act 283 in the fall “isn’t going to be any nicer than it is right now.”

Clearly frustrated, D. Smith said that instead of acting, the board is doing what government always does – forming yet another committee to study it more. The issue has already been studied, he said. “Nobody wants to touch this hot potato.”

Conan Smith observed that the county could issue general obligation bonds, which wouldn’t require a voter referendum.

Peterson noted that levying Act 283 was difficult for him during an election cycle. He said he was progressive so he didn’t worry about winning over conservatives, but he was interested in saving people’s tax dollars. Citizens haven’t brought forward this proposal, he said, nor has the request come from local community leaders.

Outcome: The resolution creating a roads funding committee was given initial approval a 6-2 vote, over dissent from Dan Smith and Conan Smith. Alicia Ping was absent. A final vote is expected on June 4.

Road Tax: Public Hearing

Later in the evening – after the road tax resolution was defeated – the board held a public hearing on the issue, which had been set at the May 7 meeting. Two people spoke.

Thomas Partridge said it was important to find funding for road repair. No business wants to locate in a county that doesn’t maintain its roads. Voters need to be educated about the importance of this issue, as well as other concerns like affordable health care, public transportation, and affordable housing. The state legislature backs away from supporting these critical needs. Partridge supported Democrat Mark Schauer for governor, saying that Schauer would support these issues.

Sandra Carolan told commissioners that she pays the taxes for her parents’ property in Chelsea. She was thankful for the discussion, but she can’t ask her 91-year-old mother who’s on a fixed income to support an increased millage “for a solution that really is just a band-aid.” New technology needs to be used on the roads. She said if she goes to the store to buy a blouse and only finds bad blouses, she doesn’t buy one at all.

Parks Millage Renewal

Voters will be asked to renew a 10-year countywide parks and recreation operations millage in November. On May 21, commissioners were asked initial approval to put the request on the Nov. 4 ballot.

During the May 21 county board meeting, Bob Tetens – director of Washtenaw County parks & recreation – sat next to the daughter of county commissioner Felicia Brabec (D-District 4).

The operations millage was first authorized by voters in November 1976 at 0.25 mills for a 10-year period and has been renewed three times. Because of the state’s Headlee amendment, the rate that’s actually levied has been rolled back and is now 0.2353 mills. The current millage expires in December 2016.

If renewed again, it would generate an estimated $3.2 million annually. That’s about half of the parks & recreation annual operating expenses of $6.7 million. Other revenue sources are admission/gate/membership fees charged seasonally at facilities including the Meri Lou Murray recreation center, the water/spray parks, and the Pierce Lake golf course. Funding is also received from state and federal grants as well as private donations. [.pdf of staff memo]

The county parks system receives most of its funding from two countywide millages. In addition to the operations millage, another millage pays for capital improvements and park development. It was also originally levied at 0.25 mills, but has been rolled back to 0.2367 mills.

In addition, a third millage – levied at 0.25 mills but rolled back to 0.2409 mills – funds natural areas preservation, bringing in about $3 million annually. It was first approved by voters in 2000, and renewed for another 10 years in 2010.

The county’s parks & recreation department is overseen by a separate entity – the parks & recreation commission – whose members are appointed by the county board. The county board has the authority to put a parks millage proposal on the ballot, but does not authorize expenditure of the funds. That responsibility rests with the parks & recreation commission. The group meets monthly at the parks & recreation office at County Farm Park, and its meetings are open to the public.

Comments were brief before the May 21 vote. Yousef Rabhi (D-District 8) said the parks staff do wonderful work. He thanked everyone who serves on the parks & recreation commission.

Outcome: Commissioners unanimously gave initial approval to put the millage renewal on the November ballot. A final vote is expected on June 4.

Board of Health

On May 21, commissioners were asked to take an initial step to create a board of health, an entity that would prove advice on public health issues for the county.

A description of the board’s duties is outlined in a staff memo that accompanied the May 21 resolution:

The purpose and role of a Washtenaw County Board of Health will be to identify public health problems and concerns in the community, establish health priorities, and advise the Board of Commissioners and the Health Department on issues and possible solutions. The Board of Health will serve as advocates and educators for public health services and policies. The Board of Health will provide oversight and guidance to the Health Department, and will recommend a program of basic health services to the Board of Commissioners.

The new Board of Health will have the authority to hear appeals and requests for variances from the local public health and environmental regulations established under the Public Health Code. The Board of Health will have the authority to hear appeals regarding the suspension or revocation of food service licenses.

The resolution creating the health board also dissolves an existing existing environmental health code appeals board and the hearing board for the Health Department Food Service Regulation. The duties of those boards would be absorbed by the new health board. [.pdf of staff memo]

The recommended size is 10 members, including one ex-officio representative from the county board of commissioners. According to the staff memo, appointments could represent “health service delivery (physicians, dentists, mental health practitioners, administrators); environmental health and conservation, land use planning, food service and nutrition, academia, K-12 education, philanthropy, social service delivery, legal services, and consumers of public health services.”

Members would be compensated for attending each meeting. The total cost for the health board, including in-kind staff support, is estimated at $19,000 annually. The board of health would be expected to convene for the first time in October 2014.

Ellen Rabinowitz, the county’s public health officer, attended the May 21 meeting but did not formally address the board. There was no discussion on this item.

Outcome: Initial approval was given on a 7-1 vote, over dissent from Rolland Sizemore Jr. Alicia Ping was absent. A final vote is expected on June 4.

Oil Drilling

Commissioners considered a resolution to oppose oil exploration and drilling in the county. The resolution was brought forward by board chair Yousef Rabhi (D-District 8) of Ann Arbor, working with Kent Martinez-Kratz (D-District 1). Rabhi had alerted the board about his plans at the previous meeting on May 7. He said he’d met with residents from the west side of the county about the threat of oil extraction. West Bay Exploration has applied to the state for a drilling permit in Scio Township, and residents are afraid that the state will grant the permit.

The two resolved clauses state:

BE IT THEREFORE RESOLVED, that Washtenaw County, Michigan:

1. Opposes said oil exploration and drilling, and any future oil exploration and drilling in this area and other areas within the boundaries of Washtenaw County; and

2. Respectfully requests that the Michigan Supervisor of Wells, as part of the Michigan Department of Environmental Quality, deny the permit application to drill the Wing 1-15 well as proposed; and

3. Hereby requests that the State of Michigan and federal legislators move to enact legislation and improve regulations to reduce the risks to public health, safety, welfare and the environment posed by the oil and gas industry, and re-commit to promoting and protecting quality of life, our economic well-being, and our environment through less reliance on non-renewable energy resources.

BE IT FURTHER RESOLVED, a copy of this resolution shall be transmitted as the County’s official comment on said oil drilling permit and application by the Clerk, to each elected official representing Washtenaw County in Lansing, the Office of the Governor, and the Michigan Department of Environmental Quality.

At its May 19, 2014 meeting, the Ann Arbor city council approved a similar resolution opposing oil exploration in Scio Township.

Oil Drilling: Public Commentary

Two people spoke on the topic during public commentary. Gus Teschke from the advocacy group Citizens for Oil-Free Backyards thanked Yousef Rabhi and Kent Martinez-Kratz for their work on the resolution opposing oil exploration and drilling in Washtenaw County. Citizens for Oil-Free Backyards was formed because of a proposed well at Miller and West Delhi, he said. If the company finds oil, then there could be a lot of oil wells in that area. That could impact individual residential wells as well as the Huron River, which provides 85% of Ann Arbor’s drinking water. Accidents can happen, and people are concerned about that, he said. About 1,200 people live within a mile of the proposed oil well, and are concerned about their health, noise and other issues. He hoped commissioners would support the resolution.

Brian Herron, a Scio Township resident, spoke during public commentary to oppose drilling in the county.

During the final opportunity for public commentary, Brian Herron introduced himself as a business owner in Ann Arbor and resident of Scio Township. Residents there find it very concerning that there’s a proposal to drill so close to residential properties. The proposed drilling would be less than a mile from the Huron River, he noted. It seemed inappropriate to allow drilling in a residential area. It doesn’t make sense, and he urged commissioners to support the resolution that opposes drilling.

Oil Drilling: Board Discussion

Yousef Rabhi (D-District 8) said that for him, this is a fundamental issue of protecting the environment in Washtenaw County, making sure the air, water and soil stayed healthy for generations to come. It’s time to take a stand, even though the county doesn’t have the ability to stop it outright, he said.

Ronnie Peterson (D-District 6) said he normally supports economic development so that residents have opportunities for jobs. But he’s in total opposition to drilling in this county. He wondered if there were any supporters of drilling at that night’s meeting, or any company representatives to talk about how the county would benefit from drilling. [No one came forward.] It seemed like they’d want to present their case to the public, he said.

Kent Martinez-Kratz (D-District 1), who represents an area that includes Scio Township, said he had attended a public forum about the proposed drilling. Someone had suggested being proactive regarding oil rights, rather than waiting for oil companies to secure them. He liked the idea, which entails having a community group purchase the oil rights and hold them in trust.

Felicia Brabec (D-District 4) said she’d visited the Irish Hills area near Jackson, where there’s been an increase in oil exploration. So she’s seen firsthand the economic, health and environmental impacts on a community. It’s very harmful, she said, and people there were distraught. It’s also frustrating, she added, because communities have little recourse and authority over these issues.

Andy LaBarre (D-District 7) characterized it as “a total NIMBY issue.” The problem is that no one in Lansing will listen to this resolution, he said, but he supported it. They also need to find ways to communicate with the state legislature, which he said has robbed local communities of their ability to make decisions regarding oil drilling.

Rabhi agreed that the issue was one of local control – and not just for oil drilling, but also for natural gas extraction. That’s the campaign that needs to be waged, he said. “We need legislators who respect local control.” The state should set a baseline standard for environmental health, but each community should have the right to set even stricter standards for cleaner air, water and other aspects of the environment, he said.

Martinez-Kratz agreed that it might be a NIMBY issue, but he argued that almost anything could be called NIMBY – like zoning and noise ordinances. The drilling proposal to him is alarming because it’s within a mile of the tributary that leads to Ann Arbor’s drinking water supply. He pointed to the 2010 oil spill in the Kalamazoo River that’s still not completely cleaned up. Even though there’s very little that the county government can do about this proposal, the board needs to take a stand, he said.

Dan Smith (R-District 2) opposed the resolution, noting that it does nothing and addresses an issue that’s outside of the board’s purview. The law is extraordinarily clear, he noted – that a county can’t control or regulate drilling. They might all wish that it was within their purview, and the concerns about drilling are valid, he said. “I certainly don’t want an oil well in my backyard either.” Concerns over environmental impacts are legitimate too. “Unfortunately, the oil is where it is, and there’s nothing any of us can do to move where the oil is located,” he said.

Smith said the oil has been untouched for years, but has finally become economically feasible to extract. That’s unfortunate, but it’s not under the county’s control, he stressed. There’s a very simple way to shut down all the drilling in the county, Smith added. “The property owners can simply refuse to lease their land to the oil companies. Problem solved.” But these property owners have signed leases with oil companies, and are getting money for that, he noted. They can put that money toward paying for their house, or a college education, or buying things or going out to eat. So there’s an economic benefit to Washtenaw County in that way, Smith said.

Smith reported that he’s recently heard about a Michigan chapter of a national service organization that had received over $500,000 annually from oil revenues, which in turn support local programs. This is an extremely complicated issue, he said, with lots of pros and cons. If commissioners don’t like the current law, they can take their case to Lansing, Smith added. There are six state legislators representing Washtenaw County, he added, including some that are “extraordinary close to members of this body.” [That was a reference to state Sen. Rebekah Warren, who is married to commissioner Conan Smith.]

D. Smith said he didn’t vote against a similar resolution opposing a mineral mining proposal in Lyndon Township, because the county parks & recreation commission is interested purchasing that property – so there was an option that the county could pursue. [Smith stated "present" during that vote, which took place on March 19, 2014.]

But in this case, the resolution serves no purpose and wastes and extraordinary amount of time, D. Smith said. “I really wish we would stop campaigning from the board table,” he concluded, saying there are much more effective ways to advocate for change.

Andy LaBarre (D-District 7) noted that Smith had been remarkably consistent in his position regarding these kinds of resolutions, which don’t have the force of law. Given that track record, it would be great to have Smith on board with this resolution, LaBarre said. “I think it would add an extra amount of credence to this.” It’s an issue of significance that they can all find ways to dislike, he said, and to express their displeasure. He hoped Smith would consider bending on this.

Rabhi also thanked Smith for his consistency, noting that Smith’s opposition wasn’t about the content of the issue, but rather about the county’s purview. But Rabhi said he had no problem campaigning from the board table, adding that he was campaigning for public health, the environment, and the welfare of county residents. He thought the county did have a role to play, as local governments are allowed to submit comments through the MDEQ’s public process. “It’s not for political gain – it’s for the community,” Rabhi said.

Outcome: The resolution passed on a 6-1 vote, over dissent from Dan Smith. Alicia Ping was absent, and Rolland Sizemore Jr. was not in the room when the vote was taken.

2014 Budget Calendar

The board considered a resolution setting a timeline for budget work in 2014. [.pdf of budget calendar resolution] Highlights are:

- July 24, 2013: Board approved budget priorities. (That document was subsequently amended on Aug. 7, 2013.)

- May 7, 2014: Board authorized county administrator to seek consultant for work on budget priorities. The review and selection process for that consultant is underway.

- June 5, 2014: Budget discussion on the board’s working session agenda, to discuss the status of any general fund surplus or shortfall.

- July 9, 2014: County administrator presents recommendation for using surplus or addressing shortfall, based on board priorities. Board to take initial vote on recommendation.

- Aug. 6, 2014: Final vote set for surplus/shortfall recommendation.

The county had a 2013 general fund surplus of $3.9 million. County administrator Verna McDaniel has recommended to keep that amount in the general fund’s unearmarked reserves, to meet the county’s goal of having reserves that total 20% of the general fund budget.

Conan Smith (D-District 9) began the discussion by saying there were some foundational problems with this approach. One of those problems is that the county administrator has made a recommendation in advance of discussing this issue with the board, he said. The disposition of taxpayer dollars should be made by people elected to make those decisions, Smith said.

In fact, Smith added, since McDaniel has already made a recommendation, much of the work outlined in the timeline isn’t necessary. They should just discuss her recommendation at the board’s June meeting, and take a final vote in July.

Smith didn’t think the board had created an open and transparent process for the community or for county staff to give input on priorities and programs. The timeline also doesn’t give direction to the board about how commissioners can effectively engage in setting priorities for allocating surplus revenues. He expressed frustration that this process “is actually turning out to be little more than a rubber stamp of a decision that’s already been proposed by the administration.”

“I feel personally let down,” Smith continued. Part of his support for a four-year budget had been based on taking this process seriously, he said, and to “engage holistically” with the community in determining how to spend a budget surplus. “I feel personally frustrated because I was a huge part of developing the budgets that resulted in these surpluses,” Smith said. He added that he’d talked to department heads who were asked to make cuts, and had told them there would be discussion about how to get back some of that money if there were surpluses. But now it sounded like the decision has already been made, he said.

Felicia Brabec (D-District 4) – chair of the ways & means committee, who has been leading this process – replied that she sees things differently, and she was sorry that Smith was frustrated. She thought the process did take into account all of the things that Smith wanted to see. Hiring a consultant would help make that happen, she said, by engaging commissioners, staff and the community in moving the needle on their priorities.

Brabec said that McDaniel has shared her recommendation, and now it’s time for the board to discuss it in a very public way. It’s probably not happening as quickly as Smith would like, she noted, and she’d also like to move more quickly, but they’re doing it as quickly as they can.

Yousef Rabhi (D-District 8) said he agreed with some of Smith’s comments. He asked about a handout that Smith had provided to commissioners. [It had not been distributed to the public.] Smith replied that it was part of an email that he’d sent to commissioners in early May. [.pdf of Smith's email]

Smith asked if there was any expectation that the $3.9 million surplus would be used for any purpose other than the fund balance. Brabec said her expectation is that McDaniel’s recommendation will be discussed. “I don’t know what the fruits of that discussion will be,” she said.

Outcome: Earlier in the meeting – prior to this discussion – the resolution had been approved unanimously as part of the board’s consent agenda.

SPARK Grant

Commissioners were asked to approve an application for a $940,000 federal grant that the county would make on behalf of Ann Arbor SPARK, the local economic development agency. Funds would be used to help redevelop the former General Motors Willow Run Powertrain plant in Ypsilanti Township for use as a connected vehicle testing facility.

The Transportation Investment Generating Economic Recovery (TIGER) grant is available through the National Infrastructure Investments Program of the U.S. Department of Transportation. SPARK asked that the county’s office of community & economic development (OCED) act as the lead applicant and fiscal agent. OCED already submitted the grant application – on April 25, 2014. According to a staff memo, “due to the grant application deadline, it was not possible to bring the matter before the [board of commissioners] for approval prior to application submission.”

The project is a partnership with SPARK, the University of Michigan, the redevelopment firm Walbridge Aldinger and Ypsilanti Township, among others. According to a staff memo, the facility could lead to the creation of up to 7,800 new jobs in the skilled trades and research sectors. [.pdf of staff memo and resolution]

There was no discussion on this item.

Outcome: Initial approval for the grant application was approved unanimously. A final vote is expected on June 4.

Coordinated Funding

Commissioners were asked to give final approval to allocate funding to local nonprofits as part of a coordinated funding approach for human services, in partnership with several other local funders. Initial approval had been granted at the board’s May 7, 2014 meeting, when the board had heard from several nonprofit and community leaders on this topic.

The county is one of the original five partners in the coordinated funding approach. Other partners are city of Ann Arbor, United Way of Washtenaw County, Washtenaw Urban County, and the Ann Arbor Area Community Foundation. It began as a pilot program in 2010.

This year, 105 applications were submitted by 50 local organizations totaling $8,732,389 in requested funding, according to a staff memo. A review committee recommended that 57 programs receive a total of $4,321,494 in available funding. Of that amount, the county is providing $1.015 million. [.pdf of staff memo and list of funding allocations]

Among the organizations that are being funded in this cycle are Corner Health Center, Interfaith Hospitality Network of Washtenaw County, Child Care Network, Catholic Social Services of Washtenaw, Food Gatherers and Legal Services of South Central Michigan. Several nonprofit leaders spoke during public commentary in support of this process, as did Ann Arbor city administrator Steve Powers.

The coordinated funding process has three parts: planning/coordination, program operations, and capacity-building. The approach targets six priority areas, and identifies lead agencies for each area: (1) housing and homelessness – Washtenaw Housing Alliance; (2) aging – Blueprint for Aging; (3) school-aged youth – Washtenaw Alliance for Children and Youth; (4) children birth to six – Success by Six; (5) health – Washtenaw Health Plan; and (6) hunger relief – Food Gatherers.

Funding for this cycle will start on July 1, 2014. In addition, the RNR Foundation will now be an additional funder in this process.

There was no discussion of this item.

Outcome: Final approval to the coordinated funding allocations was unanimous.

Appointments

The board took action on one appointment: Nicole Sandberg to the food policy council. Board chair Yousef Rabhi (D-District 8) brought the nomination forward. He reported that three applications had been received and reviewed by the council, who had recommended the selection of Sandberg.

The May 21 agenda originally included a slot to appoint someone to the board of public works, but Rabhi pulled the item, saying he wanted to solicit input from existing members of the board of public works.

Outcome: Nicole Sandberg was appointed to the food policy council.

Millage Rate

Washtenaw County commissioners were asked to take the first step in setting the county’s 2014 general operating millage rate at 4.5493 mills – unchanged from the current rate.

Several other county millages are levied separately: emergency communications (0.2000 mills), the Huron Clinton Metroparks Authority (0.2146 mills), two for county parks and recreation (for operations at 0.2353 mills and capital improvements at 0.2367 mills) and for the natural areas preservation program (0.2409 mills). That brings the total county millage rate levied in July to 5.6768 mills, a rate that’s also unchanged from 2013. [.pdf of staff memo]

This is an annual procedural action, not a vote to levy new taxes. With a few minor exceptions, the county board does not have authority to levy taxes independently. Millage increases, new millages or an action to reset a millage at its original rate (known as a Headlee override) would require voter approval.

The rates will be included on the July tax bills for property owners in Washtenaw County.

A public hearing on the millage rates is set for June 4.

Outcome: Commissioners took a unanimous initial vote to set the millage rate. A final vote is expected on June 4.

Proclamations

There were four resolutions honoring individuals or organizations: (1) a resolution of appreciation for Nancy Wheeler, the first African American woman to serve as a Washtenaw County trial court judge and who is retiring this year (she is the aunt of county commissioner Conan Smith); (2) a resolution of appreciation for Lynn Kneer, who is retiring after working as a judicial coordinator for judge Francis Wheeler; (3) a resolution proclaiming June 2014 as Relay for Life Month in Washtenaw County; and (4) a resolution honoring the 20th anniversary of the Interfaith Round Table of Washtenaw County.

Outcome: All resolutions were passed unanimously.

Communications & Commentary

During the May 21 meeting there were multiple opportunities for communications from the administration and commissioners, as well as public commentary. In addition to issues reported earlier in this article, here are some other highlights.

Communications & Commentary: Success by Six

Ypsilanti Township resident Shannon Novara, program manager at Washtenaw Success by Six Great Start Collaborative, thanked the board for its leadership in supporting the youngest members of the county. The nonprofit’s mission is to make sure every child in Washtenaw County enters kindergarten ready to succeed. She described the services that the nonprofit offers, and thanked its partners. Specifically, she thanked the county for its support of the annual Touch a Truck fundraiser that was held on May 10 at Ypsilanti Community High School. At least 1,250 children and their families participated, she said. She thanked commissioners and staff for their help, giving special recognition to Rolland Sizemore Jr. (D-District 5) for his work.

Present: Felicia Brabec, Andy LaBarre, Kent Martinez-Kratz, Ronnie Peterson, Yousef Rabhi, Rolland Sizemore Jr. (left early), Conan Smith, Dan Smith.

Absent: Alicia Ping.

Next regular board meeting: Wednesday, June 4, 2014 at 6:30 p.m. at the county administration building, 220 N. Main St. in Ann Arbor. The ways & means committee meets first, followed immediately by the regular board meeting. [Check Chronicle event listings to confirm date.] (Though the agenda states that the regular board meeting begins at 6:45 p.m., it usually starts much later – times vary depending on what’s on the agenda.) Public commentary is held at the beginning of each meeting, and no advance sign-up is required.

The Chronicle could not survive without regular voluntary subscriptions to support our coverage of public bodies like the Washtenaw County board of commissioners. Click this link for details: Subscribe to The Chronicle. And if you’re already supporting us, please encourage your friends, neighbors and colleagues to help support The Chronicle, too!

“What’s more, the boards of Willow Run and Ypsilanti public schools are considering levying tax increases this summer of 2.8 mills and 1.2 mills, respectively.”

Can you clarify this? I thought the two districts had merged. How is it they’re considering separate tax levies?

Re. “Can you clarify this?”

Thanks for raising this issue. You’re right – those districts were consolidated last year into a district called Ypsilanti Community Schools. I don’t know how the consolidation affected the management of debt from the two districts, so I’ve put out some queries to get more information.