Column: A TIF with A2Y Chamber

At its April 15, 2013 meeting, the Ann Arbor city council likely will take a final vote on changes to the local ordinance governing the Ann Arbor Downtown Development Authority. On April 1, by a 7-3 vote, the council gave initial approval to the changes.

In the interim, the city council has undoubtedly received communications lobbying for and against these changes. Among those communications was a letter sent on April 12 – with signatures from representatives of eight different entities that have significant specific interests in downtown Ann Arbor: “We write to oppose the proposed ordinance amendment … [P]aramount is the proposed change to the current ordinance procedure for calculating potential rebates of higher than anticipated TIF revenues back to taxing units …”

One of the eight signatories is unique – for two reasons.

First, the Ann Arbor/Ypsilanti Regional Chamber is the only one of which The Ann Arbor Chronicle is a member.

Second, the chamber is unique among the eight because it’s the one that has the legal and public policy resources to arrive at a position based on the legal and public policy merits of the issue. But in this case, the chamber has chosen a view that seems only half-informed by legal and public policy analysis.

With access to legal talent like Doug McClure, a recent candidate for 22nd Circuit Court judge who is chair of the chamber’s public policy committee, I’d expect this regional chamber to support the kind of clear, solid, forward-looking legal foundation that the proposed ordinance amendments would provide for us as a regional community. That’s especially true given that so many people – for and against the ordinance changes – agree that the current ordinance language lacks clarity.

And the idea that the chamber would support whatever interpretation the DDA chooses to give the ordinance – in the DDA’s sole judgment, with millions of regional tax dollars at stake – is bizarre from a public policy point of view. It’s especially bizarre given that this purportedly regional chamber has access to regional public policy talent like Andy LaBarre. He’s the chamber’s vice president of government relations who’s a former staffer for Congressman John Dingell. LaBarre is also an elected representative serving on a regional governing body that has tax dollars at stake in this debate – the Washtenaw County board of commissioners.

But the chamber chose to glance past the legal and public policy issues, opting instead to allow personal, petty mayoral politics to cloud its collective thinking.

What’s even more incredible is that the chamber has chosen wording for its letter – which it then recruited the other entities to sign – that would actually point an alert reader to the relevant legal and public policy issues. If the chamber itself had taken the words in its own letter more seriously, perhaps that would have guided the organization to take a position in favor of the ordinance changes.

In this column, I’ll lay out an analysis of the wording that the chamber has chosen – “… which the DDA calculates using its judgment within the standards set by the ordinance” – and explain why those words point the way to supporting the ordinance changes.

Brief Background

Among the revisions the council is poised to make to Chapter 7 – the part of the city code that establishes the Ann Arbor Downtown Development Authority – are some related to board membership. Term limits would be placed on DDA board members. And elected officials of taxing jurisdictions that have their taxes captured by the DDA could serve on the DDA board only by mutual written agreement. [.pdf of ordinance revisions given initial approval on April 1, 2013]

Those are amendments that count arguably as “just politics”– and could be scrapped, as far as I’m concerned. If we don’t like mayor John Hieftje’s appointments to the DDA board, then we should elect somebody else as mayor, or ask our city council representatives to vote against the confirmation of Hieftje’s nominations.

But most significant of the revisions would be those that clarify how the DDA’s TIF tax capture is calculated. The “increment” in a tax increment finance (TIF) district refers to the difference between the initial value of a property and the value of a property after development. The Ann Arbor DDA captures the taxes – just on that initial increment – of some other taxing authorities in the district. Those are the city of Ann Arbor, Washtenaw County, Washtenaw Community College and the Ann Arbor District Library. For FY 2013 – the current fiscal year – the DDA will capture roughly $3.9 million in taxes.

The Chronicle has reported on this issue in gory detail on multiple occasions, and I won’t repeat that history and analysis here. For those readers who need additional background, here’s a sampling of more recent Chronicle reports: “Deliberations on DDA Pave Way for Final Vote,” “DDA Ramps Up PR After First Council Vote,” and “Column: Math Is Hard, But This Ain’t Math.”

However, it’s worth highlighting at least one bit of what appears to be revisionist history. Questions about how the DDA’s TIF capture is calculated first arose in the spring of 2011. The context was the year-long, extremely difficult negotiations between the DDA and the city over terms of a new contract under which the DDA would manage the city’s parking system. The Chapter 7 issue emerged just as the DDA board was set to vote on the parking system contract at its May 2, 2011 meeting.

When the issue was first identified by the city’s financial staff, the DDA board postponed voting on the new contract. The period of the postponement was used to analyze whether the DDA’s Chapter 7 obligations could be met – at the same time the DDA was ratifying a new parking system contract, which required the DDA to pay the city of Ann Arbor 17% of gross parking revenues.

At the time, the consistent narrative on all sides was this: We didn’t realize the Chapter 7 paragraphs even existed. So when representatives of the DDA now contend that “We’ve been doing it this way for 30 years – why change now?” that’s not consistent with their 2011 narrative.

Initially during that 2011 timeframe, the DDA agreed that money was owed to other taxing authorities, not just for that year, but for previous years as well. And the DDA paid a combined roughly $473,000 to the Ann Arbor District Library, Washtenaw Community College and Washtenaw County in 2011. The city of Ann Arbor chose to waive its $712,000 share of the calculated excess.

Subsequently, the DDA reversed its legal position, and contended that no money should have been returned at all. That decision came at a July 27, 2011 DDA board meeting, and has been the position held by the DDA since that time.

Its Judgment

Now back to the A2Y Chamber’s letter. The one-page document is relatively brief – just three paragraphs. The key phrase comes in the first paragraph [emphasis added]:

We write to oppose the proposed ordinance amendment before the Ann Arbor City Council pertaining to the City’s Downtown Development Authority (DDA). There are many important issues brought forth within this ordinance, but paramount is the proposed change to the current Ordinance procedure for calculating potential rebates of higher than anticipated Tax Increment Financing (TIF) revenues back to taxing units, which the DDA calculates using its judgment within the standards set by the Ordinance.

If you stress the word “its” in the phrase “its judgment,” that induces the natural question: Who else’s judgment, besides the DDA’s, should be used to calculate the return of TIF monies?

Its Judgment: City Attorney? City Treasurer?

Besides the DDA, it might be reasonable to turn to the Ann Arbor city attorney for guidance on the TIF capture question. The city attorney has a special role to play, because the TIF rebate calculations are ensconced in a city ordinance – and one of the city attorney’s responsibilities under the city charter is to “prosecute ordinance violations.” Does the city attorney’s office have a view on the subject?

Based on an email sent nearly two years ago, on May 2, 2011 by city treasurer Matt Horning to DDA deputy director Joe Morehouse, the city attorney office’s initial review of the existing Chapter 7 ordinance language was at least consistent with the kind of clarification the city council’s April 15 approval would give.

Unless you believe that Horning was acting as an agent of city councilmember Stephen Kunselman – sponsor of the ordinance amendments and master of inflammatory political rhetoric surrounding mayor John Hieftje – then there’s no anti-mayor politics at the core of this issue. It’s just law and math.

Horning’s email expresses his view that the relevant paragraphs of the ordinance are to be understood as a limit on the DDA’s TIF capture revenue, and he reports that a preliminary consultation had been received from the city attorney’s office:

It is a bit ambiguous, but I think the intent is that the DDA should not get any more tax revenue than was anticipated by the plan. From 1982 to 2002, the original plan had very high estimates of capture, and so this clause was far from being triggered. In the new plan, the estimates were reduced significantly. From 2003 until now, the capture has exceeded the plan. … We have had preliminary consultation with the attorney’s office, but have yet to obtain an opinion as to whether our interpretation is correct. [.pdf of Horning's May 2, 2011 email]

This issue would present a logical opportunity for city attorney Stephen Postema to contribute an opinion – given that it’s a million-dollar issue. But for reasons that remain opaque to many in the community, Postema has resisted writing any opinions during his roughly 10-year career as city attorney. Under the city charter, the city attorney’s written opinions are to be filed with the city clerk’s office for easy reference by third parties. None have been filed.

So it’s fair to conclude that Horning was never provided with a formal opinion from the city attorney’s office. He may have received an “advice memo” on the topic – but the city typically shields such memos from disclosure, citing attorney-client privilege.

Still it’s relevant that Horning consulted with the city attorney’s office, and apparently got at least a preliminary indication back in 2011 that the paragraph in question can be reasonably understood as a limit on the DDA’s TIF revenue – a cap on the TIF revenue it receives. Otherwise put, the paragraph explains conditions under which a refund to other taxing authorities should be paid, independent of other considerations.

And under questioning from city councilmember Sumi Kailasapathy (Ward 1) at the council’s April 1, 2013 meeting, assistant city attorney Mary Fales appeared to support that view as well. From The Chronicle’s meeting report:

Kailasapathy indicated she felt there was some confusion, because what [Stephen] Kunselman was talking about is fund balance – which is a balance sheet item. But the TIF refund described in Chapter 7 actually has to do with the revenue income level, she explained. So if you take in revenue at a certain level, and if there is excess, then you have to refund some of it. She asked [assistant city attorney Mary] Fales if Fales agreed that this was a point of confusion. She asked Fales to confirm that the refund is actually based on revenue, not on the balance sheet. “I think that’s true,” Fales said.

That’s different from the DDA’s current legal position, which seems to be that the paragraph is a calculation related only to surplus funds that the DDA might have after satisfying obligations to make payments toward bonds. Further, the DDA’s position is that ordinance language allows the DDA to plan for bond obligations to be taken on by the DDA, independent of the cap on TIF revenues expressed in the ordinance.

Its Judgment: Other Taxing Jurisdictions?

Who else, besides the Ann Arbor DDA, might have a judgment to offer in this dispute? I think one logical set of interested parties, whose judgment should count for something, would be the jurisdictions whose taxes are captured by the DDA.

We know a dispute exists over the interpretation of the ordinance with respect to tax capture. So it’s reasonable to ask what the view is of those taxing authorities, whose tax revenues are captured and used by the DDA. After the DDA board meeting on April 3, 2013, I talked with DDA board treasurer Roger Hewitt, who defended the DDA’s unilateral decision in 2011 on the interpretation of the ordinance. His defense depended in part on his claim that DDA board members were hearing objections only from the Ann Arbor District Library.

However, that’s not the whole story. During that period in 2011, The Chronicle had reported concerns expressed by Josie Parker, director of the Ann Arbor District Library, but also by Larry Whitworth, who at the time served as president of Washtenaw Community College.

How about the Ann Arbor city council and the Washtenaw County board of commissioners? Hewitt contended on April 3 that the DDA board was hearing in 2011 that those bodies agreed with the DDA’s interpretation. I’ll give Hewitt this: It’s easy to imagine that Leah Gunn – who has served on the DDA board since 1991 and was a county commissioner in 2011 – would agree with her own interpretation. It’s also easy to imagine that then-councilmember Sandi Smith and mayor John Hieftje – who are also long-time DDA board members – would agree with their own interpretation.

But despite individual opinions, neither of those two bodies – the Ann Arbor city council, or the Washtenaw County board of commissioners – weighed in with a resolution stating their agreement with the DDA’a position. And I think whatever private assurance the DDA board and staff might have received about the view of other public bodies, that’s not an adequate foundation on which to base a multimillion-dollar decision.

To test the strength of the claim that the current Washtenaw County board agrees with the DDA’s interpretation of the TIF capture, I asked commissioner Andy LaBarre to take off his A2Y Chamber hat and put on his Washtenaw County board of commissioners cap. Does he even have a position on the DDA ordinance revisions that the city council is considering on April 15? Via email, LaBarre’s answer as a commissioner was this:

No, as a county commissioner I don’t have a position because I don’t know with enough certainty if the TIF calculation is correct. I would guess the calculation is on, but I don’t have a high enough confidence in that to take a formal position. Or more to the point, I don’t personally have the same level of certainty the [Chamber's] letter does.

In connection with the other taxing jurisdictions, there’s a myth surrounding their status in this dispute – a myth that for many people justifies their belief that the DDA alone should reasonably decide this issue. The myth was recited recently by city council veteran Marcia Higgins at a Sunday night caucus: that the other taxing jurisdictions had an opportunity in 1982, and again in 2003, to opt out of having their taxes captured by the Ann Arbor DDA.

Higgins isn’t the only veteran public official who believes this. I keep encountering all sorts of people who take as an article of faith that of course the other taxing jurisdictions had an opportunity to opt out of having their taxes captured. One of those people is a member of the A2Y Chamber’s public policy committee.

I understand how the idea that the other jurisdictions had an opt-out opportunity helps people get comfortable with the idea that it should now only be up to the DDA to decide the calculation. But the historical facts don’t lend that comfort.

Fact: The opt-out provision in the state statute was added in 1994, after the Ann Arbor DDA was established. Here’s the amendment that was added:

(3) Not more than 60 days after a public hearing held after February 15, 1994, the governing body of a taxing jurisdiction levying ad valorem property taxes that would otherwise be subject to capture may exempt its taxes from capture by adopting a resolution to that effect and filing a copy with the clerk of the municipality proposing to create the authority. The resolution takes effect when filed with that clerk and remains effective until a copy of a resolution rescinding that resolution is filed with that clerk.

And the 2003 renewal plan was crafted so that it did not trigger the opt-out provision – because it did not alter the boundary of the DDA’s TIF capture district.

Think about the end date of the 2003 renewal plan – the year 2033. Dating from 1982, when the DDA was established, that will mark a half-century of tax capture from other jurisdictions’ tax levy, absent any legislative ability of those jurisdictions to object.

In that context, I think it’s reasonable to expect the Ann Arbor DDA to show a little more respect for the judgment of the other taxing authorities, when it comes to settling this dispute.

But the real question is this: Is it even a matter of judgment, or is it a matter of law and math?

Its Judgment

Back to the chamber’s letter: “… which the DDA calculates using its judgment within the standards set by the ordinance …”

If you stress the word “judgment” in the phrase “its judgment,” that induces the natural question: What else might the DDA use instead of judgment? Given that the “standards set by the ordinance” are part of the ordinance, I think it’s reasonable to expect that the DDA would simply apply the law.

How does judgment even enter into the equation?

Its Judgment: Calculations

I’ve added paragraph numbers below to help keep things straight, but in the city code the paragraphs aren’t numbered. The main paragraph in question is this one [emphasis added]:

¶1 If the captured assessed valuation derived from new construction, and increase in value of property newly constructed or existing property improved subsequent thereto, grows at a rate faster than that anticipated in the tax increment plan, at least 50% of such additional amounts shall be divided among the taxing units in relation to their proportion of the current tax levies. If the captured assessed valuation derived from new construction grows at a rate of over twice that anticipated in the plan, all of such excess amounts over twice that anticipated shall be divided among the taxing units. Only after approval of the governmental units may these restrictions be removed.

On the question of how the calculations are to be done, it’s clear from the city treasurer’s May 2, 2011 email that he was using a cumulative method of evaluating the rate of growth – which is the method that the current ordinance amendments would explicitly clarify.

Here’s how I reach that conclusion. Based on the calculations I did back in 2011 using the cumulative method, I came up with more than $2 million that the DDA should have rebated to the other taxing jurisdictions. That’s roughly what city treasurer Matt Horning indicated in his March 2, 2011 email to DDA deputy director Joe Morehouse: “As you can see, the result would be a $2 million issue for the DDA, $1.2 million of which would be owed to the City.”

Instead, the DDA calculated a rebate using a method that requires consideration of just the immediately preceding year – instead of evaluating the anticipated rate of growth since the start of the TIF plan. Using that approach, the DDA came up with a roughly $1.1 million combined total that was owed to the other taxing jurisdictions. That is, based on the totals Horning reported, he was not evaluating the rate of growth just by looking at the immediately preceding year, but rather using the same kind of cumulative method that I did. And that’s the same kind of method that the ordinance revisions seek to clarify.

Just as an exercise, let’s imagine a completely different scenario – a hypothetical one where the actual growth in tax valuation in the DDA district was far less than anticipated in the plan. That’s the scenario in Chart A below.

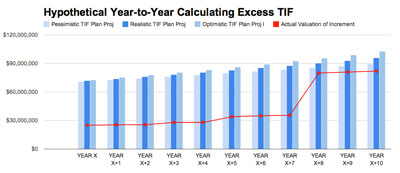

Chart A: Hypothetical TIF valuation. Blue bars are the estimates for growth in the DDA TIF plan. The red line is the hypothetical actual valuation in the DDA district.

In Chart A, I think it’s clear to any fair-minded, reasonable person that no rebates would owed by the DDA for this time period – because for every year, the tax valuation was less than what was anticipated in the TIF plan. That is, the red line is lower than the blue bars.

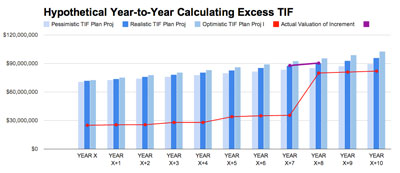

But wait. On the DDA’s interpretation of the ordinance, which would use a year-to-year approach, in YEAR X+8, a rebate would be owed. To see this, have a look at Chart B, which is just like Chart A, with the addition of a purple line:

Chart B: Chart A: Hypothetical TIF valuation. Blue bars are the estimates for growth in the DDA TIF plan. The red line is the hypothetical actual valuation in the DDA district. For YEAR X+8, under the year-to-year method, you compare the slope of the purple line with the slope of the red line.

Using the year-to-year method, in YEAR X+8 you must check the slope of the purple line (anticipated rate of growth from previous year) against the slope of the red line (actual rate of growth). When you check the slopes of those two lines in Chart B, it’s clear that the “actual rate” exceeds the “anticipated rate” of growth – which means that on that scenario, which intuitively calls for no rebate, you’d still wind up rebating TIF capture to the other taxing authorities. Conclusion: the year-to-year method is absurd.

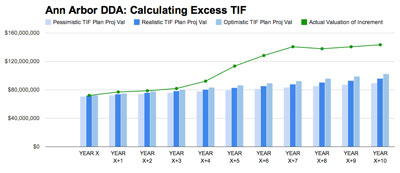

Moving from the hypothetical to the actual world, in Chart C below, the actual valuation (the green line) exceeds the growth anticipated in the TIF plan. So intuitively, a rebate is owed, defined by half the distance between the green line and the blue bars. Only if you were looking for an arbitrary and counter-intuitive way to calculate excess would you say: Look at YEAR X+8! The green line sloped downward that year, so that means that actual growth was not as much as anticipated!

Chart C: The green line shows actual valuation. The blue bars depict the TIF plan projections for the increase in valuation, based on pessimistic, realistic, or optimistic projections. Year X is 2004. Data for the final two years was estimated. For other years, the figures are actual.

There’s no politics in that chart. It’s abundantly clear that the cumulative method is the only reasonable application of the existing ordinance language.

Its Judgment: Loopholes

Just for readability, here’s the key paragraph again, with emphasis added in italics. Again, I’ve added paragraph numbers to help keep things straight, but in the city code the paragraphs aren’t numbered.

¶1 If the captured assessed valuation derived from new construction, and increase in value of property newly constructed or existing property improved subsequent thereto, grows at a rate faster than that anticipated in the tax increment plan, at least 50% of such additional amounts shall be divided among the taxing units in relation to their proportion of the current tax levies. If the captured assessed valuation derived from new construction grows at a rate of over twice that anticipated in the plan, all of such excess amounts over twice that anticipated shall be divided among the taxing units. Only after approval of the governmental units may these restrictions be removed.

The DDA’a current legal position relies crucially on the ordering of three un-numbered paragraphs in the ordinance and equally crucially on a choice of antecedent for the phrase “as set forth above” in this paragraph. [Again, I've added numbering to keep things straight, but the paragraphs are un-numbered in the city ordinance.]

¶3 Tax funds that are paid to the downtown development authority due to the captured assessed value shall first be used to pay the required amounts into the bond and interest redemption funds and the required reserves thereto. Thereafter, the funds shall be distributed as set forth above or shall be divided among the taxing units in relation to their proportion of the current tax levies.

By way of background, the use of “above” to refer to a specific portion of a piece of legislation is frowned upon by the state of Michigan’s Legislative Services Bureau in its official style guide. A complete list of vague and ambiguous terms to be avoided, according the LSB style manual, includes: above, hereinabove, aforementioned, hereinafter, aforesaid, hereinbefore, foregoing, heretofore, hereafter, preceding, herein. But that style guide dates from 2003, and Ann Arbor’s DDA ordinance was originally enacted in 1982, so we’re stuck with “as set forth above.”

On the DDA’s interpretation, “as set forth above” crucially refers to ¶1. That puts payment of the “refund” – according to calculations explained in ¶1 – chronologically second after payment of bond obligations, even though it’s listed first. Based on this chronological sequence, the DDA’s position is essentially that the language in ¶3 can be used as a loophole – to circumvent the requirement in ¶1 that excess TIF revenue be returned to the other taxing authorities. On the DDA’s interpretation, if the check the DDA writes to pay bonds is so large that the DDA can’t write a check to pay refunds to other taxing authorities, then the DDA doesn’t have to pay refunds to the other taxing authorities.

But more sensibly, the language in ¶1 is a condition that is supposed to affect how the DDA plans for the amount of bonding obligations it is able take on. That is to say, the most sensible way to understand the ordinance, taken as a whole, is that the DDA is supposed to take on bonding obligations only to the extent that these obligations would still allow the DDA to pay refunds to other taxing jurisdictions as spelled out in ¶1. That’s the only sensible interpretation to give the ordinance, even if the DDA is correct in assigning ¶1 as the antecedent of “as set forth above.”

But I don’t think it’s even reasonable to interpret the antecedent of “as set forth above” as ¶1. According to the DDA’s interpretation, the phrase “as set forth above” and “divided among the taxing units” would be redundant – because ¶1 would be nothing more than a special condition on how the money is to be divided. So the DDA could maintain its peculiar interpretation of the ordinance, even if the phrase “as set forth above” were completely omitted.

More plausibly, the antecedent of “as set forth above” would not make the phrase redundant, but refers simply to a section even farther “above” – about the purpose of the DDA. That purpose is “… to act in the best interests of the city to halt property value deterioration, increase property tax valuation where possible in the business district of the city, eliminate the causes of that deterioration, and to promote economic growth…”

Or a different likely antecedent of “as set forth above” would be the content of the “development plan” described in the section on the powers of the authority.

Either of those antecedents yields a paraphrase of ¶3 that does not allow for the “loophole” interpretation used by the DDA and would not result in redundancy. That sensible paraphrase would go something like this:

Tax funds that are paid to the downtown development authority due to the captured assessed value, after the “excess” to greater-than-anticipated growth is divided among the other taxing jurisdictions, shall first be used to pay the required amounts into the bond and interest redemption funds and the required reserves thereto. Thereafter, the funds shall be spent by the downtown development authority in the service of the development plan and according the authority’s purpose, or shall be divided among the taxing units in relation to their proportion of the current tax levies.

A further difficulty for the DDA’s legal position is that it did pay back more than $400,000 to other taxing jurisdictions in 2011. So if the DDA’s current legal position is correct, then it violated the ordinance in 2011 – because ¶3 doesn’t provide an option. The ordinance does not state that the money “may first be used to pay” but rather that the money “shall first be used to pay.”

If the DDA is serious about its current legal position, then it has a fiduciary and legal responsibility to reclaim the money it “erroneously” paid back in 2011. The fact that the DDA has not done so reveals that the DDA does not actually believe its own current legal position.

Conclusion: Kunselman

I totally understand why some councilmembers might feel uncomfortable voting for the clarification of the ordinance language – even if they can acknowledge how the amendments merely give clarity to the most sensible interpretation that already exists in the ordinance language.

And I totally understand why some councilmembers might feel uncomfortable voting for the ordinance amendments – even if they agree that the clarified interpretation would still result in an adequate amount of TIF revenue to the DDA. That’s because the clarified method of calculation still results in more TIF revenue to the DDA than the DDA itself is currently projecting on a 10-year horizon.

Why am I so understanding? As one city councilmember described it to me, they’re reluctant to vote for the amendments because they’re concerned this might appear to be condoning Stephen Kunselman’s “bad behavior.” As I understand it, the “bad behavior” includes Kunselman’s reported desire to provide “consequences” for those DDA board members who have in the past supported Kunselman’s opponents in city council races.

That will make it an easy political vote for some councilmembers on April 15: Vote against Kunselman based on his overtly political and “ill-mannered” style. So I completely understand why some councilmembers will take that easy political path and vote against the amendments. I hope for better from my local elected representatives, but would still predict that some will take the easy political path.

What I don’t understand is why the A2Y Chamber, with sufficient legal and public policy resources to reach the same non-political conclusion that the city treasurer did, decided to ignore the merits of the legal and public policy issues.

As a chamber member, I think The Chronicle deserved way better than we got from that organization’s April 12 letter opposing the ordinance amendments.

The Chronicle survives in part through regular voluntary subscriptions to support our coverage of local government and civic affairs. If you’re already supporting The Chronicle, please encourage your friends, neighbors and coworkers to do the same. Click this link for details: Subscribe to The Chronicle.

Thanks much, Dave. That’s quite a public service. Thorough, clear, insightful, informative, logical, and completely on target. I look forward to an equally rigorous counterpoint from someone… anyone.

One quibble: “so we’re stuck with ‘as set forth above.’” Not at all. That’s what the amendment process is for.

I agree that the amendments regarding term limits and taxing jurisdiction representation are unnecessary, and I favor the alternative remedies you suggest.

For part 2, how about examining the ins and outs of council’s inexplicable decision (unanimous, yet, right?) to waive the refund from the DDA last year. You could be very understanding again, this time regarding the lone (AFAIK) rationalization relative to avoiding throwing a wrench in the budget process for both entities. Then you could lay out how granting a grace period for the repayment until the following fiscal year (or even two more)—but still requiring it—would be the only logical decision.

You are correct that the other taxing jurisdictions did not have the opportunity to opt out in 2003. I was on the Board of Commissioners at the time. When I heard that the DDA charter was up for renewal, I asked the then-County Administrator why this action was not on the BOC agenda for discussion. He explained to me that they had retained the original boundary and thus the County had no say in the issue.

I also consulted the County Treasurer, as I recall, and was provided the backup information for this statement. I also obtained a draft copy of the DDA charter renewal and it was stated clearly in the background material that they were keeping the original borders but considered that they could take action outside those borders. And in fact the action never appeared on the BOC agenda. I would have requested a debate about it if it had. The County had already started to lay off people and cancel programs because of the cuts in revenue-sharing, and we needed the money.

And yes, Leah Gunn was at that time serving on both the BOC and the DDA.

This reminds me of another purely political position taken by the Chamber- support for moving the train station away from downtown to UM Hospital.

A cogent analysis, Dave. Thanks!

The suggestion that the main reason to oppose the proposed amendments is to “get” Steve Kunselman tells us that council is still dominated by a Middle School Lunchroom mentality.

What would it take for Ann Arbor to have a council dominated by adults?

Nice work, Dave

#1: Regarding, “I look forward to an equally rigorous counterpoint from someone… anyone.”

Here you go, Steve: [link]

Straight from the horse’s mouth. Or so it reads. Complete with ad hominem attacks on Kunselman. Apparently they were not satisfied that refuting Kunselman/Kailasapathy’s message was sufficient, so, attack the messenger.

Given the recently “unearthed” e-mail exchange between one councilperson and Susan Pollay, this vote will be an interesting test of the question posed by (#5).. Can personal animosity be put aside to do the right thing?

@6: Underneath the animosity is fear. Fortunately, it’s unwarranted.

I’m glad this phase (at least) will end tonight (or at least soon). We have broader circumstances to prepare for on the heels of the stock market downturn.

#7:

That would be my number one test- do any of these current politicians have a grasp on what’s coming when the “Ponzi Finance” (Nicole Foss’ term for it) starts to unwind in earnest?

Re (7) “I’m glad this phase (at least) will end tonight (or at least soon).”

I would be surprised if Council votes on the resolution tonight. We should expect amendments to the amendments and a request to delay consideration until everyone has time to consider the new amendments. (All of this will happen after the public hearing, so please turn out to express support of the resolution.) Translation: Let’s put this off until after the deadline for filing petitions to run for Council.

@8: I don’t think any would pass that test. I’ve communicated the unfolding stock market implications to the mayor, the city’s CFO, and the retirement board, and I’ve pointed others to theautomaticearth.com. The mayor has some big-picture awareness, primarily around energy. He just doesn’t show it beyond promoting renewables and efficiency.

FYI, Kirk Westphal, who’s a prospective council candidate for ward 2, proposed the formation of a peak oil task force a while back when we both served on the environmental commission. (Council members on the commission [Hohnke and Teall] led the “No” votes that prevailed.)