City Council Caucus, Plus Other Questions

A little less than a week after hearing a presentation from city administrator Roger Fraser on his recommended budget for fiscal year 2010 and a plan for 2011, mayor pro tem Marcia Higgins canceled council’s regularly scheduled Sunday night caucus (April 19). No explanation was provided on the city’s website for the cancellation, which was posted on Friday. At least one citizen was alerted to the canceled meeting by reading a sign on city hall’s door at 7 p.m. Sunday evening.

Council must act to amend the recommended budget by its second meeting in May – or the administrator’s recommended budget is automatically adopted, a provision of Ann Arbor’s city charter. There are thus possibly two more caucus meetings before council makes its decision on the recommended budget, which contains a number of proposed cuts.

One of the possible functions of council’s caucus is to assemble “caucus questions” – questions from council to city staff about issues they are going to be considering. Some council members have contended that electronic mail is a far more efficient method of communication, and that caucus is not an efficient use of their time.

Recognizing that the work that would otherwise be accomplished at caucus can achieved via electronic mail, The Chronicle asked all councilmembers and the mayor to forward their caucus questions to us, in an effort to move the more mundane and tedious work of council more squarely into public view. We report below the responses we received, plus the questions The Chronicle has identified in connection with the city’s budget – some of which have already been answered.

Background on Caucus

Attendance at caucus meetings is optional for councilmembers. For the public, the gatherings provide an opportunity to see councilmembers work through questions with each other in an informal public setting. Caucus also provides an opportunity for members of the public and the media to ask questions of councilmembers in a public setting, or to share their views in a publicly accessible back-and-forth conversation – in contrast to the public commentary segments of formal council meetings, when councilmembers do not offer direct responses at the time of the commentary. On occasion, councilmembers will respond to speakers’ sentiments during their deliberations or during the section of the meeting assigned to council communications.

Councilmembers’ Caucus Questions

We heard back from 5 councilmembers in the time frame we set (noon Monday) in response to our request for the questions they’d come up with: Mike Anglin (Ward 5), who expressed his support of caucus, but did not forward any questions; Leigh Greden (Ward 3), who said it was a reasonable request, but who also did not forward any questions – he suggested that by waiting until around 3 p.m. The Chronicle could on a regular basis obtain a comprehensive list of the questions, plus responses in the form of the staff memo; Christopher Taylor (Ward 3), who said that he had not initiated any questions this week; Sabra Briere (Ward 1), who forwarded a message she’d sent Saturday afternoon to Tom Crawford, the city’s chief financial officer; and Carsten Hohnke (Ward 5), who sent along some questions.

We’ve interpreted Greden’s comments as a suggestion that we might consider initiating a request to create a future standing procedure whereby staff or councilmembers could forward the staff response memo to The Chronicle. We’ve begun exploring that possibility. For now, we present questions posed by Briere and Hohnke. First, Briere.

Dear Tom,

I’ve been going over the budget, and I have a couple of questions.

On page 56 of the binder, the figures representing the general fund dollars for Planning and Development Services are:

FY09 $2,104,163 FY10 $2,273,907 FY11 $2,331,658

On Roger’s presentation, these same figures are:

FY09 $2,104,163 FY10 $2,611,699 FY11 $2,592,084

1. Which set of figures is correct?

2. In the first set of figures, the projection calls for an 8% increase for the first year followed by a 2.5% increase for the second year. This is not out of line, when coupled with a projected decline of .5 FTE during the first year and an additional 4.5 FTE for the second year — with VEBA and medical insurance increases factored in.

However, I cannot account for the numbers in Roger’s presentation. This projection calls for nearly a 25% increase for FY10 with a slight (just over 1%) decrease in expenses in FY11. If Roger’s presentation is correct, what accounts for these expenses?

Please break the numbers out in exquisite detail for me.

3. If Roger’s presentation was incorrect, please help me understand how this affects the bottom line and the proposed cuts.

Carsten Hohnke forwarded these questions, which he’d sent to staff in connection to DS-1 on Monday’s agenda. That item relates to a FY 2010 allocation from the general fund to nonprofit entities for human services, totaling $1,268,092 in grants with a $7,652 human services contingency fund. The questions reflect the fact that the allocation is being approved before the budget for that year is adopted.

1. We are acting on this now (as opposed to after consideration of the FY10 budget) due to the requirement for submitting the FY 10 One-Year Action Plan to HUD by the end of April. What are the consequences of approving a budget in May that differs (e.g., increases) from the one assumed here for purposes of submitting the Action Plan? Are mechanisms provided by HUD for amending the AP?

2. The currently proposed FY10 allocation, including contingency, is unchanged from FY09 (and FY08). How does the contingency amount, specifically, in FY10 compare to FY09? Same also?

3. What are the numbers of non-profit entities receiving grants, and the average and median grant amounts, for FY10 compared to FY09?

We’ll follow up with answers to these questions as they become available. Two additional, regularly scheduled caucus meetings could be held between now and the point at which council needs to act on the budget – at its second meeting in May, about a month from now.

Chronicle Questions: Senior Center

Since the April 14 town hall budget meeting, The Chronicle followed up on some questions of our own about the budget, some of which we’ve already reported on in connection with the proposed closing of the senior center in summer 2010. We’ve heard back from city staff that they’re working on getting answers to the items still labeled as “pending answers.” As of this writing, those answers remain pending.

- What will happen to the senior center programming? At the town hall meeting, Fraser stressed that the closing is proposed for the second year of the plan. Built in to the proposal was the assumption that a year would be spent working out a transition for people who are involved at the senior center, Fraser said. Later, mayor John Hieftje contended that no decision needed to be made this year, because there was a year to work through the various issues. Fraser allowed that the network of people was something that could not be replicated with a strategy of finding alternate places for certain activities.

- What will happen to the senior center facility? Answers pending.

- Will there be a citizens committee involved in the transition work? Fraser said that if council were to decide to move forward with the closing, then his assumption was that there would be an advisory group that would work with staff on that transition. [The city's website indicates a Senior Center Advisory Board consisting of Dean Cole, Mary Hill, Lois Johnson, Lois Tiffany, Nancy Wiernik, Leona Yuerhs and Cecile Frogh.]

- Wasn’t the land for the center donated specifically for a senior center? At the town hall meeting, there were no definitive answers, although Hieftje said his recollection was that there was a connection to the Ann Arbor Public Schools system. [Online archives of council minutes show that on October 2, 2000, city council voted to take over the management of the senior center from the school system, citing the financial difficulty of the school system. On June 3, 2002, council voted to establish the advisory board for the center. A history of the center written in 1985 by a University of Michigan student, Diane Crane, traces the history of the structure as a barn for the horse races in Burns Park, but does not – as far as The Chronicle can discern – include a bequest stipulating the land be used for a senior center.] Answers pending.

- What about the $100,000 gift that was made to the center? At the town hall meeting there was some uncertainty regarding the possibility that the Ann Arbor Area Community Foundation might be administering the gift. [This confusion could be due to the fact that James Harmon Flinn, Jr. bequeathed two gifts of $100,000 – one to the Ann Arbor Area Community Foundation and another to the Ann Arbor Senior Center.] Answers pending.

City staff are currently putting together, for publication on the city’s website, the figures on expenses and revenues (class fees and renting out of space) that yield the projected $141,000 cost savings. Further, they’re getting numbers on annual usage of the facility. We’ll update as that information is available.

In perusing the white binder of budget information through the week, we noticed a line item in the section for Financial and Administrative Services Area, Revenues by Fund, showing $5,000 for Senior Center Endowment, which we speculate could reflect interest on the $100,000 gift that was bequeathed to the senior center by James Flinn, Jr.

Chronicle Question: Parks

Under the “Revenues” tab of the white budget binder are proposed fee increases across a variety of services, from dumpster service, to traffic signal studies, to park shelter fees. Park shelter fees vary according to the kind of day – weekdays, holidays, and weekends are charged different rates. Different rates also apply for residents versus non-residents.

As an example, the current fee for an Ann Arbor resident to rent a park shelter for a weekend day is $125. That’s proposed to be increased to $137. City staff offer comparative data that ranges from a low of $125 in the Washtenaw County parks to $181 in Madison, Wisc., to a high of $600 for four hours in Columbus, Ohio.

Also proposed to increase are the daily rates for renting a Farmers Market Stall [Farmers Market is administered through Parks and Recreation Services]. They currently range from $2.57 to $3.67 a day, and are proposed to be increased to $3.09 to $4.41.

Question: For many of the proposed fee increases, there’s a column indicating the anticipated impact on revenue. But for park shelter fees and for Farmers Market stalls, no column for those numbers is included. As a matter of public policy, how are are these items typically evaluated – with respect to their revenue potential, with respect to comparative communities, with respect to an assumption that revenues should cover some fraction of cost?

The regular meeting of the Park Advisory Committee takes place on Tuesday, April 21, at 4 p.m. in council chambers in county board of commissioners chambers at the County Administration Building, at 220 N. Main St. when PAC will be considering the proposed budget.

Chronicle Follow-up: Debt Coverage Ratio

At the town hall meeting, held last Tuesday to introduce the budget, one resident asked about the city’s overall debt. Neither the question nor the response were included in our original report, because both seemed vague enough that reporting just the words exchanged would not serve Chronicle readers’ interest in clarity. On the night of the town hall, we put the general issue to Tom Crawford, chief financial officer for the city of Ann Arbor, and he followed up by tapping the city’s treasurer for a more detailed answer.

The city treasurer’s memo [scanned .pdf] discusses the question of the city’s overall debt in three ways: (i) the legally allowable debt, (ii) the “debt coverage ratio” and (iii) bond ratings by Moody’s and Standard & Poor’s rating indices.

The state of Michigan sets a legal limit on how much debt the city can incur. This legal limit is expressed in terms of the state equalized value (SEV) of all the property that the city taxes: 10%. The city’s tax assessment roll, as of 2008, has an SEV of a bit over $6 billion. That means that legally the city of Ann Arbor could take on up to around $600 million worth of debt.

-

The City may not issue qualifying debt in excess of 10% of the SEV (state equalized value) of its assessment roll. Some forms of bonds, such as revenue bonds for water and sewer, do not qualify.

2008 SEV $6,077,168,500 Debt limit 607,716,850 Debt subject to limit 108,740,000 Additional debt that could be incurred 498,976,850

-

The law applies to certain kinds of debt and not others (like water and sewer revenue bonds). The roughly $100 million worth of city debt to which the law applies reflects 17.9% of the city’s legal debt capacity. If all debt, not just the qualifying debt, were included in the calculation, the city would be at 36.7% of its legal debt capacity.

The Chronicle has not explored in detail how Ann Arbor stacks up against other communities in Michigan with respect to its percentage of legally allowable debt. The only city’s numbers that came up on a cursory internet search was Troy, Michigan, which has debt equal to about 7% of its legal capacity.

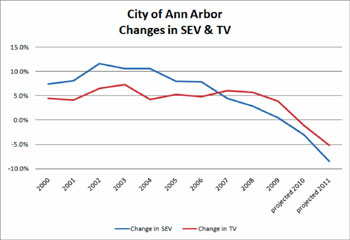

Relevant to the evaluation of the city’s debt burden in terms of its legal limit are city staff projections for the SEV, which is expected to decrease at least over the next two years. As the SEV value of the city’s tax rolls decreases, the legally allowable debt, expressed as 10% of that number, also decreases.

The blue line shows projections for the SEV of the city's tax rolls. SEV stands for state equalized value. TV is taxable value. (Image links to higher resolution file.)

A second way of evaluating certain kinds of debt is the debt coverage ratio: (net income before debt)/(debt service requirements). A number less that 1.0 would indicate that there is insufficient revenue to cover the debt service. The treasurer’s memo states that this number is generally not assessed in aggregate across the entire municipality, but rather by individual fund. The treasurer’s memo lists out examples for debt coverage ratios for different funds in the city of Ann Arbor.

-

Water 1.7 Sewer 4.5 Storm Water 15.9 DDA Parking 1.9

-

The final way that the treasurer’s memo evaluates the city’s debt burden is terms of rating services, which assess the quality of the city’s bonds.

On Standard & Poor’s rating scale, the water, sewer, and city bonds are rated AA-, AA+ and AA+, respectively.

On Moody’s scale, ratings for water, sewer, and city bonds are rated Aa3, Aa3 and Aa2, respectively.

In the chart below, we provide those ratings in order of best to worst of investment grade ratings.

-

S & P's Moody's AAA Aaa AA+ Aa1 AA Aa2 AA- Aa3 A+ A1 A A2 A- A3 BBB+ Baa1 BBB Baa2 BBB- Baa3

-

The scales extend lower into C and D ratings, but these are considered speculative grade ratings.

Chronicle Question: Local Development Finance Authority

Richard King, chair of the Local Development Finance Authority, which contracts with Ann Arbor SPARK to provide economic development services, will be making a presentation to council during the Introductions section of its April 20 meeting. He’ll be presenting the LDFA’s annual report and budget proposal. By way of background, the LDFA is funded through a mechanism similar to the Downtown Development Authority – capture of the taxes on the increased value of property.

Question: How much additional economic activity has been generated locally as compared to the economic activity the area would have seen absent any investment of tax money in this way? What are the range of ways that the LDFA measures the notion of economic activity?

In Madison, Wisconsin it costs $120 to rent a shelter on a weekend day (link to Madison park fees). In Columbus, OH (link to Columbus park fees) it costs $600 to rent a shelter HOUSE for 4 hours, which includes a refrigerator, microwave, tables, chair set-up, restrooms and a fireplace.

Minneapolis charges between $100-$200 for residents to rent a shelter.

In Berkeley, California, with a population of 101,000 and an annual budget of $350 million dollars, residents pay $60 to rent a shelter on a weekend day.

At the present $120 Ann Arbor charges residents a higher fee to rent the shelters than do most of the cities in Michigan. At $137, Ann Arbor charges residents a higher fee than most other cities in Michigan as well as much larger cities in the Midwest, such as Columbus (700,000 residents) and Minneapolis (372,000 residents).

It’s Standard & Poor’s , not Stand & Poor’s . [Editor's note: Indeed. We've corrected one of two instances of the name in the article, the second of which was already correctly rendered.]

A question for the LDFA rep: how have the activities of the DDA in blocking access to city parking data in conflict with the LDFA’s goals for locally initiated economic development?

Your question to the LDFA supporting SPARK is very good, but should go farther. According to the background provided when the county approved this LDFA under the SmartZone program (July 17, 2002),

“The purpose of the SmartZone is to support small, start-up technology companies, primarily in the information technology field within the Zone”.

It would be nice to know how much of that goal has been accomplished.

Additional background: The LDFA encompasses the area of the DDAs of both Ann Arbor and Ypsilanti. The money was supposed to be spent only within that area. There was a news story some months ago that indicated SPARK had spent some funds outside the areas designated and had to repay them. The taxes captured by the LDFA come from school funds, however the state holds harmless the local schools from this loss.

Dave

Many thanks for your explanation of city debt. Just wondering at the meeting how a budget could be presented without knowing what the debt obligations are and in what categories (seems like a new category is enlarging the Pittsfield Airport).

Still do not see why the administration will not consider salary cuts/roll-back for the non-union employees. This way,perhaps, we could keep a more substantial police force and prevent cuts in the fire department next year. All should participate in the financial burdens not just the tax payer and union employees.

Tomorrow’s (4/21/09) meeting of the Parks Advisory Commission is in the County Commission Chambers at 4pm due to the renovation at City Hall.

You’re asking the LDFA to prove a negative. While they should be able to tell you what they’ve done with their money,and how they evaluate their impact, they can’t really say with any certainty what would have happened without their involvement. There is a large body of research dating back at least to the 70′s that finds that businesses that take advantage of the types of services offered by the LDFA have a significantly higher survival rate than that of their peers that ‘go it alone.’

SAL writes: “You’re asking the LDFA to prove a negative. While they should be able to tell you what they’ve done with their money, and how they evaluate their impact, they can’t really say with any certainty what would have happened without their involvement.”

I think we’ll agree that they should be able to say what they’ve done with the money.

Still, I think that it’s a fair question to ask: What has the impact been on the economy of this investment of tax money? That would be a reasonable question to ask, even if Rick Snyder had not relentlessly pitched the creation of the SmartZone and SPARK as something which impact could and would be measured. That means more than just cataloging activities: bootcamps held, events organized, companies serviced, jobs created in connection with companies who received services, etc. Don’t get me wrong, I think it’s important to catalog those activities … as a starting point.

At Monday’s council meeting Marcia Higgins (Ward 4) asked Richard King, chair of the LDFA, if the 650 jobs created over three years of work with various companies would have been created without the LDFA, his reply was not, “It’s impossible to say,” — rather, he said, Yes, they would have. What would be hard to say, he went on, is how soon and where exactly they’d have been created.

I can imagine that answer being satisfactory or unsatisfactory, depending on your perspective. One angle might be that it’s not worth investing tax money to create jobs that would have been created anyway. A different take would be that they were created sooner and here, as opposed to later and elsewhere, which is worth spending tax payer money on.

Whatever the analysis of the answer, I just think it’s a fair question and I’m glad that Higgins asked it. To get a more detailed answer, I think it’s important to have a way of assessing how much “economic activity” there was before the LDFA was created — some measurement of what potential for “organic” growth exists here in Ann Arbor. That way we could at least begin to assess whether adding in some tax dollars is helping that or not. That’s not an easy assessment to do, I wouldn’t imagine, even if we ignore the unusual circumstances of Pfizer leaving, plus the overall economic downturn.

I agree with you, Dave, and I’m also appreciative of the attention Marcia Higgins gave to these questions. It was clear from the answer she got to one of her questions that the additional $50,000 Ann Arbor gave to SPARK essentially went to support staff and general operations. Since we are cutting staff and allocations to other organizations (yes, I’m still thinking of Project Grow), those are fair questions.

Oops, I was responding to discussion in a different article (the one actually reporting the council discussion).