Voters in the city of Ann Arbor, the city of Ypsilanti and Ypsilanti Township will be asked in a May 6, 2014 election to approve a 0.7 mill tax to support additional public transportation service over the next five years. [.pdf of ballot question information from AAATA Feb. 20, 2014 board packet]

On Feb. 11, 2014, AAATA strategic planner Michael Benham presented the board’s planning and development committee with an analysis of the millage question. The committee recommended the full board take up the question at its Feb. 20 meeting, and that resulted in a unanimous vote to put a 0.7 mill tax on the May 6 ballot for voter approval. (Photo by the writer.)

The AAATA board voted unanimously at its Feb. 20, 2014 meeting to place the question on the ballot for voters to decide. The board’s vote had been anticipated for a few months.

It was preceded by public commentary from more than a dozen people in support of the decision, including state representative Jeff Irwin (D-53) and Ypsilanti mayor pro tem Lois Richardson. Representatives from Partners for Transit, which is a coalition coordinated by the Ecology Center, and the Washtenaw Regional Organizing Coalition (WeROC) spoke. Carolyn Grawi of the Ann Arbor Center for Independent Living led supporters in a chant of, “More buses, more places, more often!”

One speaker offered a counterpoint at the start of public commentary, asking the board to place the request on the November ballot instead of May. He stressed the fact that Ann Arbor voters have supported the AAATA up to this point, funding much of the capital investments.

If approved on May 6, the 0.7 mill tax would be levied for five years, from 2014 through 2018. Under Michigan’s Act 55 of 1963, that’s the longest period the AAATA could levy a millage, without asking voters again to renew it.

In his written report to the board in advance of the meeting, CEO Michael Ford called the vote to put the question before voters “one of the most important business decisions for the [AAATA] in decades.”

If approved, the millage would be the first ever levied by the Ann Arbor Area Transportation Authority. Existing dedicated transportation taxes, levied by the two cities and passed through to the AAATA, would remain in place. In Ypsilanti Township, the AAATA calculates the 0.7 mill levy to be commensurate with the level of service the township would receive as a result of transportation improvements. But the 0.7 mill levy would generate about twice as much as the amount paid by the township in its current purchase of service agreement (POSA). So Ypsilanti Township’s POSA amount would not be paid in addition to revenue from the 0.7 mill tax.

In separate action taken on Feb. 20, the AAATA board authorized a funding agreement with Ypsilanti Township governing that POSA. The agreement makes clear that if the 0.7 mill tax passes, then the township’s service, which would increase under the transportation improvement plan, would be paid by the 0.7 mill tax. [.pdf of AAATA agreement with Ypsilanti Township]

If approved by voters on May 6, the millage is supposed to pay for a set of service improvements over a period of five years. Those improvements include increased frequency during peak hours, extended service in the evenings, and additional service on weekends. Some looped routes are being replaced with out-and-back type route configurations. The plan does not include operation of rail-based services. The AAATA has calculated that the improvements in service add up to 90,000 additional service hours per year, compared to the current service levels, which is a 44% increase.

If a millage is approved on May 6, those improvements that involve extending the hours of service later in the evening and the weekend could begin to be implemented by late 2014. However, increases in frequency along routes, which would require acquisition of additional buses, would take longer.

For Ann Arbor, the rate for the existing tax is 2.056 mills, which is expected to generate a little over $10 million by 2019, the fifth year of the transportation improvement plan. For the city of Ypsilanti, the rate for the existing transit millage is 0.9789, which is expected to generate about $314,000 in 2019. For the owner of an Ann Arbor house with a market value of $200,000 and taxable value of $100,000, a 0.7 mill tax translates into $70 annually, which would be paid in addition to the existing transit millage. If the millage were to pass, the total Ann Arbor transit tax paid on a taxable value of $100,000 would be about $270 a year.

If it’s approved by voters, the total amount of revenue expected to be generated by the 0.7 mill tax in 2014 is $4,368,847.

The recommendation to place the ballot authorization question on the board’s Feb. 20 agenda came in action taken by the planning and development committee at its Feb. 11 meeting. Voting unanimously at that meeting to recommend the ballot question to the full board on Feb. 20 were: Sue Gott, Larry Krieg, Eli Cooper and Eric Mahler.

The planning and development committee made its recommendation after receiving a presentation of results from a survey of registered voters in late 2013. The survey results show that 63% of those surveyed would definitely or probably support a millage.

The board also received input from a financial task force, which found that the 0.7 mill tax was adequate to fund the improvements. [.pdf of Feb. 5, 2014 financial task force finding] Members of that task force included Bob Guenzel (former Washtenaw County administrator), Mary Jo Callan (director of the Washtenaw County office of community and economic development), Norman Herbert (former treasurer of the University of Michigan), Paul Krutko (CEO of Ann Arbor SPARK), and Mark Perry (director of real estate services, Masco Corp.). Guenzel was invited to address the board at the Feb. 20 meeting, and he summarized some of the background of the task force’s work.

That task force finding was that the ridership estimates were reasonable. The finding cautioned that some uncertainty existed about the future of the personal property tax. The task force finding also recommends against the capture of a portion of the new millage by TIF (tax increment financing) authorities, like the Ann Arbor Downtown Development Authority (DDA) and Ann Arbor’s local development finance authority (LDFA). It’s not clear whether it’s a legal option for the DDA not to capture a portion of that new tax. The AAATA estimates that annually about $119,000 of the new millage would be captured by the Ann Arbor DDA.

To be approved, a majority of voters in the city of Ann Arbor, the city of Ypsilanti and Ypsilanti Township would need to vote for the AAATA’s millage proposal. Those are the three jurisdictions that are members of the AAATA.

The city of Ann Arbor (pop. ~116,000), the city of Ypsilanti (pop. ~19,500) and Ypsilanti Township (pop. ~53,000) make up a bit more than half the population of Washtenaw County (pop. ~351,000).

In a separate resolution approved by the board at its Feb. 20 meeting, the board authorized CEO Michael Ford to spend up to $100,000 to cover the cost of holding the May election.

The ballot language the AAATA approved at its Feb. 20 meeting – which will be submitted to the Washtenaw County clerk’s office – differs from the language drafted and included in the board packet. The approved language explicitly highlights the capture of a portion of the millage by TIF authorities. The approved language also swaps in “seniors” for “the elderly”:

PUBLIC TRANSPORTATION IMPROVEMENT MILLAGE

To improve public bus, van, and paratransit services – including expanded service hours, routes, destinations, and services for seniors and people who have disabilities – shall the Ann Arbor Area Transportation Authority levy a new annual tax of 0.7 mills ($0.70 per $1000 of taxable value) on all taxable property within the City of Ann Arbor, the City of Ypsilanti, and the Charter Township of Ypsilanti for the years 2014-2018 inclusive? The estimate of revenue if this millage is approved is $ 4,368,847.00 for 2014. This revenue will be disbursed to the Ann Arbor Area Transportation Authority and, as required by law, a portion may be subject to capture by the downtown development authorities of the Cities of Ann Arbor and Ypsilanti, the Washtenaw County Brownfield Redevelopment Authority, and the local development finance authority of the Charter Township of Ypsilanti.

The ballot language is subject to requirements in Michigan’s General Property Tax Act.

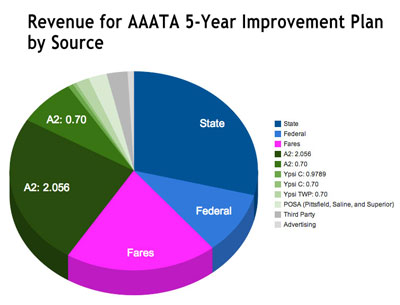

Here’s a detailed breakdown of how the roughly $4.3 million generated by the new AAATA millage would fit into the overall funding picture for AAATA services:

Revenue Source Amount

State $12,910,884

Federal $4,507,490

Fares $8,801,200

A2: 2.056 $10,980,259

A2: 0.70 $3,387,910

Ypsi C: 0.9789 $313,798

Ypsi C: 0.70 $202,730

Ypsi TWP: 0.70 $778,207

POSA $1,087,344

Third Party $1,204,196

Advertising $375,000

TOTAL $42,969,822

-

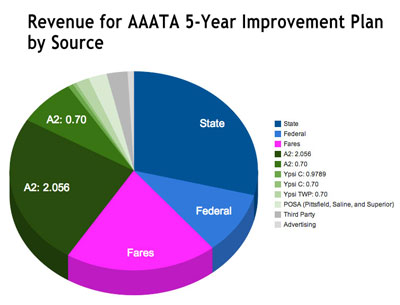

Here’s how that breakdown shapes up as a pie chart:

Pie chart of revenue sources for AAATA five-year transit improvements. (Data from AAATA, chart by The Chronicle. )

A significant portion of the added cost of providing service under the five-year improvement plan is planned to come from additional state operating assistance. While federal funding is expected to increase from about $4.1 million to about $4.5 million, state operating assistance is expected to increase from $8.5 million to $12.9 million.

Related to state operating assistance, an additional AAATA board action taken at its Feb. 20 meeting was approval of the annual resolution requesting state operating assistance. According to staff memos in the board’s information packet, the Michigan Dept. of Transportation instructed AAATA not to include assumptions of the five-year service improvement plan in this year’s application.

So this year’s application to the state for the AAATA’s portion of Act 51 money will include a budget as follows: estimated federal funds of $5,348,338, estimated state funds of $9,905,017, estimated local funds of $11,241,134, estimated fare box of $6,184,503, and estimated other funds of $647,288 – with total estimated expenses of $33,326,000. That application for state operating assistance could be amended, if the millage vote on May 6 succeeds.

The board of Michigan’s regional transit authority (RTA) voted on Feb. 17 not to ask voters for funding until 2016, which eliminates the possibility of two different transit millages on the ballot in the same year.

Information on the millage is available from the AAATA on a new website: therideyourway.org

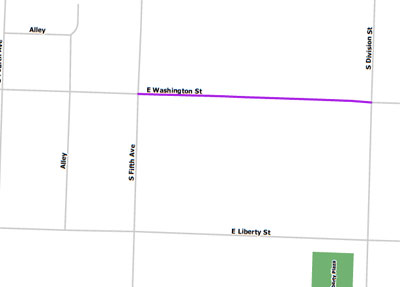

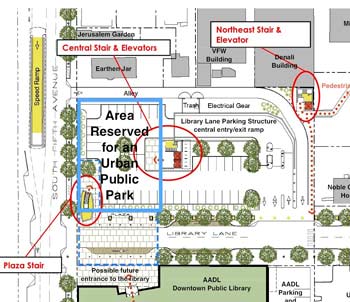

This report was filed from the downtown location of the Ann Arbor District Library at 343 S. Fifth Ave., where the AAATA board holds its meetings. A more detailed report will follow: [link]